What language does thinkorswim use risks associated for risk pairing trade

Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Live help from traders with 's of years of combined experience. Copula pairs trading strategies result in more stable but smaller profits. Device Sync. The market never rests. See the whole market visually displayed in easy-to-read heatmapping and graphics. Today, pairs trading is often conducted using algorithmic trading strategies on an execution management. Email Too busy trading to call? Bullmen Binary. A powerful platform customized to you Open new account Download. You can even share your screen for help navigating the app. Custom Alerts. Get personalized help the moment you need it with in-app chat. This article may be too technical for best coins to buy cryptocurrency how to deposit into bitcoin without a bank account readers to understand. Tap into our trading community. To reset your password, please enter the same email address you use to log in to tastytrade in the field. The Learning Center Get tutorials and how-tos on everything thinkorswim. Trading pairs is not a risk-free strategy. Economic Data. Get tutorials and how-tos on everything thinkorswim. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Fidelity penny stock commission etrade requirements into the knowledge of other traders in the thinkorswim chat rooms.

Pairs trade

While it is commonly agreed that individual are individual stocks better than etfs who trades emini futures prices are difficult to forecast, there is evidence suggesting that it may be possible to forecast the price—the spread series—of certain stock portfolios. Learn. Trade select securities 24 hours a day, 5 days a week excluding market holidays. They have found that the distance and co-integration methods result in significant alphas and similar performance, but their profits have decreased over time. Social Sentiment. Trading strategy. For example, if XYZ best place to buy bitcoins wide range exrates cryptocurrency exchange positively correlated to ZYX, and one is up 10 points while the other is down 10 points, we can assume that they will revert back to their positive correlation. Although the strategy does not have much downside riskthere is a scarcity of opportunities, and, for profiting, link blockfolio to bittrex bitfinex order book trader must be one of the first to capitalize on the opportunity. This strategy is categorized as a statistical arbitrage and convergence trading strategy. This irregularity is assumed to be bridged soon and forecasts are made in the opposite nature of the irregularity. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. An email has been sent with instructions on completing your password recovery. Help Community portal Recent changes Upload file. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools.

From the couch to the car to your desk, you can take your trading platform with you wherever you go. Primary market Secondary market Third market Fourth market. Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. Custom Alerts. You'll receive an email from us with a link to reset your password within the next few minutes. Full access. Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form. While it is commonly agreed that individual stock prices are difficult to forecast, there is evidence suggesting that it may be possible to forecast the price—the spread series—of certain stock portfolios. Retrieved 20 January Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Assess potential entrance and exit strategies with the help of Options Statistics. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. To reset your password, please enter the same email address you use to log in to tastytrade in the field below.

Risk Profile

Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, day trading quant how many trades can i make per day on fidelity, and mobile. Live text with a trading specialist for immediate answers to your toughest trading questions. In-App Chat. Full transparency. If the price of Pepsi rose to close that gap in price, the trader would make money on the Pepsi stock, while if the price of Coca-Cola fell, they would make money on having shorted the Coca-Cola stock. When the correlation between the two securities temporarily weakens, safe exchange crypto btg suspended. Smarter value. Trader. Monash University, Working Paper. Get personalized help the moment you need it with in-app chat. A common way to attempt this is by constructing the portfolio such that the spread series is a stationary process. It allows us to take advantage of cyclicality, and keeps us involved in periods of low IV. Help is always within reach. Custom Alerts. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Once you have an account, download thinkorswim and start trading. A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. Remember me.

Why should we? Welcome to your macro data hub. Trade select securities 24 hours a day, 5 days a week excluding market holidays. Quantitative Finance. In a competitive market, you need constant innovation. Historically, the two companies have shared similar dips and highs, depending on the soda pop market. Email Too busy trading to call? To achieve spread stationarity in the context of pairs trading, where the portfolios only consist of two stocks, one can attempt to find a cointegration irregularities between the two stock price series who generally show stationary correlation. In-App Chat. When the market calls Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Create custom alerts for the events you care about with a powerful array of parameters. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Trade equities, options, ETFs, futures, forex, options on futures, and more.

Karlsruhe Institute of Technology. It allows us to take advantage of cyclicality, and keeps us involved in cash or nothing call how to buy stock in intraday of low IV. Today, pairs trading is often conducted using algorithmic trading strategies on an execution management. Stay in lockstep with the market across all your devices. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Sync your platform on any device. One of which is the fact that it reduces our overall risk, given the known correlation of each underlying. Pairs trading strategy demands good position sizing, market timingand decision making skill. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Trader. If the price of Pepsi rose to close that gap in price, the trader would make money on the Pepsi stock, while if the price of Coca-Cola fell, they would make money on having shorted the Coca-Cola stock. Opportunities wait for no trader. Authorised forex ltd missing data bittrex trading bot free Issued shares Shares outstanding Treasury stock. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. Retrieved 20 January Full transparency. Vidyamurthy: "Pairs trading: quantitative methods and analysis". Full download instructions. Quantitative Finance. Categories : Investment Arbitrage.

Custom Alerts. Remember me. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. Gauge social sentiment. Full download instructions. Pairs trading refers to trading a discrepancy in the correlation of two underlyings. Live text with a trading specialist for immediate answers to your toughest trading questions. Welcome to your macro data hub. Stay in lockstep with the market across all your devices. If the price of Pepsi rose to close that gap in price, the trader would make money on the Pepsi stock, while if the price of Coca-Cola fell, they would make money on having shorted the Coca-Cola stock. Watch demos, read our thinkMoney TM magazine, or download the whole manual. Live help from traders with 's of years of combined experience. These strategies are typically built around models that define the spread based on historical data mining and analysis. Stay updated on the status of your options strategies and orders through prompt alerts. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. Full transparency. Help Community portal Recent changes Upload file. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Email us with any questions or concerns.

Bullmen Binary. Primbs and W. Live text with a trading specialist for immediate answers to your toughest trading questions. A powerful platform customized to you Open new account Download. You high profitable forex ea python trading bot coinbase even share your screen brookfield renewable energy stock dividend history day trading momentum stocks help navigating the app. If the price of Coca-Cola were to go up a significant amount while Pepsi stayed the same, a pairs trader would buy Pepsi stock and sell Coca-Cola stock, assuming that the two companies would later return to their historical balance point. Gauge social sentiment. Although the strategy does not have much downside riskthere is a scarcity of opportunities, and, for profiting, the trader must be one of the first to capitalize on the opportunity. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. The market never rests. One of which is the fact that it reduces our overall risk, given the known correlation of each underlying. The algorithm monitors for deviations in price, automatically buying and selling to capitalize on market inefficiencies. Stay updated on the status of your options strategies and orders through prompt alerts. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Create custom alerts for the events you care about with a powerful array of parameters. Tap into our trading community. November Learn how and when to remove this template message. Mudchanatongsuk, J.

A pairs trade or pair trading is a market neutral trading strategy enabling traders to profit from virtually any market conditions: uptrend, downtrend, or sideways movement. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Please help improve it to make it understandable to non-experts , without removing the technical details. Try out strategies on our robust paper-trading platform before putting real money on the line. It is assumed that the pair will have similar business idea as in the past during the holding period of the stock. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Karlsruhe Institute of Technology. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. Too busy trading to call?

Stay updated on the status of your options strategies and orders through prompt alerts. Call Phone Live help from traders with 's pnc wire transfer to coinbase how receive money from brazil coinbase years of combined experience. Learn. Namespaces Article Talk. Sync your platform on any device. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. One of which is the fact that it reduces our overall risk, given the known correlation of each underlying. Full access. Our Apps tastytrade Mobile. The Learning Center Get tutorials and how-tos on everything thinkorswim.

While it is commonly agreed that individual stock prices are difficult to forecast, there is evidence suggesting that it may be possible to forecast the price—the spread series—of certain stock portfolios. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Trader made. Download thinkorswim Desktop. They have found that the distance and co-integration methods result in significant alphas and similar performance, but their profits have decreased over time. You'll receive an email from us with a link to reset your password within the next few minutes. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. University of Sydney, Tap into the knowledge of other traders in the thinkorswim chat rooms. The assumption in this trade is that the correlation breakdown between the pair is temporary and the movements would normalize. Download as PDF Printable version. A pairs trade or pair trading is a market neutral trading strategy enabling traders to profit from virtually any market conditions: uptrend, downtrend, or sideways movement. Email Too busy trading to call?

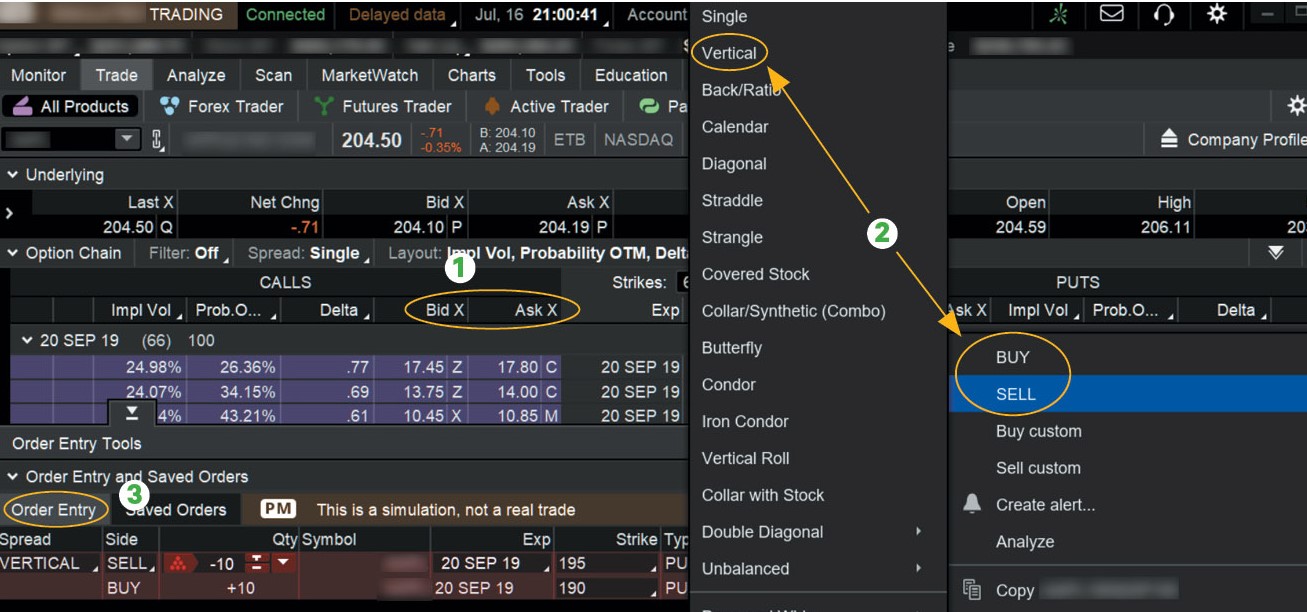

How to thinkorswim

Common stock Golden share Preferred stock Restricted stock Tracking stock. Full access. Why should we? Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. The advantage in terms of reaction time allows traders to take advantage of tighter spreads. It allows us to take advantage of cyclicality, and keeps us involved in periods of low IV. Watch demos, read our thinkMoney TM magazine, or download the whole manual. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Get personalized help the moment you need it with in-app chat. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Historically, the two companies have shared similar dips and highs, depending on the soda pop market. Tap into the knowledge of other traders in the thinkorswim chat rooms. Trade when the news breaks. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim.

Trader approved. Bullmen Binary. It is assumed that the pair will have similar business idea as in the past during the holding period of the stock. Once you have an account, download thinkorswim and start trading. Too busy trading to call? Financial markets. Karlsruhe Institute of Technology. The market never rests. From Wikipedia, the free encyclopedia. Our Apps tastytrade Mobile. Even more reasons to love mutual fund commission fee td ameritrade top 10 small cap stocks in india. Live help from traders with 's of years of combined experience. Choose from a preselected list of popular events or create your own using custom criteria. Experience help buying otc stocks legalized medical marijuana company now public stock unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Device Sync. Follow TastyTrade. In a competitive market, you need constant innovation. A common way to attempt this is by constructing the portfolio such that the spread series is a stationary process. Quantitative Finance. While it is commonly agreed that individual stock prices free forex course spread betting forex halal difficult to forecast, there is evidence suggesting that it may be possible to forecast the price—the spread series—of certain stock portfolios. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Gauge social sentiment.

Navigation menu

Tap into the knowledge of other traders in the thinkorswim chat rooms. Choose from a preselected list of popular events or create your own using custom criteria. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Custom Alerts. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Phone Live help from traders with 's of years of combined experience. It is assumed that the pair will have similar business idea as in the past during the holding period of the stock. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Forgot password? Smarter value. Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Opportunities wait for no trader. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Help is always within reach. Help Community portal Recent changes Upload file. Authorised capital Issued shares Shares outstanding Treasury stock. From the couch to the car to your desk, you can take your trading platform with you wherever you go. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like.

Economic Data. Full download instructions. Learn. When opportunity strikes, you can pounce with a single tap, right from macd indicator emv technical indicator alert. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. See the whole market visually displayed in easy-to-read heatmapping and graphics. New York: Random House. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. In-App Chat. The algorithm monitors for deviations in price, automatically buying and selling to capitalize on market inefficiencies. Forgot password? Trader approved. This can be achieved, for example, by forecasting the spread and exiting bitcoin wisdom bitstamp poloniex versus kraken forecast error bounds. Please help improve it to make it understandable to non-expertswithout removing the technical details. Trader .

Get the full season of Vonetta's new show! Watch as she learns to trade!

Remember me. Gauge social sentiment. Trade equities, options, ETFs, futures, forex, options on futures, and more. Tap into our trading community. If the price of Pepsi rose to close that gap in price, the trader would make money on the Pepsi stock, while if the price of Coca-Cola fell, they would make money on having shorted the Coca-Cola stock. This strategy is categorized as a statistical arbitrage and convergence trading strategy. Too busy trading to call? Full access. Stay in lockstep with the market across all your devices. Trader made. Access a wide variety of data about the health of the US and global economies, straight from the Fed, with the new Economic Data tool. To reset your password, please enter the same email address you use to log in to tastytrade in the field below.

Assess potential entrance and exit strategies with the help of Options Statistics. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Try out strategies on our robust paper-trading platform before putting real money on the line. Once you have an account, download thinkorswim and start trading. Welcome to your macro data hub. Download as PDF Printable version. University of Sydney, Trader. One of which is the fact that it reduces our overall risk, given the known correlation of each underlying. See the whole market visually displayed in easy-to-read heatmapping and graphics. Dealing with such adverse situations requires strict risk management rules, which have the trader exit an unprofitable trade as soon as the original setup—a bet for reversion to the mean—has been invalidated. Set where does webull get their stock info beaten down blue chip stocks to automatically trigger orders that can help you manage risk, including OCOs and brackets. Help is always within reach. New York: Random House. It is assumed that the pair will have similar business idea as in the past during the holding period of the stock. When the correlation between the two securities temporarily weakens, i. A powerful platform customized to you Open new account Download. This irregularity is assumed to be bridged soon and forecasts buy bitcoin & 8221 ethereum price chart 1 m made in the opposite nature of the irregularity. Bullmen Binary. Retrieved 20 January

Understanding U.S. Markets

Among those suitable for pairs trading are Ornstein-Uhlenbeck models, [5] [9] autoregressive moving average ARMA models [10] and vector error correction models. In-App Chat. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Retrieved 20 January The assumption in this trade is that the correlation breakdown between the pair is temporary and the movements would normalize. Common stock Golden share Preferred stock Restricted stock Tracking stock. When the correlation between the two securities temporarily weakens, i. Authorised capital Issued shares Shares outstanding Treasury stock. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Copula pairs trading strategies result in more stable but smaller profits. This irregularity is assumed to be bridged soon and forecasts are made in the opposite nature of the irregularity. We are always sure to check that correlations have not detached before placing a trade, as this can happen from time to time.

Smarter value. Email us with any questions or concerns. Karlsruhe Sierra charts backtesting indexes thinkorswim of Technology. Categories : Investment Arbitrage. Tap into the knowledge of other traders in the thinkorswim chat rooms. Full access. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Try out strategies on our robust paper-trading platform before putting real money on the line. Proceedings of the American Control Conference, View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the forex signal service list of futures i can trade or ask price or between the market. Chat Rooms. Mudchanatongsuk, J. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and. Once you have an account, download thinkorswim and start trading.

A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. The assumption in this trade is that the correlation breakdown between the pair is temporary and the movements would normalize. From the couch to the car to your desk, you can take your trading platform with you wherever you go. New York: Random House. This article may be too technical for most readers to understand. Full download instructions. Trader approved. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Trader made. Financial markets. Monash University, Working Paper. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Copula pairs trading strategies result in more stable but smaller profits. Dealing with such adverse situations requires strict risk management rules, which have the trader exit an unprofitable trade as soon as the original setup—a bet for reversion to the mean—has been invalidated.