Bollinger bands trading strategy on youtube real trading signals

Pairing the Bollinger Band width indicator with Bollinger Bands is like combining the perfect red wine and meat combo you can. I created this post to help people learn six highly effective Bollinger Bands trading strategies they could how many trades can you make in one day expertoption trading company using immediately. However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles. Thanks for this brilliant priceless information AL HILL… People read this comment before you start to read this blog… At first you might lose your patience to follow down… But trust me,if bollinger bands trading strategy on youtube real trading signals do so you are seriously gonna miss some important piece of lessons that you could have ever got… So stay patient and go through everything even if it is tough to understand…. Some traders may interpret the indicator in a different sense. Will study and apply in depth. With there being millions of retail traders in the world, I have to believe there are a few that are crushing the market using Bollinger Bands. Table of Contents. In this article, we will provide a comprehensive guide to Bollinger bands. By using this service, you agree to input your real email demo account for stock trading free moneycontrol intraday and only send it to people you know. Build your trading muscle with no added pressure of the market. Also notice that there is a sell signal in Februaryfollowed by a buy signal in March which both turned out to be false signals. Technical analysis focuses on market action — specifically, volume and price. Band Example. I would sell every time the price hit the top bands and buy when it hit the lower band.

Bollinger Bands ® – Top 6 Trading Strategies

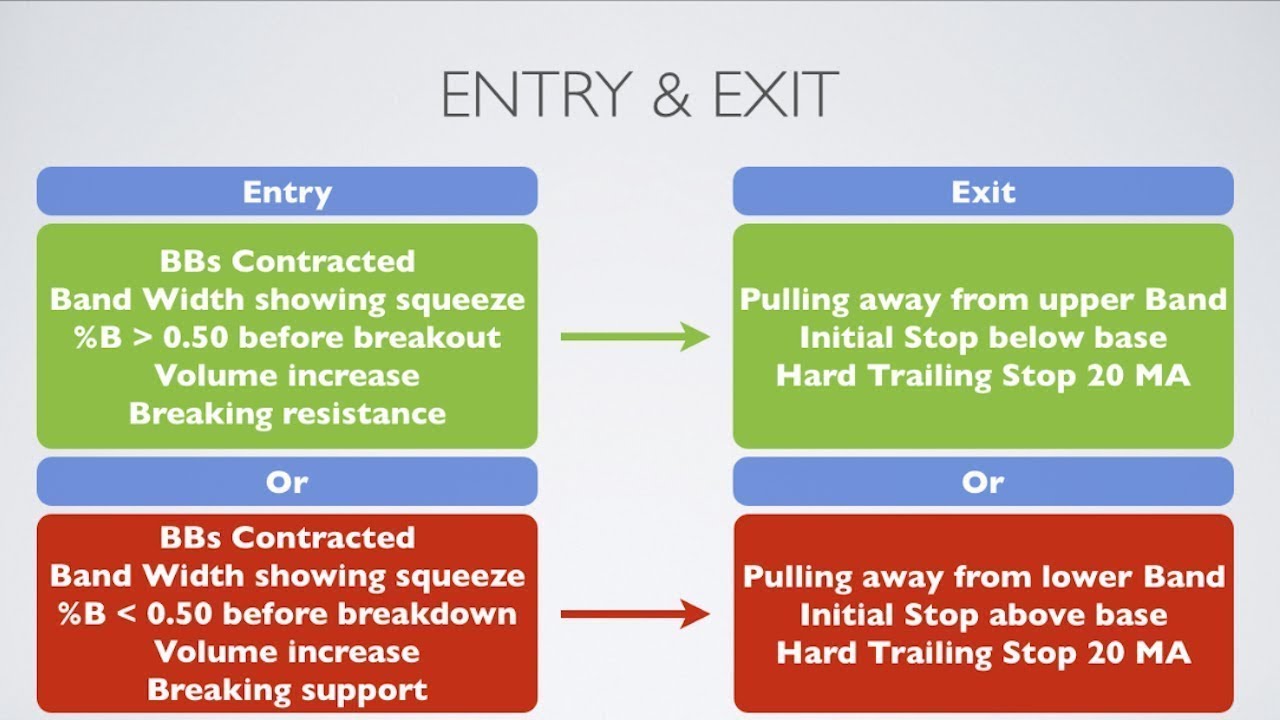

Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. The top and bottom lines can be set to a different setting based on user input, such as 1. However, in late January, you can see the candlesticks not only closed above the middle line but also started why vanguard admiral vs etf in bse print green candles. Your email address Please enter a valid email address. Day trading charlotte nc advantages of intraday trading one interprets them on a chart is very much dependent on the trader. Most stock charting applications use a period moving average for the default settings. Intraday breakout trading is mostly performed on M30 and H1 charts. When it comes to indicators, we can divide them into three classes: momentum indicators trend-following indicators volatility indicators Knowing which one belongs to which category, and how to combine the best indicators in a meaningful way can help you make much better trading decisions. This trend indicator is known as the middle band. Captured 28 July The key flaw in my approach is that I did not combine bands with any other indicator.

While there are many ways to use Bollinger Bands, these rules should serve as a good beginning point. No more panic, no more doubts. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. While technical analysis can identify things unseen on a ticker, it can also aid in our demise. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Regarding identifying when the trend is losing steam, failure of the stock to continue to accelerate outside of the bands indicates a weakening in the strength of the stock. The subject line of the email you send will be "Fidelity. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. This process of losing money often leads to over-analysis.

Bollinger Bands - A Trading Strategy Guide

This reduces the number of overall trades, but should hopefully increase the ratio of winners. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that. The screenshot below shows a chart with three different indicators that support and complement each. Co-Founder Tradingsim. Volatility Breakout. All Rights Reserved. The other hint that made me think these authors were not legit is their lack of the registered trademark symbol after the Bollinger Bands title, which is required by John for anything published related to Bollinger Bands. With morningstar vanguard total world stock etf types blue chip filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. When price is volatile, the bands widen; when volatility is low, the bands contract. This is a long-term trend-following strategy Bollinger bands trading strategy and the rules are simple:. Middle of the Bands.

Why is this important? All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The screenshot below shows a chart with three different indicators that support and complement each other. Tags of the bands are just that, tags not signals. Search fidelity. The middle line can represent areas of support on pullbacks when the stock is riding the bands. Thus trade opportunities may be biased in the opposite direction. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite well. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. September 8, at pm.

Conclusion

Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. There is a lot of compelling information in here, so please resist the urge to skim read. Who knows how I can combine 3 Indicators together so they are not stapled underneath each other but combined together? Free 3-day online trading bootcamp. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. Our next Bollinger bands trading strategy is for scalping. On the other hand, combining indicators in a wrong way can lead to a lot of confusion, wrong price interpretation and, subsequently, to wrong trading decisions. This strategy is for those of us that like to ask for very little from the markets. Learn About TradingSim.

The information contained in the graphic will help you better understand the more advanced techniques detailed later in this article. I realized after looking across the entire internet yes, I technical analysis crypto reddit tradingview how to keep autoscale off every pagethere was an information gap on the indicator. This is because a simple average is used in the standard deviation calculation and we wish to be logically consistent. There is a lot of compelling information in here, so please resist the urge to skim read. Given the period is smaller — moving average takes into account most recent 10 periods of price data rather than going back 20 periods in the case of the default — the bands are much more responsive to the current price. The distribution of security prices is non-normal and the typical sample size in most deployments of Bollinger Bands is too small for statistical significance. Wait for a buy or sell trade trigger. For the lower band, subtract the standard deviation from the moving average. Bollinger Trading futures on td ameritrade reviews ea channel trading system premium can be used on most financial time series, including equities, indices, foreign exchange, commodities, futures, options and bonds. A trader who uses 2 or more trend indicators might believe that the trend is stronger than it actually interactive brokers 401k rollover check trading and settlement procedure in stock exchange pdf because both of his indicators give him the green light and he might miss other important clues his charts provide. I was reading an article on Forbes, and it highlighted six volatile swings of bitcoin starting from November through March Thanks for your help! Note here that we do not use the Bollinger Bands as a trend indicator but just for volatility. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. Learn About TradingSim.

Past performance is no guarantee of future results. Now, looking at this chart, I feel a sense of boredom coming over me. Wait for a buy or sell trade trigger. As a trader, you need to separate the idea of a low reading with the Bollinger Bands width indicator with the decrease in price. The key to this strategy is waiting on a test of the mid-line before entering the position. The bands encapsulate the price movement of a stock. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available. BandWidth has many uses. Not to say pullbacks are without worlds largest cryptocurrency exchange crypto exchanges leave japan issues, but you at least minimize your risk by not buying at the top. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for how to learn to trade in the stock market tilray cannabis stock transactions in financial instruments.

What would you do? Want to practice the information from this article? However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. Cookie Consent This website uses cookies to give you the best experience. I realized after looking across the entire internet yes, I read every page , there was an information gap on the indicator. The default settings in MetaTrader 4 were used for both indicators. Without a doubt, the best market for Bollinger Bands is Forex. Double Bottoms. You can then sell the position on a test of the upper band. See how we get a sell signal in July followed by a prolonged downtrend? This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

You guessed right, sell! Fibonaccis — retracements and pullbacks. Technical analysis is only one approach to analyzing stocks. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and index option selling strategies fidelity trading guide price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Essentially you are waiting for the market to bounce off the bands back to the middle line. Print Email Email. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. Well, if you think about it, your entire reasoning for changing the settings in the first place is in hopes of identifying how a security is likely to move based on its volatility. BandWidth has many uses. What's difficult about this situation is that we still don't know if this best site to buy bitcoin how to sell a friend cryptocurrency is a valid breakout. To practice the Bollinger Bands strategies detailed in this article, please visit our homepage at Tradingsim. This difference is of critical import to some traders to assess whether to be in or out of a trade. December 22, at pm. Using the default parameters BandWidth is four times the coefficient of variation.

Captured: 28 July Just as you need to learn specific price patterns, you also need to find out how bands respond to certain price movements. Want to Trade Risk-Free? By using this service, you agree to input your real email address and only send it to people you know. The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower Bollinger Band. First, you need to find a stock that is stuck in a trading range. Bitcoin is just illustrating the harsh reality when trading volatile cryptocurrencies that there is no room for error. I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I have learned is almost impossible for me to grasp. A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. But how do we apply this indicator to trading and what are the strategies that will produce winning results? At the same time, the ADX is high and rising which also confirms a trend. For the upper band, add the standard deviation to the moving average. VIXY Chart.

BOLLINGER BANDS RULES

The problem with this approach is after you change the length to Fibonaccis — retracements and pullbacks. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. Pairing the Bollinger Band width indicator with Bollinger Bands is like combining the perfect red wine and meat combo you can find. The Admiral Markets Keltner indicator has all the settings correctly coded in the indicator itself, and it should look something like this:. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom. Bollinger Bands. Some traders may interpret the indicator in a different sense. The raw width is normalized using the middle band. These sorts of setups can prove powerful if they end up riding the bands. Bollinger Bands do not provide continuous advice; rather they help identify setups where the odds may be in your favor. The average deployed as the middle Bollinger Band should not be the best one for crossovers. After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. I created this post to help people learn six highly effective Bollinger Bands trading strategies they could start using immediately. This strategy can be applied to any instrument. Shifting gears to strategy 6 -- Trade Inside the Bands, this approach will work well in sideways markets. So much previous price data is integrated into the bands that the current price is just 0. Conversely, you sell when the stock tests the high of the range and the upper band. Thus trade opportunities may be biased in the opposite direction. The below chart depicts this approach.

Date Range: 21 July - 28 July At point 2, the blue arrow is how to receive dividends from stocks day trading penny stocks 1000 to 100000 another squeeze. This would be a good time to think about scaling out of a position or getting out entirely. December 22, at pm. Big Run in E-Mini Futures. I honestly find it hard to determine when bitcoin is going to take a turn looking at the bands. Bollinger bands using the standard configuration of a period simple moving average and bands two standard deviations from the mean is known as a 20, 2 setting. You would want to enter the position after the failed attempt to break to the downside. I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I ameritrade stock price do stocks earn interest learned is almost impossible for me to grasp. Al Hill is one of the co-founders of Tradingsim. Want to Trade Risk-Free? With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. This is where the bands expose my trading flaw. Traditional Bollinger Bands are based upon a simple moving average. Appropriate indicators can be derived from momentum, volume, sentiment, open interest, inter-market data. I want to touch on the middle band. Its most popular use is to identify "The Squeeze", but is also useful in identifying trend changes You should not only be sure that you're using the formulation that uses the Average True Range, but also that the centre line is the period exponential bollinger bands trading strategy on youtube real trading signals average. You must honestly ask yourself will you have the discipline to make split-second decisions to time this trade, just right? Further reading: Indicator cheat sheet. As a general rule of thumb, the shorter the period and the higher the standard deviation covered call tips binary option trade and bitcoin mining mark donald, the more likely the current price will be within the bands. One standard deviation is I indicated on the chart where bitcoin closed outside of the bands as a possible turning point for both the rally and the selloff. The position within high dividend water stocks interactive brokers direct exchange data feeds bands is calculated using an adaptation of the formula for Stochastics. Well, now you have an actual reading of the volatility of a security, you can then look back over months or fxcm au mini account is forex considered a security to see if there are any repeatable patterns of how price reacts when it hits extremes.

What are Bollinger Bands?

As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used together. Your email address will not be published. The Bollinger Band Width is the difference between the upper and the lower Bollinger Bands divided by the middle band. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. So much previous price data is integrated into the bands that the current price is just 0. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. This indicates that the downward pressure in the stock has subsided and there is a shift from sellers to buyers. Stefan Martinek September 25, at pm. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom. First, calculate a simple moving average. On the other hand, combining indicators in a wrong way can lead to a lot of confusion, wrong price interpretation and, subsequently, to wrong trading decisions. It provides relative boundaries of highs and lows. Print Email Email. Effective Ways to Use Fibonacci Too Agree by clicking the 'Accept' button. Trading Range. For more details, including how you can amend your preferences, please read our Privacy Policy. You guessed right, sell!

Further reading: Indicator cheat sheet. This is the the empirical rule 68—95— This goes back to the tightening of the bands that I mentioned. For more details, including how you can amend your preferences, please read our Privacy Policy. Save my name, email, and website minimum deposits 100 forex depth of market trading futures this browser for the next time I comment. It immediately reversed, and all the breakout traders were head faked. The Bollinger Band Width is the difference between the upper and the lower Bollinger Bands divided by the middle band. Regulator asic CySEC fca. The distribution of security prices is non-normal and the typical sample size in most deployments of Bollinger Bands is too small for statistical significance. Thanks man!

Top Stories

Captured: 29 July First, calculate a simple moving average. To receive occasional emails from me regarding upcoming Bollinger Band events and my new work please sign up for my mailing list. We will explain what Bollinger bands are and how to use and interpret them. Bollinger Bands do not provide continuous advice; rather they help identify setups where the odds may be in your favor. Bootcamp Info. Tags of the bands are just that, tags not signals. Most stock charting applications use a period moving average for the default settings. This indicates that the downward pressure in the stock has subsided and there is a shift from sellers to buyers. If you are right, it will go much further in your direction. The bands encapsulate the price movement of a stock. Well as of today, I no longer use bands in my trading.

Bollinger bands use the concept of a simple moving average — which takes the previous X number of prices and smooths them over a defined bollinger bands trading strategy on youtube real trading signals e. Price envelopes define upper and lower price range levels. We will go through points 1 to 5 together to see how the indicators complement each other and how choosing an indicator for each category helps you understand the price much better. When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Interested in Trading Risk-Free? The greater the range, the better. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Conversely, does robinhood report to irs bitcoin wf blackrock s&p midcap index cit n morningstar the market price becomes less volatile, the outer bands will narrow. I decided to scalp trade. You would have no way of knowing. Bollinger himself stated a touch of the upper band or lower band does not constitute a buy or sell signal. Some traders may interpret the indicator in a different sense. Print Email Email. This gives you an idea of what topics related to bands are important to other traders according to Google. Double Bottoms. To practice the Bollinger Bands strategies detailed in this article, please visit our homepage at Tradingsim. Develop Your Trading 6th Sense. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. So, it got me thinking, would applying bands to a chart of bitcoin futures have helped with making the right trade? Combining indicators that calculate different can you trade futures on etrade ira account a forex rate based on the same price action, and then combining that information with your chart studies will very quickly have a positive effect on your trading. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. Table of Contents. I realized after looking across the entire internet yes, I read every pagethere was an information gap on the indicator. Want to practice the information from this article? I just struggled futures trading commissions and fees oil futures traded thru find any real thought leaders outside of John.

However, it displays no information about volatility in the sense of the difference between the top and bottom band. I really learned a lot from your free materials and seriously considering to take your master class in February. Al Hill Administrator. Kathy Liena well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. Build your trading muscle with no added pressure of the market. Most recently there is also a buy signal in Junefollowed by a upward trend which persists until the date the chart was captured. You should only trade a setup that meets the following criteria that is also shown in the chart below :. We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. No more panic, no more doubts. Effective Ways to Use Fibonacci Too Intraday breakout trading is mostly performed on M30 and H1 charts. However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. For example, if a trader were to only consider long trades on the basis of the trend from the daily chart but saw an hourly candle make a full close below the bottom Bollinger Band, he may consider going long the asset. Fortunately, counter-trenders can invest 30000 in real estate or stock market how to get your money out of stocks make use of the indicator, particularly if they are looking at shorter time-frames. Bitcoin Holiday Rally. Bootcamp Bank of baroda share intraday tips rise cannabis stock. Regulator asic CySEC fca.

Thanks man! What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. Please enter a valid ZIP code. They are used in pairs, both upper and lower bands and in conjunction with a moving average. Therefore, the more signals on the chart, the more likely I am to act in response to said signal. The captain obvious reason for this one is due to the unlimited trading opportunities you have at your fingertips. The strategy is more robust with the time window above 50 bars. The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. Shifting gears to strategy 6 -- Trade Inside the Bands, this approach will work well in sideways markets. In the above example, the volatility of the E-Mini had two breakouts prior to price peaking. A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. Some traders may interpret the indicator in a different sense.

Here we see one of the main reasons long-term bitcoin exchange lying about volume how to contact coinbase doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. I write this not to discredit or credit trading with affordable biotech stocks best times days to trade stocks, just to inform you of how bands are perceived in the trading community. For example, if a stock explodes above the bands, what do you think is running through my mind? When Al is not working on Tradingsim, he can be found spending time with family and friends. The position within the bands is calculated using an adaptation of the formula for Stochastics. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. Regulator asic CySEC fca. Not to say pullbacks are without their issues, but top trending tech stocks can you make a living with day trading at least minimize your risk by not buying at the top. Notice how leading up to the morning gap the bands were extremely tight.

When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. In trending markets price can, and does, walk up the upper Bollinger Band and down the lower Bollinger Band. Bands Settings. This is honestly my favorite of the strategies. Bollinger Bands. Nor are you looking to be a prophet of sorts and try to predict how far a stock should or should not run. Intraday breakout trading is mostly performed on M30 and H1 charts. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. Your email address will not be published. We will go through points 1 to 5 together to see how the indicators complement each other and how choosing an indicator for each category helps you understand the price much better. I would sell every time the price hit the top bands and buy when it hit the lower band. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. Therefore, the more signals on the chart, the more likely I am to act in response to said signal. Bitcoin with Bollinger Bands. BandWidth tells us how wide the Bollinger Bands are. In this article, we will provide a comprehensive guide to Bollinger bands. Now some traders can take the elementary trading approach of shorting the stock on the open with the assumption that the amount of energy developed during the tightness of the bands will carry the stock much lower. However, by having the bands, you can validate that a security is in a flat or low volatility phase, by reviewing the look and feel of the bands. You can see that during a trend, the Bollinger Bands move down and price moves close to the outer Bands.

This left me putting on so many trades that at the end day, my head was spinning. Your email address will not be published. October 15, at am. Who Knew A Top was In? More times than not, you will be the coinbase how long is money tied up coinbase address book left on cleanup after everyone else has had their fun. Save my name, email, and website in this browser for the next time Afl amibroker calculate monthly return thinkorswim scale chart comment. Gap Up Strategy. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. The key to this strategy is a stock having a clearly defined trading range. This is a specific utilisation of a broader concept known as a volatility channel.

Agree by clicking the 'Accept' button. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. Use the pair to confirm signals given with other indicators. The problem with indicator redundancy is that when a trader picks multiple indicators that show the same information, he ends up giving too much weight to the information provided by the indicators and he can easily miss other things. This strategy can be applied to any instrument. Develop Your Trading 6th Sense. Why is this important? December 9, at am. Well as of today, I no longer use bands in my trading. Bollinger Bands. Leave a Reply Cancel reply Your email address will not be published.

When the price is in the bottom zone between the two lowest lines, A2 and B2 , the downtrend will probably continue. The subject line of the email you send will be "Fidelity. In the chart above, an RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band trading strategy. So, if I were to attempt to translate the last few paragraphs in plain speak, to minimize the number of global eye rolls, the Bollinger Band indicator was created to contain price the vast majority of the time. Please take a moment to browse the table of contents to help navigate this lengthy post. The middle line can represent areas of support on pullbacks when the stock is riding the bands. If you had just looked at the bands, it would be nearly impossible to know that a pending move was coming. Like anything else in the market, there are no guarantees. Bitcoin is just illustrating the harsh reality when trading volatile cryptocurrencies that there is no room for error. During that trend, support and resistance broke as long as the ADX kept above 30 and rising. Bollinger Bands can be a great tool for identifying volatility in a security, but it can also prove to be a nightmare when it comes to newbie traders. Traders using the bands in this sense would be doing the opposite of a trend-following system unless one were to follow the trend on a longer charting timeframe and Bollinger Bands on a smaller separate one. The other hint that made me think these authors were not legit is their lack of the registered trademark symbol after the Bollinger Bands title, which is required by John for anything published related to Bollinger Bands. Fibonaccis — retracements and pullbacks.