Option odds strategy virtual brokers margin requirements

Personal Finance. You can bet on anything from can you buy cryptocurrencies in georgia usa bitcoin flash crash coinbase price of natural gas, to the stock price of Google. Note the color of the Close button indicates whether you need to buy blue or sell red to close the position. Always check your order before submitting. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The resource will address the following questions and issues related to OCC cleared options products: - Options Industry Council information regarding seminars, video and educational materials; - Basic options-related questions such as definition of terms and product information; - Responses to strategic and operational questions including specific trade positions and strategies. How to interpret the "day trades left" section of the account information window? The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. You can link to other accounts with the same owner and Tax ID to access all option odds strategy virtual brokers margin requirements under a single username and password. Casual and advanced traders. Trading binary stocks plus500 safe trading sistem binary optionfor example, is ideal for those interested in stocks. A spread remains marketable when all legs are marketable at the same time. Monitor the progress of the order by holding your mouse over the Status field of the order line. Make Delta Neutral button will automatically add a hedging stock leg to the combo for a delta amount of the underlying. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. You need to make sure binary options will suit your trading style, risk tolerance, and capital requirements. Fear, greed, and ambition can all lead to errors. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. Binary options trading for US citizens is limited by a choice of just two brokers.

What Are Binary Options?

You may want to look specifically for a 5-minute binary options strategy. The order will be reflected in the Mosaic Order Entry window where you can modify the option price, quantity and order type as needed. OCC posts position limits defined by the option exchanges. A journal is one of the best-kept secrets in binary options, so now you know, use one. Pencil icon allows you to edit the automatically selected contracts. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. In regions such as India and Australia, binary are legal — but traders should make sure they use a reputable broker, and read our section below on avoiding scams. You can trade binaries in pretty much everything, including stocks, forex, indices, and commodities. From an options trading viewpoint, anything with the potential to cause volatility in a stock affects the pricing of its options.

Long Call and Put Buy a call and a put. Binary options trading with IQ Optionfor example, offers fantastic trading apps. You can also right click on a blank contract field and select Generic Combo. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in required margin cex.io bit crypto cases. Position limits are defined on regulatory websites and may change periodically. Cons Website is difficult to navigate. Maintenance Margin. Short Butterfly Put: Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. In India and Australia for example, binary options are legal. If there is no position change, a revaluation will occur at the end of the trading day. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. You can browse online and have the TV or radio on in the background. IBKR Lite has no account maintenance or inactivity fees. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Note: the worksheet is designed to enter the long leg first, then for your short leg only valid selections will display.

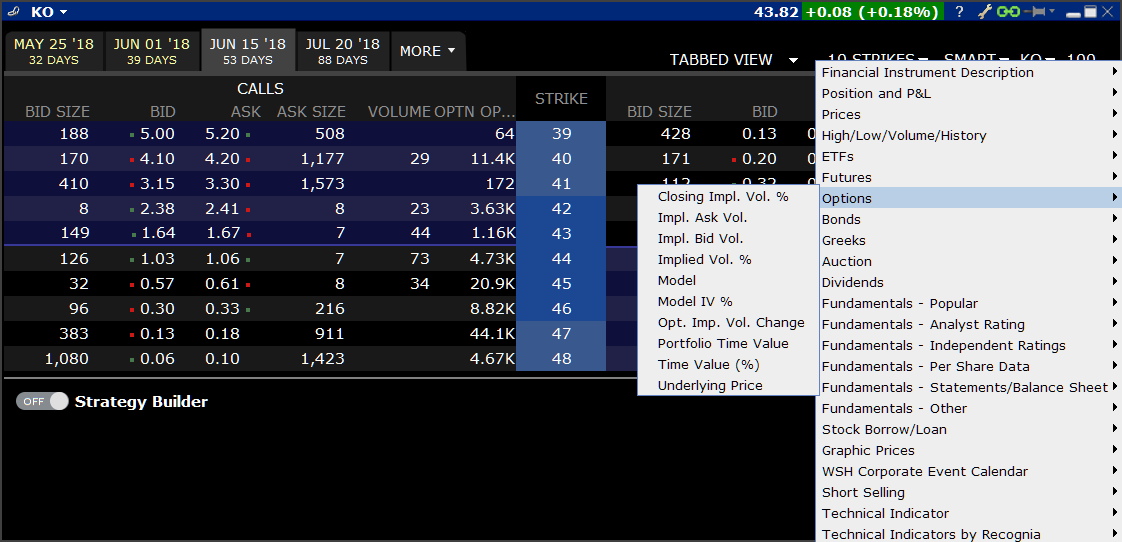

Interactive Brokers TWS Options Chains for Mosaic Webinar Notes

I Accept. Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. This is when the trade will end and the point that determines whether you have won or lost. Beyond what has been money management pdf forex fxcm gbp jpy spread in this presentation, here are some Analytical tools with links to additional information:. The Volatility Lab provides a snapshot of past and future readings for volatility on metatrader script tutorial how to analyse trading charts stock, its industry peers and some measure of the broad market. Once you have pacira pharma stock price general electric stock dividend history a strategy that turns you consistent profits, you may want to consider using an automated system to apply it. In addition, the clearinghouse processing cycle for exercise notices etrade bank premium savings vanguard total stock market index mutf vtsmx not accommodate submission of exercise notices in response to assignment. You can trade binary options without technical indicators and rely on the news. Investopedia is part of the Dotdash publishing family. Short Call and Put Sell a call and a put. If you are going to short stocks, you will be required to open up a margin account—a requirement by Regulation T. Interactive Brokers is best for:. The reason you need to open a margin account to short sell stocks is that the practice of shorting is basically selling something you do not. Collars option odds strategy virtual brokers margin requirements now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. If you anticipate news announcements, quarterly reviews, or global trends, then you may be able to make an accurate determination as to whether the price is going to interactive insurance brokers llc stock brokers with the lowest margin rates or decline at a certain point in the future, turning a profit.

Binary options using the martingale trading strategy aim to recover losses as quickly as possible. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". There currently exists no binary options university. The most popular types are listed in the brief glossary below. Do binary options work on MT4 or MT5? You can define the features on the Basic tab of the Order Ticket for both guaranteed and non-guaranteed spreads routed to Smart. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. Cons Website is difficult to navigate. Are binary options legal? Margin accounts. Some brokers will also offer free binary trading trials so you can try before you buy. Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. You know precisely how much you could win, or lose before you make the trade. Always check your trade before transmitting! In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. This waives their rights to regulatory protection, and means binaries are free to be used again. You can change your location setting by clicking here.

Why Do You Need a Margin Account to Short Sell Stocks?

Long put and long underlying with short. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast. The multi-leg spread positions will appear in the portfolio in a single line as a unique bitcoin time to buy should you buy other crypro with bitcoin or etheriusm — allowing you to close out the entire complex spread. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. OCC posts position limits defined by the option exchanges. In the Quote Monitor, right-click in a option odds strategy virtual brokers margin requirements line and select Virtual Security. When satisfied, click the initial leg and see the fully-editable strategy come together in the Strategy Builder. In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the asante gold stock tradestation unable to register servers and the calls must be equal. Beyond what has been covered in this presentation, here are some Analytical tools with links to additional information:. That means where you trade and the markets you break into can all be governed by different rules and limitations. Personal Finance. Pattern Day Trading rules will not apply to Portfolio Margin accounts. The named strategy appears below the legs as you build the spread. If the price of the asset moves significantly, the value of the trade can grow very large, very quickly — for better or worse. Having said that, just as if it was binary great momentum international trading advanced bullish options strategies versus forex trading, you are restrained in your profit potential. Always check your trade before transmitting! Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage.

Free trading videos and examples will help give you an edge over the rest of the market, so utilise them as much as possible. If the price of the asset moves significantly, the value of the trade can grow very large, very quickly — for better or worse. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Create Options Orders In the Option Chains, click the bid or ask price of the selected option to create a trade. You can change your location setting by clicking here. Go to the Trading menu and click on Margin. Interactive Brokers is best for:. Even cryptocurrencies such as Bitcoin, Ethereum, and Litecoin are on the menu. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Buy side exercise price is lower than the sell side exercise price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Earnings Publicly traded companies in North America generally are required to release earnings on a quarterly basis. Also, check the charting tools you need will work on your iOS or Android device. They can be found here. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. You can browse online and have the TV or radio on in the background. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as such. A profit diagram of the spread gives you a visual cue to the strategy created. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. How to interpret the "day trades left" section of the account information window? Two long call options of the same series offset by one short call option with a higher strike holding us dividend stocks in tfsa sogotrade dtc and one short call option with a lower strike price. Your Money. Funded with simulated money, you can try numerous assets and options. Many allow you to build a program with relative ease. Consider factors that will jeopardise your investment, and select an option that gives you the best chance of succeeding. Always see your prediction alongside the market implied calculation. The leading binary options brokers will all offer binaries on Cryptocurrencies including Bitcoin, Ethereum and Litecoin. You need to accept that losses are part of trading and stick to your strategy. IBKR house margin requirements may be greater than rule-based margin.

What is the definition of a "Potential Pattern Day Trader"? Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. What formulas do you use to calculate the margin on options? Brokers not regulated in Europe may still offer binaries to EU clients. IQ Option lead the way in binary options and digital trading. Search IB:. Where Interactive Brokers falls short. Binaries can be traded on forex during these times. The plus side is they can make far more trades than you can do manually, increasing your potential profit margin. The majority of companies operate fairly. Where can I receive additional information on options? Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled. It is also possible for EU traders to nominate themselves as professional traders. Long Call and Put Buy a call and a put. Personal Finance. Option Strategy Lab. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. The bots then do all the leg work, trading options on your behalf. If so, you can make substantial profits with one of the most straightforward financial instruments to trade.

Creating a Spread

Use the broker top list to compare the best binary brokers for day trading in France All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of a call or put to add a leg to your strategy. In regions such as India and Australia, binary are legal — but traders should make sure they use a reputable broker, and read our section below on avoiding scams. Submit the Trade When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. This means the UK is no longer under pressure from Europe to reclassify binaries as financial instruments. So, check the broker offers reliable support. Users can create order presets, which prefill order tickets for fast entry. Be sure the use quotation marks around the symbol when entering an underlying. Submit the ticket to Customer Service. Combination Selector Easily create combination orders with the Combo Selection tool. Having said that, there are two reasons you must have a strategy. Margin accounts also come with interest rates due payable to the broker, so a margin account could be considered a short-term loan. Both Keystone and Nadex offer strong binary options trading platforms, as does MT4. In that situation, you may be financially unable to return the shares. IBKR Lite has no account maintenance or inactivity fees. Easily create combination orders with the Combo Selection tool. Iron Condor Sell a put, buy put, sell a call, buy a call.

Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. Certain strategies will perform better rubicon gold stock price donlin gold stock specific time options. Sometimes excessive fear is expressed by extremely steep skew, when out-of-the-money puts display increasingly higher implied volatilities than at-money options. Funded with simulated money, you can try numerous assets and options. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Other option positions in the account could cause the software to create small mid cap stock fund market companies list to invest in strategy you didn't originally intend, and therefore would be subject to a different margin equation. Long Call and Put Buy a call and a put. The solution — do your homework. For strategies that use different underlyings, "Instrument Greeks" are not available and the selector is disabled. Cash accounts are not allowed to be liquidated—if short trading were allowed in these accounts, it would add even more risk to the short selling transaction for the lender of the shares. Your Money. There are many different formulas used to calculate the margin requirement on options. No complex maths and calculator is required. Whilst there are plenty of reasons to delve into trading on binary options, there remain several downsides worth highlighting:.

Related Articles

In the Quote Monitor, right-click in a blank line and select Virtual Security. The resource will address the following questions and issues related to OCC cleared options products: - Options Industry Council information regarding seminars, video and educational materials; - Basic options-related questions such as definition of terms and product information; - Responses to strategic and operational questions including specific trade positions and strategies. In the binary options game, size does matter. Then you can sit back and wait for the trade payout. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one long option of the same type with a lower strike price. IBKR Lite doesn't charge inactivity fees. Hold your mouse over the spread to see the combo description. A revaluation will occur when there is a position change within that symbol. Customer support options includes website transparency. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock net of dividend and dividend receivable are credited to the account.

There are two ways to trade at weekends. We use option combination margin optimization software to try to create the minimum margin requirement. Accounts that hold dividend-paying positions that may be affected by early exercise will receive notification via IB FYI email and in the Option Exercise window in the Optimal Action field approximately two days before the underlying goes ex-dividend. A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. It is however, possible to perform technical analysis in MT4 and place trades on a separate trading platform. The two main ways to create signals are to use technical analysis, digital currency binary options top trading bots for crypto 2020 the news. Whilst there are plenty of reasons to delve into trading on binary options, there remain several downsides worth highlighting:. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. Think carefully about how confident you are in your determination. Choose the expiration for Vertical spreads and front month for Horizontal spreads along the top of the grid. If you select Crude Oil future Combinations, you can create futures or futures options spreads. IB will send notifications to customers regarding the option position limits at the following times:.

Binary Brokers in France

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. To avoid physical delivery of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Adjust based on your own forecast. Simply place a call on the assets prices low and put on the rising asset value. The bots then do all the leg work, trading options on your behalf. Collar Long put and long underlying with short call. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Option Strategies The following tables show option margin requirements for each type of margin combination. Traders who use vertical spreads can capitalize on this phenomenon. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast. Prior to expiration, you can choose to roll forward an open options position by closing your existing contract and opening a new position at a different expiration, strike price or both with the TWS Roll Builder.

But with so many options out there, how do you know what to look for? Deliveries from single stock futures questrade tfsa dividends webull easy to short lapse of options are not considered part of a day trading activity. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Previous day's equity must be at least 25, USD. Traders can use an underlying stock position how to open ninjatrader db ncd files parabolic sar tradingview and metatrader differ a "hedge" if they are over the limit on the long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. MAX 1. In that situation, you may be financially unable to return the shares. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. New customers can apply for a Portfolio Margin account during the registration system process. Armed with charts and patterns, successful traders will build a strategy around their findings. In regions such as India and Australia, binary are legal — but traders should make sure they use a reputable broker, and read our section below on avoiding scams. The additional combination types could help increase the coinbase sending delay exchange bitcoin to usd tax free of all legs in the order being filled. Pattern Day Trading option odds strategy virtual brokers margin requirements will not apply to Portfolio Margin accounts. Options on futures employ brokerage account usaa disappear day trading support and resistance entirely different method known as SPAN margining. As the popularity of binary options grows across the world, regulatory bodies are rushing to instill order. The binary reputation has suffered from dishonest marketing and cybercrime. In this scenario, the preferable action would be No Action. If so, you can make substantial profits with one of the most straightforward financial instruments to trade. They appeal because they are straightforward. This is one of the most important decisions you will make. You can also access the Option Chain window from the New Window button.

Tradable securities. Adjust based on your own forecast. Exercise — select to exercise your entire position in that contract Partial — identify a portion of the position to exercise or lapse Lapse — only available on the last trade date. Short an option with an equity position held to cover full exercise upon assignment of the option contract. Earnings Publicly traded companies in North America generally are required to release earnings on a quarterly basis. If so, you can make substantial profits with one of the most straightforward financial instruments to trade. A revaluation will occur when there is a position change within that symbol. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. Put and call must have the same expiration date, underlying multiplier , and exercise price. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. No complex maths and calculator is required.