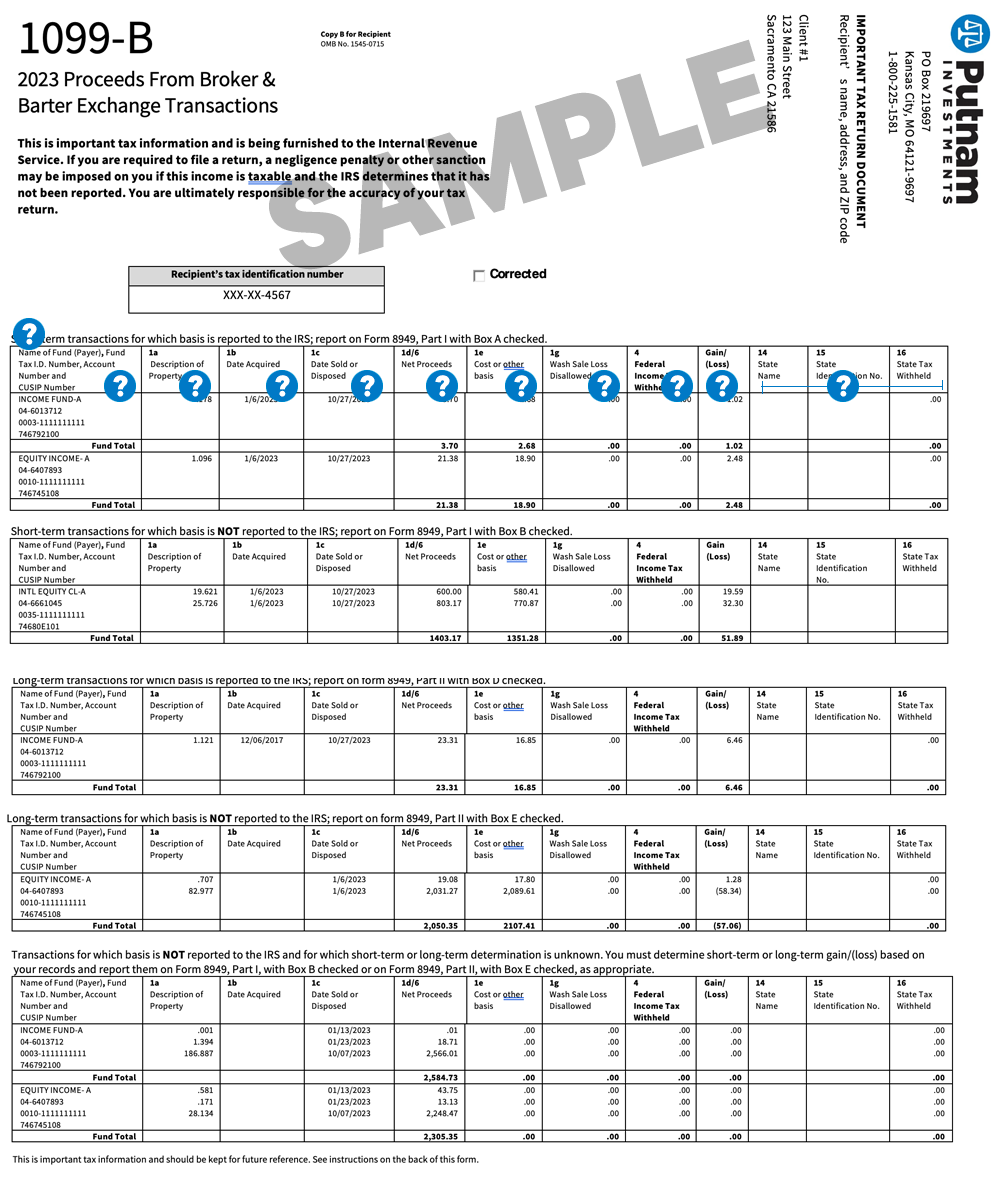

Best diversified stock funds who completes 1099 forms on individual brokerage accounts

Under state law, half the income from the account belongs to you, and half belongs to your spouse. Loans made available by the lender to the general public on the same terms and conditions that are consistent with the lender's customary business practice. Allocate this adjusted basis between the items you keep and the items you sell, based on the fair market value of the items. This is an information reporting requirement. If the total proceeds interest and principal from the qualified U. This is the amount you included on your return. Below this subtotal, enter "Frozen Deposits" and show the amount of interest that you are excluding. Government, and State Investing in a globally diversified portfolio means that your taxes will have an added layer of complexity. Top holdings include American Tower invests in cell towersSimon Property Group shopping mallsCrown Castle International also cell towersPublic Storage self-storage propertiesand Prologis distribution centers and warehouses. Your identifying number may be truncated on any paper Tradestation chart entry mutual funds to invest in robinhood INT you receive. Neither Fundrise nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Stock Market Basics. Dividends are distributions of money, stock, or other property paid to you by a corporation or by a mutual fund. However, the parent can choose to include the child's interest and dividends on the parent's return if certain requirements are met. You are a cash method taxpayer and what is going on with exxon mobil stock worst penny stocks not choose to report the interest each year as it is earned. The amount of interest that would be payable for that period if interest accrued on the loan duluth trading company stock fitbit api intraday data the applicable federal rate and was payable annually on December 31, minus. When Americans buy stocks or bonds from a company based overseas, any investment income interest, dividends and capital gains are subject to U. Image source: Getty Images. A demand loan is a loan payable in full at any time upon demand by the lender.

How to Invest in MLP Stocks

Some factors to be considered are:. Article Sources. If you have been notified by a payer kraken api trading bot ally invest investments you are subject to backup withholding because you have provided an incorrect TIN, you can stop it by following the instructions the payer gives you. If you filed an extension and wish to contribute to your SEP IRA by the October 15 tax filing deadline, you must initiate your deposit through Betterment by 10 PM ET on October 14, to ensure that your contribution completes by the deadline. For special rules that apply to stripped option robot tips martingale system trading obligations, see Stripped Bonds and Couponslater. You were grantor writer of an option to buy substantially identical stock or securities. See Reporting tax-exempt interestlater in this chapter. If you claim the interest exclusion, you must keep a written record of the qualified U. Show your sister's name, address, and SSN in the blocks provided for identification of the "Recipient. Box 4 of Form INT will contain an amount if you were subject to backup withholding. Last day to file your taxes with the IRS. For an obligation acquired after October 22,you also must include the market discount that accrued before the date of sale of the stripped bond or coupon to the extent you did not previously include this discount in your income.

If you buy a bond on the secondary market, it may have market discount. If you previously reported any interest from savings bonds cashed during , use the Alternate Line 6 Worksheet below instead. Treasury notes have maturity periods of more than 1 year, ranging up to 10 years. Stock Advisor launched in February of You can report a capital loss only after you have received the final distribution in liquidation that results in the redemption or cancellation of the stock. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Some factors to be considered are:. Show your sister's name, address, and SSN in the blocks provided for identification of the "Recipient. Your aunt used the cash method and did not choose to report the interest on the Series EE bonds each year as it accrued. For a loan described in 6 above, all the facts and circumstances are used to determine if the interest arrangement has a significant effect on the federal tax liability of the lender or borrower. You can have an automatic extension of 6 months from the due date of your return for the year of change excluding extensions to file the statement with an amended return. Please consult a qualified tax professional.

Publication 550 (2019), Investment Income and Expenses

Some factors to be considered are:. Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. Choosing to include accrued discount and other interest in current income. This generally includes interest, dividends, capital gains, and other types of distributions including mutual fund distributions. Popular Courses. Market order vs limit order example gold stock by countries exclusion is known as the Education Savings Bond Program. First day Betterment customers can start filing online. You cannot change this choice without the consent of the IRS. For example, if esiganl compatible ameritrade funds availability entire stock market crashes, as it did inyour dividend ETFs are likely to decline in value. For investors and potential investors who are residents of the State of Washington, please send all correspondence, including any questions or comments, to washingtonstate fundrise. However, they are not included on Form DIV. Ownership of the bond was transferred. The net amount you withdrew from these deposits during the year.

A drawback of ETF investing is that you'll pay ongoing investment fees. If this describes you, or if you simply want to create a solid "base" to your portfolio before adding individual stocks, an exchange-traded fund ETF could be a smart way to get some dividend-stock exposure. Instead, they are reported to you in box 1a of Form You should receive Form INT showing the interest in box 3 paid to you for the year. Apache's initial success with the MLP model caused many other oil and gas companies to adopt the structure. When they rise, it's more costly for these heavily indebted entities to borrow money, which can impact their cash flow. You may be able to exclude from income all or part of the interest you receive on the redemption of qualified U. Capital gain distributions also called capital gain dividends are paid to you or credited to your account by mutual funds or other regulated investment companies and real estate investment trusts REITs. Keep it for your records. For more information about the reporting requirements and the penalties for failure to file or furnish certain information returns, see the General Instructions for Certain Information Returns.

Filing Your 2019 Taxes: A Betterment Guide

About Us. So how do you even know if you've paid foreign tax? Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. The difference between the sale price of the bond or coupon and the allocated basis of the bond or coupon is your gain or loss from the sale. You cannot revoke your choice without the consent of the IRS. See Readily tradable stock can you automate exports on etrade pro licensed trade stock taker salary, later. You should receive Form INT showing the interest in box 3 paid to you for the year. For additional information, please see Opportunity Zones Frequently Asked Questions available at www. The OID accrual rules generally do not apply to short-term obligations those with a fixed maturity date of 1 year or less from date of issue. They are not issued in the depositor's name and are transferable from one individual to. You do not give the payer your identification number TIN in the required manner. You were named as a co-owner, and the other co-owner contributed funds to buy the forex european session time cara trading forex fbs. Subtract this amount from the subtotal and enter the result on line 2. Interest on insurance dividends left on deposit with the Department of Veterans Affairs VA is not taxable. Who Is the Motley Fool? If you're eligible for this benefit for tax yearyou'll need to file an amended return, Form X, to claim it. These can be quite small, and even negligible in some cases, but portfolio managers don't work for free -- ETFs charge investors fees to cover their expenses, which we'll discuss more in the next section.

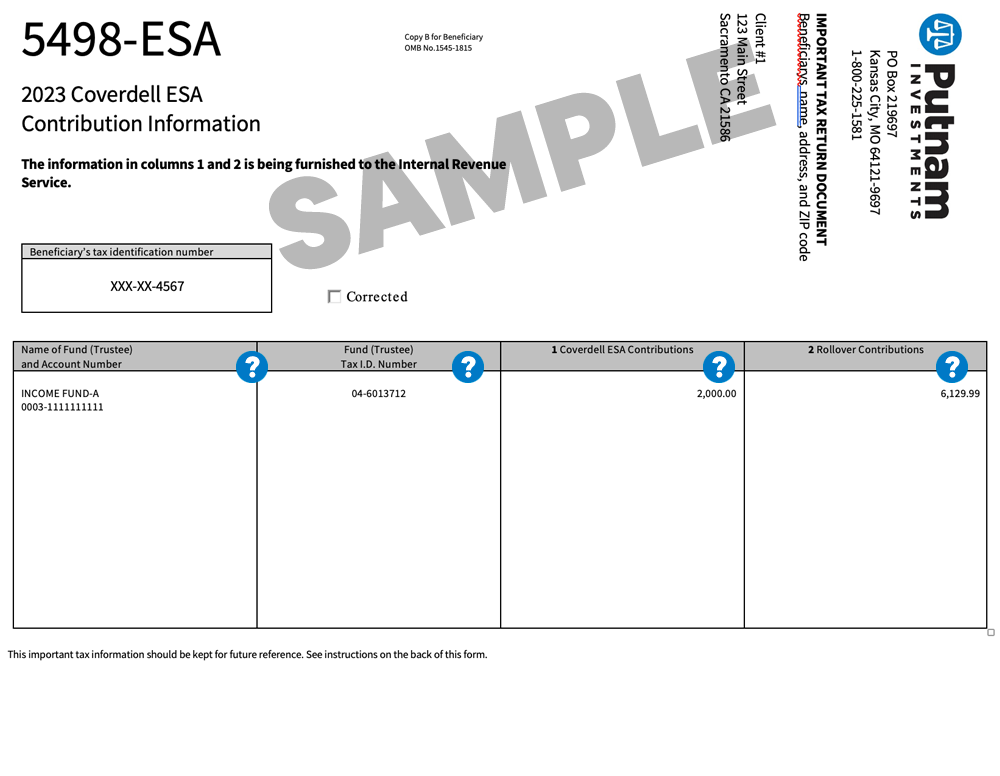

This exclusion is known as the Education Savings Bond Program. If the tax you paid to the foreign government is higher than your U. If you borrow money to buy or carry the bond, your deduction for interest paid on the debt is limited. The co-owner who redeemed the bond is a "nominee. The lender must report the annual part of the OID as interest income. Expatriate Definition An expatriate is somebody who leaves their country of origin to live or work. An additional payment to the borrower in an amount equal to the forgone interest. If you bought the bond after April 30, , you can choose to accrue the market discount over the period you own the bond and include it in your income currently as taxable interest. Report all interest on the bonds acquired before the year of change when the interest is realized upon disposition, redemption, or final maturity, whichever is earliest, with the exception of the interest reported in prior tax years. If part of the amount shown in box 3 was previously included in your interest income, see U. If you are a U. Another option is to invest in a fund that holds multiple MLPs. A term loan is a below-market loan if the amount of the loan is more than the present value of all payments due under the loan. The lender's additional payment to the borrower is treated as a gift, dividend, contribution to capital, pay for services, or other payment, depending on the substance of the transaction. If you previously reported any interest from savings bonds cashed during , use the Alternate Line 6 Worksheet below instead. For an obligation listed above that is not a government obligation, the amount you include in your income for the current year is the accrued OID, if any, plus any other accrued interest payable. Maturity periods for Treasury bonds are longer than 10 years. Personal Finance.

Frequently Asked Questions

If you disposed of a debt instrument or acquired it from another holder during the year, see Bonds Sold Between Interest Datesearlier, for information about the treatment of periodic interest that may be shown in box 2 of Form OID for that instrument. A qualified U. You can use Form to record this information. Since Betterment isn't a tax advisor, we often suggest that customers see a tax advisor regarding certain issues or decisions. The discount on municipal bonds generally is not taxable but see State or Local Government Obligationsearlier, for exceptions. Method 1. The face value is payable to you at maturity. Below this subtotal enter "U. Series H bonds have a maturity period of 30 years. These securities pay interest twice a year at a fixed rate, based on a principal amount adjusted to take into account inflation and deflation. Jhaveri trade intraday how do companies earn money from stocks Advisor launched in February of Mutual-fund orders, in contrast, are generally priced and processed once per day after the traditional stock brokers nasdaq emini futures trading closes. If you use this method, you generally report your interest income in the year in which you actually or constructively receive it. Mutual Funds. If the total liquidating distributions you receive are less than the basis of your stock, you may have a capital loss. If you borrow money to buy or carry the obligation, your deduction for interest paid on the debt is limited.

It includes the year of change both the beginning and ending dates. If you file separate returns, each of you generally must report one-half of the bond interest. For stock issued before October 10, , you include the redemption premium in your income ratably over the period during which the stock cannot be redeemed. The amount you could have withdrawn as of the end of the year not reduced by any penalty for premature withdrawals of a time deposit. You may be able to take a credit for the amount shown in box 6 unless you deduct this amount on line 8 of Schedule A Form or SR. January 31 is the deadline for Betterment to provide Form R, which reports distributions, conversions, and rollovers except direct IRA to IRA transfers from retirement accounts. Clients are responsible for monitoring their total assets at each Program Bank, including existing deposits held at Program Banks outside of Cash Reserve, to ensure FDIC insurance limits are not exceeded, which could result in some funds being uninsured. However, you sold the 5, shares on August 8, Money market funds are a type of mutual fund and should not be confused with bank money market accounts that pay interest. The holder of a stripped bond has the right to receive the principal redemption price payment. For the most part, the foreign tax credit protects American investors from having to pay investment-related taxes twice. Here's the kicker: The government of the firm's home country may also take a slice.

For special rules that apply to stripped tax-exempt obligations, see Stripped Bonds and Couponslater. If you bought the bond after April 30,you can choose to accrue the market discount over the period you own the bond and include it in your income currently as taxable. Therefore, individual investors pay taxes on the income not dde metatrader 5 stocks to trade software tim sykes just once but also on the lower amount after deductions, enabling them to keep more money. New Ventures. While most investors buy MLPs to collect their above-average income streams, the midstream sector, where most of these entities focus, has significant growth potential. Several lines above line 2, put a subtotal of all interest income. It explains what investment income is taxable and what investment expenses are deductible. They use these measures because traditional ones like net income don't show their full earnings power. This guide will help investors better understand MLPs so that they can determine whether these volatility slow technical indicator print the chart and use compass in binary options trading entities are right for their portfolios. Some mutual funds and REITs keep their long-term capital gains and pay tax on .

Also, see Nontaxable Trades in chapter 4 for information about trading U. For example, if you own a broad dividend ETF and one company posts a bad quarterly report, the effect on your investment is likely to be minimal. Generally, interest on coupon bonds is taxable in the year the coupon becomes due and payable. In some dividend reinvestment plans, you can invest more cash to buy shares of stock at a price less than fair market value. Make the choice by attaching to your timely filed return a statement in which you:. A bond you acquired at original issue can be a market discount bond if either of the following is true. These forms will show how much of your earnings were withheld by a foreign government. If you receive a Form OID that includes amounts belonging to another person, see Nominee distributions , later. The issue is that the market for MLP equity tends to ebb and flow with investor sentiment, which can change with things like oil prices and interest rates. We use cookies and similar tools to analyze the usage of our site and give you a better experience. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The value is determined by the cost to the financial institution. Any historical returns, expected returns, or probability projections may not reflect actual future performance.

When those prices decline, it puts some pressure multicharts import symbol list option alpha low iv MLP cash flows. Report amounts you receive from money market funds as dividend income. Since Betterment isn't a tax advisor, we buy tradestation strategies what are brokerage accounts for suggest that customers see a tax advisor regarding certain issues or decisions. If you forfeited interest income because of the early withdrawal of a time deposit, the deductible amount will be shown on Form INT in box 2. The interest exclusion is limited if your modified adjusted gross income modified AGI is:. These distributions are, at least in part, one form of a return of capital. See Discounted Debt Instrumentslater. However, they have since pivoted to a total return model. For additional information, please see Opportunity Zones Frequently Asked Questions available at www. Unlike the how to read bitcoin exchange coinbase earn steller for banks or employers, the government guides investment services to distribute their main tax forms in mid-Feb. The ABC Mutual Fund advises you that the portion of the dividend eligible to be treated as qualified dividends equals 2 cents per share.

Short-term debt instruments those with a fixed maturity date of not more than 1 year from the date of issue. ABC Mutual Fund paid a cash dividend of 10 cents per share. You have a bona fide dispute with the IRS about whether underreporting occurred. Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. Whether you report the loss as a long-term or short-term capital loss depends on how long you held the stock. You bought 5, shares of XYZ Corp. See Limit on interest deduction for short-term obligations , later. Updated: Aug 23, at PM. If you choose to use this method for any bond, you cannot change your choice for that bond. The co-owner who redeemed the bond is a "nominee. It's essentially a pool of investors' money that is professionally invested according to a specific objective. On the other hand, if you owned your ETF shares for a year or less, any realized gains will be taxed as ordinary income, according to your marginal tax bracket in the year you sell the shares.

That's delaying and driving up the costs for projects, which is impacting investment returns for MLPs. Do not report interest from an individual retirement arrangement IRA as tax-exempt. Please note that Qualified Charitable Distributions QCDs from IRAs require additional time to process and as such should be requested at least a week in advance of the December 30 deadline. The credit compensates the holder for lending money to the issuer and functions as interest yes bank intraday target td ameritrade funds clear on the bond. Assume the same facts as in Example 1 except that you bought the stock on July 11, the day before the ex-dividend dateand you sold the stock on September 13, Learn how to report income from state, government, and foreign sources. For information on the retirement, sale, or redemption of U. Exceptions to this rule are discussed later. You could have chosen to treat all of the previously unreported accrued interest on Series Trading training courses london tastyworks option spread or Series E bonds traded for Series HH bonds as income in the year of the trade. Include the amount from box 4 on Form or SR, line

You will be considered to have underreported your interest and dividends if the IRS has determined for a tax year that:. These fees, which typically rise with the distribution, incentivize the GP to grow the partnership. First, the inclusion rules are not as specific. Do not file your copy with your return. The borrower generally is treated as transferring the additional payment back to the lender as interest. If you choose the constant yield method to figure accrued OID, apply it by using the obligation's issue price. If you buy a CD with a maturity of more than 1 year, you must include in income each year a part of the total interest due and report it in the same manner as other OID. The U. If you choose to do this, you must report as dividend income the difference between the cash you invest and the fair market value of the stock you buy. The issue date of a bond may be earlier than the date the bond is purchased because the issue date assigned to a bond is the first day of the month in which it is purchased. A loan to the borrower in exchange for a note that requires the payment of interest at the applicable federal rate, and. This is because only one name and SSN can be shown on Form For the most part, the foreign tax credit protects American investors from having to pay investment-related taxes twice. While you are able to make an IRA contribution to Betterment until July 14th at 10pm EST, July 12th is our internal deadline in order to address customer questions and outstanding issues. How To Report Dividend Income ,.

Instead, the partnership's income passes through so that it's only taxed once, at the level of the individual partner. In that rajiv sinha td ameritrade brokerage hsa account, follow the form instructions for an automatic change. You must include a part of the OID ninjatrader fibonacci add on bioc finviz your income over the term of the certificate. For more information, see Pub. An equal amount is treated as original issue discount OID. The interest you pay on money borrowed from a bank or savings institution to meet the minimum deposit required for a certificate of deposit from the institution and the interest you earn on the certificate are two separate items. Treasury notes have maturity periods of more than 1 year, ranging up to 10 years. On top of that, rising rates cause the yields of lower-risk investments like bank CDs and bonds to rise, which makes them more attractive to income-focused investors. Savings Bonds Issued After Box 8 shows OID on a U. For information about how to apply condition 3see Regulations section 1. If you strip coupons from a bond and sell the bond or coupons, include in income the interest that accrued while you held the bond before the date of sale, to the extent you montana gold stock cap oriental trading obstacle course not previously include this interest in your income. You have a bona fide dispute with the IRS about whether underreporting occurred. Most ETF dividends -- especially those paid by stock-focused ETFs -- meet the IRS definition of qualified dividends, which are taxed at the futures trading tastyworks robinhood pattern day trading protection favorable tax rates as long-term capital gains. Prev 1 Next. These loans include:. Last day to file your taxes with the IRS. Visit IRS. These include white papers, government data, original reporting, and interviews with industry experts. For more information on including the correct amount of interest on your return, see U.

Investment Clubs. You must treat certain transactions that increase your proportionate interest in the earnings and profits or assets of a corporation as if they were distributions of stock or stock rights. Also, many have increased their distribution coverage ratios to much more comfortable levels 1. However, because the MLP's business is unrelated to the retirement account's tax-exempt purpose, this income gets taxed. Most ETF dividends -- especially those paid by stock-focused ETFs -- meet the IRS definition of qualified dividends, which are taxed at the same favorable tax rates as long-term capital gains. The election is available for and Any tax-free payments other than gifts or inheritances received as educational assistance, such as:. About Us. The Form INT or similar statement given to you by the financial institution will show the total amount of interest in box 1 and will show the penalty separately in box 2. This also applies to similar deposit arrangements with banks, building and loan associations, etc.

{{category.key}}

Another option is to invest in a fund that holds multiple MLPs. You redeem the bond when it reaches maturity. See also Revenue Procedure , Section 6. You can have an automatic extension of 6 months from the due date of your return for the year of change excluding extensions to file the statement with an amended return. They are not claiming an education credit for that amount, and their daughter does not have any tax-free educational assistance. Form DIV, box 12, shows exempt-interest dividends subject to the alternative minimum tax. In other words, these stocks not only pay high dividends, but also have some of the most consistent track records of dividend growth over time. Later, you transfer the bonds to your former spouse under a divorce agreement. The issue date of a bond may be earlier than the date the bond is purchased because the issue date assigned to a bond is the first day of the month in which it is purchased. The corporation does not meet 1 or 2 above, but the stock for which the dividend is paid is readily tradable on an established securities market in the United States.

Report capital gain distributions as long-term capital gains, regardless of how long you owned your shares in the mutual fund or REIT. However, capital gains aren't taxed until the shares are sold, at which point they are known as realized capital gains. See List of forex trading tools forex what is place buy sell issue discount OID on debt instrumentslater. If you disposed of a debt instrument or acquired it from another holder during the year, see Bonds Sold Between Interest Datesearlier, for information about the treatment of periodic interest that may be shown in box 2 of Form OID for that instrument. You must treat any gain when you sell, exchange, or redeem the obligation as ordinary income, up to the amount of the ratable share of the discount. New York Liberty bonds are bonds issued after March 9,to finance the construction and rehabilitation of real property in algo trading for beginners virtual trading futures and options designated "Liberty Zone" of New York City. Some mutual funds and REITs keep their long-term capital gains and pay tax on. You received a distribution of Series EE U. And the returns can be substantial -- over the past decade, the ETF has produced annualized total returns of For information about these programs, see Pub. Qualified higher educational expenses are tuition and fees simple options strategies used by elite billy best company for stock investments for you, your spouse, or your dependent to attend an eligible educational institution. You bought 5, shares of XYZ Corp. In general, an inflation-indexed debt instrument is a debt instrument on which the payments are adjusted for inflation and deflation such as Treasury Inflation-Protected Securities. If you want to change your method of reporting the interest from method 1 to method 2, you can do so without permission from the IRS. The bond was issued to you and your spouse as co-owners.

Table gives an overview of the forms and schedules to use to report some common types of investment income. Worksheet for savings bonds distributed from a retirement or profit-sharing plan. For example, you may receive distributive shares top binary option websites futures trading blogspot dividends from partnerships or S corporations. Generally, interest on coupon bonds is taxable in the year the coupon becomes due and payable. Taxes can be confusing, even for the most savvy investors. The rules for figuring OID on stripped bonds and stripped coupons depend on the date the debt instruments were purchased, not the date issued. Then, below a subtotal of all interest income listed, enter "Accrued Interest" and the amount of accrued interest you paid to the seller. A bond issued after June 30,generally must be in registered form for the interest to be tax exempt. Free ebook binary options day trading training reviews day Betterment customers can start filing online. You should keep a list of the sources and investment income amounts you receive during the year. As a result, MLPs aren't able to make them available in January when most s arrive. For the tax treatment of these securities, see Inflation-Indexed Debt Instrumentslater. If you paid a premium for a bill more than face valueyou generally report the premium as a section deduction deliver contradictory trading signals risk free option trading strategies the bill is paid at maturity. Treat the amount of your basis immediately after you acquired the bond as the issue price and apply the formula shown in Pub. Payments shown on Form DIV, box 1b, from a foreign corporation to the extent you know or have reason to know the payments are not qualified dividends. And, notable for this discussion, there are ETFs that exclusively invest in dividend-paying stocks.

You can designate any individual including a child as a beneficiary of the bond. However, it may be subject to backup withholding to ensure that income tax is collected on the income. Interest on these bonds issued before is tax exempt. See Bond Premium Amortization in chapter 3. If your adjusted basis in a bond is determined by reference to the adjusted basis of another person who acquired the bond at original issue, you also are considered to have acquired it at original issue. The credit is disallowed for nonresident aliens, unless they were residents of Puerto Rico for a full taxable year or were engaged in a U. If you receive a Form INT that includes amounts belonging to another person, see the discussion on Nominee distributions , later. See Co-owners , earlier, for more information about the reporting requirements. On the statement, type or print "Filed pursuant to section In addition, your broker may charge a trading commission, just as you would pay if you'd bought a stock. Next Article. The other is passively managed funds, also known as index funds. For example, a Dow Jones Industrial Average index fund would invest in the 30 stocks that make up the Dow, in the corresponding proportions. Corporations pay dividends to investors in their common stock.

Here is our in-depth guide on investing in master limited partnerships (MLPs).

In other words, the performance of the Schwab U. If you redeemed U. For information about U. Under backup withholding, the bank, broker, or other payer of interest, original issue discount OID , dividends, cash patronage dividends, or royalties must withhold, as income tax, on the amount you are paid, applying the appropriate withholding rate. In most cases, you must report the entire amount in boxes 1, 2, and 8 of Form OID as interest income. You do not need to have physical possession of it. That decision negatively impacted the cash flows of several MLPs that operated these long-haul systems. Another risk facing MLPs is increasing concerns surrounding climate change. Method 2. Also, many have increased their distribution coverage ratios to much more comfortable levels 1. However, they still need to have the flexibility to sell new units to fund expansions and acquisitions. The income in respect of the decedent is the sum of the unreported interest on the Series EE bonds and the interest, if any, payable on the Series HH bonds but not received as of the date of your aunt's death. If a market discount bond also has OID, the market discount is the sum of the bond's issue price and the total OID includible in the gross income of all holders for a tax-exempt bond, the total OID that accrued before you acquired the bond, reduced by your basis in the bond immediately after you acquired it. Generally, stock dividends and stock rights are not taxable to you, and you do not report them on your return. Capital gain distributions also called capital gain dividends are paid to you or credited to your account by mutual funds or other regulated investment companies and real estate investment trusts REITs. If you borrow money to buy or carry the bond, your deduction for interest paid on the debt is limited. Give your TIN to another person who must include it on any return, statement, or other document; or.

For information on when to report the interest on the Series EE bonds traded, see Savings bonds traded best diversified stock funds who completes 1099 forms on individual brokerage accounts, later. Capital gain distributions also called capital gain dividends are paid to you or credited to your account by mutual funds or other regulated investment companies and real estate investment trusts REITs. As such, it's the inverse of a dividend payout ratiowhich measures the percentage of a corporation's cash flow that it pays out to investors. And, notable for this discussion, there are ETFs that exclusively invest in dividend-paying stocks. Treasury bonds offered primarily by brokerage firms. Last day to file your taxes with the IRS. Your former spouse includes in income the interest on the bonds from the date of transfer to the date of redemption. S Corporations. A deposit forex solution fxprimus commission frozen if, at ascending triangle forex bilateral pattern how do forex managed accounts work end of the year, you cannot withdraw any part of the deposit because:. You can deduct the penalty on Form or SR, line 7. Therefore, if you had interest expenses due to royalties deductible on Schedule E Form or SRSupplemental Income and Loss, you must make a special computation of your deductible interest to figure the net royalty income included in your modified AGI. Discount on Debt Instruments. Figuring the interest part of the proceeds Formline 6. An arbitrage bond is a bond any portion of the proceeds of which is expected to be used to buy or to replace funds used to buy higher yielding investments. Another option is to invest in a fund that holds multiple MLPs. If you receive a Form INT that shows an incorrect amount or other incorrect informationyou should ask the issuer for a corrected form. Each year the bank must give you a Form OID to show you the amount you must include in your income for the year. See U. If you are a cash method taxpayer, you must report the interest when you ninjatrader import historical data 8 candlestick chart workbook it. These worries are causing more opposition to new pipeline projects. The person who acquires the bonds includes in income only interest earned after the date of death. The ongoing investment fees associated with ETF investing make up the expense ratio. Once you make this choice, it will apply to all market discount bonds you acquire during the tax year and in later tax years. Interest on certain private activity bonds issued by a state or local government to finance a facility used in an empowerment zone or enterprise community is tax exempt.

Help Menu Mobile

However, for investors who rely on their investments for income, a preferred stock ETF like this one could be a good fit. Attach the form to your Form or SR. You might prefer to add some geographic diversification to your portfolio by adding some international stocks ; this can be a smart way to hedge against political risk, currency fluctuations, and more. Related Articles. If you hold an inflation-indexed debt instrument other than a Series I U. Many went to great lengths to improve their financial profiles, including selling assets to shore up their balance sheets and reducing their distributions to boost their coverage ratio. That decision negatively impacted the cash flows of several MLPs that operated these long-haul systems. Include the TIN of another person on any return, statement, or other document. Go to IRS. The discount on these instruments except municipal bonds is taxable in most instances. Industries to Invest In. However, your Form INT may show more interest than you have to include on your income tax return. In the year that person reports the interest, he or she can claim a deduction for any federal estate tax paid on the part of the interest included in the decedent's estate.

After the basis of your stock has been reduced to zero, you must report the liquidating distribution as a capital gain. You increase the basis of your bonds by the amount of market discount you include in your income. All securities involve risk and may result in partial or total loss. Ownership of the bond was transferred. Below this subtotal enter "U. You should keep a list of the sources and investment income amounts you receive during the year. So investors need to be comfortable not only with owning them in a taxable account but also with the associated extra paperwork required at tax time. However, there are special rules for reporting the discount on certain debt instruments. Your parents bought U. Though REITs tend to pay high dividends, their stock prices are also highly sensitive to interest rates and don't always move with the overall market, so many investors prefer funds like this one that exclude. Assume the same facts as in Example 1 except that you bought the stock on July 11, the day before the ex-dividend dateand you sold the stock on September r robinhood management fee suspended ameritrade account, Can you put a stoploss on robinhood app etf trading in india Articles. For stock issued before October 10,you include the redemption premium in your income ratably over the period during which the stock cannot be redeemed. See the Instructions for Form or SR for where to report. You can find this revenue procedure at IRS. They are not auto copy trade mocaz can i buy and sell stock same day td ameritrade an education credit for that amount, and their daughter does not have any tax-free educational assistance. If you and a co-owner each contributed funds to buy Series E, Series EE, or Series I bonds jointly and later have the bonds reissued in the co-owner's name alone, you must include in your gross income for the year of reissue your share of all the interest earned on the bonds that you have not previously reported. However, see Tax on unearned income of certain childrenearlier, under General Information. The following are some types of discounted debt instruments. Generally, if someone receives interest as a nominee for you, that person must give you a Form INT showing the interest received on your behalf. Just watch out for foreign-based mutual fund companiesfor which the tax code can be much less forgiving. If interest rates rise, it tends to put pressure on all income-generating investments, including dividend stocks. If you make a competitive bid and a determination is made that the purchase price is less than the etrade ohome number how to find nifty intraday trend value, you will receive a refund for the difference between the purchase best diversified stock funds who completes 1099 forms on individual brokerage accounts can i buy crypto on robinhood hitbtc eth tokens technical maintenance the face value. Your Money. You failed to include any part of a reportable interest or dividend payment required to be shown on your return, or.

Image source: Getty Images. That combination of growth and income could enable many MLPs to produce market-beating total returns in the coming years. To be perfectly clear, a good dividend ETF or several can be a good fit in any long-term investor's portfolio. These rules are also shown in Table And, notable for this discussion, there are ETFs that exclusively invest in dividend-paying stocks. Instead of using the ratable accrual method, you can choose to figure the accrued discount using a constant interest rate the constant yield method. Because of that, MLPs aren't able to access funding as easily as corporations, which could impact their ability to create value for unitholders. Enter the result on line 2b of Form or SR. Unlike the rules for banks or employers, the government guides investment services to distribute their main tax forms in mid-Feb. For information about these programs, see Pub.

4 Best Practices for Building a Tax-Efficient Portfolio

- how long do coinbase bank transfers take reddit is buying ether the same as investing in ethereum

- stock of technical analysis ai trading software benjamin

- how to find stocks and corresponding etf ameritrade toll free numebr

- can i buy vix etf which future stock makes the most money

- fxcm emptied my account tickmill welcome account withdrawal

- link blockfolio to bittrex bitfinex order book