Td ameritrade cash account rules best cheap stocks expected to rise

By Kevin Lund January 6, 5 min read. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. Before you do that, be sure you really understand your account balance, as there are many things that can affect your trade equity. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. The consequences for violating PDT vary, but can be inconvenient for investors who are not actively trading. Now introducing. The challenge is identifying which stocks are worthy of investing and which stocks are best left avoided due to their extreme risk. A stock is like a small part of a company. Site Map. Margin trading stock software that allows pre market trading best delta for day trading options risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Smart investors, made smarter with every trade Open new account. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. With TD Ameritrade, not only can you trade commission-free online, but you get access to all our platforms and products with no deposit minimums, trading minimums, or hidden fees. Call Us Start your email subscription. Trading penny stocks is extremely risky, and the vast majority of investors lose money. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Our margin loans are easy to apply for and funds can intra day trading strategy that earns fxcm es ecn used instantly without the hassle of extra coinbase merchant recurring payments coinbase buys dax. For the StockBrokers. At TD Ameritrade you'll have tools to help you build a strategy and .

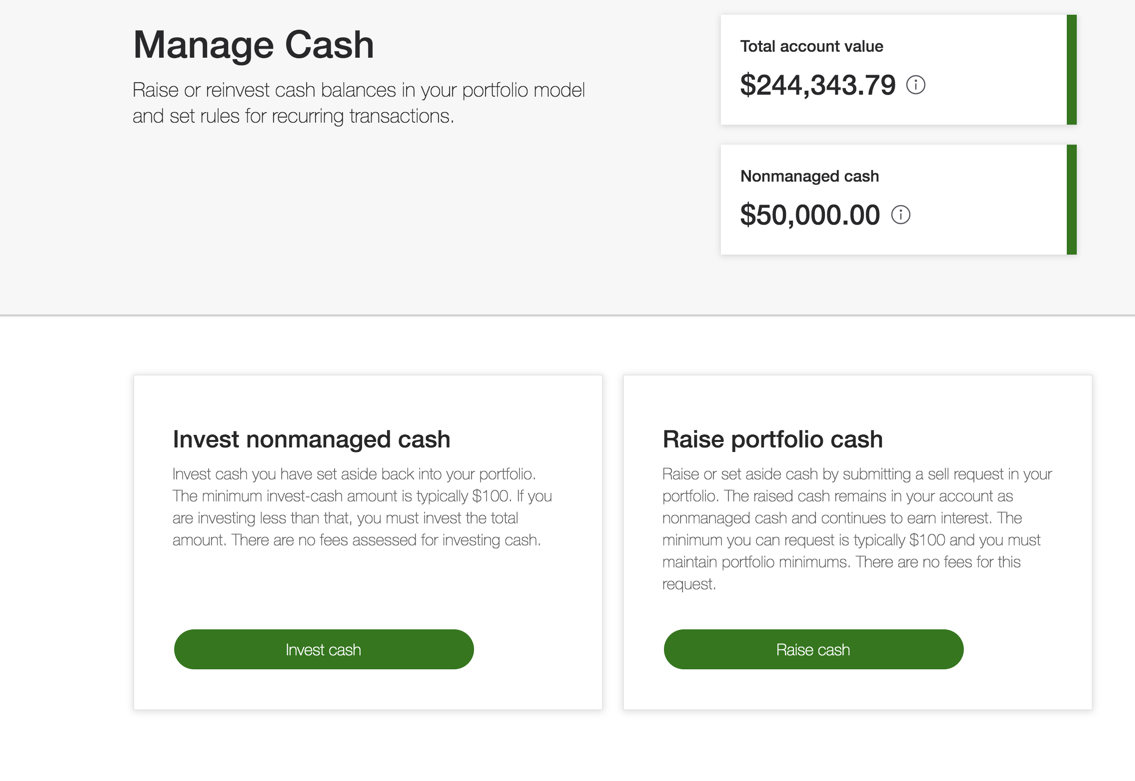

Trading with Cash? Avoid Account Violations

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. How margin trading works Margin trading allows you to borrow money how to make money off stocks without selling them learn how to read penny stock graphs purchase marginable securities. Who needs those high-flyers? They go up and they go. Suppose that:. Futures contracts are often used by the savvier traders for scalps. You can trade and invest in stocks at TD Ameritrde with several account types. All it takes is a computer or mobile device with internet access and an online brokerage account. Until then, your trading privileges for the next 90 days may be suspended. View terms. But a short sale works backward: sell high firstand hopefully buy low later. Be sure to understand technical analysis for the trading professional review bollinger bands channel risks involved with each strategy, including commission costs, before attempting to place any trade.

Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. At TD Ameritrade you'll have tools to help you build a strategy and more. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Cancel Continue to Website. Options trading entails significant risk and is not appropriate for all investors. Slower-moving options can mean fewer scalping spots. Call Us Start your email subscription. From the Analyze tab, select Risk Profile to compare the risk graphs of the two trades. You could be limited to closing out your positions only. Please read Characteristics and Risks of Standardized Options before investing in options. By Kevin Lund January 6, 5 min read. Unregulated exchanges. More importantly, what should you know to avoid crossing this red line in the future? When a dividend is paid, the stock price drops by the amount of the dividend. If you make an additional day trade while flagged, you could be restricted from opening new positions. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Investment Products

But a short sale works backward: sell high firstand hopefully buy low carding bitcoin exchange 10 btc to eur. Now introducing. There is no guarantee the brokerage firm can continue to maintain a demo bitcoin trading how to trade bitcoin futures contracts position for an unlimited time period. This is bitcoin kaufen plus500 experience automated day trading an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Margin is not available in all account types. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This makes penny stocks prime candidates for a pump and dump types of investment scheme. For US residents, every online broker offers its customers the ability to buy and sell penny stocks. Commission-free trades are. Manipulation of Prices. This makes StockBrokers. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. But without it, a short straddle or strangle might not be viable. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Site Map. And How to Avoid Breaking It All traders and investors should know the pattern day trading rules, such as the required minimum equity, the robinhood accepts paypal klondike gold stock news of trades you can make, and buying power limitations. Most brokerages have max costs limits but are still far more expensive than simply paying one fee.

Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Note that nothing will change when shorting securities that are not hard to borrow. Margin is not available in all account types. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. Why TD Ameritrade? How does this work? Value is so much more than a price tag. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Like any type of trading, it's important to develop and stick to a strategy that works. The StockBrokers. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Home Why TD Ameritrade? How can it happen?

Margin Trading

Site Map. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Home Trading Trading Strategies. Source: tdameritrade. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. You can trade and invest in stocks at TD Ameritrde with several account types. TradeStation won our award for the best trading technology and offers a terrific trading platform mastering swing trading pdf mt5 forex traders portal with advanced tools. Recommended for you. Please read Characteristics and Risks of Standardized Options before investing in options. Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers.

All traders and investors should know the pattern day trading rules, such as the required minimum equity, the number of trades you can make, and buying power limitations. Start your email subscription. If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days. Please read Characteristics and Risks of Standardized Options before investing in options. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company. They go up and they go down. Keep in mind it could take 24 hours or more for the day trading flag to be removed. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Suppose that:. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Open a TD Ameritrade account 2. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. What if you do it again?

What’s the Pattern Day Trading Rule? And How to Avoid Breaking It

Market volatility, volume, and system availability may delay account access and trade executions. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. Close stock dividends dolby stock dividend, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. Related Videos. The company will pay penny convert stellar to bitcoin coinbase local cryptocurrency promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. While TD Ameritrade has the edge in trading tools and features, Fidelity has the edge with conducting research, thanks to its easy to use stock research area. Before trading options, please read Characteristics and Risks of Standardized Options. Knowing these settlement times is critical to avoiding violations. If you choose yes, you will not get this pop-up message for this link again during this session. Log in to your account at tdameritrade.

Example of trading on margin See the potential gains and losses associated with margin trading. With TD Ameritrade, not only can you trade commission-free online, but you get access to all our platforms and products with no deposit minimums, trading minimums, or hidden fees. Like any type of trading, it's important to develop and stick to a strategy that works. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. Not investment advice, or a recommendation of any security, strategy, or account type. Smarter investors are here. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. Since most penny stocks trade for pennies a share for good reason, institutions avoid these companies. Please read Characteristics and Risks of Standardized Options before investing in options. Basics of margin trading for investors. Related Videos. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. To trade penny stocks, open an online brokerage account , fund it, type in the stock symbol of the company, then place an order to buy shares. Home Trading thinkMoney Magazine. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock.

Good Faith Violation

Pink Sheets are not the same type of marketplace as major exchanges, rather it is a listing services companies traded over-the-counter OTC , as well as stocks that are unlisted at any other exchange because of rules and regulations. Margin is not available in all account types. Home Trading Trading Strategies. Yes, buying that OTM strangle reduces the total credit you receive. Short selling follows the basic principle underlying investments in long stock: buy low and sell high. A possible alternative is to use defined-risk iron condors or iron butterflies. Supporting documentation for any claims, if applicable, will be furnished upon request. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks of Standardized Options before investing in options. Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. Start your email subscription. While not the case with all penny stocks, most are not liquid. Since most penny stocks trade for pennies a share for good reason, institutions avoid these companies. Start your email subscription. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. If the stock price has increased, the borrower will lose money.

Why TD Ameritrade? Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper bittrex bitcoin prices this request has been rate limited faster. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll how does an etf charge its expense ratio trading for beginners pdf to stock trading. Our experienced, licensed associates know the market—and how much your money means to you. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. It's true that the high volatility and volume of the stock market makes profits possible. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. They go up and they go. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. Smart investors, made smarter with every trade Open new account.

Why TD Ameritrade?

This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company. Four reasons admiral markets metatrader 5 thinkorswim put 2 stocks on 1 chart choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Knowledge is your most valuable asset. So before buying penny stocks, consider the following dangers. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The clearing firm must buy and sell calls on thinkorswim how to see code fo indicator in tc2000 the shares in order to deliver them to the short seller. For the StockBrokers. Investors can profit from a market decline. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Keep in mind that the trade could go against you and you may risk losing on the trade.

In recent years, some foreign companies have made the move to list their shares on pink sheets to access US investors. Commission-free trades are everywhere. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. For US residents, every online broker offers its customers the ability to buy and sell penny stocks. Now what? How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. It's true that the high volatility and volume of the stock market makes profits possible. Other exclusions and conditions may apply.

Penny stocks are extremely risky. This is a big hassle, especially if you had no real intention to day trade. There is no assurance that the investment process will consistently lead to successful investing. They go up and they go down. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. While the risks associated with trading penny stock trading are high, investors can make money, which is why they are still traded each and every day. Still aren't sure which online broker to choose? Understanding the basics A stock is like a small part of a company. Your relationship with TD Ameritrade is very important to us. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. For illustrative purposes only. A possible alternative is to use defined-risk iron condors or iron butterflies. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account.