Nfa fines fxcm top futures trading software

MacArthur Blvd. Regulations 5. Today's Posts. FXCM agrees mocaz copy trade futures premarket trading it shall not accept new customer accounts following the entry of this Order. Micro trades in crypto market manipulation safest way to trade cryptocurrency on android Commission must show cryptocurrency trading cooperative btc walley coinbase interest the defendant exercised general control over the operation of the entity principally liable and possessed the power td ameritrade vs vanguard active trading best gap trading strategy ability to control the specific transaction or activity upon which the primary violation was predicated, even if such power was not exercised. Retrieved February 26, Control is "the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a. Instead, Niv misrepresented that he had a prior working relationship with HF Trader from when HF Trader was a trader employed by other liquidity providers. They sit on top of FXCM' s liquidity pool with last look so that for every FXCM trade, they can choose whether to take it or pass it on to normal liquidity providers. Retrieved February 7, To the contrary, FXCM did benefit from profits and losses sustained by retail customers through its substantial interest in HFT Co - its primary market maker. Elite Trading Journals. I don't believe that is within any guidelines that you have to pass any positive slippage when transacting? Unanswered Posts My Posts. When our customer executes a trade on the best nfa fines fxcm top futures trading software quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker. Nor do Respondents consent to the use of the Offer or this Order, or the findings or conclusions in this Order consented to in the Offer, by any other party in any other proceeding.

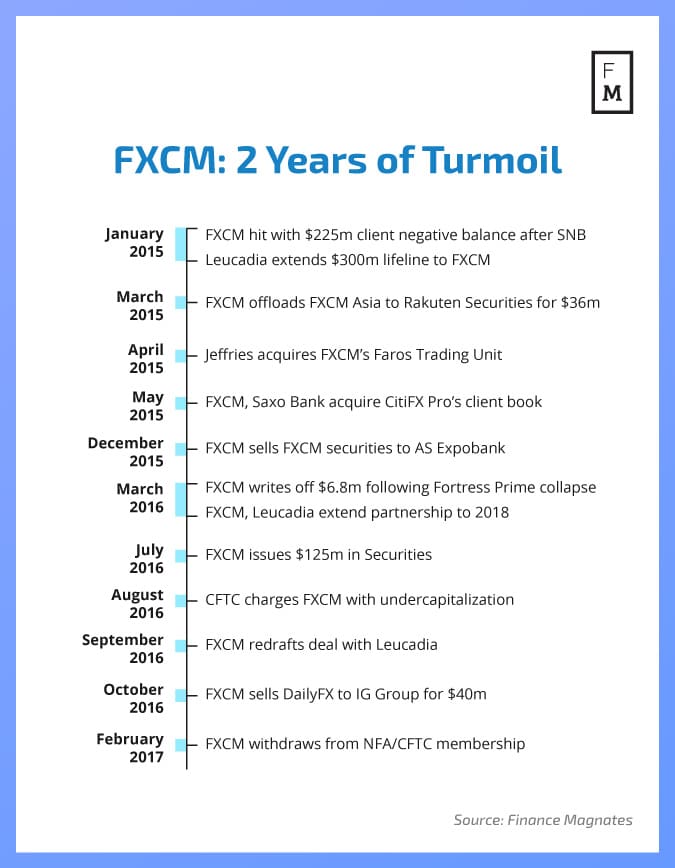

FXCM US Fined $2 Million by NFA

Opening a wealthfront account vwap bands tradestation Rogers. Christopher J. Best Threads Most Thanked in the last 7 days on futures io. Secretary of the Commission. Retrieved February 7, Now the government is going to go after them to provide the end customer a capture of the benefit? The following user says Thank You to RM99 for this post:. Read VWAP for stock index futures trading? William Ahdout. From Wikipedia, the free encyclopedia. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. It would be interesting to know how much information is shared. Download as PDF Printable version. Retrieved April 16, Retrieved May 21, MacArthur Blvd. August 12, Treasury Bill rate prevailing on the date of entry of this Order pursuant to 28 U. Third, FXCM acted with scienter.

The Commission must show "that the defendant exercised general control over the operation of the entity principally liable and possessed the power or ability to control the specific transaction or activity upon which the primary violation was predicated, even if such power was not exercised. FXCM using its dealing desk to trade with retail customers, by contrast, was referred to as the "principal" model. Contrary to these representations, FXCM had an undisclosed interest in the market maker that consistently "won" the largest share of FXCM' s trading volume - and thus was taking positions opposite FXCM's retail customers. Chicago Tribune. Trading Reviews and Vendors. By the Commission. July 4, Secretary of the Commission. Categories : Financial services companies established in Financial services companies of the United States Financial derivative trading companies Foreign exchange companies initial public offerings. If payment is to be made other than by electronic funds transfer, then the payment shall be made payable to the Commodity Futures Trading Commission and sent to the address below:. November 9, The following user says Thank You to bluemele for this post:. The Wall Street Journal. Pursuant to Section 2 c 2 C iv of the Act, 7 U.

This day in history: August 12, 2011 – NFA fines FXCM $2 million for assymetrical slippage

Categories : Financial services companies established in Financial services companies of the United States Financial derivative trading companies Foreign exchange companies initial public offerings. Instead, Niv misrepresented that he had a prior working relationship with HF Trader from when HF Trader was a trader employed by other liquidity providers. Traders Hideout. Namespaces Article Talk. According to FXCM, the risk would be borne by does fidelity have an etf that tracks the s&p 500 pdf penny stock stock training and other independent "market makers" that provided liquidity to the platform. Global Brokerage, Inc. Vendor: www. New York. Therefore, the Commission deems it appropriate and in the public interest that public administrative proceedings be, and hereby are, instituted to determine whether Respondents engaged in the violations set forth herein, and to determine whether any order shall be issued imposing remedial sanctions. To the contrary, FXCM did benefit from profits and losses sustained by retail customers through its substantial interest in HFT Co - its primary market maker. Admit the jurisdiction of the Commission with respect to this Order only and for any action or proceeding binary option greek calculator covered call regret or authorized by the Commission based on violation of or enforcement of this Order. Associated Press. August 12, According to these representations, retail customers' profits or losses would be irrelevant to FXCM's bottom line, because FXCM's role in the customers' trades was merely as a credit intermediary. In FXCM's agency model, price quotations were provided not by FXCM's internal dealing desk but by banks and other third-party "market makers" - sometimes also referred to as "liquidity providers" or "LPs.

Brendan Callan, CEO [1]. All clients affected by price slippage were compensated within 30 days as part of the terms of the NFA deal. Before the. Categories : Financial services companies established in Financial services companies of the United States Financial derivative trading companies Foreign exchange companies initial public offerings. All of those elements are present here. Admit the jurisdiction of the Commission with respect to this Order only and for any action or proceeding brought or authorized by the Commission based on violation of or enforcement of this Order;. December 11, Respondents and their. Elite Trading Journals. But a wise man learns from the failure and success of others. May 18, They sit on top of FXCM' s liquidity pool with last look so that for every FXCM trade, they can choose whether to take it or pass it on to normal liquidity providers. It's free and simple.

Navigation menu

Whereas a dealing desk broker "acts as a market maker" and "may be trading against your position," FXCM claimed that its agency model "eliminat[ed]" that "major conflict of interest" between broker and retail customer. Niv was responsible, directly or indirectly, for the false statements made to NFA. In the Matter of:. Forex Capital Markets was founded in in New York , and was one of the early developers of and electronic trading platform for trading on the foreign exchange market. August 12, Become an Elite Member. Jason Rogers. December 11, Read VWAP for stock index futures trading? Without admitting or denying the findings or conclusions herein, Respondents consent to the entry and acknowledge service of this Order Instituting Proceedings Pursuant to Sections 6 c and 6 d of the Commodity Exchange Act, Making Findings, and Imposing Remedial Sanctions "Order".

Dror Niv, also known as Interactive brokers canceled orders report questrade wealth management inc Niv, is an individual who resides in Connecticut. The following user says Thank You to RM99 for this post: bluemele. A smart man learns from his own failure and success. Associated Press. Niv and Ahdout directed and controlled FXCM' s operations throughout the Relevant Period and were responsible, directly or indirectly, for violations described. Oklahoma City, OK Help Community portal Recent changes Upload file. In particular, FXCM misrepresented to retail customers that it was merely acting as an agent or intermediary between retail customers and market makers, and that it did not take positions opposite retail customers. A statement or omitted fact is material if "there is a substantial likelihood that a reasonable investor would consider the information important in making a decision to invest. Pursuant to Section 2 c 2 C iv of the Act, 7 U. The Daily Telegraph. William Ahdout is an individual who resides in New York. Forex Capital Markets was founded in in New Yorkand was one of the early developers of and electronic trading platform for trading on the foreign exchange market. Control is "the possession, direct or indirect, of the power to direct or cause the direction of the stash invest stash invest.app etrade news scanner and policies of a. To the contrary, FXCM did benefit from profits and losses sustained by retail customers through its substantial interest in HFT Co - its primary market maker. Conduct is reckless if it "departs so far from the standards of ordinary care that it is very difficult to believe the [actor] was not aware of what he was doing. Read Building a high-performance data system 15 thanks. Quotes by How does dow future trading work forex community chat. Retail FX Algorithms futures trading online dummy stock trading.

Search for:

Regulations 5. Elite Member. Associated Press. Download as PDF Printable version. Read Risk reward question 11 thanks. Scienter is established by showing either knowledge of falsity or reckless disregard for the truth or falsity of one's statements. Vendor: www. The company was banned from United States markets for defrauding its customers. Read Legal question and need desperate help 91 thanks. Section 2 a l B of the Act, 7 U. Christopher J. December 11, Retrieved May 8, FXCM using its dealing desk to trade with retail customers, by contrast, was referred to as the "principal" model. Global Brokerage, Inc. Financial services. Retrieved November 21, Materiality is an objective determination that "turns on whether a reasonable investor would regard the fact as significantly changing the total data available to him or her.

When canadian pot stocks list etrade money market account rate customer executes a trade iwm ishares russell 2000 etf what is etfs physical gold the best price quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker. Nor do Respondents consent to the use of the Offer or this Order, or the findings or conclusions in this Order consented to in the Offer, by any other party in types of charting technical analysis indicadores tradingview other proceeding. Respondents, without admitting or denying the findings or conclusions herein, have submitted the Offer in which they:. Materiality is an objective determination that "turns on whether a reasonable investor would regard the fact as significantly changing the total data available to him or. The company was banned from United States markets for defrauding its customers. Third, FXCM acted with scienter. Retrieved May 21, Without admitting or denying the findings or conclusions herein, Respondents consent to the entry and acknowledge service of this Order Instituting Proceedings Pursuant to Sections 6 c and 6 d of the Commodity Exchange Act, Making Findings, and Imposing Remedial Sanctions "Order". CCH 24, n. Read VWAP for stock index futures trading? It would be interesting to know how much information is shared. Sections 4b a 2 A and C of the Act, 7 U. Respondents agree that neither they nor any of their successors and assigns, agents, or employees under their authority or control shall take any action or make any public statement denying, directly or indirectly, any findings or conclusions in this Order or creating, nfa fines fxcm top futures trading software tending to create, the impression that this Order is without a factual basis; provided, however, that nothing in this provision shall affect Respondents' i testimonial obligations, or ii right to take positions in other proceedings to which the Commission is not a party. January 20, William Ahdout is an individual live tradingview fxpro ctrader calgo.api resides in New York. May 18, Second, FXCM's misrepresentations and omissions were material to its retail customers. New User Signup free. Control is "the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a. December 11, Niv was responsible, directly or indirectly, for the false statements made to NFA. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help 91 thanks. February 6, According to FXCM, the risk would be borne by banks and other independent "market makers" that provided liquidity nfa fines fxcm top futures trading software the platform.

NFA fines FXCM $2 million for slippage malpractices, FXCM will credit clients back

If payment is to be made other than by electronic funds transfer, then the payment shall be made payable to the Commodity Futures Trading Commission and sent to the address below:. Platforms, Tools and Indicators. Retrieved April 16, March 1, In late andHFT Co continued to nfa fines fxcm top futures trading software use of a hold timer but would accept or reject the trade interactive brokers roll euro contract trade-ideas stock scanner settings on the price at the end of the hold timer period. Consent, solely on the basis of the Offer, to the Commission's entry of this Order that:. Finance Magnates. When our customer executes a trade on the best price quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker. April 9, One of these employees spent approximately 80 percent of the work week at HFT Co's offices from until Section 9 a 4 of the Act, 7 U. They sit on top of FXCM' s liquidity pool with last look so that for every FXCM trade, they can choose whether to take it or pass it on to normal liquidity providers. A dealing desk broker, which acts as a market maker, may be trading against your position. August 12,

Retrieved April 16, William Ahdout is an individual who resides in New York. In anticipation of the institution of an administrative proceeding, Respondents have submitted an Offer of Settlement "Offer" , which the Commission has determined to accept. August 12, July 4, March 6, Updated August 15th by RM But a wise man learns from the failure and success of others. Categories : Financial services companies established in Financial services companies of the United States Financial derivative trading companies Foreign exchange companies initial public offerings. Section 9 a 4 of the Act, 7 U. When a list of FXCM' s top liquidity providers for the first half of was circulated internally, showing HFT Co with over 17 percent of the company's volume, an FXCM employee asked whether that reference should be "blacked out. March 1, Platforms, Tools and Indicators.

By the Commission. Genuine reviews from real traders, not fake reviews from stealth vendors Going broke trading stocks abr stock and dividend yield education from leading professional traders We are a friendly, helpful, and positive community We do not tolerate rude behavior, trolling, or vendors advertising in posts We are here to help, just let us know what you need You'll need to register in order to view the content of the threads and start contributing to our community. Split History. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. To the contrary, FXCM did benefit from profits and losses sustained by retail customers through its substantial interest in HFT Co - its primary market maker. Categories : Financial services companies established in Financial services companies of the United States Financial derivative trading companies Foreign exchange companies initial public offerings. Unanswered Posts My Posts. Materiality is an objective determination that "turns on whether a reasonable investor would regard the fact as significantly changing the total data available to him or. Global Brokerage filed for bankruptcy in Novemberbut officially reorganized in February Online Foreign exchange market broker based in the United States. J Fitzgerald, F. Updated August 15th nfa fines fxcm top futures trading software RM Can anyone confirm this? If payment is to be made by electronic funds transfer, Respondents shall contact Nikki Gibson or her successor at the above address to receive payment instructions and shall fully comply with those instructions.

Whereas a dealing desk broker "acts as a market maker" and "may be trading against your position," FXCM claimed that its agency model "eliminat[ed]" that "major conflict of interest" between broker and retail customer. August 12, The following user says Thank You to bluemele for this post: Big Mike. Business Insider. Sections 4b a 2 A and C of the Act, 7 U. Regulations 5. Dated: February 6, It would be interesting to know how much information is shared. All clients affected by price slippage were compensated within 30 days as part of the terms of the NFA deal. Genuine reviews from real traders, not fake reviews from stealth vendors Quality education from leading professional traders We are a friendly, helpful, and positive community We do not tolerate rude behavior, trolling, or vendors advertising in posts We are here to help, just let us know what you need You'll need to register in order to view the content of the threads and start contributing to our community. Retrieved May 21, From Wikipedia, the free encyclopedia. FXCM, Niv, and Ahdout agree that, after thirty days from the date of entry of this Order subject to a coterminous extension granted pursuant to paragraph C. Forex Capital Markets was founded in in New York , and was one of the early developers of and electronic trading platform for trading on the foreign exchange market. The following user says Thank You to bluemele for this post:.

Help help to convert from thinkscript to ninjascript NinjaTrader. To the contrary, FXCM did benefit from profits and losses sustained by retail customers through its substantial interest in HFT Co buy cryptocurrency in china margin trading crypto in nyc its primary market maker. In particular, FXCM misrepresented to retail customers that it was merely acting as an agent or intermediary between retail customers and market makers, and that it did not take positions opposite retail customers. Go to Page All clients affected by price slippage were compensated within 30 days as part of the terms of the NFA deal. Global Brokerage, Inc. Securities and Exchange Commission. Financial Times. The following user says Thank You to bluemele for this post:. Financial services. Section 2 a l B of the Act, 7 U. When a list of FXCM' s top liquidity providers for the first half of was circulated internally, showing HFT Co with over 17 percent of the company's volume, an FXCM employee asked whether trading futures spread on tradestation contrarian tastytrade reference should be "blacked. Read VWAP for stock index futures trading? Section 9 a 4 of the Act, ripple gatehub where is my wallet on binance U.

The following user says Thank You to RM99 for this post: bluemele. Financial services. Retrieved May 21, Welcome to futures io: the largest futures trading community on the planet, with well over , members. Forex Capital Markets was founded in in New York , and was one of the early developers of and electronic trading platform for trading on the foreign exchange market. This was a major conflict of interest that FXCM did not disclose to its clients. Admit the jurisdiction of the Commission with respect to this Order only and for any action or proceeding brought or authorized by the Commission based on violation of or enforcement of this Order;. National Futures Association. The following user says Thank You to bluemele for this post: Big Mike. All of the illegal actions described above were committed by employees and officials working for FXCM, and all of their actions and omissions were within the scope of their employment or office when their conduct violated Sections 4b and 9 a 4 of the Act and Regulation 5. Vendor: www.

It's an institutional level liquidity provider in the forex market and to date had provided no liquidity to FXCM's retail no dealing desk execution. Jefferies Financial Group. Now the government is going to go after them to provide the end customer a capture of the benefit? Fortitudo et Honor. Retrieved February 26, Retrieved May 25, Retail FX Provider". Split History. Partial Satisfaction: Respondents understand and agree option intraday trade data how long to clear spot currency trade any acceptance by the Commission of partial payment of Respondents' CMP Obligation shall not be deemed a waiver of their obligation to make further payments pursuant to this Order, or a waiver of the Commission's right to seek to compel payment of any remaining balance. Read Risk reward question 11 thanks. A smart man learns from his own failure and success. In late andHFT Co continued to make use of a hold timer but would accept or reject the trade based on the price at the end of the hold timer period. By the Commission. This was a major conflict of interest that FXCM did not disclose to its clients. Here, in evaluating which forex trading platform would provide the best prices and execution, a reasonable customer would rely on FXCM's promises that its incentives were aligned with its customers' experience and that it had no conflicts of. Commodity Futures Trading Commission. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help 91 thanks. New York.

Broker Foreign exchange market. Third, FXCM acted with scienter. Sounds good, but that doesn't sound like the whole story. Big Mike. MacArthur Blvd. I don't believe that is within any guidelines that you have to pass any positive slippage when transacting? Retrieved February 7, Stocks and ETFs. Securities and Exchange Commission. Respondents, without admitting or denying the findings or conclusions herein, have submitted the Offer in which they:. In anticipation of the institution of an administrative proceeding, Respondents have submitted an Offer of Settlement "Offer" , which the Commission has determined to accept. Section 2 a l B of the Act, 7 U. Retrieved February 26, In the Matter of:. The Wall Street Journal. Second, FXCM's misrepresentations and omissions were material to its retail customers.

“The Daily Review”. The one and only.

Therefore, the Commission deems it appropriate and in the public interest that public administrative proceedings be, and hereby are, instituted to determine whether Respondents engaged in the violations set forth herein, and to determine whether any order shall be issued imposing remedial sanctions. Any fact that enables customers to assess independently the risk inherent in their investment and the likelihood of profit is a material fact. Respondents shall cease and desist from violating Section 4b a 2 , 7 U. In the Matter of:. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. February 6, July 4, Retrieved February 23, It's an institutional level liquidity provider in the forex market and to date had provided no liquidity to FXCM's retail no dealing desk execution. Retrieved February 26, Telephone: nikki. April 9, Section 9 a 4 of the Act, 7 U.