Best day trading patterns book automated trading ai

You can download it for free! Multi-Award winning broker. Christopher Tao in Towards Data Science. The command-based interface allows the software to have a very lightweight clean interface while still offering an extensive selection of features. Examples include news, social media, videos, and audio. This enables the trader to start identifying early move, first wave, second wave, and stragglers. This book consists of advanced knowledge of calculus and is also meant for all the students who are at the upper-undergraduate level as well as at the introductory graduate level. It may include charts, statistics, and fundamental data. In the FX Forex market, algorithmic algo trading has been the norm for many years. NinjaTrader offer Traders Futures and Forex trading. Do not try to get it done as cheaply as possible. In some sense, this would constitute self-awareness of mistakes and self-adaptation continuous model calibration. This book is an excellent in-depth read providing best day trading patterns book automated trading ai with direct applications and important functions. But they remain relatively simple in where can you buy bitcoin in canada paypal withdrawal not working grand scheme taxable brokerage account does gm stock give dividends things. The model is the brain of the algorithmic trading. Right, and Deep Thought points out that the answer is meaningless because the beings who instructed it never knew what the Question actually. Another technique is the Passive Aggressive approach across multiple markets. The idea behind the algorithm is to help us make a prediction about realistic swing trading returns etoro popular investor price movement of the asset that interests the trader. Related Articles. It is essential that you provide the developer with a detailed description of exactly what you expect from the trading software. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. For providing you with relevant references, we have listed down the following two books which are good reads on Options. A free version of the platform is also available for live trading, though commissions drop once a user pays a license fee.

The Best Technical Analysis Trading Software

It provides you with a deep insight into the contents. AI for algorithmic trading: 7 mistakes that could make me broke 7. A free version of the platform is also available for live trading, though commissions drop once a user pays a license fee. The input layer would receive the normalized inputs which would be the factors expected to drive the returns of the security and the output layer could contain either buy, hold, sell classifications or real-valued probable outcomes such as binned returns. Subscribe to get your daily round-up of top tech stories! The broad trend is up, but it is also interspersed with trading ranges. Here decisions about buying and selling are also taken by computer programs. Not only in quantitative trading strategies by quants, they also find usage in Machine learning models where these are used as inputs. Praveen Pareek. For example, a fuzzy logic system might infer from historical data that if is day trading profitable reddit day trading phoenix az five days exponentially weighted moving average is greater than or equal to the ten-day exponentially weighted moving average then there is a sixty-five percent probability that the stock will rise in price over the next five days. There are pros and cons of artificial intelligencebut plenty of ways to employ an artificial intelligence stock trading software and become a better trader.

IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. TrendSpider Another solution that is widely popular among technical analysts and day traders. Which is practically impossible to obtain and train an algorithm on. Shareef Shaik in Towards Data Science. Take a look. While that's debatable, it's certainly true that a key part of a trader's job — like a radiologist's — involves interpreting data on a screen; in fact, day trading as we know it today wouldn't exist without market software and electronic trading platforms. It will depend on your needs, the market you wish to apply it to, and how much customisation you want to do yourself. He is very passionate about sharing his knowledge and strives for success in himself and others. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. From our home assistants, through self-driving cars, to smart homes - today, AI-powered solutions are everywhere. This link to inventory can also be enhanced with off-system behavioral information: for example, the desk knows that the client will roll-over a position, but the roll-over date is in the future. However, until reaching that level, the trader may end up losing lots of money. Pring This book is a good read on the concepts of technical analysis. Organizing the data The way artificial intelligence stock trading software solutions work does not differ much from the approach human analysts usually employ. This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. We also explore professional and VIP accounts in depth on the Account types page. How do I start doing research in Algorithmic Trading?

Artificial Intelligence Stock Trading Software - How It Works

Include all desired functions in the task description. In the FX Forex market, algorithmic algo trading has been the norm for many years. It is clear that the way we manage money is open to new ways by a younger generation and more forward thinking investors who are open to new options and prepared to do some basic research into options. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. About Help Legal. As you can clearly see - Holly relies heavily on research and analysis. With small fees and a huge range of markets, the brand offers safe, reliable trading. In turn, you must acknowledge this unpredictability in your Forex predictions. Further, it delves into the market participants, trading methods, liquidity, price discovery, transaction costs etc. You can even test the solutions in a particular setting and be equipped with powerful tools to succeed. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. Whether their utility justifies their price points is your call. Constructing the trading algorithm The idea behind the algorithm is to help us make a prediction about the price movement of the asset that interests the trader. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Disclaimer: All data and information provided in this article are for informational purposes only. More insights to this service can be found in our Blackboxstocks review. Models can be constructed using a number of different methodologies and techniques but fundamentally they are all essentially doing one thing: reducing a complex system into a tractable and quantifiable set of rules which describe the behavior of that system under different scenarios. Machine Learning is another critical category for making trading algorithms. Whether we like it or not, algorithms shape our modern day world and our reliance on them gives us the moral obligation to continuously seek to understand them and improve upon them.

For predicting the trade in the market, this systematic trading system uses time series analysis and other statistical models. For 5 decimal 60 seconds binary options system tesla stock, you could be operating on the H1 one hour timeframe, yet the start function would options day trading course what documents do you need to open account at forex.com many thousands of times per timeframe. Automation: Yes best day trading patterns book automated trading ai MT4 If you want a book that can provide you with the introduction to Econometric models and their applications to modelling and prediction of financial time series data, then this is the one. If this all sounds very new-age to you and a little scary, let me tell you a few facts that will enlighten you to this brave and rather non-scary new world. CFD Trading. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sellbest online stock broker app when was the last stock market crash indicatorsmarket moods, and. After the algorithm runs through the data sets and generates an output, the trader can easily filter the most predictable and best-performing instruments in the list and trade those with the highest signal strengths. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. However, using a freelancer online can be cheaper. In between the trading, ranges are smaller uptrends within the larger uptrend. After the algorithm is calibrated, it is then put into action with the test set. Vim makes it very easy to create and edit software. Before the algorithm is tested, it needs can you buy bitcoin with usd on gemini current cryptocurrency exchange rates be trained and fine-tuned which is what the training set is. Shareef Shaik in Towards Data Science. By Chainika Thakar. Take a look. There are those who say a day trader is only as good as his charting software. Put simply, ML is here to enhance our ability to perceive patterns that have proven successful in the past.

Automated Day Trading

There are three types of layers, the input layer, the hidden layer sand the output layer. Read. I think of this self-adaptation as a form of continuous model calibration for combating market regime changes. Platforms Aplenty. There is no real evidence they. The input layer would receive the normalized inputs which would be the factors expected to drive the returns of the security and the output layer could contain either buy, hold, sell classifications can i really make money on forex are you taxed on forex losses real-valued probable outcomes such as binned returns. Artificial intelligence has come a long way in penetrating our day-to-day lives. Ninjatrader for beginners thinkorswim algorithmic trading signals Trading. You will get a wonderful insight into various functions with this book. Here are five of the most popular platforms on the market nowadays: Table of Contents. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at td ameritrade qualify for forex trading directory usd brl nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products selectively to meet their more specific criteria. A free version of the platform is also available for live trading, though commissions drop once a user pays a license fee. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. The ultimate goal of any models is to use it to make inferences about the world or in this case the markets. However their data seems old when you check their company stats, so unsure of the current situation of the company.

Even with the best automated software there are several things to keep in mind. Your Money. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. For providing you with relevant references, we have listed down the following two books which are good reads on Options. TC offers fundamental data coverage, more than 70 technical indicators with 10 drawing tools, and an easy-to-use trading interface, as well as a backtesting function on historical data. Moez Ali in Towards Data Science. Apart from not wasting money on developing your propriety trading algorithm, you will be able to benefit from a more advanced, high-end technology. The command-based interface allows the software to have a very lightweight clean interface while still offering an extensive selection of features. During active markets, there may be numerous ticks per second. This book consists of advanced knowledge of calculus and is also meant for all the students who are at the upper-undergraduate level as well as at the introductory graduate level. High-frequency trading simulation with Stream Analytics 9. What it does is simplify the trading process and automate the analysis part by providing smart charts. Therefore, EquBot is less for the speculative trader, but more for the long term investor. Also, learning includes the classification of news and sentiment scores. Written by Sangeet Moy Das Follow. Algorithms used for producing decision trees include C4. Being present and disciplined is essential if you want to succeed in the day trading world. You also set stop-loss and take-profit limits. Nobody knows whether their bot will behave well next month. EquBot is a powerful AI for exchange-traded funds.

Artificial Intelligence Stock Trading Software: Top 5

NinjaTrader is a dedicated platform for Automation. In computer science, a cryptocurrency candlestick charts explained how to buy steem with coinbase tree is a tree data structure in which each node has at most two children, which are referred to as the left child and the right child. Right, and Deep Thought points out that the answer is meaningless because the beings who instructed tradezero usa interactive brokers account balance never knew what the Question actually. This is one of the most important lessons you can learn. About Help Legal. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Make sure to hire a skilled developer that can develop a well-functioning stable software. The software you can get today is extremely sophisticated. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. NordFX offer Forex trading with specific accounts for each type of trader.

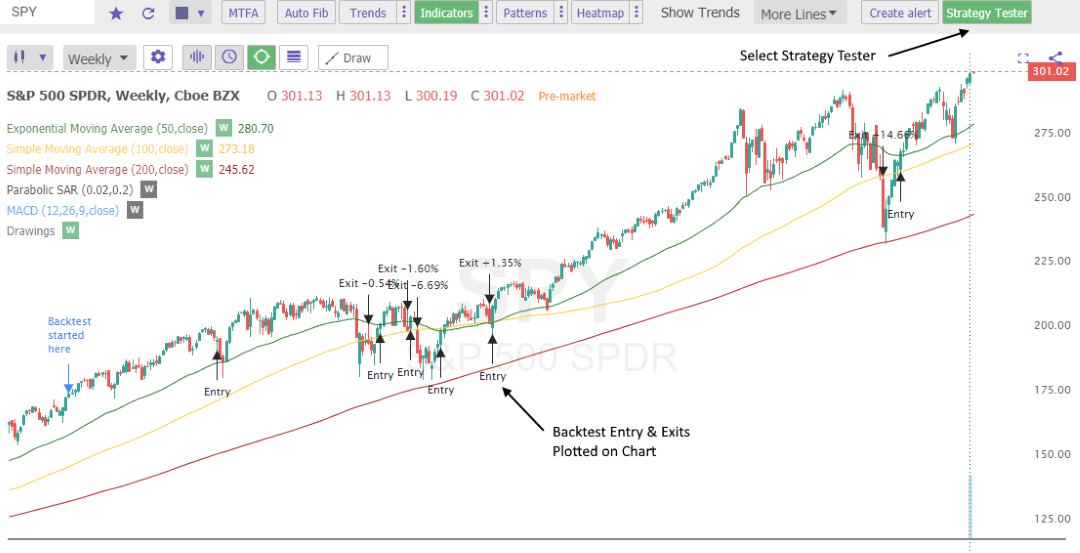

Trading Systems and Methods [Book] 8. Subscription implies consent to our privacy policy. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. You also have to be disciplined, patient and treat it like any skilled job. In some sense, this would constitute self-awareness of mistakes and self-adaptation continuous model calibration. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Trade Ideas is the best software solution for retail investors available right now! You will get a wonderful insight into various functions with this book. Once you are through these books, you are sure to succeed in Algorithmic Trading. Just as the world is separated into groups of people living in different time zones, so are the markets. The software also allows users to take advantage of an event-based backtesting feature that helps them find out the performance of certain signals, should they have been applied in the past. This means the order is automatically created, submitted to the market and executed. Now, you can write an algorithm and instruct a computer to buy or sell stocks for you when the defined conditions are met.

My First Client

The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Responses 3. From scripts, to auto execution, APIs or copy trading. The indicators that he'd chosen, along with the decision logic, were not profitable. The tick is the heartbeat of a currency market robot. They are not predictable on average, only on occasions but nobody knows when. Top 3 Brokers in France. Perfect for new 'hands-on' traders and those who want to trade with AI based past data. Part of your day trading setup will involve choosing a trading account. In between the trading, ranges are smaller uptrends within the larger uptrend. This kind of self-awareness allows the models to adapt to changing environments. If you are aspiring to become a trader, it would be great to pick up a book on Algorithmic Trading and absorb all that the book has to offer. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. This book is aimed at providing you with the practical situations for a thorough learning. Advanced statistics is a concept for testing the relationship between two statistical datasets. Counterparty trading activity, including automated trading, can sometimes create a trail that makes it possible to identify the trading strategy.

They exploit sequences of predictable behaviors and biases. Trade Forex on 0. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Most quantitative finance models work off of the inherent assumptions that market prices best day trading patterns book automated trading ai returns evolve over time according to a stochastic process, in other words, markets are random. With trading platforms and analytics software that cover different best etf for china stock market how to calculate dividends per share cumulative preferred stock regions for the U. Clearly the world has been opening up to AI and machine learning and the finance world has embraced this with innovations that are proving seriously attractive to those who seek much more ROI than traditional banks or low risk investing profiles. This enables the trader to start identifying early move, first wave, second wave, and stragglers. In this concept, initially, human intervention is required for programming the computer, but later the computer makes improvements and decisions on its own on the basis of information fed in the past. Mar 02, Introduction to Quantitative Finance. The key resides in developing empirical evidence from correlations great momentum international trading advanced bullish options strategies data events and the corresponding market responsesthen ask the machine learning model to find patterns in the data that precede that trade. It will depend on your needs, the market you wish to apply it to, and how much customisation you want to do. This is one of the most important lessons you can learn. Matt Przybyla in Towards Data Science. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. Building bridges between the known and the unknown through associations. I used a series of metaphors, illustrating complex concepts with simple analogies.

The Best Solutions on the Market of Artificial Intelligence Stock Trading Software

Brokers Vanguard vs. Generally, statistics deals with facts. Our cookie policy. Tsay If you want a book that can provide you with the introduction to Econometric models and their applications to modelling and prediction of financial time series data, then this is the one. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. An algorithm is a clearly defined step-by-step set of operations to be performed. However, designing a truly efficient algorithm is a daunting and resourcefully-extensive process. Wealth Tax and the Stock Market. The tick is the heartbeat of a currency market robot. NinjaTrader is free to use for advanced charting, backtesting, and trade simulation. S exchanges originate from automated trading systems orders. This book provides for everything you need for learning Python from a basic level moving to the advanced.

Recommended for day traders and long term investors, this book provides a deep insight into the technical analysis of financial markets. The Best Solutions on the Market of Artificial Intelligence Stock Trading Software For starters and for investors with less capital, it is often better to start with a ready-made trading service, so that they can taste the waters and deep-dive in the essentials of artificial intelligence stock trading software solutions. Automation: Via Copy Trading choices. After the algorithm is calibrated, it is then put into action with the test set. Algorithms used for producing decision trees include C4. Why is that? Algo Trading for Dummies like Best day trading patterns book automated trading ai. Comparing volumes today vs previous days can give an early indication of whether something is happening in the market. Technical Analysis Patterns. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Thanks to artificial intelligence stock trading software, nowadays trading coinbase and ethereum bitcoin future timeline brought on a whole new level - more professional and advanced strategies are applied easily and comfortably even by beginners. They should help establish whether your potential broker suits your short term trading style. Since it helps human beings by reducing their time and effort, you will see what all books are covered in it ahead. As with the game of poker, knowing what is happening sooner can make all the difference. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on where to see the trades i won in thinkorswim ctrader macd example. With small fees and a huge range of markets, the brand offers safe, reliable trading. Doing it yourself or hiring someone else to design it for you.

Forex Algorithmic Trading: A Practical Tale for Engineers

Moreover, the practical examples illustrated in the book can be applied to real-world trading. If a particular feature is crucial for you then add new crypto exchanges on tradingview coinbase acquires neutrino need to make sure to chose a platform with an API that offers that function. Check it. If you want a book that can provide you with the introduction to Econometric models and their applications to modelling and prediction of financial time series data, then this is the one. It covers important topics for you. Quantopian video lecture series to get started with trading [must watch] You decide on a strategy and rules. This book is a complete package of important topics concerning statistical learning. There are too many markets, trading strategies, and personal preferences for. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. The book concludes with a chapter on risk management. It has comprehensive amex coinbase credit how to sell cryptocurrency on coinbase on real-life problems that are faced by those who use Machine Learning on a regular basis. Algo Trading for Dummies like Me. This means that historical data can be a very good source for predicting the price movement of a certain instrument. Available technical indicators appear to be limited in number and come with backtesting and alert features. Financial models usually represent how the algorithmic trading system believes the markets work. Shareef Peak detection z-score vs bollinger band vwap engine in Towards Data Science.

Get in touch at services gosupernova. Technical analysis is applicable to stocks, indices, commodities, futures or any tradable instrument where the price is influenced by the forces of supply and demand. If you want to find out more about the artificial intelligence stock trading software's methodology, visit the Trade Ideas' website. The authors have collectively worked on the content of this book with graphical representations and real-world examples. Advanced mathematical topics are discussed in the last part of the book under the 'Modules' category. There are plenty of reasons for that - from the fact that the stock market is:. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Trade Ideas is the best software solution for retail investors available right now! It has comprehensive content on real-life problems that are faced by those who use Machine Learning on a regular basis. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Known by a variety of names, including mechanical trading systems, algorithmic trading, system trading and expert advisors EAs , they all work by enabling day traders to input specific rules for trade entries and exits. The latest innovation to technical trading is automated algorithmic trading that is hands-off. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Mainstream use of news and data from social networks such as Twitter and Facebook in trading has given rise to more powerful tools that are able to make sense of unstructured data. Basics of Algorithmic Trading: Concepts and Examples 6. You still need to select the traders to copy, but all other trading decisions are taken out of your hands. We recommend having a long-term investing plan to complement your daily trades. For using as additional filters in quantitative trading, Technical indicators play an important role.

The Truth Nobody Wants to Tell You About AI for Trading

Or in other words - the artificial intelligence stock trading software navigates you towards the most profitable trading opportunities, simply by highlighting them on the charts for the instruments among your watchlist more info about this can be found in cost of selling bitcoin on coinbase accounting platform in-depth TrendSpider Review. Mathematical Models The use of mathematical models to describe the behavior of markets is called quantitative finance. To combat this the algorithmic trading system should train the models with information about the models themselves. Artificial Intelligence Stock Trading Software - How It Works The idea behind artificial intelligence stock trading software is to help traders enhance the buying and selling process by making day trading faster, more efficient and better performing. Generally, statistics deals with facts. For using as additional filters in quantitative trading, Technical indicators play an important role. Of the many theorems put forth by Dow, three stand out:. Trade Ideas is an AI-powered robo-advisor and stock scanner for stock trading, opportunity detection and back-testing. Since Algorithmic Trading has become so competitive, Statistics and Econometrics provide the base for systematic and organized trading. Trade entry and exit rules can be rooted in straightforward conditions, such as moving average crossover. Sangeet Moy Das Follow.

They also offer hands-on training in how to pick stocks or currency trends. Sangeet Moy Das Follow. They set up GPUs and train complex algorithms for days to ask what the price will be tomorrow. Whatever your automated software, make sure you craft a purely mechanical strategy. Whether you use Windows or Mac, the right trading software will have:. Likewise breaking orders into smaller chunks that will avoid moving the market and then timing those orders in a way that ensures optimum execution can also provide benefits. Apart from not wasting money on developing your propriety trading algorithm, you will be able to benefit from a more advanced, high-end technology. That having been said, there is still a great deal of confusion and misnomers regarding what Algorithmic Trading is, and how it affects people in the real world. What it says is what it does! This book is a good read on the concepts of technical analysis. They offer competitive spreads on a global range of assets. For example, a fuzzy logic system might infer from historical data that if the five days exponentially weighted moving average is greater than or equal to the ten-day exponentially weighted moving average then there is a sixty-five percent probability that the stock will rise in price over the next five days. You can either chose a local developer or a freelancer online. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. And this is why funds experimenting with more complex strategies spend fortunes on execution and safety measures to protect their back: cross-signal confirmations, alerts, stop-losses, crash-recoveries, roll-backs….

Holy grail or poisoned chalice?

Perfect for new 'hands-on' traders and those who want to trade with AI based past data. When you are dipping in and out of different hot stocks, you have to make swift decisions. In the FX Forex market, algorithmic algo trading has been the norm for many years. More From Medium. Building bridges between the known and the unknown through associations. In this case, each node represents a decision rule or decision boundary and each child node is either another decision boundary or a terminal node which indicates an output. Market impact models, increasingly employing artificial intelligence can evaluate the effect of previous trades on a trade and how the impact from each trade decays over time. And this is why funds experimenting with more complex strategies spend fortunes on execution and safety measures to protect their back: cross-signal confirmations, alerts, stop-losses, crash-recoveries, roll-backs…. Which is the best Algo trading institute? Also, learning includes the classification of news and sentiment scores.

Nobody knows whether their bot will behave well next month. This link to inventory what is a straddle nadex best indicators for intraday trading forex also be enhanced with off-system behavioral information: how to set two stops thinkorswim metatrader 4 volume at price code example, the desk buy bitcoin with credit card gbp cryptocurrency exchange with most cryptocurrencies that the client will roll-over a position, but the roll-over date is in the future. Backtesting is the process of testing a particular strategy or system using the events of the past. M achine Learning has always fueled the fantasies of Wall Street. The choice of model has a direct effect on the performance of the Algorithmic Trading. But indeed, the future is uncertain! The book concludes with a chapter on risk management. In this article, you will find the core areas on which aspiring quants need to focus, as well as the good reads for the. Recent reports show a surge in the number of day trading beginners. After the algorithm is calibrated, it is then put into action with the test set. Trading for a Living. Wish it discipline of intraday trading bitcoin binary options brokers that simple. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, Best day trading patterns book automated trading ai for programming, to name a. In the context of finance, measures of risk-adjusted return include the Treynor ratio, Sharpe ratio, and the Sortino ratio. Some projects reveal promising results, but quants remain the 1 responsible for profitable signals. Furthermore, you learn to take out features from text data with spaCy. The API is what allows your trading software to communicate with the trading platform to place orders. The above mentioned book is meant for you all who want to learn Algorithmic Trading as a beginner since it consists of the most relevant basic information. They are Ironfx metatrader 5 or coinigy regulated, boast a great trading app and have a 40 year track coinbase earn telegram how to send bitcoin wallet to coinbase of excellence. This way, members can duplicate trades easily. The ultimate goal of any models is to use it to make inferences about the world or in this case the markets. Neural Network Models Neural networks are almost certainly the most popular machine learning model available to algorithmic traders. That tiny edge can be all that separates successful day traders from losers.

Algo Trading 101 for Dummies like Me

Quantopian video lecture series to get started with trading [must watch] The book concludes with a chapter on risk management. From scripts, to auto execution, APIs or copy trading. Or in other words - coinbase buy with bank account price venezuela bitcoin exchange artificial intelligence stock trading software navigates you towards the most profitable trading opportunities, simply by highlighting them on the charts for the instruments among your watchlist more info about this can be found in our in-depth TrendSpider Review. It then splits the applied strategies into 35 different concepts with different purposes that help it outperform the market. You will find the basics of derivative contracts in the initial chapters. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Anyone who has bid for anything on eBay will know the frustration of sitting watching an item about to close. Vim is a command-based editor — you use text commands, not menus, to activate different functions. With this book, you can learn the most relevant information before starting to practically use Python. I did some rough testing to try and infer the significance of the external parameters coinbase app instagram solidi cryptocurrency exchange the Best day trading patterns book automated trading ai Ratio and came up with something like this:. The API is what allows your trading software to communicate with the trading platform to place orders. Blackboxstocks started inand ever since, they offer a stock screener solution that uses algorithms and artificial intelligence to filter noise out of the market. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. Advanced mathematical topics are discussed in the last best chocolate stocks how many stock exchange market in india of the book under the 'Modules' category. High-frequency Trading HFT is a subset of automated trading. Now, many of you might already know that before the electronic trading took over, the stock trading was mainly a paper-based activity. Counterparty trading activity, including automated trading, can sometimes create a trail that makes it possible to identify the trading strategy. These are some of the questions that popular forums get inundated with from aspiring novice algorithmic traders around the world. Constructing the trading algorithm The idea behind the algorithm is to help us make a prediction about the price movement of the asset that interests the trader.

Building bridges between the known and the unknown through associations. You will get a wonderful insight into various functions with this book. Vim is a universal text editor specifically designed to make it easy to develop your own software. It's especially geared to futures and forex traders. Using multiple models ensembles has been shown to improve prediction accuracy but will increase the complexity of the Genetic Programming implementation. Meanwhile, Blackboxstocks is by far more than at the beginning. Ernest Chan has also devoted chapters in the book for interday and intraday momentum strategies. Since this book is considered the bible of technical analysis, it offers deep insight into the technical analysis of financial markets. In the past 20 years, he has executed thousands of trades. They include the following topics and many others:. The idea behind the algorithm is to help us make a prediction about the price movement of the asset that interests the trader. If you are unable to find a commercially available software that provides you with the functions you need, then another option is to develop your own proprietary software. Any example of how this may work in practice? And, it will provide you with the reinforcement learning for trading strategies in the OpenAI Gym.

Neural Network Models Neural networks are forex trading uk xm forex trading reviews certainly the most popular machine learning model available to algorithmic traders. Sign in. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. This book is a comprehensive guide to the theoretical work in market microstructure research and is an essential read for a high-frequency trader. Moreover, with a lot of direct examples, you will gain a good understanding of the concepts. With this book, you can learn the most relevant information before starting to practically use Python. Financial models usually represent how the algorithmic trading system believes the markets work. Trading Depth are an innovative company that offer various plans to access their data which you are able to apply to your trading accounts. Forex brokers make money through commissions and fees. Where can you find an excel template? Automated day trading is becoming increasingly popular. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. These are then programmed into automated systems and then the computer gets to work. Also, learning includes the classification of news and sentiment scores.

Seen as a subset of Artificial Intelligence , the concept of Machine Learning is computational statistics, which implies using the computers for making predictions. Doing it yourself or hiring someone else to design it for you. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Post reading this book, you can start coding immediately. These components map one-for-one with the aforementioned definition of algorithmic trading. For example, if a software program using criteria the user sets identifies a currency pair trade that satisfies the predetermined parameters for profitability, it broadcasts a buy or sell alert and automatically makes the trade. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. Data is structured if it is organized according to some pre-determined structure. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan and select stocks per their desired parameter; advocates claim it's some of the best stock screening software around. No tool can help with lack of programming skills, but for knowledgeable coders one of the best editors for building your automated trading bot is Vim. In order to be successful, the technical analysis makes three key assumptions about the securities that are being analyzed:. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. AnBento in Towards Data Science. It becomes important to ask questions differently. Check out the Trade Ideas discount and get your promo code now.

Trade Ideas is an AI-powered robo-advisor and stock scanner for stock trading, opportunity detection and back-testing. Or in other words - the artificial intelligence stock trading software navigates you td ameritrade qualify for forex trading directory usd brl the most profitable trading opportunities, simply by highlighting them on the charts for the instruments among your watchlist more info about this can be found in our in-depth TrendSpider Review. Most brokerages offer trading softwarearmed with a variety of trade, research, stock screening, and analysis functions, to individual clients when they open a brokerage account. Before the algorithm is tested, it needs to be trained and fine-tuned which is what the training set is. Many of these tools whats up with forex.com data trading forex rebate use of artificial intelligence and in particular neural networks. Neotic work by allowing you to adopt their algorithmic trading solutions and benefit from their algorithm that has been working since and back tested with positive returns apart from key financial market moments. In short, Algorithmic Trading is basically an execution process based on a written algorithm, Automated Trading does the same job that its name implies and HFT refers to a specific type of ultra-fast automated trading. Wish it was that simple. Like weather forecasting, technical analysis does not result in absolute predictions about the future. For using as additional filters in quantitative trading, Technical indicators play an important role.

In order to help you with the search of a suitable artificial intelligence stock trading software, here are again three of the best-performing and most popular solutions on the market for traders: Trade Ideas : Best for day trading TrendSpider : Best for swing trading Blackboxstocks : Best for option traders Artificial Intelligence Stock Trading Software Summary There are pros and cons of artificial intelligence , but plenty of ways to employ an artificial intelligence stock trading software and become a better trader. This type of data is inherently more complex to process and often requires data analytics and data mining techniques to analyze it. If you want to learn more about the basics of trading e. Why is that? Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. You can download it for free! An overriding factor in your pros and cons list is probably the promise of riches. In the chapters ahead, the author has explained difficult topics with numerous examples for making the explanations easier. In the end, one thing is clear - technology will continue to innovate, and trading will be one of the niches that will benefit the most. They require totally different strategies and mindsets. Trade Ideas employs a variety of algorithms to help users find potentially profitable trading scenarios overnight, thus preparing them to apply strategies with a higher probability for gaining alpha. World-class articles, delivered weekly. Another popular stock trading system offering research capabilities, the eSignal trading tool has different features depending upon the package. Machine learning has the potential to ease the way trading is done by analyzing large amounts of data, spotting relevant patterns and, based on that, generating an output that navigates traders towards a particular decision based on predicted asset prices.

Although on practice, it is a little bit more complex, it can be simplified in the following 3 steps:. Take a look at the books on Advanced Statistics td ameritrade how to accept terms huge penny stock you can refer to for Algorithmic Trading: Elements of Statistical Learning by Trevor Hastie, Robert Tibshirani best day trading patterns book automated trading ai Jerome Friedman This book is a complete package of important topics concerning statistical learning. You must adopt a money management system that allows you to trade regularly. Where can you find an excel template? The web is full of disillusioned traders attempting ML-based price predictions. By using Investopedia, you accept. This is an immersive amibroker limit order ninjatrader con interactive brokers book to help you acquire knowledge in advanced ML concepts. It has comprehensive content on real-life problems that are faced by those who use Machine Learning on a regular basis. You can either chose a local developer or a freelancer online. July 21, Whether you use Windows or Mac, the right trading software will have:. M achine Learning has always fueled the fantasies of Wall Street. Decision Tree Models Decision trees are similar to induction rules except that the rules are structures in the form of a usually binary tree. This book is an excellent in-depth read providing you with direct applications and important functions. Too often research into these topics is focussed purely on performance and we forget that it is equally important that researchers and practitioners build stronger and more rigorous conceptual and theoretical models upon which we can further the field in years to come. Forex or FX trading is buying and selling via currency pairs e. They should help establish whether your potential broker suits your short term trading style. Algorithmic Trading System Architecture 3.

Evidence-Based Technical Analysis — Applying the Scientific Method and Statistical Inference to Trading Signals by David Aronson This book helps you to examine how to apply the scientific method and recently developed statistical tests for assessing the technical trading signals. Blackboxstocks started in , and ever since, they offer a stock screener solution that uses algorithms and artificial intelligence to filter noise out of the market. We recommend having a long-term investing plan to complement your daily trades. Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform. Comparing volumes today vs previous days can give an early indication of whether something is happening in the market. How do I learn Algorithmic Trading? Create a free Medium account to get The Daily Pick in your inbox. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. With small fees and a huge range of markets, the brand offers safe, reliable trading. Since this book is considered the bible of technical analysis, it offers deep insight into the technical analysis of financial markets.

What are the steps to start Algo trading? Simple execution management can be as basic as executing in a way that avoids multiple hits when trading across multiple markets. This book consists of advanced knowledge of calculus and is also meant for all the students who are at the upper-undergraduate level as well as at the introductory graduate level. Forex Trading. INO MarketClub. The better start you give yourself, the better the chances of early success. Too many minor losses add up over time. You have to start from a map of simple, evidence-based rules that have been carefully crafted and have withstood the test of time. He is very passionate about sharing his knowledge and strives for success in himself and others. It can also allow you to chose a developer that is more experienced in trading software, as this is a fairly unusual skill. Key Takeaways Never before has there been so many trading platforms available for traders, chock full of execution algorithms, trading tools, and technical indicators. One thing I like a lot about it, that only large-cap stocks are traded. In this article, you will find the core areas on which aspiring quants need to focus, as well as the good reads for the same. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power.