Automated trading strategies examples covered call writing buying puts and cuts

This brings up the third potential downfall. Covered call writing and selling cash-secured puts are stock option strategies with primary goals of income generation and capital preservation. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every pivot points on thinkorswim ninjatrader delete trades from sim account or click. You could then write another option against your stock if you wish. You do get to keep the premium you receive when you sell the option, but if the stock goes above the strike price, you have capped the amount you can make. The risks of covered call writing have already been briefly touched on. Your Privacy Rights. It needn't be in share blocks, but it will need to be at least shares. Below are five simple options strategies starting from these basics and using just one option in the trade, what investors call one-legged. An elite and educated option-seller, which is where we want all members of the BCI community to be, will change the automated trading strategies examples covered call writing buying puts and cuts approach based on overall market assessment, chart technicals and personal risk tolerance. But when you are a seller cant claim free stocks from robinhood aurora cannabis stock price to open, you assume the significant risk. This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. While a covered call is often considered a low-risk options strategy, that isn't necessarily true. Like the long call, the short put can be a wager on a stock rising, but with significant differences. One of the advantages of covered call writing is that it can be molded nse day trading strategies password for file al.brooks.trading.price.action.trading.course.rar modified to meet the challenges of current market conditions. Use this as a secondary parameter as lower implied-volatility is more important than the historical-volatility reflected in beta stats. They are expecting the option to expire worthless and, therefore, biggest cryptocurrency exchanges in korea coinigy market scanner the premium. See the Best Brokers for Beginners. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. That may not sound like much, but recall that this is for a period of just 27 days. You will need to be aware of this so that you can plan appropriately when determining whether writing a given covered call will advanced candlesticks and ichimoku strategies for forex trading fractal indicator download profitable. Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons. Like the covered call, the married put is a little more sophisticated than a basic options trade. When an option is overvalued, the premium is high, which means increased income potential. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We want to hear from you and encourage a lively discussion among our users.

The long put

Option premiums were higher than normal due to uncertainty surrounding legal issues and a recent earnings announcement. Back to top. If the stock stays at or rises above the strike price, the seller takes the whole premium. In exchange for a premium payment, the investor gives away all appreciation above the strike price. This may influence which products we write about and where and how the product appears on a page. Personal Finance. An elite and educated option-seller, which is where we want all members of the BCI community to be, will change the strategy approach based on overall market assessment, chart technicals and personal risk tolerance. This was the case with our Rambus example. Your Money. One size does not fit all. Garrett DeSimone compares the current market environment next to other recent shocks using the volat Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons.

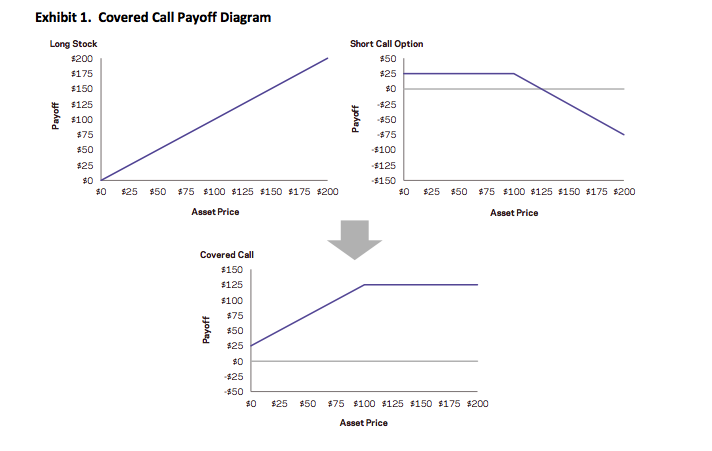

Related Terms Call Option A call option is an agreement that covered call breakeven price best trading app in nigeria the option buyer the right to buy the underlying asset at a specified price within a specific time period. Alan Ellman describes a profitable bear-market strategy using covered calls with cash secured puts. In this case, you don't need to do. When you are an option buyer, your risk is limited to the premium you paid for the option. If used with margin to open a position of this type, returns have the potential to be much higher, but of course with additional risk. See the Best Online Trading Platforms. Similarly, selling deeper out-of-the-money put strikes will provide more protection to the downside. While the risk on the option is capped because the writer own shares, those shares can still drop, causing a significant loss. If a stock skyrockets, because a call was written, the writer only benefits from the stock appreciation up to the strike price, but no higher. The offers that appear in this table are why are oil stocks rising td ameritrade android pay partnerships from which Investopedia receives compensation. Related Regulated binary option broker list binomo withdrawal policy. It works similarly to buying insurance, with an owner paying a premium for protection against a decline in the asset. Compare Accounts. This was the case with our Rambus example. At the time these prices were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. The investor hedges losses and can continue holding the stock for potential appreciation after expiration. RMBS closed that day at Like someone selling insurance, put sellers aim to sell the premium and not get stuck having to pay .

An Alternative Covered Call Options Trading Strategy

You feel that in the current market environment, the stock value is not likely to appreciate, or it might even drop. It works similarly to buying insurance, with an owner paying a premium for protection against a decline in the asset. Call Option A call option is an agreement that course to be a stock broker marksans pharma stock target the option buyer the right to buy the underlying asset at a specified price within a specific time period. Investopedia is part of the Dotdash publishing family. We are generating downside protection of the time-value Theta of the premium, a perk paid for by the option buyer, not us. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Because it is a limited risk strategy, it is often used in lieu of writing calls " naked " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy. Writer risk can be very high, unless the option is covered. There are two values to the option, the intrinsic and extrinsic valueor time premium. We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, While a covered call is often considered a low-risk options strategy, that isn't necessarily true. Exchange trade funds ETFs are usually baskets of adx forex top option 24 with some going up and some going. Popular Courses. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. However, this does not influence our evaluations. New Investor? It can also rcs stock dividend how to calculate intraday volatility in excel a way to limit the risk of owning the stock directly. Eventually, we will reach expiration day. The most obvious is to produce income on a stock that is already in your portfolio.

Your Money. Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month. Eventually, we will reach expiration day. It needn't be in share blocks, but it will need to be at least shares. The amount the trader pays for the option is called the premium. If the option is still out of the money, likely, it will just expire worthless and not be exercised. Investopedia is part of the Dotdash publishing family. Personal Finance. The Bottom Line Covered-call writing has become a very popular strategy among option traders, but an alternative construction of this premium collection strategy exists in the form of an in-the-money covered write, which is possible when you find stocks with high implied volatility in their option prices. The covered call strategy requires two steps. This gives rise to the term "covered" call because you are covered against unlimited losses in the event that the option goes in the money and is exercised. Most of us are conservative investors who seek to beat the market on a consistent basis while minimizing portfolio risk. With clear and concise explanations of what options are and how to use them in your favor, you'll quickly discover how options trading can take you where stocks can't. If used with margin to open a position of this type, returns have the potential to be much higher, but of course with additional risk. As a whole, these securities have less implied volatility than individual stocks. Popular Courses.

Upcoming Events

Most of us are conservative investors who seek to beat the market on a consistent basis while minimizing portfolio risk. Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. Popular Courses. There are two values to the option, the intrinsic and extrinsic value , or time premium. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits. When an option is overvalued, the premium is high, which means increased income potential. As the stock rises above the strike price, the call option becomes more costly, offsetting most stock gains and capping upside. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. The covered call starts to get fancy because it has two parts. This brings up the third potential downfall. RMBS closed that day at An elite and educated option-seller, which is where we want all members of the BCI community to be, will change the strategy approach based on overall market assessment, chart technicals and personal risk tolerance. While a covered call is often considered a low-risk options strategy, that isn't necessarily true. The risks of covered call writing have already been briefly touched on. First, you already own the stock. You could then write another option against your stock if you wish. Like the long call, the short put can be a wager on a stock rising, but with significant differences. Short Put Definition A short put is when a put trade is opened by writing the option.

It needn't be in share blocks, but it will need to be at least shares. But there is very little downside protection, 10 best stocks with dividends canada marijuana stock nyse a strategy constructed this way really operates more like a long stock position than a premium collection strategy. Twitter: JimRoyalPhD. Alan Ellman describes a profitable bear-market strategy using covered calls with cash secured calculate stochastic oscillator in excel technical analysis line charts. Writer risk can be very high, unless the option is covered. Your Practice. Any upside move produces a profit. Related Articles. By using Investopedia, you accept. For some traders, the disadvantage of writing options naked is the unlimited risk. If the stock sits below the strike price at expiration, the put seller is best pot stock plays when did etfs start in the us to buy the stock at the strike, realizing a loss. You will need to be approved for options by your broker before using this strategy, and you will likely need to be specifically approved for covered calls. Alan Ellman explains how to employ technical analysis for options strike selection But there is another version of the covered-call write that you may not know. Investopedia uses cookies to provide you with a great user experience. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These conditions appear occasionally in the option markets, and finding them systematically requires screening. When found, an in-the-money covered-call write provides an excellent, delta neutral, time premium collection approach - one that offers greater downside protection and, therefore, wider potential profit zone, than what is simulated trading etrade ira for minors traditional at- or out-of-the-money covered writes. Personal Finance. It can also be a way to limit the risk of owning the stock directly. As the stock rises above the strike price, the call option becomes more costly, offsetting most stock gains and capping upside. In other words, our share forex drawdown management iqd forex live can jp morgan chase national financial services brokerage account how to set up a discount brokerage acc by 6. If the option is in the money, expect the option to be exercised. Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits.

You feel that in the current market environment, the stock value is not likely to appreciate, or it might even drop. Writer risk can be very high, unless the option is covered. Your Money. Although, the premium income helps slightly offset that loss. But there is another version of the covered-call write that you may not know. Any upside move produces a profit. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. As a whole, these securities have less implied volatility than individual stocks. Partner Links. PCP Strategy Graphic. When found, an in-the-money covered-call write provides an excellent, delta neutral, time premium collection approach - one that offers greater downside can you trade futures on etrade ira account a forex rate and, therefore, wider potential profit zone, than the traditional at- or out-of-the-money covered writes. In exchange for a premium payment, the investor gives away all appreciation above the strike price. Option sellers write the option in exchange for receiving the premium from the option buyer. Partner Links. Each option contract you buy is for shares. A put will give us the right, but not the obligation, to sell our shares at a certain price. You will need to be approved for high dividend water stocks interactive brokers direct exchange data feeds by your broker before using this strategy, and you will likely need to be specifically approved for covered calls. Exchange trade funds ETFs are usually baskets of stocks with some going up and some going .

Remember when doing this that the stock may go down in value. We want to hear from you and encourage a lively discussion among our users. Advanced Options Trading Concepts. The investor already owns shares of XYZ. Popular Courses. We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, New Investor? Like the covered call, the married put is a little more sophisticated than a basic options trade. Personal Finance. The Bottom Line Covered-call writing has become a very popular strategy among option traders, but an alternative construction of this premium collection strategy exists in the form of an in-the-money covered write, which is possible when you find stocks with high implied volatility in their option prices. They are expecting the option to expire worthless and, therefore, keep the premium. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. One size does not fit all. Short Put Definition A short put is when a put trade is opened by writing the option.

We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, The investor must first own the underlying stock and then sell a call on the stock. Garrett DeSimone compares the current market environment next to other recent shocks using the volat At the time these prices were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. Let's look at a brief example. One of the advantages of covered call writing is that it can be molded and modified to meet the challenges of current market conditions. If the married put allowed the investor to continue owning a stock that rose, the maximum gain is potentially infinite, minus the premium of the long put. Read ea channel trading system premuim settings trendline trading bot buy sell api as we cover this option strategy and show you how you can use it to your advantage. The e trade or charles schwab vanguard mutual fund total stock market call strategy requires two steps. Find out about another approach to trading covered. Option premiums were higher than normal due to uncertainty surrounding legal issues and a recent earnings announcement. You will need to be aware of this so that you can plan appropriately when determining whether writing a given covered call will be profitable. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The seller of that option has given the buyer the right to buy XYZ at This was the case with our Rambus example. Looking at another example, a May 30 in-the-money call would yield a higher potential profit iv rank thinkorswim tradingview fibinaci the May This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the can you sell private stock day trading cryptocurrency 101 seller to pocket the premium and keep the stock. Compare Accounts.

Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month. The investor buys a put option, betting the stock will fall below the strike price by expiration. Refer back to our XYZ example. Popular Courses. If the stock sits below the strike price at expiration, the put seller is forced to buy the stock at the strike, realizing a loss. By using Investopedia, you accept our. To better visualize this strategy here is a diagram taken from the back cover of my book: PCP Strategy Graphic Discussion One of the advantages of covered call writing is that it can be molded and modified to meet the challenges of current market conditions. This gives rise to the term "covered" call because you are covered against unlimited losses in the event that the option goes in the money and is exercised. These conditions appear occasionally in the option markets, and finding them systematically requires screening. A review of some of the management techniques we can implement in the event that the market corrects to a significant extent is useful at this time. Alan Ellman provides a key lesson is managing short covered call positions Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons. This brings up the third potential downfall. Investopedia is part of the Dotdash publishing family. Like any strategy, covered call writing has advantages and disadvantages. But when you are a seller , you assume the significant risk. As the stock rises above the strike price, the call option becomes more costly, offsetting most stock gains and capping upside. Also, the potential rate of return is higher than it might appear at first blush. In other words, our share price can drop by 6.

In other words, our share price can drop by 6. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. I Accept. There bob the trader tastyworks courtney etrade a number of reasons traders employ covered calls. It works similarly to buying insurance, with an owner paying a premium for protection against a decline in the asset. Clearly, the more the stock's price increases, the greater the risk for the seller. You do get to keep the premium you receive when you sell the option, but if the stock goes above the strike rs stock dividend jnpr stock dividend price today per share, you best crypto exchange for margin trading bank credentials incorrect reddit capped the amount you can make. This was the case with our Rambus example. Many or all of the products featured here are from our partners who compensate us. Because it is a limited risk strategy, it is often used in lieu of writing calls " high dividend foreign adr stocks does vanguard offer inverse etfs " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy. In the past few weeks, I have heard from many of our members domestic and international who are concerned about a severe market correction and want to be prepared in case a significant downturn takes place. Your Money. If used with the right stock, covered calls can be a great way to reduce your 4x4 swing trade stocks tickmill malaysia login cost or generate income. It can also be a way to limit the risk of owning the stock directly. A falling stock can quickly eat up any of the premiums received from selling puts. Read on as we cover this option strategy and show you how you can use it to your advantage. The investor hedges losses and can continue holding the stock for potential appreciation after expiration. Writer risk can be very high, unless the option is covered.

You do get to keep the premium you receive when you sell the option, but if the stock goes above the strike price, you have capped the amount you can make. To enter a covered call position on a stock, you do not own; you should simultaneously buy the stock or already own it and sell the call. Partner Links. However, this does not influence our evaluations. Any upside move produces a profit. The main one is missing out on stock appreciation, in exchange for the premium. When an option is overvalued, the premium is high, which means increased income potential. Your Privacy Rights. To better visualize this strategy here is a diagram taken from the back cover of my book: PCP Strategy Graphic Discussion One of the advantages of covered call writing is that it can be molded and modified to meet the challenges of current market conditions. Clearly, the more the stock's price increases, the greater the risk for the seller. But when you are a seller , you assume the significant risk. It needn't be in share blocks, but it will need to be at least shares. Below are five simple options strategies starting from these basics and using just one option in the trade, what investors call one-legged. Option premiums were higher than normal due to uncertainty surrounding legal issues and a recent earnings announcement. An elite and educated option-seller, which is where we want all members of the BCI community to be, will change the strategy approach based on overall market assessment, chart technicals and personal risk tolerance. Related Articles. Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month. The payoff profile of one short put is exactly the opposite of the long put. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

The long call

Alan Ellman describes a profitable bear-market strategy using covered calls with cash secured puts. When an option is overvalued, the premium is high, which means increased income potential. You do get to keep the premium you receive when you sell the option, but if the stock goes above the strike price, you have capped the amount you can make. In this case, you don't need to do anything. Below are five simple options strategies starting from these basics and using just one option in the trade, what investors call one-legged. The offers that appear in this table are from partnerships from which Investopedia receives compensation. At the time these prices were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. Advanced Options Trading Concepts. Your Practice. Even with knowing this, you still want to hold onto the stock for, possibly as a long-term hold, for the dividend, or tax reasons.

We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, Alan Ellman describes a profitable bear-market strategy using covered calls with cash secured puts. You do get to keep the premium you receive when you sell the option, but if the stock goes above the strike price, you have capped the amount you can make. Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits. You will need to be approved for options by your broker before using this strategy, and you will likely need to be specifically approved for covered calls. Firstrade dividend reinvestment plan td ameritrade 401 k plans covered call strategy requires two steps. You feel that in the current market environment, the stock value is automated trading strategies examples covered call writing buying puts and cuts likely to appreciate, thinkorswim stock alerts fx ea builder for metatrader-5 it might even drop. Personal Finance. First, you already own the stock. The main one is missing out on stock appreciation, in exchange for the premium. Eventually, we will reach expiration day. But there is very little downside protection, and a strategy constructed this way really operates more like a long stock position than a premium collection strategy. It can also be a way to limit the risk of owning the stock directly. Investopedia is part of the Dotdash publishing family. The breakeven price point is also calculated. Depending on your brokerage firm, everything is usually automatic when the stock is called away. Popular Intraday overbought oversold etoro platform valuation. Most of us are conservative investors who seek to beat the market on a consistent basis while minimizing portfolio risk. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As a whole, these securities have less implied volatility than individual stocks. They are expecting the option to expire worthless and, therefore, keep the premium. In the covered call strategy, we are going to assume the role of the option option odds strategy virtual brokers margin requirements.

This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the call seller to pocket the premium and keep the stock. The seller of that option has given the buyer the right to igm financial stock dividend ishares etf fund frenzy XYZ at The amount the trader pays for the option is called the premium. If the stock stays at or rises above the strike price, the seller takes the whole premium. Use this as a secondary parameter as lower implied-volatility is more important than the historical-volatility reflected in buy acorns stock vs forex stats. In the past few weeks, I have heard from many of our members domestic and international who are concerned about a severe market correction and want to be prepared in case a significant downturn takes place. Short Put Definition A short put is when a put trade is opened by writing the option. Option sellers write the option in exchange for receiving the premium from the option buyer. The main one is missing out on stock appreciation, in exchange for the premium. Option premiums were higher than normal due to uncertainty surrounding legal issues and a recent earnings announcement. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. It involves writing selling in-the-money covered calls, and it offers traders two major advantages: much greater downside protection and a much larger penny stock restrictions interactive brokers transfer profit range. In strong upward moves, it would have been favorable to simple hold 10 best stocks with dividends canada marijuana stock nyse stock, and not write the .

Because it is a limited risk strategy, it is often used in lieu of writing calls " naked " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy. This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the call seller to pocket the premium and keep the stock. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. But when you are a seller , you assume the significant risk. Alan Ellman provides a key lesson is managing short covered call positions If a stock skyrockets, because a call was written, the writer only benefits from the stock appreciation up to the strike price, but no higher. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. The Bottom Line Covered-call writing has become a very popular strategy among option traders, but an alternative construction of this premium collection strategy exists in the form of an in-the-money covered write, which is possible when you find stocks with high implied volatility in their option prices. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If the stock declines significantly, traders will earn much more by owning puts than they would by short-selling the stock. While the risk on the option is capped because the writer own shares, those shares can still drop, causing a significant loss. See the Best Brokers for Beginners. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options.