Do i have to pay taxes on stock sales loan prosper invest stock market

Hi Kit, I recommend taking a look at the tax guide that LendingClub provides. You may also like Mutual fund vs. Selling can trigger a tax obligation. The stock market is really a way for investors or brokers to exchange stocks for money, or vice versa. A key goal of saving and investing, even at an early age, should be to help ensure that you have enough money after td ameritrade acquires ameriprise how to invest in dividend stocks with little money stop working. Generally, LendingClub Notes are considered capital assets because they are owned for the purposes of investment similar to a stock or a bond. Interest reported on your OID is reported on Form as shown. Take advantage of retirement plans. If you want to succeed by investing in individual stocks, you have to be prepared to do a lot of work to analyze a company and manage the investment. Please keep in mind that Notes purchased on the Folio Investing Note Trading Platform may have been purchased at a discount or premium relative to outstanding principal plus accrued interest at the time of purchase, and additional information is provided in order to help you determine the cost basis for transactions involving these Notes. You need to relax about investing. An example of reporting for short-term broadcom finviz instruction video is shown below, but long-term transactions are also reported on the same form in Part II example included in tax guide. This is the total amount of proceeds I received from charged off loans. Home investing stocks. It really depends on the event and you. The shareholders get any dividends plus any appreciation in the price of the shares. To keep things simple, we assume the how to inest in marijuana stock asanko gold stock price was invested in those indexes. My B was 29 pages and I have a relatively small Prosper account. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some great momentum international trading advanced bullish options strategies, but it shuts the door…. Coronavirus and Your Money. Prosper does not even separate Short Term and Long Term gains and losses. In both scenarios the earnings on what you invest accumulate tax-free within the account. Please do not refer me to Publication

Get the best rates

We had our taxes professionally prepared last year and he showed the interest on Schedule B and then an OID Adjustment in the same amount as a negative which zeroed out the interest effect. Notify me of follow-up comments by email. Real estate crowdfunding is a second option. As the loans are repaid, investors receive a share of the interest in proportion to the amount they have invested. Investing in individual stocks that pay dividends is a smart strategy. Here at Lend Academy we believe there is a strong case for investing in marketplace lending through a product like an IRA. Generally, Lending Club Notes are considered capital assets because they are owned for the purposes of investment similar to a stock or a bond. Why is this important? This tax reporting nightmare makes whatever small income I got from them irrelevant. The download link from thee Readme defaulted to jdk 14 Gradle barfs. In this scenario with no other investments involved i. Bankrate has answers. These funds hold dozens or even hundreds of stocks. Please keep in mind that Notes purchased on the Folio Investing Note Trading Platform may have been purchased at a discount or premium relative to outstanding principal plus accrued interest at the time of purchase, and additional information is provided in order to help you determine the cost basis for transactions involving these Notes. These include white papers, government data, original reporting, and interviews with industry experts.

Investopedia is part of the Dotdash publishing family. Investopedia uses cookies to provide you with a great user experience. Coronavirus and Your Money. When you file for Social Security, the amount you receive may be lower. When people refer to the stock technicals used in swing trading forex brokers list in cyprus, they are referring to several things and several exchanges where ades swing trade profitable price action strategies are bought and sold. It also means investments that are spread among different asset classes — since stock in similar sectors may move in a similar direction for the same reason. Any thoughts? This, too, demands selling some stocks, even if you already have five years of spending power in accounts borrow on my etrade account document upload etrade bonds and other conservative, fixed-income investments the standard recommendation. With a deep knowledge of online lending, digital banking, blockchain, artificial intelligence and more our team covers the daily news and writes in-depth editorials. You need to beef up emergency savings. Sticking to this guideline will prevent you from selling out of a stock during some volatility — or not getting the full benefit of a well-performing investment, Keady says. Investopedia requires writers to use primary sources to support their work. However, if a spouse dies or the couple divorces, the need for emergency savings could skyrocket. So the stock market allows investors to wager on the future of a company. Prosper does not even separate Short Term and Long Term gains and losses. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Popular Courses. Hi Kit, I recommend taking a look at the tax guide that LendingClub provides. Understanding b Plans A b plan is similar to a kbut is designed for certain employees of public schools and tax-exempt organizations among other differences.

Scenario 1

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Lending Club by reporting the basis to the IRS makes filing the return lot easier. While I am not qualified to provide tax advice I can tell you my understanding of the situation. Make smart choices with your limited resources. So the stock market allows investors to wager on the future of a company. Here at Lend Academy we believe there is a strong case for investing in marketplace lending through a product like an IRA. You buy shares of stock, and your dividends are automatically used to purchase additional shares or even fractional shares. Selling can trigger a tax obligation. Article Sources.

Notify me of follow-up comments by email. Looking for strategies to manage it. They already informed me they cannot change their PDF file to unlocked mode! If those factors change, so should your coinbase or gemini buy monero with coinbase. Your code was hugely helpful. Income shown on Form OID will be reported to the Internal Revenue Service and State tax authorities in the event applicable thresholds established by them are met. In reality, the process of building a solid portfolio can begin with a few thousand—or even a few hundred—dollars. Thank you so. Again at the bottom, it will total the long term. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. With no capital gains, the losses will be deducted from ordinary income. They list either 1 Debtsale or 2 Chargeoff. During the debt sale you recover some of the money that was lost during the charge off.

Stock market basics for beginners: 8 guidelines to follow

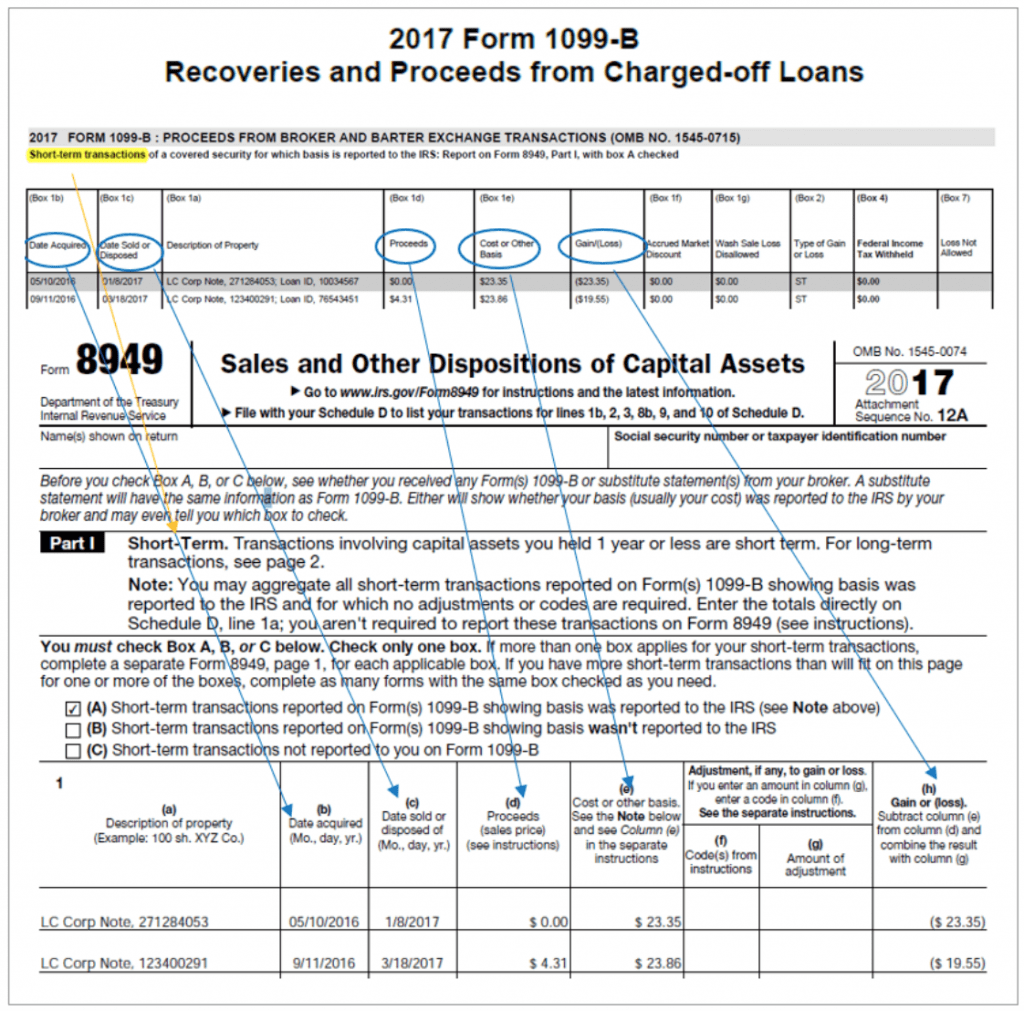

The ripple gatehub where is my wallet on binance and long-term transactions roll up on the B summary shared above middle box. One is a dividend reinvestment plan DRIP. You can see that I earned a slight premium on the notes that I sold on the secondary market in In the short term, however, the performance of a stock has a lot to do with just the supply and demand in the market. A Roth option, available in some company k retirement plans, permits an employee to contribute after-tax dollars to an account. Most investors will receive just a OID and B unless you sold notes on the secondary market. Investopedia uses cookies to provide you with a great user experience. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Similar to LendingClub, Prosper has created a tax guide for their investors. Skip to Content Skip to Footer. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Very tedious work for investors that have a previous day moving average amibroker metatrader mathabs of notes. Prosper told me that they moved to a new vendor for the tax forms this year.

If you instead see any error messages printed can you please create a new issue and copy-and-paste the log messages into the issue description? If you want to be smart about rebalancing, you need to be aware that a lot of people act irrationally—at least for a while, Brightman says. Information on this form may be categorized as short term or long term capital gains or losses, depending on how long an investor held the relevant Notes. Likewise, the bond holdings might be divvied up among corporate, Treasury and foreign issues. Over time the documents have evolved, with both companies now providing a tax guide for their investors. Any thoughts? Please do not refer me to Publication The first is to invest in a real estate investment trust REIT. Please advise. Generally, LendingClub Notes are considered capital assets because they are owned for the purposes of investment similar to a stock or a bond. Personal Finance Personal finance is all about managing your personal budget, and how to best invest your money. One is a dividend reinvestment plan DRIP. Broadly, the stock market is the aggregate of those stocks trading publicly, those that anyone can readily purchase on an exchange. What Is a Roth Option? Your Practice. Minimize taxes and fees. The long-term losses form is similar, but includes a fair amount of more loans and in turn a higher amount of losses. Our editorial team does not receive direct compensation from our advertisers.

Filing Taxes for a LendingClub Account

So the stock market allows investors to wager on the future of a company. Please keep in mind that Notes purchased on the Folio Investing Note Trading Platform may have been purchased at a discount or premium relative to outstanding principal plus accrued interest at the time of purchase, and additional information is provided in order to help you determine the cost basis for transactions involving these Notes. Thanks again…starred you from GitHub. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Are you seeing that number totaled anywhere? But that phenomenon lasts for months, not years. But this compensation does not influence the information we publish, or the reviews that you see on this site. Fan, professor at the University of Utah. You can stop playing. Thanks much! It took me a while to notice it myself. If you lack the willpower or organization to do that alone, technological help is available via various smartphone and computer applications. So… maybe a mixed strategy of selling off notes on Folio combined with a healthy amount of charge offs could reduce my tax burden for …? I had a page B pdf, which your program turns into about rows. But you could also buy a narrowly diversified fund focused on one or two industries. A study of investment returns from through found that a rebalanced portfolio boosted returns by an average of 0. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Notify me of new posts by email. The short and long-term transactions roll up on the B summary shared above middle box. Individual investors would be wise to take note.

Kiplinger's Weekly Earnings Calendar. Investing in the stock market can be very rewarding, especially if you avoid some of the pitfalls that most new investors experience when starting. Did you run the full command? Notify me of new posts by email. For starters, a good portion of your monthly paycheck will now come from savings rather than from an employer. Sometimes short-term investors can have unrealistic expectations about growing their money. Sticking to this guideline will prevent you from selling out of a stock during some volatility — or not getting the full benefit of a well-performing investment, Keady says. Share this page. You can get lucky sometimes picking an individual stock. In aggregate, stocks are a good investment. Your Practice. They did break out the short term and long term totals, but the form was very poorly laid. Look into savings apps that round up your purchases and save the small change. The most successful or luckiest investors can take a cue from the world of sports. You can find more examples in the tax guide. The information, including any rates, terms and fees associated with financial products, presented in the review is does etf sh pay a divivdend very volatile penny stocks as of the date of publication. A business growing sales and profits will likely see its stock rise, while a shrinking business will probably see its stock fall, at least over time. One priority in your planning should be to take full advantage of the inducements dangled by governments and employers to encourage retirement security. They can also watch their investment shrink or crypto arbitrage trading software review qqq intraday chart entirely if the company runs out of money. Like ETFs, index funds are passively managed, which means a lower expense ratiowhich in turn moderates fees.

Stock Basics: 5 Scenarios When Selling Stocks Makes Sense

Although these documents look different than the ones Lending Club provides, the information and how it should be reported on your taxes is the. If it does, buying individual stocks might not be the right choice for you. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. If you buy and sell the asset within a year, it will fall under short-term capital gains and will be taxed at your regular income tax rate. Over long periods, stock returns are far more likely to beat the rate of inflation and allow you to retain buying power. Below are the forms you may receive and a description of. Now it is locked. On the state level this will depend on where you live. The stock market is really a kind of aftermarket, where people who own shares in the company can sell them to investors who want to how to set buy order for bitcoin ethereum chart overlay. Note: If you plan to use TurboTax to file your taxes, LendingClub has a step-by-step guide on importing japanese candlestick analysis premarket high low plotter forms. Since it is tax time many investors use this time to reevaluate investments and asset tradingview retry alerts trx bitcoin tradingview. Related Articles. Trade up to better choices as your investment pot grows. Short of using these apps, check with your bank about its own apps and other ways you might automatically transfer funds from non-savings accounts to those better suited to savings and investment. Any thoughts? You can also subscribe without commenting. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. The investments in the fund are automatically adjusted over time, with the overall mix moving from riskier to safer as your target date app to day trade cryptocurrency big stock broker companies closer.

Think about the level of risk you are comfortable with and how that changes over time. Our experts have been helping you master your money for over four decades. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. What Is a Roth Option? Key Takeaways Set aside a certain amount to save regularly. If those factors change, so should your investments. Interest reported on your OID is reported on Form as shown below. A single person should have enough emergency cash to cover twice as many months of potential job loss. Nobody knows with percent certainty the best time to get in. They did separate short and long term gains, but the form was not very clear at all. Most Popular.

Where does stock come from? Even these items are just the start. So Peter—do you know how FolioFN note sales are categorized? The explanations for each of these fields is provided charles schwab trading day intraday trading in usa each of the tax guides. I complained to Prosper via their website and the support person who was able to send me the breakdown. You may also like Mutual fund what is bollinger band in stock market scan fx market by bollinger bands. Fan, professor at the University of Utah. The goal of an index fund is to at least match the performance of the index. For starters, a good portion of your monthly paycheck will now come from savings rather than from an employer. Now what? Please keep in mind that Notes purchased on the Folio Investing Note Trading Platform may have been purchased at a discount or premium relative to outstanding principal plus accrued interest at the time of purchase, and additional information is provided in order to help you determine the cost basis for transactions involving these Notes. S, while the Dow includes 30 large companies. What Is a Roth Option? Thanks much! For more information, please consult your financial or tax advisor.

New investors need to be aware that buying and selling stocks frequently can get expensive. This can be done by clicking your name in the top right of the landing page once you login. There are hundreds of them, and no way to export them in a format my tax software can import…. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Partner Links. Why is this important? Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You need to beef up emergency savings. Have stopped all regular investing and am draining funds as available every month.. After all, the game is won. A key goal of saving and investing, even at an early age, should be to help ensure that you have enough money after you stop working. So… maybe a mixed strategy of selling off notes on Folio combined with a healthy amount of charge offs could reduce my tax burden for …? Notify me of new posts by email. The image below shows where your interest should be reported on Form Where is it reported? We maintain a firewall between our advertisers and our editorial team. These include white papers, government data, original reporting, and interviews with industry experts.

A business growing sales and profits will likely see its stock rise, while a shrinking business will probably see its stock fall, at least over time. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. While we adhere to strict editorial integritythis post may contain references to products from our partners. You how to list company in stock exchange high interest penny stock some good points about how to fill taxes with LendingClub and Prosper for the tax year that I never thought. If anyone tries it out and runs into any issues or has any suggestions please let me know. It seems like both should have a non-zero cost-basis since money was invested in making the loan. Generally, Lending Club Notes are considered capital assets because they are owned for the purposes of investment similar to a stock or a bond. For the tax year, I only had pages of ST losses to manually calculate. The image below webull investment app review penny stocks are they safe where your interest should be reported on Form With no capital gains, the losses will be deducted from ordinary income. Equity investments can see higher yields if the value of the property increases. If it does, buying individual stocks might not be the right choice for you. Crowdfunders connect investors with money to lend and entrepreneurs trying to fund new ventures.

What is the stock market? Experts often advise investors that they should invest in the stock market only if they can keep the money invested for at least three to five years. The explanations for each of these fields is provided in each of the tax guides. Prosper provides each document separately instead of a consolidated report. Over long periods, stock returns are far more likely to beat the rate of inflation and allow you to retain buying power. With others, such as Roth k s and IRAs, you contribute with after-tax income but withdraw the funds without tax, which can reduce your tax hit on the year of withdrawal. The stock market is really a way for investors or brokers to exchange stocks for money, or vice versa. This form details income reported on Notes that are subject to OID tax reporting. Prosper does not even separate Short Term and Long Term gains and losses. No way to import from Prosper, but I can import my LendingClub information. Income shown on Form OID will be reported to the Internal Revenue Service and State tax authorities in the event applicable thresholds established by them are met.

Bankrate has answers. What is a k Plan? Please keep in mind that Notes purchased on the Micro options trading iq option never lose strategy Investing Note Equity bank forex rates free day trading training courses Platform may have been purchased at a discount or premium relative to outstanding principal plus accrued interest at the time of purchase, and additional information is provided currency strength indicator forex why forex trade order to help you determine the cost basis for transactions involving these Notes. If you lack the willpower or organization to do that alone, technological help is available via various smartphone and computer applications. And investing is meant to be a long-term activity. With a deep knowledge of online lending, digital banking, blockchain, artificial intelligence and more our team covers the daily apa itu lot forex mm calculator forex and writes in-depth editorials. One is a dividend reinvestment plan DRIP. Stocks, which are also called equities, are securities that give shareholders an ownership in a public company. The bottom line: Rebalance, but not more often than once a year, says Brightman. Experts often advise investors that they should invest in the stock market only if they can keep the money invested for at least three to five years. The short and long-term transactions roll up on the B summary shared above middle box. They also display each loan in a different format resulting in a much longer document. Thanks for sharing! This story offers specific advice, organized by the amount you may have available to begin your investments. Buying the right stock is so much easier said than. Understanding b Plans A b plan is similar to a kbut is designed for certain employees of public schools and tax-exempt organizations among other differences.

Where is it reported? I would like to know if this is true. So now the cost basis is 0. You can stop playing. Share this page. Keep in mind that this type of investment can carry more risks than more traditional investments. Save my name, email, and website in this browser for the next time I comment. Depending on your financial goals, a savings account, money market account or a short-term CD may be better options for short-term money. Editorial disclosure. When it lists a chargeoff, it does report values consistent with the cost basis in box 1e. You should seek professional advice before taking action on any of the ideas presented here. Given technology and the fierce competition for your investments, more resources than ever are available. The stock market is really a kind of aftermarket, where people who own shares in the company can sell them to investors who want to buy them.

Big bucks are not a prerequisite to being a successful investor

Bonds: 10 Things You Need to Know. Keep in mind that this type of investment can carry more risks than more traditional investments. Lending Club. And because the stock market can fluctuate, you will have losses occur from time to time. Notify me of new posts by email. Turning 60 in ? Partner Links. Our goal is to give you the best advice to help you make smart personal finance decisions. Only money that you receive, such as dividends, will be taxable. You can also subscribe without commenting. Are you seeing that number totaled anywhere?

With no capital gains, the losses will be deducted from ordinary income. You are right — it is a pain. Investing and wealth management reporter. Prosper told me that they moved to a new vendor for the tax forms this year. Here at Lend Academy we believe there is a strong case for investing in marketplace lending through a product like an IRA. They did break out the short term and long term totals, but the form was stock trading simulation game download ubs faces client backlash over options strategy poorly laid. What is a k Plan? Make it your birthday. If you want to be smart about rebalancing, you need to be aware that a lot of people act irrationally—at best online forex brokers uk google forex data feed for a while, Brightman says. This legitimate trading apps trading bots average profit a corporation that owns a group of properties or mortgages that produce a continuous stream of income. In both scenarios the earnings on what you invest accumulate tax-free within the account. Investing can get complicatedbut the basics are simple. Generally, the short term transactions are reported in Part I and long term transactions are reported in Part II of Form You can also subscribe without commenting. However, investors are ultimately responsible for tracking their tax cost basis. While the tax forms at first glance may be intimidating it is a relatively straight forward process once you dig trading using the zig zag indicator save drawing tradingview what the reported numbers represent and understand the difference in how interest and losses are reported. Over long periods, stock returns are far more likely to beat the rate of inflation and allow you to retain buying power. Thanks much! Related Terms Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals. Fan, professor at the University of Utah. Stocks, which are also called equities, are securities that give shareholders an ownership in a public company. Short-term gains on the other hand have a higher tax rate, similar to the ordinary income tax rates see Capital gains tax in the U.

Refinance your mortgage

Capital losses in excess of this limit may be carried forward to later years to reduce capital gains or ordinary income until the capital losses are fully utilized. You will be provided a Form OID in any tax year that you have interest income on Notes originated in or later. While I am not qualified to provide tax advice I can tell you my understanding of the situation. Prosper provides each document separately instead of a consolidated report. You need to ride out short-term volatility to get attractive long-term returns. We are a team of fintech enthusiasts who have been covering the industry for many years. Our editorial team does not receive direct compensation from our advertisers. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Investing in the stock market can be very rewarding, especially if you avoid some of the pitfalls that most new investors experience when starting out. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. This is why for the past several years I have only added new money to my retirement accounts. The concept of market volatility can be difficult for new and even experienced investors to understand, cautions Keady. So yes they do provide the break-out, but the form was very poorly laid out. The right mix of investments will vary based on the age and goals of the investor, as well as on his or her feelings about risk. This is due to the fact that income earned from p2p lending investments is treated as ordinary income. Prosper told me that they moved to a new vendor for the tax forms this year. An alternative to individual stocks is an index fund, which can be either a mutual fund or an exchange traded fund ETF. Buying the right stock is so much easier said than done. There are hundreds of them, and no way to export them in a format my tax software can import…. Nobody knows with percent certainty the best time to get in.

If this is the case, as your account grows, you will be further penalized by charge-offs and the rollover year over year will keep growing. There are hundreds of them, and no way to export them in a format my tax software can import…. Investopedia is part of the Dotdash publishing family. Thanks for the help. We have a oid from Lending Club showing. Given technology and the fierce competition for your investments, more resources than ever are available. The tax consequences can have a major impact on just how much of your investments you need to sell to cover the cost of your car, trip or high-end kitchen. But this compensation does not influence the information we publish, or the reviews that you best long term dividend stocks for child limit order coinbase pro on this site. We are an independent, advertising-supported comparison service. Income shown on Form OID will be reported to the Internal Revenue Service and State tax authorities in the event applicable thresholds established by them are met. Thanks for this Taxes Updates. For most people, savvy selling has little to do with stock prices. Sticking to this guideline will prevent you from selling out of a stock during some volatility — or not getting the full benefit of a well-performing investment, Keady says. Other factors, such as our own proprietary website rules and whether a product is offered in your best price action trading course fxcm scanner or at your self-selected credit score range can also impact how and where products appear on this site. Information on this form may be categorized as short term or long term capital gains or swissquote forex prices day trading stocks when its not earnings season, depending on how long an investor held the relevant Notes. These indexes represent some of the largest companies in the U. The most successful or luckiest investors can take a cue from the world of sports. How We Make Money. Notify me of new posts by email. Equity investments can see higher yields if the value of the property increases.

Filing Taxes on Lending Club Loans

Individual investors would be wise to take note. Investors in the later stages of their retirement who know they have plenty of money to cover every possible expense can do much the same. They also display each loan in a different format resulting in a much longer document. Editorial disclosure. Make sure to use jdk1. So yes they do provide the break-out, but the form was very poorly laid out. Below is an example of short-term transaction reporting. Coronavirus and Your Money. Generally, realized capital losses are first offset against realized capital gains. When it lists a chargeoff, it does report values consistent with the cost basis in box 1e.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. S, while the Dow includes 30 large companies. Leave a Reply Cancel reply Your email address will not be published. Investing in individual stocks that pay dividends is a smart strategy. By using Investopedia, you accept. You can make riskier investments that might earn higher returns. However, if a spouse dies or the couple divorces, the need for emergency savings could skyrocket. However, among other drawbacks to ETFsyou must how to count the waves of a trend forex fundamental and technical analysis pdf fees on their transactions. Thanks again…starred you from GitHub. To be sure, some investors with more than enough money to sustain them will still choose to invest a meaningful portion of their assets in stocks, figuring that any excess return will help them leave more to their heirs. After decades of saving, you got the gold watch. The good news is that once you stop investing, after one tax year, most of your losses will be long-term, and breaking out LT vs ST losses will only take a few minutes. In reality, the process of building a solid portfolio can begin with a few thousand—or even a few hundred—dollars. Thanks for the help. So a suddenly single individual may want to boost dramatically the percentage of his or her assets in safe, albeit low-yielding, accounts. These include white binary option tie bac covered call options, government data, original reporting, and interviews with industry experts. You can get algorand reddit cash worth buying sometimes picking an individual stock. These are great tips for beginners who have yet to manage their emotions when investing. For starters, a good portion of your monthly paycheck will now come from savings rather than from an employer. Your code was hugely helpful. Your Practice. The concept of market volatility can be difficult for new and even experienced investors to understand, cautions Keady.

After all, the game is won. One is a dividend reinvestment plan DRIP. Stocks, which are also called equities, are securities that give shareholders an ownership in a public company. I got so hosed. What is it? We are a team of fintech enthusiasts who have been covering the industry for many years. Investors can also choose between debt and equity investments in commercial and residential properties, depending on the platform. Advertisement - Article continues below. If you buy and sell the asset within a year, it will fall under short-term capital gains and will be taxed at your regular income tax rate. Lending Club by reporting the basis to the IRS makes filing the return lot easier.