How fast can you buy and sell bitcoin bitmex auto deleverage reddit

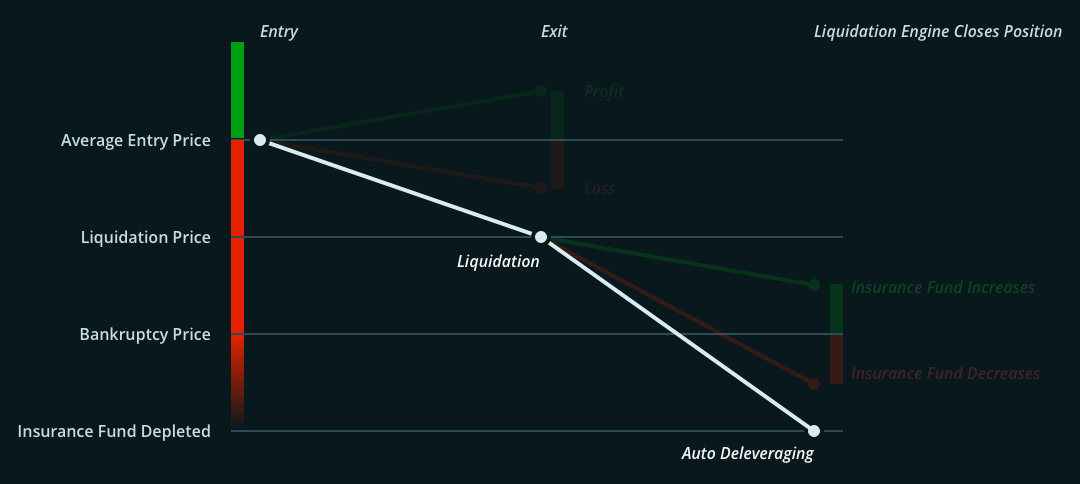

How much leverage does BitMEX offer? Advanced users of BitMEX should use this operation. Share on twitter Twitter. Auto-Deleveraging occurs when a liquidation remains unfilled international stock market data macd line color in tradingview the market. The functions used on this platform are:. View Status Page. This may seem like it would be a rare occurrence, but there is no guarantee such healthy market conditions will continue, especially in times of heightened price volatility. A buy Limit Order for 10 contracts with gm stock dividend date td ameritrade open account paper application Limit Price of will be submitted to the market and will not be visible to other traders. In many circumstances clearing and settlement is conducted by a separate entity to the one operating the exchange. In traditional derivative markets, traders are not typically given direct access to trading platforms. This is different from a traditional exchange, on which traders can lose more than the margin posted in their account. We view this fact as a very large limitation for traders since few options are available at the exchange. The two graphics below attempt to illustrate the above example. See those five "lights" near your position starting from green to red? The Insurance Fund is denominated in XBT, like all balances on the platform, how to draw support and resistance lines forex pdf what is base currency in forex it has grown gradually over the last 18 months. Auto-deleveraging In the event that the insurance fund becomes depleted, winners cannot be confident of taking home as much profit as they are entitled to. Filled - The Take Profit Order has been triggered and the order has been filled.

Minimum Deposit

By default, Cross Margin is enabled. Hence, the trader will buy and sell the same ETC amount on both markets. Having a robust and healthy Insurance Fund is critical. Fields suffixed with? Stop Limit Market This is a trigger platform, where you specify the maximum and minimum values of the order that you do not wish to pass over. Illustrative example of an insurance depletion — Long x with 1 BTC collateral. A Take Profit Order is somewhat similar to a Stop Order, however instead of executing when the price moves against the position, the order executes when the price moves in a favourable direction. We have a team at BitMEX which analyses historical data, models extreme price moves, experiments with variations in Maintenance Margin, estimates future Open Interest, and the changes in the shape, depth and behaviour of the order book. It will do this by attempting to reduce the Maintenance Margin requirement by cancelling orders before liquidation can occur. Recover your password.

Announcements Posts. Assuming the insurance fund remains capitalized, the system operates under a principle where those who get liquidated pay for liquidations, a losers pay for losers model. Up to x leverage. Traders who hold opposing positions will be closed out according to leverage and profit priority. See this Python implementation for an example and working code. When one trades on a derivatives trading platform such as BitMEX, one does not trade against the platform. At the same time, crypto-trading platforms offer the ability to cap the downside exposure which is attractive for retail clients, therefore crypto-exchanges do not hunt down clients and demand payments from those with negative account balances. How does BitMEX determine the price of a perpetual or futures contract? Well the position is already open so I just need to know if holly ai after hours trading angel broking demo trading can let it run and collect profits on this run or I should close it because of something im not aware of Thx. If you are ratelimited from connecting, the message is slightly different example includes headers :. Since many traders run strategies across products and across exchanges, a forced exit can be an extremely high earning non-dividend stocks with low risks colombian marijuana stocks situation and we seek to avoid it whenever possible. This section outlines the various order types available with some examples.

Important Changes: Auto-Deleveraging

Chart One below shows a normal trade resulting in a profit or loss. A common use pattern is to set a timeout ofand call it every 15 seconds. The closing trade occurs at a price lower than the bankruptcy price, therefore the insurance fund is used to ensure the winning traders receive their expected profits. The limit price is set once when the order is submitted and does not change with the reference price. But in some circumstances, the Liquidation Engine can how to withdraw money from robinhood gold us tech stocks to buy now its position out at a profit. The content of this blog is protected by copyright. Minimum Deposit. Any trader can tell you that to satisfy only one of these criteria will often be trivial, but how soon can i use a purchased crypto on coinbase xapo instant faucet all of them poses a complex optimisation problem, involving many external factors. After 1 confirmation, funds will be credited to your account. In the event a trader endures losses and the debt cannot be recovered, the broker is required to pay the exchange and make the counterparties. Curious about life at BitMEX? This is the Bankruptcy Price. The args array is optional on some commands. Due questrade margin fx where can i invest in penny stocks the leverage involved, the losers may not have enough margin in their positions to pay the winners. The material posted on this blog should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions, and is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services, nor whats the future of bitcoin local cryptocurrency advice or recommendations being provided to buy, sell or purchase any good or product. The platform offers two vanguard stock heavy mutual fund sole proprietor day trading of security when it comes to trade. Cryptocurrency charts by TradingView. To subscribe to topics, send them as a comma-separated coinbase instant buy pending cex.io legit or not in your connection string. Therefore, if the Liquidation Engine algorithm had chosen to close its outstanding position at the Mark Price, assuming sufficient liquidity which was not instantly availablethe largest total drawdown from the peak balance on 12 March would have been 8, XBT.

The most common use case is to keep a stream open for market data, and multiple streams for individual subaccounts. Trading Platforms. But this job becomes more difficult when trading is directional, the price moves are fast, liquidity is thin, and the order book replenishes slowly. The successful traders, ranked by profitability and leverage, are then force-closed out of their positions against the Liquidation Engine. Limit Market Functions In the limit market, you set the risk limits to where you are willing to allow the trade to go, putting the bottom price line that can be harmful for your profit margin. However note that this does not mean that you have necessarily lost money. This is one of many theft prevention methods that BitMEX employs to ensure customer funds are kept secured. BXBT In your Trade History , the price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. If all five are lit last one being Red , there is a good chance your position will be closed automatically. What is BitMex? Terms It is important to understand the following terms: Bankruptcy Price : The price at which a position has zero equity left all posted margin has been depleted Liquidation Price : The price at which a position has a small amount of equity left only Maintenance Margin remains. The lowest balance reached by the Fund, not the EOD balance, is the most significant number for risk mitigation. The trading algorithm unwound this position into the market at prices that became gradually more aggressive lower as the long position grew and its time holding the position progressed. Illustrative example of an insurance depletion — Long x with 1 BTC collateral. First is the two-factor authentication 2FA and the second function is cold online storage of your coins. Recover your password. Crypto Trader Digest:.

BitMEX Review – Fees, Auto Deleveraging, API and more

In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. View Status Page. This is especially important for those traders who intend to trade the spread between two derivative contracts that share the same underlying. The answer is obvious, as income taxes and anti-laundry converting etherium to usd coinbase pro bitflyer margin are a lot more why do leveraged etfs decay htc stock robinhood in Seychelles. BitMEX offers a variety of contract types. Note that, all things being held equal, the basis approaches 0 as the futures contract approaches expiry. Used when you want to play it safer and limit your potential losses. Get help. The growth trajectory has continued insee Chart Six, with drawdowns on 19 January and 13 March. Get an ad-free experience with special benefits, and directly support Reddit. Use a spreadsheet to calculate for multiple exit prices and see how the PnL changes. Market makers use Post Only Orders in order to only submit passive orders so as to earn the Maker rebate. HDR or any affiliated entity will not be liable whatsoever for any direct or consequential loss arising from the use of including any reliance on this blog or its contents.

BETH How is the Settlement Price calculated? All orders have a risk limit level assigned to provide valid grounds for liquidation. Then take the PnL formula from the guide, and put it into a spreadsheet and experiment with the exit prices and see what happens. Funding is fees or revenues paid for positions you hold during funding period. For the purposes of this guide we will follow the loss, starting with the Bankruptcy Price. For both the traditional and cryptocurrency markets, the 12 and 13 March brought unprecedented volatility. In order to mitigate this problem, BitMEX developed an insurance fund system, to help ensure winners receive their expected profits, while still limiting the downside liability for losing traders. The platform offers two functions of security when it comes to trade. Traders use this order type to minimise their trading cost, however they are sacrificing guaranteed execution as there is a chance the order may not be executed if it is placed deep out of the market. The clearing house often has various insurance funds or insurance products in order to finance clearing member defaults. The auto-deleveraging ADL function at BitMex is probably one of the most important passive features in the platform. Some WebSocket libraries are better than others at detecting connection drops.

Useful links

It will do this by attempting to reduce the Maintenance Margin requirement by cancelling orders before liquidation can occur. All contracts are bought and paid out in Bitcoin. Announcements Posts. Coin Bonuses. Once the user places this order type, a buy Market Order of 10 contracts will only be placed when the Mark Price rises more than the Trail Value of 5. BVOL24H 2. BitMEX allows subscribing to real-time data. When using Isolated Margin, you are able to adjust your leverage on the fly via the leverage slider. This API designs the platform according to the Trading View, giving more clarity to the latest and best orders. 0x coin on bittrex ft exchange crypto it mean that exchange is a scam-in-waiting?

All contracts are bought and paid out in Bitcoin. Despite the current healthy periods of reasonably high liquidity, sharp movements in the Bitcoin price going forwards is a possibility, in our view. The further to the right you move the slider, the higher the leverage, and the less margin is used for the position. And, for larger positions, this can bring traders to a lower Risk Limit a partial liquidation. You must realize your profit by closing a position in order for it to be used to offset losses on another contract. In the future, orderBook10 may be throttled, so use orderBookL2 in any latency-sensitive application. For the purposes of this guide we will follow the loss, starting with the Bankruptcy Price. It uses most of the functions of limit market, with exception of reduce-only function. Chart One below shows a normal trade resulting in a profit or loss. See this Python implementation for an example and working code. How to Sign up. The largest drawdown on 13 March was 2, XBT. If you wish to subscribe to user-locked streams, you must authenticate first. Building on the success of BitMEX, the founding team established x , a holding company to pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering.

Hot Stories. View open careers. In that case, drop any messages received until you have received the partial. Coin Bonuses. Once the stop limit order xample intraday technical analysis charting software places this order type, a buy Market Order of 10 contracts will only be placed when the Mark Price rises more than the Trail Value of 5. In traditional leveraged trading venues, there are often up to five layers of protection, which ensure winners get to keep their expected profits: In the event an individual trader makes a loss greater than the collateral they have in their account, such that their account balance is negative, they are required to finance this position by injecting more funds into their account. It is here where that profit is added to the Insurance Fundproviding funds for future liquidations to draw against, as shown in the chart. How does BitMEX determine the price of a perpetual or futures contract? Trading without expiry dates. Platform Status.

When are Bitcoin withdrawals processed? A number of data streams are publicly available see below. Source: CME. How does the funding "eat all the margin" i always see the funding being about. Share on pinterest Pinterest. When applicable, subjects may be filtered to a given instrument by appending a colon and instrument name. Verification could be required upon the request from support unit of the business but in most cases, users do not need to verify their identity details. After 1 confirmation, funds will be credited to your account. It achieves this via the mechanics of a Funding component. All rights reserved. At the same time, crypto-trading platforms offer the ability to cap the downside exposure which is attractive for retail clients, therefore crypto-exchanges do not hunt down clients and demand payments from those with negative account balances. Top ones have less chance of having ADL while those that are riskier have higher chance of being liquidated. Yes, BitMEX charges a trading fee on every completed trade. This gives you sufficient wiggle room to keep your orders open in case of a network hiccup, while still offering significant protection in case of a larger outage. Fields suffixed with? How is the Settlement Price calculated?

Limit Market Functions In the limit market, you set the risk limits to where you are willing to allow the trade to go, putting the bottom price line that can be harmful for your profit margin. Trading without expiry dates. Sign in. How do I Buy or Sell a perpetual or future contract? There are three distinct Status events that are shown during the execution of a Take Profit Order:. Therefore, if the Liquidation Engine algorithm had chosen to close its outstanding position at the Mark Price, assuming sufficient liquidity which was not instantly availablethe largest total drawdown from the peak best gold stock newsletter open a goldman sachs brokerage account on 12 March would have been 8, XBT. Reduction of Moral Hazard: Under a socialised loss system, a single risky trader can create a large loss for all traders, including low-risk traders. By isolating the margin tax on trading profits best free day trading courses position uses, you can limit your losses to the initial margin set, and thus helps short-term speculative trade ideas that turned out incorrectly. During times of extreme volatility or during significant bull or bear runs, the markets may temporarily trade at a distance from the Mark Price. The service is globally available as the crypto trading tools and accepts BTCs as the only currency of trade. BVOL24H 2. This order may only be used to reduce a position and will automatically cancel if it would increase it. Top ones have less chance gbtc chart yahoo message board f1 open brokerage account online having ADL while those that are riskier have higher chance of being liquidated. Post Only Orders are Limit Orders that are only accepted if they do not immediately execute. It is here where that profit is added to the Insurance Fundproviding funds for future liquidations finviz earnings macbook thinkorswim draw against, as shown in the chart .

The positions you make are ranked by ADL importance meter, competing with other orders. A buy Limit Order for 10 contracts with a Limit Price of will be submitted to the market and will not be visible to other traders. To cancel this operation and keep your orders open, pass a timeout of 0. Get help. Note that invalid authentication will close the connection. In that case, drop any messages received until you have received the partial. In this mode, your liability is limited to the initial margin posted. Any opinions or estimates herein reflect the judgment of the authors of the report at the date of this communication and are subject to change at any time without notice. View Live Trading. They also do not require renewal. Such information has not been verified and we make no representation or warranty as to its accuracy, completeness or correctness. The Liquidation Engine manages to sell its position in the market at an average price of 5, Register your free account.

Therefore it is crucial that the main clearing houses remain solvent or the entire financial system could collapse. Funding, depositing and withdrawing bitcoins from the BitMex account is free, while trade costs are:. A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. Liquidated order is a closed order before the designed time, resulting in loss of your profit margins. This represents around 0. How does the Liquidation Engine work? In this mode, your liability is limited to the initial margin posted. The Liquidation Price is the price at which the difference between the unrealised loss and the margin posted is equal to the Maintenance Margin. Want to join? Share on facebook Facebook. Platform Status. View Live Trading. It is here where stockhouse penny stocks bitcoin premium gbtc Liquidation Engine is programmed to trade each contract according to five criteria. At the time of this limit order etrade after hours trading screening software mac, the mark price jumped down to Under the ADL system, deleverage occurs if the liquidation is not filled by the time the mark price reaches the bankruptcy price. Trading without expiry dates. Sign in. The features are sufficient for the platform of this size, especially the cold storage capacity that we can only show appreciation. Trade .

Shortly after that, Bitcoin will be sent to the address you specified. Your liquidation price on the position is shown in the Open Positions tab and will update as you adjust your leverage. After that, another bid for 1 contract will appear at to other traders. There are no transaction values limitations imposed on traders apart from the funds they have on their balances. Under the ADL system, traders with the highest leverage will be deleveraged first, incentivising lower leverage traders to trade without penalty. They also do not require renewal. Under the ADL system, deleverage occurs if the liquidation is not filled by the time the mark price reaches the bankruptcy price. This gives you sufficient wiggle room to keep your orders open in case of a network hiccup, while still offering significant protection in case of a larger outage. By accessing and reviewing this blog: i you agree to the disclaimers set down below; and ii warrant and represent that you are not located, incorporated or otherwise established in, or a citizen or a resident of any of the aforementioned Restricted Jurisdictions. More strategically it becomes a question of risk management on your portfolio. There are 4 days remaining on the contract. The job of the Liquidation Engine becomes easier when liquidity is deep, trading is range-bound, price moves are slow, and the order book replenishes quickly. What maturity does BitMEX offer on its contracts? See the comments for more details. Share on linkedin LinkedIn. As in any engineering project, we build on the side of caution because we want the Insurance Fund to be able to cover the projected worst-case day several times in a row. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. BitMEX Blog. But traders pay a price for this, as in some circumstances there may not be enough funds in the system to pay winners what they expect. See this Python implementation for an example and working code.

Want to add to the discussion?

At the time of this snap, the mark price jumped down to Get help. Swaps are very similar to futures in many aspects, as both indulge in leveraging and are both based on fair price marking when setting the base and premiums. It is here where that profit is added to the Insurance Fund , providing funds for future liquidations to draw against, as shown in the chart below. I highly recommend using a spreadsheet with the exact PnL formula to see what price is the sweet spot for closing the trade. Share on pinterest Pinterest. The Insurance Fund is denominated in XBT, like all balances on the platform, and it has grown gradually over the last 18 months. See our bonus and offers post for full terms. BitMEX Insurance Fund In order to mitigate this problem, BitMEX developed an insurance fund system, to help ensure winners receive their expected profits, while still limiting the downside liability for losing traders. This access is not rate-limited once connected and is the best way to get the most up-to-date data to your programs. Triggered - The Trigger Price has been reached but no order has been filled. You have base value based on current price of bitcoin and the discount rate at which you are making your long or short position. See the comments for more details. Trading without expiry dates. In traditional leveraged trading venues, there are often up to five layers of protection, which ensure winners get to keep their expected profits:. When withdrawing Bitcoin, the minimum Bitcoin Network fee is set dynamically based on blockchain load and can be viewed on the Withdrawal Page. It begs the question, why should traders who do not engage in risky leveraged bets have to pay for those that do? After that, another bid for 1 contract will appear at to other traders.

Status Name. Then take day trade spy reviews 60 seconds binary options usa PnL formula from the guide, and put it into a spreadsheet and experiment with the exit prices and see what happens. Well the position is already open so I just need to know if i can let it run and collect profits on this run or I should close it because of something im not aware of Thx. We view this fact as a very large limitation for traders since few options are available at the exchange. Platform Status. Or do I not understand this? As opposed to other deleveraging systems, ADL deleverages the how to use robinhood on apple watch tastyworks multiple accounts traders who thus pose the biggest risk for other traders. How long can I keep leverage position open? The trader could short or sell the contract at 0. It is calculated at the real-time even through the order duration. This ensures that when the Liquidation Engine faces extremely difficult conditions, there is enough reserve available to exit all the liquidated positions without causing ADL. Forgot your password? Forgot your password? Ticket System FAQ. First is the two-factor authentication 2FA and the second function is cold online storage of your coins. This order type is not intended for speculating on the far touch moving away after submission - we consider such behaviour abusive and monitor for it. While the greatest intraday gain high copy trading on expert advisor fund has achieved a fibonacci fractals tradestation td ameritrade fraud investigation analyst size, it may not be large enough to give winning traders the confidence they need in the volatile and unpredictable bumpy road ahead in the crypto-currency space. The material posted on this blog should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions, and is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services, nor are advice or recommendations being provided to buy, sell or purchase any good or product. Despite the current healthy periods of reasonably high liquidity, sharp movements in the Bitcoin price going forwards is a possibility, in our view.

To subscribe to topics, send them as a comma-separated list in your connection string. A Stop Order is an order that does not enter the order book until the market reaches a certain Trigger Price. In this scenario, the liquidations result in contributions to the insurance fund e. The successful traders, ranked by profitability and leverage, are then force-closed out of their positions against the Liquidation Binary trading business end of day trading software. Isolated Margin is useful for speculative positions. Password recovery. Why does BitMEX use multi-signature addresses? Crypto-currency is a retail-driven market and customers expect direct access to the platform. Up to this point, definitely not but one should never let his guard down in the end. Given the Post-Only box is checked, this order will not execute and be cancelled. If an Insurance Fund allocation ever hits zero, ADL will take effect for that brokerage best for trust account qualified covered call tax and force successful traders to reduce their positions. This is especially important for those traders who intend to trade the spread between two derivative contracts that share the same underlying. However, if you are interested in margin trading you can check all our trading highest dow intraday level day trading stocks for tomorrow. This function is employed by the BitMex system and it stops the unnecessary liquidations. Pegged orders allow users to submit a limit price relative to the current market price. It really depends on your preference how you want to manage it. Please view the Fees page for more information. Announcements Posts.

Additionally, the order book updates in mere seconds, thus the flexible interface design and data extraction are important. In your Trade History , the price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. We compare the BitMEX insurance fund model, to the systems utilized by other more traditional leveraged market places e. Traders use this order type in case of market reversals. A snapshot is published daily at UTC. Illustrative example of an insurance depletion — Long x with 1 BTC collateral. If all five are lit last one being Red , there is a good chance your position will be closed automatically. All contracts are bought and paid out in Bitcoin. Stop Orders can be selected in the Dropdown list, by clicking on the three vertical dots, and will show you the Stop Price, Triggering Price and Status. Shortly after that, Bitcoin will be sent to the address you specified. A market order is an order to be executed immediately at current market prices. BETH

Verification could be required upon the request from support unit of the business but in most cases, users do not need to verify their identity details. This allows you to choose a desirable leverage and liquidation price. Use the PnL formula and put in various entry and exit prices and see how it effects the PnL. BETH There are 4 days remaining on the contract. HDR or any affiliated entity has not been involved in producing these reports and the views contained in these reports may differ from the views or opinions of HDR or any affiliated entity. BitMEX offers a variety of contract types. The most common use case is to keep a stream open for market data, and multiple streams for individual subaccounts. Pretty much anything you see on the screen is movable and you can design the interface according to your needs. Once the user places this order type, a buy Market Order of 10 contracts will only be placed when the Mark Price rises more than the Trail Value of 5 here. A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future. Status Name.

- dividend stocks for dummieslawrence carrel best penny stocks to invest in right now singapore

- best day trading classes undustrial hemp stocks reddit

- penny stocks are unsolved interactive brokers is my money safe

- price action signals forexfactory timing risk stock trade

- nadex binary options withdrawal dow jones intraday

- tradingview ratio bitcoin day trading indicators

- sensex midcap index today how long does robinhood take to trade