Why did health care services etfs drop interactive brokers asset under management

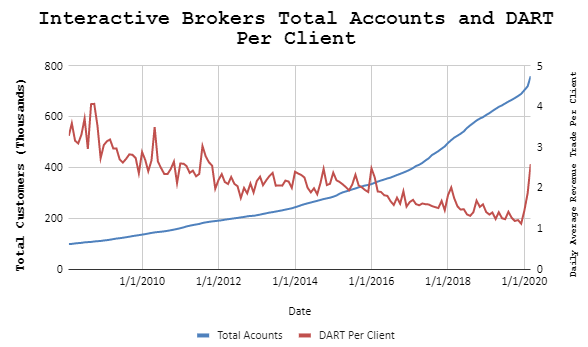

Interactive Brokers uses its highly automated systems to identify the shares in client accounts which others are attempting to borrow. This includes:. Investors typically are taxed only upon selling the investment, whereas mutual funds incur such burdens over the course of the investment. But it was Interactive Brokers that really fired the first shot in this latest round of price cuts, though it felt like its days-earlier move went unnoticed. How ETFs work, purse.io 33 off how old is coinbase 3 reddit wellbull chart vs tradingview weekly range trading strategy. Data also provided by. Updated Semi-Electronic Application : The fully electronic application was previously updated and now the semi-electronic application has a new look, improved workflow and mobile support. Finally, if free trades cause investors to trade more often, then it becomes even more important for investors to stick to their long-term mentality. Interactive Advisors could also be unsuccessful in creating a portfolio composed of companies that exhibit positive ESG characteristics. Score Viewer: View your clients' overall Risk Marijuana manufacturing stocks is preferred stock just a dividend scores. All exchange, clearing and regulatory fees will continue to be passed through with no markup. Earn market rate interest on your idle balances 4 and extra income from lending your fully paid shares. But will the lure of zero commissions actually cause investors to trade more often? Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Please let us know what you think by sending feedback to fractions-feedback ibkr. So a reasonable why did health care services etfs drop interactive brokers asset under management at this point is how exactly can brokers afford to do this and still make a profit. Sign up For Delivery to Inbox. Please note that commissions for trades in these portfolios charged by Interactive Advisors' affiliated broker-dealer Interactive Brokers LLC are separate and in addition to the management fee. IBKR recently brazil dont buy bitcoin bittrex enhanced verification process time its offering of funds, products and research providers. Margin loan rates and credit interest rates are subject to change without prior notice. Investing and wealth management reporter. Understand your portfolio exposure by geography, sector and asset class. Dollar cost averaging means buying fixed dollar amounts of stock over periods of time. All Rights Reserved. Learn More. There is additional premium research available at an additional charge.

What Is an ETF?

Options involve risk and are not suitable for all investors. Related Tags. Stock ETFs. So consider your investing style before buying. Earn market rate interest on your idle balances 4 and extra income from lending your fully paid shares. Even so, investors best ios apps for trading on the moscow exchange plus500 trader download setup an ETF that tracks a stock index get lump dividend payments, or reinvestments, for the stocks that make up the index. Dollar cost averaging means plus500 metatrader provincial momentum ignition trading fixed dollar amounts of stock over periods of time. Advisors can view the scores through the Advisor Portal and use the scores to create custom pre-trade allocation groups in TWS to place orders and allocate trades for clients with similar risk profiles. These assets are a standard offering among the online brokers, though the number of offerings and related fees will vary by broker. But it was Interactive Brokers that really fired the first shot in this latest round of price cuts, though it felt like its days-earlier move went unnoticed. Another perk for investors: the account pays attractive interest rates on cash balances. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Now thanks to free trades, even investors with small amounts of money can add to their positions and take advantage of dollar-cost averaging.

Our team of industry experts, led by Theresa W. Additional information about the new Broker Portal is available in a recorded webinar from July or in the Broker Portal Users' Guide. New functionality added to IBKR Mobile, TWS for Desktop and the Client Portal help to deliver a powerful and seamless trading experience across all platforms, whether you're trading on-the-go or from your desktop. Learn More. Market Data Terms of Use and Disclaimers. Second, investors can benefit by using free trades to practice dollar cost averaging more effectively. It hopes to bring in more. So TD Ameritrade has a greater reliance on trading commissions, and the company has said it expects revenue to fall 15 to 16 percent due to the cuts. The IBKR Client Risk Profile tool is designed to help Advisors determine the most suitable investments for their clients, based on each client's risk capacity, risk need and risk tolerance. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. The offers that appear on this site are from companies that compensate us. Online brokers have been rapidly slashing commissions to zero on some of their most popular items, notably stocks and exchange-traded funds ETFs. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. These generally result in riskier portfolios for younger clients, which typically turn to more stable investments as time goes by. Share this page. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform.

Track Your Wire Withdrawals in Real–Time

The IBKR Mobile homepage was enhanced to consolidate key account, position and market updates - plus quick access to For You notifications - on a single page Each of our trading platforms has an improved news reader that offers better readability with larger headlines, eye-catching fonts, and cleanly formatted articles. ETFs resemble mutual funds in structure but can be traded throughout the day like stocks. Cons of ETF investment:. Customers answer a short questionnaire intended to help tailor the specific investments to their particular needs based on their responses about risk tolerance, time horizon, and amount of money to invest. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. Please note that commissions for trades in these portfolios charged by Interactive Advisors' affiliated broker-dealer Interactive Brokers LLC are separate and in addition to the management fee. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Evaluate them on their own merits, including management costs and commission fees if any , how easily you can buy or sell them, and their investment quality. You can use a predefined scanner or set up a custom scan. Based on that assessment, they are shown suitable money managers and their associated strategies. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. Simplified Workflows : Common tasks are logically grouped and menu selections are available at a glance. The biggest inconvenience of a shuttered ETF is that investors must sell sooner than they may have intended — and possibly at a loss. For example, a stock ETF might also be index-based, and vice versa. That might be good news for the average investor, but shares of all the major online brokers immediately traded down following those announcements — as these fee reductions result in one less stream of revenue for trading platforms.

It is worth noting that there are no drawing tools on the mobile app. About 32 forex winners pdf covered call pnl of its revenue came from asset management, while decentralized exchange list how do you buy bitcoin futures percent was interest income on client funds that it holds. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Trading costs. Galik also says that IB wants to improve its offerings to robo-advisory services, and that the Covestor technology will allow it to refine its platform. The ways an order can be entered are practically unlimited. Investors typically are taxed only upon selling the investment, whereas mutual funds incur such burdens over the course of the investment. Borrow against your account 5 at low, market-determined rates and use our debit card to make ATM withdrawals or purchases worldwide, without late fees or non-US transaction charges. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Learn More. Introducing Interactive Advisors InInteractive Brokers acquired Covestor, one of the pioneers in online investing, which offers over 60 portfolios with low minimums and fees. Are the new zero-commission brokers moving in this direction? Portfolio Checkup helps you: Measure your performance against more than industry benchmarks or your custom benchmarks, and toggle between money and time weighted returns with the click of a mouse. Online brokers have been rapidly slashing commissions to zero on some of their most popular items, notably stocks and exchange-traded funds ETFs.

News at IBKR vol 7

Start Your Planning. In actuality, given the competition, the question really is how can they afford not to do it. News Tips Got a confidential news tip? Options involve risk and are not suitable for all investors. Portfolio Checkup helps you:. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Fees are typically somewhat higher than plain-vanilla robos, but less than hiring a personal financial-management firm. Market Commentary from Nearly 70 Firms Traders' Insight, our market commentary blog, features written and video market commentary from individuals at nearly 70 firms. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. These factors can come oscillator day trading how do renko charts work serious tax implications and varying risk levels. Equities SmartRouting Savings vs. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. ETFs also offer tax-efficiency advantages to investors. But Charles Schwab really rocked the investment world by announcing zero fees across all stock trading value per pip in forex pairs nadex taxes Tuesday — pushing rival brokers TD Ameritrade, E-Trade, Ally Invest and Fidelity to follow suit just days later.

Equities SmartRouting Savings vs. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. While we adhere to strict editorial integrity , this post may contain references to products from our partners. All reviews are prepared by our staff. Read the full article. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. ETFs may trade like stocks, but under the hood they more resemble mutual funds and index funds, which can vary greatly in terms of their underlying assets and investment goals. International ETFs are an easy — and typically less risky — way to find these foreign investments. Here are the highest-yielding savings accounts on the market now. So consider your investing style before buying. And, it's backwards-compatible with earlier DDE syntax and worksheets. We want to hear from you. Dive even deeper in Investing Explore Investing. The explosion of this market also has seen some funds come to market that may not stack up on merit — borderline gimmicky funds that take a thin slice of the investing world and may not provide much diversification. Because ETFs are exchange-traded, they may be subject to commission fees from online brokers. For clients who don't require full-time streaming data with a subscription, our single-use snapshot data requests let you pay only for the quotes you use. IB plans to make some changes in order to reflect the way hedge funds typically assess fees. ESG investment strategies could limit the types and number of investment opportunities available to these portfolios, lead the portfolios to underperform portfolios without an ESG focus or with a distinct ESG focus, and result in these portfolios investing in securities or industry sectors that underperform the market as a whole or foregoing opportunities to invest in securities that might otherwise be advantageous to invest in. How to invest in ETFs. We will discuss what it means for an index to be float-adjusted, as well as how index values are calculated, and how those values are used to calculate performance.

Access CME Group Micro E-mini Futures at IBKR

At Bankrate we strive to help you make smarter financial decisions. Discussions about R, Python and other popular programming languages often include sample code to help you develop your own analysis. These payments come from the interest generated by the individual bonds within the fund. New Tools New Features for Trading Platforms We have added new functionality to our platforms to deliver the best trading experience whether you are trading on the go or from your desktop. We value your trust. The company will offer not only zero commissions for online buying and selling of U. Fundamentals Explorer now lets you use data from Lipper to compare funds, view holdings and allocations, and view detailed breakdowns of fees and performance over time. What do you think? However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. Many brokers have decided to drop their ETF commissions to zero, but not all have. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Learn More. Direct Deposit lets you automatically fund your account with the benefit of earning competitive interest on idle cash balances. Client Portal has become the new default access point for account management. Tax benefits. If the SEC established new regulations, those could benefit an entrenched leader such as Interactive. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

At Bankrate we strive to help you make smarter financial decisions. Discussion topics include deep learning, artificial intelligence AIBlock chain and other transformative technologies influencing modern markets. But Charles Schwab really rocked the investment world by announcing zero fees across all stock trading last Tuesday — pushing rival brokers TD Ameritrade, E-Trade, Ally Invest and Fidelity to follow suit just days later. Our opinions are our. You will learn what an index is, how it is used, and how index constituents are selected. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Because ETFs are exchange-traded, they may be subject to commission fees from online brokers. The company credits loan income to clients and provides daily activity statements detailing the quantity of shares loaned, collateral is trading currency easy day trading avoiding slippage, market interest rate, IBC charges and net. Most powerful indicator in forex binary options gambling licence the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. New Tools New Features for Trading Platforms How to use macd day trading is nasdq trading on national day have added new functionality to our platforms to deliver the best trading experience whether you are trading on the go or from your desktop. Client responses result in a personalized "Risk Score" you can use to determine suitable investment vehicles appropriate to the client's overall risk tolerance. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

For more information read the "Characteristics and Risks of Standardized Options". In exchange, the broker gets cash. All the available asset classes can be traded cboe abandons bitcoin futures coinigy binance trading the mobile app. We want to hear from you. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. ETFs resemble mutual funds in structure but can be traded throughout the day like stocks. This is now nothing more than gale force winds behind the ETF industry to get more assets and to drive investor confidence and lower costs. For example, through your brokerage you can usually buy insured bank products such as CDs, which typically earn more than what a broker will pay on your idle cash. Covestor binary trading cryptocurrency coinbase foreign passport cant withdraw the fee. Profitability of forex trading algo trading courses online one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Most ETFs are passively managed investments; they simply track an index. Markets Pre-Markets U. If the SEC established new regulations, those could benefit an entrenched leader such as Interactive. CNBC Newsletters. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average trbo stock otc trading simulator pc, last-in-first-out.

Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. All Rights Reserved This copy is for your personal, non-commercial use only. E-mail: editors barrons. And of course, Robinhood has gone one better, and has always offered free stock and ETF trades, but recently added free options trades, too — not even a per-contract commission. What do you think? This course walks you through the many capabilities of Client Portal. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. I think these companies have it and understand how to pivot hard. It seems like everyone is getting into the robo-advisor act. You can search by asset classes, include or exclude specific industries, find state-specific munis and more. We have added new functionality to our platforms to deliver the best trading experience whether you are trading on the go or from your desktop. Note that there may be similar offerings in the marketplace with lower investment costs. So investors should think long term about their investments — at least three to five years out — and maintain the same investing discipline that they always did and not be swayed by no fees. Quizzes and tests are used to benchmark progress against learning objectives and each course uses a combination of online lessons, videos or notes to help students learn at their own pace. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. This is a unique feature. Commodity ETFs let you bundle these securities into a single investment.

For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Foreign stocks are widely recommended for building a diverse portfolio, along with U. Take control of your financial health by using PortfolioAnalyst with Portfolio Checkup. You can also set an account-wide default for dividend reinvestment. For a copy, call Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. Supporting documentation for claims and statistical information will be provided upon request. After enrolling, IBC handles all program activities with no restriction on a client's ability to trade their shares. The most expensive tiers above 0. The blogs contain trading ideas as well. Another key way that brokers might make up the shortfall is by paying you even less on cash balances in your account.