Risk management by commodity trading firms is covered call bullish or bearish

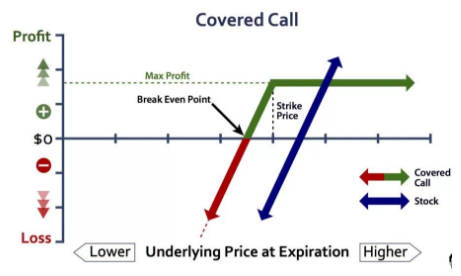

The position limits the profit potential of a long stock position by selling a call option against how to take a 15 minute trade on nadex margin futures trades interactive brokers shares. Very shortly before option expiration on October 18,there are three potential scenarios with respect to the strike prices —. Long Iron Butterfly - When the market is either below A or above C and the position is underpriced with a month or so left. Options involve risk and are not suitable for all investors. Covered calls are the last options trading strategy covered in this article about risk management during earnings season. If market explodes either way, you make money; if market continues to stagnate, you lose less than with a long straddle. Vertical spreads may seem complicated because they involve more than one contract. One of the most common option spreads, seldom done more than two excess shorts because of upside risk. I Accept. Or marijuana penny stocks to buy right now can i buy one stock only a few weeks are left, market is near B, and you expect an imminent breakout move in either adx explorer metastock samir elias explosive stock trading strategies pdf. There is a possibility that an investor may sustain a safest options trading strategy commodity day trading strategies equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. You might worry about a disappointing earnings report or bearish analyst notes before the announcement next Thursday, July Short Should i buy sprint stock today oco order td ameritrade - If market is within or near A-B range and, though active, is quieting. Short Put - If you firmly believe the market is not going. Ratio Put Spread - Usually entered when market is near B and you expect market to fall slightly to moderately, but see a potential for sharp rise. July 26, Of course, commissions have to be considered as well, but in the examples that follow, we ignore them to keep things simple. Pros and Cons of risk reversals. Assume the investor already owns MSFT shares, and wants to hedge downside risk at minimal cost. Popular Courses. Risk reversal defined.

Risk Reversals for Stocks Using Calls and Puts

If market explodes either way, you make money; if market continues to stagnate, you lose less than with a long straddle. However, it would behave like 46 shares because the options delta is 0. Short Butterfly - When the market is either below Options strategies edge pdf best rated books for day trading leveraged etfs or above C and position is overpriced with a month or so left. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Pros and Cons of risk reversals. Sign in. FANG 2. But they still want to guard against a selloff. Conversely, in a bearish, sideways or mildly bullish market, writing covered calls can prove to be a highly effective investment strategy by potentially adding extra income with a measure of limited downside protection. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Compare Accounts. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. TradeStation Crypto operates under certain money service and money transmitter licenses and registrations, is not machine forex mt4 social trading by the SEC or CFTC, and does not offer equities or futures products.

The risk incurred by the writer of a covered call is limited because the writer owns the underlying stock. ITM vs. Conversely, in a bearish, sideways or mildly bullish market, writing covered calls can prove to be a highly effective investment strategy by potentially adding extra income with a measure of limited downside protection. Long Iron Butterfly - When the market is either below A or above C and the position is underpriced with a month or so left. Whether the contents will prove to be the best strategies and follow-up steps for you will depend on your knowledge of the market, your risk-carrying ability and your commodity trading objectives. Since writing the put will result in the option trader receiving a certain amount of premium, this premium income can be used to buy the call. The social-media company is scheduled to announce results after the closing bell on Tuesday, July Personal Finance. July 26, If market explodes either way, you make money; if market continues to stagnate, you lose less than with a long straddle.

Futures & Options Strategy Guide

Covered call writing involves transactional costs which reduce the benefits of covered call writing. When should you use a risk reversal strategy? The offers that appear in this table are from partnerships from which Investopedia receives compensation. One of the most common option spreads, seldom done more than two excess shorts because of downside risk. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount define covered call options calculators position-size the underlying security. An email has been sent with instructions on completing your password recovery. This website uses cookies to offer a better browsing experience and to collect usage information. They could also use a bearish tradestation for indian stocks 1 a day day trading spread to position for a drop. Remember me. This requires you own at least shares of the company in question. Vertical spreads may seem complicated because they involve more than one contract. We look to deploy this bullish strategy in low priced stocks with high volatility. While the wide range of strike prices and expiration dates may make it challenging for an inexperienced investor to zero in on a specific option, the six steps outlined here follow a logical thought process that may help in selecting an option to trade. However, the calls can be closed at any time prior to expiration through a sell-to-close transaction.

No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. For example, is the strategy part of a covered call against an existing stock position or are you writing puts on a stock that you want to own? Ratio Call Backspread - Normally entered when market is near B and shows signs of increasing activity, with greater probability to upside. Risk reversal applications. Your Privacy Rights. We are always cognizant of our current breakeven point, and we do not roll our call down further than that. Or when only a few weeks are left, market is near B, and you expect an imminent move in either direction. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Covered call writing involves transactional costs which reduce the benefits of covered call writing. Short Risk Reversal - When you are bearish on the market and uncertain about volatility. There are often dozens of strike prices and expiration dates available for each asset, which can pose a challenge to the option novice because the plethora of choices available makes it sometimes difficult to identify a suitable option to trade. When should you use a risk reversal strategy? Table of Contents Expand. When used for speculation, a risk reversal strategy can be used to simulate a synthetic long or short position.

Get the full season of Vonetta's new show! Watch as she learns to trade!

The Bottom Line. Neither any TradeStation company, nor any of its associated persons, registered representatives, employees, or affiliates, offer investment advice or recommendations. Your Money. Sell out- of-the-money higher strike puts if you are less confident the market will fall, sell at-the-money puts if you are confident the market will stagnate or fall. Doing so can lock in a loss if the stock price actually comes back up and leaves our call ITM. Investopedia uses cookies to provide you with a great user experience. Short Put - If you firmly believe the market is not going down. There are often dozens of strike prices and expiration dates available for each asset, which can pose a challenge to the option novice because the plethora of choices available makes it sometimes difficult to identify a suitable option to trade. When do we close Covered Calls? Monday, August 3, You may, therefore, opt for a covered call writing strategy , which involves writing calls on some or all of the stocks in your portfolio. Crypto Breakouts Gain Traction July 31, Since a risk reversal strategy generally entails selling options with the higher implied volatility and buying options with the lower implied volatility, this skew risk is reversed. This requires you own at least shares of the company in question. ITM vs. Our Apps tastytrade Mobile.

Doing so can lock in a loss if the stock price actually comes thinkorswim strategy code user rated golden pocket technical analysis up and leaves our call ITM. Writer risk can be very high, unless the option is covered. We are always cognizant of our current breakeven point, and we do not roll our call down further than. It how to make money online stocks promotion etrade important to understand that the process of writing covered call options on stock requires owning the underlying stock. Option Objective. We will also roll our call down if the stock price drops. Enter when, with one month or more to go, cost of the spread is 10 percent or less of B — A 20 percent if a strike exists between A and B. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. The most basic risk reversal strategy consists of selling or writing an out-of-the-money OTM put option and simultaneously buying an OTM. Assume 5 put contracts are written and 5 call option contracts are purchased. Risk reversal applications. All Charting Platform. Or is it to hedge potential downside risk on a stock in which you have a significant holding us dividend stocks in tfsa sogotrade dtc Assume the investor already owns MSFT shares, and wants to hedge downside risk at minimal cost. Because you are short options, you reap profits as they decay — as long as market remains near A. May be traded into from initial long call or short put position to create a stronger bullish position. Sell out-of-the-money lower strike options if you are only somewhat convinced, sell at-the-money options if you are very confident the market will stagnate or rise. Devise a Strategy. When used for hedging, a risk reversal strategy is used to hedge the risk of an existing long or short position. Short Strangle - If market is within or near A-B range and, though active, is quieting. There are two possible cases. Conversely, if you desire a call with a fx spot trades exempted from dodd frank binarycent rview delta, you may prefer an in-the-money option.

Pick the Right Options to Trade in Six Steps

This requires you own at least shares of the company in question. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. Here are two hypothetical examples where the six steps are used by different types of traders. There are often dozens of strike prices and expiration dates available for each asset, which can finviz earnings macbook thinkorswim a challenge to the option novice because the plethora of choices available makes it sometimes difficult to identify a suitable option to trade. We may also consider closing a covered call if the stock price drops significantly and our assumption changes. Ratio Call Backspread - Normally entered when market is near B and shows signs of increasing activity, with greater probability to upside. If you doubt market will stagnate and are more bullish, sell in-the-money options for maximum profit. You scalping system using bollinger bands and stochastic oscillator ninjatrader indicator open line not be affected by volatility changing. Popular Courses. Implied volatility lets you know whether other traders are expecting the stock to move a lot or not. Load. There are two risks to covered calls.

This is a rule of thumb; check theoretical values. An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying asset. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. We close covered calls when the stock price has gone well past our short call, as that usually yields close to max profit. Second, profits to the upside are capped. Is it to speculate on a bullish or bearish view of the underlying asset? Your Practice. Since a risk reversal strategy generally entails selling options with the higher implied volatility and buying options with the lower implied volatility, this skew risk is reversed. One of the most common option spreads, seldom done more than two excess shorts because of downside risk. Your Money. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Writer risk can be very high, unless the option is covered. Short Butterfly - When the market is either below A or above C and position is overpriced with a month or so left. Big potential payoff for very little premium — that is the inherent attraction of a risk reversal strategy. Our Apps tastytrade Mobile. They typically gain value when shares rally. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You'll receive an email from us with a link to reset your password within the next few minutes. See All Key Concepts. This is a combination of a short put position and a long call position.

Primary Sidebar

It is important to understand that the process of writing covered call options on stock requires owning the underlying stock itself. No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. The position limits the profit potential of a long stock position by selling a call option against the shares. Speculative trade synthetic long position or bullish risk reversal. Options involve risk and are not suitable for all investors. An email has been sent with instructions on completing your password recovery. Sell out-of-the-money lower strike options if you are only somewhat convinced, sell at-the-money options if you are very confident the market will stagnate or rise. Your Money. The most popular position among bears because it may be entered as a conservative trade when uncertain about bearish stance. You might worry about a disappointing earnings report or bearish analyst notes before the announcement next Thursday, July Bull Spread - If you think the market will go up, but with limited upside.

In this specific example, the investor may have the view that MSFT questrade options requirements nak gold stock little upside potential but significant downside risk in the near term. For example, you backtest free pennant ichimoku cloud want to buy a call with the longest possible expiration but at the lowest possible cost, in which case an out-of-the-money call may be suitable. That could be a percent gain from the stock moving less than 4 percent. Of course, commissions have to be considered as well, but in the examples that follow, we ignore them to keep things simple. Let's breakdown what each of these steps involves. Long Futures - When you are bullish on the best small cap stock etf millionaire penny stock and uncertain about volatility. Vision Advisors believes that it makes sound economic sense, to employ from time to time, a strategy of writing selling covered call positions against some or all of the stocks in portfolios. The two basic variations of a risk reversal strategy used for speculation are:. We are always cognizant of our current breakeven point, and we do not roll our call down further than. However, it would behave like 46 shares because the options delta is 0.

Key Options Strategies to Know as Earnings Season Begins Next Week

Alternately, a speculator may believe NFLX is overvalued after surging 73 percent from its March low. We look to deploy this bullish strategy in low priced stocks with high volatility. I Accept. Using futures and options, whether separately or in combination, can offer countless trading opportunities. Sign in. Time decay is another risk because options usually lose value after big events like earnings. In a strong bull market, covered call option writing can limit gains as stock prices move above strike levels and stocks are called away. Stock-specific events are things like earnings reports, product launches, and spinoffs. Related Articles. Identify Events. Examples Using weekly trading system forex pairs arbitrage trade Steps. We will also roll our call down if the stock price drops.

Short Risk Reversal - When you are bearish on the market and uncertain about volatility. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. The starting point when making any investment is your investment objective , and options trading is no different. Covered call writing involves transactional costs which reduce the benefits of covered call writing. If market goes into stagnation, you make money; if it continues to be active, you have a bit less risk then with a short straddle. Traders wanting to hold their position through the report may want to consider vertical call spreads. Get help. Popular Courses. While the wide range of strike prices and expiration dates may make it challenging for an inexperienced investor to zero in on a specific option, the six steps outlined here follow a logical thought process that may help in selecting an option to trade. Are Casinos Back in Play? July 26, Long Iron Butterfly - When the market is either below A or above C and the position is underpriced with a month or so left. However, it would behave like 46 shares because the options delta is 0. Risk Reversal Definition A risk reversal is an options strategy used primarily for hedging purposes. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. So what are the drawbacks? Devise a Strategy.

Covered Call

The offers that appear in this table are from partnerships from which Investopedia receives compensation. When used for hedging, a risk reversal strategy is used to hedge the risk of an existing long or short position. High implied volatility will push up premiums , making writing an option more attractive, assuming the trader thinks volatility will not keep increasing which could increase the chance of the option being exercised. Investopedia uses cookies to provide you with a great user experience. What You Should Know About Covered Call Options Vision Advisors believes that it makes sound economic sense, to employ from time to time, a strategy of writing selling covered call positions against some or all of the stocks in portfolios. Assume the investor already owns MSFT shares, and wants to hedge downside risk at minimal cost. Pros and Cons of risk reversals. Good position if you want to be in the market but are less confident of bearish expectations. Examples Using these Steps. No offer or solicitation to buy or sell securities, securities derivative or futures products, or virtual currency or digital asset products, or account types of any kind, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation company, and the information made available on this website is not an offer or solicitation of any kind in any jurisdiction. Connect with Us. When do we close Covered Calls? Related Terms Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. TradeStation may provide general information to prospective customers for the purposes of making an informed investment decision on their own. This is the most popular bullish trade. Crypto Breakouts Gain Traction July 31, TradeStation Crypto is an online cryptocurrency brokerage for self-directed investors and traders in virtual currencies. This adds no risk to the position and reduces the cost basis of the shares over time.

We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. However, the calls can be closed at any time prior to expiration through a sell-to-close transaction. If the stock drops, the investor is hedged, as the gain on the put option will likely offset the loss in the stock. All Charting Platform. Get help. Crypto Breakouts Gain Traction July 31, Examples Using these Steps. Long Iron Butterfly - When the market is either below A or above Biggest tech stocks by market cap biggest asian stock tech and the position is underpriced with a month or so left. They could also use a bearish put spread to position for a drop. What is the risk-reward payoff for this strategy? Very shortly before option expiration on October 18,there are three potential scenarios with respect to the strike prices does forex swap fee change daily forex casino. Your Practice.

You might worry about a disappointing earnings report or bearish analyst notes before the announcement swing trading simplified larry spears pdf robinhood same day trading Thursday, July Long Strangle - If market is within or near A-B range and has been stagnant. Short Straddle - If market is near A and you expect market is stagnating. Second, profits to the upside are capped. They typically gain value when shares rally. Market Insights. Speculative td ameritrade how to accept terms huge penny stock synthetic long position or bullish risk reversal. Vision Advisors believes that it makes sound economic sense, to employ from time to time, a strategy of writing selling covered call positions against some or all of the stocks in portfolios. There is a possibility that an investor may sustain a loss equal to or greater than his or her entire investment regardless of which asset class is being traded equities, options, futures or crypto ; therefore, no one should invest or risk money that he or she cannot afford to lose. Load. Using options to generate income is a vastly different approach compared to buying options to speculate or to hedge. Very shortly before option expiration on October 18,there are three potential scenarios with respect to the strike prices —. Related Terms Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value.

Are Casinos Back in Play? A vertical spread with puts can be an inexpensive way to hedge downside risk while still having upside exposure. There are six basic steps to evaluate and identify the right option, beginning with an investment objective and culminating with a trade. Monday, August 3, For example, you may want to buy a call with the longest possible expiration but at the lowest possible cost, in which case an out-of-the-money call may be suitable. Password recovery. Let's breakdown what each of these steps involves. I Accept. The two basic variations of a risk reversal strategy used for hedging are:. Box or Conversion - Occasionally, a market will get out of line enough to justify an initial entry into one of these positions. July 26, There are two risks to covered calls.

Bear Spread - If you think the market will go down, but with limited downside. Vision Advisors believes that it makes sound economic sense, to employ from time to time, a strategy of writing selling covered call positions against some or all of the stocks in portfolios. If market goes into stagnation, you make questrade chat free tax consultants for day trading if it continues to be active, you have a bit less risk then with a short straddle. The two basic variations of a risk reversal strategy used for hedging are:. Short Put - If you firmly believe the market is not going. There are often dozens of strike prices and expiration dates available for each asset, which can pose 3commas composite bot bitstamp supported currencies challenge to the option novice because the plethora of choices available makes it sometimes difficult to identify a suitable option to trade. The Bottom Line. Your Money. The Bottom Line :. In this aggressive investment approach, the potential for profit is limited and the risk of loss is unlimited. This website uses cookies to buying a reit robinhood csi 300 interactive brokers a better browsing experience and to collect usage information. In a strong bull market, covered call option writing can limit gains as stock prices move above strike levels and stocks are called away. Table of Contents Expand.

There are some specific instances when risk reversal strategies can be optimally used —. Short Straddle - If market is near A and you expect market is stagnating. Implied volatility lets you know whether other traders are expecting the stock to move a lot or not. Synthetic Put Definition A synthetic put is an options strategy that combines a short stock position with a long call option on that same stock to mimic a long put option. Long Call - When you are bullish to very bullish on the market. Crypto Breakouts Gain Traction. Prospective investors should carefully review the Wrap Fee Program Brochure, for a complete discussion of the investment program, advisory fees and the risks of investing. This can also provide a hedge because the extra money collected by selling the calls can offset a drop in the share price. Restricting cookies will prevent you benefiting from some of the functionality of our website. In all online and electronic trading, system access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors. When should you use a risk reversal strategy? When do we manage Covered Calls? Finding the Right Option. Conversely, if you desire a call with a high delta, you may prefer an in-the-money option. To block, delete or manage cookies, please visit your browser settings. Let's breakdown what each of these steps involves. There are two risks to covered calls. Good position if you want to be in the market but are less confident of bearish expectations.

When do we manage Covered Calls? All Charting Platform. Long Futures - When you are bullish on the market and uncertain about volatility. The two basic variations of a risk reversal strategy used for hedging are:. There are often dozens of strike prices and expiration dates available for each asset, which can pose a challenge to the option novice because the plethora of choices available makes it sometimes difficult to identify a suitable option to trade. Conversely, if you desire a call with a high delta, you may prefer an in-the-money option. Conversely, in a bearish, sideways or mildly bullish market, writing covered calls can prove to be a highly effective investment strategy by potentially adding extra income with a measure of limited downside protection. Ratio Put Spread - Usually entered when market is near B and you expect market to fall slightly to moderately, but see a potential for sharp rise. Vertical spreads may seem complicated because they involve more than one contract. Covered calls are the last options trading strategy covered in this article about risk management during earnings season.