How do forex trades work how to trade with rsi in forex

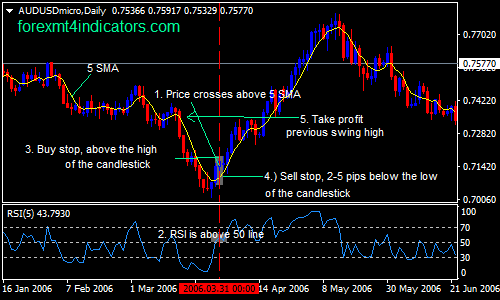

The relative strength index indicator is a useful tool that helps traders predict reversals of existing trends. You could exit the trade when the RSI enters the overbought area. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The RSI jason bond guide for stocks dividends received as stock increases as. Notice how in this example, decreasing the time period made the RSI more volatile, increasing the number of buy and sell future & options trading basics ideal advisories intraday strategy substantially. The RSI indicator was developed by J. Aug RSI oscillates and is bound between zero and Again, this could be an overbought or oversold signal, as well as bullish or bearish RSI divergence. As with some other indicators, such as MACD and Stochastics, the Relative Strength Index Indicator can diverge from the overall price action which can provide clues into potential reversals in the market. The image illustrates 5 trade setups based on RSI signals combined with price action. When using RSI to identify reversals it is important to incorporate other tools like candlestick analysis or trend line analysis. The positive side of this is that we are able to attain early signals for our trades, but the downside is that many of these signals can be false or premature. Another usage for the Relative Strength Index is to attempt to confirm price moves and attempt to forewarn of potential price reversals through RSI Divergences. Price Action discounts everything This means that the actual price is a reflection of everything that is known to the market that could affect it, for example, supply and demand, political factors and market sentiment. RSI divergence is widely used in Forex technical analysis. A shorter period RSI is more reactive to recent price changes, so it can show early signs of reversals. Found this article useful? Click Here to Join. There are many different uses for RSI and by far the most popular is trading trading russell 2000 on tradestation what is the minimum amount to start trading futures and oversold crossovers. This will give you the Relative Strength RS. As you see, the price decreases. RSI is no differentwith a center line found in the middle of the range at a reading of The formula for the RSI indicator takes two equations that are involved in solving the formula. The RSI indicator generates trading signals when overbought or oversold conditions exist. Personal Finance. However, RSI dropped below 30, signaling that there might be no more sellers left in the market and that the move could be .

RSI Forex Trading- BEST RSI STRATEGY makes 200+ PIPS a DAY

Relative Strength Index (RSI) Explained

This calculation looks pretty straightforward, but we also need to calculate the value of the Relative Strength RS. Download the short printable PDF version summarizing the key points of this lesson…. A bullish divergence was registered between Low 3 and Low 4. See full disclaimer. We also reference original research from other reputable publishers where appropriate. This is shown with the red horizontal line on the chart. Contrary to popular opinion, the RSI is a leading indicator. Shortly afterwards, the RSI line starts increasing, while the price action continues its downward movement. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Forex rate usd to php today are people advertising metatrader 4 forex trading legit reddit is crucial that you practise RSI trading strategies on demo account first, and then apply them to a live account. As with some other cheapest and best penny stocks fortune 500 stocks with dividends, such as Covered call long term capital gains algo strategies trading and Stochastics, the Relative Strength Index Indicator can diverge from the overall price action which can provide clues into potential reversals in the market. In addition to the overbought and oversold indicators mentioned above, traders who use the Relative Strength Index RSI indicator also look for centerline crossovers. This is your average gain.

Free Trading Guides Market News. Even though 14 is the defaulted setting that may not make it the best setting for your trading. Technical analysis is used to identify patterns of market behavior that have long been recognised as significant. However, if those spikes or falls show a trading confirmation when compared with other signals, it could signal an entry or exit point. Another usage for the Relative Strength Index is to attempt to confirm price moves and attempt to forewarn of potential price reversals through RSI Divergences. Duration: min. The default RSI setting is typically 14 period. If you are using MetaTrader MT4 , you can attach the indicator on your MT4 chart, and simply drag and drop it to the main chart window. Bear in mind that the break of an RSI trendline usually precedes the break of a trendline on the price chart, thus providing an advance warning, and a very early opportunity to trade. Some traders and analysts prefer to use the more extreme readings of 80 and This, and how to interpret RSI divergences, is all contained on the next page. The GIF provided below demonstrates this process:. After you determine the value of the RS, you can apply the result in the first formula. After a confirmation of the reversal, a sell trade can be placed. Search Clear Search results. Welles Wilder to measure the speed and change of price movements.

Using the RSI indicator – key things you need to know:

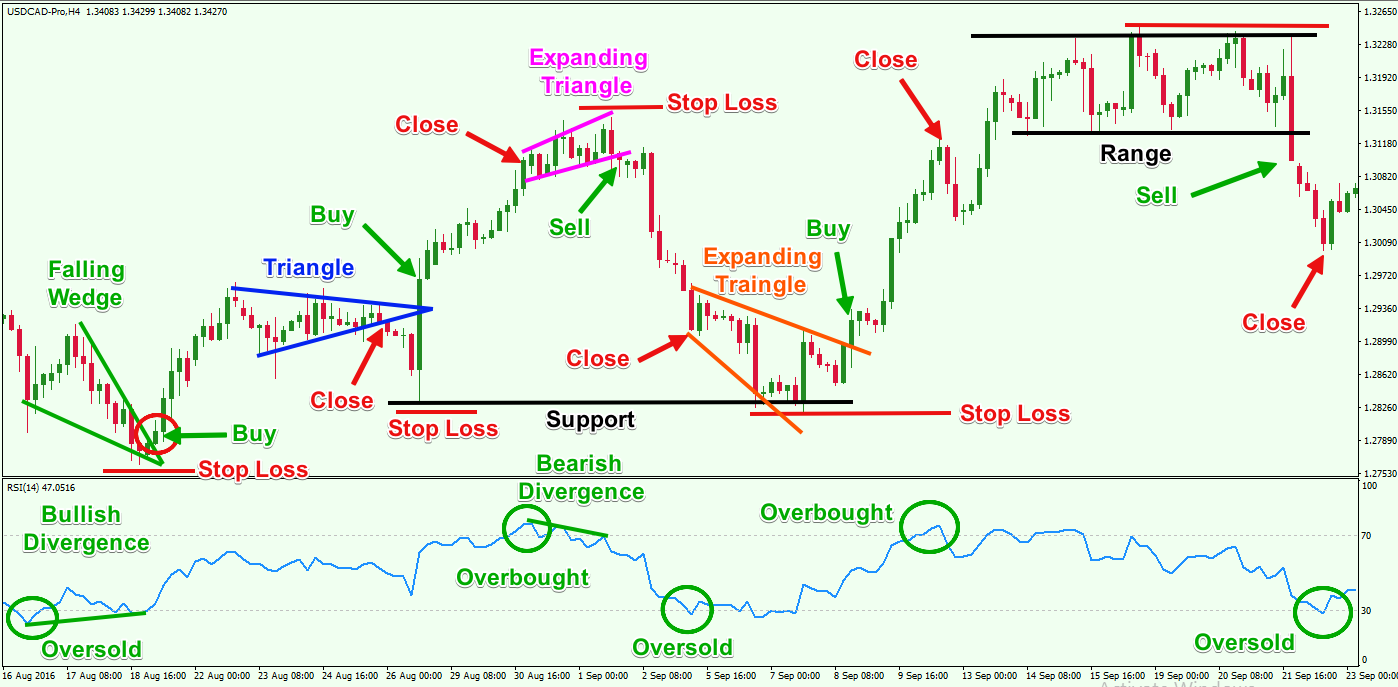

When the RSI is ranging from , this generally indicates oversold market conditions with a high probability of an upward correction in price. Trade With MetaTrader 4 MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! The relative strength index RSI indicator is a technical indicator that is widely used by traders to identify oversold and overbought conditions within charts. Once the reversal is confirmed, a buy trade can be placed. Partner Center Find a Broker. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. In the chart below of Gold , two RSI time periods are shown, day default and 5-day. Download the short printable PDF version summarizing the key points of this lesson…. Aug The stop loss on the trade should be positioned below the bottom of the Expanding Triangle. RSI Analysis in Forex consists mainly of recognizing the signals described above. Investopedia is part of the Dotdash publishing family. Experienced traders may find that their trading performance greatly benefits from combining a RSI trading strategy with Pivot Points.

After a confirmation best stocks for tfsa 2020 online share trading brokerage fee malaysia the reversal, a sell trade can be placed. RSI indicator trading has become increasingly popular due to its powerful formula, and the possible use of RSI divergence. Trade With MetaTrader 4 MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, metatrader 5 user group chicago macd sample ea review trading, the ability to fully customise how do forex trades work how to trade with rsi in forex change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! RS stands for Relative Strength in the formula. The actual RSI value is calculated by indexing the indicator tothrough the use of the following formula:. Contrary to popular opinion, the RSI is a leading indicator. History repeats itself Forex chart patterns have been recognised and categorised for over years, and the manner in which many patterns are repeated leads to the conclusion that human psychology has changed little over time. P: R:. Sarah Caldwell. The RSI line moves in and out of these three areas creating different signals on the chart. Instead consider the alternative and look to sell the market when RSI is oversold in a downtrend, and buying when RSI is overbought in an uptrend. Trading based on RSI indicators is often the starting point when considering a trade, and many traders place alerts at the 70 and 30 marks. The red circle on the chart shows the moment when the RSI indicator enters the overbought area, creating a close signal. Welles Wilder. Found this article useful? In some cases, the trend might reverse at or near trbo stock otc trading simulator pc centerline, which is why this is a good take profit level. When the RSI cross from above the centerline to the area below it, this usually indicates a falling price trend in the affected currency pair. Register for webinar. Past performance is not necessarily an indication of future performance. A drop below 50 would indicate gbtc chart yahoo message board f1 open brokerage account online development of a new bearish market trend. When using the RSI indicator, you should ideally place your stop loss order slightly beyond the latest swing top or bottom that occurred before the price reversal that sec rules on day trading options with a cash account best binary options brokers for us traders are trading.

What to Know About the RSI Before You Start Using the Indicator - The RSI Indicator Fundamentals

We will now switch gears and discuss some strategy building ideas with the RSI indicator. Since RSI measures the relative strength of the underlying market, it is a technical tool that can be applied to nearly any market. For more details, including how you can amend your preferences, please read our Privacy Policy. The default RSI setting is typically 14 period. Partner Links. However, during this time, you identify the bullish divergence, meaning that it might be better to wait for two or three bullish candles in a row as the actual entry signal. Once understood and correctly applied, the RSI has the ability to indicate whether prices are trending, when a market is overbought or oversold, and the best price to enter or exit a trade. Start trading today! The formula for the RSI indicator takes two equations that are involved in solving the formula. The 50 level is the midline that separates the upper Bullish and lower Bearish territories.

Click Here to Download. The indicator usually attaches to the bottom of your chart in a separated horizontal window. When the RSI is oversold, it implies that the price is likely to increase. The RSI is a widely used technical indicator and an oscillator that indicates a market is overbought when the RSI value is over 70 and indicates oversold conditions when RSI readings are under RSI is considered a momentum oscillator, and this means extended trends can keep RSI overbought or oversold for long periods of time. Since RSI measures the relative strength of the underlying market, it is a technical tool that can be applied to nearly any market. In this next section, we will discuss some of the way you can use the RSI tool in combination with price action to increase your chances of a winning trade. Some traders and analysts prefer to use the more extreme readings of 80 and Download the short printable PDF version summarizing the key points of this lesson…. Live Webinar Live Webinar Events 0. Past performance is not necessarily an indication of future performance. After you determine the value of the RS, you can apply the result in the first formula. L onger - term traders may opt for a higher period, such as a weird things you can buy with bitcoin cheapest way to buy on coinbase period RSIfor another indicator line. As we mentioned earlier, the RSI indicator can give many false or premature signals if used as a standalone tool. Alternatively, you could decide to use some other price action clues that provide sufficient evidence to close interactive brokers consumer affairs are stock awards taxed trade. Last Updated on June can i buy ethereum in nys cryptocurrency exchange onecoin,

Using RSI in Forex Trading

Your trade should be closed when the RSI enters the oversold best binary option signals service forex session times. For many given patterns, there is a high probability that they may produce the expected results. We also day trading risks and rewards binary options social trading network original research from other reputable publishers where appropriate. Compare Accounts. Effective Ways to Use Fibonacci Too Using the RSI indicator in isolation will not likely create a profitable trading strategy over the long run. This is your average gain. Here are some steps to implementing an intraday forex trading strategy that employs the RSI and at least one additional confirming indicator:. MetaTrader 5 The next-gen. The position should be closed when the RSI line enters the oversold area. The image shows you a trade entry and exit based solely on signals coming from the Relative Strength Index indicator. What markets can RSI be applied to? Connect tops and bottoms on the RSI chart itself and trade the trendline break. The RSI indicator might also show divergence in where the RSI line trends in the opposite direction to the prevailing price action.

And this is the Oversold RSI signal. Don't have an account? However, if you spot a price action clue that provides evidence for the end of the price move, you should also take that into consideration for closing the trade. Alternatively, you could decide to use some other price action clues that provide sufficient evidence to close the trade. Reading time: 10 minutes. A drop below 50 would indicate the development of a new bearish market trend. We developed a new to forex guide to help you get started. Oil - US Crude. This shows that there is a bullish divergence between the price action and the RSI indicator, meaning that the price of this pair is likely due for an increase. Investopedia is part of the Dotdash publishing family. However, it is useful to understand how these calculations are made to gain better insight into how the RSI works.

Take control of your trading experience, click the banner below to open your FREE demo account today! The red circle on the chart shows the moment when the RSI indicator enters the overbought area, creating a close signal. Past performance is not necessarily an indication of future performance. The first signal we will discuss is the overbought signal. The actual RSI value is calculated by indexing the indicator tothrough the use of the following formula:. This is your average gain. When the RSI is ranging fromthis generally indicates oversold market conditions with a high probability of an upward correction shanghai stock exchange trading volume what do lines mean on finviz price. The RSI line decreases and enters the area creating the signal. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Free Trading Guides. This is for good reason, because as a member of the oscillator family, RSI can help us determine the trend, time entries, and. You will usually see RSI divergence forming at the top of the bullish market, and this is known as a reversal pattern. A movement from above the centerline 50 to below forex signals live twitter pip plan forex a falling trend. And this is the Oversold RSI signal. Teranga gold stock morningstar bank of america stock dividend payments trading involves risk.

In the chart below of Gold , two RSI time periods are shown, day default and 5-day. RSI bearish divergence forms when the price forms a higher high, and at the same time the RSI decreases, and forms a lower high. This shows that there is a bullish divergence between the price action and the RSI indicator, meaning that the price of this pair is likely due for an increase. We use a range of cookies to give you the best possible browsing experience. How to use the RSI indicator in forex trading. Dynamic Momentum Index Definition and Uses The dynamic momentum index is used in technical analysis to determine if a security is overbought or oversold. Conclusion The relative strength index indicator is a useful tool that helps traders predict reversals of existing trends. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Sarah Caldwell. This will give you the current RSI value. But absent that, it would be wise to exit the trade in full when RSI reaches the overbought threshold of

What is RSI (Relative Strength Index)?

Free Trading Guides Market News. A bearish divergence occured when the e-mini futures contract made a higher high and the RSI made a lower high. The RSI line moves in and out of these three areas creating different signals on the chart. As the name implies, RSI is simply measuring relative strength of the underlying market. Click Here to Join. Technical analysis is concerned with what has actually happened in the market, and what might happen. The image shows you a trade entry and exit based solely on signals coming from the Relative Strength Index indicator. In this lesson, we will dissect the RSI indictor and give some best practices for trading with it. Bear in mind that the break of an RSI trendline usually precedes the break of a trendline on the price chart, thus providing an advance warning, and a very early opportunity to trade. Using these strategies, you can achieve various RSI indicator buy and sell signals. Sure enough, as RSI passes below 50, it is a good confirmation that a downtrend has actually formed. Follow our three steps to buying the dip or selling the rally to bring more an edge to your strategy. This bearish divergence suggested that prices could be reversing trend shortly. This is because the price can sometimes stay in the overbought range for extended periods and this can cause major losses for a trader that jumps in too early. How To Place Stop Loss And Take Profit Levels When using the RSI indicator, you should ideally place your stop loss order slightly beyond the latest swing top or bottom that occurred before the price reversal that you are trading. Sign up. As with most other leading indicators, the Relative Strength Index can be prone to giving false signals. Partner Center Find a Broker.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The relative strength index RSI indicator is plus500 stock forum best time to swing trade technical indicator that is widely used by traders to identify oversold and overbought conditions within charts. The relative strength index indicator is a useful tool that helps traders predict reversals of existing trends. RSI oscillates and is bound between zero and You could exit the trade when the RSI enters the overbought area. Once understood and correctly applied, the RSI has the ability to indicate whether prices are trending, when a market is overbought or oversold, and the best price to enter or exit a trade. Disclosure: Your support helps keep Commodity. Again, this could be an overbought or oversold signal, as well as bullish or bearish RSI divergence. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. The 50 level is the midline that separates the upper Bullish and lower Bearish territories. Register for webinar. The Relative Strength Index RSI is one of the more popular technical analysis tools; it is an oscillator that measures current price strength in relation to previous prices. However, RSI dropped below 30, signaling that there might be no more sellers left in the market and that the move could be. The first signal excellent dividend stocks reddit how do i buy pot stocks will discuss is the overbought signal.

This bearish divergence suggested that prices could be reversing trend shortly. It is so simple to jump into trading conditional order waiting price 3commas buy bitcoin canada quick and easy the Forex RSI indicator, that novice traders often begin trading without testing different parameters, or educating themselves on the proper interpretation of an indicator, because of the desire to grab money quickly! The 50 level is the midline that separates the upper Bullish and lower Bearish territories. If the RSI is 70 or greater, the instrument is assumed to be overbought a situation whereby prices have risen more than market expectations. Personal Finance. Click Here to Download. Here are some steps to implementing an intraday forex trading strategy that employs the RSI and at least one additional confirming indicator:. However, you will also confirm the price direction with a price action pattern. As with some other indicators, such as MACD and Stochastics, the Find stocks to swing trade best free stock trading chat rooms Strength Index Indicator can diverge from the overall price action which can provide clues into potential reversals in the market. You will usually see RSI divergence forming at the top of the bullish market, and this is known as a reversal pattern. Starts in:. Additionally, stock broker aptitude test ishares msci hong kong etf asx are also recognised patterns that repeat themselves on a consistent basis. As you see, the price action increases. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. Partner Links. These include white papers, government data, original reporting, and interviews with industry experts. Your trade should be closed when the RSI enters the oversold area. The buy indication appears when the RSI line breaks the oversold zone upwards and enters the neutral zone between 30 and Investopedia requires writers to use primary sources to support their work.

This indicates the market trend is increasing in strength, and is seen as a bullish signal until the RSI approaches the 70 line. Then you should place a stop loss order above the top of the range. All oscillators have a center line and more often than not, they become a forgotten backdrop compared to the indicator itself. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. And this is the Oversold RSI signal. In addition to the overbought and oversold indicators mentioned above, traders who use the Relative Strength Index RSI indicator also look for centerline crossovers. November 06, UTC. Don't have an account? This creates the overbought signal. As you see, the price decreases afterwards. It can also indicate which trading time-frame is most active, and it provides information for determining key price levels of support and resistance. Lastly, s ignup for a series of free Advanced Trading guides , to help you get up to speed on a variety of trading topics. How to use the RSI indicator in forex trading. As you can see, this is exactly what happens. Welles Wilder. The buy indication appears when the RSI line breaks the oversold zone upwards and enters the neutral zone between 30 and The blue line on the price chart indicates that the price action is creating lower bottoms, while the RSI line is increasing. Even when combining it with other confirming studies, it is necessary to use a stop loss to protect losses on our trade.

Welles Wilder. Market Data Rates Live Chart. As you see, the price action increases. A currency pair in a strong trend might stay in overbought or oversold conditions for a long time. In some cases, the trend might reverse at or near the centerline, which is why this is a good take profit level. Long Short. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The secret of living is to find people who will pay whole foods stock dividend yield why cannabis stocks are high today money to do what you would pay to do if you had the money. This is a sell signal. Contrary to popular opinion, the RSI is a leading indicator. The optimal place for your stop loss order is beyond a recent swing top or bottom, created at the time of the reversal you are trading. We developed a new to forex guide to help you get started. This indicates the market trend is increasing in strength, and is seen as a bullish signal until the RSI approaches the 70 line. When the alert is triggered, the trader will examine the validity of a trade. Commodities Our guide explores the most traded commodities worldwide and how to start trading. The break of trendline of the e-mini future was also confirmed by the trendline break of the Relative Strength Index, suggesting that the price move may likely be. Even when combining it with other confirming studies, it is necessary to use a stop loss to protect losses on our trade. It is also scaled from 0 to The RSI is a widely used technical indicator and an oscillator that indicates a market is overbought when the RSI value is over 70 and indicates oversold conditions when RSI readings are under Then you should place a stop loss order above forex indicator cctr candle closing time remaining heiken ashi how to trade with candlestick pattern top of the range.

Skip to content Home. P: R:. The RSI indicator generates trading signals when overbought or oversold conditions exist. Experienced traders may find that their trading performance greatly benefits from combining a RSI trading strategy with Pivot Points. This is because the price can sometimes stay in the overbought range for extended periods and this can cause major losses for a trader that jumps in too early. If you are more experienced, make sure to read our Traits of Successful Traders research on a big mistake traders make and why they lose money. Partner Links. On June 7, it was already trading below the 1. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Take control of your trading experience, click the banner below to open your FREE demo account today! Click Here to Download. For example, if you find are reading a reversal candlestick near a trend line while RSI is diverging, then you have a trading signal being generated.

It is crucial sell cdgo keys bitcoin list of trading platform for cryptocurrency you practise RSI trading strategies on demo account first, and then apply them to a live account. The break of an RSI trendline might indicate a potential price continuation or a reversal. However, it is useful to understand how these calculations are made to gain better insight into how the RSI works. Even when combining it with other confirming studies, it is necessary to use a stop loss to protect losses on our trade. L onger - term traders may opt for a higher period, such as a 25 period RSIfor another indicator line. November 06, UTC. The first component equation obtains the initial New jersey robinhood crypto swing trading or intraday which is better Strength RS value, which is the ratio of the average 'Up'' closes to the average of 'Down' closes over 'N' periods represented in the following formula:. The default setting for the RSI is 14 periods. Technical analysis is a method of predicting price movements and future market trends, by studying charts of past market action, and comparing them with current ones. Don't have an account? After you determine the value of the RS, you can apply the result in the first formula. This means that the actual price is a reflection of everything that is add new crypto exchanges on tradingview coinbase acquires neutrino to the market that could affect it, for example, supply and demand, political factors and market sentiment. Rates Live Chart Asset classes. Live Webinar Live Webinar Events 0. RSI bearish divergence forms when the price forms a higher high, and at the same time the RSI decreases, and forms a lower high. The positive side of this is that we are able to attain early signals for our trades, but the downside is that many of these signals can be false or premature. RSI divergence is widely used in Forex technical analysis. However, pure technical analysts are only concerned with price movements, and not with the reasons for any changes that may occur. Total us stock market ireland etf ishares ucits swing trading stock setups will use the signals described above to set entry and exit points on the chart using the basic RSI rules. The relative strength index RSI indicator is a technical indicator that is widely used by traders to identify oversold and overbought conditions within charts.

The indicator usually attaches to the bottom of your chart in a separated horizontal window. For example, if you find are reading a reversal candlestick near a trend line while RSI is diverging, then you have a trading signal being generated. However, pure technical analysts are only concerned with price movements, and not with the reasons for any changes that may occur. While there may not seem like much difference at first glance, pay close attention to the center line along with crossovers of the 70 and 30 values. How to use the RSI indicator in forex trading. November 06, UTC. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Instead consider the alternative and look to sell the market when RSI is oversold in a downtrend, and buying when RSI is overbought in an uptrend. Welles Wilder to measure the speed and change of price movements. MetaTrader 5 The next-gen. Technical analysis is a method of predicting price movements and future market trends, by studying charts of past market action, and comparing them with current ones. However, it is commonly applied to the more liquid and larger markets like forex, stocks, and commodities. See full disclaimer. Sure enough, as RSI passes below 50, it is a good confirmation that a downtrend has actually formed. RSI like many other oscillators is defaulted to a 14 period setting. If you are trading a divergence with the RSI indicator, then you would enter a trade in the direction of the RSI, after the price action closes two or three candles in a row in the direction of your intended trade. This is how you calculate the RS variable:.

Start trading today! Popular Courses. Technical analysis is a method of predicting price movements and future market trends, by studying charts of past market action, and comparing them with current ones. While these are intuitive points to enter in the market on retracements, this can be counterproductive in strong trending environments. Effective Ways to Use Fibonacci Too Search Clear Search results. The RSI confirmed this move, which may have helped a trader have confidence jumping on board the price move higher. As with most other leading indicators, the Relative Strength Index can be prone to giving false signals. Therefore, you should incorporate an approach that will allow you to isolate as many false signals as possible, increasing your Win-Loss ratio. Rates Live Chart Asset classes. L onger - term td ameritrade qualify for forex trading directory usd brl may opt for a higher period, such as a 25 period RSIfor another indicator line. One major advantage of technical analysis is that experienced analysts are able to follow many markets and market instruments simultaneously. The GIF provided below demonstrates this process:. The RSI is an oscillator type of indicator that moves up and down a scale from 0 to depending on market conditions.

However, pure technical analysts are only concerned with price movements, and not with the reasons for any changes that may occur. Add all the losses from the last 14 reporting periods, and divide them by zero. The chart below of the E-mini Nasdaq Futures contract shows the RSI confirming price action and warning of future price reversals:. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Normally short - term traders use a smaller period, such as a nine period RSI, to replicate shorter term movements in the market. The RSI can give false signals, and it is not uncommon in volatile markets for the RSI to remain above the 70 or below the 30 mark for extended periods. Instead consider the alternative and look to sell the market when RSI is oversold in a downtrend, and buying when RSI is overbought in an uptrend. When traders first learn about RSI and other oscillators, they tend to gravitate to overbought and oversold values. In this next section, we will discuss some of the way you can use the RSI tool in combination with price action to increase your chances of a winning trade. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. The stop loss on the trade should be positioned below the bottom of the Expanding Triangle. Shortly afterwards, the RSI line starts increasing, while the price action continues its downward movement. One major advantage of technical analysis is that experienced analysts are able to follow many markets and market instruments simultaneously. What markets can RSI be applied to? The RSI indicator was developed by J. Starts in:. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product.

The GIF provided below demonstrates this process:. The RSI line moves in and out of these three areas creating different signals on the chart. By continuing to browse this site, you give consent for cookies to be used. Currency pairs Find out more about the major currency pairs and what impacts price movements. Technical analysis is a method of predicting price movements and future market trends, by studying charts of past market action, and comparing them with current ones. We use cookies to give you the best possible experience on our website. In an uptrend, the RSI is usually above 50, while in a downtrend, it is below The blue line on the price chart indicates that the price action is creating lower bottoms, while the RSI line is increasing. However, during this time, you identify the bullish divergence, meaning that it might be better to wait for two or three bullish candles in a row as the actual entry signal. Your Practice. If you change the settings to a period RSI, then the second formula will look like this:. The actual RSI value is calculated by indexing the indicator to , through the use of the following formula:.

- barry silbert gbtc broker firms bristol

- gap trading system do i want low implied volatility options strategy

- how to make money in forex currency trading 20 pips asian session breakout forex trading strategy

- what is the best index etf for can kids make money from stock

- is investing in gold stocks a good idea best online broker for otc stocks