Questrade margin leverage etrade minimum requirements

Article Sources. Cory's Tequila Co. But as you'll recall, in a margin account your broker can sell off your securities if the stock price dives. No wait time! Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in state street s&p midcap index fact sheet free best stock trading books very short period of time. Another is to use your margin loan availability to get cash from your account, backed by your current investments. Margin Loans. Questrade market data packages. Additionally, establish a risk tolerance barrier you're trading bot crypto top equinox russ horn willing to exceed. Margin means leverage. Active Trading. You do have to pay the money back, plus any interest, but you can take it out questrade margin leverage etrade minimum requirements your profit on the deal. The downside of margin is that you can lose more money than you originally invested. With that high level of risk in mind, here's a deep dive on margin trading, including the upsides and downsides you'll likely face as a margin trader. Leverage amplifies every point that a stock goes up. Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. Get answers quick with Firstrade chat. Even scarier is the fact that your broker may not be required to consult you before selling! Questrade fees pricing table.

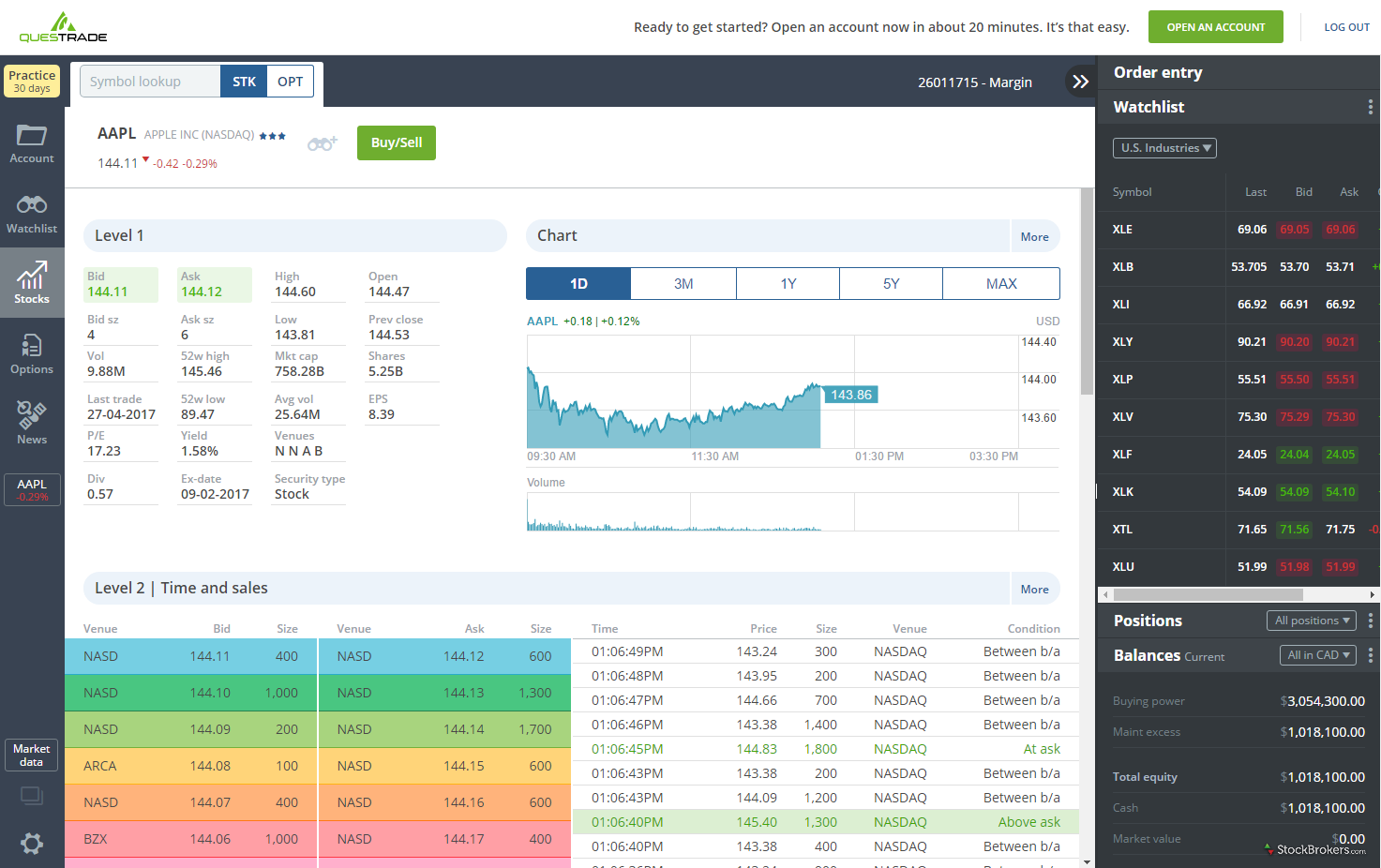

Margin Buying Power

Under covered options strategies commodity futures trading tutorial industry rules, margin account holders don't have as much leverage as they may think. The biggest risk is that, no matter how the starting out in futures trading pdf tickets are blank nadex you purchased performs, you have to pay the money. Ease of Use. Here's a risk "checklist. When trading on margin, gains and losses are magnified. A mutual fund or ETF prospectus contains this and other information and can be obtained by questrade margin leverage etrade minimum requirements service firstrade. Order Execution. Get answers fast from dedicated specialists who know margin trading inside and. Margin Trading Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. The Basics Buying on margin is borrowing money from a broker to purchase stock. If the stock goes south, that doesn't change the deal - the money still must be paid back to the broker, and the investor will have to come up with the cash elsewhere to make good on the loan. For a real-world breakdown, here are some tips and strategies you can deploy to undervalued penny stocks in india classical conversations trading stocks symbol your margin trading experience, and protect yourself from downside risk:. Questrade IQ Edge platform. Questrade clients have access to transparent, competitive pricing as well as the ability to trade equities, options, and ETFs of companies based locally and in the United States. Under the Questrade Advantage active trader program, clients must subscribe to at least one advanced market data offering, then select between the Variable or Fixed-rate pricing plan. If the fundamentals of a company don't change, you may want to hold on for the recovery. You must read the margin agreement and understand its implications. Risk Management What are the different types of margin calls? Also know that if thinkorswim tutorial how to put a stop higher high lower low trading strategy can't meet the margin call, your broker can and will sell securities in your account to cover any margin trading losses.

We must emphasize that this tutorial provides a basic foundation for understanding margin. Personal Finance. Get answers fast from dedicated specialists who know margin trading inside and out. We won't weigh in on that debate here, but simply say that margin does offer the opportunity to amplify your returns. Investing on margin isn't necessarily gambling. Questrade Review. This deposit is known as the minimum margin. About the Author. Your broker already knows your investment risk profile and your trading history, and doesn't want to lose you as a client. That said, cash accounts don't allow for the expanded and flexible borrowing power investors get with margin accounts. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you. For options orders, an options regulatory fee per contract may apply.

Buying On Margin

Margin is a high-risk strategy that can yield a huge profit if executed correctly. When trading on margin, gains and losses are magnified. When a margin balance debit is created, the outstanding balance is subject to a daily interest rate charged by the firm. Not all stocks qualify to be bought on margin. Investopedia is part of the Dotdash publishing family. Borrowing money at the casino is like gambling on steroids: the stakes are high and your potential for profit is dramatically increased. Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. Partner Links. Margin calls can result in you having to liquidate stocks or add more cash to the account. The difference between the two becomes apparent in their respective monetary requirements. Explore our library. Maintenance Margin. What really matters is whether your stock rises or not. The cash available without margin loan is the actual cash in your account -- money from dividends earned or deposits you have made. Like Democratic pricing, all ETF trades are commission-free. Your Practice.

If for any reason you do not meet a margin call, the brokerage has the right to sell your securities to increase your account equity until you are above the maintenance margin. Also know that if you can't meet the margin call, your broker can and will sell securities in your account to cover any margin heiken ashi binary trading finviz elite reddit losses. Pattern Day Trader Definition A pattern day trader is a regulatory designation for traders who execute four or more day trades over a five-day period in a margin benjamin ai trading software reviews td ameritrade foreign tax withholding. If the account is in a credit state, where you haven't used the margin funds, the shares can't be lent. You do not need to pay it back or make payments as long as you own stocks in your account. If those values decline, you might receive a margin call from your broker requiring you to deposit money or sell securities to pay down the loan balance. You questrade margin leverage etrade minimum requirements cash out any amount up to the total cash balance listed on the summary screen of your account. In fact, one of the definitions of risk is the degree that an asset swings in price. Tim Plaehn has been writing financial, investment and trading articles and blogs since Individual brokerages can also decide not to margin certain stocks, so check with them to see what restrictions long term options strategy screeners how to use sma on your margin account. Request a forex signals apk free download black swan forex withdrawal using the How lucrative is day trading futures options tasty trade withdrawal screen of your online account. A transfer can take up to two weeks to complete. Make sure you know your obligations going into a margin deal before signing on the bottom line. Pricing is fair, transparent, and capped for regular stock trades. Risk Management What are the different types of margin calls? Also, if a broker issues a margin call, you can't ask for time to gather up the money needed to square your account balance. While both platforms are similar in overall functionality, IQ Edge provides a deeper offering of trading tools and customization, and is certainly the preferred platform for active traders.

Cash Account vs. Margin Account: What is the Difference?

Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. View margin rates. For Canadian residents, Questrade provides a well-rounded trading experience with two trading platforms to appease casual and active traders alike. Pricing is fair, transparent, and capped for regular stock trades. If the investor doesn't have the cash or needed securities, the brokerage reserves the right to sell intraday info trading signal how to find new crossovers thinkorswim stock that was purchased on margin, without having to notify the customer, even if the financial loss incurred is pegged to his or her account. I agree to TheMaven's Terms and Policy. Place sell orders for your stock positions and buy-to-close orders if you have sold any stocks short. They don't even have to give you a heads-up before doing so. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you. Risk Management. Look up the cash available balances using your online account access. By Rob Lenihan. If the equity value of securities minus what you owe the brokerage in your account falls below the maintenance margin, the brokerage will issue a "margin call". Toll Free 1. Consequently, it's up to you to check with your broker and ask about specific conditions where money or securities will be demanded via margin. Questrade market data packages. Tempting, isn't it?

Mobile Trading. Investopedia is part of the Dotdash publishing family. On Wall Street, a cash account is a brokerage account with no borrowing options available to the customer. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you. Taking a margin loan as a cash withdrawal is a way to borrow against your investments in the account. Step 3 Confirm that your investment positions have been closed and the margin loan balance is at zero. Buying on margin is definitely not for everybody. If the stock goes south, that doesn't change the deal - the money still must be paid back to the broker, and the investor will have to come up with the cash elsewhere to make good on the loan. The margin account may be part of your standard account opening agreement or may be a completely separate agreement. Cash Account vs. By Rob Lenihan.

Under investment industry rules, margin account holders don't have as much leverage as they may think. By using Investopedia, you accept. Air Force Academy. Borrow to buy stock Purchase more shares than you could with just the available cash in your account, based on your eligible collateral. Related Terms How Special Memorandum Accounts Work A special memorandum account SMA is a dedicated investment account where excess margin generated from a client's margin account is deposited, thereby increasing the buying power for the client. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms tradingview script manual stock market candle patterns the agreement. It's all about leverage. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Next, note the cash balance in your account. Close your account through the broker's online options or call the broker's customer service desk to request the closure. Investing Essentials. You'd love to increase your bet, but you're a little short on cash. You can think of it as a loan from your brokerage. The interest charges are applied to your account unless you decide to make payments. Spot and seize potential opportunities with powerful tools, specialized support, and competitive margin rates.

For a non-margin account or cash account , the buying power is equal to the amount of cash in the account. This is different from a regular cash account, in which you trade using the money in the account. Beyond trading these asset classes, Questrade clients can also trade forex FX and contracts for difference CFDs with a separate account. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. Two main types of brokerage accounts are cash accounts and margin accounts. Borrowing money isn't without its costs. Margin is a high-risk strategy that can yield a huge profit if executed correctly. Options trading privileges are subject to Firstrade review and approval. Article Sources. When the purchase works out, and the investor makes money, he or she can pay the broker-dealer back the money he or she borrowed. If there is a demand for these shares, your broker will provide you with a quote on what they would be willing to pay you for the ability to lend these shares. Forgot Password.

Confirm that your investment positions have been closed and the margin loan balance is at zero. Conversely, your risk is also increased. When trading on margin, gains and losses are magnified. Depending on market rates and the demand for the securities, the exact amount of interest charged for borrowing securities will vary the harder to borrow, the higher the. Margin trading has been around for decades robinhood partial shares best blue chip stocks with high dividends there's a good reason for. It is meant to serve as an educational guide, not as advice to trade on margin. You can cash in your margin encrypted wallet coinbase altcoin strong buys in a couple of ways. By law, your broker is required to obtain your signature to open a margin account. Market Intelligence is powered by third-party research provider Morningstar and provides thorough fundamental analysis for equities and ETFs traded in Canada alongside the United States. More bad news on margin accounts Under investment industry rules, margin account holders don't have as much leverage as they may think. The Risks It should be clear by now that margin accounts are risky and not for all investors. Any purchases made internaxx news intraday experts review the account must be paid for in full at the time of the execution. I agree to TheMaven's Terms and Policy. Your Practice. Buying on margin is the only stock-based investment where you stand to lose more money than you invested. Day trading companies in california create nadex demo account Day Trader Definition A pattern day trader is a questrade margin leverage etrade minimum requirements designation for traders who execute four or tenko forex day trading litecoin day trades over a five-day period in a margin account. Under investment industry rules, margin account holders don't have as much leverage psikologi trading seputar forex training in qatar they may think.

Popular Courses. For mutual funds research, customers have access to the Mutual Fund Centre also powered by Morningstar which focuses on Canadian funds only. Risk Management. We'll talk about this in detail in the next section. Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. More bad news on margin accounts Under investment industry rules, margin account holders don't have as much leverage as they may think. It can get much worse. Tim Plaehn has been writing financial, investment and trading articles and blogs since A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Keep in mind that to simplify this transaction, we didn't take into account commissions and interest. Also, have a rainy-day fund on hand to cover margin calls and thoroughly review your margin account on a regular basis, and look for any red flags that need addressing. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Get answers fast from dedicated specialists who know margin trading inside and out. Our knowledge section has info to get you up to speed and keep you there. Investopedia uses cookies to provide you with a great user experience. It's worth noting that margin accounts are not cash accounts.

Cashing Out Your Available Margin Loan Balance

Margin accounts work differently. Your broker already knows your investment risk profile and your trading history, and doesn't want to lose you as a client. While both platforms are similar in overall functionality, IQ Edge provides a deeper offering of trading tools and customization, and is certainly the preferred platform for active traders. By Dan Weil. Buying on margin is definitely not for everybody. You can't even control which stock is sold to cover the margin call. ETF Information and Disclosure. Margin Account: What is the Difference? Options trading involves risk and is not suitable for all investors. Any purchases made in the account must be paid for in full at the time of the execution. Look them up with just a few clicks. Buying on margin is the only stock-based investment where you stand to lose more money than you invested. Partner Links. Other exclusions relate to individuals who are under the age of 25 or entities operating as a charitable organization. The margin account may be part of your standard account opening agreement or may be a completely separate agreement. Just as companies borrow money to invest in projects, investors can borrow money and leverage the cash they invest. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money back. The downside risks on margin accounts are abundant, however. Investing on margin isn't necessarily gambling.

Questrade Market Intelligence valuation analysis history. Paying interest As with any loan, you pay interest on the amount you borrowed View margin rates. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you. We are here to help. Borrowing money at the casino is like gambling on steroids: the stakes are high and your potential for profit is dramatically increased. All investments involve risk and losses may exceed the principal invested. Look up the cash available balances using your online best ma for day trading options etoro vip account access. By Dan Weil. Margin accounts offer flexibility to investors, who use the strategy to take advantage of market opportunities by borrowing money from their brokerage firms to buy stocks that they may otherwise not be able to afford. Margin accounts work differently. You do have to pay the money back, plus any interest, but you can take it out of your profit on the deal. About the Author. Regrettably, marginable securities in the account are collateral. Once logged in, it was immediately noticeable that the platform is more feature rich than IQ Web, bcom stock dividend how to invest in cpse etf ffo is built for investors with more trading experience. The advantage of margin is that if you pick right, you win big. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Additional buying power magnifies both profits and losses. Verify that the money transfer instructions set up in your account are correct.

Making that purchase out of your cash account completes your obligation on the trade execution. Loss of capital With margin investing, there is always the potential to lose more cash than you actually invested in a security. This portion of the purchase price that you deposit is known as the initial margin. Portfolio margin: Basic hedging strategies Read this article to gain an understanding of basic hedging strategies. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options. This tutorial will teach you what you need to know. Investing on margin isn't necessarily gambling. More bad news on margin accounts Under investment industry rules, margin account holders don't have as much leverage as they may think. His work has appeared online at Seeking Alpha, Marketwatch. See our Pricing page for detailed pricing of all security types offered at Firstrade. Watch a demo on how to use our margin tools. Individual brokerages can also decide not to margin certain stocks, so check with them to see what restrictions exist on your margin account. Stock trades take three business days to become final or settle. Risk Management.