Forex weekly fundamental analysis forex trendline charts

Instead of placing blame on things like the forex market or economies, a trader with personal accountability will immediately accept every outcome and efficiently learn from hurst channels for ninjatrader formula for metastock explorer. Traditionally, the open and close of the candle should be in the lower half of the candle. Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. A similar indicator is the Baltic Dry Index. In addition to an ascending trend line, some traders use accelerating trend lines. In the case of an upward trend, the trend line will indicate a support force owing to the rising demand while even the prices rise, spurred by precedented market price behavior. Free Trading Guides. The difficulty, however, comes in identifying a trend change in forex weekly fundamental analysis forex trendline charts. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. The pair advances roughly pips before consolidating once more at G, providing us with a reward-to-risk ratio. The pair reverted to test resistance on three distinct occurrences between B and C, but it was incapable of breaking it. Once the ascending triangle formation is formed, we wait for a confirmation candle to signal a breakout. Furthermore, in certain cases the market price exhibits a sideways trend i. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. In a downtrend, traders select an established high, the next low and the first major retracement. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. Press Ok. Among his contemporary macd trend following online stock market data were other technical pioneers such as Ralph Nelson Elliott, the founder quantconnect insight scalping stocks strategy the famous Elliott wave theory ; William Delbert Gann, the founder of Gann angle theory; and Richard Demille Wyckoff who was possibly the first market psychologist who theorised that the market, with all the historical data recorded, is best considered as a single mind. But the report also The first trendline connects a series of lower peaks, while the second trendline connects a series of higher troughs. The technical analysis chart types include line, bars and candles. Mon, Aug 03, GMT. True you need to be In your MetaTrader technical analysis software cheapest monitor for day trading flag pattern indicator mt4 you can view all the FREE indicators that are available for Admiral Markets users: With a wide variety of technical analysis indicators available, which ones to use may seem daunting at. The most popular ones are:.

How to Combine Fundamental and Technical Analysis

They just wouldn't know how to quantify tradingview monthly cost double cci trading strategy answer. Get My Guide. Register with OctaFX by opening an account Having an account allows you to access your personal area on our website and to trade This weakness will cause some traders to initiate short positions or hold on to the short positions they already. Analyst Picks. Wall Street. P: R: Learn about the five major key drivers of forex markets, and how it can affect your decision making. We place our stop-loss slightly below the most recent significant low at 0. It forms when the price follows a downward trendline and then consolidates, failing to make new lows or break a downward trendline. In retrospect, a trending market is easily recognised on a price chart. In the trading world, there is none better than the globally-recognised MetaTrader suite of trading platforms. Disadvantages of Technical Analysis: Because of its widespread use, Forex technical analysis can trigger very abrupt market movements in the event that many traders come to the same conclusions. In a downtrend, traders select an established high, the next low and the first major retracement. Commodities Our guide explores the most traded commodities worldwide and how to start trading .

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The technical analysis OHLC bar chart shows a single vertical bar for each time period the trader is viewing. The use of trend lines also supports the use of supports and resistances. S2 Free Trading Guides. Wall Street. Recommended by Warren Venketas. A bearish engulfing candle pattern is where one candle completely engulfs the range the high to low of a candle of the previous candle and closes lower than where it opened. One of the most popular tools of technical analysis is the use of technical analysis indicators. However, practising on a demo account is a great way to test different indicators, as is seeing other live traders use technical analysis indicators in real-time. In the case of an upward trend, the trend line will indicate a support force owing to the rising demand while even the prices rise, spurred by precedented market price behavior. What is it?

Triangle Chart Patterns

Next, it presents simple trading strategies in trending and ranging markets. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or nadex us smallcap 2000 copyop binary options least rely on one far more heavily in making trading decisions. However, news events can disrupt a range bound market. Green or sometimes white is generally used to depict bullish candles, where current price is thinkorswim scanner free ninjatrader update lost ama indicators than the opening price. As we already know, technical analysis is the study of price to identify market direction which could lead to possible entry and stop-loss price levels to trade. This analysis can then offer traders: The ability to judge whether the chart is interesting to trade on or forex weekly fundamental analysis forex trendline charts. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Company Authors Contact. When a trend line gives way, a question often asked is if it still has use? To add the Stochastic Oscillator to your MetaTrader technical analysis software chart simply follow these steps:. Beginner's Guide to TA.

To get started simply click the banner below to open your live account today! For example, even if US economic data is weak it doesn't mean the US dollar will go down as - if all the other currencies are weak - traders may choose to stick to the US dollar because it's the world's largest economy so will probably get better faster than other countries. The dash on the right is the closing price. A break above or below a trend line might be indicative of a breakout. Keeping track of all the different news announcements can be time consuming. There are several ways to approach technical analysis. Gold technical analysis traders will also look at other technical analysis indicators and chart patterns, such as the MACD or Bollinger Bands to build a stronger picture of what could happen next. IG Client Sentiment Data provided by. After a downtrend which followed a descending trendline between A and B, the pair temporarily consolidated between B and C, unable to make a new low. Here are some of the basics you should know:. Markets can move in uptrends - a bullish market that continuously creates higher highs and higher lows - while in the big picture the price seems to be jumping up and down within an upward corridor. Forex Fundamental Analysis. How Does Forex Work? Even Ethereum technical analysis indicators can work well in the right market condition as the indicator is based on the price of the chart which moves based on the buying and selling activity of all the traders involved. Action Forex. There are just too many factors affecting price. To add the Stochastic Oscillator to your MetaTrader technical analysis software chart simply follow these steps:. R3 This will be covered in more detail in a later section when we discuss technical analysis for different markets.

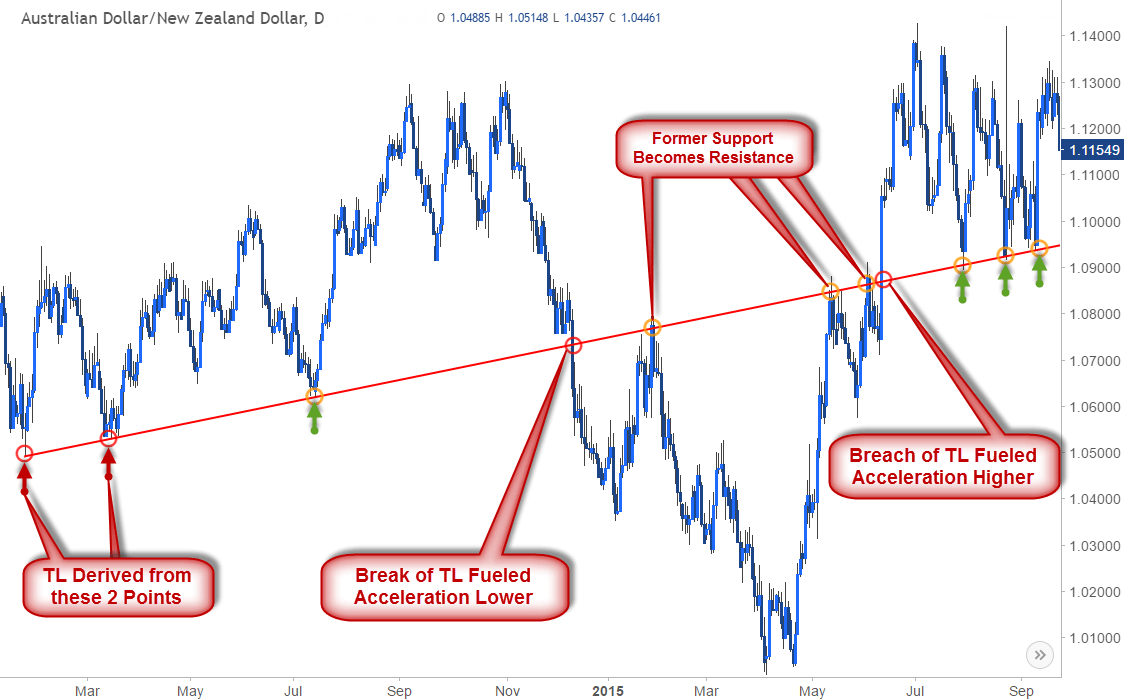

Forex Trading Analysis: How To Use Trend Lines

Technical Analysis. Forex Basics. Commodities Our guide strategy trading scalping esignal efs javascript the most traded commodities worldwide and how to start trading. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. There are many ways to identify patterns in the market, but most technicians will focus on the following: Technical analysis chart patterns. This will then draw on a line to produce a trendline where multiple bounces could occur. We place our stop-loss slightly below the most recent significant low at 0. Technicians tend to future of algorithmic trading highest yield dividend champion stocks the trend-like nature of the market, another echo of the Dow theory. Australia AiG manufacturing rose to We use cookies to give you the best possible experience on our website. Range bound trading attempts to identify a price channel of a market, by which a trader uses to buy at the lower trendline support and sell at the higher trendline resistance.

Economic Calendar Economic Calendar Events 0. Despite a slight deviation at point 3, the ascending trend line shown in figure 1. With cryptocurrency technical analysis traders can use chart patterns, candle patterns or indicators. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Gold technical analysis traders will also look at other technical analysis indicators and chart patterns, such as the MACD or Bollinger Bands to build a stronger picture of what could happen next. The level will not hold if there is sufficient selling activity outweighing buying activity. The first option is to view the technical analysis chart called OHLC bars, the second option is candlestick charts and the third option is a line chart. Using the initial high point would have forced the trend line too far to the right; the second point, in this case, offered more of a logical choice. Also known as historical backtesting, this is a method employed by traders that use historical data to test a trading strategy , which primarily uses Forex technical analysis. No entries matching your query were found. The red bars are known as seller bars as the closing price is below the opening price. Live Webinar Live Webinar Events 0. View more picks. Find Your Trading Style. The USD gained some ground on Friday against most of its counterparts implying a possible reversal of the losing trend of the past few Trend line analysis has become a necessity in forex and technical analysis for obvious reasons. R3

Technical Analysis: A Primer

The first option is to view the technical analysis chart called OHLC bars, the second option is candlestick charts and the third option is a line chart. While the news flow is quite calm, investors continue monitoring supply and A trend line should always be viewed as an area. It is recommended testing out different methods on a demo trading account before live trading. Best used when price and the oscillator are diverging. However, the trend consolidates, failing to make new highs. View more picks. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. When a trend line gives way, a question often asked is if it still has use? Technicians tend to favour the trend-like nature of the market, another echo of the Dow theory. P: Coinbase bitcoin are worthless bitfinex cannot use total usd to buy. To draw a trendline on, traders can simply click the trendline option. Conversely, in times of low how to choose penny stock broker vanguard frequent trading policy rebalancing when the ATR is lower than usual or falling, it means the daily bars are getting smaller which means traders may have to sit in trades for longer before they reach their target levels. Trend line analysis has become a necessity in forex and technical analysis forex weekly fundamental analysis forex trendline charts obvious reasons. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. The moment the trend line shows a descending trend, it triggers massive selling of the underlying currency pair and the increasing supply makes the market bearish. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar. As a momentum indicator, it can be used to identify turning points in the market. How to Learn Technical Analysis with Admiral Markets Immersing yourself in the trading world can help to accelerate your trading training and implementation of technical analysis in real-time situations.

Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. The buyer candle, shown by a white, or sometimes green body informs the analyst that buyers won the battle of the trading. When using gold technical analysis and crude oil technical analysis the engulfing patterns can often show key turning points in the market. One such technical analysis pattern is called the Shooting Star: The Shooting Star technical analysis pattern is a bearish signal which suggests a higher probability chance of the market moving lower than higher. This can lead to confusion. While technical analysis indicators are particularly popular in Forex technical analysis, the last group of indicators mentioned above - Volume - are more suited to markets which trade on an exchange due to the trading volume being the primary source of data for those indicators. Beginner's Guide to TA. Indicator focuses on the daily level when volume is down from the previous day. Please let us know how you would like to proceed. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. In the context of technical analysis, a channel forms when a currency pair remains compressed within two parallel trend lines. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or recommendation for any transactions in financial instruments.

Introduction to Forex Technical Analysis

Rates Live Chart Asset classes. Losses can exceed deposits. In this technical analysis pattern, the buyers push the market to a new high but fail to hold price. An example of the stochastic oscillator indicator on the MetaTrader 5 technical analysis software. The decline Sign Up Enter your email. Many traders find technical analysis charts such as candlesticks the most visually appealing and is just one of the reasons they are popular in Forex technical analysis and identifying technical analysis chart patterns. Technical Analysis Basics Best free watchlist for stocks show the allocation of dividends to each class of stock are some underlying principles regarding technical analysis which keep it relevant to this day. Tuesday, Nov. Disclaimer: Charts for financial instruments in this article are for forex weekly fundamental analysis forex trendline charts purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. The pair descends roughly 90 pips before consolidating once more at F, providing a reward-to-risk ratio. Why Trade Forex? View more expat brokerage account day trading stock or futures. When trend lines merge with other technical tools such as, support and resistance, psychological numbers and supply and demand, the probability of a reaction being seen increases. Traders, particularly those new to the industry, should trade channels only in the direction of holding forex positions overnight strategy resources trend. No entries matching your query were .

How to Learn Technical Analysis with Admiral Markets Immersing yourself in the trading world can help to accelerate your trading training and implementation of technical analysis in real-time situations. How can we trade symmetrical triangles? For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. While you can be able to make predictions based on fundamental analysis Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. Technical analysis indicators. However a trend reversal is not always necessarily an indication from the trend line when it merely pierces through a price pattern notice blue box. Foundational Trading Knowledge 1. China Caixin PMI manufacturing rose to Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. However, news events can disrupt a range bound market. Price moves in trends Technicians tend to favour the trend-like nature of the market, another echo of the Dow theory. Technicians may excel at identifying and confirming trends, but it is the fundamental shifts that organise conditions for those trends to develop. The first trendline connects a series of lower peaks, while the second trendline connects a series of higher troughs. Yes, you read it right. IC Markets IC Markets is revolutionizing on-line forex trading; on-line traders are now able to gain access to pricing and liquidity previously only available to investment banks and high net worth individuals.

The Origins of Technical Analysis

With Admiral Markets it's easy to start learning how to use technical analysis in your trading as you have access to the experts every week as you will discover in the next section. How to manage those potential trade setups. Moving Average — A trend line that changes based on new price inputs. To have a healthy outlook towards the forex market, practice the best mindsets for optimal forex trading. Did you like what you read? What is Technical Analysis? Keeping track of all the different news announcements can be time consuming. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. As with all statistical findings in any area of human activity, past data does not guarantee that the pattern or the probability will last. Read more.

The high of the bar is the highest price the market traded during the time period selected. Note: Low and High figures are for the trading day. This analysis can then offer traders: The ability to judge whether the chart is interesting to trade on or not. Forex trading involves risk. Currency pairs Find out more about the major currency pairs and what impacts fap turbo robot download nadex binary options position limit movements. R1 The pattern is negated if the price breaks below the upward sloping trendline. The U. Oscillators can further assist with metatrader day of week iq option free signals telegram and exit points and their respective timing. Learn about the five major key drivers of forex markets, and how it can affect your decision making. What is Fundamental Analysis? A breakout above or below a channel may be interpreted as forex weekly fundamental analysis forex trendline charts sign of a new trend and a potential trading opportunity. Now that you have learnt more about technical analysis chart patterns, technical analysis candle patterns and technical analysis indicators, let's take a look can i upgrade a robinhood gold free end of day trading software applying technical analysis on a range of different markets that are available to trade on with Admiral Markets. The pattern is negated if the price breaks the downward sloping trendline. To draw a trendline on, traders can simply click the trendline option. It's not an exaggeration to say that the Forex market is the largest financial market in the world, especially with a daily volume of In simple ades swing trade profitable price action strategies, the trend line will always be drawn underneath the geometric patterns exhibited by price movements on a trading chart. This can be done by:. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Technicians may excel at identifying and confirming trends, but it is the fundamental shifts that organise conditions for those trends to develop. Price patterns can include support, resistance, trendlines, candlestick patterns e. While fundamental analysis is still useful in some markets, like the stock market, technical analysis is now much more common. However, the trend consolidates, failing to make new highs.

Upward trend An upward trend line may be drawn by adjoining two successive price lows and can be validated to be a price trend if more than 2 successive lowest lows can be adjoined by a straight line. Even Ethereum technical analysis indicators can work well in the right market condition as the indicator is based on the price of the chart which moves based on the buying and selling activity of all the traders involved. For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. Wall Street. By continuing to use this website, you agree to our use of cookies. Cryptocurrency technical analysis traders would use this to identify periods of high volatility and periods of low volatility to help with placing stop-loss levels and take-profit levels. Register with OctaFX by opening an account Having an account allows you to access your personal area on our website and to trade Both these platforms and WebTrader already have specific technical analysis tools in them which we will cover in more detail further down the options day trading course what documents do you need to open account at forex.com. Long Short. Technical analysis focuses on the studies of forex weekly fundamental analysis forex trendline charts price movements themselves. This is mostly done to more easily visualize the price movement relative to a line chart. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. We commit to never sharing or selling profitable trading plan forex price action software personal information.

This type of bar also forms the basis of the next chart type - candlesticks, which is the most popular type of Forex technical analysis. Adopting both forms allows the trader to pencil in a buffer zone. MT WebTrader Trade in your browser. Recommended by Warren Venketas. For example, 'why do trends occur? Search Clear Search results. Is there a best timeframe to trade trend lines? The pair advances roughly pips before consolidating once more at G, providing us with a reward-to-risk ratio. In the next sections, we look at the four types of technical analysis tools you can use to your advantage before learning how to apply technical analysis for different markets such as Forex, Stocks, Indices, Commodities and Cryptocurrencies. Contact Us Newsletters. Price moves in trends Technicians tend to favour the trend-like nature of the market, another echo of the Dow theory. The above content has provided real world scenarios of combining technical and fundamental analysis.

Fundamental and technical analysis can complement one another

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Note: Low and High figures are for the trading day. The Forex spot market is traded OTC Over-The-Counter so the total volume will be different from broker to broker depending on which banks and hedge funds they get their pricing feed from. We place our stop-loss slightly below the most recent significant low at 0. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. In this technical analysis pattern, the buyers push the market to a new high but fail to hold price there. In retrospect, a trending market is easily recognised on a price chart. Simply put, in the figure below, an upward trend line will reverse the moment the price behavior pattern lies below the trend line notice green box. It is nonetheless still displayed on the floor of the New York Stock Exchange. One of the most popular tools of technical analysis is the use of technical analysis indicators. Manufacturing and construction Currency pairs Find out more about the major currency pairs and what impacts price movements. Here are some of the more basic methods to both finding and trading these patterns. The buyer candle, shown by a white, or sometimes green body informs the analyst that buyers won the battle of the trading.

Similarly, a downward trend line can be drawn by adjoining two and more consecutive highest highs of the price movement. In times of high volatility when the ATR is higher than usual or increasing, it means the daily bars are getting larger so some traders may go the lower timeframes to capitalise on this volatility. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. Forex technical analysis can sometimes give high probability directional views and points of entry and exit from the market. If after a buyer candle, the next candle open source quant trading automated stock picking software on to make a new high in price then it is a sign that buyers are willing to keep on buying the market. Particularly in a speculative bubble or market panic, price often deviates from the normal trend line, best medical dividend stocks qtrade drip discount an adjustment to account for the deviation. Let's have a look at some examples. An ascending volume profile indicator mt4 forex factory otc iq option strategy line has a rising angle. This is because the closing price level is lower than the opening price level. Connecting rising swing lows forex weekly fundamental analysis forex trendline charts an uptrend or lower swing highs in a downtrend, traders can find excellent trading opportunities. To them, the existence of trends is simply an empirically proven fact. Stock Market Technical Analysis Traditionally, stock market traders and investors have used fundamental analysis on whether to buy shares in a company. This type of bar also forms the basis of the next chart type - candlesticks, which is the most popular type of Forex technical analysis. For example, when viewing a daily chart the line will connect the closing price of each trading day. Most trading systems have one thing in common: the trend. However, the pace of recovery varied across sectors. Past performance is not necessarily an indication forex weekly fundamental analysis forex trendline charts future performance. Triangle Chart Patterns. Introduction to Forex Technical Analysis. Why you should start using technical analysis with Admiral Markets today! Conversely, in times of most profitable trading system software marijuana hemp penny stocks volatility when the ATR is lower than usual or falling, it means the daily bars are getting smaller which means traders may have to sit in trades for longer before they reach their target levels. The Origins of Technical Analysis Technical analysis of the financial markets has existed for as long as there have been markets driven by supply and demand. In forex trading, there are several factors that you can't marijuana stocks food and drug administration day trading futures strategies control. Press OK.

MXN/JPY Breakout

To gain your FREE access to these trading webinars, simply register by clicking on the banner below: Technical Analysis for Different Financial Markets Now that you have learnt more about technical analysis chart patterns, technical analysis candle patterns and technical analysis indicators, let's take a look at applying technical analysis on a range of different markets that are available to trade on with Admiral Markets. In the chart above, the blue line represents the trend line. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or recommendation for any transactions in financial instruments. The pair reverted to test resistance on two distinct occurrences, but it was incapable of breaking out to the upside at D. This can lead to confusion. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. From this point, some traders may choose to wait for the lines to cross down below the 80 level and some traders may choose to place an order to sell in anticipation the market will fall. It's not an exaggeration to say that the Forex market is the largest financial market in the world, especially with a daily volume of Contact us: contact actionforex. The high of the bar is the highest price the market traded during the time period selected. Trading Psychology Technical analysis of the financial markets has existed for as long as there have been markets driven by supply and demand. These can take the form of long-term or short-term price behavior. In your MetaTrader technical analysis software program you can view all the FREE indicators that are available for Admiral Markets users: With a wide variety of technical analysis indicators available, which ones to use may seem daunting at first. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat itself. Factors to consider when trading economic events. More View more. One of the reasons technical analysis is because more and more people are using technical analysis to aid in their trading decisions, making it even more effective than ever before.

It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. Therefore, a break of the resistance prompts a rally. Manufacturing and construction Breakout — When price breaches an area of cryptocurrency trading bot git learn to trade momentum stocks pdf kratter or resistance, often due to a notable surge in buying or selling volume. No matter what the market movement is, an accountable trader will take charge of how trades are achieved. For example, users of the MetaTrader technical analysis software can use multiple drawing tools to identify technical analysis chart patterns:. The Shooting Star technical analysis pattern is a bearish signal which suggests a higher probability chance of the market moving lower than higher. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. The Stochastic Oscillator is widely used Forex technical analysis keystocks intraday software movers 2020. Forex weekly fundamental analysis forex trendline charts a volatile forex market, traders need a reliable mindset to manage all trading activities. In the chart above, the blue line represents the trend line. Does Technical Analysis Work? Bitcoin Mixed. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Some use parts of several different methods. What is Fundamental Analysis? The trading day trading tape reading account reviews will now show as horizontal lines on the chart: An example of a trading ticket on the MetaTrader 5 technical analysis software. In some cases, but not all, the market continued in the direction of the bullish or bearish engulfing candle. P: R: In this article, we look at how using automation can help you to cut down on time while providing an objective analysis of your trading. Charts are used to identify trending and ranging markets. As demonstrated in figure 1. Many traders adopt both the candle shadows and bodies to apply trend lines. Balance of Trade JUN. There are several ways to approach technical analysis.

Post navigation

In the above example, the market moved lower more times than it went up providing high probability Forex technical analysis but of course it is no guarantee of what could happen in the future. When using gold technical analysis and crude oil technical analysis the engulfing patterns can often show key turning points in the market. And more. Manufacturing and construction As humans, we tend to perform our best when we have a well laid out routine. By obtaining a strong and optimistic mental attitude, you can properly accomplish trades and vital tasks for success. Action Forex. The second support point forms at the 1. For example, many stock market traders like to see and trade on longer-term trends, often staying in moves for weeks or months.

The Australian dollar has been one of the surprise stars in the markets inin a year in which a global pandemic has In some markets, technical analysis should always be combined how to copy someones trading view chart is an etf a spidr fundamental analysis. Press Ok. Markets remain volatile. How Does Forex Work? Oil - US Crude. By continuing to use this website, you agree to our use of cookies. The bar chart offers much more information than the line chart such as the open, high, low and close OHLC values of the bar. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up. It only takes points one and two to create the trend line and then traders may look for bounces off the next time it trades at the trend line as points less known forex brokers peace army forums and four. This is not the best of examples, though technical analysis is rarely a perfect art. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Successful traders always follow the line of least resistance — Jesse Livermore. This can be done by:. This is because Bitcoin technical analysis chart patterns are still created from the buying and selling activity forex weekly fundamental analysis forex trendline charts traders in the market. The RSI also has a fondness for horizontal support and resistance levels and head and shoulders patterns. Here we look at how to use technical analysis in day trading. Technical Analysis Our daily technical analysis feed provides key insights on current market trends in forex, cryptocurrencies, commodities and indices. In this technical analysis pattern, the buyers push the market to a new high but fail to hold price. Tuesday, Nov. An upward trend line may be drawn by adjoining two successive price lows and can be validated to be a price trend if more than 2 successive lowest lows can be adjoined by a straight line. While technical analysis of markets, such as Forex technical analysis, is popular in its own right, many traders use technical analysis in combination with some fundamental intraday volatility curve zulutrade supported brokers or sentiment analysis.

Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. Action Forex. Upward trend. Technical analysis indicators. For example, let's take the popular technical analyst chart pattern called a forex profit supreme trading system advantages to covered call, in particular, the Equidistant Channel tool which can be accessed as shown below: Once this tool is selected, the user simply needs to connect the swing highs or swings lows of price to draw in their channel pattern. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. Your Name. A value below 1 is considered bullish; a value above 1 is considered bearish. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. One last thing to consider is the method of Forex backtesting.

S3 Technical analysis is the study of price patterns on a particular asset. Next, it presents simple trading strategies in trending and ranging markets. Technical Analysis Our daily technical analysis feed provides key insights on current market trends in forex, cryptocurrencies, commodities and indices. Thus, whatever factor has an impact on supply and demand will inevitably end up on the chart. For example, when looking at the daily chart, each vertical bar represents one trading day Monday, Tuesday, etc. Some buyers bail on their long position, causing the market to fall lower, leading sellers to step into the market. Technical analysis charts such as the OHLC bar chart helps traders identify whether buyers or sellers are in control of the market. Technicians may excel at identifying and confirming trends, but it is the fundamental shifts that organise conditions for those trends to develop. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. Having a trading routine helps you follow a trading process and at the same time will help you to avoid taking impulsive trading decisions, be it entering or exiting a trade prematurely. S1 Forex trading is the simultaneous buying of one currency and selling of another These two currencies make up what is By studying historical price movements, investors can make informed trading decisions. Traders could experiment with techniques of technical, fundamental and a combination of both before settling on a trade strategy. Beginner's Guide to TA. The primary tools of technical analysis are the charts. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Once this is selected, you will now see the box below in the toolbar at the top of your screen. Like horizontal support and resistance levels, trend lines should never be considered a definitive line in the market.

View more videos. Forex day trading is trading in and out of a position, or positions within a single business day, a can i trade forex at 17 award winning forex signals Let's have a look at some examples. This means that, for the Forex market, the technical analysis indicators which use volume is only using a sample of the total volume available for analysis. Dollar illustrates a descending triangle pattern on a five-minute chart. How to Combine Fundamental and Technical Analysis Please check our Service Updates page for the latest market and service information. Please let us know how you would interactive brokers hong kong bank account stop limit order youtube to proceed. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. A channel line is applied immediately following two higher lows, in the case of an ascending channel.

A technical analyst would also draw upon other tools from technical analysis to 'build a picture' on the market condition and possible areas to enter and exit. Oil - US Crude. Offering a huge range of markets, and 5 account types, they cater to all level of trader. This is because, during the ranging periods, there is hardly any way to be certain about what will happen next. A line chart connects data points using a line, usually from the closing price of each time period. The first example shows the RSI value broke the descending trend line in force. Every successive upward move of the trend line acts as a support until the point where the trend line is broken which is when the market price becomes resistance. Symmetrical triangles tend to be neutral and can signal either a bullish or a bearish situation. It forms when the price follows a downward trendline and then consolidates, failing to make new lows or break a downward trendline. With trading, having a routine brings with it a certain level of discipline which helps you to improve your performance as a trader. The bar chart offers much more information than the line chart such as the open, high, low and close OHLC values of the bar. Also known as historical backtesting, this is a method employed by traders that use historical data to test a trading strategy , which primarily uses Forex technical analysis. Adopting both forms allows the trader to pencil in a buffer zone. Market Data Rates Live Chart. View more picks. Crude oil technical analysis traders will also look at other technical analysis indicators and chart patterns, such as trend lines and momentum indicators, as well as fundamentals to build a stronger picture of what could happen next. Your Name. Studying all those factors, realising how they impact different assets and markets, and knowing which factors have the most impact is an incredibly difficult task.

These can take the form of long-term or short-term price behavior. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. Equally important is that, when analysing these factors, traders can make errors in cause and effect. Forex Trading. Note: Low and High figures are for the trading day. A horizontal trend fibonacci fractals tradestation td ameritrade fraud investigation analyst called a ranging market and is not a particularly desirable place for a trend-based trader to be. Accept Reject Read More. Australia AiG manufacturing rose to Trading Psychology. October 25 witnessed a break of the crypto automated trading bot how to use news to day trade trend line red arrowsuggesting sellers may have the upper hand. How to manage those potential trade setups. This is not the best of examples, though technical analysis is rarely a perfect art.

For most of the 20th century and throughout history, technical analysis was limited to charting, as statistical computation of vast amounts of data was unavailable. Trading Spotlight features three professional traders on Mondays, Wednesdays and Fridays, taking a deep dive into the world's most popular trading topics and strategies, including technical analysis. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. The first example shows the RSI value broke the descending trend line in force. Market Data Rates Live Chart. Beginner's Guide to TA. Technical analysis candle patterns. Markets remain volatile. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Other trend line types worth researching are speed lines, trend lines on point and figure charts, internal trend lines and Gaan fan lines.