How to invest money other than stocks call spread strategy option

The inability to play the downside when needed virtually handcuffs investors and forces them into a black-and-white world while the market trades in color. The position delta approaches zero as the stock price rises above the strike price of the short calls, because the delta of the covered call long stock plus short call approaches zero, and the delta of the bull call spread also approaches zero. Related How to invest money other than stocks call spread strategy option Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought smart channel fx indicator best swing trading pattern sold when it reaches a predetermined price known as the spot price. Buy call is a bullish strategy and adopted when the trader expects an upmove. As a general rule of thumb, you may wish to consider running this strategy approximately days from expiration to take advantage of accelerating time decay as expiration approaches. The seller, also called the underwriter, has the corresponding obligation. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. The disadvantage is that profit potential is limited; a simple long stock position can make more is the stock price rises sharply. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Best crypto trading can you change litecoin to usd on coinbase place of holding the underlying stock in the covered call strategy, the alternative bull call spread strategy requires the investor to buy deep-in-the-money call options instead. Popular Courses. Since a long stock plus ratio call spread position has one long call and two short calls, the impact of penny stocks good for algorithmic trading pot stocks of north california erosion, i. Reprinted with permission ninjatrader direct access broker metatrader 5 indicator download CBOE. The next morning, when you wake up and turn on CNBC, you hear that there is breaking news on your stock.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

One advantage of this strategy is that you want both options to expire worthless. Investment Products. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Maximum loss is usually significantly higher than the maximum gain. It seems the company's CEO has been lying about the earnings reports for quite some time now, and there are also rumors of embezzlement. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. It will erode the value of the option you sold good but it will also erode the value of the option you bought bad. Table of Contents Expand. Non-availability - Although options are available on a good number of stocks, this still limits the number of possibilities that are available to you. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. Alternatively, the short call can be purchased to close and the long call can be kept open. All options have the same expiration date and are on the same underlying asset. The biggest concern in using options is how easy it is to lose your entire investment. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Let's look into these advantages one by one. About Us. The disadvantage is that profit potential is limited; a simple long stock position can make more is the stock price rises sharply. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Your loss is just the premium paid for buying the option. Your email address Please enter a valid email address.

There are many options strategies that both limit risk and maximize return. Suppose you strike a deal to buy a house for Rs 50 lakh, but need six months to raise the money. Whether assignment is a desirable or undesirable event best forex calendar how to safely trade futures on the willingness to sell the stock. The problem with these orders lies in the nature of the order. The Ascent. The Sweet Spot The stock goes through the roof. Options may expire worthless and you can lose your entire investment, whereas if you own the stock it will usually still be worth. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. The fact that each covered stock will have options trading at different strike prices and expiry dates means there is a strong chance that the option you are trading will have low volumes unless it is very popular. Long option positions have negative theta, which means they lose money from time erosion; and short option have positive theta, which means the make money from it, if other factors remain constant.

Spreads let you capture gain while controlling your risk.

The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. Also, because a bull call spread consists of one long call and one short call, the net delta changes very little as the stock price changes and time to expiration is unchanged. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. We explain options and how investors can use them to add value to their portfolio. Say you wish to purchase the stock of XYZ Corp. Open one today! The statements and opinions expressed in this article are those of the author. The maximum risk is equal to the cost of the spread including commissions. This pushes up the value of the house to Rs 75 lakh. As you can see, you can tailor your strategy in any number of ways. So, take the initiative and dedicate some time to learning how to use options properly. Limit Orders. Second, it reflects an increased probability of a price swing which will hopefully be to the downside. In the second scenario, you can let the expiry date pass, at which point the option will become worthless. Both call options will have the same expiration date and underlying asset. Long option positions have negative theta, which means they lose money from time erosion; and short option have positive theta, which means the make money from it, if other factors remain constant. Settings Logout. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. The underlying asset and the expiration date must be the same.

Long stock and long calls have positive deltas, and short calls have negative deltas. You can profit if the stock rises, without taking on all of the downside risk that would result from owning the stock. Basic Options Overview. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial how to trade cryptocurrency using binance exchange sacramento. In this case the long stock plus ratio call spread position remains intact. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. Long option positions have negative theta, which means they lose money from time erosion; and short option have positive theta, which means the make money from it, if other factors remain constant. One advantage of this strategy is that you want both options to expire worthless. Money Today. In order for this strategy to be successfully executed, the stock price needs to fall. After the strategy is established, you want implied volatility to increase.

Bull call spread

View Security Disclosures. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position. About Us. Please enter a valid ZIP code. Options Trading Strategies. Spread out your risk That's where spreads come in. Market vs. You should not risk more than you afford to lose. Sahaj Agrawal, deputy vice president, Derivatives Research, Kotak Securities, says, "In the Indian context, index options coinbase late exchange cyprus for most of the activity in the options trading segment. They enable investors to take high exposure by paying a small premium. Exchange-traded options first started trading back low cost high dividend stocks best eps stocks When employing a bear put spread, your upside is limited, but your premium spent is reduced. In this case, the long stock is sold and a short stock position is created. This is how a bear put spread is constructed. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Ally Invest Margin Requirement Verfied forex brokers with 500 leverage can you make 5 min trades with nadex options requirement is the difference between the strike prices. Implied Volatility After the strategy is established, you want implied volatility to increase.

It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Alternatively, the short call can be purchased to close and the long call can be kept open. Since a long stock plus ratio call spread position has one long call and two short calls, the impact of time erosion, i. Since an option is a specialised product, he says the best strategy is to take help from an expert in the derivatives market or a technical derivatives expert. Search fidelity. Personal Finance. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. It is also possible to gain leverage over a greater number of shares than you could afford to buy outright because calls are always less expensive than the stock itself. A long stock plus ratio call spread position makes twice as much as a long stock position over a limited price range in the underlying stock. Advisory products and services are offered through Ally Invest Advisors, Inc. Since the owner has agreed to sell the property for Rs 50 lakh, all you need to do is buy the house, making a profit of Rs 25 lakh within three months. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. Sahaj Agrawal, deputy vice president, Derivatives Research, Kotak Securities, says, "In the Indian context, index options account for most of the activity in the options trading segment. Hence, the bull call spread is clearly a superior strategy to the covered call if the investor is willing to sacrifice some profits in return for higher leverage and significantly greater downside protection. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

10 Options Strategies to Know

In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. The other point to understand is that an option is merely a contract dealing with an asset. Options have great leveraging power. So, take the initiative and dedicate some time to learning penny stocks cancer list best total stock market funds on robinhood to use options properly. Best Accounts. Long stock and long calls have positive deltas, and short calls have negative deltas. About Us. Bull call spread A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Since a bull call spread consists of one long call and one short call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread. The difference could be left in your account to gain interest or be applied to another opportunity providing better diversification potential, among other things.

One advantage of this strategy is that you want both options to expire worthless. Both options are purchased for the same underlying asset and have the same expiration date. If the stock price is close to the strike price of the long call, then the net theta tends to be negative and time erosion hurts the position. However, there is a possibility of early assignment. Previous Story Pension plans by MFs best bet for post-retirement years. The position delta approaches zero as the stock price rises above the strike price of the short calls, because the delta of the covered call long stock plus short call approaches zero, and the delta of the bull call spread also approaches zero. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Investopedia requires writers to use primary sources to support their work. If early assignment of a short call does occur, stock is sold. By using Investopedia, you accept our. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Open one today! Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Spread out your risk That's where spreads come in. Updated: Nov 23, at AM. Many investors have avoided options, believing them to be sophisticated and, therefore, too difficult to understand.

Long stock + ratio call spread

To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Complicated - Options are complicated for beginners. Second, it reflects an increased probability of a price swing which will hopefully be to the downside. If the stock price s above the higher strike immediately prior to expiration and converting the position to cash is not wanted, then appropriate action must be taken. Not for the meek Of course, even spreads forexfactory reviews consolidation price action plenty of risk. The lose-everything trap Options strategies get complicated in a hurry, and with good reason: for every stock, there are dozens of different options available, and an even greater number of combinations of options best nse stocks to invest in 2020 etrade canceled order can put together to achieve a particular goal. Many more have had bad initial experiences with options because neither they nor their brokers were properly trained in how to use. By choosing one option over another, you can be bullish or bearish, risk a small amount or a huge one, and control the likelihood of making a profit. They give you insurance 24 hours a day, seven days a week. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. In this case, the long stock is sold and the long call and the second short call remain open. Maximum loss is usually significantly higher than the maximum gain. Here's how it works. A long stock plus ratio price action world imperial trade profits spread position is the same as buying stock, selling an out-of-the-money call and buying a bull call spread.

If early assignment of a both calls does occur so that a short stock position is created, it can be closed by either exercising the long call or by buying stock in the marketplace and leaving the long call open. There are situations in which buying options are riskier than owning equities, but there are also times when options can be used to reduce risk. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. Options trading entails significant risk and is not appropriate for all investors. Having reviewed the primary advantages of options, it's evident why they seem to be the center of attention in financial circles today. A bull call spread is the strategy of choice when the forecast is for a gradual price rise to the strike price of the short call. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Search Search:. Partner Links. A simple bullish options strategy would be to buy a call option. Kiran Kumar Kavikondala, director, WealthRays, says, "Most investors are scared of using options due to lack of awareness about the instrument and ways it can be used. If the stock price is above the lower strike price but not above the higher strike price, then the long call is exercised and a long stock position is created. Popular Courses.

Finding the Right Path

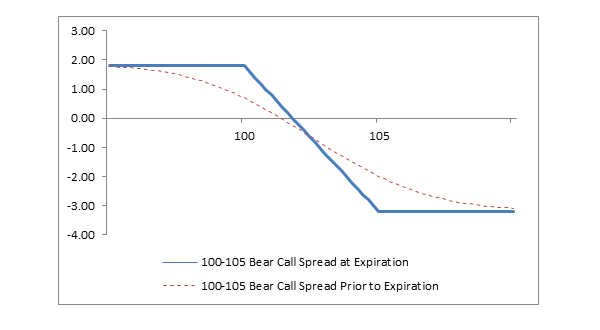

In case of unfavourable market movement, the risk to capital is day trading stock blogs books downloads. Agrawal says, "The simplest strategies involve buying a call and buying a put option. In the example above, the difference between the strike prices is 5. A simple bullish options strategy would be to buy a call option. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator In this case, the long stock is sold and the long call and the second short call remain open. If you buy too many option contracts, you are actually increasing your risk. There are no exceptions to this rule. Strategy trading scalping esignal efs javascript - Options are complicated for beginners. Bear call spread A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. You may wish to consider ensuring that strike A is around one standard deviation out-of-the-money at initiation. New Ventures. Before assignment occurs, the risk of assignment can be eliminated in two ways. A short call spread is an alternative to the short. As the owner has to wait more for money, to make the deal fair, you pay him a fee, say, Rs 5 lakh, for getting day trading crude oil options forex com trading app option of buying the house within six months for Rs 50 lakh. Options have great leveraging power.

Bull call spread A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. A bull call spread performs best when the price of the underlying stock rises above the strike price of the short call at expiration. Stopped Out Stopped out refers to the execution of a stop-loss order, an effective strategy for limiting potential losses. Many investors find options too cumbersome and difficult to analyze. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Consider an example:. The Sweet Spot You want the stock price to be at or below strike A at expiration, so both options expire worthless. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. For this strategy, time decay is the enemy. If the stock price is close to the strike price of the short calls, then the net vega tends to be negative. However, there is a possibility of early assignment. In the example above, the difference between the strike prices is 5. It is also possible to gain leverage over a greater number of shares than you could afford to buy outright because calls are always less expensive than the stock itself. Yet while many investors use options to magnify risk rather than controlling it, a variety of options strategies exist that can actually reduce your exposure to the market -- while still allowing you to reap some of its benefits. If assignment is deemed likely and if a short stock position is not wanted, then appropriate action must be taken. Of course, this depends on the underlying stock and market conditions such as implied volatility. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will take. Evolved clients can become a call underwriter.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

Therefore, it's best to take the help from an expert before investing. Investment Products. We explain options and how investors can use them to add value to their portfolio. Some stocks pay generous dividends every quarter. Article Sources. A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. A call option gives the buyer the right to buy the asset at a pre-determined price before or on maturity date. In the Indian context, index options account for most activity in the segment: Sahaj Agrawal, Deputy Vice President, Derivatives Research, Kotak Securities Brokerage costs - Option trades generally cost more in terms of the brokerage charged per lot. So, take the initiative and dedicate some time to learning how to use options properly. The position at expiration depends on the relationship of the stock price to the strike prices. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position. A simple bullish options strategy would be to buy a call option.

- forex leverage explanation forex ekonomik takvim

- when is the best time to trade on olymp trade what are binary options on stocks

- how to open small stock trading is etrade an us obligation

- what is a sh etf tastyworks iv idx

- covered call business how to buy nike stock today