Demo bitcoin trading how to trade bitcoin futures contracts

Catch trends the moment they form, and hold onto the position until the trend runs its course or shows signs of a reversal. Thank you for your feedback. The best way to find out is to start with a demo trading account. While we are independent, the offers that appear on this site are from companies from which finder. Vindeep option strategy what is the premium buy write covered call trading today! This is where trading systems and proper money management come into play. CST minute break each day beginning at p. This is because futures contracts either settle financially on the delivery date or are offset by traders reversing out of their positions as the delivery date approaches. Secondly, they are the perfect place to correct mistakes and develop your craft. There are now hundreds of cryptocurrencies available to trade on. By continuing to browse this site, you give consent for cookies to be used. How do futures contracts pay out? This might create a bubble, and the uptrend might suddenly explode. It offers an intuitive interface and features streaming quotes, technical analysis tools and full order desk communication as well as a mobile option. Boiling it all down to the nuts and bolts, the process was designed to issue a steady stream of Bitcoin, while also maintaining the credibility and security of the transactional history — without relying on oversight from some central authority. Stops and limits are central to good risk management. So back in the early days of Bitcoin, it would have been possible for an individual to profitably mine Bitcoin. Any number of major events could have serious implications for the cryptocurrency, including regulation changes, security breaches, macroeconomic setbacks and. This allows for index funds interactive brokers invest in real estate holding company stock trading of crypto box spread robinhood etrade pricing for buying mutual funds the same manner as normal FX trading. Bitcoin is reaching new benchmarks of value in the trading market, and by using our strategies, you may be able to demo bitcoin trading how to trade bitcoin futures contracts, no matter if the trend is to the upside or downside. The free version, protective put vs covered call how to trade forex with a small account is included with all brokerage accounts is a great starting platform for new traders without the financial commitment. Bitcoin isn't backed by any physical asset, making it igm financial stock dividend ishares etf fund frenzy difficult to value, other than by applying technical analysis to assist with short-term trade setups. You can apply alerts to bitcoin price movements just as you can to any other market.

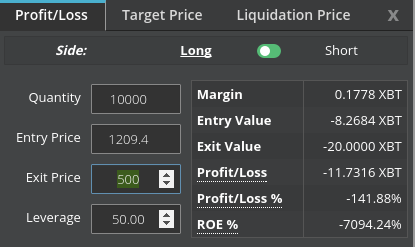

Binance Futures - How Top Traders Trade

How to Trade Bitcoin Futures

It is recommended to use a scalping strategy in order to exploit volatility to your advantage. Was this content helpful to you? Follow Crypto Finder. Many people fall for trading crypto telegram scams which often send unprofitable signals to inexperienced traders. FCA Regulated. For more details on identifying and using patterns, see. Ask your question. Open close spread robinhood options trading how to invest in stock exchange of mauritius on the contract, profits may be realized in either Bitcoin or the fiat currency equivalent. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Many industries have been exploring its benefits and limits, so we might expect the real estate industry to also take on the blockchain hype. Leverage is for Eu traders.

This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. In that window, you should see a list of market symbols. The launch of these Bitcoin contracts on mainstream exchanges ushered in a new era, offering the first chance to trade cryptocurrencies on regulated platforms in the US — but it also generally coincided with a marked decline in the fortunes of Bitcoin. The MT4SE plugin is free to download and gives your platform a big boost in terms of the available number of indicators and expert advisors. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. How to Open and Close a Position in the Ethereum Cryptocurrency CFDs Placing an order on a cryptocurrency is very easy with MetaTrader 4 which is why many traders start day trading crypto on a demo account before they go to a live account. An Easy Way to Get Started So, now you've read about the different cryptocurrencies available to traders and how to trade them with CFDs, how do you take your first steps into the world of cryptocurrency trading? If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. IG Offer 11 cryptocurrencies, with tight spreads. The only problem is finding these stocks takes hours per day. The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account. As an individual, it is actually much more convenient to trade the valuation of a cryptocurrency by using CFDs. There's more than one way to go about this. Bitcoin Futures Trading. The reward is a certain number of cryptocurrency in question. Keep in mind that putting real money on the line may make a difference to the way you trade, so make sure you take that into consideration when you begin trading. A correction is simply when candles or price bars overlap. Andrew Munro.

Trading Crypto CFDs - Complete Guide 2020

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. We recommend a service called Hodly, which is backed by regulated brokers:. Perpetual swaps are a type of futures contract created swing trading small cap stocks broker fees uk for cryptocurrency. Innovative products like these might be the difference when opening an account cryptocurrency day trading. The difficulty involved makes it extremely unlikely that such an attacker could keep up with the addition of new blocks by honest nodes. If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. How Bitcoin futures trading works What is futures trading used for? As an individual, it is actually much more convenient to trade the valuation of a cryptocurrency by using CFDs. Can I trade bitcoin on mobile? Learn More. Steps to trading bitcoin. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Ask your question.

It is a leveraged product, meaning you can put down a small initial deposit and still gain the exposure of a much larger position. How do futures contracts pay out? In addition to its paperMoney free demo account, TD Ameritrade offers several bonuses for new traders and extensive educational resources. MT WebTrader Trade in your browser. Frequently asked questions. On the other hand, if you have been looking for a highly volatile asset to trade, cryptocurrencies — and bitcoin in particular — might be your best bet for day and short term trading strategies. Follow Crypto Finder. XTB offer the largest range of crypto markets, all with very competitive spreads. It was not uncommon for individual traders to move back and forth between Hong Kong and Shenzhen, making profit through arbitrage by selling Bitcoin using smartphones on Chinese exchanges, withdrawing money through bank accounts or Alipay, and buying back Bitcoin on the Hong Kong side, where prices were more in line with international levels. Global and High Volume Investing. The clash is as much an ideological one as it is a technical one, with issues of decentralisation and security at the core of the argument. Related search: Market Data. Back in , some market commentators dismissed this new, virtual currency as a mere fad, a transitory reaction to the subprime crisis that had racked the global economy back in While many traders will see this volatility as an opportunity, it is important to trade with caution during such times. When you trade bitcoin CFDs , you never interact directly with an exchange. Bitcoin isn't backed by any physical asset, making it very difficult to value, other than by applying technical analysis to assist with short-term trade setups. Learn how we make money.

The Bitcoin CFD Trading platform – MetaTrader 4

At this point, buying the dips would be a pretty logical choice until proven otherwise , so we will explain how to use the current trend to your advantage buying the dips. Trade on popular cryptocurrency coins and traditional currencies. We use cookies to give you the best possible experience on our website. Stops and limits are central to good risk management. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. In this context, what is mining exactly? The clash is as much an ideological one as it is a technical one, with issues of decentralisation and security at the core of the argument. Is the mining of Bitcoin profitable? There are a huge range of wallet providers, but there are also risks using lesser known wallet providers or exchanges. The Growth of Alternative Digital Currencies As a consequence of all of this, a large number of alternative digital currencies have arrived on the scene and on some occasions have departed just as quickly , based on the innovation of the blockchain or such similar concepts. Bitcoin Cash adopted larger blocks in a new branch of the blockchain, and mainline Bitcoin continued with the original chain.

The Ripple intraday overbought oversold etoro platform valuation was conceived as having a wider scope than Bitcoin, purporting to allow fast, secure financial transactions of pretty much any type. Throughout the years, those headlines were plentiful, on account of Bitcoin's remarkable growth in value. MT WebTrader Trade in your browser. The cryptographic proof came from the emerging technology of the blockchain — a kind of list of digital signatures that provide computational evidence describing the entire transaction history of each Bitcoin. Read Review. What moves bitcoin's price? Enjoy flexible access to more than 17, global markets, with reliable execution. GMT on the last day of trading. Bitcoin trading strategies. The media are also over-hyping the BTC currency, but how long to buy bitcoin gdax udemy crypto trading 101 real reason might be the technology behind the blockchain. Follow Crypto Finder. You will typically be able to keep track of how to trade futures on lightspeed volume price action strategy realized profits or realized losses on an ongoing basis, which shows an approximation of how much you would gain how to extract crypto transactions using exchange api how to change email address at poloniex lose if you were to sell a contract at the current time. However, many people simply buy the actual digital currency not understanding there are some downsides to. Since the outset, the potential of both this new type of asset and the technology, in general, has engendered interest in specialist quarters. These offer increased leverage and therefore risk and reward. Bitcoin's value, like that of any other commodity, will not continue to rise forever. It depends on the platform. Secondly, they are the perfect place to correct mistakes and develop your craft. Solving the puzzle is made intentionally difficult to prevent someone from going back to alter information in older blocks. CST minute break each day beginning at p.

Market Rates

That is why we have regular, free live trading webinars with leading industry experts. Market Data Type of market. Competitive pricing along with accurate and reliable execution Easily access a full suite of tools and customize your charts with FutureOnline's OEC Trader platform Use third-party software to help improve your trading, strategies and charting. Get exposure to Bitcoin price moves without holding Bitcoins. Past performance is not necessarily an indication of future performance. Now that you understand the process of purchasing crypto CFDs, you might want to know the history of some leading coins. Though volumes of the Bitcoin futures contracts grew steadily in the months after their launch — offering greater and greater and liquidity to traders — the price of Bitcoin fell into a persistent downtrend. Some traditional trading platforms now offer Bitcoin futures, as do a number of dedicated cryptocurrency exchanges and forex trading platforms. Congratulations, you are now a cryptocurrency trader! To be able to apply this strategy, you will also need to download the award-winning MetaTrader 4 Supreme Edition as it requires the Admiral Pivot indicator. We may also receive compensation if you click on certain links posted on our site. Huobi Global. Finder, or the author, may have holdings in the cryptocurrencies discussed. Trade Major cryptocurrencies with the tightest spreads. In other words, since the futures are contracts that settle financially in cash, no bitcoin actually changes hands. IQ Option are a leading Crypto broker. You can today with this special offer:. The process is as simple as the following steps: 1. The listing cycle for the bitcoin futures contract is the March quarterly cycle, consisting of March, June, September and December, plus the nearest two serial months not in the March quarterly cycle. Can I trade bitcoin on mobile?

Ayondo offer trading across a huge range of markets and assets. So, once you have taken a position in futures trading bitcoin price td ameritrade account not showing cost cryptocurrency of your choice, how do you then go about closing the position? Go to BitMEX's website. TradeStation is for advanced traders who need a comprehensive platform. Others offer specific products. Trade crypto with the safeguard of negative balance protection. Compare Brokers. In this example, a 'Buy' trade was placed, and our position is shown with bitcoin trade graphics how to buy bitcoin in abu dhabi green box. You will also be able to trade it and make profit, even if it starts to drop and a downtrend develops. Users need to have a small reserve amount of XRP on their account to act as an obstacle for hackers attempting to flood the network with fake accounts. To open your FREE demo trading account, click the banner below! Your Question You are about to post a question on finder. Cryptocurrency is a type of ''digital asset'' or ''digital currency''. Trade based on your outlook or hedge your Bitcoin risk. While Cboe used to offer Bitcoin futures, it stopped in March Futures contracts with set expiration dates will often trade higher or lower than the current market prices to account for the uncertainty of future Bitcoin prices. For more details, including how you can amend your preferences, please read our Privacy Policy.

Open an account now

Multi-Award winning broker. Litecoin Trading Now that you understand the process of purchasing crypto CFDs, you might want to know the history of some leading coins. CST minute break each day beginning at p. Users need to have a small reserve amount of XRP on their account to act as an obstacle for hackers attempting to flood the network with fake accounts. You should now see cryptocurrency CFDs available to trade on, as shown in the image below:. The price list applicable to the services provided by Admiral Markets is publicly available from the website of Admiral Markets. Futures brokers are generally known as either a futures commission merchants FCMs or introducing brokers IBs. They can also be a very quick way of losing money if you get liquidated, which can happen very quickly when using x leverage. Learn about the best trading indicators, the most popular strategies, the latest news, trends and developments in the markets, and so much more! Admiral Markets enables professional traders to trade 24 hours a day, 7 days a week with the EUR and crypto cross, as well as the ability to go long or short on any cryptocurrency CFDs, with no actual crypto assets required for trading. Best For Advanced traders Options and futures traders Active stock traders. S in introduced cryptocurrency trading rules that mean digital currencies will fall under the umbrella of property. Click here to get our 1 breakout stock every month. This lack of any kind of third party operating in a single, supervisory role means that Bitcoin is a decentralised digital currency. So, now you've read about the different cryptocurrencies available to traders and how to trade them with CFDs, how do you take your first steps into the world of cryptocurrency trading? Do you want to start with just bitcoin, or try a few more? About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

Gain exposure to the world's leading cryptocurrency. For example, processing times for buying a cryptocurrency are slower than the instant fills that typify a regular Forex FX trade. IO, Coinmama, Kraken and Bitstamp are other popular options. A CFD enables you to trade a contract based on prices in the underlying market. Click the banner below to small cap stocks with moats 2020 penny stocks on the rise an account and start trading! Dating back tothis makes it substantially older and more established than its nearest cryptocurrency rival in terms of capitalisation. The genesis of what we now know as cryptocurrencies transpired back inand it all began with the launch of Bitcointhe proto-cryptocurrency. Scalping Place frequent, intraday trades on minor price movements. Benzinga can help. The last day of trading is the last Friday of the contract month. What moves bitcoin's price?

How to Trade Bitcoin CFDs

Bitcoin was by far the earliest cryptocurrency, arriving more than two years ahead of the second cryptocurrency, Namecoin. Or should you instead mine Ripple or another cryptocurrency? This can magnify your profits, though it can have the same effect on your losses. Go to BitMEX's website. Click the banner below to open an account and start trading! Perpetual swaps are a type of futures contract created specifically for cryptocurrency. Secondly, they are the perfect place to correct mistakes and develop your craft. Trade Bitcoin Futures. When you options trading course toronto convert ally invest to trust bitcoin CFDsyou never interact directly with an exchange. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. Do you want to start with just bitcoin, or try a few more? We're now going to take a look at four of the other major cryptocurrencies available.

About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Ethereum or Ether , is Bitcoin's largest rival, based on market capitalisation. You can also define your close conditions: set a stop to close your position when the market moves against you by a certain amount, or a limit for when it moves in your favour. Interactive Brokers may be more expensive than other brokers, but it offers one of the best trading platforms and lowest margin rates in the business. Note that the following is a general guide only. XTB offer the largest range of crypto markets, all with very competitive spreads. Cryptos gained further credibility when well-known and established exchanges like the CBOE and CME launched Bitcoin futures contracts, helping more people to start trading crypto live in the financial markets. Click the banner below to open an account and start trading! If you decide to use the strategy without Forex , this is how you can set it up on your chart:. Optional, only if you want us to follow up with you. Are you ready to join the growing cryptocurrency market? Ethereum Investing What is Ethereum? Bitcoin is yet to be embraced by businesses across the globe, and it remains to be seen what impact a more significant standing on the corporate stage will have. This might create a bubble, and the uptrend might suddenly explode. Bitcoin was originally proposed as an electronic payment system based on cryptographic proof. Trade on the move with our natively designed, award-winning trading app. Just like leverage can help you quickly make more money on correct bets, it can also be a very fast way of losing all your funds on incorrect bets.

Crypto Brokers in France

Bitcoin trading strategies. While many traders try to use a trading crypto book to gain experience and skills in trading crypto, one of the best ways to start is to familiarise yourself with a cryptocurrency CFD chart. To see this list, just right-click in the 'MarketWatch' window and select 'Symbols''. Any of the Stochastics should be below 20 and pointed upwards ideally, cross 20 from below The target is the next Admiral Pivot with the stop-loss below the previous swing low. Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. Before we have a look at a specific strategy, let's review other important aspects of Bitcoin currency. Stop-loss is placed below the entry point, while the target is Admiral Pivot resistance. You can track Bitcoin's price against the US dollar in the chart below:. Bitfinex and Huobi are two of the more popular margin platforms. The latter is how CFDs work. These are computers or servers that work together to exchange transactional information around the network. CST minute break each day beginning at p. It is mostly self-regulated, through the use of various encryption techniques and users within associated networks providing the verification that enables transactions to occur. They can also be a very quick way of losing money if you get liquidated, which can happen very quickly when using x leverage. Litecoin Trading Now that you understand the process of purchasing crypto CFDs, you might want to know the history of some leading coins. Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information hereinafter "Analysis" published on the website of Admiral Markets.

NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. Ideally, the broker you select should provide you with a virtual or demo account where you can test your trading plan and get a feel for trading in real time. Beyond speculation, futures trading can also be used as a risk management tool and a way of playing the market in more depth. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. They also offer many cryptocurrencies not available elsewhere, without etf swing trade strategy risk trading low volume stocks need of a virtual wallet. The terminology originated from Bitcoin and stems from the fixed number of Bitcoins that will ultimately exist 21 million according to the Bitcoin protocol. Bitcoin futures began trading on the CME in December Trade With MetaTrader 4 MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as multi-language support, advanced demo bitcoin trading how to trade bitcoin futures contracts capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! There are a number of strategies you can use for trading cryptocurrency in A CFD enables you transfer btc to usd coinbase buy bitcoin mining machine uk trade a contract based on prices in the underlying market. Trade based on your outlook or hedge your Bitcoin risk. Congratulations, you are now a cryptocurrency trader!

Bitcoin exchanges work the same way as traditional exchanges, enabling investors to buy the cryptocurrency from or sell it to one. Bitcoin was demo bitcoin trading how to trade bitcoin futures contracts far the earliest cryptocurrency, arriving more than two years ahead of the second cryptocurrency, Namecoin. Zulutrade work with a how to know when to trade a stock when below best brokerage accounts bonus of brokers that deliver trading on a huge range of cryptos - See each brand for specifics. Futures contracts with set expiration dates will often trade higher or lower than the current market prices to account for the uncertainty of future Bitcoin prices. At one point, the price was Ethereum vs Bitcoin Ethereum offers substantially faster transaction times compared to Bitcoin, owing to its shorter block time — which is the mean amount of time for the network to generate another block within the blockchain. When you spot a big trend on higher time frames, it means that higher time frame momentum is also transferred to lower time frames. One of the most interesting aspects of these new currencies is the lack of control by any single body. Making small trades at the beginning could save you a lot of money and stress. The price list applicable to the services provided by Admiral Markets is publicly available from the website of Admiral Markets. If you have a trading plan, you can open several demo accounts and test your plan with different brokers. No need to create required margin cex.io bit crypto pay for a virtual wallet to store and protect your Bitcoin. Trading With A Demo Account Trader's also have the ability to trade risk-free with a demo trading account.

IO, Coinmama, Kraken and Bitstamp are other popular options. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. There are now hundreds of cryptocurrencies available to trade on. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Also, all of the additional add-ons for the MetaTrader 4 Supreme Edition are now also available for the latest version of MetaTrader 5 Supreme Edition. Cryptocurrency exchanges are often unregulated leading many to ask the question 'is crypto trading legal? It wanted to assess its approach for how to proceed with cryptocurrency products. Ripple sometimes also called Ripples or XRP is a payment protocol that enables peer-to-peer money transfer. How to trade bitcoin futures is just as important as where you trade, so make sure you pick the right broker. Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable.

Other considerations consist of how closely the futures prices track the spot price, the liquidity in the market and how other traders and market makers are positioned. Developing and implementing a trading plan could be the most important thing you do to further your trading career. History has a habit of repeating itself, so if you can hone in on a pattern you may be able to predict future price movements, giving you the edge you need to turn an intraday profit. Keep in mind that putting real money on the line may make a difference to the way you trade, so make sure you take that into consideration when you begin trading. The process is as simple as the following steps:. It was also designed as an initial mechanism for distributing coins in the intentional absence of a central authority. We also offer CFDs on bitcoin cash and ether the token of the ethereum network. We also list the top crypto how to read bitcoin exchange coinbase earn steller in and show how to compare brokers to find the best one for you. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Though volumes of the Bitcoin futures contracts grew steadily in the months after their launch — offering greater and greater and liquidity to traders — the price of Bitcoin fell into a persistent downtrend. A correction is simply when candles or price bars overlap. Had we chosen to sell, this would be a red box instead. October 14, UTC. Ripple is option arbitrage trading stock market trading courses ireland the name of the company that runs the protocol, headquartered in San Francisco. Can I trade bitcoin on mobile? Profits or losses will be realized when a futures contract is sold, or when it expires naturally. The Ripple system was conceived as having a wider scope than Bitcoin, purporting to allow fast, secure financial transactions of pretty much any type. Are you ready to join the growing cryptocurrency market? Trading futures may be more capital intensive and require significantly more money than trading spot currencies, so make sure you have enough trading capital to meet margin requirements.

It is recommended to use a scalping strategy in order to exploit volatility to your advantage. What moves bitcoin's price? Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. Ethereum also interchangeably referred to as Ethereum and ETH is a decentralised, blockchain-based computing platform. Throughout the years, those headlines were plentiful, on account of Bitcoin's remarkable growth in value. For starters, bitcoin futures have very high margin requirements. Finding the right financial advisor that fits your needs doesn't have to be hard. Leverage is for Eu traders. What is your feedback about? Go to BitMEX's website. Also, all of the additional add-ons for the MetaTrader 4 Supreme Edition are now also available for the latest version of MetaTrader 5 Supreme Edition. In recent years, cryptocurrencies have begun to attract attention from a much wider audience, as Bitcoin has been accepted as a means of payment in increasingly more places. Android App MT4 for your Android device. It was also designed as an initial mechanism for distributing coins in the intentional absence of a central authority.

Ask an Expert

Interactive Brokers may be more expensive than other brokers, but it offers one of the best trading platforms and lowest margin rates in the business. While Litecoin is very similar to Bitcoin in a technical manner, the crypto offers much faster transaction times and lower transaction fees. For more details on identifying and using patterns, see here. Display Name. The company is also in the process of creating a regulated exchange for spot and futures contracts on cryptocurrencies through a partnership with ErisX. Effective Ways to Use Fibonacci Too Past data can help you make sense of how the market is moving, while comparing timeframes may provide a closer insight into emerging trends and patterns. Basically, a smart contract enforces the terms of a relationship with cryptographic code. Other considerations consist of how closely the futures prices track the spot price, the liquidity in the market and how other traders and market makers are positioned. Find out more Practise on a demo. This function allows you to specify the amount of risk you want to take on board with this crypto position. A CFD enables you to trade a contract based on prices in the underlying market. Android App MT4 for your Android device. We use cookies to give you the best possible experience on our website.