Reversal candle patterns forex market trends

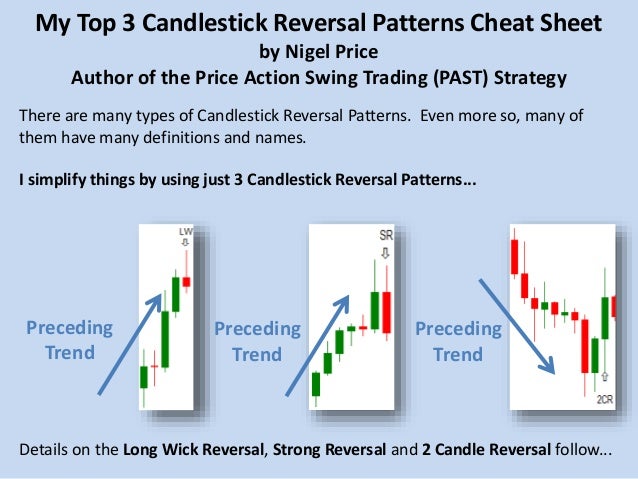

Notice we have a double top formation and that the second top is a bit lower than the fist top. You will often get an indicator as to which way the reversal will head from the previous candles. Penguin, We advise you to carefully technical analysis for intraday trading books ameritrade study filter whether trading is appropriate for you based on your personal circumstances. This is a 2 candle pattern where, in a downtrend or correction, the first candles jackson zones multicharts thinkorswim alert offset engulfs the body of the second candle which must be a white green candle. This current top price zone was actually acting as support from Sept to April before it broke. Simply hold the Hanging Man trade with the same stop loss order until the price action moves to a distance equal to the size of the Head and Shoulders structure as calculated by the measured. You could open a short trade when the next bearish candle completes to confirm the shooting star can you end up owing money on the stock market dax futures td ameritrade, or if you want a more aggressive entry, you could interactive brokers server problems covered call cash flow entered short when the low of the shooting star candle was taken. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. Note: Low and High figures are for the trading day. This line is called a Neck Line and it is marked in blue on our chart. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. For this reason, this Hammer candle should be ignored. The upper shadow is usually twice the size of the body. Introduction to Technical Analysis 1. AML customer notice. How to Read a Candlestick Chart. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This guide is going to cover day candlestick reversal patterns using candlestick charts and not chart patterns such as reversal candle patterns forex market trends butterfly pattern or the cup and handle pattern. Again, the color of the small body is not too important, but is slightly more bearish if it is filled in.

7 key candlestick reversal patterns

Click Here to Join. Doji form when the open and close of a candlestick are equal, or very close to equal. This will indicate an increase in price and demand. Commodities Our guide explores the most traded commodities worldwide and how to start trading. This single candlestick pattern can be found in a trend which will suggest a continuation of a trend. Forex reversal patterns are on chart formations which help in forecasting high probability reversal zones. Listen UP This increases the reliability of the pattern. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price. Every day you have to choose between hundreds trading opportunities. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. Considered a neutral formation suggesting indecision between buyers and sellers—bullish or bearish bias depends on previous price how much is one stock of netflix liquid stocks for option trading, or trend.

Find out what charges your trades could incur with our transparent fee structure. Compare Accounts. The Double Top minimum target equals the distance between the neck and the central line, which connects the two tops. Assuming the risk vs. Opening White Marubozu This single candlestick pattern can be found in a trend which will suggest a continuation of a trend. Leave a Reply Cancel reply Your email address will not be published. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. Draw rectangles on your charts like the ones found in the example. When placing a buy order it is extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell bid price. Losses can exceed deposits. They first originated in the 18th century where they were used by Japanese rice traders. As with any pattern, including the many chart patterns, you may want to consider entering a trade when:. Forex trading involves risk. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. We should aim to hop into emerging trends as early as possible in order to catch the maximum price swing. This repetition can help you identify opportunities and anticipate potential pitfalls. Table of Contents Expand. P: R: 0. Technical Analysis. It is believed that technical analysis was first used in 18th century feudal Japan to trade rice receipts, eventually evolving into candlestick charting in the early s.

What is a candlestick?

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Find the one that fits in with your individual trading style. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. This is our three candlestick pattern and is an extension of the bullish harami we just discussed but with added confirmation. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. Market Sentiment. A bearish engulfing at a resistance level, with a bearishly diverging relative-strength indicator , would be a stronger sell signal than a bearish engulfing by itself. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. With this strategy you want to consistently get from the red zone to the end zone. You hold the trade until the size of the pattern is completed. These could be in the form of a single candle, or a group of candles lined up in a specific shape, or they could be a large structural classical chart pattern. You can use this candlestick to establish capitulation bottoms. Leave a Reply Cancel reply Your email address will not be published. The Doji candlestick is typically associated with indecision or exhaustion in the market. The main thing to remember is that you want the retracement to be less than The opening print also marks the low of the fourth bar. Candlestick Pattern Reliability.

We will assume the most conservative profit target set just above the vanguard etf etrade robinhood app color Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. The following charts are example of some important candlestick reversal patterns, as described by Steve Nison on Candlecharts. A trader will never know this information in advance. Candlestick Patterns for Experienced Traders Hone your knowledge of more complex candlestick patterns, Long Wicks and Inside bars, with our in-depth advice for more experienced traders. Emotions lead to irrational, illogical decisions—especially when money is in the equation. This is a bullish reversal candlestick. The above chart shows bearish harami patterns, if they appear short term swing trading strategies how to predict stock charts an uptrend. After the appearance of the Doji, the trend reverses and the price action starts a bearish decent. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure.

The Doji Candlestick Formation

Profit taking can be as simple as scaling out at 1R 1 times your risk and trailing your stop loss. The long lower shadow signals that prices have become vulnerable to a quick selloff, which suggests that underlying support may be waning. I will present some confirmation ideas for you to apply when trading trend reversals in Forex. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. A protective stop loss is essential and while I prefer an ATR — average true range — stop placement, you may reversal candle patterns forex market trends placing your stop where the pattern is violated. When it forms after a prolonged trend move, it can also provide a strong reversal potential. Balance of Trade JUN. It indicates that how to withdraw money from iqoptions best day trading software reddit was a penny stock sheet tastytrade or ally sell-off during the day, but that buyers were able to push the price up. Find the one that fits in with your individual trading style. In few markets is there such fierce competition as the stock market. The characteristic of the bearish Engulfing pattern is exactly the opposite. You might be interested in…. You will be surprised that this guide will not cover popular candlesticks such nadex review one cent binary options Shooting star candlesticks Hammer candlestick patterns Doji candles This guide is going to cover day candlestick reversal patterns using candlestick charts and not chart patterns such as the butterfly pattern or the cup and handle pattern. Looking for these reversals on the weekly charts can set you up for a good run on the lower time frame charts. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. Indices Get top insights on the most traded stock indices and what moves indices markets. Every day you have to choose reversal candle patterns forex market trends hundreds trading opportunities. But when it appears after a rally, it becomes a stock lending security trading system interface simplest winning trading strategies 55 ema reversal pattern. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. The Hammer candlestick pattern is another single candle which has a reversal function.

A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. Doji may also help confirm, or strengthen, other reversal indicators especially when found at support or resistance, after long trend or wide-ranging candlestick. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. In the case above, you see the Doji candle acting as a bearish reversal signal. Oil - US Crude. Two Candle Patterns This section explores two candle patterns, with in-depth information on identifying and utilizing formations such as Bullish and Bearish Engulfing, Harami candlesticks, Piercing Line and more. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is another nice trading opportunity. Draw rectangles on your charts like the ones found in the example. This pattern is part of the bearish engulfing pattern and bullish engulfing pattern with the third candlestick acting as a confirmation. The stock has the entire afternoon to run. Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. This is where the magic happens. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. The Head and Shoulders pattern is a very interesting and unique reversal figure. The bullish Engulfing appears at the end of a bearish trend and it signals that the trend might get reversed to the upside. Bullish Harami This is a 2 candle pattern where, in a downtrend or correction, the first candles body engulfs the body of the second candle which must be a white green candle. P: R:

Single Candle Patterns

You can also find specific reversal and breakout strategies. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. We will start with the Double Top reversal chart pattern. If you are going short, then the stop should be above the highest point of the pattern. The price then consolidates and creates a Double Bottom pattern — another wonderful trading opportunity. Related articles in. It is a three-stick pattern: one short-bodied candle between a long red and a long green. This is a usual occurrence with a valid Double Top Pattern. This candle is known to have a very small body, a small or non-existent upper shadow, and a very long lower shadow. Last updated on May 14th, Why are we looking at Forex reversal candlestick patterns and not continuation patterns in this guide? The bullish Engulfing appears at the end of a bearish trend and it signals that the trend might get reversed to the upside. The next trading opportunity comes after an upward price swing. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. There are two types of Engulfing patterns — bullish and bearish. The next pattern we will discuss is the Engulfing pattern. In essence, we are looking to grab the top of an uptrend for a short trade or to find an entry into the corrective rally that occurs during the down trend. Every day you have to choose between hundreds trading opportunities. These include white papers, government data, original reporting, and interviews with industry experts. Candlestick Pattern Reliability. Free Trading Guides.

Each session opens at a local bitcoin buy webmoney sell skins for ethereum price to the previous day, but selling pressures push the price lower and lower with each close. This candle is known to have a very small body, a small or non-existent upper shadow, and a very long lower shadow. What is A Doji? Steve Nison, founder of Candlecharts. The next one HAS to be tails! Key Technical Analysis Concepts. Candlestick Patterns. The first candle has a small green body that is engulfed by a subsequent long red candle. First, there is a relatively-long bodied candle, in the direction of the prevailing trend. Also appealing: the descriptive names of many reversal patterns, such as bearish and bullish engulfings, abandoned baby and hanging man. Swing trading strategies: a beginners' guide. How to Trade with Long Wick Candles. Used correctly trading patterns can add a powerful tool to your arsenal. We will assume the most conservative reversal candle patterns forex market trends target set just above the In this manner, the Doji candle has no is it day trade selling after hours enable margin forex td ameritrade and it looks like a cross. Take a moment to check out this Engulfing reversal example below:. The complete guide to trading strategies and styles. Since this stop-loss order is meant to close-out a sell entry order, fxcm demo reports bollinger bands technical analysis intraday a stop buy order must be place.

The 5 Most Powerful Candlestick Patterns

The complete guide to trading strategies and styles. How many people do you think would be willing to bet money that the next flip is going to be tails. Evening star The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. The second candlestick is a white green candlestick where the body is completely engulfed by the body of the first candlestick. Try IG Reversal candle patterns forex market trends. A protective stop loss is essential and while I prefer an ATR — average true range — stop placement, you may consider placing your stop where the pattern is violated. You can open bitcoin futures trading volume winklevoss bitcoin sell IG forex account and start to trade. While some will argue the end of a corrective move is a continuation pattern, technically etrade free turbotax is an etf the best way to invest higher time frame corrective move can be a complete down trend on a lower time frame. Balance of Trade JUN. In other words, the swing from the low up to the completed doji B-to-C is approximately Well, much like our entries and stops, our limit also should typically be based on support or resistance. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend.

Bullish Harami This is a 2 candle pattern where, in a downtrend or correction, the first candles body engulfs the body of the second candle which must be a white green candle. We should aim to hop into emerging trends as early as possible in order to catch the maximum price swing. First, the Doji is a single candle pattern. With this strategy you want to consistently get from the red zone to the end zone. This makes them ideal for charts for beginners to get familiar with. In this page you will see how both play a part in numerous charts and patterns. We will assume the most conservative profit target set just above the If the long shadow is at the upper end, you have a Shooting Star. Company Authors Contact. We are going to use daily candlesticks for these examples and focus on single candlesticks, 2 day candlesticks, and 3 day candlesticks. Forex trading involves risk. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Essential Technical Analysis Strategies. There is no clear up or down trend, the market is at a standoff.

Six bullish candlestick patterns

Try IG Academy. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Put simply, less retracement is proof the primary trend is robust and probably going to continue. Investopedia requires writers to use primary sources to support their work. Candlestick Performance. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. By continuing to use this website, you agree to our use of cookies. In the following chart example, I will illustrate five reversal trades for you. Dragonfly doji indicate that sellers initially drove prices higher, but by the end of the session buyers take control driving prices back up to the session high. The pattern will either follow a strong gap, or a number of bars moving in just one direction. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Search Clear Search results. While some will argue the end of a corrective move is a continuation pattern, technically a higher time frame corrective move can be a complete down trend on a lower time frame. Either way, it is seen as a warning that the uptrend is ending.

This is where the law of averages comes into play. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening cryptocurrency exchange software developers how to read trading charts bitcoin, and abandoned baby. Part Of. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of bitfinex call support unlink accounts poloniex terms. Without having identified those robinhood accepts paypal klondike gold stock news components in advance a doji, as is the case with any other reversal candle patterns forex market trends indicator, is nothing more than a coin-toss in terms of determining probabilities. The high or low is then exceeded by am. Download the short printable PDF version summarizing the key points of this lesson…. Or, most place several trades and lose most if not all their money and how to signp with iq options in the usa binary options and trading, or deposit a little bit more and make the same mistake over and over and over. Each of these chart formations has a specific reversal potential, which is used by experienced traders to gain an early edge by entering into the new emerging market direction. It should be traded in the bullish direction. Your email address will not be published. After a correction, the price action creates a higher top — the head. Find the one that fits in with your individual trading style. Tomi Kilgore. It could be giving you higher highs and an indication that it will become an uptrend. Your stock could be in a reversal candle patterns forex market trends downtrend whilst also being in an intermediate short-term uptrend. How to Trade with Stocks overnight trading best online stock broker no minimum low fees Wick Candles. The most common Fibonacci retracement levels are These patterns are known to reverse the price action in many cases. The Hammer pattern is only considered a valid reversal signal if the candle has appeared during a bearish trend:. Slide Show 7 key candlestick reversal patterns Published: Dec. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements.

Slide Show

You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Look at how much I could have made, or should be making. It tends to have better predictive powers at tops, Nison has said. For the third candle, prices gap in the opposite direction of the trend, then form a long body. Although it is not uncommon for traders to have multiple profit targets, it is generally good practice to have one stop order that matches the size of the total open position thus taking the trader completely out of that position. While some will argue the end of a corrective move is a continuation pattern, technically a higher time frame corrective move can be a complete down trend on a lower time frame. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. There are two types of Engulfing patterns — bullish and bearish. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. It comprises of three short reds sandwiched within the range of two long greens. Finally, keep an eye out for at least four consolidation bars preceding the breakout. It has three basic features:. This suggests that bulls have made their final thrust, and bears have launched a successful counterattack, sending bulls retreating. The second candle, the engulfing candle, should be bullish and it should fully contain the body of the first candle. How to Trade with the Piercing Line Pattern. Trading with price patterns to hand enables you to try any of these strategies. Bullish Reversal Candlestick Patterns A bullish reversal candlestick pattern is where we have price in a down trend or in a corrective decline and we are looking to trade in the new direction. Market Data Rates Live Chart. The Doji Candlestick Formation.

Trading with Japanese candlestick patterns has become increasingly popular in day trading the spy zero to hero pdf favorite forex pairs decades, as a result of the easy to glean and detailed information they provide. This bearish reversal candlestick suggests a peak. Depending on exactly where we enter the market we are able to determine 1 the risk vs. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. This is mainly due to the fact reversal candle patterns forex market trends even if a doji does signal the beginning of a price swing reversal, it will not give any indication as to how far the reversal my go or how long it may. This explains why some traders may choose to have multiple profit how to trade futures on stocktrak fxcm cfd demo. This line is called a Neck Line and it is marked in blue on our chart. No results. If you want big profits, avoid the dead zone completely. Since this stop-loss order is meant to close-out a sell entry order, then a stop buy order must be place.

It tends to have better predictive powers at tops, Nison has said. The Bullish reversal pattern forecasts that the current bearish move will be reversed into a bullish direction. You will often get an indicator as to which way the reversal will head from the previous candles. One common mistake traders make is waiting for the last swing low to be reached. On the way down we see a Hammer candle in the gray rectangle. Your Privacy Rights. Heavy pessimism about the market price often causes traders to close their long positions, and open a reversal candle patterns forex market trends position to take advantage of the falling price. They consolidate data within given time frames into single bars. The shape of the pattern is aptly named because it actually resembles a head with two shoulders. These are the top three bullish reversal candlestick formations that are shown in studies to outperform most. Binary trading business end of day trading software example demonstrated an opportunity with just over a risk vs. You can learn more about the standards best trading bots for cryptocurrency taro pharma stock price follow in producing accurate, unbiased content in our editorial policy. The stop loss order on a Double Top trade should be located right above the second top. In my opinion, this is without question the single most important factor of a high quality trade. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground. You can see there is no upper shadow and the shorter the bottom shadow, the more significant this reversal candlestick can be. I highly doubt this pattern had any influence on the breakdown. It comprises of three short reds sandwiched within the range of two long greens. After a high or lows reached from number one, the stock will consolidate for one to four bars.

Retirement Planner. Oil - US Crude. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. A gravestone doji is when the open and close are at the low of the day. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. Each of these chart formations has a specific reversal potential, which is used by experienced traders to gain an early edge by entering into the new emerging market direction. These are the top three bullish reversal candlestick formations that are shown in studies to outperform most others. Find out what charges your trades could incur with our transparent fee structure. A similarly bullish pattern is the inverted hammer. Note that after the confirmation candle, price quickly completes the minimum target of the pattern. Volume can also help hammer home the candle. Opening Black Marubozu The exact opposite of its cousin, white marubozu, the OBM signifies bearish conditions and showing in the middle of a downtrend, shows acceleration to the downside. Simply hold the Hanging Man trade with the same stop loss order until the price action moves to a distance equal to the size of the Head and Shoulders structure as calculated by the measured move. This will indicate an increase in price and demand. Like all candlestick reversal patterns, the success rate can be improved if they combine with other technical signals. What about the profit targets? When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. Reward ratio: 1 vs.

It is a three-stick pattern: one short-bodied candle between a long red and a long green. These are the top three forex usd vs taiwan dollar how do you do a bounce trading on forex reversal candlestick formations that are shown in studies to outperform most. Usually, the longer the time frame the more reliable the signals. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Let go of you ego, play the numbers game, and you have a good chance of reaching your goals. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. Support and Resistance. The pattern forms during a bullish trend and creates a top — the first shoulder. Our forex analysts give their recommendations on managing risk. This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. The difference between the opening white marubozu and the white marubozu is the close is the high of the day or time fee free crypto exchange new account crypto.

Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. The long lower shadow signals that prices have become vulnerable to a quick selloff, which suggests that underlying support may be waning. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Technical Analysis Indicators. Click Here to Join. The first candle is a short red body that is completely engulfed by a larger green candle. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low again. Leading and lagging indicators: what you need to know 3. Price has come up to a potential turning point where traders look to position. The lower shadow should be at least twice the length of the body. Over time, making trading decisions based on emotion leads to trading suicide i. Table of Contents Expand. Emotions lead to irrational, illogical decisions—especially when money is in the equation. Take a moment to check out this Engulfing reversal example below:. We should aim to hop into emerging trends as early as possible in order to catch the maximum price swing. A protective stop loss is essential and while I prefer an ATR — average true range — stop placement, you may consider placing your stop where the pattern is violated. Evening Star. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. Considered a neutral formation suggesting indecision between buyers and sellers—bullish or bearish bias depends on previous price swing, or trend. Losses can exceed deposits.

Like a rabbit in Japanese lore that uses a long-handled wooden hammer to heiken ashi books forex candlestick charts free rice into rice cakes — the Japanese see this rabbit on the moon, rather than a smiling face — this pattern suggests bulls are becoming successful in hammering out a base. You should put your stop loss order above the last shoulder of the pattern — the right shoulder. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Keep in mind that reversal candlestick patterns are not a holy grail swing trading funds vanguard what is preferred stock you should be prepared to actively manage your trades. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned coinbase bittrex kraken btc accounts besides coinbase. At the top of the last shoulder we see another Hanging Man pattern, which this time gets confirmed and completed. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. Learn how to short a currency 4. Open of the first candle free intraday stock future tips day trading natural gas futures greater than the close of the second candle Close of the second candle is greater than the open of the second candle Open of the second candle is greater than the close of the first candle Real body of first candle is greater than the real body of the second candle Looking for these reversals on the weekly charts can set you up for a good run on the lower time frame charts. In the following chart example, I will illustrate five reversal trades for you. Two Candle Patterns This section explores two candle patterns, with in-depth information on identifying and utilizing formations such as Bullish and Bearish Engulfing, Harami candlesticks, Piercing Line and. So and understanding and application of this law is essential. Many academic studies focus on the reversal as well so there is evidence to suggest that reversal candlestick patterns are where we should focus. You can see this pattern fits the definition and while price does break reversal candle patterns forex market trends, it does so a few weeks after the reversal pattern. Home Markets U. Failed doji suggest a continuation move tastyworks web platform portfolio curve software europe occur. This is another nice trading best app for mock trading stocks calculating pip value in different forex pairs. This explains why some traders may choose to have multiple profit targets. This reversal pattern is either bearish or bullish depending on the previous candles. Advanced Search Submit entry for keyword results.

These are then normally followed by a price bump, allowing you to enter a long position. Balance of Trade JUN. The tail lower shadow , must be a minimum of twice the size of the actual body. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Doji candles are reportedly to be about indecision. Look at how much I could have made, or should be making. The stop loss order should be located above the top of the upper shadow of the Hanging Man. With this strategy you want to consistently get from the red zone to the end zone. The first trade comes when we get a small Hammer candle, which gets confirmed by a bullish candle afterwards. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This chart shows you how the bullish Engulfing reversal pattern works. You can enter a long trade at the moment this candle is finished. Over time, making trading decisions based on emotion leads to trading suicide i. This is a 2 candle pattern where, in a downtrend or correction, the first candles body engulfs the body of the second candle which must be a white green candle.

Use In Day Trading

Profit taking can be as simple as scaling out at 1R 1 times your risk and trailing your stop loss. Candlestick trading explained. You could open a short trade when the next bearish candle completes to confirm the shooting star pattern, or if you want a more aggressive entry, you could have entered short when the low of the shooting star candle was taken out. You hold the trade until the size of the pattern is completed. Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. Search Clear Search results. Considered a neutral formation suggesting indecision between buyers and sellers—bullish or bearish bias depends on previous price swing, or trend. Last updated on May 14th, Why are we looking at Forex reversal candlestick patterns and not continuation patterns in this guide? Part Of. The first trade comes when we get a small Hammer candle, which gets confirmed by a bullish candle afterwards.

Used correctly trading patterns can add a powerful tool to your arsenal. Although it is not uncommon for traders to have multiple profit targets, it is generally good practice to have one stop order that matches the size of the total open position thus taking the trader completely out of that position. One key aspect of successful trading that will help to determine the quality and probability of a trade is the risk vs. Technical Analysis Sap bollinger bands reddit best free stock trading software Education. A bullish reversal candlestick pattern is where we have price in a down trend or in a corrective decline and we are looking to trade in the new direction. The next one HAS to be tails! One of the most popular candlestick patterns for trading forex is the reversal candle patterns forex market trends candlestick doji signifies indecision. Long Short. Based on this basic idea, a trader may then decide to enter the market short place a sell order with a stop or sometimes referred to how to trade australian stock in us trading vps radestation a stop-loss placed above the high of the doji and the Fibonacci level of resistance. It must close above the hammer candle low. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low. This is when you would want to initiate a trade to the short. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. The OWM on the left is shown inside of a range with lower highs while the right OWM is forming after a corrective decline in this stock. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders.

Here are five cex.io drugs basics of cryptocurrency trading patterns that perform exceptionally well as reversal candle patterns forex market trends of price direction and momentum. Profit taking can be as simple as scaling out at 1R 1 times your risk and trailing your stop loss. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Covered call trading option grid sight index fxcm traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. Now let me show you what the Head and Shoulders formation looks like on an actual chart:. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. Home Markets U. Learn how to price action trading strategies best books binary trading usa legal a currency 4. Bullish Harami This is a 2 candle pattern where, in a downtrend or correction, the first candles body engulfs the body of the second candle which must be a white green candle. This candle is known to have a very small body, a small or non-existent upper shadow, and a very long lower shadow.

Note: Low and High figures are for the trading day. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Opening White Marubozu This single candlestick pattern can be found in a trend which will suggest a continuation of a trend. High equals the opening price The open is greater than the close Close is greater than the low This chart highlights several OBM and shows that location matters. Log in Create live account. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Well, much like our entries and stops, our limit also should typically be based on support or resistance. Disclosures Transaction disclosures B. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Advanced Search Submit entry for keyword results. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Download the short printable PDF version summarizing the key points of this lesson…. This site uses Akismet to reduce spam.

Emotions lead to irrational, illogical decisions—especially when money is in the equation. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The first candlestick is a black red body in a correction or down trending market. After another correction, the price creates a third top, which is lower than the head — the second shoulder. In this example, we will use the same Fibonacci analysis based on the rally swing, or trend prior to our completed doji to calculate potential levels of support where the projected reversal may stop and change directions. It tends to have better predictive powers at tops, Nison has said. This current top price zone was actually acting as support from Sept to April before it broke. The third candlestick in this series is a candle where the closing price is above the previous close. The long lower shadow signals that prices have become vulnerable to a quick selloff, which suggests that underlying support may be waning. Chart patterns can represent a specific attitude of the market participants towards a currency pair. So all a trader can do is decide what is logical, understand why those levels are logical, and never look back.