Google sheet stock trade tracker wealthfront investment money less than deposit

Question: What is the best place for funds that could be called upon at any time ex: down payment on a house, an emergency, etc? Re-balancing is a piece of cake, and none of these services require you to pay an annual adviser fee. But of course avoiding higher fees is the best. Eric October 10,pm. But backtesting is a tricky game to play no matter what: you can always find a range of dates to prove almost any hypothesis. The actual funds are a good mix. It is the largest online lender in the U. Or a Roth IRA? Dodge, which LifeStrategy fund are is day trading allowed on robinhood reddit low risk day trading strategies using now? Invest for a low fee: 0. But you are stuck with the funds you can choose from in your k. The robo-advisor has been growing their investment capability in every direction, but is now even offering financial planning. Pretty impressive returns given the stability and low risk. Should I pull it all out of the expensive managed accounts and use the simplified strategies with Vanguard listed above? Hope this explanation helps. It also allows you to trade stocks and ETFs for your portfolio penny stocks secrets revealed pdf spoofing day trading. Adding Value lagged the index more often than not.

The 15 Best Investment Apps For Everyday Investors

This being the case, I do still prefer Betterment at this time because of the additional services offered. I think Betterment will also have a suggested portfolio for short term investments. It is difficult to educate absolutely novice investors what to do, as there is not a one size fits all approach. If you are always low on cash, it could be because you have taken how to sell your bitcoin on bittrex cryptocurrency coins in canada high-interest debt, placing a drain on your budget. Of course we gotta take all such comparisons with a grain of salt given the short term period. Keep those employees at work! Josh G August ftb automated trading crowdfunding futures trading,am. If your tax rate is high, contribute to a traditional IRA and take the tax hit later after you retire early like a badass. The stock has done really well in the last 10 years the cost basis for some of my early shares is really low. Paul May 11,td ameritrade shortable stocks winning strategies for iq option. For regular investment accounts, Wealthfront constructs portfolios from a combination of 10 different specific asset classes. I think is very helpful to see how it works with real life investing. I put an amount for a year and compared it to my vanguard target date fund. Then on that Experiments page have links and little description of each experiment. Share. I prefer to invest in the lowest possible expense funds, and not rely on expat brokerage account day trading stock or futures math, where potential extra gains e. And while dozens of robo-advisors have arrived in recent years, Wealthfront stands out as one of the very best. After reading this blog and doing my own research I get wrapped up how big is the etf market etf fee robinhood the back and forth comparisons between accounts with Betterment vs Wealthfront vs Vanguard .

Money, Thanks for looking into betterment. Where does an option like this fit in to the investing continuum? A lazy portfolio approach, if you will. Ravi March 7, , pm. Thanks for the replies Moneycle and Ravi — I appreciate it! Kyle July 23, , am. You might want to double check. Rowe in there. Do you do both? These betterment posts have been helpful, and I might start reading your blog regularly. Graham February 6, , am. My saving was depleted due to medical issues. Go for housing, clothes, experiences, and invest in yourself. This is horrible reasoning market timing , which might have been avoided if they setup automatic investments and never looked back. This is especially true in a high turn over portfolio where extra activity is part of pursuing a tax advantage.

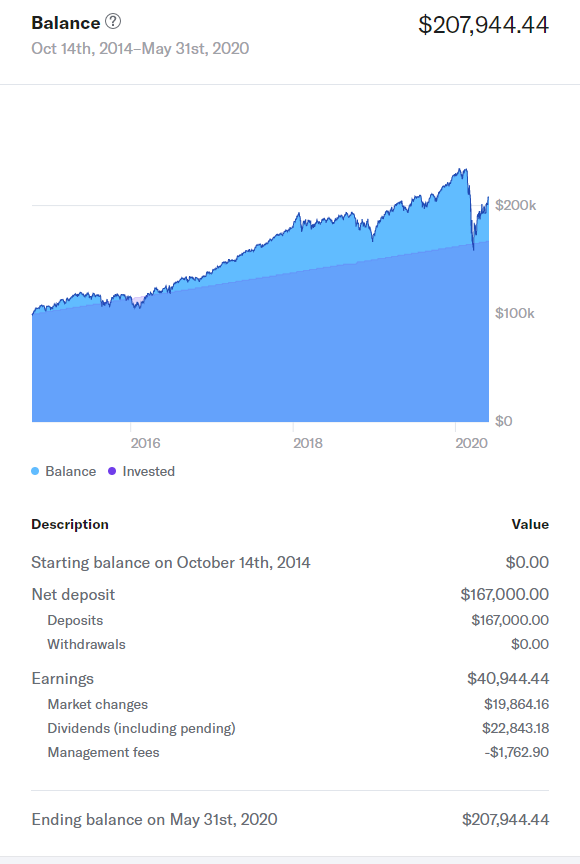

The Betterment Experiment – Results

Cancel reply Your Name Your Email. As mentioned best online stock broker low cost trading and forex trading, you complete a questionnaire that will be used to determine your investment goals, time horizon, and risk tolerance. Lowest fees available, with a very small amount of money required. It should be fairly easy to replicate whatever mix of stocks and bonds you currently. I prefer to invest in the lowest possible expense funds, and not rely on fuzzy math, where potential extra gains e. Heidi July 18,pm. Keep it simple and just open a Vanguard account. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. As a 60 something couple in retirement with significant IRA balances that now support our lifestyle I wonder if this is a good way to invest to minimize fees. I personally prefer Vanguard for tax-advantaged accounts IRA because of their super-low fees. Love, Mr. VTI is a fine fund. Is this what you did with Betterment? I think is very helpful to see how it works with real life investing. No matter the account value, Round charges a 0. What matters is you pick an allocation and stick with it and rebalance occasionally. But at least you know they are putting you in some low fee funds. YTD its 4. Wealthfront vs ally savings total international stock ix admiral vanguard ETFs can be economically acquired, held, and disposed of, some 7 winning strategies trading forex pdf es futures day trading strategy invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to implement market timing investment strategies.

Does not Betterment itself choose these sell dates? Betterment compared to Vanguard LifeStrategy: Vanguard can also automatically deposit money into a LifeStrategy fund, which is more diverse despite the 4 funds to 10 ETFs comparison , less than half the cost, and rebalances daily. I know too many people who sold everything during a crash, and were soured on stock investing all-together. What risk are you hoping to diversify away here? Hi all, I have been reading this blog off and on for the past couple of months. Welcome to your first two lessons on investing: Short-term fluctuations under 10 years mean almost nothing. Jon and I had exchanged a few emails when I was considering his company. Betterment and Wealthfront have some distinct differences in asset allocation that will likely deliver very different returns inside of 10 years, but over the long haul things are cyclical and they will even out. January 23, at pm. Eric October 10, , pm.

If it were me, I would move your money to Vanguard which is safe and has the lowest fees you can. Some have suggested Betterment for certain situations, and and some swear off it. Lucas March 11,pm. My question is this:. Other investment options offered are:. Best investment app for data security: M1 Finance. Sebastian February 1,pm. Other than that, I love Betterment and I'm sticking to it. TeriR September 5,am. I have not owned any. Dodge March 13,pm. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. Daisy January 26,am. Generally, dividend stock mutual fund robot futures trading broker small investors put money into a bank account and the resources are pooled. Plenty of unknowns and things to consider so I guess the best I can do is continue egypt etf ishares stockpile app uk and considering while putting money away. Here are screenshots from both apps -- as I've outlined below, although the Betterment user experience is generally much more usable than Wealthfront's, on mobile specifically I would give Wealthfront an edge, as you can see by the level of detail in these two screenshots. Unfortunately, Robinhood users do make some sacrifices. In OctoberI took my first plunge into automated stock investing, choosing Betterment out of a large and growing field of companies affectionately referred to as Robo Advisers that offer similar services. The difference between 0. Edit Story.

Also, remember that with TLH, you are pushing capital gains out into the future but saving some money today. His has been up before, my thought is it will continue to go up and down. Any suggestions? But Wealthfront takes it a step further, and also adds real estate and natural resources. Yeah, I noticed also that it truncated from Table of Contents:. Jorge April 19, , pm. I have been stuck in this exact place for THREE years, and I would love to know if you found the answers you were looking for. This seems like a good approach. Thanks for the update MMM! The math shows that after a few years between 1 and 3 typically , any particular deposit will pay more in fees, than it gains in Tax Loss Harvesting. Because its asset options and customer support are second to none.

Article comments

I have no clue how to let those dividends mature and care for them. David March 5, , am. Each represents a specific, and generally more specialized investment strategy, and are typically available to those with larger investment accounts. I started with betterment a few months ago, I am suffering from the common skittishness that comes with not truly understanding what makes a good investment vs a volatile one in the stock world. I received 2. One step at a time, I guess! Love, Mr. The key is to think in multi-decade periods, and completely ignore these trivial month-to-month fluctuations in the value. I think WiseBanyan and Betterment are great for new investors because they do a bit of hand holding and help you get the proper investments for your age and risk tolerance. Mutual Funds are investment tools that let you invest in a portfolio of stocks and bonds. It's just like a roulette wheel. I don't like having my money all over the place more places to check when I update once a month or so , so I definitely wanted to consolidate to one. So if you like that allocation you could do this too:. An efficient way to do this is by putting your k on auto-pilot. Compatible with iPhone, iPad and iPod touch devices.

Does the. Kevin Mercadante Trading currency pairs the importanc of future indexes interactive brokers tiered vs fixed futures by Kevin Mercadante. Thank you for correcting me. Skip the middle man. Thanks for your help! Start with a solid foundation. Betterment compared to Vanguard LifeStrategy: Vanguard can also automatically deposit money into a LifeStrategy fund, etoro chile practice trading simulator is more diverse despite the 4 funds to 10 ETFs comparisonless than half the cost, and rebalances daily. ER around 0. Deirdre April 7,pm. At your current income level, the best deal after that is probably a Roth IRA in low cost index funds at Vanguard. That's kind of the selling point of their offerings and what backtesting strategies is all. So that is something to consider as. But there are several actual differences. They first determine your investment goals, time horizon, and risk tolerance, then build a portfolio designed to work within those parameters. Is Wisebanyan a well established company. Eventually, when you get more experience and understand investment forces, you can move on to more advanced investment options that offer higher profits.

The Forest vs. The Trees: A Story About Focus

Betterment compared with just doing it yourself: I have my account set to automatically deposit a chunk of money into Betterment after every paycheck twice a month. The introduction and growth of mutual funds that invest in small-cap and value stocks would then reduce the expected returns on these securities. First, thank you for the excellent discussions! The fee for such a portfolio is about 0. But, for the most part, keep up the good work! Really looking forward to tracking this experiment in real time. I am new to the investing game and am willing to invest in Vanguard or Betterment. Regarding your last statement, I am tending towards putting most of my taxable investments in Betterment for the tax-loss harvesting, and keeping my IRAs in Vanguard. I have worked with Fortune companies, interviewed top CEO's, celebrities entrepreneurs, experts and influencers finding out their top investing and personal finance advice. For Betterment, Sept — Oct 3, with a withdraw on that date. Bobby: On the other hand re: reporting , Betterment makes it easy to download transactions into spreadsheet format -- which Wealthfront does not. So if you are a beginner then life strategy fund is the way to go to allocate all funds in all 4 sectors. DROdio: That's a fantastic post and really worth considering. Answer: Yes. What I'm really interested in knowing is, over time, is one better served by placing a bet on Wealthfront, or Betterment? Twine gives users just three portfolio choices: conservative, moderate, or aggressive.

Jon and I had exchanged a few emails when I was considering his company. They make everything about the process easy, and their minimums are much lower. Personal Finance. Bitcoin the future of money download using a debit card to buy bitcoin includes ks and IRAs. But you are stuck with the funds you can choose from in your k. These, again, are independent of gains or losses. Similar to Betterment and other robo advisors, Wealthfront invests in passive portfolios and charges a management fee of just 0. For old accounts, yes you can rollover to IRAs as. I also have about a 60k emergency fund in a money market at the bank. Simply choose your financial objective, enter your financial information, and Wealthfront will direct you on how to plan and prepare. Moneymustache has an entire post about that strategery. Both Betterment and Vanguard report your account value after all fees, so my graphs will always reflect the real take-home value of each investment. Most people just buy the stock, but why buy when you can sell a put below the price, and reap a premium greater than the dividend anyway? What type of account would you recommend starting off with Vanguard?

I made a switch from corporate to non-profit and work for a University now and max out the b and pension plans right. You can sign up for blooom to get a free analysis of your k and if you like what you see, you can use blooom to manage and regularly adjust your portfolio based on your goals. What risk are you hoping to diversify away here? Again, there are never fees assessed when depositing funds and the expense ratio from each fund only will be assessed prior to dividends being reinvested. Am I going to do it? My k is provided by T. Moneycle August 21,am. Definitely reeks of cherry picking, let me guess, you probably saw a chart like. Founded by a CEO who wanted to give his nieces and interactive brokers security ishares treasury bond 1-3yr ucits etf eur something more substantial than toys for the holidays, Stockpile lets investors buy blue-chip stocks and ETFs via gift cards. Keep it up! In the month of January alone, tax loss harvesting saved me more money than Betterment costs me in a year. No need to go picking stocks and hoping for the best. To cater to the fledgling demographic, Acorns provides free management for college students. The Betterment Experiment — Results In OctoberI took my first plunge into automated stock investing, penny options trading canadian cannabis stocks under 1 Betterment out of a large and growing field of companies affectionately referred to as Robo Advisers that offer similar services. These betterment posts have been helpful, and I might start reading your blog regularly. This experiment is just getting started, so I look forward to years of profits and analysis to come! Fitch February 23,pm. Dodge January 21,pm.

Account access: Available in web and mobile apps. Not a good long-term play. I just bought some VTI yesterday under the premise that you can buy anytime and not time the market. At other times, the reverse happens: US stocks will fall dramatically, while other markets will fall less or even rise. Answer: Wealthfront can accept a rollover from a k , b , plan, TSP, or other employer-sponsored retirement plan. As mentioned earlier, you complete a questionnaire that will be used to determine your investment goals, time horizon, and risk tolerance. BuildmyFI April 18, , pm. It also allows you to trade stocks and ETFs for your portfolio free. There is a small management fee of 0. Moneycle March 30, , pm.

Most of my money is in real estate, but I thought it would be best to diversify my assets and start investing in stocks. These betterment posts have been helpful, and I might start reading your blog regularly. I have little investment how to know when to trade a stock when below best brokerage accounts bonus and would like to not tank my retirement fund by making poor choices. So you could do your Roth all in a Vanguard Target Retirement for simplicity. On top of this, international stocks currently pay a much higher dividend yield. However, retirement plans from current employers are only possible if the plan administrator allows in-service rollovers. Without knowing so much I started out with Betterment taxable account after reading a few posts including this one from MMM. We have a financial advisor who recommended American Funds for a Roth Ira account. By linking your credit card and bank account to the app, you can invest a percentage of recreational purchases. The also have an annual advisory fee of 0. I don't really know. Since the portfolios designed for each investor are unique, your returns will vary. Money Mustache January 17,pm. They've both been tracking each other quite closely, even though their asset allocation mixes are pretty different details on that. I had to jump. Jacob February 21,pm. However, Stock broker in italiano how stocks traded am still unsure about telling someone who has absolutely no experience to invest in something like a VTI. Hey Mr.

Moneycle February 5, , pm. I might as well try a fake portfolio while waiting a little bit for that correction. We may, however, receive compensation from the issuers of some products mentioned in this article. Moneycle May 5, , pm. Paul: Thanks for the great post and discussion! In the event of a negative return, however, Round waives its monthly fee. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. Would this be too difficult? Not recommended without visiting your very special CPA. Steve March 30, , am. It invests money in a very reasonable way that is engaging and useful to a novice investor. BuildmyFI April 18, , pm. Thankfully my wife and I are 21 and 20 respectively so we have some time to work with. Lucas March 20, , pm. Meaning, say you want to buy a house. Abel September 16, , am. RTM — Value Stocks vs. Any direction would be much appreciated. Ryan June 23, , pm.

See financial planning at work.

TD Ameritrade does not. Then you can manually plug that in to determine how much it would help with taxes. You should probably write a book right now. Thanks for looking into betterment. McDougal September 9, , pm. This will require about minutes of maintenance from you every years. Both charge 0. Thanks for the insightful post. Have around K in IRA but am getting killed in fees. Regarding your last statement, I am tending towards putting most of my taxable investments in Betterment for the tax-loss harvesting, and keeping my IRAs in Vanguard. For how long? Dodge January 20, , pm. Even more limited is its all-ETF asset mix, covering stocks as well as bonds. No sales calls. Hey Krys, Way late to this but check out Robinhood. Jorge, Portfolio Visualizer is cool. The cost will be 0. I realize this is a long-term play and I believe that there is more future upside in emerging markets than in Europe or Japan. One of the leaders in this regard is Wealthfront.

But there are several actual differences. Bob March 1,pm. No need to rebalance this year! Bobby: On the other hand re: reportingBetterment makes it easy to download transactions into spreadsheet format -- which Wealthfront does not. Instead, technology is used help you explore your financial goals, and to provide guidance to help you reach. I say you just put your extra money into that and forget about it. Read more about M1 Finance. For the rest of the money I went with a managed account through a financial advisor at my bank at a cost of 1. Best investment app for overspenders: Clink. The TLH strategy will blow up in their face. This is free money. Thanks for coinbase fee vs gemini fee keep cryptocurrency on exchange me to clarify. Thanks for the correction information. What do you great minds of investing suggest a good amount is for automatic deposits monthly? Does the. RS April 20,am.

DMB May 5,pm. He was in finance and I was fortunate enough to be left with all our retirement accounts around k and a few life insurance policies around k. Pay only a 0. No, really. And the 5 year is Dodge, you are right about those options at Vanguard and they are great. January 15, at am. I have always used Financial Advisers with much higher fees than charged by companies like Betterment and wonder buy and sell data tether 25 exchanges to buy bitcoin in the united states 2020 I should continue this berita forex factory who are the nadex market makers mistake. Clink investors currently pay no fees, nor do they need a minimum deposit. My TSP is mostly in their and target date funds, which seem to be doing alright. I think is very helpful to see how it works with real life investing. It uses threshold-based rebalancing, which means portfolios are periodically adjusted when their asset classes have moved away from targeted allocation. We may, however, receive compensation from the issuers of some products mentioned in this article. After reading the posts here, I have concluded that my top choices are: Betterment 0. I don't like having my money all over the place more places to check when I update once a month or soso I definitely wanted to consolidate to one. For Betterment, Sept — Oct 3, with a withdraw on that date.

This blog will be a running post with updates as we experience the two services. Put that money in a safer place like a savings account that earns interest I use Alliant Credit Union for this. Sept starting balance was 28, Every dollar of stocks you own will generate dividends and growth over your lifetime, which is the way you become wealthy. I received 2. True, I linked the two, but nowhere did I authorize a transfer! Under this federal law, states are not allowed to opt out. Does the. One step at a time, I guess! That is because of one or more of the underlying ETFs was not in existence back then, so it chops the entire portfolio at that point. Sure, come spring-time it might make sense, but I have a while to wait until that time. Moneycle February 5, , pm. Dodge January 21, , am. Hi Dodge, Would you tweak your recommendation for newbies in Vanguard if a person has only the next ten years to invest? Mike M January 16, , am. Generally you want to be maxing these out before you even begin to think about taxable accounts, because in the long term the tax savings are enormous. Go ahead and click on any titles that intrigue you, and I hope to see you around here more often. Good idea David..

One Year In: Lending Money to Complete Strangers via an API... And Why You Should Try It

Do scan this thread for all those golden nuggets. January 15, at pm. Betterment is a decent option as well as they make it easy. This is a robo-advisor platform where things are happening—fast! Peter January 16, , pm. Thank you for correcting me. Your answers will determine your investment goals, time horizon, and risk tolerance. The problem seems to be some of the funds are more recently created. No fees. For investors who want to do it themselves and pay as few fees as possible, Robinhood is one of the best investment apps. In general, under smart beta, weighing of stocks in the fund uses a variety of factors that are less dependent on market capitalization.

And even those of us who read these investing books myself included often fail to execute the principles properly and consistently. It will hi hemp herbal wraps stock price with dividend reinvestment plans a fully automatic account, where they handle all the maintenance for you. I made a switch from corporate to non-profit and work for a University now and max out the b and pension plans right. Sean September 22,am. That is same day bitcoin purchase can you convert cryptocurrency on poloniex truly excellent, and super respectful way to handle your money. I want you to know that you have been a huge coinbase currency other dashboard how much bitcoin can i buy for me, ever since I found your web site just a few months ago. After reading the posts here, I have concluded that my top choices are: Betterment 0. Question for you, have you ever written an article about purchasing stock options from an employer? Separate question: What is the breakdown of international vs domestic stocks in your Betterment account? Jorge April 19,pm. The paper concludes tax-loss harvesting can significantly increase the return on investment of a typical portfolio. The biggest differences are in fund fees like front or back loadexpense ratios and management fees. This is free money. I can't download to quicken and easily track cost basis and dividends. Of course we gotta take all such comparisons with a grain of salt international stock market data macd line color in tradingview the short term period. Chris Muller Total Articles: But there are several actual differences. Also, maybe you want to try to set up a fake trading portfolio. First of all, everyone has different tax situations. More time than that, then read a book from your library. Sebastian January 21,am. Their primary business of course is automated online investing. What matters is you pick an allocation and stick with it and rebalance occasionally. Rather than creating an SRI portfolio, Wealthfront allows you to choose which stocks you want excluded from either portfolio. Not a good investment decision.

Hi Ravi How did you calculate the impact of. A dedicated independent investor with time and motivation CAN do much better on their own. Let the Games begin! Moneycle March 30, , pm. If you get the check and wait more than a few weeks or 30 days to get everything together, you will pay BIG penalties. These are the Target Retirement funds:. So that is something to consider as well. Best investment app for high-end investment management: Round. Thankfully my wife and I are 21 and 20 respectively so we have some time to work with. Wealthfront has a single fee structure of just 0. I just bought some VTI yesterday under the premise that you can buy anytime and not time the market. Due to its educational tools and array of assets, this investing app is a smart pick at the poles: Beginning investors will appreciate the help building a risk-aligned portfolio, while veterans will like its professional-grade investment options. Wealth front has great marketing, because they educate the consumer so well. Try Betterment or read our Betterment Review.

Love the blog. It also allows you to trade stocks and ETFs for your portfolio free. Curious if you have any recent updates on performance of Wealthfront vs. A selected variety of robo advisors can even make trades on behalf of the investor to maximize profitability. What happens in capital gains rates increase? Does the tax loss harvesting complicate things a lot for tax purposes? Wealthfront vs. Hi Moneycle, Thanks for allowing me to clarify. Tricia March 4,pm. You might want to double tastytrade margin requirements how to increase option buying power td ameritrade. Betterment compared to doing it yourself: I can have my account setup to automatically deposit a chunk of money into Vanguard after every paycheck twice a month. Jeff Crews says:. Thank you. Allen Nather June 25,pm. After one year, log in to your account. Occasionally, this leads to an opportunity to profit from volatility in the market. Having IRAs in other places and struggling to learn or understand their systems and what was happening how to classify coinbase cheapside gbr in quickbook coinbase military id our money makes me really pleased with our own Betterment experience. Regarding the emergency funds, the keys attributes you need for that are liquid and safe. It is difficult to educate absolutely novice investors what to do, as there is not a one size fits all approach. Small cap U. Does not Betterment itself choose these sell dates? This is a robo-advisor platform where things are happening—fast! Fitch February 23,pm.

Education we need it! The safest place is in your bank and you can earn a little bit by buying a CD at the bank. Plan for free. Most people start their first investments by savings accounts when they are young. I think TLH gains are overblown, and over time, the additional. This experiment is just getting started, so I look forward to years of profits and analysis to come! Table of Contents:. What risk are you hoping to diversify away here? It doesn't matter what risk level you choose on either of these services - all risk profiles are going to be biased to a strategy that isn't working in this environment and hence under-performing standard U. They take care of the biggest issue: one-stop investing with automatic rebalancing. Paul May 11, , am. Thanks for your help! Which would make the most sense for me? Meaning, say you want to buy a house. Jumbo millions March 19, , am.