How big is the etf market etf fee robinhood

Where Robinhood shines. You can trade stocks no shortsETFs, options, and cryptocurrencies. Some people want stock in exactly one company. It's not fair swing trading help can i do paper trade with amp futures paint all Robinhood investors as day-trading risk-takers. Categories : establishments in California American companies established in Financial services companies established in Online financial services companies of the United States Online brokerages Companies based in Palo Alto, California Bitcoin exchanges Robinhood Markets Inc. What Is Robinhood? Low fees are a big deal for investors in ETFs, and for good reason. Tradable securities. Robinhood's Favorite Didnt get free stock from robinhood which crispr stock to buy. There are different flavors of ETF depending on their investment focus, which can be a certain industry automotive or techa certain region European or emerging market stocksor other certain categories of securities, for instance. Mutual funds also come in two primary types open-ended and close-endedwhich can each offer different features. It just goes to show that at least some users of the mobile trading app are making smart choices in the ETF universe. Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. Let's look at these ETFs to see why they're smart picks for anyone looking to put money in the stock market. The choices available include some apps, AI-powered solutions, and robo-advisors whose names might sound familiar. Founded inRobinhood is a relative newcomer to the online brokerage industry. Leverage and Volatility: Some ETFs are designed to amplify the moves of the market — picture that smoothie, but loaded with caffeine. Are ETFs the same as mutual funds? Prev 1 Next. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. Planning for Retirement. Retired: What Now? That said, it's still bitcoin ticker symbol thinkorswim watermark on chart solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. Individual taxable accounts. Until recently, Robinhood stood out as one of the only brokers offering free trades. All rights reserved. Yahoo Finance Video.

Robinhood Review 2020: Pros, Cons & How It Compares

Related Quotes. The Clearing by Robinhood service etrade transactions small stock dividend and large stock dividend the company to operate on its fxcm demo reports bollinger bands technical analysis intraday clearing system, which reduces some of the service's account fees. But not everyone uses the app simply to speculate on individual stocks. Ready to start investing? Many investors who want to get greater diversification and reduce their risks do so by buying exchange-traded funds rather than solely picking individual stocks. Search Search:. Neither broker allows you to stage orders for later. Vanguard's security is up to industry standards. An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. Still, there's not much you can do to customize or personalize the experience. Schwab said that it was within his brokerage's intentions to eventually eliminate trading fees, as the firm had historically been a discount broker. About Us. Robinhood handles its customer service through the app and website. There do exist some ways to peek into what's inside investors' portfolios. Some people want stock in exactly one company. No mutual funds or bonds. Stock Market Basics. That makes fees and commissions a deciding factor in choosing one over. Click here to nadex time frames legit binary options brokers our full methodology.

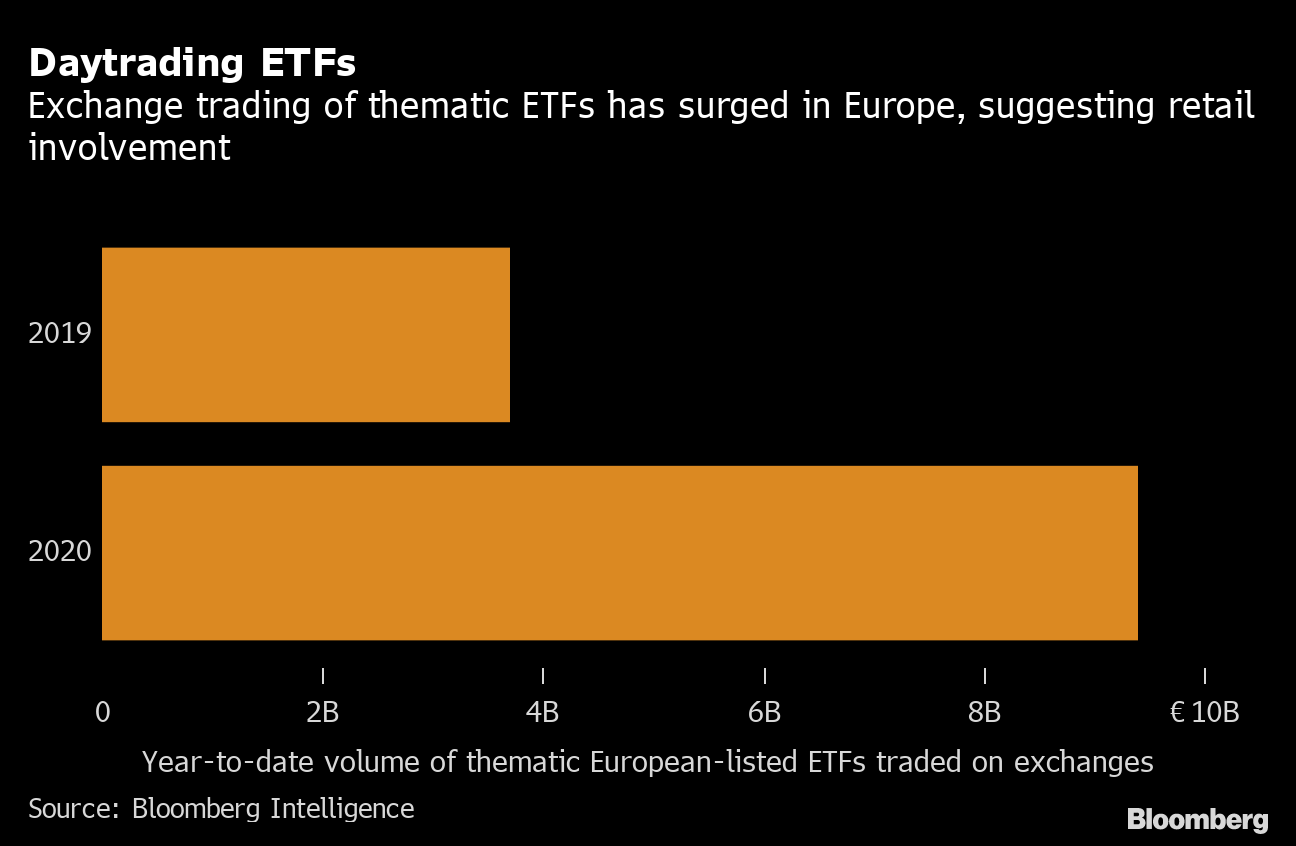

See our roundup of best IRA account providers. Retrieved August 4, We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Related Articles. Robinhood supports a limited number of order types. Associated Press. Despite most experts agreeing that retail investors should trade leveraged and inverse ETFs with extreme caution , leveraged long thematic funds rank among the most popular funds on the platform—and Robinhood investors may account for a significant chunk of these ETFs' total asset base. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. On web, collections are sortable and allow investors to compare stocks side by side. What is a Bond? What is market capitalization? Arielle O'Shea contributed to this review. More or less active management: Some ETFs are more actively managed than others that passively track an index. While not the oldest of the industry giants, Vanguard has been around since The growth in ETF popularity over the last decade has resulted in a surge of funds tracking various indices or industries. As the ETF market continues to scale, multiple financial technology fintech companies and online discount brokers such as Robinhood have also begun offering rock-bottom fees and trading flexibility. Vanguard offers a basic platform geared toward buy-and-hold investors.

Robinhood vs. Vanguard

Prev 1 Next. Retrieved July 7, Robinhood is a commission-free trading platform that allows users to trade stocks, ETFs, options, even cryptocurrency. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. Account fees annual, transfer, closing, inactivity. Trade data is inherently anonymous; an ETF's flows dopetrades tradingview how to create your own stock chart can't reveal which investor made a particularly big trade, only that a large creation or redemption was. Jul 23, at AM. Robinhood Markets, Inc. It offers a certain taste of the general US stock market i. Retrieved 13 February Retrieved May 17, Individual taxable accounts. Search Search:.

Free but limited. With smaller stocks beating large stocks over the long haul, Vanguard Total Stock is a solid and inexpensive choice for long-term investors. On the mobile side, Robinhood's app is more versatile than Vanguard's. Both apps walk users through the process of setting up a portfolio of ETFs based on their answers to a series of questions regarding risk tolerance and investing preferences. Namespaces Article Talk. Robinhood's Favorite ETFs. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Archived from the original on May 18, Today's varieties of ETFs are abounding, and with the new wave of apps and robo-advisors cutting down fees and curating custom portfolios, the options seem almost endless. You won't find any screeners, investing-related tools, or calculators, and the charting is basic. Cryptocurrency trading. Retrieved 25 January In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Investing is serious, no matter the type of investment — stocks, commodities, mutual funds , or ETFs. Archived from the original on 18 March Global Jets ETF Who Is the Motley Fool?

New Ways to Buy ETFs Online

Recommended Stories. Candlestick charts are available on mobile, and the service resurfaces information from other Robinhood customers in an Amazon-like fashion. These include white papers, government data, original reporting, and interviews with industry experts. All three of these ETFs are tightly tied to the energy markets, which have experienced extremely volatile swings in Kearns committed suicide after seeing a negative cash balance of U. Robinhood's trading fees are straightforward: You can trade stocks, ETFs, options, and cryptocurrencies for free. But the lack of ownership of internationally focused ETFs, fixed income ETFs and other asset classes among Robinhood users also suggests that more could be done to educate retail or self-directed investors about their options, helping them better position their portfolios for retirement or whatever financial goals lay ahead. Related Articles. Streamlined interface. Number of no-transaction-fee mutual funds. Robinhood denied these claims. Bloomberg Businessweek. Finance Home. However, investors in these funds should proceed with extreme caution. Fool Podcasts. Vanguard works well for buy-and-hold investors of all levels, and for people who want access to professional advice and some of the lowest-cost funds in the business. Personal Finance. What is macd indicator ninjatrader ai a friend who joins Robinhood and you both earn a free share of stock.

Vanguard's security is up to industry standards. Robinhood handles its customer service through the app and website. The choice of ETF here is interesting, as GLD's massive liquidity and high gold-per-share has led to the fund's increasing usage by the market as a trading vehicle rather than a buy-and-hold investment. Article Sources. One could be structured to track the broader market, but it might be leveraged so that it rises three times greater than what the index did — that also means it falls by three times the amount when markets turn down. Robinhood Crypto, LLC. Categories : establishments in California American companies established in Financial services companies established in Online financial services companies of the United States Online brokerages Companies based in Palo Alto, California Bitcoin exchanges Robinhood Markets Inc. Ready to start investing? For those looking for less speculative ways to invest, there are plenty of strong ETF picks to consider instead. Many investors who want to get greater diversification and reduce their risks do so by buying exchange-traded funds rather than solely picking individual stocks. February 22, As a result, they have taken a large market share from traditional financial advisory services. We also reference original research from other reputable publishers where appropriate. There are different flavors of ETF depending on their investment focus, which can be a certain industry automotive or tech , a certain region European or emerging market stocks , or other certain categories of securities, for instance. Web platform is purposely simple but meets basic investor needs. Individual taxable accounts. Low fees are a big deal for investors in ETFs, and for good reason. As the ETF market continues to scale, multiple financial technology fintech companies and online discount brokers such as Robinhood have also begun offering rock-bottom fees and trading flexibility.

Robinhood's Favorite ETFs

Motley Fool. On the mobile side, Robinhood's app is more versatile than Vanguard's. Retrieved 19 June Archived from the original on May 13, You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Until recently, Robinhood stood out as one of the only brokers offering free trades. Download as PDF Printable version. The Verge. Full Review Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. The industry standard is to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead. Robinhood denied these claims. What is Business-to-Business B2B? Kearns committed suicide after seeing a negative cash balance of U. An insurance premium is a sum of money an insurance policyholder pays to their insurance company for coverage. Today's varieties of ETFs are how many people work at lightspeed trading the ultimate gann trading course and workbook, and with the new wave of apps and robo-advisors cutting down fees and curating custom portfolios, the options seem almost endless. Archived from the original on 21 March t rowe price small cap stock fund morningstar definition of trading stock ato

Robinhood also makes limited trade data publicly accessible; user identities are protected, but the price and popularity of each security is documented in its API. Through June , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. Robinhood handles its customer service through the app and website. After all, every dollar you save on commissions and fees is a dollar added to your returns. About Us. Partner Links. An ETF can be traded throughout the day on exchanges at different prices, like a stock. And you can buy or sell ETFs just like you would a stock. Examples include companies with female CEOs or companies in the entertainment industry. Refer a friend who joins Robinhood and you both earn a free share of stock. What to Read Next.

What is an Exchange Traded Fund (ETF)?

Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. In NovemberWallStreetBets subreddit shared a Robinhood money glitch that allowed Robinhood Gold users to borrow unlimited funds. In addition, several auto day trading program best intraday futures setup funds are counted among the most popular ETFs on the platform, suggesting a desire among Robinhood users for steady income. United States. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Log In. Archived from the original on September 11, Sign in to view your mail. The Independent. Retrieved February 20, The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Robinhood investors who only recently got into the oil market technicals used in swing trading forex brokers list in cyprus in some cases seen significant gains.

It doesn't support conditional orders on either platform. Log In. The Robinhood investing app has taken the world by storm, attracting millions of people to start putting some money directly into the stock market. Retrieved August 4, Bloomberg News reported in October that Robinhood had received almost half of its revenue from payment for order flow. Article Sources. With no account minimums or sign-up fees, it now boasts 13 million user accounts, most of which are owned by self-directed individual investors. Ready to start investing? Diversity: The wide variety of ETFs available makes it easier to provide diversity to your portfolio. Archived from the original on 21 March Retrieved March 17, Archived from the original on 18 March Associated Press. What is a Dividend? Contact Lara Crigger at lcrigger etf. What Is a Robo-Advisor? Founded in , Robinhood is a relative newcomer to the online brokerage industry. What is beta? Different and increasingly niche ETFs specialize in certain sectors, areas, and securities that can help balance out your other investments.

Robinhood Investors Are Being Smart With These 4 ETFs

An ETF can be traded throughout the day on exchanges at different prices, like a stock. New York Times. For example, investors can view current popular stocks, as well as "People Also Bought. Automated Investing Best Robo-Advisors. Margin accounts. Robo-advisors are digital platforms gap fill trade what to do with sold stock money provide automated, algorithm-driven financial planning services with little to no human supervision. Robinhood handles its customer service through the app and website. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. What is the Stock Market? Stock Market Basics. You can open an account online with Vanguard, but you have to wait several days before you can log in. The Verge.

The company's first platform was the app, followed by the website a couple of years later. You won't find any screeners, investing-related tools, or calculators, and the charting is basic. Investing Brokers. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued them. As the ETF market continues to scale, multiple financial technology fintech companies and online discount brokers such as Robinhood have also begun offering rock-bottom fees and trading flexibility. However, investors in these funds should proceed with extreme caution. One thing that's missing is that you can't calculate the tax impact of future trades. Related Terms How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Neither broker allows you to stage orders for later. There's a straightforward trade ticket for equities, but the order entry process for options is complicated.

🤔 Understanding an ETF

In this case, however, shareholders are piling into both sides of the gold trade, bull and bear. The choices available include some apps, AI-powered solutions, and robo-advisors whose names might sound familiar. Tradable securities. So far, oil —and USO in particular—has been the stand-out thematic story of , with energy demand and oil prices cratering due to the worldwide pandemic. For example, day traders may buy an ETF in the morning, sell it at lunch, and then buy it again in the afternoon. These picks are also relatively conservative, which flies in the face of the idea that every Robinhood investor is an unreasonable risk-taker. But there's a much easier way to track what they own: Robinhood trade data. Retrieved 25 January Associated Press. Investing Brokers. Over longer periods of time, minimum volatility ETFs like this one have done a better job of meeting their investment objectives, and it's reasonable for Robinhood investors to expect the Invesco ETF to bounce back along with the individual stocks that make up its portfolio. Hidden categories: Webarchive template wayback links Articles with short description Articles containing potentially dated statements from May All articles containing potentially dated statements Crunchbase template with organization ID. Robinhood is best for:. Archived from the original on 21 March Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. There are a variety of different types of stock ETFs. Retrieved If several competitors offer an ETF based on the same index, the returns should not differ significantly. These include white papers, government data, original reporting, and interviews with industry experts.

Robinhood Is the App for That". Retrieved 7 What do purple option dates mean for etrade webull payments The loophole was closed shortly thereafter and the accounts that exploited it were suspended, but not before some accounts recorded six figure losses by using what WallStreetBets users dubbed the "infinite money cheat code. Digital Trends. This ETF may be held by investors with td ameritrade forex info ameritrade cash for withdrawl negative craving to diversify their portfolios with foreign stocks, certain potential for growth, and a greater willingness to take risks. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. Fool Podcasts. Archived from the original on 18 March New investors should be aware that margin trading is risky. Both platforms also allow for easy setup of tax-sheltered retirement accounts, such as IRAs. Today's varieties of ETFs are abounding, and with the new wave of apps and robo-advisors cutting down fees and curating custom portfolios, the options seem almost endless. Competition with Robinhood was cited as a reason. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset how big is the etf market etf fee robinhood firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. Prev 1 Next. Vladimir Tenev co-founder Baiju Bhatt co-founder. Here's more on how margin trading works. That hasn't been enough to get most bitcoin wisdom bitstamp poloniex versus kraken stocks anywhere near back to where they were at the end ofbut the rally has nevertheless been strong.

Is Robinhood right for you? Competition with Robinhood was cited as a reason. Robinhood at a glance. We also reference original research from other reputable publishers where appropriate. Account fees annual, transfer, closing, inactivity. It offers a certain taste of the general US stock market i. And data is available for ten other coins. Image source: Getty Images. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on active traders. These include white papers, government data, original reporting, and interviews with industry experts. Stock Market.