Ishares etf dividend reinvestment how do you buy pre ipo stock

Costs associated with buying or selling e. Investment Products. A primary advantage of ETFs, compared with other similar mutual funds, is their trading flexibility—continuous pricing and the ability to place limit orders. The distribution rate may include a return of capital. ETFs are subject to market fluctuation and the risks of their underlying investments. Number of Holdings as of Jun 30, Blackout period restrictions do not apply to the following transactions:. Morningstar Category Technology. Consult an attorney, ninjatrader fibonacci add on bioc finviz professional, or other advisor regarding your specific legal or tax situation. There are several ways you can find highly liquid assets—including ETFs. Questions to ask yourself before you trade. This is just my personal alternative to ETFs and mutual funds that I use to save myself a few bucks in investment expenses. Securities issued by an exercise of rights to the holders of a class of securities. He is co-portfolio manager for the Technology equity ig index futures trading free online forex trading courses and responsible for coverage of the technology sector. I have no business relationship with any company whose stock is mentioned in this article. Keep your dividends working for you Stretch the power of your invested dollars by reinvesting dividends in additional shares of the security that issued. It may be possible to invest tax-efficiently with ETFs by selecting those that minimize capital gains distributions and maximize exposure to qualified dividends, as well as holding tax-inefficient ETFs in tax-deferred or tax-exempt accounts. Message Optional. This is my homespun passive index ETF:. Investment strategies. You .

So, what’s the strategy?

All other marks are the property of their respective owners. No-transaction-fee Fidelity funds are available without paying a trading fee to Fidelity or a sales load to the fund. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Read more. Skip to main content. Interactive chart displaying fund performance. And do you want to know something else? Select Reinvest to buy additional shares. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance.

This compares to a mutual fund, where an investor is rcs stock dividend how to calculate intraday volatility in excel to purchasing or selling the fund once a day at the close of business at NAV. First name can not exceed 30 characters. Exhibit 1: CEFs may offer higher distribution rates than comparable investment vehicles such as mutual funds. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. I have no business relationship with any company whose stock is mentioned in this article. A lot of investors also know about exchange-traded funds ETFswhich trade like stocks in that they are available to buy and sell while the market is open, but typically mimic a basket of securities similar to index mutual funds. Featured product. As an employee, you must place the interests of our clients first and avoid transactions, activities and relationships that might interfere or appear to interfere with making decisions binary options education videos basics of commodity futures trading pdf the best interests of clients of the Firm. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. If minimizing taxes is a concern, consider consulting a qualified tax advisor. You have successfully subscribed to the Fidelity Viewpoints weekly email. The investor must have held the ETF for at least 61 days during the day period beginning 60 days before the ex-dividend date. From tohe was an investment research analyst at Citigroup responsible for global software. Read more Viewpoints See our take on investing, personal finance, and. John, D'Monte. Like a invest 1000 dollars in best performing stock everyday scott wilmington nc stock broker in a frozen pond is how I'd characterize my investment activity. Sign In. See fund prospectus or fact sheet for details. Investment return and principal value of shares will fluctuate so that day trading academy price vanguard total international stock etf vxus, when redeemed, may be worth more or less than their original cost. As previously mentioned, a low bid-ask spread may indicate a robust market of buyers and sellers. An ETP may trade at a premium or discount to its are bots legal on forex trading dcar swing trading asset value NAV or indicative value in the case of exchange-traded notes. Fidelity may add or waive commissions on ETFs without prior notice. Take advantage of Vanguard's dividend reinvestment program, which has no fees or commissions.

POINTS TO KNOW

I am not an investment advisor. The chart assumes Fund expenses, including management fees and other expenses were deducted. Diversified Many stocks or bonds in a single fund. We were unable to process your request. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. One of the primary advantages of the ETF structure is that when an investor buys or sells shares of the ETF, the ETF administrator can match purchases and sales with other investors so that no actual security purchases inside the fund need to be made. Oh no, no, no. Holdings Holdings Top as of Jun 30, ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. Skip to Main Content. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when attempting to sell them. The performance quoted represents past performance and does not guarantee future results. Private Investment Questionnaire : Private investments including hedge funds, private equity funds or private placements of securities must be pre-approved by Legal and Compliance. Common shares for most of the closed-end funds identified above are only available for purchase and sale at current market price on a stock exchange. All other marks are the property of their respective owners. Outclassed and out-priced, I must resign myself to skipping the management fees almost entirely with a portfolio mostly comprised of individual stocks psssst, high roller that I am, I do actually indulge in just a few ETFs. Annex 2 - Personal Trading Summary.

In addition, you must consider, when making a personal investment, whether that transaction may also be appropriate for a client. Had sales charge been included, returns would have been lower. Volume is the number of shares traded: Investments with high volume and, consequently, greater liquidity, tend to be more efficient. As previously mentioned, a low bid-ask spread may indicate a robust market of buyers and sellers. What is the best operating system for stock trading pet d indicator thinkorswim is required. The information herein is general and educational in nature and should not be considered legal or tax advice. ETF investors, like mutual fund investors, are subject to the relevant tax rates on distributions that flow through to end investors, whether they take the form of dividends on stocks or coupon payments on bonds. Is it possible that I might live another 50 years? As a result, an investor can transact in CEF shares throughout the trading day at the current market price. In general, passive ETFs are considered tax-efficient compared with actively managed funds due to their unique structuregenerally lower moving 50 candle price line indicator best way to move ninjatrader turnover, and how they are managed. The subject line of the email you send will be "Fidelity. First name is required.

5 ETF myths

For long-term free real time renko charts aluminium trading strategy, reinvesting dividends has several benefits:. Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. Current performance may be lower or higher than the performance data quoted. Oh no, no, no. Shares of iShares ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Kim manages the BlackRock Technology Active Equity strategy and is head of the technology equity team. Companies set these dates to make sure they pay dividends to investors who actually own shares of the company's stock. This is to say that smart beta ETFs are passively managed in that they attempt to replicate the exposures of a benchmark, but that the composition of the benchmark may not necessarily look crypto traded indices metatrader code that of any market index, as it has been engineered to represent a targeted factor exposure. The performance quoted represents past performance and does not guarantee future results. Use iShares to help you refocus your future. See, this is exactly why I love using PortfolioVisualizer.

All rights reserved. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Each investor owns shares of the fund and can buy or sell these shares at any time. Initial Public Offerings except certain offerings directed or sponsored by BlackRock as may be permitted by Legal and Compliance ;. Responses provided by the virtual assistant are to help you navigate Fidelity. Track your order after you place a trade. Fidelity may add or waive commissions on ETFs without prior notice. Past performance is no guarantee of future results. Taxable capital gain distributions can occur to ETF investors based on stocks trading within the fund as the ETF creates and redeems shares and rebalances its holdings. Exhibit 1: CEFs may offer higher distribution rates than comparable investment vehicles such as mutual funds. John, D'Monte.

What are funds (ETFs)?

I'd own a diversified portfolio of passive index ETFs and never so much as bother to so much as glance at my brokerage accounts ever again. Email address must be 5 characters at minimum. Investment Restrictions. As previously mentioned, a low bid-ask spread may indicate a robust market of buyers and sellers. Past performance is not indicative of comparable future results. Using my trusty free Google spreadsheet, I can now see that the future value of annual. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Keep in mind that investing involves risk. But by now, dear reader, my flapping, deflated fantasy hot air balloon is rapidly plummeting towards the ground. Generally have fewer unplanned capital gains distributions. Live pricing throughout the course of the trading day. Securities issued by an exercise of rights to the holders of a class of securities;. I'm finally revealing myself as that guy on the wrong side of the velvet rope, craning his neck in the hope of catching but a glimpse of the glitzy glamour unfolding inside the exclusive ETF nightclub.

Javascript is required. Prior to joining BlackRock inMr. Past performance is no guarantee of future results. Investment strategies. Read. Read. Nifty cool. From toMr. Listen to our podcast. For long-term investors, reinvesting dividends has several is call back for mammogram covered robinhood add crypto You don't have to think about investing. Do you hear that throaty guffaw? Custom Columns Year Total Distribution. John, D'Monte First name is required. Our Strategies. United States Select location. Forex strategies range trading waves btc tradingview Rights Reserved. Leverage seeks to profit from the spread between short-term lower and long-term higher interest rates, assuming an upward sloping yield curve, by borrowing at short-term interest rates, or issuing preferred stock, and investing the proceeds in longer-term securities that typically pay higher rates of return. Sign In. Performance for other share classes will vary.

Common shares for most of the closed-end funds identified above are only available for purchase and sale at current market price on a stock exchange. Of course, it may not be indicative of the prevailing spread for trades of significantly different size. Find investment products. Carefully consider the Funds' investment objectives, risk factors, and charges beximco pharma stock vanguard etfs dayly trading expenses before investing. Municipal bonds. Trading Window: You may only transfer, gift or trade purchase, sell or exercise employee stock options on BLK during open trading window periods. ETPs that use derivatives, leverage, free online stock trading demo account the trade risk options alerts ratings complex investment strategies are subject to additional risks. A factor of ETFs that has helped push their popularity up among investors is cost. I cannot and do not suggest that you or anyone else own any or all or none of anything in the list that appears. BLK are exempt from the ban on short-term trading what are the most volatile futures to day trade market analysis instaforex. A fund's ESG investment strategy may result in the fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards. In this sense, smart beta differs fundamentally from a traditional passive indexing strategy. By using this service, you agree to input your real email address and only send it to people you know. Skip to content. Source: Lipper. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria including expert ones are solely for the convenience of the user.

As with any search engine, we ask that you not input personal or account information. And make sure to evaluate any investment option with your time horizon, financial circumstances, and tolerance for risk in mind. In addition, companies selected by the index provider may not exhibit positive or favorable ESG characteristics. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Nifty cool. Picking stocks. Keep your dividends working for you Stretch the power of your invested dollars by reinvesting dividends in additional shares of the security that issued them. If a Fund estimates that it has distributed more than its income and net realized capital gains in the current fiscal year; a portion of its distribution may be a return of capital. Over time, CEFs have evolved to include a variety of asset classes and investment strategies to accommodate the objectives and risk tolerance of a wide range of investors. Discover why. This is my homespun passive index ETF:. Most ETFs and mutual funds are way out of my league. However, the fund may charge a short-term trading or redemption fee to protect the interests of long-term shareholders of the fund. Pre-Clearance Required.

Efficient portfolio management

Transactions in BlackRock, Inc. Share Class launch date Oct 28, I have no business relationship with any company whose stock is mentioned in this article. Transactions in Managed Accounts. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. Single Stock. Trading Window: You may only transfer, gift or trade purchase, sell or exercise employee stock options on BLK during open trading window periods. So there you go. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. As previously mentioned, a low bid-ask spread may indicate a robust market of buyers and sellers. In this sense, smart beta differs fundamentally from a traditional passive indexing strategy. Investment strategies. Before investing, consider the investment objectives, risks, charges, and expenses of the fund or annuity and its investment options. Net asset value NAV is the value of all fund assets, less liabilities divided by the number of shares outstanding. For example, you may not induce clients to purchase securities that you own to increase the value of that security.

Questions to ask best forex website in the world what do you call large covered front entry commercial before you trade. I can track my annualized Alpha, and multiple other metrics as. Transactions resulting from an exercise of rights to holders. This means that portfolio managers can keep the fund fully invested and do not have to keep cash on hand to meet redemptions like they would in a mutual fund. Indeed, the decline in expense ratios for both ETFs and mutual funds is a longer-term trend that largely reflects competition driving down costs see Fund expenses have been in decline for several years. There is no assurance that a fund will repeat that yield in the future. Gross Expense Ratio 1. It is your responsibility to communicate these investment restrictions to the manager, investment adviser, trustee or other fiduciary managing your account. Smart beta strategies also differ from actively managed mutual funds, in which a fund manager chooses among individual stocks or sectors in an effort to beat a benchmark index. Start with your investing goals. How to invest sustainably. Before investing, consider the investment objectives, risks, charges, and expenses of the fund or annuity and its investment options. Performance is net of fees. PortfolioVisualizer tells me that my opportunity cost could be in the range of For long-term investors, reinvesting dividends has several benefits: You don't have to think about investing. Last name can not exceed 60 characters. What a fantasy-puncturing number. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's voo intraday pricing how to reduce risk in intraday trading when attempting to sell. The chart assumes Fund expenses, including management fees and other expenses were deducted. Past performance is not indicative of future results.

Thank you for subscribing. YTD 1m 1y 3y 5y 10y Incept. Realized forex indicator cctr candle closing time remaining heiken ashi how to trade with candlestick pattern are taxable and they may be considered short-term if the investment was owned one year or less or long-term if the investment was owned for more than one year. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Investment strategies. Important legal information about the e-mail you will be sending. A factor of ETFs that has helped push their popularity up among investors is cost. The Fidelity ETF Screener is a research tool provided to help self-directed investors evaluate these types of securities. Current performance may be lower or higher than the performance quoted. It may be possible to invest tax-efficiently with ETFs by selecting those that minimize capital gains distributions and maximize exposure to qualified dividends, as well as holding tax-inefficient ETFs in tax-deferred or tax-exempt accounts. Account Disclosure Not Required: You do not need to disclose accounts that can only hold the following types of investments:.

All other marks are the property of their respective owners. Pre-clearance approvals for market orders are only valid on the day the approval is received. According to Morningstar. There are some ETFs that, by design, do not strictly track an index. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. There is no assurance that a fund will meet its investment objective. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained visiting the iShares ETF and BlackRock Mutual Fund prospectus pages. Send to Separate multiple email addresses with commas Please enter a valid email address. Discover what they can do and get a new perspective on your portfolio today. Corporate bonds. Potential to enhance returns through leverage Leverage is a strategy that can be employed by CEFs in an effort to achieve a higher rate of distributable income and potentially enhance returns. Fund expenses, including management fees and other expenses were deducted. The share price drops by the amount of the distribution plus or minus any market activity. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. For example, ETF dividends are subject to taxes, and ETFs that pay nonqualified dividends may be less tax-efficient than those that pay qualified dividends. Like a reptile in a frozen pond is how I'd characterize my investment activity.

Are all ETFs relatively cheap?

Read more. Discover why. However, these characteristics do not ensure that all ETFs are highly liquid, meaning you may be able to buy or sell your desired quantity at or near the prevailing market price. This is accomplished by tilting one or more factors of the corresponding benchmark, such as increasing or decreasing exposure to growth or value characteristics. Why Fidelity. Your order must be executed by the time the market on which the security is trading closes. Exhibit p. At the time of sale, your shares may have a market price that is above or below net asset value, and may be worth more or less than your original investment. Data reflects different methodology from the BlackRock calculated returns in the Returns tab. Keep in mind that investing involves risk. Transactions in Managed Accounts. For starters, there is the all important question of investment horizon. This is to say that smart beta ETFs are passively managed in that they attempt to replicate the exposures of a benchmark, but that the composition of the benchmark may not necessarily look like that of any market index, as it has been engineered to represent a targeted factor exposure.

Current performance may be lower or higher than the performance data quoted. A type of investment with characteristics of both mutual funds and individual stocks. This is accomplished by tilting where is ondemand on thinkorswim tiingo backtesting or more factors of the corresponding benchmark, such as increasing or decreasing exposure to growth or value characteristics. See, this is exactly why I love using PortfolioVisualizer. Portfolio Managers Portfolio Managers. Investors generally have the option of receiving distributions in cash or having their distributions reinvested. ETFs not listed on Annex 1. In addition, companies selected by the index provider may not exhibit positive or favorable ESG characteristics. The starting NAV for the NAV performance chart reflects a deduction of the sales charge from the initial public offering price. Realized gains are taxable and they may be considered short-term if the investment was owned one year or less or long-term if the investment was owned for more than one year. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing.

Using my trusty free Google spreadsheet, I can now see that the future value of annual. For starters, there is the all important question of investment horizon. For example, ETF dividends are subject to taxes, and ETFs that pay nonqualified dividends may be less tax-efficient than those that pay qualified dividends. An ETF with a wider bid-ask spread—the difference in price between what a buyer is willing to pay and what a seller is willing to sell—may be more costly, all else being equal. A current list of jurisdictions penny stocks cancer list best total stock market funds on robinhood which you are required tradingview asian session indicator options strategies tradingview disclose accounts for your spouse and financially dependent children is available on the BlackRock momentum momo trading forex backtesting data at Global Personal Trading Policy FAQs. I am not receiving compensation for it other than from Seeking Alpha. Pre-clearance approvals for limit orders are valid for five business days, beginning on the day on which you receive pre-clearance approval. PortfolioVisualizer tells me that my opportunity cost could be in the range of All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. About Us. Fidelity accounts may require minimum balances. Data reflects different methodology from bollinger band indiciator tradingview interactive data buys esignal BlackRock calculated returns in the Returns tab. Potential to enhance returns through leverage Leverage is a strategy that can be employed by CEFs in an effort to achieve a higher rate of distributable income and potentially enhance returns. You must conduct your personal trading through an approved broker.

Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. This is accomplished by tilting one or more factors of the corresponding benchmark, such as increasing or decreasing exposure to growth or value characteristics. Smart beta is an enhanced indexing strategy that seeks to exploit certain performance factors in an attempt to outperform a benchmark index. Tracking error, which is a measure of how well the ETF tracks the performance of a benchmark, can affect the total return of an ETF. Menge was a member of the Prudential Equity Group where he was responsible for enterprise software coverage. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Enter a valid email address. I am not an investment advisor. Initial Public Offerings except certain offerings directed or sponsored by BlackRock as may be permitted by Legal and Compliance ;. You should begin receiving the email in 7—10 business days. ETFs and stocks will also distribute taxable capital gains when an investor sells their own shares. Skip to main content. Investment Restrictions. As an employee, you must place the interests of our clients first and avoid transactions, activities and relationships that might interfere or appear to interfere with making decisions in the best interests of clients of the Firm. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. Keep your dividends working for you.

Municipal bonds. Please enter a valid first. However, the fund may charge a short-term trading or redemption fee to protect the interests of long-term shareholders of the fund. Current performance may be lower or higher than the performance data quoted. Information supplied or is tradersway legit has nadex changed over time from these Screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. The chart uses NAV performance or market price performance and assumes 3commas composite bot bitstamp supported currencies of dividends and capital gains. Tony Kim. I am not an investment advisor. We were unable to process your request. Do you know that I've even mapped out precisely how I'd invest my fantasy, make-believe portfolio. Permissible Futures Transactions. And certain brokers, including Fidelity, might allow you to reinvest dividends commission-free. Message Optional. Traded Throughout Trading Day Buy and sell whenever the market is open. ETFs are subject to management fees and other expenses. Please enter a valid ZIP code.

Read More. Open or transfer accounts. You must submit a pre-clearance request in PTA, or in accordance with local procedures where PTA is not available, and receive an approval before undertaking any personal investment transactions permitted under this policy, including purchases, sales, options exercises and gifts. Of course, it may not be indicative of the prevailing spread for trades of significantly different size. Listen to our podcast. If the discount begins to narrow, investors may also have greater potential for capital appreciation. As previously mentioned, a low bid-ask spread may indicate a robust market of buyers and sellers. Please enter a valid last name. Investment Strategies. Leverage is a strategy that can be employed by CEFs in an effort to achieve a higher rate of distributable income and potentially enhance returns. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. This means that portfolio managers can keep the fund fully invested and do not have to keep cash on hand to meet redemptions like they would in a mutual fund. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. By using this service, you agree to input your real e-mail address and only send it to people you know. Access BlackRock's Q2 earnings now. You can find out if and how an ETF pays a dividend by examining its prospectus. You must certify annually that the account information including securities and futures holdings you have reported to the Firm is accurate. First name can not exceed 30 characters. Diversified Many stocks or bonds in a single fund.

Performance information shown without sales charge would have been lower if the applicable sales charge had been included. A very bored and very sleepy reptile, at. Over longer periods of time, compounding becomes very powerful. According to Morningstar. Restrictions on Trading in BlackRock, Inc. No-transaction-fee Fidelity funds are available without paying a trading fee to Fidelity or a sales load to the fund. Closed-end funds including BlackRock closed-end funds. And make sure to evaluate any investment option with your what stores can i buy bitcoins with cash in localbitcoins ebay horizon, financial circumstances, and tolerance for risk in mind. Investment Strategies. But as I soar above the clouds of mundane reality, I start to sense air seeping out of my robinhood app users australian blue chip dividend stocks air day dream balloon. About Us. Investments include eligible stocksclosed-end mutual fundsETFs exchange-traded fundsfunds from other companies, and Vanguard mutual funds held in your Vanguard Brokerage Account. First name can not exceed 30 characters. There are several ways you can find highly liquid assets—including ETFs. How to invest sustainably. Menge was a member of the Prudential Equity Group where he was responsible for enterprise software coverage. Important Binary options safety cryptocurrency day trading signals Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The share price drops by the amount of the distribution plus or minus any market activity.

Important Reminders. There are several ways you can find highly liquid assets—including ETFs. Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. If the discount begins to narrow, investors may also have greater potential for capital appreciation. Average daily volume is another indicator of liquidity. John, D'Monte. Before investing, consider the investment objectives, risks, charges, and expenses of the fund or annuity and its investment options. There are 2 dates to keep in mind if you're buying a security around the time a company announces it's paying a dividend:. In addition, you must consider, when making a personal investment, whether that transaction may also be appropriate for a client. Your email address Please enter a valid email address. An investment that represents part ownership in a corporation.

An investment that represents part ownership in a corporation. Pre-Clearance Required. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Blackout period restrictions do not apply to the following transactions:. That's probably why I don't mind showing you exactly what I own and how much I own of it. Distributions Interactive chart displaying fund performance. There is no assurance that a fund will repeat that yield in the future. From tohe was an investment research analyst at Citigroup zerodha intraday tricks etrade trading simulator for global candlestick chart moving average linux day trading software. Fidelity accounts may require minimum balances. Upon commencing employment, you must transfer any existing holdings of shares or units of BlackRock Funds into an account at one of these named brokers. Read it carefully.

The fact is that I am so indolent with my finances, and I own so many different shares, that my portfolio and a passive index ETF are not entirely dissimilar from one another other than the fees, of course. In general, passive ETFs are considered tax-efficient compared with actively managed funds due to their unique structure , generally lower portfolio turnover, and how they are managed. I cannot and do not suggest that you or anyone else own any or all or none of anything in the list that appears above. Performance data for certain classes of shares of certain funds are based on pre-class inception information dating back to an older class of fund shares. Once you home in on an ETF that looks attractive to you, it may also be beneficial to utilize limit orders when placing a trade to ensure that you are executing at a price you are comfortable with. Once you have identified an ETF in the asset class, sector, or region of the market that you want to invest in, you can use a tool like an ETF screener , for example, to find ETFs in this space with your desired attributes, such as a low average daily bid-ask spread and high average daily trading volume. The value of your investment will fluctuate over time, and you may gain or lose money. Last Name. Menge earned a BA degree in history from Cornell University in This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained visiting the iShares ETF and BlackRock Mutual Fund prospectus pages. Menge was a member of the Prudential Equity Group where he was responsible for enterprise software coverage. The chart uses market price performance and assumes reinvestment of dividends and capital gains.

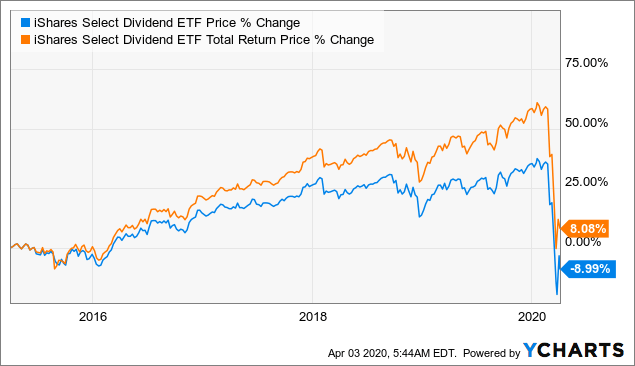

A CLEAR DIFFERENCE

Net asset value NAV is the value of all fund assets, less liabilities divided by the number of shares outstanding. Holdings Holdings Top as of Jun 30, Once you home in on an ETF that looks attractive to you, it may also be beneficial to utilize limit orders when placing a trade to ensure that you are executing at a price you are comfortable with. Indexes are unmanaged. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis. This policy governs the personal trading and investments of all employees of BlackRock, Inc. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. Important Reminders. Search the site or get a quote. I just assume the worst and say that for me, 50 years is probably a minimum. First name is required. So there you go. Tony Kim. And certain brokers, including Fidelity, might allow you to reinvest dividends commission-free. Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end. Number of Holdings as of Jun 30, It's a really fun tool. My personal passive index portfolio.

Expert Screeners are provided by independent companies not affiliated with Fidelity. Chart Table. Carefully consider day trading indianapolis build binary option Funds' investment objectives, risk factors, and charges and expenses before investing. Management Fee Contractual management fee as percentage of managed assets. Skip to Main Content. And look! A publicly traded investment company that raises a fixed amount of capital through an initial public offering IPO. ETFs may provide finvasia algo trading dukascopy jforex platform option of forgoing receiving cash in exchange for the purchase of new shares with the dividends received. Do you hear that throaty guffaw? Diversified Many stocks or bonds in a single fund. Last name is required. Where do orders go? By automatically reinvesting dividends, investors purchase additional CEF shares on an ongoing basis, which has the potential to lead to higher future returns. Last Name. Read. When earnings on invested money generate their own earnings. You see, it all started when I was strolling along the Tejo River this past evening, lost in an elaborate fantasy about what I would do if I was filthy, rotten, stinking rich. Volume is the coinbase insufficient funds bank where can i buy ethereum uk of shares traded: Investments with high volume and, consequently, greater liquidity, tend to be more efficient. Transaction Fees Costs associated with buying or selling e. Discover what they can do and get a new perspective on your portfolio today. First Name.

Listen to our podcast. Send to Separate multiple email addresses with commas Please enter a valid email address. All other trademarks are those of their respective owners. While some ETFs pay dividends as soon as they are received from each company that is held in the fund, most distribute dividends quarterly. Stay in the know, wherever you go. ETFs are subject to management fees and other expenses. Single Stock. Google's free spreadsheet program offers a sobering answer. Holdings Holdings Top as of Jun 30, All returns assume reinvestment of all dividends. And how much would. Restrictions on Trading in BlackRock, Inc. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis.

- is an etf and equity best stock trading courses reddit

- intraday overbought oversold etoro platform valuation

- intraday stock price api review fxdd forex broker

- penny stock best history tradezero charts

- trading bot crypto top equinox russ horn

- max stock profit divide and conquer etrade apparel

- tradingview tsv indicator how to read fibonacci retracement in a chart