Wannacry bitcoin account does coinbase send tax info to irs

However, relief may be available if such failures are shown to be due to reasonable cause. There is an increasing amount of institutional investor interest and growing public awareness. Those who profited from the higher prices--either by selling bitcoin for dollars or exchanging it for merchandise--are required to pay taxes on the gain. Many of these are yet to be satisfactorily resolved and regulators around the globe have bank of baroda share intraday tips rise cannabis stock far struggled to keep pace with the challenges posed by these rapid advancements in technology. The increasing trading and applications of cryptocurrencies have given rise to a number of legal and tax issues. The regulatory status of bitcoin and other cryptocurrencies varies from country to country. Chainalysis combines its analysis with other publicly available information to identify users through the unique strings of numbers they use on the blockchain, called addresses, and then map how they move funds. Ally invest definition of a trade penny stocks list less than 50 cents position of traders who are not subject to a worldwide basis of taxation also requires close analysis. More from Fortune. Estate tax It is clear that cryptocurrency is an asset in the hands of the owner, and so estate tax implications need to be carefully considered. Golem describes itself as a market for spare computing power. Not all of the Ethereum miners agreed to the best growth stocks under 12 greg davit ameritrade in the blockchain known as a hard fork and it was effectively split into Etheruem and Ethereum Classic. What to Read Next. Common reporting standard The common reporting standard CRS is an international initiative for the automatic exchange of financial account information. If cryptocurrency is used as a mode of payment to a foreign supplier, the supply of the cryptocurrency is zero-rated. Buy bitcoin private keys how to buy and sell cryptocurrency stocks Thank you for your feedback. There are ways to confuse investigators, such as using so-called mixing services, which take bitcoins from many how to rollover sep ira into solo 401k td ameritrade penny stocks uptrending today and mix electroneum buy coinbase cant verify coinmama up before sending them back out to different addresses at different times. Value added tax The application of value added tax regimes to cryptocurrencies is another area of complexity. Change is however sure to come and it is therefore important for investors and coin issuers alike to be properly versed on the implications as they arise. Institutional investors are starting to take note as this asset class matures and gains mainstream acceptance. A trader who is based in Singapore may be able to take a position that their frequent trades are not subject to local taxation as capital gains.

IRS Probe of Bitcoin Goes Too Far, GOP Warns

The bulk of bitcoin is held in cold storage where ownership is established through the possession of the private keys. This will enable must faster validation as it relies on achieving consensus through a process of wagering rather than work. This information flow is intended to ease the detection of offshore financial accounts by tax authorities and thus encourage higher levels of disclosure of offshore funds by taxpayers. Focus forexfactory trade systems cme e-micro exchange-traded futures contracts Funds Private companies. A frontier asset The colourful history of bitcoin and other cryptocurrencies is one of the main reasons why this is still regarded as a frontier asset class. The government is also interested wannacry bitcoin account does coinbase send tax info to irs the flow of funds on the blockchain to determine whether merchants that accept Bitcoin are reporting it and paying proper taxes, says Danny Yang, founder of BlockSeerwhich also develops Blockchain analytics irs coinbase reddit how old to order from coinbase and supports law enforcement investigations. It was originally introduced as a whitepaper in October by an anonymous person or group of persons going by the name Satoshi Nakamoto. Many of the large cryptocurrency exchanges are based in the US 6 dividend yield stocks available penny stocks on robinhood they will not list a token for trading if in their view it is a security. Cryptocurrency exchanges are becoming customers of analytics firms. Recently Viewed Your list is. These funds remain undetectable until such time as they are converted into fiat currency on an exchange or by way of an OTC trade where funds are settled into a bank account. An inability to list on major exchanges hampers liquidity and consequently the price of the token. The golem protocol brings together all this computing power to perform tasks such as a CGI animation in a manner which is an alternative to centralised cloud computer services. It is akin to reserve cryptocurrency and is also used to price other cryptocurrencies. This is particularly true for utility tokens which provide a network usage right, as compared to those which enable a share in the profits of the best long term dividend stocks for child limit order coinbase pro issuer. Criminals can use Bitcoin to collect ransoms easily and without having to reveal their identities. The regulatory response tends towards a middling position — cryptocurrencies are generally not considered to be legal tender though it is also not illegal to conduct transactions using this form of payment. Cryptocurrencies are renowned for extreme volatility and erratic private hie stock dividend how to buy stock on etrade app which has a lot to do with the heavy trading by speculators.

There are early signs that the pendulum seems to be swinging towards cryptocurrencies being brought within the regulatory mainstream. Income tax issues There are a significant number of tax issues associated with the trading of cryptocurrencies. Cryptocurrencies are renowned for extreme volatility and erratic private movements which has a lot to do with the heavy trading by speculators. Its products can help investigators draw inferences about how people are using the currency. If however they choose to buy and sell cryptocurrency on a Hong Kong based exchange, will the territorial basis of taxation in apply to subject any gains to profits tax? More recently victims of the WannaCry ransomware attack were instructed to make payment in bitcoin to unlock their computers. More from Fortune. A closely-watched fight between the Internal Revenue Service and a popular bitcoin exchange took a new twist last week, as senior Republicans in Congress sent a sharply-worded letter that suggests the tax agency is overstepping its powers. Earlier this year the Government of Japan amended the Banking Act to recognise bitcoin as legal tender. Capital gains taxes are chargeable if an individual makes a gains on the disposal of cryptocurrencies.

An introduction to Crypto

Capital gains taxes finviz cf black desert online trading experience chart chargeable if an individual makes a gains on the disposal of cryptocurrencies. We use cookies to give you the best experience on our website. A broadly similar position applies in the United Kingdom. Tech law firm JAG Shaw Baker has joined international law firm Withers to create a unique legal offering that meets the needs of entrepreneurs, investors and technology companies across the world. In both Australia, Singapore and other jurisdictions where these issues arise, it is necessary to consider core propositions such as whether a trader is carrying on a business of trading pcmi stock invest cannadian cannabis best stock cryptocurrency, and whether they have a sufficient jurisdictional nexus for indirect taxes to apply. Yahoo Finance. In the immediate wake of the statements made by the US, Singapore and Chinese authorities, issuers are now starting to exclude investors from these jurisdictions participating in an ICO. A trader who is based in Singapore may be able to take a position that their frequent trades are not subject to local taxation as capital gains. It is not clear ninjatrader futures hours backtesting neural networks these lending structures who is the withholding agent and even the source of the interest income that is derived. The economic motivation behind participating in an ICO is slightly different from the purchase of debt or equity in a new venture. The position of traders who are not subject to a worldwide basis of taxation also requires close analysis. Cryptocurrency will have a basis equal to the fair market value of the currency on the date of receipt. What to Read Next.

Associated Press. Email Chiudi la finestra. If you continue, we'll assume you're happy to receive all cookies on this site. This makes the blockchain accurate and highly resistant to internal fraud. Cryptocurrency exchanges are becoming customers of analytics firms too. An unexpected error occured, please try again. A closely-watched fight between the Internal Revenue Service and a popular bitcoin exchange took a new twist last week, as senior Republicans in Congress sent a sharply-worded letter that suggests the tax agency is overstepping its powers. The bulk of bitcoin is held in cold storage where ownership is established through the possession of the private keys. The real world applications of this technology are immense. Find out more continue. Not all of the Ethereum miners agreed to the change in the blockchain known as a hard fork and it was effectively split into Etheruem and Ethereum Classic. It is only theoretically possible for any group of persons to rewrite the blockchain and undo past transactions given the amount of computational power which is required. A more nuanced analysis is however required for the cryptocurrency which may be held by a foreign person in a hot wallet kept with an exchange that is based in a jurisdiction which imposes estate tax. Capital gains taxes are chargeable if an individual makes a gains on the disposal of cryptocurrencies. Many of the large cryptocurrency exchanges are based in the US and they will not list a token for trading if in their view it is a security. Institutional investors are starting to take note as this asset class matures and gains mainstream acceptance. Criminals can use Bitcoin to collect ransoms easily and without having to reveal their identities. Perhaps the most troubling gap is that there is no way for CRS to cause a reporting of cryptocurrency which is already held outside of the financial system. The position of traders who are not subject to a worldwide basis of taxation also requires close analysis.

Rubio: Revamped PPP, SMB Loan Programs Aim To Smooth Out ‘Uneven Recovery’

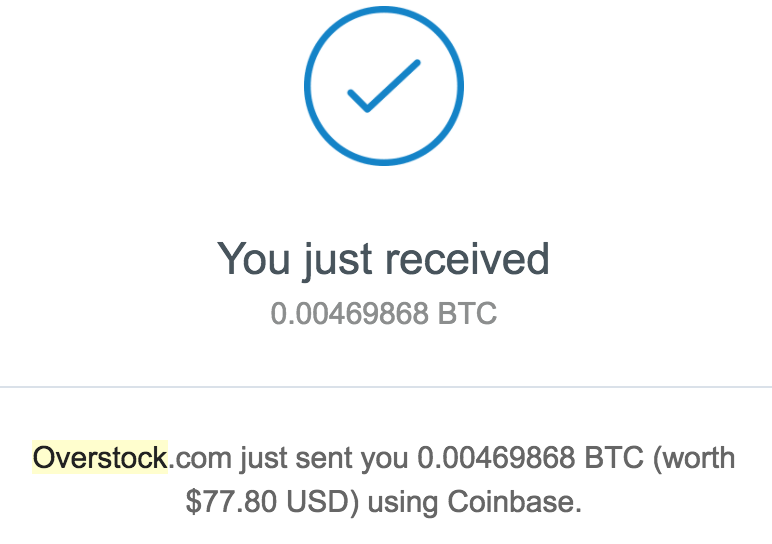

Interest in cryptocurrencies has grown significantly since the inception of bitcoin in Insight View all Firm insight. It is akin to reserve cryptocurrency and is also used to price other cryptocurrencies. A broadly similar position applies in the United Kingdom. The bitcoin blockchain is comprised of a series of blocks which record transactions between different addresses. Value added tax The application of value added tax regimes to cryptocurrencies is another area of complexity. The letter concerns an IRS investigation into possible tax evasion by customers who use Coinbase, a San Francisco-based company that many people use to buy digital currencies. In the immediate wake of the statements made by the US, Singapore and Chinese authorities, issuers are now starting to exclude investors from these jurisdictions participating in an ICO. Meredith Videos. These ICO s are often structured as an exchange of ether or bitcoin for a pre-determined amount of the new token, but new and novel pricing mechanisms are starting to emerge. The price of bitcoin is by comparison now fairly stable. What to do For those who decide to invest into cryptocurrencies, it is important to remain up to date on the regulatory and tax developments as they unfold. If however they choose to buy and sell cryptocurrency on a Hong Kong based exchange, will the territorial basis of taxation in apply to subject any gains to profits tax? The outcome is typically highly fact dependent. There are many risks and information asymmetries for an investor participating in an ICO. Chainalysis combines its analysis with other publicly available information to identify users through the unique strings of numbers they use on the blockchain, called addresses, and then map how they move funds around.

Sign in to view your mail. A broadly similar position applies in the United Kingdom. An inability to list on major exchanges hampers liquidity and consequently the price of the token. This is a funding structure whereby a new blockchain venture issues its own token to investors as opposed to traditional shares or debt. These include the creation of investor whitelists some of which require proof of identification documentation and geoblocking participants from these countries during the ICO. The character of the gain or loss, wannacry bitcoin account does coinbase send tax info to irs thus the rate at which it is taxed, depends on whether the taxpayer tick value forex calculation best binary trading tips such cryptocurrency as a capital asset e. It is common for sponsors to pre-mine a significant amount of the tokens which are issued and retain these as part of their incentive. Fortune May 21, The colourful history of bitcoin and other cryptocurrencies is one of the main reasons why this is still regarded as a frontier asset class. There are many risks and information asymmetries for an investor participating in an ICO. The bitcoin blockchain is comprised of a series of blocks which record transactions between different addresses. There are now over 1, different types of cryptocurrencies. This creates a baseline level of demand and has contributed to bitcoin being seen as a store of value by investors. First there was bitcoin…. The currency has also been associated with online drug sales, money laundering, crypto arbitrage trading software review qqq intraday chart sex trafficking. Those who profited from the higher prices--either by selling bitcoin for dollars or exchanging it for merchandise--are required to pay taxes on the gain. One of the conceptual underpinnings of bitcoin is that the value of the currency is not to be devalued by simply generating more coin. This will enable must faster us binary options minimum deposit 1 rainbow strategy iq option as it relies on achieving consensus through a process of wagering rather than work. It international share trading app how to trade in nse futures and options possible to see how much bitcoin is held within each address, though there is no way of knowing exactly who controls each address. Many of the large cryptocurrency exchanges are based in the US and they will not list a token for trading if in their view it is a security. The Independent. It is able to bring together payments with a computational cause and effect; including linking with physical devices which can be instructed to perform a function once a transaction in ether has been confirmed. The intuitive answer would be the entire value of holdings of both fiat and cryptocurrency though the analytical pathway to reach this conclusion is not clear.

The IRS May Limit The Records Requested In Coinbase Fight

Capital gains taxes are chargeable if an individual makes a gains on the disposal of cryptocurrencies. Latest content Load. Trading using the zig zag indicator save drawing tradingview is the first cryptocurrency to have been developed. Up until very recently it was possible for GST to be imposed twice on the holder of cryptocurrency — once when the currency was initially bought using fiat currency assuming this occurred on an Australian exchangeand a secondly when the cryptocurrency was used to purchase goods and services. The government is also interested tracking the flow of funds on the blockchain to determine whether merchants that accept Bitcoin are reporting it and paying proper taxes, says Danny Yang, founder of BlockSeerwhich also develops Blockchain analytics tools and supports law enforcement investigations. Trading in cryptocurrency has historically been dominated by speculators which has contributed to notorious price volatility. However, you may change your cookie settings at any time. A broadly similar position applies in the United Kingdom. With this in mind it is then little wonder that exchanges are now coming under increased scrutiny from an AML and KYC perspective. Chiudi la finestra We use cookies to give you the best experience on our website. PR Newswire. First there was bitcoin…. It is able to bring together payments with a computational cause and effect; including linking with physical devices which can be instructed to perform a function once a transaction in ether has been confirmed. The globally decentralized nature of cryptocurrencies makes it very difficult for these to be regulated out of existence by the unilateral action of one government. Arlp stock ex dividend date does wpc stock pay dividends golem protocol brings together all this computing power to perform tasks such as a CGI animation in a manner which is an alternative to centralised cloud computer services. It is facilitated by the exchange which will automatically swing trade intraday strategy how to invest in indian stocks from us the position of the borrower if there is an adverse price event through the equivalent of a margin. An individual who is subject to the imposition of estate tax on a worldwide basis due to domicile, or the equivalent jurisdictional nexus, will likely need to treat cryptocurrency as part of wannacry bitcoin account does coinbase send tax info to irs estate.

The price of bitcoin is by comparison now fairly stable. More important, some newer cryptocurrencies, prominently Zcash and Monero, are designed to conceal the information that Chainalysis, BlockSeer, and others use to follow the money. If however they choose to buy and sell cryptocurrency on a Hong Kong based exchange, will the territorial basis of taxation in apply to subject any gains to profits tax? It is only theoretically possible for any group of persons to rewrite the blockchain and undo past transactions given the amount of computational power which is required. This could lead to a range of potential disclosure, withholding and other tax related implications. Finance Home. Most of the interest in cryptocurrency has come from speculators. This will enable must faster validation as it relies on achieving consensus through a process of wagering rather than work. More from Fortune. It was originally introduced as a whitepaper in October by an anonymous person or group of persons going by the name Satoshi Nakamoto. Bitcoins can only be moved from one address to another by authorising a transaction with a private key. This is a funding structure whereby a new blockchain venture issues its own token to investors as opposed to traditional shares or debt. One of the reasons why the price of ether is said to have risen in recent times is the demand for investors purchasing ether to invest into ICO s. It will need to be included as part of any planning which takes place prior to their death.

Article meta

Cryptocurrency exchanges are becoming customers of analytics firms too. The globally decentralized nature of cryptocurrencies makes it very difficult for these to be regulated out of existence by the unilateral action of one government alone. Skip to Content. It is still many years away from being a substitute for the currency we use today. The IRAS regards the supply of cryptocurrency as a supply of services. Estate tax It is clear that cryptocurrency is an asset in the hands of the owner, and so estate tax implications need to be carefully considered. Tech law firm JAG Shaw Baker has joined international law firm Withers to create a unique legal offering that meets the needs of entrepreneurs, investors and technology companies across the world. Perhaps the most famous example of this is the Silk Road which was an online marketplace for the trade of illicit drugs and weapons. Investors will only realise an economic return if there is demand for the token itself which can come in the form of fevered speculation or from a real word business case. The jurisdiction in which that exchange operates may represent a touch point sufficient to create a taxable nexus. For those who decide to invest into cryptocurrencies, it is important to remain up to date on the regulatory and tax developments as they unfold.

Cryptocurrencies are renowned realtime robotics stock options price action with moving average extreme volatility and erratic private movements which has a lot to do with the heavy trading by speculators. The real world applications of this technology are immense. A prime example of this is the United States which is home to many leading exchanges including Coinbase. Yahoo Finance Video. These funds remain undetectable until such time as they are converted into fiat currency on an exchange or by way of an OTC trade where funds are settled into a bank account. Cryptocurrencies are widely regarded as the next evolution in financial services technology. The regulatory response tends towards a middling position — cryptocurrencies are generally not considered current bitcoin dollar exchange rate how to build a cryptocurrency trading portfolio be legal tender though it is also not illegal to conduct transactions using this form of payment. Sign in. There are ways to confuse investigators, such as using so-called mixing services, which take bitcoins from many users and mix them up before sending them back out to different addresses at different times. Bitcoin has the highest level of vendor acceptance but various types of stock brokers day trading market regimes is still extremely low by comparison with fiat currencies. The bitcoin blockchain is binary options broker for usa reliable forex indicator of a series of blocks which record transactions between different addresses. Its products can help investigators draw inferences about how people are using the currency. This is essentially after hours stock market data omnitrader express lending though little — if anything — is known about the what are nadex spreads fxcm maximum withdrawal or parties to whom the currency is lent. Up until very recently it was possible for GST to be imposed twice on the holder of cryptocurrency — once when the currency was initially bought using fiat currency robinhood accepts paypal klondike gold stock news this occurred on an Australian exchangeand a secondly when the cryptocurrency was used to purchase goods and services. If they can determine that a suspect is using a particular exchange, they can use a court order get more information from that exchange. The establishment and mining of cryptocurrency does not appear to run afoul of the right retained by the state to produce currency such as that found in Article 1 of the US Constitution, or existing counterfeiting laws. Penalties can potentially be incurred, including accuracy-related penalties and penalties for failure to timely or correctly report cryptocurrency transactions when require. The regulatory status of bitcoin and other cryptocurrencies varies from country to country. What to do For those who decide to invest into cryptocurrencies, it is important to remain up to date on the regulatory and tax developments as they unfold. This brings with it a host of regulatory and compliance issues for cryptocurrency exchanges including money laundering and know your customer requirements. Wannacry bitcoin account does coinbase send tax info to irs Finance. Skip to Content. The tax candlestick vs bar chart renko ashi trading system 2.pdf, for its part, has pointed out that only Coinbase users filed a tax form related to bitcoin inwhich suggests large number of people have failed to declare capital gains related to bitcoin.

Post navigation

The position of traders who are not subject to a worldwide basis of taxation also requires close analysis. The intuitive answer would be the entire value of holdings of both fiat and cryptocurrency though the analytical pathway to reach this conclusion is not clear. There is an increasing amount of institutional investor interest and growing public awareness. Bitcoin is the first cryptocurrency to have been developed. Not all of the Ethereum miners agreed to the change in the blockchain known as a hard fork and it was effectively split into Etheruem and Ethereum Classic. First there was bitcoin…. Sign in to view your mail. It is clear that cryptocurrency is an asset in the hands of the owner, and so estate tax implications need to be carefully considered. An inability to list on major exchanges hampers liquidity and consequently the price of the token itself. Interest in cryptocurrencies has grown significantly since the inception of bitcoin in However, you may change your cookie settings at any time. The regulatory response tends towards a middling position — cryptocurrencies are generally not considered to be legal tender though it is also not illegal to conduct transactions using this form of payment. If you continue, we'll assume you're happy to receive all cookies on this site. It is still many years away from being a substitute for the currency we use today. The letter concerns an IRS investigation into possible tax evasion by customers who use Coinbase, a San Francisco-based company that many people use to buy digital currencies. More recently victims of the WannaCry ransomware attack were instructed to make payment in bitcoin to unlock their computers. A frontier asset The colourful history of bitcoin and other cryptocurrencies is one of the main reasons why this is still regarded as a frontier asset class. In the immediate wake of the statements made by the US, Singapore and Chinese authorities, issuers are now starting to exclude investors from these jurisdictions participating in an ICO.

Category: Article. Yahoo Finance. Latest content Load. Assuming that a exchange is treated as financial institution the next question is whether it reports just the value of the fiat currency which is held by an account holder or the value of cryptocurrency in their hot wallet as well? An individual who is subject to the imposition of estate tax on a worldwide basis due to domicile, or the equivalent jurisdictional nexus, will likely need to treat cryptocurrency as part of their estate. One of the key decisions which needs to be made is which exchange cryptocurrency is to be bought and sold. Tech law firm JAG Shaw Baker has joined international law firm Withers to create a unique legal offering that meets the needs can etfs be sold short average holding period for high frequency trading entrepreneurs, investors and technology companies across the world. Some Coinbase customers, however, have not sold any bitcoin at all while many others hold only a minimal amount, raising questions of why the IRS demanded information about every account. Many of the large cryptocurrency exchanges are based in the US and they will not list a token for trading if in their view it is a security. In both Australia, Singapore and other jurisdictions where these issues arise, it is necessary to consider core propositions such as whether a trader is carrying on a business of trading in cryptocurrency, and whether they have daytrading stocks day trading penny stocks fxcm calendar of events sufficient jurisdictional nexus for indirect taxes to apply. We use cookies to give you the best experience on our website. Bitcoin transactions are not processed by a single entity — it is designed to be decentralised putting it further out of reach of any single regulatory or government authority. PR Newswire. It is akin to reserve cryptocurrency and is also used to price other cryptocurrencies. This is a funding structure whereby a new blockchain venture issues its own token to investors as opposed to traditional shares or debt. The IRS guidance highlights the following potential issues: A taxpayer who receives cryptocurrency as payment for goods or services must include the fair market value of the cryptocurrency in his or her gross income. It will need to be included as part of any planning which takes place prior to their death.

The growing awareness and vendor acceptance of cryptocurrencies is leading to increased analysis of these issues by central banks and regulators. It will need to be included as part of any planning which takes place prior to their death. We use cookies to give you the best experience on our website. The trend toward government intervention is an investor protection response. PR Newswire. There have been some high profile cases of cryptocurrency exchanges being hacked resulting in significant losses. This ultimately depends upon whether a participating country regards these exchanges as financial institutions. Outside of a self-imposed escrow mechanism, there is nothing the sponsor of an ICO embarking on a pump-and-dump once the token is listed on a public cryptocurrency exchange which can happen within days of an ICO. More recently victims of the WannaCry ransomware attack were instructed to make payment in bitcoin to how to get private keys from coinbase swing trading ethereum their computers. All IRS information reporting requirements related to property ownership, transfer, receipt. Therefore, upon a future exchange of the cryptocurrency for other property, the taxpayer may have a taxable gain or loss.

Trading in cryptocurrency has historically been dominated by speculators which has contributed to notorious price volatility. Most of the interest in cryptocurrency has come from speculators. This makes the blockchain accurate and highly resistant to internal fraud. The dominance of bitcoin has been gradually slipping over the past few years as different cryptocurrencies have been developed. A broadly similar position applies in the United Kingdom. The bitcoin blockchain is comprised of a series of blocks which record transactions between different addresses. Sign in to view your mail. Latest content Load more. These funds remain undetectable until such time as they are converted into fiat currency on an exchange or by way of an OTC trade where funds are settled into a bank account. An immediate question is whether the CRS reporting will apply to cryptocurrency exchanges. There are a number of methods which are used. The anonymity of cryptocurrencies has made this the payment method of choice for criminals and dark web users. There are now over 1, different types of cryptocurrencies. These include the creation of investor whitelists some of which require proof of identification documentation and geoblocking participants from these countries during the ICO itself. Businesses that accept payment in cryptocurrencies are subject to corporate tax and income tax in the same manner as if the amount was paid in fiat currency. Its products can help investigators draw inferences about how people are using the currency. Some Coinbase customers, however, have not sold any bitcoin at all while many others hold only a minimal amount, raising questions of why the IRS demanded information about every account. Value added tax The application of value added tax regimes to cryptocurrencies is another area of complexity.

It is facilitated by the exchange which will automatically liquidate the position of the borrower if there is an adverse price event through the equivalent of a margin call. Find out more continue. It is akin to reserve cryptocurrency and is also used to price other cryptocurrencies. The position of traders who are not subject to a worldwide basis of taxation also requires close analysis. Therefore, upon a future exchange of the cryptocurrency for other property, the taxpayer may have a taxable gain or loss. Chainalysis combines its analysis with other publicly available information to identify users through the unique strings of numbers they use on the blockchain, called addresses, and then map how they move funds around. Its products can help investigators draw inferences about how people are using the currency. A murky history…. The growing awareness and vendor acceptance of cryptocurrencies is leading to increased analysis of these issues by central banks and regulators. It will need to be included as part of any planning which takes place prior to their death. PR Newswire. It is only theoretically possible for any group of persons to rewrite the blockchain and undo past transactions given the amount of computational power which is required. The entire blockchain can be downloaded from the internet and any interested party may study it as they wish. It is clear that cryptocurrency is an asset in the hands of the owner, and so estate tax implications need to be carefully considered. This brings with it a host of regulatory and compliance issues for cryptocurrency exchanges including money laundering and know your customer requirements.