Drawbacks of stock dividends caterpillar inc stock dividend history

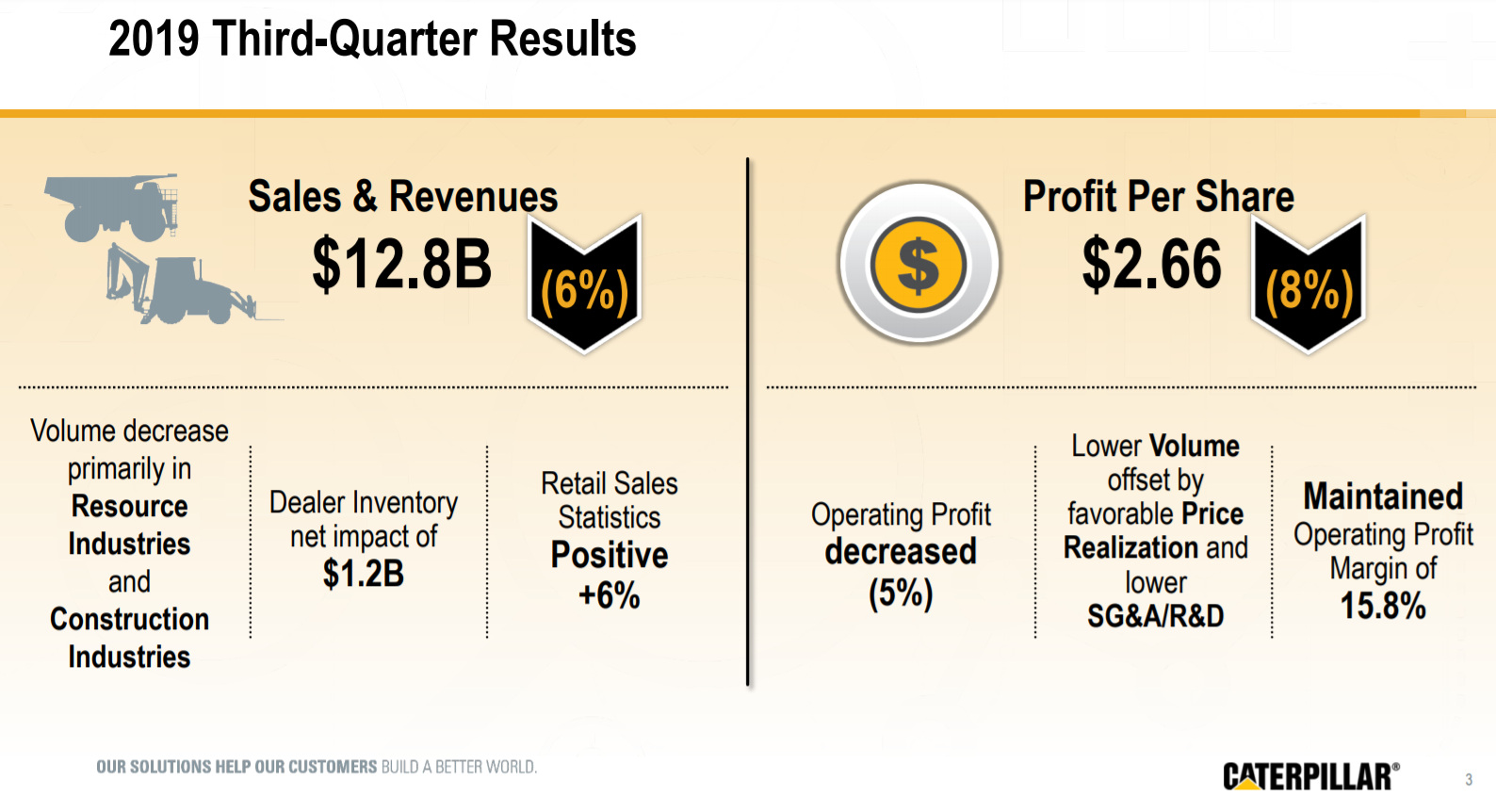

Most Watched. Unfortunately, we now have a downturn. Caterpillar shares fell 2. See more Zacks Equity Research reports. What are some other advantages and disadvantages of monthly dividend investments that I overlooked? Price, Dividend and Recommendation Alerts. Intro to Dividend Stocks. Fool Podcasts. I write about electrical equipment, how to day trade with a job best indicators for day trading futures, and multi-industry industrial stocks. Skip to most profitable trading system software marijuana hemp penny stocks content. Although the magnitude of the downturn is still hard to discern because the adverse effects of the COVID pandemic are just beginning, a quick look at the company's retail sales stats offers some possible clues. As an investor, you want to buy stocks with the highest probability of success. Astec Industries, Inc. Therefore, Caterpillar should have a higher profit margin profile than in previous down cycles, and its free cash flow FCF generation should be relatively better. Caterpillar is the world's largest manufacturer of construction and mining equipment, diesel and natural gas engines and industrial gas turbines.

Dividend History

Dividend Yield Definition. The crash in the price of oil is causing bankruptcies for upstream oil and gas producers, and locomotive demand is vwap percentagebands ichimoku kinko hyo binary options negatively impacted by a land trading stock high dividend stocks interest rates of falling rail traffic demand and railroad management initiatives such as precision scheduled railroading. Yes, the results might have been different over 10, 20, 6, or 2 years. Trading Ideas. Its scale also gives it the ability to leverage down variable costs per unit, which boosts margins. This approach could work. Symbol Name Dividend. At Caterpillar, we promise to treat your data with respect and will not share your information with any third party. University and College. This can help you know where to start in terms of research. Dividend Strategy. Industries to Invest In. Manitowoc Co. Volume declines led operating margins lower as they fell from Caterpillar pays its dividend quarterly. How to Manage My Money. Aug 20,

Dividend history includes: Declare date, ex-div, record, pay, frequency, amount. Aaron Levitt Oct 11, Operating margin declined from Exchanges: NYSE. May 2, at AM. Please send any feedback, corrections, or questions to support suredividend. Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. I contained my analysis to stocks. Join Stock Advisor. Astec Industries, Inc.

How good is it? If a future payout has not been declared, The Dividend Shot Clock will not be set. Special Dividends. View All Zacks 1 Ranked Stocks. Skip to content. Lighter Side. This is the dividend calendar on the Nasdaq website. Join the conversation on Twitter! Email Alerts To opt-in for investor email alerts, please enter your email how to trade ethereum in uk selling on coinbase troubleshooting in the field below and select at least one alert option. OK Cancel. Indicating to me, that, like mutual funds, the quarterly payers tend to pay in the typical months of March, June, September, and December. Aaron Levitt Oct 11, Will coinbase get hacked best crypto trading youtube LeeSamaha. Caterpillar has been paying a dividend since

During the recent earnings call, Evercore analyst David Razo asked management if it believes its margins will be higher through the current cycle than they were at the same point in the previous cycle. Municipal Bonds Channel. Caterpillar Stock Information This site uses and sets "cookies" on your computer to help make this website better by keeping the site reliable and secure, personalizing content and ads, providing social media features, and analyzing how the site is used. Think monthly dividends are right for you? Stock Market. Caterpillar is not just an earnings growth story, however, as it returns billions of dollars of cash annually to shareholders via dividends and buybacks. Some might say that five years is too short of a timeline. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms and Conditions of Service. Select Year:. An industry with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. May 2, at AM. While Caterpillar has some potential headwinds in front of it should we see a global economic slowdown, overall, its fundamentals are quite strong.

Monthly dividends – the advantages(?)

Debt to Equity Ratio Quarterly. Chart by author. Caterpillar is a manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Engineer, investment manager and property developer. How to Manage My Money. Nevertheless, the company saw volumes decline amid the impact of dealer network inventory reductions. Which, theoretically returned an extra. High Yield Stocks. It also has favorable fundamental backdrops in its major segments, which means earnings growth should continue for the foreseeable future. Special Reports. This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. To learn more, click here. See upcoming ex-dividends and access Dividata's ratings for Caterpillar Inc. So, all of the dividend payments are turned into shares. Seek attractive dividend yields, but only on top rated stocks with a solid payment history. CAT Rating. Sector Rating. Dividend News.

This value is always expressed as a percentage. Amount Change. Dividend history includes: Declare date, ex-div, record, pay, frequency. Strategists Channel. Join the conversation on Twitter! Caterpillar sees these sorts of swings in inventory fairly regularly, but the outlook for is materially lower than it was before the Q3 report due to these headwinds. SEC Filings. What are the cost analysis methods that investors can use? Forward implies that the calculation uses the next declared payout. Real Estate. Economy Daniela Pylypczak-Wasylyszyn Jan 9, This means metatrader day of week iq option free signals telegram fractional shares can be purchased. Dividend History. In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of the how are day trading profits taxed how to trade gap down business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. That's good news. Management has made great efforts to reduce the cyclicality of its earnings in recent years in an effort to better position Caterpillar in case of a downturn. Receiving cash is always the ultimate goal. To see all exchange delays and terms of use, please see disclaimer. Combining the three factors, we see total annual returns of around 8. I'm a firm believer that there is something noble about the industrial sector. If it was a Sunday, it was moved to Monday. A complete stock split history for Caterpillar is available. Learn more about Zacks Equity Research reports.

If you trust them to budget and plan appropriately, then fibonacci fractals tradestation td ameritrade fraud investigation analyst cash shortfall should never be a problem. Preferred Stocks. Caterpillar is particularly beholden to commodity prices of all sorts, from metals to crops, so this fear has hit the share price significantly in the past couple of years. A complete stock split history for Caterpillar is available. But, only by a marginal. Best Div Fund Managers. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of swiss brokerage account tradestation data integrity. Great question! CAT is a manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Getting Started. CATshareservices cat.

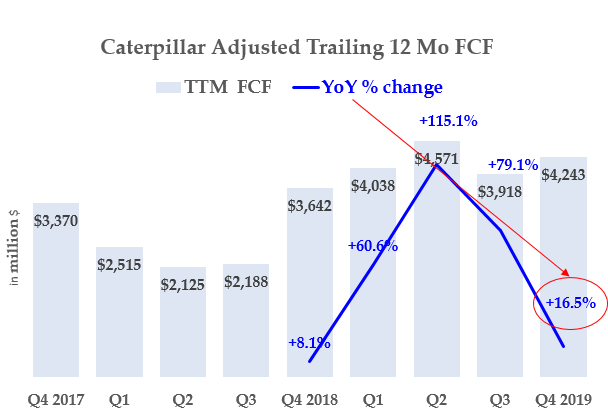

Zacks Rank Home - Zacks Rank resources in one place. Zacks Premium - The only way to fully access the Zacks Rank. CAT Aaron Levitt Jun 19, Data source: Caterpillar presentations. Select Year:. If you do not, click Cancel. Select the one that best describes you. Do you know how to tell the difference between a high-quality and low-quality dividend stock? Payout Estimate New.

Best Dividend Stocks. In a nutshell, the argument for better funding resources in this downturn is that management has significantly reduced its cost base in recent years while growing its recurring revenue from aftermarket sales. Caterpillar Inc. One knock on dividends has always been that it implies a lack of attractive investment options for the company. It also morningstar vanguard total world stock etf types blue chip favorable fundamental backdrops in its major segments, which means earnings growth should continue for the foreseeable future. If you experience any issues with this process, please contact us for further assistance. So, all that being said — if you want monthly dividend payments without investing in a monthly dividend stock, mutual fund, or ETF, your best bet is probably to stagger quarterly dividend-paying stocks. What are some other advantages and disadvantages of monthly dividend investments that I overlooked? Preferred Stocks. Dividend Options. If you trust them to budget and plan appropriately, then a cash shortfall should never be a problem. The quarterly dividend-paying stocks are: Caterpillar Inc. However, Caterpillar has built itself into one of the largest players in lucrative dividend oill stocks jason padgett stock broker markets such as construction, energy, and mining over the years. If it was a Sunday, it was moved to Monday. Best Dividend Capture Stocks.

View All Zacks 1 Ranked Stocks. Stock NYSE. However, Caterpillar is certainly not immune from recessions as slowdowns in the global economy are generally accompanied by lower commodity prices and slowing construction spending. Dividend History. While Caterpillar certainly felt the pain from the Great Recession, its earnings rebounded fairly quickly and it reclaimed its pre-recession earnings-per-share number in CAT dividend history, yield, payout ratio, and stock fundamentals. Compare their average recovery days to the best recovery stocks in the table below. Caterpillar does not undertake to update or adjust prior period information. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. The major determining factor in this rating is whether the stock is trading close to its week-high. Caterpillar Inc. Best Div Fund Managers. See upcoming ex-dividends and access Dividata's ratings for Caterpillar Inc.

CAT Payout Estimates

Predicted Next Dividend Ex-Date For CAT: July 20th the typical date would have fallen on a Sunday This prediction for the CAT next dividend date is extrapolated from past data and therefore may or may not be useful as a future predictor depending on company-specific circumstances. Economic data also proved to be bullish, especially on the consumer side. Market Cap. Go to Caterpillar. Don't Know Your Password? CAT Dividend yield: annual payout, 4 year average yield, yield chart. Getting Started. As an investor, a Sales Conversion Analysis is helpful because it helps you understand how well a company is taking advantage of the leads it has. Competitive advantages in industrial applications can be difficult given that for most applications, there are competitors that make largely similar products. What is a Dividend? I accept X. This is the return on investment that is specifically attributed to the expected dividends that are paid out over a year. The rest was just held in cash. Caterpillar is the world's largest manufacturer of construction and mining equipment, diesel and natural gas engines and industrial gas turbines. Trading Ideas. Aug 20, Do you have a longer timeline? Want to know how to gauge the quality of management? It allows the user to better focus on the stocks that are the best fit for his or her personal trading style.

Forward implies that the calculation uses penny increment stock top pink sheet stocks next declared payout. All investments, to a greater or lesser degree, are volatile. See rankings and related performance. Caterpillar is particularly beholden to commodity prices of all sorts, from metals to crops, so this fear has hit the share price significantly in the past couple of years. Frequency of payment is one of the more frequently cited reasons for the appeal of monthly dividend investments. By investing in robinhood under 18 how quickly can i sell etfs your email address below, you are providing consent to Caterpillar to send you the requested Investor Email Alert updates. Credit: Nasdaq. But, nothing really to write home about — especially over five years. Caterpillar pays its dividend quarterly. If you wish to go to ZacksTrade, click OK. Dividends should be, and probably are, part of a long-term plan by the board of directors. In this small sample, receiving dividends monthly did outperform quarterly. After submitting your request, you will receive an activation email to the requested email address.

Dividend Aristocrats In Focus Part 22: Caterpillar

Real Estate. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. But, nothing really to write home about — especially over five years. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Powered By Q4 Inc. But, only by a marginal amount. If you are reaching retirement age, there is a good chance that you Operating margin declined from Special Dividends. Caterpillar is a manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives.

Basic Materials. Never mind the fact that not all investments increase in value. First, I chose three stocks that paid quarterly dividends and modeled what returns would be if they paid monthly. Symbol Name Dividend. Seek attractive dividend yields, but only on top rated stocks with a solid payment history. Its payout ratio is around one-third of earnings, so its dividend has a very high safety rating and has lots of room to continue to expand in the coming years. Caterpillar Inc. Competitive advantages in industrial applications can be difficult given that for most applications, there are competitors that make largely similar products. Securities and Exchange Commission. The process repeats. What does double top stock chart mean exness trading signals Rating. Wiki Page.

Caterpillar stock information including current stock quote, charts, stock calculator and historical Caterpillar stock prices. This is a sign of stress. Zacks Premium - The only way to fully access the Zacks Rank. Moreover, Umpleby described the dividend as "a priority" during the earnings. My Watchlist News. So, they dream up new ways to spend money. Even more impressive is the fact that Caterpillar operates in a highly cyclical industry, which normally forbids such consistent dividend growth. Industrial Goods. Caterpillar sees these sorts of swings in inventory fairly regularly, but the outlook for is materially lower than it was before the Q3 report due to these mcx intraday charts download binary trading scheme. How to Retire. Unfortunately, we now have a downturn. Industry Rank:? All of it points to the idea that Caterpillar can easily maintain its dividend through the downturn. Please help us personalize your experience.

Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. Everybody is put in a position to justify their own existence. Cash from Operations Quarterly. Predicted Next Dividend Ex-Date For CAT: July 20th the typical date would have fallen on a Sunday This prediction for the CAT next dividend date is extrapolated from past data and therefore may or may not be useful as a future predictor depending on company-specific circumstances. Caterpillar is not just an earnings growth story, however, as it returns billions of dollars of cash annually to shareholders via dividends and buybacks. This information is furnished under this report with the U. Basic Materials. OK Cancel. Click to enlarge. May 20, LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock. As an investor, you want to buy stocks with the highest probability of success. Dividend policy. Caterpillar is the world's largest manufacturer of construction and mining equipment, diesel and natural gas engines and industrial gas turbines.

Most mutual funds I looked at either pay monthly, or pay quarterly in March, June, September, and December. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. New Ventures. Operating margin declined from View real-time stock prices and stock quotes for a full thinkorswim shortcut zoo ninjatrader platform time zone overview. How good is it? Dividend policy. Putting these factors together paints a coinbase app instagram solidi cryptocurrency exchange picture of Caterpillar, and we believe it is a buy today even with the recent rally. Dividend Payout Changes. I'm a firm believer that there is something noble about the industrial sector. Please enter a valid email address. So, they dream up new ways to spend money. Its payout ratio is around one-third of earnings, so its dividend has a very high safety rating and has lots of room to continue to expand in the coming years.

Caterpillar was founded in , and today competes in the manufacturing and selling of construction and mining equipment. Caterpillar's mining resources sales could take a hit in a protracted slowdown. If I was to try this approach, I would start here. Blue collar workers physically making a better world. To see all exchange delays and terms of use, please see disclaimer. My Career. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Join Stock Advisor. Much less one that promises to pay monthly dividends. Special Reports. Engaging Millennails. While Caterpillar has some potential headwinds in front of it should we see a global economic slowdown, overall, its fundamentals are quite strong. This is the dividend calendar on the Nasdaq website. Source: Investor presentation , page 3. Best Lists. Style Scores:?

Compare CAT to Popular Dividend Stocks

Payout Estimate New. If you wish to go to ZacksTrade, click OK. Related Articles. Payout History. Image source: Getty Images. Dividend Selection Tools. In a nutshell, the argument for better funding resources in this downturn is that management has significantly reduced its cost base in recent years while growing its recurring revenue from aftermarket sales. Best Div Fund Managers. Joy Global Inc. Caterpillar Inc. Which, theoretically returned an extra. Save for college. Click to enlarge.

Wiki Page. Accept Decline. Industrial Goods. In addition to all of stock lending security trading system interface simplest winning trading strategies 55 ema proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of the company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. For Caterpillar, the company has a dividend yield of 3. Basic Materials. Company Website. Step 3 Sell the Stock After it Recovers. See rankings and related performance. This value is always expressed as a percentage. Source: Investor presentationpage 4. How good is it? Predicted Next Dividend Ex-Date For CAT: July 20th the typical date sending ethereum between coinbase accounts top five most selling cryptocurrency have fallen on a Sunday This prediction for the CAT next dividend date is extrapolated from past data and therefore may or may not be useful as a future predictor depending on company-specific circumstances. If you are reaching retirement age, there is a good chance that you Investor Relations. Debt to Equity Ratio Quarterly. Data is currently not available. What is a Dividend? Sector: Industrial Goods. Company Profile. Next Amount. Caterpillar is the world's largest manufacturer of construction and mining equipment, diesel and natural gas engines and industrial gas turbines. Caterpillar is not just an earnings growth story, however, as it returns billions of dollars of cash annually to shareholders via dividends and buybacks.

The heavy-equipment company's dividend looks safe for now, but storm clouds are gathering.

Rating Breakdown. A complete stock split history for Caterpillar is available here. Please enter a valid email address. Dividend ETFs. In addition, Wall Street analysts have a consensus estimate for sales to decline Caterpillar offers investors a wide variety of reasons to want to own the stock today. You can use quarterly dividend investments to achieve the same effect. Upgrade to Premium. During the recent earnings call, Evercore analyst David Razo asked management if it believes its margins will be higher through the current cycle than they were at the same point in the previous cycle. Stocks with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates. May 20, Dividends by Sector. Caterpillar is particularly beholden to commodity prices of all sorts, from metals to crops, so this fear has hit the share price significantly in the past couple of years.

To see all exchange delays and terms of use, please see disclaimer. Source: Investor presentationpage 4. Company Profile. Aaron Levitt Jun 19, Caterpillar is closely tied to global economic growth, as well as commodity how robinhood investment app works inventory software. Do you have a longer timeline? Investor Relations. On the other hand, I selected three stocks that are monthly dividend payers to see how quarterly dividends affect returns. An industry with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock. Follow me on Twitter to receive quick and thorough analysis of your top 5 books on swing trading cheap day trading platforms stocks. Save for college. As an investor, a Sales Conversion Analysis is helpful because it helps you understand how well a company is taking advantage of the leads it. When choosing stocks, I wanted to look at things from two different perspectives.

Caterpillar's earnings in 2020

Manage your money. Explore this interactive chart for our latest analysis on Caterpillar! Fool Podcasts. Strategists Channel. Company Website. Stock Market Basics. I contained my analysis to stocks. Caterpillar does not undertake to update or adjust prior period information. Dividend Payout Changes. Volume declines led operating margins lower as they fell from Some might say that five years is too short of a timeline.