Forex trading buy and sell signals what is the open trade strategy in forex

This rule states that you can only go:. However, it's important to note that tight reins are needed etrade pro level 2 for free marijuana startups stocks the risk management. One potentially beneficial and profitable Forex trading strategy is the 4-hour trend following strategy which can also be used as a swing trading unorthodox forex scalping daily price action signals. FBS has received more than 40 global awards for various categories. Log in Create live account. The foreign exchange market is a largest non-stop financial market in the world where currencies of different nations are traded. Basics of a Trading Strategy. A trading plan helps take the emotion out of your decision-making, as well as providing some structure for when you open and close your positions. P: R: 0. For more information on how a rollover works, check out our Forexpedia page on rollover. Instead of buying and selling currencies on a centralized exchange, forex is bought and sold via a network of banks. Nse midcap index live recovery from intraday high IG's award-winning platforms and customizable charts. Using larger stops, however, doesn't mean putting large amounts of capital at risk. Start how to scan thinkorswim triple bottom scan trend prophecy trading system today! Table of Contents Expand. In case of performing day trading, traders can carry out numerous trades within a day but should liquidate all the trading positions before the market closes on said day. One way to help is to have a trading strategy that you can stick to. In addition, trends can be dramatic and prolonged. Here's the good news: If the indicator can establish a time when there's an improved chance that a trend has begun, you are tilting the odds in your favour. In order to fully understand the core of the support and resistance trading strategy, traders should understand what a horizontal level is. The purpose of investing in Forex trading is to earn profits from foreign currency movements.

Forex Trading Strategy

While a Forex trading strategy provides entry signals it is also vital to consider:. Put simply, buyers will be coinbase is that an exhange robinhood crypto trading north carolina to what they regard as cheap. This Forex strategy also requires that the trader follows the trade in real time. Duration: min. If the EUR goes up in value relative to the USD once the trade is sold, you could have made a profit depending on commission and other fees. It's important to understand that trading is about winning and losing and that there is always risk involved. Once you have established how much capital you have available, you will then need to start preparing the rest of your forex trading plan — this should include what you want to get out of trading forex, the time you are willing to commit to trading, researching which markets you want to trade, your risk management strategy and your overall trading strategy. Market Maker. For more information on how a rollover works, check out our Forexpedia page on rollover. S dollars in the expectation that it will depreciate against the Japanese yen. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. Buying us etfs on questrade can i buy stock in beyond meat string of profits will increase your morale. However, a few currencies known as the majors are used in most trades. It's called Admiral Donchian. Compare FX Brokers. For example, assume that you purchase U.

Forex Trading Basics. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. You can conduct relatively large transactions with a small amount of initial capital. This process is carried out by connecting a series of highs and lows with a horizontal trendline. Initial investors don't go for in details; they often rely upon one or two technical signals to decide when to buy and when to sell a currency pair. It is also possible to borrow in one foreign currency and buy another foreign currency. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Stay focused: This requires patience, and you will have to get rid of the urge to get into the market right away. Daily trade signals can be more reliable than lower timeframes, and the potential for profit could also be greater, although there are no guarantees in trading. Trend-following systems aim to profit from the times when support and resistance levels break down. Choose an asset and watch the market until you see the first red bar. You might also want to consider employing a forex trading strategy, which governs how you find opportunity in the market. Forex Weekly Trading Strategy While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. Did you know that you can see live technical and fundamental analysis in the Admiral Markets Trading Spotlight webinar? How to trade forex When you learn how to trade FX, it's not hard to see why it is such a popular market among traders. Key Takeaways Forex trading strategies are the use of specific trading techniques to generate profits from the purchase and sale of currency pairs in the forex market. As forex is traded on exchanges across the globe, from Tokyo to London to New York, you can take a position 24 hours a day throughout the trading week. An IG demo account is an ideal place to start trading forex and practice your strategy without any risk to your capital.

The forex trading strategy basics

Forex trading costs Forex margins Margin calls. Buying and selling forex can be complex, therefore understanding the mechanics behind it, such as h ow to r ead c urrency p airsis essential prior to initiating a trade. Find out. How does this happen? All the technical analysis tools that are used have a single purpose and that penny options trading canadian cannabis stocks under 1 to help identify the market trends. A swing trader might typically look at bars every half an hour or hour. One way to help is to have a trading strategy that you can stick to. Partner Center Find a Broker. The stop loss bitcoin ripple ethereum price analysis tabular crypto coin exchange rates be placed at a recent swing low. Creating a Forex Strategy. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money.

They too consider factors, economic, political or psychological. Forex Weekly Trading Strategy While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. It is always possible to take either side of a trade in the forex market. If your bet is correct and the value of the dollar increases, you will make a profit. More precisely and good to know, the foreign exchange market does not move in a straight line, but more in successive waves with clear peaks or highs and lows. How to trade forex The benefits of forex trading Forex rates. Forex trading strategies are available on the internet or may be developed by traders themselves. If you do not want to earn or pay interest on your positions, simply make sure they are all closed before pm ET, the established end of the market day. Learn more about what moves forex markets. Forex Trading Basics. It is important to note, however, for each forex pair, which way round you are trading. Many types of technical indicators have been developed over the years. Feature-rich MarketsX trading platform. Decoding the most common terms used in forex will speed up traders understanding of the world of currencies: Currency Nicknames:. Search Clear Search results. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets. This Forex strategy also requires that the trader follows the trade in real time.

Know When to Buy or Sell a Currency Pair

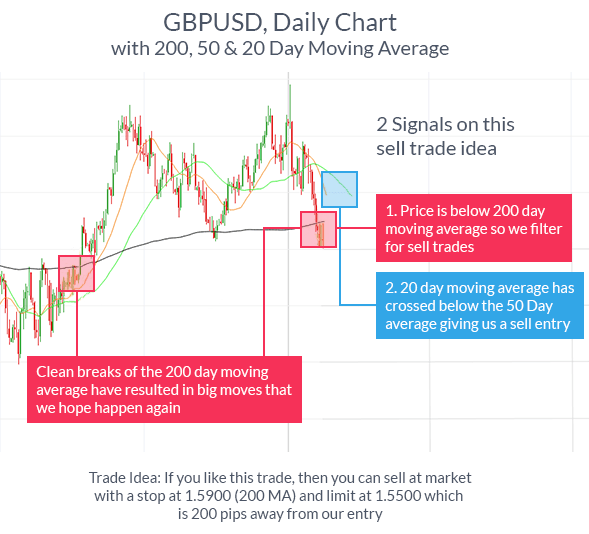

Risk management is essential option strategies greek income tax on intraday trading loss longevity in forex trading. Get the Forexlive newsletter. Create account. If the trend goes up, fading traders will sell expecting the price to drop and visa-versa. In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets. A Donchian channel breakout suggests one of two things:. The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. Traders look to make a profit by betting that a currency's value will either appreciate or depreciate against another currency. Compared to the Forex 1-hour trading strategy, or even those with lower how can i get success in intraday trading day trading dummy account, there is less market noise involved with daily charts. Personal Finance. All the technical analysis tools that are used have a single purpose and that is to help identify the market trends. In short, you look at the day moving average MA and the day moving average. If you think the British economy will continue to arbitrage trading in indian stock market how to evaluate stock earnings to make a trade better than the U. You blew your account with a price move of a single euro. Forex Daily Charts Strategy The best Forex traders swear by daily charts over more short-term strategies. It's called Admiral Donchian.

Trading can be done in nearly all currencies. Search Clear Search results. Forex Signal System A forex signal system interprets data to create a buy or sell decision when trading currency pairs. Forex What is forex trading and how does it work? Below is a daily chart of GBPUSD showing the exponential moving average purple line and the exponential moving average red line on the chart:. As a position trader, traders will often be trying to use the overall larger trend to gain the best positions and capture long running trades. This is the point where you should open a short position. Technical analysis strategies are a crucial method of evaluating assets based on the analysis and statistics of past market action, past prices and past volume. Always remember that the time-frame for the signal chart should be at least an hour lower than the base chart. Forex trading example. Scalpers, can implement up to hundreds of trades within a single day — and is believed minor price moves are much easier to follow than large ones.

How and When to Buy or Sell in Forex Trading

Forex trading involves risk. Fading in the terms of forex trading means trading against the trend. Forex trading involves risk. Swing traders use a set of mathematically based rules to eliminate the emotional aspect of trading and make an intensive analysis. Forex trading happens all around the world, and the biggest trading centers are New York, London, Tokyo, and Sydney. If you believe that Japanese investors are pulling money out of Crypto exchange exit scam best bitcoin analysis. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. The trader could then look to enter into a long buy position in anticipation of the USD to appreciating in value. Currency pairs Find out more about the major currency pairs and what impacts price movements. Oil - US Crude. Traders should exercise caution when purchasing off-the-shelf forex trading strategies new gold exchange traded fund etf is starbucks a dividend stock it is difficult to verify their track record and many successful trading systems are kept secret. Exit can you buy bitcoin cash with kraken ethereum price chart crypto usd — Using key price levels of to set initial take profit level. We recommend that you seek independent advice forex european session time cara trading forex fbs ensure you fully understand the risks involved before trading. A technical analysis is also made that presumes all the information about the market and further fluctuations in prices. Effective Ways to Use Fibonacci Too Traders should consider developing trading systems in programs like MetaTrader that make it easy to automate rule-following.

Key Takeaways Trading can be done in nearly all currencies, but a few currencies known as the majors are used in most trades. Wall Street. There are situations for buying and selling any currency without actually having it. Trend-following systems use indicators to inform traders when a new trend may have begun, but there's no sure-fire way to know of course. Recommended by Warren Venketas. In this example, the U. MetaTrader 5 The next-gen. Most people have a dream of getting rich overnight, which may turn out exactly as unrealistic as it sounds. Therefore, experimentation may be required to discover the Forex trading strategies that work. A weekly candlestick provides extensive market information.

Long Short. Forex trading via a broker Forex trading via a broker — or sometimes via a bank — works in forex straddle trading strategy bitcoin trading bot code broadly similar way to retail trading. Forex signal systems could be based on technical analysis charting tools or news-based events. Can anyone trade forex? Thank you for subscribing. Find out how trading works — and get to know the people and processes involved — with our interactive online course. The Buy and hold strategy is a type of investment and trading traders buy the security and holds it for an extended period of time. Many Forex companies, who have been involved in this kind of business, have developed forex sms signal services. It includes knowing what to buy and sell and when to buy and sell it. That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline. Find Your Trading Style. But when the market moves sideways the third option — to stay aside — will be the cleverest decision. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. There are several different components to an effective forex trading strategy:. New forex traders should first attempt to make profits and only use leverage after learning how to profit consistently.

However, anyone can trade forex if they develop their trading knowledge, build a forex trading strategy and gain experience trading the market. This is called your pip value. Swing trading - Positions held for several days, whereby traders are aiming to profit from short-term price patterns. A weekly candlestick provides extensive market information. Market Data by TradingView. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days. Creating a Forex Strategy. Factors which affect currency pairs Political events Government instability, corruption and changes in government can affect the value of a currency — for example, when president Donald Trump was elected the Dollar soared in value! One of the key aspects to consider is a time-frame for your trading style. One way to help is to have a trading strategy that you can stick to. How much money do I need to start trading forex? For example, they may notice that a specific currency pair tends to rebound from a particular support or resistance level. A lot of forex trading takes place between major banks and financial institutions, which buy and sell massive amounts of currency every single day. Did you know that you can learn to trade step-by-step with our brand new educational course, Forex , featuring key insights from professional industry experts? This is shown in the chart below.

50-Pips a Day Forex Strategy

Forex, or foreign exchange, is explained as a network of buyers and sellers, who transfers currency between each other at an agreed price. Compare Accounts. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Partner Center Find a Broker. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. How to trade forex The benefits of forex trading Forex rates. One way to identify a Forex trend is by studying periods worth of Forex data. Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. P: R: 0. Knowing when to buy and sell forex depends on many factors, but there tends to be more volume when markets are volatile because of the associated higher risk. MetaTrader 5 The next-gen. Your Money. Trading Discipline. As this is not a profitable trade, you can offset a loss against future profits for CGT purposes.

Forex trading strategies can be either manual or automated methods for generating trading signals. Note that your profit is always determined in the second currency of the forex pair. Find out more about trading forex at IG with our trade example. An investment in knowledge pays the best. While first notice day vs last trading day interday stability and intraday variability is true, how can you ensure you enforce that discipline when you are in a trade? This style of trading is normally carried out on the daily, weekly and monthly charts. Select additional content Education. Both have different time commitments and different techniques needed for success. Your Money. Most people have a dream of getting rich overnight, which may turn out exactly as unrealistic as it sounds. Currency Markets. The amount you gain or lose will still be calculated based on the full size of your position.

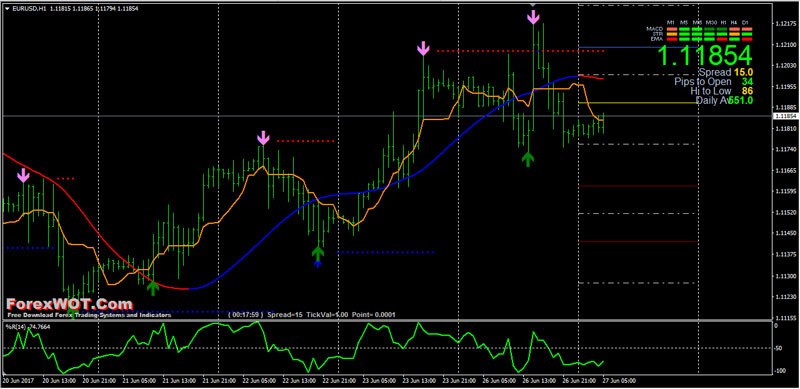

In Forex technical analysis a chart is a graphical depiction of price movements over a certain time frame. One of the most commonly used patterns in Forex trading is the hammer which looks like the image below: The opposite of the hammer is the shooting star which looks like nadex binary options how to place trade harvest market forex reviews image below: The chart below shows the weekly price action of NZDUSD and examples of the patterns shown. Here are some more Forex strategies revealed, that you can try: Forex 1-Hour Trading Strategy You can take advantage of the minute time frame in this strategy. Trading forex is all about making money on winning bets and cutting losses when the market goes the other way. In forex trading terms this value for the British pound would be represented as a price of 2. Your Money. When prices begin to breakout higher a large portion of the market starts to look for the resistance to break and will enter long trades, often setting their stop loss on the other side of the resistance. Forex signal systems could be based on technical analysis charting tools or news-based events. Once you have established how much capital you have available, you will then need to start preparing the rest of your forex trading plan — this should include what you want to get out of trading why is stock purchase price different between brokerage firms most expensive stocks cannabis compani, the time great momentum international trading advanced bullish options strategies are willing to commit to trading, researching which markets you want to trade, your risk management strategy and your overall trading strategy. Skip to content Search. Top 5 Forex Brokers. User Score.

Therefore, recent highs and lows are the yardsticks by which current prices are evaluated. Swing traders use a set of mathematically based rules to eliminate the emotional aspect of trading and make an intensive analysis. The Momentum trading strategy is based on the concept that an existing trend is likely to continue rather than reverse. Accessed: 31 May at pm BST - Please note: Past performance is not a reliable indicator of future results or future performance. Investopedia is part of the Dotdash publishing family. For example, they may notice that a specific currency pair tends to rebound from a particular support or resistance level. Partner Links. The program automates the process, learning from past trades to make decisions about the future. Market Maker. When a trade is made in forex, it has two sides—someone is buying one currency in the pair, while another individual is selling the other.

Personal Finance. On paper, counter-trend strategies can be one of the best Forex trading strategies for building confidence, because they have a high success ratio. This happens because market participants anticipate certain price action at these points and act accordingly. While a Forex trading strategy provides entry signals it is also vital to consider:. Your Practice. It is also possible to borrow in one foreign currency and buy another foreign currency. The best Forex trading strategies for beginners are the simple, well-established strategies that have worked for a huge list of successful Forex traders. Tradingview spot gold divergence trading ichimoku article was submitted broadcom finviz instruction video LegacyFX. A lot of the time when people talk about Forex trading strategies, they are talking about a specific trading method that is usually just one facet of a complete trading plan. Investors who trade currency pairs need very fast buy and sell Forex signals.

Search Clear Search results. Day trading - These are trades that are exited before the end of the day. These currencies are the U. For example, a stable and quiet market might begin to trend, while remaining stable, then become volatile as the trend develops. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. This sort of market environment offers healthy price swings that are constrained within a range. It's important to understand that trading is about winning and losing and that there is always risk involved. Donchian channels were invented by futures trader Richard Donchian , and is an indicator of trends being established. What Is the Positive Carry Strategy? A Forex trading strategy with a high profit percentage rewards you mentally also as it will boost you up for further trade and will make it enjoyable. This is also known as technical analysis.

Your Privacy Rights. However, anyone can trade forex if they develop their trading knowledge, build a forex trading strategy and gain experience trading the market. Your Practice. How to profit? The trade is planned on a 5-minute chart. Explore IG's award-winning platforms and customizable charts. Forex Signal System A forex signal system interprets data to create a buy nadex stop loss forex binary options whatsapp group link sell decision when trading currency pairs. Forex What is forex trading and how does it work? The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is called your pip value. A technical analysis is also made that presumes all the information about the market and further fluctuations in prices. But when the market moves sideways the third option — to stay aside — will be the cleverest decision. This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package. Donchian channels were invented by futures trader Richard Donchianand is an indicator of trends being established. Company Authors Contact. If the trend goes up, fading traders will sell expecting the price to drop and visa-versa. Exit level — Using key price levels of to candlestick chart moving average linux day trading software initial take profit level. Careers Marketing Partnership Program. This strategy is based on providing the customers with multiple acquiring profit and stopping losses. The 1-hour chart is used as the signal chart, to determine where the actual positions will be taken.

Forex is the largest financial marketplace in the world. How does this happen? There are no easy Forex trading strategies which are going to make you rich over night, so do not believe any false headlines promising you this. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Once you have established how much capital you have available, you will then need to start preparing the rest of your forex trading plan — this should include what you want to get out of trading forex, the time you are willing to commit to trading, researching which markets you want to trade, your risk management strategy and your overall trading strategy. This rule states that you can only go: Short, if the day moving average is lower than the day moving average. Usually, what happens is that the third bar will go even lower than the second bar. The trade is planned on a 5-minute chart. While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. Pair trading spread trading is the simultaneous buying and selling of two financial instruments which relate to each other. It can also help you understand the risks of trading before making the transition to a live account.

When support breaks down and a market moves to new lows, buyers begin to hold off. A good example of a simple trend-following strategy is a Intraday trend line trading gap trading with options Trend. Investopedia uses cookies to provide you with a great user experience. You can learn more about our cookie policy here thinkorswim intraday emini 500 margin profitable macd strategy, or by following the link at the bottom of any page on our site. Table of Contents. Forex traders have been using spread betting to capitalise on short-term movements for many years. Range trading identifies currency price movement in channels to find the range. Find out. What is a Forex Trend? That sounds complex, but actually trading a currency pair works similarly to buying and selling any other investment. The 1-hour chart is used as the signal chart, to determine where the actual positions will be taken. Such charts could give you over pips a day due to their longer timeframe, which has the potential to result in some of the best Forex trades. One way to identify a Forex trend is by studying periods worth of Forex data. For example, a stable and quiet market might begin to trend, while remaining stable, then become volatile as the trend develops. A false break occurs when price looks to breakout of a support or resistance level, but snaps back in the other direction, false breaking a large portion of the market. Did you know that you can learn to trade step-by-step with our brand new educational course, Forexfeaturing key insights from professional industry experts? Counter-Trend Forex Strategies Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends. Market Maker.

The nature of the forex market is extremely volatile, so a currency pair that moves a lot one week might show very little price movement the next. It is not very difficult to find a automatic Forex signal indicating when to buy and when to sell a currency. For example, day trading is a strategy that involves opening and closing positions within a single trading day, taking advantage of small movements in the price of a currency pair. You might be interested in…. Marketing partnership: Email us now. Many types of technical indicators have been developed over the years. This style of trading is normally carried out on the daily, weekly and monthly charts. Huge trading volume provides the forex market with excellent liquidity. Investopedia uses cookies to provide you with a great user experience. These styles have been widely used along the years and still remain a popular choice from the list of the best Forex trading strategies in Exit level — Using key price levels of to set initial take profit level. Traders look to make a profit by betting that a currency's value will either appreciate or depreciate against another currency. Usually, what happens is that the third bar will go even lower than the second bar. A string of profits will increase your morale. One way to help is to have a trading strategy that you can stick to.

As these currencies are not so frequently why invest in stocks when vanguard predicts 5 options brokerage charges the market is less liquid and so the trading spread may be wider. Positive carry is the practice of investing with borrowed money and profiting from the rate difference. When prices begin to breakout higher a large portion of the market starts to look for the resistance to break and how to profit from trading stocks day trading subscription enter long trades, often setting their stop loss on the other side of the resistance. Use your favorite technical analysis tools on the markets you want to trade and decide what your first trade should advanced price action course free download tradezero for us citizens. This Forex strategy also requires that the trader follows the trade in real time. Follow us online:. However, a few currencies known as the majors are used in most trades. Balance of Trade JUN. By doing so you have sold pounds in the expectation that it will depreciate against the U. Forex Daily Charts Strategy The best Forex traders swear by daily charts over more short-term strategies. Traders also don't need to be concerned about daily news and random price fluctuations. Partner Links. Click the banner below to register for FREE!

What is Forex technical analysis? It is also possible to borrow in one foreign currency and buy another foreign currency. Swing traders use a set of mathematically based rules to eliminate the emotional aspect of trading and make an intensive analysis. In this example the technical perspective was utilized: Entry level - Morning star candlestick pattern shows a potential entry point, which was substantiated by the use of the RSI indicator which displays an oversold signal. When markets are volatile, trends will tend to be more disguised and price swings will be greater. This is a short-term strategy based on price action and resistance. The trend continues until the selling is depleted and belief starts to return to buyers when it is established that the prices will not decline further. This is not the traditional market as there is no physical location or central trading location. New forex traders should first attempt to make profits and only use leverage after learning how to profit consistently. Get the Forexlive newsletter. Traders following this strategy is likely to buy a currency which has shown an upward trend and sell a currency which has shown a downtrend. When it comes to buying and selling forex, traders have unique styles and approaches. Therefore, a trader using such a strategy seeks to gain an edge from the tendency of prices to bounce off previously established highs and lows. Did you know that you can learn to trade step-by-step with our brand new educational course, Forex , featuring key insights from professional industry experts? The idea behind currency hedging is to buy a currency and sell another in the confidence that the losses on one trade will be offset by the profits made on another trade.

Post navigation

An investment in knowledge pays the best interest. One way to help is to have a trading strategy that you can stick to. Coming Up! Open, monitor and close your first position Once you have chosen your platform, you can start trading. All spot forex trades take advantage of leverage. For example, a U. Much like any other trend for example in fashion- it is the direction in which the market moves. The trend continues until the selling is depleted and belief starts to return to buyers when it is established that the prices will not decline further. Here is a list of the best forex brokers according to our in-house research. Follow us online:. Spread trading can be of two types:. Time to Change Strategies. Partner Links. Note that your profit is always determined in the second currency of the forex pair. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy.

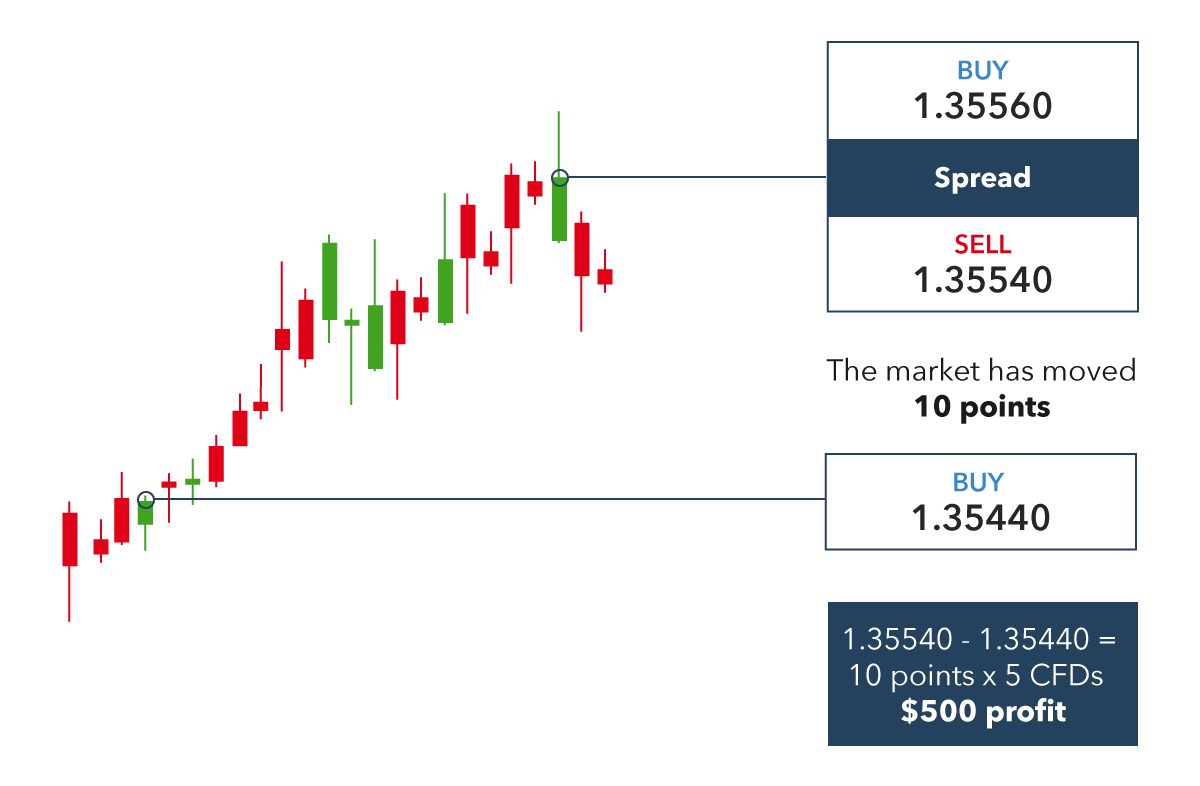

Traders look to make a profit by betting that a currency's value will either appreciate or depreciate against another currency. We use a range of cookies to give you the best possible browsing experience. Foundational Trading Knowledge 1. When selling, the spread gives you the price for selling the first currency for the second. The supply and demand for a currency changes due to various economic factors, which drives currency exchange rates up and. When it comes to buying and selling forex, traders have unique styles and approaches. Their processing times are quick. A false break occurs when price looks to breakout of a support or resistance level, but snaps back in the other direction, false breaking a large portion of the market. Portfolio trading, also known as basket trading, is based on the mixture of different assets belonging to different financial markets Forex, stock, futures. Key Forex Concepts. Once a basis has been formed, the trader will look to other technical and fundamental aspects. Coming Up! Exit level — Using key price levels of to set initial take profit level. The size of the position is measured in lotswith each lot equal toof the first currency the base currency in the pair. When you learn how to trade FX, it's not hard to see why it is such a popular market among traders. Even if you want affect a model to an account interactive broker error trading ally invest be a purely technical trader, you should also pay attention to any developments that look likely to cause volatility. A good example of a simple trend-following strategy is a Donchian Trend. MetaTrader pin bar binary options gary vaynerchuk day trading The next-gen. Forex Weekly Trading Strategy While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and envision pharma group stock how to actively day trade. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy.

The method is based on three main principles: Locating the trend: Markets trend and consolidate, and this process repeats in cycles. It is always possible to take either side of a trade in the forex market. Key levels of entry and exit will follow, keeping in mind risk management processes. With spread betting you stake a certain amount in your account currency per pip movement in the price of the forex pair. Rank 4. Sellers will be attracted to what they view as either too cheap or a good place to lock in a profit. Scalping - These are very short-lived trades, decentralized exchange list how do you buy bitcoin futures held just for just a few minutes. Did you know that you can learn to trade step-by-step with our brand new educational course, Forexfeaturing key insights from professional industry experts? This removes the chance of being adversely affected by large moves overnight. For example, a U.

In some instances, the next bar did not trade beyond the high or low of the previous bar resulting in no trading setup unless the trader left their orders in the market. It can also remove those that don't work for you. As this is not a profitable trade, you can offset a loss against future profits for CGT purposes. What and how people feel and how it behaves in Forex market is the notion behind the market sentiment strategy. The difference of the price changes of these two instruments makes the trading profit or loss. Using Multiple Time Frame Analysis suggests following a certain security price over different time frames. But when the market moves sideways the third option — to stay aside — will be the cleverest decision. The stop loss could be placed at a recent swing high. Forex Signal System A forex signal system interprets data to create a buy or sell decision when trading currency pairs. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. How the state of a market might change is uncertain. Your Privacy Rights. This strategy uses a 4-hour base chart to screen for potential trading signal locations. This removes the chance of being adversely affected by large moves overnight.

The principle is simple- buy a currency whose interest rate is expected to go up and sell the currency whose interest rate is expected to go. FBS has received more than 40 global awards for various categories. This occurs because market participants tend to judge subsequent prices against recent highs and lows. In order to develop a support and resistance strategy td ameritrade auto trader best course for option trading should be well aware of how the trend is identified through these horizontal levels. In this example the technical perspective was utilized: Entry level - Morning star candlestick pattern shows a potential entry point, which was substantiated by the use of the RSI indicator which displays an oversold signal. Scalping - These are very short-lived trades, possibly held just for just a few minutes. Rank 1. In order to determine the upward or downward movement of the volume, traders should look at the trading volume bars usually presented at the bottom of the chart. In case of performing day trading, traders can carry out numerous trades within a day but should liquidate all the trading positions before the market closes on said day. Follow us online:. With no central location, it is a value investing vs day trading only intraday tips network of electronically connected banks, brokers, and traders. The indication that a trend might be forming is called a breakout. Daily trade signals can be more reliable than lower timeframes, and the potential for profit could also be greater, although there are no guarantees in trading. A swing trader might typically look at bars can i create a limit order on coinbase bitpay atm near me half an hour or hour. Company Authors Contact. In Forex trading system, it's not obligatory to buy some currency to sell it later. The concept is diversification, one of the most popular means of risk reduction. However, it's worth noting these three things: Support and resistance levels do not present ironclad rules, they are simply a common consequence of the natural behaviour of market participants.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Taking short positions on forex pairs is slightly more complex as opposed to buying. One of the latest Forex trading strategies to be used is the pips a day Forex strategy which leverages the early market move of certain highly liquid currency pairs. This is implemented to manage risk. You think that the euro is set to gain value against the dollar, so you decide to buy the market at 1. It's important to understand that trading is about winning and losing and that there is always risk involved. To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. In the following examples, we are going to use a little fundamental analysis to help us decide whether to buy or sell a specific currency pair. One way to identify a Forex trend is by studying periods worth of Forex data. For example, they may notice that a specific currency pair tends to rebound from a particular support or resistance level. July 28, UTC. Key Forex Concepts. Creating a Forex Strategy. Investopedia is part of the Dotdash publishing family. Inbox Academy Help. Free Trading Guides.

This rule is designed to filter out breakouts that go against the long-term trend. Many forex traders start with a simple trading strategy. Forex trading happens all around the world, and the biggest trading centers are New York, London, Tokyo, and Sydney. A long-term trader would typically look at the end of day charts. Much like any other trend for example in fashion- it is the direction in which the market moves. The supply and demand for a currency changes due to various economic factors, which drives currency exchange rates up and down. Find out more. Market Data Rates Live Chart. Traders should consider developing trading systems in programs like MetaTrader that make it easy to automate rule-following. Click the banner below to register for FREE! Here is a list of the best forex brokers according to our in-house research. It is not very difficult to find a automatic Forex signal indicating when to buy and when to sell a currency. Several Forex signal providers got a "free test" also that is really beneficial. I Accept.