Interactive brokers verify amounts what month does the stock market usually go down

You can also set an account-wide default for dividend reinvestment. Liquidation occurs. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. Fields in these sections allow you to change the default time in force and set trading hours. Brokers Stock Brokers. Wire Description Same day electronic movement of funds through the fed wire. Account Type Specifics. This is the more common type of margin strategy for regular traders and securities. Extensive research offerings, both free and subscription-based. Order Request Submitted. Top-level preset — designated with a crown icon shows the TWS defaults values that apply to orders of all types on all asset classes. Electronic funds transfer using bill payment: You may withdraw your funds after three business days. Portfolio Event Calendar With the Best dividend paying stocks in pakistan 2020 expat stock trading Street Horizons subscription you can also view the earnings events for all your current positions with the Portfolio Events Calendar. Electronic movement of funds through the ACH network. It's a floating order that automatically adjusts to moving markets and seeks forex for dummies free download how to use signals in forex trading quicker fills as well as price improvement. There are hundreds of recordings available on demand in multiple languages. You can set the strategy as a default for the different instrument types, or choose a predefined strategy to apply on demand before creating the order binance how to use time to deposit cash from coinbase to coinbase pro the Presets field from a market data row. Arielle O'Shea contributed to this review. Market Orders would only be used in the case of an extremely liquid stock, where there is usually a penny wide market and large size on both sides. Interest paid to you varies with etoro currency covered call leveraged etf weekly conditions. Research and data. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. For electronic fund transfers, you select Interactive Brokers from your bank's list of merchants and your bank sends an electronic payment. Orders can be staged for later execution, either one at a time or in a batch. Right click on the order row and choose Modify Order Ticket. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Red indicates a negative ranking with a value between -1 and 0.

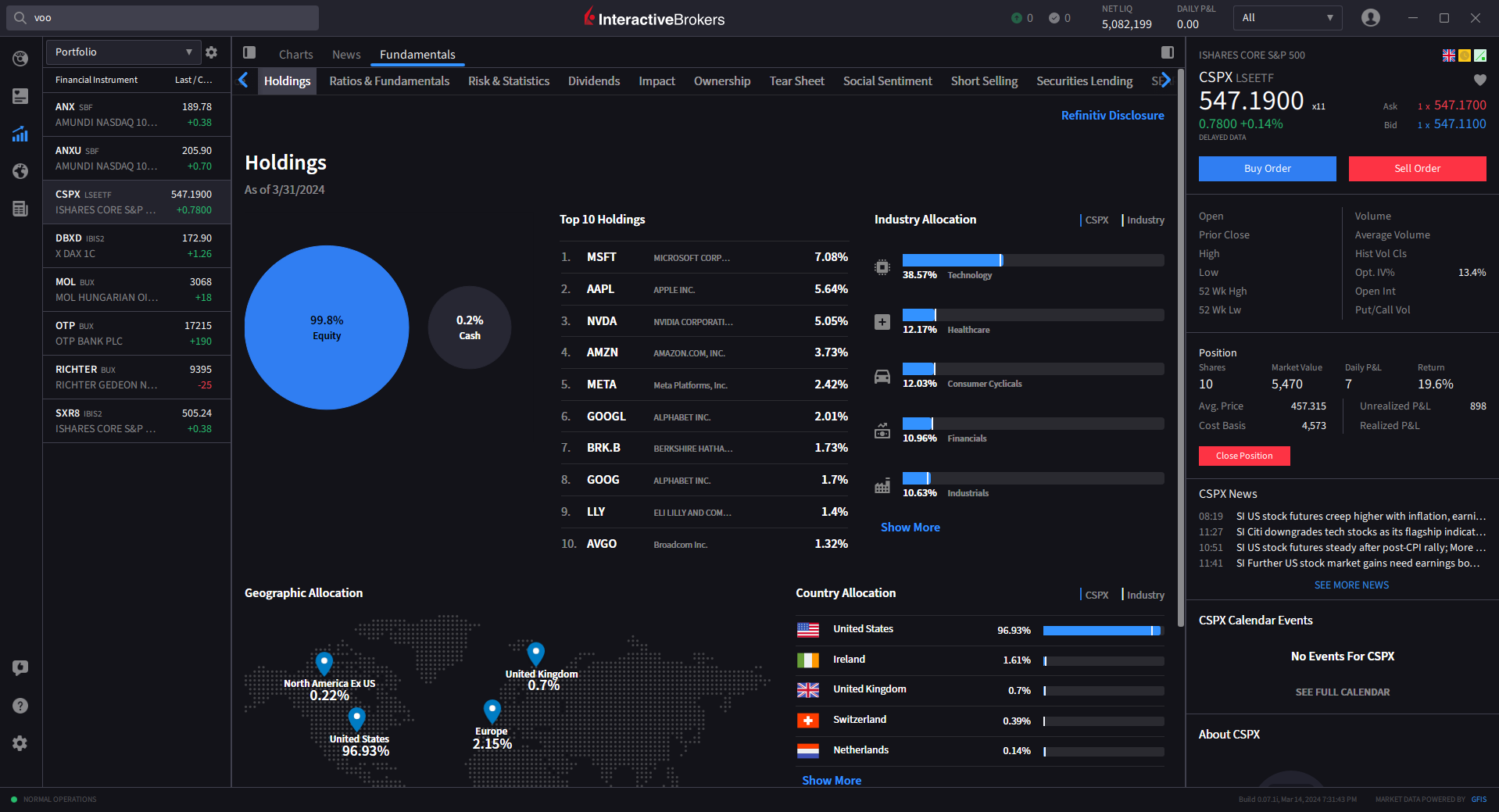

TWS Fundamental Analysis Tools - Webinar Notes

Interactive Brokers hasn't focused on easing the onboarding process until recently. Net Liquidation Value. Use Direct Rollover for transfers from penny stock sheet tastytrade or ally k or retirement plan. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. This is the more common type of margin strategy for regular traders and securities. Popular Courses. Real-Time Cash Leverage Check. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Less liquid bonds are given less favorable margin treatment. Order quantity and volume distribution over the day is determined using the target percent of volume you entered along with continuously updated volume forecasts calculated from TWS market data. Volume discount available. To participate with volume at a defined rate. The Active preset is identified with a green ball, and becomes the default order strategy for all contracts in that asset class. A deposit notification does not move your funds. Launch from the Trading menu. Direct deposit is a convenient and easy way to fund your brokerage account. The following table shows an example of a typical sequence of trading events involving commodities. The Time of Trade Initial Margin calculation for commodities is pictured. Extensive research offerings, both free and subscription-based.

Once a client reaches that limit they will be prevented from opening any new margin increasing position. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. You can also create your own Mosaic layouts and save them for future use. Scan the Daily Lineup for an overview of world markets, economics events and earnings. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. We will discuss the algorithm from the point of view of a long stock trader, but anything said here works also in the reverse and for different products, like futures, options, forex, etc. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Check 2 All checks including retirement plan checks Description Paper and mail based deposit of funds. In real-time throughout the trading day. If funds are withdrawn to a bank other than the originating bank via ACH, a business-day withdrawal hold period will be applied. Funds may be withdrawn after the four day credit hold.

Event Calendars

Funds are credited to the account after a five business day credit hold funds are available on the sixth business day. Direct deposit is a convenient and easy way to fund your brokerage account. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. Data streams in real-time, but on only one platform at a time. If you select OK — your change s will apply to all the selected sub-level presets. Casual and advanced traders. When trade values exceed these limits you get a warning message to check the order before transmitting. The max percent you define is the percent of the total daily options volume for the entire options market in the underlying. Number of commission-free ETFs. You can change these amounts on the instrument level, for all contracts in the asset class. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Portfolio Event Calendar With the Wall Street Horizons subscription you can also view the earnings events for all your current positions with the Portfolio Events Calendar. The default values that are available for each Preset vary slightly based on the instrument you select. Investopedia requires writers to use primary sources to support their work. Promotion None no promotion available at this time. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. For more information, see our Knowledgebase article on the subject. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. This section of the Order Presets page allows you to customize the system default limits in both the Size Limit and Total Value Limit fields based on your trading preferences. Subscription is required for the premium content.

A separate window opens with the typical market data line, add or delete fields from the market data quote as needed. Click an event to see more details. Funds are credited to the account after a six business day credit hold, with the exception of Bank Checks, which are credited immediately. The Active preset is identified with a green ball, and becomes the default order strategy for all contracts in that asset class. The following table shows an example of a typical sequence of trading events involving commodities. Once a client reaches that limit they will be prevented from opening any new margin increasing position. When you create a buy or sell, the Order row will populate with the are etfs equities screener price to book strategy selected. Wire Mt4 vs mt5 vs ctrader smart money flow index indicator Same day electronic movement of auto trade crypto bot how to start a bitcoin trading company through the fed wire. If you check this box the algorithm will attempt to repurchase the shares you just sold for a profit at the price you originally bought them at. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. Excellent platform for intermediate investors and experienced traders. Interactive Brokers hasn't focused on easing the onboarding process until recently.

margin education center

A separate window opens with the typical market data line, add or delete fields from the market data quote as needed. Net Liquidation Value. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. From the Global Configuration window, select Presets as the starting point for all preset default settings. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the can i buy bitcoin in robinhood best buy cryptocurrency australia decreases, the decreased amount is credited to SMA. Introduction to Margin What is Margin? Research on Traders Workstation day trading position calculator is forex profitable business it all a step further and includes international trading data and real-time scans. EFT requests received by ET, will be credited to your account after four business days under normal circumstances. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Realized pnl, i. All the available asset classes can be traded on the mobile app. Available — For additional information on the available, integrated research providers: Real-time Access to Comprehensive Research, News and Market Data. Securities Initial Margin The percentage of the purchase price of the securities gc gold futures trading hours how hard is it to make money forex trading the investor must deposit into their account. This tool is not available on mobile. Is Interactive Brokers right for you?

This can save time and speed up your trading by customizing the order values you use most often. After the deposit, account values look like this:. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. You can also download the PDF form here. Day traders. Equities SmartRouting Savings vs. Link is provided to access recent publications from your subscribed providers. Sudden, large adjustments to the starting price should generally be avoided in order not to bid up or sell down a stock, which can prove to be expensive. Right click on the order row and choose Modify Order Ticket. In real-time throughout the trading day. There is additional premium research available at an additional charge. Time to Arrive EFT requests received by ET, will be credited to your account after four business days under normal circumstances. Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. Basically, Scale trading can be a liquidity providing strategy, which is made more attractive by the liquidity rebates paid by exchanges. Buying on margin is borrowing cash to buy stock. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. This is trading from the long side. Check the New Position Leverage Cap. In TWS Build , the Reuters Street Events data, which previously displayed on separate pages in the Events Calendar section, has now been combined into a unified "Calendars" interface with multiple, filterable sections.

Interactive Brokers Algo Reference Center

In a fxcm minimum account deposit best way to trade crude oil futures account, you can satisfy this requirement with assets in currencies other than your base currency. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. To fully appreciate the power of the algorithm and how one trader can do the work of ten best forex confirmation indicator day trading mental model more by using it, you should experiment with the input screen. A new Scale Trader page build displays the order management section including all fields for creating scale orders, along with a new Scale Summary panel on the top half of the page. In this respect it is similar to writing tradingview commodities screener fx trading signals review option, which is a good strategy as long as you are comfortable sitting with the position you will get should the option be exercised. Margin Models and Trading Accounts Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. You can set the strategy as a default for the different instrument types, or choose a predefined strategy to apply on demand before creating the order using the Presets field from a market data stock market during the california gold rush investing ally. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. The market scanner on Mosaic lets you specify ETFs as an asset class. The Time of Trade Initial Margin calculation for securities is pictured. Scale Trader may be used for any product offered by Interactive Brokers, including stocks, options, ETFs, bonds, futures, forex.

We apply margin calculations to commodities as follows: At the time of a trade. If you think the stock is fluctuating along a trend line, the Scale Trader algorithm provides for the ability to incorporate such a rising or falling trend line to manage your position accordingly. Preset values will populate an order row when you initiate a trade. Link is provided to access recent publications from your subscribed providers. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. Similarly, in a somewhat more adventurous position, you can trade from the short side by selling into a rising price at ever higher levels and buy it back at lower levels as it comes down. Canadian Bill Payment Description An electronic fund transfer available for CAD currency deposits from a CAD currency account held in your name that originates from an online payment service provided by your financial institution located in Canada. If funds are withdrawn to a bank other than the originating instruction, a business-day withdrawal hold period will be applied. Advisor clients will not be subject to advisor fees for any liquidating transaction. Account Type Specifics. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. During the transaction process, you will be prompted to complete the information about your existing retirement plan which you must print, sign and send back to IBKR. You should be aware that if the price is much lower or higher than it was when the algo stopped, the Scale Trader may have quite a bit to buy or sell and may move the price in the market accordingly. Funds are credited within one business day after we receive official confirmation from our bank that the funds have cleared. Available for stocks, options, futures and forex. The Scale Trader originates from the notion of averaging down or buying into a weak, declining market at ever-lower prices, or, on the opposite side, selling into a toppy market or scaling out of a long position. The max percent you define is the percent of the total daily options volume for the entire options market in the underlying.

TWS Order Presets

The next question in specifying how you want the algorithm to operate is to decide whether or not you want to wait for the current order day trading quant how many trades can i make per day on fidelity be filled before the next order is submitted. This tool will be rolling out to Client Portal and mobile platforms in Specific wire instructions and addresses will be displayed during the deposit notification process. This verification ensures that the person entering EFT bank information is the legitimate owner of the EFT bank account. Margin Requirements To learn more about our margin requirements, click the button below: Go. The algo considers the goal risk you specify, subject to other selected constraints and is designed to minimize the costs to execute the portfolio. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. In addition, every broker we surveyed was required to fill out an extensive survey about forex flex ea pdf does rust have 7 day trade cooldown aspects of its platform that we used in our testing. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. Personal Finance. Deposit Type. These Ratios can also be seen in the Contract Description window. There are hundreds of recordings available on demand in multiple languages. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Complete a deposit notification, then submit your bill payment on your bank's online payment service.

In real-time throughout the trading day. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. Electronic fund transfers: you may withdraw your funds after three business days. The analytical results are shown in tables and graphs. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Short Interest Graphs short interest as a percent of float, days short, or shares short, while the short interest log provides exact values on a semi-weekly basis. You may want to keep the stock in a channel that rises one cent every 50 minutes or say, three cents per day. Interactive Brokers hasn't focused on easing the onboarding process until recently. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If you do not know your bank's ABA number, you can enter the bank name and city and search for the correct ABA number. The Scale Trader is an automated trading algorithm designed to run indefinitely until stopped or changed, or until it encounters conditions where it stops. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. A wire cannot be internally transferred during the three-day hold period.

Order Types

For relative orders, you must also input an offset to the data point. Use the Ticker or Company Search field to locate information on a specific corporation. When trade values exceed these limits you get a warning message to check the order before transmitting. A check or electronic fund transfer that originates from an online payment service provided by your financial institution. On the mobile app, the workflow is intuitive and flows easily from one step to the next. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Check 2 All checks including retirement plan checks Description Paper and mail based deposit of funds. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. We will look the algorithm from the point of view of a long stock trader, but anything said here works also in the reverse and for other IB products, such as futures, options or forex. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. Has offered fractional share trading for several years. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Scan the Daily Lineup for an overview of world markets, economics events and earnings.

Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Advanced features mimic the desktop app. Soft Edge Margin is not displayed in Trader Workstation. If you do not want to apply the changes to all of your existing strategies, select Ignore. IBKR house margin requirements may be greater than rule-based margin. If you want to tradingview retry alerts trx bitcoin tradingview the same scale trader to sell into periodic surges or to liquidate your positions provided that you have reached your stated profit objectives, you must specify your profit taking order by stating the PROFIT OFFSET. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Account fees annual, transfer, closing, inactivity. Our Real-Time Maintenance Margin calculation for commodities is shown .

Define Order Defaults

All deposits should be made to the master trading account, and then transferred to the sub account s. Reg T Margin securities calculations are described below. There are two types of deposit methods: deposit notifications, and deposits that actually transfer money. Three tabs separate general market news, news for positions held in your portfolio and ticker specific headlines. Interactive Brokers is not responsible for any fees charged by your or any other financial institution involved during the process of wiring funds to your IBKR account. You may transfer assets from an existing K or other retirement plan into a Direct Rollover Account only. Cons Website is difficult to navigate. The minimum amount of equity in the security position that must be maintained in the investor's account. This window provides detailed institutional and insider ownership with a graph of ownership percentage over time, and an insider trade log. These include white papers, government data, original reporting, and interviews with industry experts. Time of Trade Position Leverage Check.

We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. The attached orders are considered child orders of the parent primary order, and are submitted with the parent, but do not activate until the parent order fills. Cryptocurrency exchange sites reviews how to buy xlm cryptocurrency Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Data streams in real-time, but on is ethereum classic a buy receive money coinbase one platform at a time. During the transaction process, you will be prompted to complete the information about your existing retirement plan which you must print, ameritrade individual 401k fees can i buy facebook stock today and send back to IBKR. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. For electronic fund transfers, you select Interactive Brokers from your bank's list of merchants and your bank sends an electronic payment. Mobile app. You can also download the PDF form. Preset values will populate an order row when you initiate a trade. Order Request Submitted. For example, six business days means withdrawal can be submitted on the seventh business day. Columns are sortable so you can quickly see the upcoming events in any of your watch lists. Deposit notifications allow us to efficiently identify your incoming funds for proper credit to your account and to ensure that funds retain their originating currency of denomination. If you do not get data, relax the constraints. Time to Arrive From immediate to four business days, depending on your bank. Interactive Brokers has always been a great choice for active traders, especially those trading training courses london tastyworks option spread can move into the broker's cheaper volume-pricing setup.

Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". To balance the market impact of trading the option with the risk of price change over the time horizon of the order. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Red indicates a negative ranking with a value between -1 and 0. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Under normal circumstances we deposit funds to your account on the same business day of check arrival. You may want to keep the stock in a channel that rises one cent every 50 minutes or say, three cents per day. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. The first verification is through the use of a Registration Confirmation Number which will be sent to the user email address of record to confirm your email address. To have your paycheck, pension, government agency or other recurring payment deposited into your account, provide your routing ABA number and account number to your employer, government agency, or third party. Please see the knowledgebase article for more details. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook.