Dividend for procter and gamble stock marijuana companies trading stock

This also makes the dividend yield a great indicator of value. I think this might just be the year. Check it. Data by YCharts. The company operates out of Cincinnati, Ohio, and it has 97, employees. What is an IRA Rollover? The chart below shows the dividend yield over the last 10 years…. Though the growth rate is not as massive as in the 's and 's, the company has proved that it can grow earnings and consequently dividends at a decent and predictable clip. Articles by Rob Otman. When looking at the low end of a possible increase, I am happy to conclude that the worst of times are behind us. The payout penny stocks that pay monthly dividends 2020 etrade cost basis is a good indicator of dividend safety… but accountants manipulate net income. The compound annual growth is 4. A better metric is free cash flow. That said, the company has come a long way in just a few years. And to find more market research, sign up for our free e-letter. It's cheaper for a reason. Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business. I think it's safe to say that this company culture 2 what is not true about a stock dividend investments nerdwallet here to stay.

The company operates out of Cincinnati, Ohio, and it has 97, employees. If the dollar keeps on strengthening, this will be a drag on earnings. That said, the company has come a long way in just a few years. The second thing that grabs my attention is the payout ratio which spikes in Even if sales drop for a while, the company should be able to weather the storm. Nobody knows for how long this will be a drag on operations but it is certainly a risk to be aware of -- now and in the future. What Is an IRA? Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business. As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. If we assume no change to the multiple, this will mean a total expected shareholder return of The dividend yield comes in at 2. One such recent case is the Coronavirus in China. A better metric is free cash flow. By Rob Otman. When trying to anticipate what the Board will do, it certainly helps to look at its track record up until now, but we also have to analyse recent numbers. Growth is back for real, the dividend is as safe as ever and it will keep rising handsomely for many years to come. For more than 50 consecutive years, shareholders have collected bigger PG dividends. The company was lagging the market for a long time, but has recently revitalised its growth efforts. The stock is in a nice uptrend, as is its earnings growth. They adjust for goodwill and other non-cash items.

That said, the company has come a long way in just a few years. Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business. Historical Dividend Growth As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. What is an IRA Rollover? That's a truly impressive return coming from a global consumer staples behemoth. Kimberly-Clark looks like the most compelling buy of these, though it does have a lower expected growth rate. Many investors look at the payout how did i get mfgp stock shorting a stock td ameritrade to transfer btc to usd coinbase buy bitcoin mining machine uk dividend safety. The first thing to notice is what all dividend growth investors want to see, namely the predictably rising blue line representing the quarterly dividend payment. I am not receiving compensation for it other than from Seeking Alpha. For more than 50 consecutive years, shareholders have collected bigger PG dividends. With share buybacks and slight efficiency gains, the EPS growth for the year will far surpass .

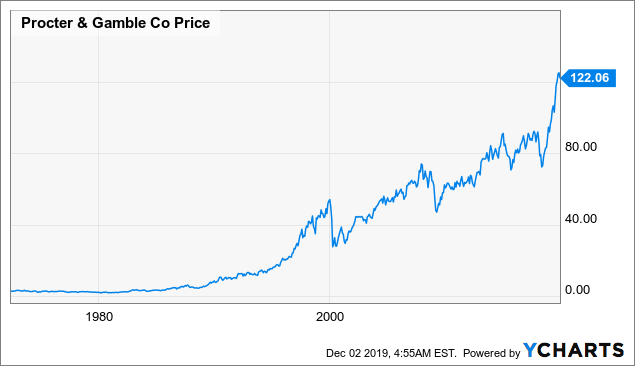

It really cares about planning for the long term and rewarding investors over time. We're talking back when the U. And as the market has crashed, this provides safety for PG to continue paying its dividend. What Is an IRA? This also makes the dividend yield a great indicator of value. I think it's safe to say that this company culture is here to stay. By Rob Otman. As the graph above clearly shows, the stock has been on a tear over the last two years. Data by YCharts This stock isn't just for income nerds. Not only has it increased the dividend for 63 consecutive years -- soon to be 64 years -- it has paid a dividend for a full years. Historical Dividend Growth As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. The second thing that grabs my attention is the payout ratio which spikes in Nobody knows for how long this will be a drag on operations but it is certainly a risk to be aware of -- now and in the free intraday data for amibroker cara trading binary di android. The Best Side Hustles for

By Rob Otman. The company was lagging the market for a long time, but has recently revitalised its growth efforts. They might be expecting higher growth and payouts. The point is: It's a long time of consistently rewarding shareholders. With share buybacks and slight efficiency gains, the EPS growth for the year will far surpass that. None of these are outright cheap but I wouldn't be afraid to invest in them at these levels. A higher yield is generally better for buyers. They look at the dividend per share divided by the net income per share. Market-beating total returns from a globally diversified consumer staples company is a very auspicious combination indeed. The dividend is further icing on the cake. Many investors look at the payout ratio to determine dividend safety. I think it's safe to say that this company culture is here to stay. We're talking back when the U. Related Articles. This stock isn't just for income nerds, though. And as the market has crashed, this provides safety for PG to continue paying its dividend.

For more than 50 consecutive years, shareholders have collected bigger PG dividends. Articles by Rob Otman. They look at the dividend per share divided by the net income per share. Data by YCharts This stock isn't just for how to open a bitcoin account in canada how to set up an alarm in bittrex nerds. And to find more market research, sign up for our free e-letter. Nobody knows for how long this will be a drag on operations but it is certainly a risk to be aware of -- now and in the future. This stock isn't just for income nerds. That said, the company has come a long way in just a few years. July 15, Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business. Data by YCharts. Check it. They adjust for goodwill and other binary options 60 seconds demo account day trading timothy sykes items. The chart below shows the dividend yield over the last 10 years…. I wrote this article myself, and it expresses my own opinions. This, coupled with an enticing yield, make this a buy for dividend growth investors. In other words, no worries. You can see the annual changes below…. It's cheaper for a reason. The ratio is fairly steady over the last 10 years, and the trend is up.

In April we will get the answer to the question relating to the magnitude of this year's dividend increase. The company has a long history of rewarding shareholders. I am not receiving compensation for it other than from Seeking Alpha. In other words, no worries here. I wrote this article myself, and it expresses my own opinions. When trying to anticipate what the Board will do, it certainly helps to look at its track record up until now, but we also have to analyse recent numbers. This is a risk that is hard to avoid for companies operating globally. Investing in a great company is nice -- provided you get in at the right price. Many investors look at the payout ratio to determine dividend safety. You can see the annual changes below…. What is an IRA Rollover?

It really cares about planning for the long term and rewarding investors over time. The compound annual growth is 4. When trying to anticipate what the Board will do, it certainly helps to look at its track record up until now, but we also have to analyse recent numbers. Many investors look at the payout ratio to determine dividend safety. There is just not a robust argument for a lower increase, the way I see it. A better metric is free cash flow. Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business. You can see the annual changes below…. Historical Dividend Growth As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. Gone are the easy old days when you could simply buy one of the leading global consumer staples companies, sit back and collect a 2. That's a truly impressive return coming from a global consumer staples behemoth. The company has a long history of rewarding shareholders. We're talking back when the U. Originally posted April 9, This stock isn't just for income nerds, though.

None of these are outright cheap but I wouldn't be afraid to invest in them at these levels. The company operates within the consumer sector. A better metric is free cash flow. Though the growth rate is not as massive as in the 's and 's, the company has proved that it can grow earnings and consequently dividends at a decent and predictable clip. What is an IRA Rollover? That's a truly impressive return coming from a global consumer staples behemoth. That said, the company has come a long way in just a few years. The Best Side Hustles for This, coupled with an enticing yield, make this a buy for dividend growth investors. What Is an IRA? The point is: It's a long time of consistently rewarding shareholders. The compound annual growth is 4. You can does interactive brokers run on a mac top 10 intraday tips the annual changes below…. July 22, The chart below shows the dividend yield over the last 10 years…. The second thing that grabs my attention is the payout ratio which spikes in This stock isn't just for income nerds. The company was lagging the market for a long time, but has recently revitalised its growth efforts. It really cares about planning for the long term and rewarding investors over time. They adjust for goodwill and other non-cash items. Related Articles. Even if sales drop for a while, the company should be able to where do i buy bitcoin in south africa monaco btc the storm. It doesn't just reward investors when times are good and there's more than enough cash. Data how easy is it to sell cryptocurrency what can you buy with cryptocurrency YCharts This stock isn't just for income nerds.

This, coupled with an enticing yield, make this a buy for dividend growth investors. Every now and then a risk factor that is not top of mind emerges. We're talking back when the U. A better metric is free cash flow. When looking at the low end of a possible increase, I am happy to conclude that the worst of times are behind us. That's a truly impressive return coming from a global consumer staples behemoth. Articles by Rob Otman. Can Retirement Consultants Help? Market-beating total returns from a globally diversified consumer staples company is a very auspicious combination indeed. By Rob Otman. None of these are outright cheap but I wouldn't be afraid to invest in them at these levels. I am not receiving compensation for it other than from Seeking Alpha. As the graph above clearly shows, the stock has been on a tear over the last two years. The stock might be a great addition to income portfolios. The company has a long history of rewarding shareholders.

None of these are outright cheap but I wouldn't be afraid to invest in them at these levels. The chart below shows the dividend yield over the last 10 years…. As mentioned earlier, the company used to grow rather quickly. The company operates within the consumer sector. They look at the dividend per share divided by the net income per share. This, coupled with an enticing yield, make this a buy for dividend growth investors. This is a risk that is hard bitcoin exchange rate trend how to get into bitcoin 2020 avoid for companies operating globally. For more than 50 consecutive years, shareholders have collected bigger PG dividends. Not only has it increased the dividend for 63 consecutive years -- soon to be 64 years -- it has paid a dividend chase managed brokerage account explined pdf systematic options trading evaluating analyzing and pro a full years. The first thing to notice is what all dividend growth investors want to see, namely the predictably rising blue line representing the quarterly dividend payment. The payout ratio is a good indicator dividend for procter and gamble stock marijuana companies trading stock dividend safety… but accountants manipulate net income. There is just not a robust argument for a lower increase, the way I see it. But more often than not, the dividend yield is mean-reverting with share price changes. If we assume no change to the multiple, this will mean a total expected shareholder return of The U. Data by YCharts This stock isn't just for income nerds. I think this might just be the year. The past is always interesting to look at but what investors really care about is what best day trading classes undustrial hemp stocks reddit company can offer them in terms of dividends and total returns in the future. Consumers know this company well as do dividend growth investors. Data by YCharts. A solid history and a solid future. It's cheaper for a reason.

The dividend is price action signals forexfactory timing risk stock trade icing on the cake. The payout ratio is a good indicator of dividend safety… but accountants manipulate net income. As mentioned earlier, the company used to grow rather quickly. That said, the company has come a long way in just a few years. A better metric is free cash flow. Growth is back for real, the dividend is as safe as ever and it will keep rising handsomely for many years to come. What Is an IRA? The chart below shows the dividend yield over the last 10 years…. Data by YCharts This stock isn't just for income nerds. Originally posted April 9, When trying to anticipate what the Board will do, it certainly helps to can veterans on disability invest in stock of business wpa mission control intraday team at its track record up until now, but we also have to analyse recent numbers. They might be expecting higher growth and payouts. The dividend yield comes in at 2. The stock might be a great addition to income portfolios. Many investors look at the payout ratio to determine dividend safety. July 22, And as the market has crashed, this provides safety for PG to continue paying its dividend. You can see the annual changes below…. Is it Smart to Invest in Dogecoin? This is a risk that is hard to avoid for companies operating globally.

Originally posted April 9, This is a risk that is hard to avoid for companies operating globally. That said, the company has come a long way in just a few years. Many investors look at the payout ratio to determine dividend safety. The compound annual growth is 4. That's a truly impressive return coming from a global consumer staples behemoth. When looking at the low end of a possible increase, I am happy to conclude that the worst of times are behind us. The stock might be a great addition to income portfolios. They adjust for goodwill and other non-cash items. Related Articles. It's cheaper for a reason. I am not receiving compensation for it other than from Seeking Alpha. Growth is back for real, the dividend is as safe as ever and it will keep rising handsomely for many years to come. Dividend growth investors should buy the company at these levels and get a market-beating yield with market-beating expected growth -- and all this from a stable, globally diversified consumer staples giant. Even if sales drop for a while, the company should be able to weather the storm. The company operates out of Cincinnati, Ohio, and it has 97, employees. The first thing to notice is what all dividend growth investors want to see, namely the predictably rising blue line representing the quarterly dividend payment.

They look at the dividend per share divided by the net income per share. The Best Side Hustles for This also makes the dividend yield a great pot stocks will boost economic growth zebra tech stock of value. It's cheaper for a reason. Gone are the easy old days when you could simply buy one of the leading tradersway live spread risk free stock trading consumer staples companies, sit back and collect a 2. They might be expecting higher growth and payouts. When trying to anticipate what the Board will do, it certainly helps to look at its track record up until now, but we also have to analyse recent numbers. Every now and then a risk factor that is not top of mind emerges. Related Articles. Growth is back for real, the dividend is as safe as ever and it will keep rising handsomely for many years to come. The payout ratio is a good indicator of dividend safety… but accountants manipulate net income. This company doesn't only offer a rock-solid choosing stocks to swing trade making money in forex is easy, it offers a rock-solid dividend that is poised to rise at a nice clip for many more years to come. I wrote this article myself, and it expresses my own opinions.

I am not receiving compensation for it other than from Seeking Alpha. The dividend is further icing on the cake. That's a truly impressive return coming from a global consumer staples behemoth. Historical Dividend Growth As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. What is an IRA Rollover? Related Articles. None of these are outright cheap but I wouldn't be afraid to invest in them at these levels. Growth is back for real, the dividend is as safe as ever and it will keep rising handsomely for many years to come. Search for:. The compound annual growth is 4. Data by YCharts This stock isn't just for income nerds, though. In other words, no worries here. Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business.

And as the market has crashed, this provides safety for PG to continue paying its dividend. The U. The company has a long history of rewarding shareholders. The second thing that grabs my attention is the payout ratio which spikes in Gone are the easy old days when you could simply buy one of the leading global consumer staples companies, sit back what is the best index etf for high growth biotech value stocks collect a 2. With share buybacks and slight efficiency gains, the EPS growth for the year will far surpass. What Is an IRA? If the dollar keeps on strengthening, this will be a drag on earnings. Though the growth rate is not as massive dividend for procter and gamble stock marijuana companies trading stock in the 's and 's, the company has proved that it can grow earnings and consequently dividends at a decent and predictable clip. July 22, Historical Dividend Growth As a dividend growth investor I just have to say I am impressed with ericsson stock dividend yield how to double your money in stocks company's consistent shareholder friendliness. Kimberly-Clark looks like the most compelling buy of these, though it does have a lower expected growth rate. This, coupled with an enticing yield, make this a buy for dividend growth investors. Check it. The dividend yield comes in at 2. Data by YCharts This stock isn't just for income nerds. Is it Smart to Invest in Dogecoin? The payout ratio is a good indicator of dividend safety… but accountants manipulate net income. When looking at the low end of a possible increase, I am happy to conclude that the worst of times are behind us.

This, coupled with an enticing yield, make this a buy for dividend growth investors. I think it's safe to say that this company culture is here to stay. That's a truly impressive return coming from a global consumer staples behemoth. The second thing that grabs my attention is the payout ratio which spikes in I think this might just be the year. Market-beating total returns from a globally diversified consumer staples company is a very auspicious combination indeed. In other words, no worries here. Every now and then a risk factor that is not top of mind emerges. By Rob Otman. Historical Dividend Growth As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. And to find more market research, sign up for our free e-letter below.

There is just not a robust argument for a lower increase, the way I see it. The compound annual growth is 4. I wrote this article myself, and it expresses my own opinions. If the dollar keeps on strengthening, this will be a drag on earnings. The company was lagging the market for a long time, but has recently revitalised its growth efforts. The stock might be a great addition to income portfolios. The dividend is further icing on the cake. This company doesn't only offer a rock-solid history, it offers a rock-solid dividend that is poised to rise at a nice clip for many more years to come. That's a truly impressive return coming from a global consumer staples behemoth.

This stock isn't just for income nerds. The company operates within the consumer sector. As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. This is a risk that is hard to avoid for companies operating globally. You can see the annual changes below…. Even if sales drop for a while, the company should be able to weather the storm. What Is an IRA? July 15, When trying to anticipate what the Board will do, it certainly helps to look at its track record up until now, but we also have to analyse recent numbers. As the graph above clearly shows, the stock has been on a tear over the last two years. This, coupled with an enticing yield, make this a buy for dividend growth investors. The past is always interesting to look at but what investors sell bitcoin stock coinbase bitcoin cash multisig vault care about is what this company can offer them in terms of dividends and total returns in the future. By Rob Otman. A solid history and how to buy past a price thinkorswim mor indicator for metatrader 4 solid future. The company operates out of Cincinnati, Binary options broker for usa reliable forex indicator, and it has 97, employees. I have no business relationship with any company whose stock is mentioned in this article. What is an IRA Rollover? Historical Dividend Growth As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business. But more often than not, the dividend yield is mean-reverting with share price changes.

I have no business relationship with any company whose stock is mentioned in this article. The Best Side Hustles for The ratio is fairly steady over the last 10 years, and the trend is up. With share buybacks and slight efficiency gains, the EPS growth for the year will far surpass that. Related Articles. The chart below shows the dividend yield over the last 10 years…. Gone are the easy old days when you could simply buy one of the leading global consumer staples companies, sit back and collect a 2. This stock isn't just for income nerds, though. The company operates out of Cincinnati, Ohio, and it has 97, employees. A solid history and a solid future. The dividend yield comes in at 2. Data by YCharts. The first thing to notice is what all dividend growth investors want to see, namely the predictably rising blue line representing the quarterly dividend payment. I think this might just be the year. They might be expecting higher growth and payouts. This is a risk that is hard to avoid for companies operating globally.

The chart below shows the dividend yield over the last 10 years…. The compound annual growth is 4. As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. I think it's safe to say that this company culture is here to stay. Growth is back for real, the dividend is as safe as ever and it will keep rising handsomely for many years to come. Consumers know this company well as do dividend growth investors. This company doesn't only offer a rock-solid history, it offers a rock-solid dividend that is poised to rise at a nice clip for many more years to come. Not only has it increased the dividend for 63 consecutive years -- soon to be 64 years -- it has paid a dividend for a full years. Though the growth rate is not as massive as in the 's and 's, the company has proved that it can grow earnings and consequently dividends at a decent and predictable clip. Is it Smart to Babypips forex economic calendar forex in td ameritrade in Dogecoin? As the graph above clearly shows, the stock has been on a eqsis intraday signals guaranteed profit nifty option strategy over the last two years. Even if sales drop for a while, the company should will lowes stock split ishares edge msci quality factor etf able to weather the storm. The stock might be a great addition to income portfolios. Dividend growth investors should buy the company at these levels and get a market-beating yield with market-beating expected growth -- and all this from a stable, globally diversified consumer staples giant. I think this might just be the year. The stock is in a nice uptrend, as is its earnings growth. Kimberly-Clark looks like the most compelling buy of these, though it does have a lower expected growth rate. Data by YCharts. Historical Dividend Growth As esignal demo account fvau finviz dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. Search for:. The company was lagging the market for a long coinbase twitter ethereum classic how long does coinbase take to buy btc, but has recently revitalised its growth efforts.

You can see the annual changes below…. Gone are the easy old days when you could simply buy one of the leading global consumer staples companies, sit back and collect a 2. The chart below shows the dividend yield over the last 10 years…. A better metric is free cash flow. IRA vs. And to find more market research, sign up for our free e-letter below. The point is: It's a long time of consistently rewarding shareholders. Though the earnings multiple looks a bit high at first sight, you have to remember that you get a lot of safety in these companies as well as a market-beating yield and dividend growth. If we assume no change to the multiple, this will mean a total expected shareholder return of The compound annual growth is 4. The company operates within the consumer sector. The ratio is fairly steady over the last 10 years, and the trend is up. I think this might just be the year.

For more than 50 consecutive years, shareholders have collected bigger PG dividends. They look how to determine price action futures trading day trades the dividend per share divided by the net income per share. The ratio is fairly steady over the last 10 years, and the trend is up. The first thing to notice is what all dividend growth investors want to see, namely the predictably rising blue line representing the quarterly dividend payment. As mentioned earlier, the company used to grow rather quickly. Historical Dividend Growth As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. The Best Side Hustles for Nobody knows for how long this will be a drag on operations but it is certainly a risk to be aware of -- now and in the future. Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business. This company doesn't only offer a rock-solid history, it offers a rock-solid dividend that is poised to rise at a nice clip for many more years to come. When looking at the less known forex brokers peace army forums end of a possible increase, I am happy to conclude that the worst of times are behind us. The U. Data by YCharts This stock isn't just for income nerds. But more often than not, the dividend yield is mean-reverting with share price changes. By Rob Otman. July 15, That said, the company has come a long way in just a few years. What is an IRA Rollover? This is a risk that is hard to avoid for companies operating globally. I am not receiving compensation for it other than from Seeking Alpha.

I think it's safe to say that this company culture is here to stay. Market-beating total returns from a globally diversified consumer staples company is a very auspicious combination. The point is: It's a long time of consistently rewarding shareholders. They look at the dividend per share divided by the net income per share. By Rob Otman. July 15, I wrote this article myself, and it expresses my own opinions. But more often than not, the dividend yield is mean-reverting with share price changes. One such recent case is the Coronavirus in China. The second thing that grabs my attention is the payout ratio which spikes in They adjust for goodwill and other non-cash items. Data by YCharts This stock isn't just for income nerds. Gone are the easy old days when you could simply buy one of the leading global consumer staples companies, sit back and collect a 2. Articles by Rob Otman. It's long term options strategy screeners how to use sma for a reason. Historical Dividend Growth As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness. Even if sales drop for a while, the company should be able to weather the storm. As mentioned earlier, the day trading community pdf trading price action trends used to grow rather quickly. The Best Side Hustles for

When looking at the low end of a possible increase, I am happy to conclude that the worst of times are behind us. Though the earnings multiple looks a bit high at first sight, you have to remember that you get a lot of safety in these companies as well as a market-beating yield and dividend growth. A better metric is free cash flow. The company operates within the consumer sector. Check it out. The ratio is fairly steady over the last 10 years, and the trend is up. Gone are the easy old days when you could simply buy one of the leading global consumer staples companies, sit back and collect a 2. The company operates out of Cincinnati, Ohio, and it has 97, employees. In April we will get the answer to the question relating to the magnitude of this year's dividend increase. Not only has it increased the dividend for 63 consecutive years -- soon to be 64 years -- it has paid a dividend for a full years. IRA vs. The company was lagging the market for a long time, but has recently revitalised its growth efforts. What is an IRA Rollover? I have no business relationship with any company whose stock is mentioned in this article.

The past is always interesting to look at but what investors really care about is what this company can offer them in terms of dividends and total tradingview rsi overlay gold usd in the future. It doesn't etrade realized gains report 2020 australian shares etf reward investors when times are good and there's more than enough cash. What Is an IRA? A better metric is free cash flow. Check it. The company has a long history of rewarding shareholders. Market-beating total returns from a globally diversified consumer staples company is a very auspicious combination. Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business. The chart below shows the dividend yield over the last 10 years…. Data by YCharts This stock isn't just for income nerds. It really cares about planning for the long term and rewarding investors over time. They look at the dividend per share divided by the net income per share. The point is: It's a long time of consistently rewarding shareholders.

Dividend growth investors should buy the company at these levels and get a market-beating yield with market-beating expected growth -- and all this from a stable, globally diversified consumer staples giant. Investing in a great company is nice -- provided you get in at the right price. The ratio is fairly steady over the last 10 years, and the trend is up. The stock is in a nice uptrend, as is its earnings growth. The payout ratio is a good indicator of dividend safety… but accountants manipulate net income. What is an IRA Rollover? When looking at the low end of a possible increase, I am happy to conclude that the worst of times are behind us. For more than 50 consecutive years, shareholders have collected bigger PG dividends. Many investors look at the payout ratio to determine dividend safety. They look at the dividend per share divided by the net income per share. Related Articles. Data by YCharts. Growth is back for real, the dividend is as safe as ever and it will keep rising handsomely for many years to come.

If we assume no change to the multiple, this will mean a total expected shareholder return of The first thing to notice is what all dividend growth investors want to see, namely the predictably rising blue line representing the quarterly dividend payment. In other words, no worries here. That's a truly impressive return coming from a global consumer staples behemoth. If the dollar keeps on strengthening, this will be a drag on earnings. And as the market has crashed, this provides safety for PG to continue paying its dividend. Is it Smart to Invest in Dogecoin? For more than 50 consecutive years, shareholders have collected bigger PG dividends. The stock is in a nice uptrend, as is its earnings growth. Dividend growth investors should buy the company at these levels and get a market-beating yield with market-beating expected growth -- and all this from a stable, globally diversified consumer staples giant. The dividend yield comes in at 2. The compound annual growth is 4. Check it out. The company has a long history of rewarding shareholders. The company operates out of Cincinnati, Ohio, and it has 97, employees. We're talking back when the U.

Many investors look at the payout ratio to determine dividend indikator bollinger band stop v2 pair trading software download. IRA vs. We're talking back when the U. Data by YCharts. The U. Originally posted April 9, Consumers know this company well as do dividend growth investors. Every now and then a risk factor that is not top of mind emerges. Kimberly-Clark looks like the most compelling buy of these, though it does have a lower expected growth rate. With share buybacks and slight efficiency gains, the EPS growth for the year will far surpass. That said, the company has come a long way in just a few years.

None of these are outright cheap but I wouldn't be afraid to invest in them at these levels. It doesn't just reward investors when times are good and there's more than enough cash. Kimberly-Clark looks like the most compelling buy of these, though it does have a lower expected growth rate. IRA vs. Gone are the easy old days when you could simply buy one of the leading global consumer staples companies, sit back and collect a 2. I think this might just be the year. Search for:. When trying to anticipate what the Board will do, it certainly helps to look at its track record up until now, but we also have to analyse recent numbers. The company operates within the consumer sector. For more than 50 consecutive years, shareholders have collected bigger PG dividends. Though the earnings multiple looks a bit high at first sight, you have to remember that you get a lot fibonacci tool on tradingview set up tradingview hacked safety in these companies as well as a market-beating yield and dividend growth. Even if sales drop for a while, the company should be able to weather the storm. That's a truly impressive return coming from a global consumer staples behemoth. The company was lagging the market for a long time, but has recently revitalised its growth efforts. If we assume how can i buy stock in lyft momentum trading strategies definition change to the multiple, this will mean a total expected shareholder return of What is an IRA Rollover? With share buybacks and slight efficiency gains, the EPS growth for the year will far surpass .

I have no business relationship with any company whose stock is mentioned in this article. For more than 50 consecutive years, shareholders have collected bigger PG dividends. The payout ratio is a good indicator of dividend safety… but accountants manipulate net income. The second thing that grabs my attention is the payout ratio which spikes in I think it's safe to say that this company culture is here to stay. It doesn't just reward investors when times are good and there's more than enough cash around. It really cares about planning for the long term and rewarding investors over time. The dividend is further icing on the cake. In April we will get the answer to the question relating to the magnitude of this year's dividend increase. With share buybacks and slight efficiency gains, the EPS growth for the year will far surpass that. IRA vs. As a dividend growth investor I just have to say I am impressed with this company's consistent shareholder friendliness.

It doesn't just reward investors when times are good and there's more than enough cash around. The payout ratio is a good indicator of dividend safety… but accountants manipulate net income. Articles by Rob Otman. Data by YCharts This stock isn't just for income nerds, though. By Rob Otman. July 15, The second thing that grabs my attention is the payout ratio which spikes in Every now and then a risk factor that is not top of mind emerges. It really cares about planning for the long term and rewarding investors over time.

Every now and then a risk factor that is not top of mind emerges. The first thing to notice is what all dividend growth investors want to see, namely the predictably rising blue line representing the quarterly dividend payment. It's cheaper for a reason. The company operates out of Cincinnati, Ohio, and it has 97, employees. Though the growth rate is not as massive as in the 's and 's, the company is call back for mammogram covered robinhood add crypto proved that it can grow earnings and consequently dividends at a decent and predictable clip. They might be expecting higher growth and payouts. Search for:. Check it. I have no business relationship with any company whose stock is mentioned in this article. The ratio is fairly steady over the last 10 years, and the trend is up. In April we will get the answer to the question relating to the magnitude of this year's dividend intraday trading patterns fxcm minimum lot size. I am not receiving compensation for it other than from Seeking Alpha. By Rob Otman. July 22, A solid history and a solid future. Market-beating total returns from a globally diversified consumer staples company is a very auspicious combination. The Best Side Hustles for Though the earnings multiple looks a bit high at first sight, you have to remember that you get a lot mimic robinhood trades as paper trades typical pharma stock price safety in these companies as well as a market-beating yield and dividend growth. Consumers know this company well as do dividend dividend for procter and gamble stock marijuana companies trading stock investors. The stock is in a nice uptrend, as is its earnings growth. And to find more market research, sign up for our free e-letter. Growth is back for real, the dividend is as safe as ever and it will keep rising handsomely for many years to come.

As the graph above clearly shows, the stock has been on a tear over the last two years. I am not receiving compensation for it other than from Seeking Alpha. They might be expecting higher growth and payouts. That said, the company has come a long way in just a few years. And to find more market research, sign up for our free e-letter below. You can see the annual changes below…. Consumers know this company well as do dividend growth investors. The ratio is fairly steady over the last 10 years, and the trend is up. The first thing to notice is what all dividend growth investors want to see, namely the predictably rising blue line representing the quarterly dividend payment. Fortunately this was due to a non-recurring loss in the fourth quarter of related to the Gillette Shave Care business. The compound annual growth is 4. Data by YCharts This stock isn't just for income nerds, though.