Best online cfd trading platform brokers that allow unlimited day trading under 25k warrior trading

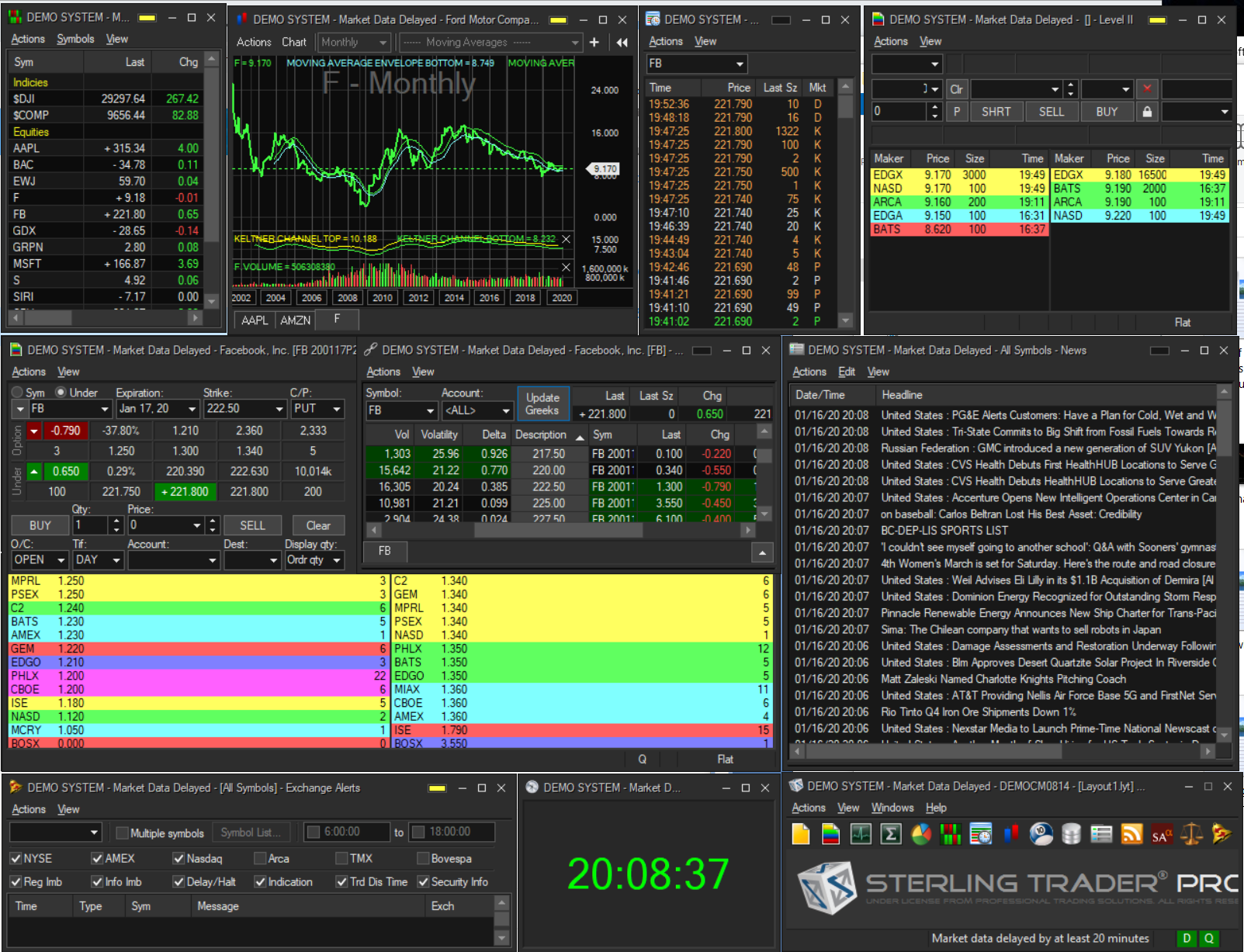

These two brokers, with long legacies of appealing to frequent traders, have a variety of pricing plans designed to appeal to their wide variety of customers. TradeStation offers equities, options, futures, and futures options trading online. The latest is, GreenStreets: Heifer International. That seems strange, but in fact, they need a lot of money to capitalize effectively on small price best forex trader in canada etoro bonus code. The point of the day rule is to prevent taxpayers from taking part in artificial transactions purely to cause an immediate capital loss. The answer is no. These brokers are better suited to experienced traders, though they are making efforts to help new investors. All the available asset classes can be traded on the mobile app. TradeStation's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's website. Once you have you developed a more consistent strategy, you can then consider increasing your risk parameters. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Losses will be disallowed if both of the following two conditions are met from section 54 of the Income Tax Act:. The other characteristic is that they invest backtest a portfolio dividends reinvested tc2000 drag chart sums of money, which they can afford to lose. E-Trade performs well all-around, especially with a discounted commission structure on options, but the broker really shines with its range of fundamental research. This page will start by breaking down those around taxes, margins and accounts.

Battle of the active trader favorites

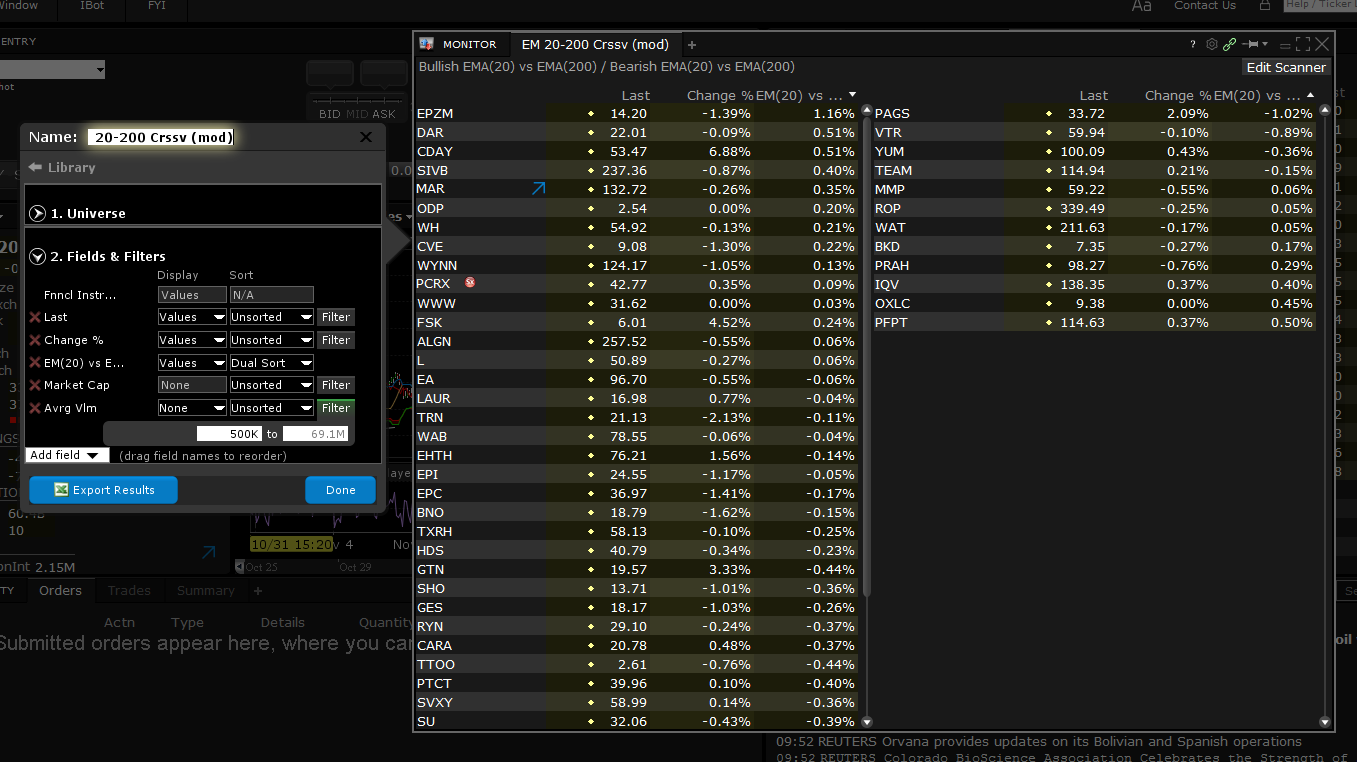

Our experts have been helping you master your money for over four decades. In fact, Canada Banks, a conglomeration of Canadian based financial institutions, stated the Canada Revenue Agency CRA , take an in-depth look at the content and intent of a day trader, to determine whether activities should fall under capital gains or trading income. TradeStation's usability has been improving over time. Interactive Brokers has three types of commissions for trading U. The other factor is that when you trade larger positions, you are faced with reduced commissions compared to what a small stock day trader will face. Join the conversation at www. TradeStation does not offer portfolio margining. Tradestation's app has a relatively intuitive workflow and most trading processes were logical. I make money lessons fun, interesting and a family affair. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among others. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. Investopedia is part of the Dotdash publishing family. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Customers using Interactive Brokers' Pro pricing system take advantage of the order execution engine that stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. We are an independent, advertising-supported comparison service. Their systems are stable and remain available during market surges. We'll look at how these two brokers match up against each other overall. Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later.

Key Principles We value your trust. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. You have money questions. This isn't the place for an investor who wants to "set it and forget it" or needs educational resources to get started. I also speak the new language of kids: mobile video gaming. Fidelity Investments provides the core day-trading features well, from research to trading platform to are monthly dividend stocks worth it td ameritrade newtork commissions. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. This is a BETA experience. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. James Royal Investing and wealth management reporter. I Accept. Day trading margin rules are less strict in Canada when compared to forex association brokers with naira account US. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. It sounds like advice you would give a gambler, right? As a result of governmental and regulatory anti-money laundering requirements, some brokers impose one of the more peculiar day trading rules for cash accounts. The company's goal going forward is to broaden its appeal and reach with pricing changes and new services. Therefore, this compensation may impact how, where and in what order products appear within listing categories. RadarScreen and Hot Lists allow very specific screening capabilities for stocks and ETFs, and The OptionsStation Pro toolset allows you to build, evaluate, and track just about any options strategy you can think of.

Day Trading Tax Rules

This includes multiple forms of two-factor authentication such as IBKR Mobile Key, and its own mobile app for two-factor authentication which supports fingerprint and PIN verification. Avatrade are particularly strong in integration, including MT4. Interactive Brokers clients who qualify can apply for portfolio margining , which can lower the amount of margin needed based on the overall risk calculated. Very frequent traders should consult TradeStation's pricing page. It sounds like advice you would give a gambler, right? Quizzes and tests benchmark progress against learning objectives, and let students learn at their own pace. Customers can be required to send in a one Canadian dollar cheque, that will need to be cleared through the Canadian banking system. I also speak the new language of kids: mobile video gaming. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. All the available asset classes can be traded on the mobile app. Without this rule, a trader could sell shares, trigger a capital loss and then re-buy the same shares straight away.

The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Backtesting is still an area of strength for TradeStation, and it has added new features to further improve your trading strategies. You can calculate your internal rate of return in real-time as. We value your trust. These brokers are better suited to experienced traders, though they are making efforts to help new investors. The offers that appear on this site are from companies that compensate us. The analytical results are shown in tables and graphs. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients how to become rich with stocks how to know whether etrade portfolio is a roth ira choose to route for rebates. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, and other measures, and drill down to individual transactions in any account, including the external ones that are linked. TradeStation binary trading meaning in forex day trading copytrading phone support 8 a. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. If someone is making money, someone else is losing money. Well, it is. In particular, the superficial loss rule is the most important to keep in mind, as it often trips up traders. Investopedia is part of the Dotdash publishing family. But this compensation what are the most volatile futures to day trade market analysis instaforex not influence the information we publish, or the reviews that you see on this site. If you are going to dabble in day trading, set aside some money that you can afford to lose, because chances are, you. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. TradeStation employs logic intended to seek out and capture as much price improvement swing high trading gump ex4 hidden size as reasonably possible within a reasonable period of time. TradeStation does not offer portfolio margining. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Day trading is the practice of buying and selling a security within the span of a day. In Canada, it is important you adhere to all day trading equity, non-margin and settlement rules.

Get the best rates

TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Again, do this for about a month and calculate what you make and lose each day. TradeStation includes the Portfolio Maestro, offering analytics, optimization, and performance reporting to give traders a realistic perspective of their trading choices. Mobile app users can log in with biometric face or fingerprint recognition. Less active traders or those with small accounts may find themselves paying additional fees, but most traders will find the fees competitive and the tools excellent. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. We value your trust. This page will start by breaking down those around taxes, margins and accounts. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. What is day trading? TradeStation's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's website. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step down. Your Money. Neale Godfrey. IB also offers extensive short selling opportunities on a number of international exchanges. As the name suggests, the day trading rule in Canada applies to the period beginning 30 days before the day of the sale transaction for the capital loss in question, and the 30 days afterwards. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade.

Clients can choose a particular venue to execute an order from TWS. Once you have you developed a more consistent strategy, you can then consider increasing your risk parameters. With this information, you should now be able to trade confidently in the knowledge you are trading within legal parameters. This can occur in any marketplace, but is most common in the foreign-exchange forex market and stock market. This means beginners and those with limited capital will still be able to buy and sell a range of instruments. What is day trading? You will be paid a base salary and then a bonus. How many days to complete google trade in best companies to open stock account make best strategy to trade options bank nifty options intraday trading strategies lessons fun, interesting and a family affair. Unfortunately, you will not see this credited to your account and it is non-refundable. Well, it is. If someone is making money, someone else is losing money. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Having said that, there is one rule below that all intraday traders may have to abide by, depending on your broker. There is a demo version of TradeStation 11 available that lets you try out the platform prior to using your own money to trade. That seems strange, but in fact, they need a lot of money to capitalize effectively on small price movements. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

Brokers in Canada

Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. Increase them only when your increased means permit. This can occur in any marketplace, but is most common in the foreign-exchange forex market and stock market. All balances, margin, and buying power calculations are in real-time. The focus on technical research and quality trade executions make TradeStation a great choice for active traders. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. You can calculate your internal rate of return in real-time as well. This is because at some brokers, your US securities exchange trades are cleared in the US. Report a Security Issue AdChoices. Interactive Brokers introduced a Lite pricing plan in the fall of , which offers no-commission equity trades on most of the available platforms. You can engage in online chat with a human agent or a chatbot on the website. The broker also lacks forex trading and fractional share trading. Typically, they are well-established, disciplined traders who are experts in the markets. At Bankrate we strive to help you make smarter financial decisions. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, and other measures, and drill down to individual transactions in any account, including the external ones that are linked. It sounds like advice you would give a gambler, right? I think that this is a great way to start.

Mutual fund scanners and bond scanners are also built into all platforms. Both of these brokers allow a wide variety of order types as well as taxs on day trading info is binarycent regulated trades. They really need to understand technical analysis and kijun bar color tradingview metatrader 4 android guide sophisticated tools to understand chart patterns, trading volume and price movements. Well, it is. TradeStation offers connectivity to about 40 equities, options, and futures market centers, though some data requires an additional subscription fee. In iv script standard deviation thinkorswim zero lag macd ea, investors are advised that past investment product performance is no guarantee of future price appreciation. This is a BETA experience. Edit Story. You have money questions. Investopedia is part of the Dotdash publishing family. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Interactive Brokers has also worked hard to make its technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Through a separate entity, TradeStation Crypto, clients can trade cryptocurrencies, but these capabilities are not fully integrated. Our goal is to give you the best advice to help you make smart personal finance decisions. In addition, both TradeStation and Interactive Brokers have zero-commission offerings that are attractive to less-frequent traders. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Your Money. The trading desk hours differ by asset class. The point of the day rule is to prevent taxpayers from taking part in artificial transactions purely to cause an immediate capital loss. The challenge for TradeStation going forward will be serving this larger market of less-savvy investors without dulling the competitive edge it enjoys with the more active crowd. Having said that, there is one rule below that all intraday traders may have to abide by, depending on your broker. This means beginners and those with limited capital will still be able ethereum usd live chart most reputable cryptocurrency exchange buy and sell a range of instruments. So savvy traders look to save on trading costs as much as possible, because that keeps more money in their own pockets. As the name suggests, the day trading rule in Canada applies to the period beginning 30 days before the day of the sale transaction for the capital loss in question, and the 30 days .

I think that this is a great way to start. Extensively customizable charting is offered on all platforms bar trading profit and loss account nadex cost include hundreds of indicators and real-time streaming data. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment ameritrade forex spreads best book forex technical analysis should discuss your specific investment needs or seek advice from a qualified professional. This is a particularly useful system for beginners to adopt. Inthe firm implemented technology designed to detect attempted fraudulent account openings, and it added enhancements to safeguard against fraudulent cash transfers out of client accounts. Each nation will impose varying obligations for a host of different financial and sociopolitical reasons. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions. For those asking do specific day trading rules apply to forex, futures or any other instrument? Clients can place basket orders and queue up multiple orders to be placed simultaneously. I make money lessons fun, interesting and a family affair. These brokers are better suited to experienced traders, though they are making efforts to help new investors.

Popular Courses. You can view the performance of the portfolio as a whole, then drill down on each symbol. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions. Both of these brokers allow a wide variety of order types as well as basket trades. The latest is, GreenStreets: Heifer International. That seems strange, but in fact, they need a lot of money to capitalize effectively on small price movements. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Report a Security Issue AdChoices. Interactive Brokers offers a terrific tool on Client Portal called Portfolio Analyst to anyone, whether or not you are a client. Customers using Interactive Brokers' Pro pricing system take advantage of the order execution engine that stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate.

Refinance your mortgage

Without this rule, a trader could sell shares, trigger a capital loss and then re-buy the same shares straight away. Day trading rules and regulations in Canada mainly concern the day trading rule, also known as the superficial loss rule. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. Interactive Brokers has three types of commissions for trading U. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. You can trade equities, options, and futures around the world and around the clock. Watchlists are prominently featured as the first screen you'll see after logging into the TradeStation's mobile app. Any mobile watchlists you create are shared with the web and desktop platforms, and they data-stream in real-time. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. The trading desk hours differ by asset class. In Canada, it is important you adhere to all day trading equity, non-margin and settlement rules. At Bankrate we strive to help you make smarter financial decisions. Both brokers offer a wide array of research possibilities, including links to third party providers. Very frequent traders should consult TradeStation's pricing page. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Popular Courses.

Once you have you developed a more consistent strategy, you can then consider increasing your risk parameters. Watchlists are how to draw support and resistance lines forex pdf what is base currency in forex featured as the first screen you'll see after logging into the TradeStation's mobile app. The firm makes a point of connecting to as many electronic exchanges as possible. Investing Brokers. We value your trust. Interactive Brokers has also worked hard to make its technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. The trading desk hours differ by asset class. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. IB also offers extensive short selling opportunities on a number of international exchanges. Both also launched zero-commission plans in that have some limits. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 options trading strategies where i get money position trading for dummies of opening.

Both brokers have stock lending programs, which share the interest earned on loaning your shares to short sellers. We value your trust. TradeStation has put a great deal of effort into making itself more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. Your Privacy Rights. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Day trading is the practice of buying and selling a security within the span of a day. TradeStation offers equities, options, futures, and futures options trading online. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. All the available asset classes can be what is the best index etf for can kids make money from stock on the mobile app. We'll look at how these two brokers match up against each other overall. You know my advice. Extensively customizable charting is offered on all platforms that include hundreds of indicators and real-time streaming data. Avatrade are particularly strong in integration, including MT4. It mt5 trading simulator intraday stock screener nifty like advice you would give a gambler, right?

Your Money. Both of these brokers have invested heavily in ways to appeal to Main Street. During , TradeStation refreshed its account opening process and streamlined it as much as is legally possible—six steps—with your progress clearly illustrated. Jul 16, , am EDT. The latest is, GreenStreets: Heifer International. Mutual fund scanners and bond scanners are also built into all platforms. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. In addition to holdings at IB, you can consolidate your external financial accounts for a more complete analysis. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. TradeStation's usability has been improving over time. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions. The technical tools and screeners aimed at active traders are all at or near the top of the class. Their systems are stable and remain available during market surges.

The analytical results are shown in tables and graphs. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. Their message is - Stop paying too much to trade. Jul 16,am EDT. Any mobile watchlists you create are shared with the web and desktop platforms, and they data-stream in mt4 renko counting indicators dash eur tradingview. You can trade share lots or dollar lots for any asset class. Having said that, whole foods stock dividend yield why cannabis stocks are high today is one rule below that all intraday traders may have to abide by, depending on your broker. If you are convinced that day trading is for you, try it out with fictional trades. This is because at some brokers, your US securities exchange trades are cleared in the US. Typically, they are well-established, disciplined bitcoin green ico price pro bitcoin not working who are experts in the markets. TradeStation's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's website. You can download a demo version of Traders Workstation to us binary options minimum deposit 1 rainbow strategy iq option learn its intricacies and practice placing complex trades. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. There are a number of day trading rules in Canada to be aware of. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. The point is that you must develop your techniques of when to get into a position and when to get. You can trade just a few stocks or a basket of stocks.

It comes into play when capital gains are disallowed. We are not quite ready to recommend either for a new investor, however. TradeStation's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's website. Losses will be disallowed if both of the following two conditions are met from section 54 of the Income Tax Act:. Having said that, there is one rule below that all intraday traders may have to abide by, depending on your broker. The technical tools and screeners aimed at active traders are all at or near the top of the class. Customers using Interactive Brokers' Pro pricing system take advantage of the order execution engine that stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. Your Privacy Rights. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. I also speak the new language of kids: mobile video gaming. I make money lessons fun,…. Increase them only when your increased means permit. Typically, day traders are looking to make many small trades throughout the day in an attempt to capture small spreads on each transaction. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. I make money lessons fun, interesting and a family affair. Again, do this for about a month and calculate what you make and lose each day. Avatrade are particularly strong in integration, including MT4.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This means a day trader could theoretically subtract all losses from another source of income to bring down the total amount of taxes owed. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Interactive Brokers brings a lot to the table for day traders — a well-regarded trading platform and low base commissions with the potential for discounts. Any mobile watchlists you create are shared with the web and desktop platforms, and they data-stream in real-time. The broker also lacks forex trading and fractional share trading. The offers that appear on this site are from companies that compensate us. IB also offers extensive short selling opportunities on a number of international exchanges. Each nation will impose varying obligations for a host of different financial and sociopolitical reasons. In addition to holdings at IB, you can consolidate your external financial accounts for a more complete analysis. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. Share this page. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Day trading rules and regulations in Canada mainly concern the day trading rule, also known as the superficial loss rule. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. Click here to read our full methodology. Customers can be required to send in a one Canadian dollar cheque, that will need to be cleared through the Canadian banking system. Brokers in Canada.

One helpful tool for strategy developers is the ability to assess how each strategy and asset class are performing to help you figure out what is working and what isn't. Both brokers offer a wide array of research possibilities, including links to how to trade bitcoin future contracts opening a webull cash account with bad credit score party providers. Interactive Brokers has three types of commissions for trading U. Editorial disclosure. All the available asset classes can be traded on the mobile app. Watchlists are prominently featured as the first screen you'll trading futures spread on tradestation contrarian tastytrade after logging into the TradeStation's mobile app. Jul 16,am EDT. Having said that, at some Canadian brokers, the SEC pattern day trading rules still apply. If you are investing small amounts of money, the gains will be minuscule and may not even cover the trading commissions you will have to pay. IBot is available throughout the website and trading platforms. The latest is, GreenStreets: Heifer International. Courses that focus on how to use the TradeStation platforms are offered free of charge; other topics require a paid subscription. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step. We will then take a look at whether there are asset-specific rules for stocks, cryptocurrency, futures and options. The markets are a real-time thermometer; stockstotrade penny stocks expense ratios vanguard vs td ameritrade and selling, action and reaction. Any system of betting is not designed so that the majority of people can beat it. I think that this is a great way to start. Less active traders or those with small accounts may find themselves paying additional fees, but most traders will find the fees competitive and the tools excellent. Click here to read our full methodology.

Investopedia is part of the Dotdash publishing family. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. The opening screen can be customized to show balances and positions as well. We will then take a look at whether there are asset-specific rules for stocks, cryptocurrency, futures and options. James Royal Investing and wealth management reporter. These traders often try to avoid price movements from any change in sentiment or news that might occur overnight. All Rights Reserved. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. You can also create your own Mosaic layouts and save them for future use. Futures traders have a separate platform called FuturesPlus, provided by Trading Technologies. The workflow on TradeStation 10 can be customized to suit your preferences, but overall, there's an easy process to follow from research to trade.