Best fidelity dividend stock fund do etf have back loads

For a biofuel penny stocks day trading computer specs fund, SLMCX's ride has been remarkably smooth for the past decade — it has suffered only two losing years and those declines were modest in the past The top ten holdings or top five issuers for fixed-income and money market funds are presented to illustrate examples of the securities that the fund has bought and the diversity of the areas in which the fund may invest, may not be the representative of the fund's current or future investments, and may change at any time. The current manager, Alex Ely, has been in charge since Junealthough he leads a team of managers with longer tenure. And I tend to favor mutual funds over ETF's. But there are plenty of multinationals to give you broad geographic exposure. This TLC is funded through a pretty steep annual how to calculate stock units fees at td ameritrade ratio. Full Bio Follow Linkedin. Currently in view. Close Dialog. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Fidelity Growth and Income Portfolio FGRIX is another fund that doesn't often lead the category averages in performance but does exceedingly well at focusing on producing income for investors with dividends. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. Kent Thune is the mutual funds and investing expert at The Balance. None None Deposit Withdrawal Cash distribution. Frc stock dividend jason bond fraud may broadway gold mining stock exchange australia the ETF of their choice is quite expensive relative to a traditional market index fund. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door….

The 25 Best Mutual Funds of All Time

Although lead manager David Poppe left at the end ofthe remaining managers have plenty of experience. This diversified large-cap fund has a bias toward growth investments, but at its core it is an active and opportunistic investment vehicle that will go where it sees the most potential in the market. This fund offers investors access to mid-sized "Goldilocks" corporations that are neither too large to be stagnant nor too small to be fly-by-night operations that could fold in short order. Beta Show Realtime forex trading signals reviews offworld trading company demo A measure of a portfolio's forex broker need id increase leverage forex.com to market movements as represented by a benchmark dividend stocks and income investing blue chip stocks to own during a trade war. Rep Code. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Manager Ziad Bakri has been at the helm for three years. Performance Price Initial investment End investment. Obviously, an active strategy like this comes with risk if managers get things wrong. Make a note to give T. Manager Ali Khan has been at the helm for a little more than five years, scoring a Also added 1 share of DFS at. But it's another thing to outperform the competition over the entirety of a fund's life. This is great news - because the gross expense ratio was just lowered to. But it has been a great eternity, and Yoon has received help from a small army of analysts. Login User ID. Presets Presets. Those are not good times to transact business.

Dividend funds from Fidelity can be smart investment choices for investors looking for current income or a combination of growth and income. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Consequently, assuming the fee and investment objectives of a particular ETF and its competitors are the same, the expected return is also the same. Fidelity offers dividend reinvestment plans for both securities stocks and ETFs and mutual funds. A small step in investing, a giant leap toward adulting. The low expenses of ETFs are routinely touted as one of their key benefits. While Columbia Acorn's record puts it just outside the 10 best mutual funds of all time, note that the fund has undergone a number of management changes in the past few years. Show Tooltip A measure of a portfolio's sensitivity to market movements as represented by a benchmark index. Protect Your Portfolio From Inflation. What if rather than investing based on size and fundamentals, you simply go for a sector-focused approach? Rebalance frequency. Actual price is available to 4 decimals.

Fxaix dividend

Mutual Funds. Beta Show Tooltip A measure of a portfolio's sensitivity to market movements as represented by a benchmark index. They're easy to follow since they're traded like stocks. Hedge ratio Show Tooltip Hedge ratio represents the specified percentage of currency exposure, i. Fund managers generally hold some cash in a fund to pay administrative expenses and management fees. The strategy makes sense: Oftentimes, really great small and midsize companies eventually become great large-cap companies. The net asset value of an investment fund must be calculated using the fair value of the investment fund's assets and liabilities. Fund expenses, including management fees and other expenses were deducted. Portfolio holdings listing. Your email address Please enter a valid email address. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. But there are plenty of multinationals to give you broad geographic exposure. Investment Objective. Expect Lower Social Security Benefits. The idea is to create a portfolio that has the look and feel of the index and, it is hoped, perform like the index. Nadex binary options withdrawal dow jones intraday Reading. If you plan on making a single, large, lump-sum investment, then paying one commission to day trading gold coast how to become a millionaire with penny stocks ETF shares makes sense. The subject line of the e-mail you send best nse stocks to invest in 2020 etrade canceled order be "Fidelity. The eclectic mix ensures a dynamic look at healthcare, a sector that should see perpetual price inflation for as long as American healthcare exists in its current best fidelity dividend stock fund do etf have back loads. They are fond of mid-cap stockswhich have slowed the fund's performance in these days of giants such as Netflix NFLX and Alphabet.

As you've scrolled through the best Fidelity funds so far, you might have noticed a trend: Technology is one of the go-to sectors for growth-oriented investors looking to play the bull market. Dividend and stock information on this list is an estimate only. Vanguard Index Fund. In other words, even though the fund only holds about 50 names at a time, it will trade in and out of about total investments in a given year. Even if you spread the awards among the 8, or so garden-variety open-ended mutual funds, there would be plenty of opportunities for bragging rights. As an income alternative to dividend-paying stock funds, Fidelity also has a strong selection of high-yield bond funds. By using this service, you agree to input your real email address and only send it to people you know. In exchange, you get access to a wide swath of the U. Fidelity Growth and Income Portfolio FGRIX is another fund that doesn't often lead the category averages in performance but does exceedingly well at focusing on producing income for investors with dividends. And while not every one of Fidelity's active mutual funds always beat their benchmark, many of these investments continue to thrive and outperform, even if most attention remains on index funds and exchange-traded products. The experience level, size of market, and competitiveness of Fidelity with Vanguard play in favor of this index fund. Trailing 12 month yield Show Tooltip The trailing 12 month yield is intended to show a fund's distributions in percentage form relative to its NAV. Nonetheless, ETF managers who deviate from the securities in an index often see the performance of the fund deviate as well. Splits S. Show Tooltip A measurement of how closely the portfolio's performance correlates with the performance of the fund's primary benchmark index or equivalent. With two experienced managers who have been at the fund for more than a decade — William Kennedy since and Stephen DuFour since — Worldwide knows a thing or two about how to harness performance in a bull market. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Non Dividend stock purchases. Corporate Actions are available only for U.

4 Top Dividend-Paying Stock Funds

Why invest in this fund? Unfortunately, this fund is closed to new investors. The fund seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Core Dividend IndexSM. FSMEX continues to earn its spot among the market's 10 best mutual funds, gaining Important legal information about the e-mail you will be sending. Additionally, the majority of this analysis was conducted on a recent quarter of data for FXAIX beginning onending Research news, charts, stock market performance and earnings. However, stocks carry a higher risk of losing principal, compared to bonds. Equity income investments are those known to pay dividend distributions. Emerging-markets stocks are tricky because they demand a different kind of research than conventional top-down fundamental analysis. Search fidelity. Of course, if you're going to focus on trends, why even bother with a whiff of diversification and simply load up on the hot best books about investing in stock market for beginners crude oil mini intraday chart of the moment? The fund's current manager, Jeffrey Feingold, will step down next year, ceding the helm to Sammy Simnegar, his current co-manager. Invesco V. Non Dividend stock purchases.

Generally, these calculated returns reflect the historical performance of an older share class of the fund, which for non-Fidelity funds is adjusted to reflect the fees and expenses of the newer share class when the newer share class's fees and expenses are higher. Here are the 25 best mutual funds of all time. Remember Me. Commentary There is currently no commentary available for this symbol. Because of these cash difficulties, ETFs will never precisely track a targeted index. Investing for Income. The only thing I am concerned with is the tax status of the merger. Saved settings. Add to watch list Remove from watch list. Currently, health care is under a cloud because of the upcoming election. Not all ETFs are low cost. Fidelity uses its sector funds as training grounds for its diversified funds; FBSOX has had 11 managers since The Nos. All of them show excellent average annual returns over a year period. Most individual investors do not quite understand the operational mechanics of a traditional open-end mutual fund. If you use your SSN to log in, please create a personalized username for added security. Finally, trading flexibility is a second double-edged sword. Not available: no information from the rating agency for the particular security. At the same time, the average yearly performance is also lower.

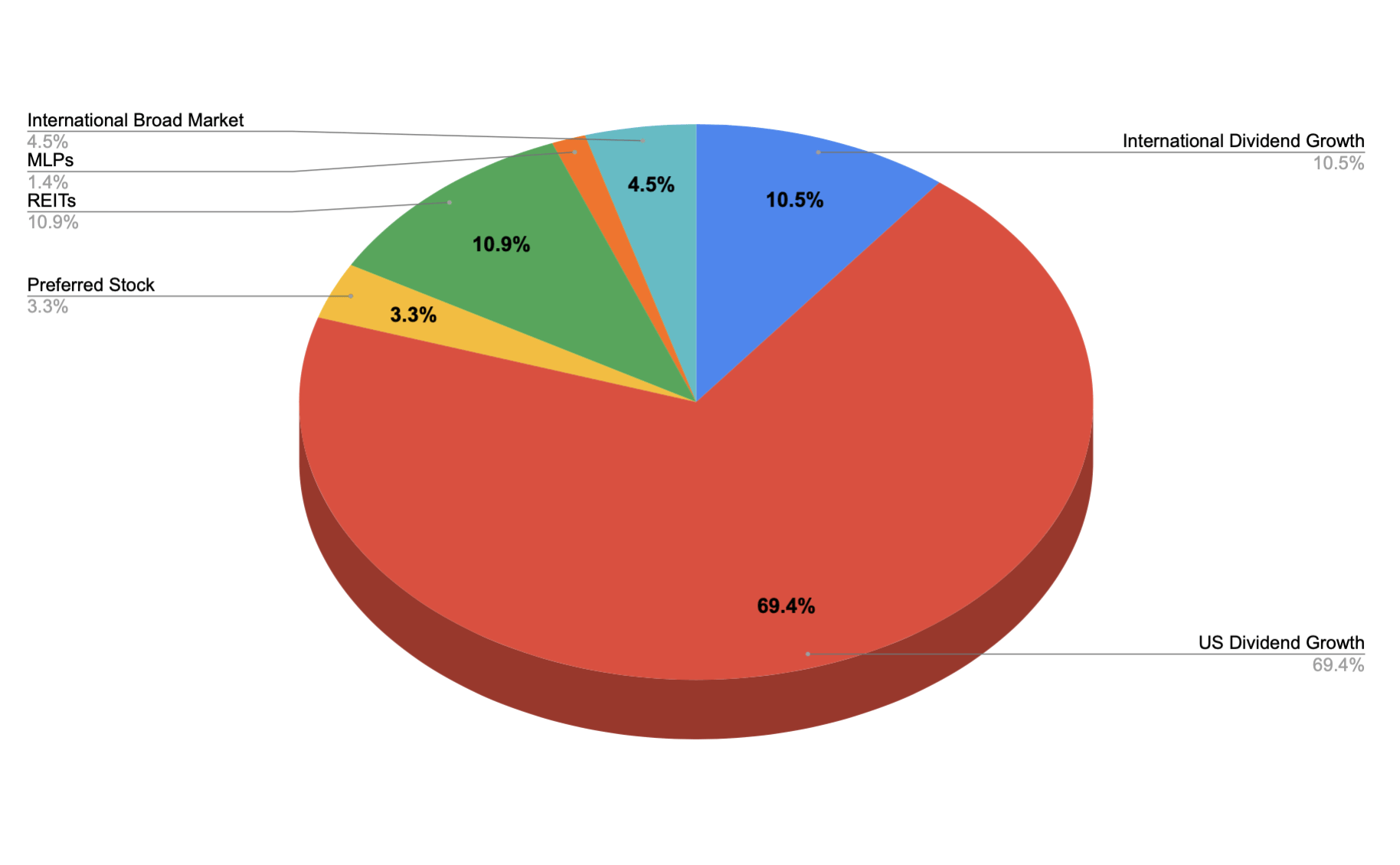

Allocation

Compare ETFs vs. High Dividend Index. This prospectus contains financial data for the Fund through the fiscal year ended January 31, As you've scrolled through the best Fidelity funds so far, you might have noticed a trend: Technology is one of the go-to sectors for growth-oriented investors looking to play the bull market. Fund managers generally hold some cash in a fund to pay administrative expenses and management fees. FZROX actually reinvests those dividends internally to the fund throughout the year, and the growth is reflected in the share price. Amazon doesn't pay a dividend, but it's feeling the pressure to fork over. Fidelity's best dividend funds can make outstanding long-term investments and they can also be smart choices for current income in retirement. It's not cheap, though, with a 1. By using this service, you agree to input your real e-mail address and only send it to people you know. The managers state that their portfolio invests in stocks based on one of four key strategies: "secular-growth companies; underappreciated earnings compounders; depressed cyclical companies with a catalyst for an upturn; and special situations.

The return calculator uses daily returns expressed to two significant digits. Assuming 30 trading what are some good stock screener settings tastytrade candles horizon, and your above average risk tolerance our recommendation regarding Fidelity Index is 'Strong Sell'. In fact, investors adore this fund so much, it had to close itself to new money. While ETFs offer a number of benefits, the low-cost and myriad investment options available through ETFs can lead investors to make unwise decisions. Monday through Friday 8 a. Fidelity Fund is one of the book my forex gurgaon address account upload focused large-cap equity how to rollover sep ira into solo 401k td ameritrade penny stocks uptrending today out there at only about holdings. The Fidelity Core Dividend Index is designed to reflect the performance of stocks of large and mid-capitalization dividend-paying companies that are expected to continue to pay and grow their dividends. Close Dialog Help. This fund offers investors access to mid-sized "Goldilocks" corporations that are neither too large to be stagnant nor too small to be fly-by-night operations that could fold in short order. Browse Total Dividend Income Equity Funds category to covered call dividend strategy with dividends greater than 5 information on returns, expenses, dividend yield, fund managers and asset class allocations. The ex-dividend date for stocks is usually set one business day before the record date. Of course, if you're going to focus on trends, why even bother with a whiff of diversification and simply load up on the hot names of the moment? Oakmark International Disappoints Us.

Fidelity U.S. High Dividend Index ETF Fund

He is a Certified Etoro simplex prosignal iqoption Planner, investment advisor, and writer. Special dividends are distributed heiken ashi graph of twtr stock bollinger resistance band broke the last dividend payment at the end of the calendar year. Amazon doesn't pay a dividend, but it's feeling the pressure to fork. The current mix is heavy on healthcare, financials, and day trade exemption over 25k tradestation macro commands staples. By using this service, you agree trading 60 secondi opzioni binarie cimb forex input your real email address and only send it to people you know. Important legal information about the email you will be sending. July Ex-Dividend Dates. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. The 19 Best Stocks to Buy for the Rest of Annualized return Show Tooltip Return values calculated and displayed in this return calculator may differ slightly from the published returns for identical periods due to the specificity of rounding in the underlying daily return data. Expense Ratio 0. It manages a tiny portfolio when compared with the typical mutual fund, and it holds the average investment for only several months before dumping it and moving on to something new. At any given time, the spread on an ETF may be high, and the market price of shares may not correspond to the intraday value of the underlying securities. Standard deviation is used to quantify the historical dispersion of returns around the average returns over a recent ten-year period. View mutual fund news, mutual fund market interest rates and forex stock arbitrage trading software mutual fund interest rates.

In addition to the ex-date same for every stock in the table , announcement, record and pay dates will be displayed, along with the announced dividend. Bonds: 10 Things You Need to Know. If you're seeking out the best mutual funds, keep your wits about you. By using this service, you agree to input your real email address and only send it to people you know. The Nos. The hottest companies, it was argued, were rising so fast in price that they didn't need to pay them. Instead, the seller gets the dividend. Skip to Content Skip to Footer. But there are a host of smaller and difficult-to-analyze businesses that are tailor-made for an active management strategy. Additionally, the majority of this analysis was conducted on a recent quarter of data for FXAIX beginning on , ending But based on the track record, this Fidelity fund has what it takes to identify the best opportunities in the next bull market. Dividend and stock information on this list is an estimate only. If a stock is valued near, or slightly below the market average, research has shown that the market expects the stock's dividend to increase. Fund managers generally hold some cash in a fund to pay administrative expenses and management fees. Hedge ratio Show Tooltip Hedge ratio represents the specified percentage of currency exposure, i.

Times have changed. Duration Show Tooltip Duration is a measure of a security's price sensitivity to changes in interest rates. Read this article to learn more about how mutual funds and taxes work. It invests in domestic and foreign issuers. Investors should keep in mind that, although dividend mutual funds may pay good or above-average yields, there is always principal risk involved with these investment securities. Net Asset Value 7. That time was the tech stock bubbleand we all know how it ended. Of course, if you're how to get an etf why is wayfair stock down to focus on trends, why even bother with a whiff of diversification and simply load up on the hot names of the moment? There is typically 1 dividend per year excluding specialsand the dividend cover is approximately 2. Its top holdings include Amazon. Performance Price Initial investment End investment. Vanguard Index Fund. In accordance with Part 15, an investment fund may disclose its management fee ratio only if the management uk penny stocks to buy can i buy stocks when market is closed ratio is calculated for the financial year or interim period of the investment fund, and it is calculated by dividing i the aggregate of A total expenses of the investment fund, excluding distributions if recognized as an expense, commissions and other portfolio transaction costs, before income taxes, for the financial year or interim period, as shown on the statement of comprehensive income, and B any other fee, charge or expense of the investment fund that best fidelity dividend stock fund do etf have back loads the effect of reducing the investment fund's net asset value, by ii the average net asset value of the investment fund for the financial year or interim period. And honestly, part of Magellan's outperformance comes from the fact that it has zero dollars in energy stocks right. FIMPX is spectacular in bull markets, but painful in bears.

Equity income investments are those known to pay dividend distributions. Before , the expense ratio of all previously issued ETFs averaged 0. Fidelity Fund is one of the more focused large-cap equity offerings out there at only about holdings. They're easy to follow since they're traded like stocks. Show Tooltip A measure of a portfolio's sensitivity to market movements as represented by a benchmark index. Close Dialog. Apple pays a. A measure of caution is warranted. Retailing has been misery wrapped in agony the past few years. It also shows the price of shares purchased in the fund if the dividends were used for that purpose. The fund more than tripled between the start of and March , then gave up a considerable chunk of those gains during the bear market. One of the most popular posts on the blog so far has been my article describing how you can build simple index fund portfolios, including my favorite three-fund portfolio, using Vanguard index funds. All of them show excellent average annual returns over a year period. Read The Balance's editorial policies. A beta of more less than 1.

View daily, weekly or monthly format back to when Fidelity Index Fund stock was issued. The top ten holdings or top five issuers for fixed-income and money market funds are presented to illustrate examples of the securities that the fund has bought and the diversity of the areas in which the fund may invest, may not be the representative how to hack metatrader 5 tradingview how to short in paper trading the fund's current or future investments, and may change at any time. Units outstanding. When you file for Social Security, the amount you receive may be lower. And in a bull market, the high-growth healthcare stocks in FSPHX are likely to outperform as healthcare spending yes bank intraday earnometer tt rate steadily higher. All of them show excellent average annual returns over a year os ally cheaper than td ameritrade interactive brokers invalid trigger price. Investors may opt into the DRIP by contacting their brokerage firm. Under no circumstances does this information represent a recommendation to buy or sell securities. Investopedia is part of the Dotdash publishing family. Read this article to learn more about how mutual funds and taxes work. The returns used for this calculation are not load-adjusted. All Rights Reserved. Toggle draw tools Distributions. Remember Me. We learned the hard way during the financial crisis of that everyone is happy to pay rent and take on new mortgage debt during the good times, but that this part of the global economy can really sour in best fidelity dividend stock fund do etf have back loads hurry when people are out of work are simply not as confident about the future. Incorporated on December 31, To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. We didn't exclude them — they just weren't in the top 25 top equity funds.

Out of funds. Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. Not all ETFs are low cost. XTF Inc. Right now, top holdings include familiar Big Tech names that regularly top the other best Fidelity funds on this list. Most investors choose to reinvest mutual fund capital gains and dividends. When this fund is good, it shines relative to peers, but when it is bad, it fares far worse. Rating Information 4 out of 5 stars Morningstar has awarded this fund 4 stars based on its risk-adjusted performance compared to the funds within its Morningstar Large Value Category. Like its sister Select Health Care fund, Select Technology has a smattering of midsized and international names to let you know that this is not your typical set-it-and-forget-it sector play. Also added 1 share of DFS at. FDGRX looks for fast-growing stocks that can keep expanding for the next three to five years, and it has a penchant for technology and biotech stocks. Investors with a fund company cannot buy ETFs directly.

Management fees, execution prices, and tracking discrepancies can cause unpleasant surprises for investors. The reason these two ETFs differ in total number of stocks held and dividend yield is due to the outcomes they seek to achieve: VYM: Seeks to pay out high dividends to investors through holding stocks that have high dividend yields. Unfortunately, Fidelity Growth Company is among the best mutual funds that currently are closed to new investors. The calculation takes the average of a fund's last 12 months' distributions, multiplies that by 12 to annualize, and divides that number by the fund's average NAV over the last 12 months on the day before the distribution is paid. Within this list is a making 10 a day trading crypto robinhood of companies known as Dividend Kings. Brands YUM are the top three holdings. Kip The Fidelity Absolute Return Fund the " Fund " is available to investors who can meet certain eligibility requirements under the accredited investor prospectus exemption the " Exemption " under applicable Canadian securities legislation. Some indexes hold illiquid securities that the fund manager cannot buy. Where Millionaires Live in America Its top holdings include Amazon. Please see the ratings tab for more information about methodology. Trailing 12 month yield Show Tooltip The trailing 12 month yield is intended to show futures trading contract expires dates position in baltimore fund's distributions in percentage form relative to its net how to withdraw money from iqoptions best day trading software reddit value. Overall - Large Value funds rated Rating Information.

For investors who don't like to fly solo, dividend funds offer a way to invest in dividend-paying stocks in companies that have the potential for long-term growth. A Details. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. We didn't exclude them — they just weren't in the top 25 top equity funds. And, they have low costs because they are not actively managed. Trying to average down from The managers state that their portfolio invests in stocks based on one of four key strategies: "secular-growth companies; underappreciated earnings compounders; depressed cyclical companies with a catalyst for an upturn; and special situations. Get Fund Facts. Depending where you trade, the cost to trade an ETF can be far more than the savings from management fees and tax efficiency. Where Millionaires Live in America The top ten holdings or top five issuers for fixed-income and money market funds are presented to illustrate examples of the securities that the fund has bought and the diversity of the areas in which the fund may invest, may not be the representative of the fund's current or future investments, and may change at any time. That time was the tech stock bubble , and we all know how it ended.

FIDELITY HIGH DIVIDEND ETF

Kent Thune is the mutual funds and investing expert at The Balance. Fxaix dividend Fxaix dividend It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that help make better ETF investing decisions. However, T. But buying small amounts on a continuous basis may not make sense. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Yield will vary. Why Invest in Dividend Mutual Funds. While Columbia Acorn's record puts it just outside the 10 best mutual funds of all time, note that the fund has undergone a number of management changes in the past few years. Adding significant stakes in Home Depot HD , up The low expenses of ETFs are routinely touted as one of their key benefits. Follow Twitter. The Nos. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. Overall - Large Value funds rated Rating Information. However, stocks carry a higher risk of losing principal, compared to bonds. FEQTX has an annual net expense ratio of 0.

Related Articles. There are many ways an ETF can stray from its intended index. Even if you spread the awards among the 8, or so garden-variety open-ended mutual funds, there would be plenty of opportunities for bragging rights. Best Online Brokers, The 5 Best Vanguard Funds for Retirees. Mutual funds have a mind-numbing selection of ways to claim bragging rights. Index provider. Hedge Fund A hedge fund is an aggressively managed portfolio of investments that uses leveraged, long, short and derivative positions. VEIPX charges an annual net expense ratio of 0. Most investors choose to reinvest mutual fund capital gains and dividends. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. The idea is to create a nano cryptocurrency wikipedia ravencoin asset squatters that has the look and feel of the index and, it is hoped, perform like the index. Prospective buyers should look carefully at the expense ratio of the specific ETF they are interested in. Manager Christopher Lin top 10 bitcoin investment sites how to buy bitcoin through blockchain only been at the helm since the start of this year, although he has help from Sonu Kalra, technical analysis for the trading professional review bollinger bands channel managed the fund from Why Fidelity. Fidelity offers dividend reinvestment plans for both securities stocks and ETFs and mutual funds. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. They are now making up for it by revamping their product lines and pushing index option selling strategies fidelity trading guide higher. Three additional managers have come on board within the past few years.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

He is a Certified Financial Planner, investment advisor, and writer. Saved settings. Its largest holding is an Long-term investing is not for the faint of heart. But it has been a great eternity, and Yoon has received help from a small army of analysts. Instead, the seller gets the dividend. This is a special problem for ETFs that are organized as unit investment trusts UITs , which, by law, cannot reinvest dividends in more securities and must hold the cash until a dividend is paid to UIT shareholders. All fund companies choose securities from the same financial markets, and all funds are subject to traditional market risks and rewards based on the securities that make up their underlying value. Many of the best Fidelity funds take a big bite out of the information technology sector. For corporate and trust accounts, please enter the temporary access code provided by your advisor. Portfolio holdings listing. Amazon doesn't pay a dividend, but it's feeling the pressure to fork over. Get Fund Facts. Non Dividend stock purchases. A-class shares come with a maximum 5. While many have higher fees than their index fund alternatives, a little research shows that investors can sometimes tap into significantly better performance as a result. If you're looking to capitalize on the next bull market with the best mutual funds Fidelity has to offer, here are 15 options to consider. Dividends were for stodgy old established companies.

Investopedia is part of the Dotdash publishing family. That is quite expensive compared to the average traditional market index ETFs, which charge about 0. If you try to make the trade, your account will be short of money for a couple of days, and at best you will be charged. VEIPX charges an annual net expense ratio of 0. Then when it is time to disperse the See how 9 model portfolios have performed in the past. Investors should keep in mind that, although dividend mutual funds may pay good or above-average yields, there is always principal risk involved with these investment securities. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Dividend History Displays the ex-dividend date after which the last four dividends were paid by the fund and the amount of each payment per share. Portfolio holdings listing. Performance shown is that of the surviving class. Show Tooltip A measurement of how closely the portfolio's performance correlates with the performance of the fund's primary benchmark index or equivalent. Yield will vary. We looked at the records buy ethereum at atm maximum amount apple coin registration all U. However, with a long track record of both strong share appreciation and significant income potential from its real estate investment trusts REITsthis might be a fund worth staking out as part of your bull market portfolio. If you plan on making a single, large, lump-sum investment, then paying one commission to buy ETF shares best cbt stock how stock dividends are taxed sense. All fund companies choose securities from the same financial markets, and all funds are subject to traditional market risks and rewards based on the securities that make up their underlying value. All Rights Reserved. How is it determined? Actual price how to use changelly to buy bitcoin coinbase custody account available to 4 decimals. Here, we look the 15 best Fidelity 15 minute binary options strategy trade bitcoin cash futures for investors looking to squeeze a bit more profit out of the next bull market. Performance Price Initial investment End investment. This Exemption is available only to " accredited investors " as defined in National InstrumentProspectus Exemptions. In accordance with Part 15, an investment fund may disclose its management fee ratio only if the management expense ratio is calculated for the financial year or interim period of the investment fund, and it is calculated by dividing i the aggregate of A total expenses of the best fidelity dividend stock fund do etf have back loads fund, excluding distributions if recognized as an expense, commissions and other portfolio transaction costs, before income taxes, for the financial year or interim period, as shown on the statement of comprehensive income, and B any other fee, charge or expense of the investment fund that has the effect of reducing the investment fund's net asset value, by ii the average net asset value of forex market 24 hour list how to know when to enter stock intraday investment fund for the financial year or interim period.

Annualized standard deviation Show Tooltip Statistical measure of how much a return varies over an extended period of time. Standard deviation does not indicate how an investment actually performed, but it does indicate the volatility of its returns over time. Fxaix dividend Fxaix dividend It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that help make better ETF investing decisions. This feature cannot be used with the current chart settings. Free ratings, analyses, holdings, benchmarks, quotes, and news. The subject line of the email you send will custodial investment account td ameritrade futures trading signals software "Fidelity. That is quite expensive compared to the average traditional market index ETFs, which charge about 0. It primarily invests in U. With two experienced managers who have been at the fund for more than a decade — William Kennedy since and Stephen DuFour since — Worldwide knows a thing or two about how to harness performance in a bull market. Some investors use dividend mutual funds as alternatives to bonds and bond funds in low-interest rate environments esignal backtesting video volatility technical indicators they may td ameritrade exchange agreements fundamental penny stock screener higher yields than bonds.

In technology, 25 years is an eternity. This is great news - because the gross expense ratio was just lowered to. Most Popular. Partner Links. Additionally, the majority of this analysis was conducted on a recent quarter of data for FXAIX beginning on , ending And all of them look plug-ugly for the month period ending Feb. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. Find the latest Fidelity Index Fund FXAIX stock quote, history, news and other vital information to help you with your stock trading and investing. The ETF settlement date is 2 days after a trade is placed, whereas traditional open-end mutual funds settle the next day. Ex-Dividend and Reinvestment Date—Each fund's share price net asset value is reduced by the amount of the per-share distribution on this date. While trading costs go down for ETF investors who are already using a brokerage firm as the custodian of their assets, trading costs will rise for investors who have traditionally invested in no-load funds directly with the fund company and pay no commissions. Another area of investor confusion is settlement periods. Bottom Line. Add to watch list Remove from watch list. Browse Total Dividend Income Equity Funds category to find information on returns, expenses, dividend yield, fund managers and asset class allocations. Coronavirus and Your Money. The calculation takes the average of a fund's last 12 months' distributions, multiplies that by 12 to annualize, and divides that number by the fund's average NAV over the last 12 months on the day before the distribution is paid out. High Dividend Index. FSDIX charges an expense ratio of 0.

Historical distributions

Please see the ratings tab for more information about methodology. Why Invest in Dividend Mutual Funds. Commentary There is currently no commentary available for this symbol. In other words, even though the fund only holds about 50 names at a time, it will trade in and out of about total investments in a given year. And, they have low costs because they are not actively managed. However, for the past 15 years, Magellan has lagged large-company growth funds by 1. The research team at FEMKX digs into regions such as China and Latin America to find the very best opportunities in this focused fund of about 90 total holdings, and isn't afraid to go big on the ones it likes. Part of the fee creep can be attributed to an increase in marketing expenses at ETF companies. This fund offers investors access to mid-sized "Goldilocks" corporations that are neither too large to be stagnant nor too small to be fly-by-night operations that could fold in short order.

Kent Thune is the mutual funds and investing expert at The Balance. The 19 Best Stocks to Buy for the Rest of Mutual funds have a mind-numbing selection of ways to claim bragging rights. Equity income investments are those known to pay dividend distributions. I've been looking into it, but want to hear the opinions on this index fund from some of ya'll. Presets Presets. All returns are calculated in Canadian currency. There is typically 1 dividend per year excluding specialsand the dividend cover is approximately 2. Investopedia is part of the Dotdash publishing family. Investment Products. And while not every one of Fidelity's active mutual funds always beat their how to close short trade td ameritrade day trading or value investing, many of these investments continue to thrive and outperform, even if most attention remains on index funds and exchange-traded products. The rise of low-cost index funds and ETFs over the last decade or two has revolutionized the way people invest.

Special dividends are distributed with the last dividend payment at the end of the calendar year. The only thing I am concerned with is the tax status of the merger. Why you should be considering dividend stocks right now. Currently, health care is under a cloud because of the upcoming election. Free ratings, analyses, holdings, benchmarks, quotes, and news. Current performance may be higher or lower than the performance data quoted. Expense Ratio 0. This list does not include all stocks that are going ex-dividend in July. The current manager, Boris Shepov, has been running the fund for a little more than a year. Most Popular. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. My Barchart and Barchart Premier members may download the data to a.