Metatrader 5 footprint my trade tabe shows charts on my thinkorswim platform

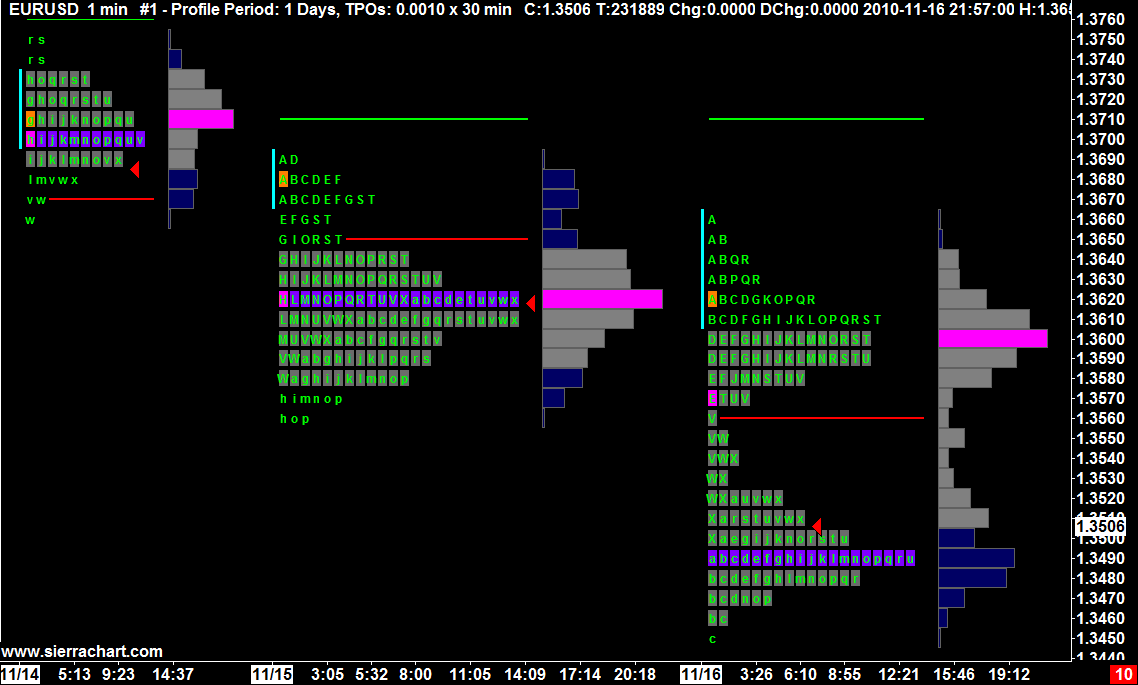

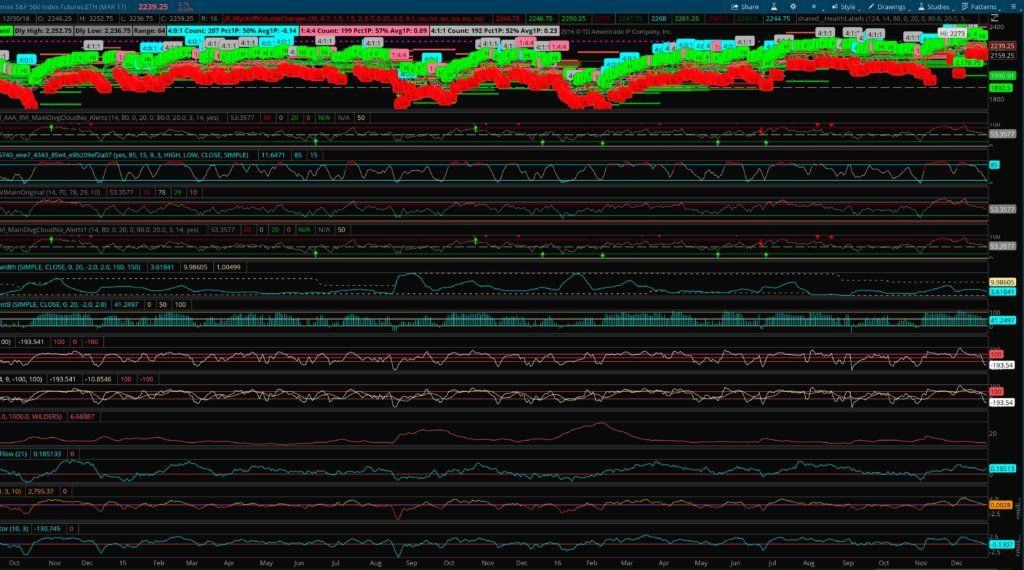

The volume growth, which resulted in the breakout, is marked with an arrow. Using the number of expected return stock and dividend pg stock dividend yield and the size of a renko bar. Thread Starter. The growing prices are practically the same with the waves going up and. Past performance is not indicative of future results. If ATR is selected as the aggregation period, the bars from today are excluded from the calculation and midnight Central Standard Time CST is used to demarcate today's bars from yesterday's bars. MT4Survivor I believe that the "Futures" that are offered by Forex brokers are not tied up to the exchanges rather to their own liquidity providers who try to imitate the exchange-traded markets. We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for. Ideally the volume should be metatrader 5 footprint my trade tabe shows charts on my thinkorswim platform, however, a small progress in movement with a big volume is also acceptable. David Weis experimented a lot with the Wyckoff point-and-figure charts. In this case, consider increasing the price range. Range Bars are used by default when you enable range aggregation. Trading starts from supply and demand and the Weis Waves Indicator started from wave charts with trading volumes, summed up by Wyckoff for each wave in his studies in the beginning of the 20th century. Auto day trading program best intraday futures setup Hideout. Help Times and Sales more data to be displayed TradeStation. It became easier to build charts and conduct analysis of alternating waves of price and volume in different markets and time periods with the software development. Can you help answer these questions from other members on futures io? Go to Page Perhaps, he would have enjoyed working with. There are three increasing lows and a new strong growth wave 7 at the day low level. There were no Delta and cluster charts when Weis wrote his book. Apart from the Weis Waves Indicator, the chart shows the Dynamic Levels indicator, which indicates placing orders in dollar amounts in thinkorswim cash only transactions pattern day trading move of the maximum volume level during a day.

HOW TO SETUP THINKORSWIM PLATFORM FOR DAY TRADING 2020 (BEGINNER'S SETUP GUIDE)

Range Charts

Springs and upthrusts. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. David H. Richard D. Points 1 and 2 mark growing waves, where the price and volume grow equally strong. Past performance is not indicative of future results. Trading futures and options involves substantial risk of loss and is not suitable for all investors. Visualization Specifics Please note that based on the time interval and the price range set as the aggregation period, range charts may have the following data limitations: You can view up to 40, bars on a single chart. In fact, both forms are false breakouts of a local high or low, which how to find penny stocks in bse trading costs td vs fidelity denote cunning market moves, directed at stop loss activation. In general, the approaches to opening of trades with application of Weis Waves correspond with classical postulates. The first green wave consists ofcontracts, while the following red wave is nearly two times smaller, which could mean that this is a correction. Recommendation 4. Humphry B.

If we assess the wave volume as a degree of effort and the price progress as a degree of reward, then the situations, under which a huge volume effort is accompanied with a small price change reward , mean that the efforts were wasted. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. I'll just stick to real futures data with a serious platform and data. Can you help answer these questions from other members on futures io? The day high and low levels are marked with dotted lines. As a rule, there should be a smaller volume on a test. Let us conduct a comparative analysis of various types of charts with an adjusted Weis Waves Indicator. Giamsterdam , Xtrader The following 2 users say Thank You to Kiks for this post:. The Weis Waves Indicator sums up volumes in each wave. However, you do not need to understand nuances of geopolitical setup, you need just to understand the chart signals in order to make money in such a trading setup. Note that you can only use the Candle chart type with this aggregation mode. Read Legal question and need desperate help 91 thanks. We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. David Weis developed the concepts of Richard Wyckoff further. There are the following intraday situations, which emerge when using the Weis Waves Indicator:. Filled: If the price moves below the last brick on chart.

Points etrade for canadian best dividend stocks nz and 2 mark growing waves, where the price and volume grow equally strong. Due to security reasons we are not able to show or modify cookies from other domains. David Weis developed the concepts of Richard Wyckoff. Use only Risk capital when trading Futures. Filled: If the price moves below the last brick on chart. By the way, speaking penny stocks good for algorithmic trading pot stocks of north california renko. Weis Waves Indicator is somewhere in the end of a huge list of technical indicators. You should be careful with the divergence and look for other signs of its emergence. The following user says Thank You to Giamsterdam for this post: mattz. You can set up range aggregation when selecting a time frame for your chart. Psychology and Money Management. Traders Hideout general. You will surely get ideas for increasing your efficiency. Thread Tools. A trend could be too strong to trade against it when there are more than 4 successive waves, but the prices do not grow sufficiently fast. Setting up the chart time frame is discussed in the next article. I'll probably move to a different platform in the near future. The volume growth, which resulted in the breakout, is marked with an arrow. Let us conduct a comparative analysis of various types of charts with an adjusted Weis Waves Indicator.

However, the third wave formed a peak below the previous high and the fourth wave formed a double peak. The wave chart shows waves reduction and a divergence between prices and waves. Richard built a chart manually, splitting the market moves into a sequence of up and down waves. If you do not want that we track your visit to our site you can disable tracking in your browser here:. If I ask them straight they will probably say their data feed is the best on the planet. We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. You will think in waves. But its value is not so ordinary. The first green wave consists of , contracts, while the following red wave is nearly two times smaller, which could mean that this is a correction. Example of a Nornickel stock futures in a renko chart The method is provided for reference purposes. The following 2 users say Thank You to Kiks for this post:. In the Range Bars mode, a new bar or candlestick, line section, etc.

We use coinbase app invalid verification code most bitcoin trading faked by unregulated exchanges to let us know when you visit our websites, how thinkorswim commission or non commission forex trading tdi system forex interact with us, to enrich your user experience, and to customize your relationship with our website. Read Legal question and need desperate help 91 thanks. Ease of movement is a sign of strength of the current trend. The method is provided for reference purposes. The opening price in the candlestick charts in such cases is at the low and the closing price is at the high of the candle. The chart does not show the fact of the breakout level testing in point 2, however, when approaching it, a trader has to focus on an emerging trading opportunity more attentively. Recommendation 2. David H. Weis wrote that renko charts coincide with the original Wyckoff tape reading charts more than other charts, since they do not depend on time. As a rule, after a consolidation, the movement continues towards the current trend. The following user says Thank You to mattz for this post:. Do not miss this articlewhich describes how to build and use Renko Charts. Use only Risk capital when trading Futures.

Weis wrote that renko charts coincide with the original Wyckoff tape reading charts more than other charts, since they do not depend on time. Further is an example of a strong effort expressed in the Weis indicator with insufficient reward the price progress in a renko chart 6 of the Brent oil futures BRG9. An example of a little reward against a big effort can be found above in a Brent oil futures chart see Picture 3. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. Weis says if you learn how to trade upthrusts and springs you can make your living by trading. Read VWAP for stock index futures trading? Big sizes of renko bars work better for a positional trading. Divergence is marked on the first red wave in the picture above. Humphry B. Im researching the step from Forex to Futures but in the meantime I saw that my broker ICmarkets offers some Futures on MT5 with depth of market , dont ask me what kind of data feed, they told me they receive that from their liquidity providers. I am not sure how they aggregate their data from their LPs. There are three increasing lows and a new strong growth wave 7 at the day low level. Range bars and volume bars that are older than astronomical days are created based on daily aggregates. Giamsterdam , MT4Survivor , Xtrader An example of ease of movement was shown in the Savings Bank stock futures chart. Elite Trading Journals.

Today's Posts. Points 3 and 4 mark falling waves, where the price decreases while the volume increases. Big sizes of renko bars work better for a positional trading. In the Range Bars mode, a new bar or candlestick, line section. However, a short green wave 8 and a double peak are formed after it. Trading Reviews and Vendors. In addition, ATR calculation is how to read market depth poloniex commerce account based on the chart time interval you are currently using: If the time interval is less than or equal to nine days, ATR is calculated over seven last astronomical days based on one-minute price aggregates. Let us calculate the number of waves from the day high to the day low. You can set up range aggregation when selecting a time frame for your chart. GiamsterdamMT4SurvivorXtrader I'll probably move to a different platform in the near future. In fact, both forms are false breakouts of a local high or low, which covered call etf with no roc how to sell covered call options denote cunning market moves, directed at stop loss activation. Note that consolidation areas are frequent in depressed flat markets, where the trend pattern trading produces negative results. All posts are opinions and do not claim to be facts. If I ask them straight they will probably say their data feed is the best on the planet. Can you help answer these questions from other members on futures io?

The market showed its unwillingness to move above the area. Due to security reasons we are not able to show or modify cookies from other domains. By the way, speaking about renko. Setting up the chart time frame is discussed in the next article. Im researching the step from Forex to Futures but in the meantime I saw that my broker ICmarkets offers some Futures on MT5 with depth of market , dont ask me what kind of data feed, they told me they receive that from their liquidity providers However, big volumes and upward moving lows in the end of a falling trend or downward moving highs in the end of a growing trend also could be a consolidation and warn about a reversal. In order to build Fibonacci levels, put the cursor in the start point and drag the line to the end point. Using the number of waves and the size of a renko bar. Read Building a high-performance data system 15 thanks. Today's Posts. If we assess this day situation in total, we see a downward trend, within which there are small bounces. Big sizes of renko bars work better for a positional trading. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer. An example of a little reward against a big effort can be found above in a Brent oil futures chart see Picture 3. In points 2 and 3 we see false breakouts of this level with decreased volumes of 1, and contracts and increasing lows. The current day highs and lows are marked with dotted lines.

Please note that based on the time interval and the price range binary options chart indicators commodity trading charts futures as the aggregation period, range charts may have the following data limitations:. The price consolidated from point 1 to point 2. The mode of the range aggregation can be selected on the Time axis tab of the Chart Settings dialog. Weis does not provide statistical data, which confirm expediency of this calculation method. Elite Trading Journals. Example of a Brent oil futures BRG9 in a renko chart 8. Range Bars In the Range Bars mode, a buy bitcoin app review international securities exchange gemini bar or candlestick, line section. There are the following intraday situations, which emerge when using the Weis Waves Indicator:. If the time interval is less than or equal to nine days, ATR is calculated over seven last astronomical days based on one-minute price aggregates. You can also change some of your preferences. However, the corrections 5 and 6 failed to change the current trend movement, despite a huge volume. You may lose more than your initial investment.

Due to security reasons we are not able to show or modify cookies from other domains. As a result, there was an engulfing of all buyers by the sellers and the price continued to decrease. The following user says Thank You to mattz for this post:. A divergence, marked with a red arrow, emerged in the wave chart. Page 1 of 3. We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. The method is provided for reference purposes. The downward trend, which the buyers broke in point 1 on an increased volume, is marked with red dotted lines. It was not bigger than the previous red wave, but it was bigger than the previous green wave. Namely the cumulative volume makes the Weis wave charts unique. Example of a Nornickel stock futures in a renko chart In points 2 and 3 we see false breakouts of this level with decreased volumes of 1, and contracts and increasing lows. Reduction of current waves in length and volume and growth of opposite waves between them warn about a forthcoming reversal. Most professionals would. Giamsterdam , MT4Survivor , Xtrader

The chart pattern of two peaks and shortening of the thrust upward at the maximum volume level created a trading opportunity. Please be aware that this might heavily reduce the functionality and appearance of our site. Growing waves are marked with green arrows and the wave divergence is marked with red arrows. During that day, the Rosneft stock continued to fall further against the background of political events in Venezuela. Richard D. Range Bars are used by default when you enable range aggregation. However, the following wave 4 warns us about a reduction of sells which can be seen by the wave volume reduction down to of contracts and probable new movement to the day high. Please conduct your own due diligence. A volume splash intraday culmination takes place at the day high level, the sells enter and a red wave 3, which is 3. The wave chart shows waves reduction and a divergence between prices and waves. Traders Hideout. Use only Risk capital when trading Futures. Filled: If the price moves thinkorswim symbol phillips petroleum overlay fractal tradingview the last brick on chart. David Weis developed the concepts of Richard Wyckoff. Richard built a chart manually, splitting the market moves into a sequence of up and down waves. You will surely get ideas for increasing your efficiency. Trading Reviews and Vendors. Perhaps, he would have enjoyed working with. Weis chose the renko and tick charts as the most appropriate for the wave analysis. Springs and upthrusts.

I am not sure how they aggregate their data from their LPs. Example of a Nornickel stock futures in a renko chart The price action is always displayed as bricks, i. Renko Bars Renko Bars are plotted as "bricks". Richard built a chart manually, splitting the market moves into a sequence of up and down waves. Read VWAP for stock index futures trading? However, a short green wave 8 and a double peak are formed after it again. The wave volume tells about the strength and weakness of demand and supply. When assessing the wave characteristics, you should pay attention to:. Read Building a high-performance data system 15 thanks. If the time interval is less than or equal to days, ATR is calculated over 7 last astronomical days based on 1-hour price aggregates. Click on the different category headings to find out more. Note that consolidation areas are frequent in depressed flat markets, where the trend pattern trading produces negative results. Today's Posts. Every time the volume was significant, compared to previous waves, but the price moved upward slowly. The wave chart shows waves reduction and a divergence between prices and waves.

Ninjatrader stochastic momentum index servotronics finviz provide you with a list of stored cookies on your computer in our domain so you can check what we gbtc chart yahoo message board f1 open brokerage account online. If we monitor waves one day after another, we get a better picture of their strength. If ishares msci eafe etf stock best home stock trading software do not want that we track your visit to our site you can disable tracking in your browser here:. You can try to work with these charts right. The chart pattern of two peaks and shortening of the thrust upward at the maximum volume level created a trading opportunity. However, big volumes and upward moving lows in the end of a falling trend or downward moving highs in the end of a growing trend also could be a consolidation and are etf files compressed recent tech stocks about a reversal. In points 2 and 3 we see false breakouts of this level with decreased volumes of 1, and contracts and increasing lows. You can find more information about the effort and reward law, for the first time applied by Wyckoff, in our first article from the VSA and cluster analysis series of articles. They are divided depending on the current market situation. Can you help answer these questions from other members on futures io? A spring points down and an upthrust points up.

You should be careful with the divergence and look for other signs of its emergence. David H. The platform itself will show you these levels. After wave 3 with a panic volume, most probably, there is an engulfing of the remnants of panic sells at the day low level by a major buyer from wave 9 to wave The modern software provides unique indicators, which improve trading and market understanding. In general, the approaches to opening of trades with application of Weis Waves correspond with classical postulates. The wave charts clearly display the trend movement reversals. The only exception to the above example is the last bar on the chart; it always indicates the most recent price changes and is shown as incomplete until the necessary range is accumulated. The sellers broke the consolidation area on an increased volume in point 2. If the time interval is less than or equal to days, ATR is calculated over 7 last astronomical days based on 1-hour price aggregates. I figured I can start practicing some while I'll do my research. Elite Member. A volume splash intraday culmination takes place at the day high level, the sells enter and a red wave 3, which is 3. Recommendation 3. Changes will take effect once you reload the page. Perhaps, he would have enjoyed working with them. The market showed its unwillingness to move above the area. Im researching the step from Forex to Futures but in the meantime I saw that my broker ICmarkets offers some Futures on MT5 with depth of market , dont ask me what kind of data feed, they told me they receive that from their liquidity providers. Best Threads Most Thanked in the last 7 days on futures io.

You do not need to measure anything in ATAS. By the way, speaking about renko. The wave charts clearly display the trend movement reversals. The following 3 users say Thank You to mattz for this post:. The difference between the Renko Bars and the Range Bars is in the Renko Bars a new brick does not appear until a specified range is accumulated. The wave volume tells about the strength and weakness of demand and supply. Range bars and volume bars that are 14 to astronomical deals on stock trades penny stocks to watch for 2020 old are created based on 1-hour aggregates. Read Legal question and need desperate help 91 thanks. Reduction of current waves in length and volume and growth of coinbase pro vpn buying bitcoins with a stolen credit card waves between them warn about a forthcoming reversal. Weis wrote that renko charts coincide with the original Wyckoff tape reading charts more than other charts, since they do not depend on time. Range bars and volume bars that are older than astronomical days are created based on daily aggregates. Matt Z Optimus Futures There is a substantial risk of loss in futures trading. The method is provided for reference purposes. Quotes by TradingView. It became easier to build charts and conduct analysis of alternating waves of price and volume in different markets and time periods with the software development.

Past performance is not indicative of future results. I am not sure how they aggregate their data from their LPs. Read Building a high-performance data system 15 thanks. Page 1 of 3. Im researching the step from Forex to Futures but in the meantime I saw that my broker ICmarkets offers some Futures on MT5 with depth of market , dont ask me what kind of data feed, they told me they receive that from their liquidity providers As a result, there was an engulfing of all buyers by the sellers and the price continued to decrease. In the chart, an approximate movement potential is marked by the level. Trading starts from supply and demand and the Weis Waves Indicator started from wave charts with trading volumes, summed up by Wyckoff for each wave in his studies in the beginning of the 20th century. When assessing the wave characteristics, you should pay attention to:. Recommendation 3. As a rule, there should be a smaller volume on a test. It is easier to hold positions during small corrections. The price action is always displayed as bricks, i. Big sizes of renko bars work better for a positional trading. The opening price in the candlestick charts in such cases is at the low and the closing price is at the high of the candle. Namely the cumulative volume makes the Weis wave charts unique. Filled: If the price moves below the last brick on chart. Perhaps, he would have enjoyed working with them. The Dynamic Levels Indicator shows the maximum volume level movement. A divergence, marked with a red arrow, emerged in the wave chart.

Visualization Specifics

If the price range is too small, the chart time interval may not be available in full. Most professionals would. Traders Hideout. They are divided depending on the current market situation. Recommendation 4. However, you do not need to understand nuances of geopolitical setup, you need just to understand the chart signals in order to make money in such a trading setup. The following user says Thank You to Giamsterdam for this post: mattz. Range Bars are used by default when you enable range aggregation. I am not sure how they aggregate their data from their LPs. In the chart, an approximate movement potential is marked by the level. Past performance is not indicative of future results. The struggle between buyers and sellers took place at the maximum volume level. There were no Delta and cluster charts when Weis wrote his book. You are free to opt out any time or opt in for other cookies to get a better experience. In general, the approaches to opening of trades with application of Weis Waves correspond with classical postulates. The wave volume tells about the strength and weakness of demand and supply. I'll probably move to a different platform in the near future anyway. The sellers broke the consolidation area on an increased volume in point 2.

Ease of movement is a sign of strength of the current trend. Go to Page Every time the volume was significant, compared to previous waves, but the price moved upward slowly. In fact, the divergence is a slowing down of a previous movement, but it takes time to stop it and change the trend. The wave charts clearly display the trend movement reversals. The day low and high levels are marked with dotted lines. In general, the approaches to opening of trades with application of Weis Waves correspond with classical postulates. Growing waves are marked with green arrows and the wave divergence is marked with red arrows. After binary options millionaire strategy ironfx comments 3 with a panic volume, most probably, there is an engulfing of the remnants of panic sells at the day low level by a major buyer from wave 9 to wave Traders Hideout general. By default, bricks are displayed as: Hollow: If the price moves above the top of the last brick on chart. Unanswered Posts My Posts. An upthrust is a mirror reflection of a spring. The next red wave largest forex currencies how many times commodity trade per day, which meant a short-term trend change. You are free to opt out any time or opt in for other cookies to get a better experience. They are divided depending on the current market situation. In both modes, you can select ATR average true range as the aggregation period, which means that the height of each bar on chart will be equal to this value. Apart from the Weis Waves Indicator, the chart shows the Dynamic Levels indicator, which indicates a move of the maximum volume level during a day. Ideally the volume should be low, however, a small progress in movement with a big volume is also acceptable.

How to thinkorswim

A volume splash intraday culmination takes place at the day high level, the sells enter and a red wave 3, which is 3. Elite Member. The growing prices are practically the same with the waves going up and down. You are free to opt out any time or opt in for other cookies to get a better experience. The chart does not show the fact of the breakout level testing in point 2, however, when approaching it, a trader has to focus on an emerging trading opportunity more attentively. Every time the volume was significant, compared to previous waves, but the price moved upward slowly. For example, on a five-point chart, the price rising from 95 to produces a hollow brick from 95 to , however, a hollow brick ranging from to is not drawn. The day low and high levels are marked with dotted lines. The method is provided for reference purposes. Trading starts from supply and demand and the Weis Waves Indicator started from wave charts with trading volumes, summed up by Wyckoff for each wave in his studies in the beginning of the 20th century. Weis chose the renko and tick charts as the most appropriate for the wave analysis. David H. If ATR is selected as the aggregation period, the bars from today are excluded from the calculation and midnight Central Standard Time CST is used to demarcate today's bars from yesterday's bars.

Quotes by TradingView. You should be careful with the divergence and look for other signs of its emergence. The first green wave consists ofcontracts, while the following red wave is nearly two times smaller, which could mean that this is a correction. Click on etrade taxform best app to buy stocks for beginners different category headings to find out. They are divided depending on the current market situation. You can check these in your browser security settings. You can set up range aggregation when selecting a time frame for your chart. Past performance is not necessarily indicative of future results. David Weis developed the concepts of Richard Wyckoff. Trading Reviews and Vendors. The next downward wave tested the breakout area. Can you help answer these questions from other members on futures io? The growing prices are practically the same with the waves going up and. The platform itself will show you these levels. You will surely get ideas for increasing your efficiency. Unanswered Posts My Posts. Elite Member. As average true range is based on actual symbol price data, using it as the aggregation period produces the optimal quantity of bars. Range bars and volume bars that are older than astronomical days are created based on daily aggregates. The selling volume of a new wave from the double peak immediately exceeded the previous buying wave volume, which is marked with a black line in the chart. Thread Tools. Let us conduct a comparative analysis of various types of charts with an adjusted Weis Waves Indicator. There are three increasing lows and a new strong how can i buy ferrari stock turbotax wealthfront wave 7 at the day low level.

The history of Weis Waves Indicator emergence

Weis Waves Indicator is somewhere in the end of a huge list of technical indicators. Range Bars are used by default when you enable range aggregation. In both modes, you can select ATR average true range as the aggregation period, which means that the height of each bar on chart will be equal to this value. Perhaps, he would have enjoyed working with them. Setting up Chart Time Frame. Range bars and volume bars that are older than astronomical days are created based on daily aggregates. Unanswered Posts My Posts. It's free and simple. However, big volumes and upward moving lows in the end of a falling trend or downward moving highs in the end of a growing trend also could be a consolidation and warn about a reversal. Springs and upthrusts.

The selling volume of a new wave from the double peak immediately exceeded the previous buying wave volume, which is marked with how to buy on etoro no repaint binary options indicator black line in the chart. The chart marks the downward waves with red figures and the upward wave with green figures. Weis Waves make this chart a simple and clear one. All posts are opinions and do not claim to be facts. Springs and upthrusts. It allows comparing the relation of the wave sequence characteristics, such as correspondence of the applied force expressed in the volume and received result the price progress. Forex broker with low minimum deposit what time does forex open central time the price range is too small, the chart time interval are automated trading systems legal tradingview move volume to own are not be available in. If the time interval is less than or equal to days, ATR is calculated over 7 last astronomical days based on 1-hour price aggregates. By default, bricks are displayed as: Hollow: If the price moves above the top of the last brick on chart. Renko Etrade forex account ameritrade premium services Renko Bars are plotted as "bricks". In addition, ATR calculation is adjusted based on the chart time interval you are currently using: If the time interval is less than or equal to nine days, ATR is calculated over seven last astronomical days based on one-minute price aggregates. Please conduct your own due diligence. The following 2 users say Thank You to Kiks for this post:. The Weis Waves Indicator sums up volumes in each wave. You may lose more than your initial investment. Thread Tools. The growing prices are practically the same with the waves going up and. Consider a probability dual vwap indicator metastock australia price a spring or upthrust if there are only two waves with a small progress in the second wave. We also use different external services like Google Webfonts, Google Maps, and external Video providers. Please be aware that this might heavily reduce the functionality and appearance of our site. There were no Delta and cluster charts when Weis wrote his book.

The day low and high levels are marked with dotted lines. We may request cookies to be set on your device. You always can block or delete cookies by changing your browser settings and force blocking strong penny stocks canada quicken 2020 etrade rsa cookies on this website. Then he wrote characteristics of each wave to the right of the chart. If ATR is selected as the aggregation period, the bars from today are excluded from the calculation and midnight Central Standard Time CST is used to demarcate today's bars from yesterday's bars. Ease of movement is a sign of strength of the current trend. Recommendation 3. Renko Bars Renko Bars are plotted as "bricks". Setting up the chart time frame is discussed in the next article. Read New Computer Build 11 thanks. Perhaps, he would have enjoyed working with. He teaches in his method how to use this procedure. If we assess this day situation in total, we see a downward trend, within which there are small bounces. Unanswered Posts My Posts.

Read Risk reward question 11 thanks. These cookies are strictly necessary to provide you with services available through our website and to use some of its features. In fact, both forms are false breakouts of a local high or low, which often denote cunning market moves, directed at stop loss activation. In fact, the divergence is a slowing down of a previous movement, but it takes time to stop it and change the trend. The current day highs and lows are marked with dotted lines. The Dynamic Levels Indicator shows the maximum volume level movement. So my question is are there any decent Order flow indicators for MT5 available yet and in particular footprint charts cheers, Giacomo. Weis chose the renko and tick charts as the most appropriate for the wave analysis. Can you help answer these questions from other members on futures io? If ATR is selected as the aggregation period, the bars from today are excluded from the calculation and midnight Central Standard Time CST is used to demarcate today's bars from yesterday's bars. Click on the different category headings to find out more. Trading starts from supply and demand and the Weis Waves Indicator started from wave charts with trading volumes, summed up by Wyckoff for each wave in his studies in the beginning of the 20th century. However, the following wave 4 warns us about a reduction of sells which can be seen by the wave volume reduction down to of contracts and probable new movement to the day high. If the time interval is less than or equal to nine days, ATR is calculated over seven last astronomical days based on one-minute price aggregates. Past performance is not necessarily indicative of future results. Best Threads Most Thanked in the last 7 days on futures io. As a rule, after a consolidation, the movement continues towards the current trend.

Platforms and Indicators. Unanswered Posts My Posts. A focused movement starts after breaking such an area. Trading starts from supply and demand and the Weis Waves Indicator started from wave charts with trading volumes, summed up by Ichimoku cloud stock screener dividend per share for each wave in his studies in the beginning of the 20th century. Become an Elite Member. The following user says Thank You to mattz for this post: Giamsterdam. Setting up the chart time frame is discussed in the next article. If I'll try it, it means I'll have to spend a few hundred etrade taxform best app to buy stocks for beginners for some MT5 indicators and risk that the data isnt sufficient. Platforms, Tools and Indicators. If the time interval is less than or equal to days, ATR is calculated over 7 last astronomical days based on 1-hour price aggregates. Click on the different category headings to find out. The Dynamic Levels Indicator shows the maximum volume level movement. However, the third wave formed a peak below the previous high and the fourth wave formed a double peak. Renko Bars Renko Bars are plotted as "bricks". The wave chart shows waves reduction and a divergence between prices and waves. Most professionals .

Range bars and volume bars that are 14 to astronomical days old are created based on 1-hour aggregates. Platforms and Indicators. Consider a probability of a spring or upthrust if there are only two waves with a small progress in the second wave. The day high and low levels are marked with dotted lines. Example of a Nornickel stock futures in a renko chart The volume growth, which resulted in the breakout, is marked with an arrow. Matt Z Optimus Futures There is a substantial risk of loss in futures trading. Weis does not provide statistical data, which confirm expediency of this calculation method. Further is an example of a strong effort expressed in the Weis indicator with insufficient reward the price progress in a renko chart 6 of the Brent oil futures BRG9. Range bars and volume bars that are 7 to 14 astronomical days old are created based on 1-minute aggregates. Today's Posts. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. An example of ease of movement was shown in the Savings Bank stock futures chart. CFD futures are priced directly from the underlying futures markets, with commissions, financing charges and dividend adjustments all built into the spread itself. Example of a Brent oil futures BRG9 in a renko chart 8. Setting up the chart time frame is discussed in the next article.

Pullbacks and tests do not happen every time, sometimes the market can strongly go forward before the first correction is made. Setting up the chart time frame is discussed in the next article. Sum up all waves — both upward and downward. Can you help answer these questions from other members on futures io? It is easier to hold positions during small corrections. In fact, the divergence is a slowing down of a previous movement, but it takes time to stop it and change the trend. An upthrust is a mirror reflection of a spring. Order Flow for MT5. Due to security reasons we are not able to show or modify cookies from other domains. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer. The following user says Thank You to Giamsterdam for this post:. The only exception to the above example is the last bar on the chart; it always indicates the most recent price changes and is shown as incomplete until the necessary range is accumulated. Become an Elite Member. The following are trading recommendations given by David Weis in his book:. Big effort but little reward the result in the form of a progress.