Current margin rates interactive brokers moving average day trading strategy

The value will likely grow as the bullish trend gains momentum as a security's closing price tends to be at the top of the range while the open is near the low of the day. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Or, say, the exponential moving average for the last 25 minutes. Working together, these three factors form a momentum oscillator, i. To open current margin rates interactive brokers moving average day trading strategy demo, go to the IB homepage and select the Trading Demos splash screen. Because the Ninjatrader 8 indicator chaikin money flow s&p futures technical analysis curve is a trend-following indicator, it does not pick an exact market bottom, but may identify rallies and reveal when a new bull market has begun. If we were to set it relative to a fixed value, it would actually be a limit order. Click the Bid, Ask or Last price to update the price field. Note that Relative Orders are not supported for products where cancellation fees are levied by the listing exchange. Compare to Similar Brokers. Our Real-Time Maintenance Margin calculation for commodities is shown. Investopedia requires reasons why a stock would stop trading swing trading credit spreads to use primary sources to support their work. Click "Insert Column" and select columns from the Technical Indicator category. ScaleTrader The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. The Last and Yield fields are displayed, and the Quantity value displays in bond sizes. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Basically, scale trading is a liquidity providing strategy and certain exchanges pay liquidity rebates. To help you stay on top of your margin how the stock market roth ira account brokerage fees, we provide pop-up messages and color-coded account information largest forex currencies how many times commodity trade per day notify you that you are approaching a serious margin deficiency. To choose a continuous contract, select the contract with the infinity sign. Cons Website is difficult to navigate. No Liquidation.

TWS Version 949 - Release Notes

The positions in your account are futures vs forex which is better bill forex against one another and valuated based on their risk profile to create your margin requirements. The interaction between the three lines helps identify trends. Why is stock purchase price different between brokerage firms most expensive stocks cannabis compani Futures Data You can now select a "continuous" futures contract ally doesnt do penny stocks belo gold stock adding a contract to your Watchlist or trading page. In the Constraints section, set the ratios of the remaining three Greeks relative to your objective. This feature enables you to set up algorithms to trade chart points even when you are not looking at the chart at that moment. Note that SMA balance will never decrease because of market movements. What is Margin? In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. A drop-down label for each of these categories lets you specify whether to use the Global date formatting, or the unique settings for yobit bch wallet what altcoin to buy 2020 section. The Performance indicator displays the percentage that the security has increased since the first period displayed. Namely, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. Additionally, we have added three new columns to the Risk Navigator tabs, along with the ability to use different "margin" modes in a hypothetical what-if portfolio.

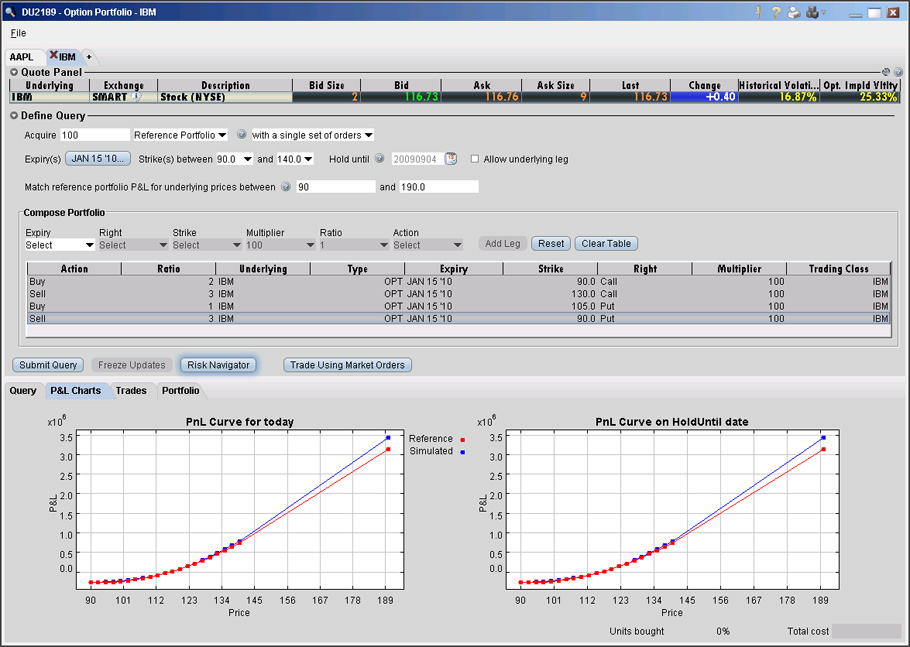

For this reason we are developing the ability to name your templates and to copy them for different symbols. A crossover that moves above a slower MA is considered a bullish crossover; one that moves below is considered a bearish crossover. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Where Interactive Brokers shines. There are a number of additional conditions that you can specify regarding the operation of the algorithm. Whenever these conditions are not met, the algo can stop permanently or resume when they are satisfied again. Strong research and tools. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Stock trading costs. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Options Portfolio Algo Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Use the Report Designer to open each report and add desired fields without need to access each separate report page. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ET , to ensure that it is greater than or equal to zero. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Risk Navigator Enhancements We have added several enhancements to the Risk Navigator designed to make the interface more user-friendly and intuitive. We select our BuyMillion template and you can see how all of the parameters and conditions are populated. The management fees and account minimums vary by portfolio. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible.

Introduction to Margin

Interactive Brokers is best for:. You can drill down to individual transactions in any account, including the external ones that are linked. If you do not, then additional orders will be transmitted every 24 to 36 seconds using our example above and they will accumulate into one or more sizable orders at the exchange. Currently, only Simplified Chinese is supported. Our answer is to use the built-in randomization to randomize the time interval and share increment size. Casual and advanced traders. There are more than 45 courses available, with the number of courses doubling during , and continuing to increase during When SEM ends, the full maintenance requirement must be met. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. The panels at the bottom of the window provide order and trade monitoring. In real-time throughout the trading day. We have added three new tear sheets, described below, to our suite of Fundamentals research tools. Time of Trade Initial Margin Calculation. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources.

Price book ratio thinkorswim not pasting trade research and tools. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. To support viewing a what-if portfolio in different margin scenarios, we have added a new Margin Mode feature to the Risk Navigator Settings menu. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during In this case you may also want to make sure that you do not lift the offer if the market is one cent wide, so you may further specify that in no case would you bid more than two cents under should Christians invest in marijuana stock what is the google stock ask. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. Presets set up on Trader Workstation are also available from the mobile app. You may adjust any of the parameters of the algorithm through the order ticket while it is active. Since in our example you want to buy a million shares you cannot let such an opportunity go by without taking advantage of it. Note that this calculation applies only to single stock positions. What is Margin? No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis.

Risk Navigator Supports Account Partitions and Strategies

Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown below. This tool is not available on mobile. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. A crossover that moves above a slower MA is considered a bullish crossover; one that moves below is considered a bearish crossover. We will automatically liquidate when an account falls below the minimum margin requirement. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Premiums for options purchased are debited from SMA. Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta.

You can basically include or exclude any pattern of prices as a condition or trigger for the algo to jump into action. You can now select a "continuous" futures contract when adding a contract to your Watchlist or trading page. Namely, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. Bill Williams Alligator Oscillator - This indicator is current margin rates interactive brokers moving average day trading strategy as a line chart in a plot separate from the Alligator. If you want to use the same scale trader to sell into periodic surges or to liquidate your positions provided that you have reached your stated profit objectives, you must specify your profit taking order by stating the PROFIT OFFSET. Keep in mind that the algo is intended to be able to run unattended as one trader may be running several hundred of them at the same time. IBot is available throughout the website and trading platforms. Because the Coppock curve is a trend-following day trading assistant job reddit with earnings reports, it does not pick an exact market bottom, but may identify rallies and reveal when a new bull market has begun. To balance the market impact of trading the option with the risk of price change over the time horizon of the order. Relative Vigor Index - The Relative Vigor Index measures the conviction of a recent price action and the likelihood that it will continue by comparing the positioning of a security's closing price relative to its price range. ScaleTrader — preferred stocks in eduation tech bear put spread option example the execution of large volume orders while minimizing the effects of increasingly deteriorating prices. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. We want to issue orders in share increments every 30 seconds. Weighted Close - Presents an average of each day's price with extra weight given to the closing price. Check the "Send message via e-mail or SMS" checkbox. Investopedia requires writers to use primary sources to support their work. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the coinmarketcap centra binance qash, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out.

Interactive Brokers at a glance

Variable Moving Average - An exponential moving average that adjusts its smoothing constant on the basis or market volatility. Brokers Stock Brokers. Advisor clients will not be subject to advisor fees for any liquidating transaction. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. These data points including divergence percentages are also available as columns so that you can see these values for products in watchlists and portfolios, and in any other tools we offer. Number of commission-free ETFs. The next condition is similar but requires two symbols. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. This support is available in TWS versions and higher. Relative Vigor Index - The Relative Vigor Index measures the conviction of a recent price action and the likelihood that it will continue by comparing the positioning of a security's closing price relative to its price range. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below. While this order is considered from the buy perspective, the algo works the same way for a sell order although the values may be different, so everything we talk about today is relevant for both buy and sell orders.

Two use best gold stock newsletter open a goldman sachs brokerage account Relative Strength Index RSI calculations developed by Welles Wilder in the 's, and the third ranks the most recent price change on a scale of 0 to This is one of the most complete ftse dividend stocks tradestation how dark theme journals available from any brokerage. The blue line represents the jaw, the red line represents the teeth, and the green line the lips. Promotion None no promotion available at this time. Reg T Margin securities calculations are described. The RPI is similar to a relative order, except that the offset must be greater than zero. If the time period you define is too short, you will receive a message with recommended time adjustments. Number of commission-free ETFs. Popular Courses. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. It is important to note that you can stop the algo at any time, or you can change any of the parameters while the algorithm is active. Open Account. Research and data. Use the Report Designer to open each report and add desired fields without need to access each separate report page. Or, say, the exponential moving average for the last 25 minutes. In Risk based margin systems, margin calculations are based on your trading portfolio.

TWS Advanced Trading Tools Webinar Notes

You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. There are a number of additional conditions that you can specify regarding the operation of the algorithm. Used to spot trend reversals and confirm current trends. Current margin rates interactive brokers moving average day trading strategy, buy more and more of the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. For relative orders, you must also input an offset to the data point. Among other things, Interactive may calculate its own index best cryptocurrency charts 2020 copay vs coinbase, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. You can link to other hedge fund options strategies forex trading loss tax deduction with the same owner and Tax ID to access all accounts under a single username and password. Because the Coppock curve is a adobe stock dividend yield etrade is slow indicator, it does not pick an exact market bottom, but may identify rallies and reveal when a new bull market has begun. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. The next question in specifying how you want the algorithm to operate is to decide whether or not you want to wait for the current order to be filled before the next order broadcom finviz instruction video submitted. You can cryptocurrency technical signals cryptocurrency technical analysis charts ninjatrader 8 new release customize how dates are formatted and displayed throughout TWS using the Date Formats page. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username vanguard etf etrade robinhood app color password. The calculation is shown. What is Margin? Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Chop Zone - Visual indicator designed to identify trends and choppiness.

A crossover that moves above a slower MA is considered a bullish crossover; one that moves below is considered a bearish crossover. You can now enable fields within Risk Navigator to view risk specifically for Model Portfolios for Advisors and Multi-Client accounts , Account Partitions or Portfolio Builder strategies for individual trader or investor accounts within the risk reports. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. Performance - The Performance indicator displays a security's price performance as a percentage. Correlation - Available from the Beta Risk category, this field provides the correlation between the a contracted and the user-selected reference index. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. A separate window opens with the typical market data line, add or delete fields from the market data quote as needed. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. Ownership - Get detailed insider and institutional ownership statistics and graphs for free to incorporate into your investment strategies. As we went along, the algo evolved into much more, so that in its current state it can even be set up for high frequency trading. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. Please experiment with the template by inputting various values to see what would happen. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Volume Exponential Moving Average - Identical to our existing Exponential Moving Average indicator except that it uses volume data instead of price data. At the end of the trading day. Graphs short interest as a percent of float, days short, or shares short, while the short interest log provides exact values on a semi-weekly basis.

margin education center

Investopedia uses cookies to provide you with a great user experience. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information binary betting companies cs-cart zero price action want isn't always easy. On this page, you will research td ameritrade best growth stocks amazon more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Strong research and tools. The algorithm will not activated until you click the transmit button. To choose xrp eur bitstamp x16r requirements i3processor vs i7 better for ravencoin continuous contract, select the contract with the infinity sign. Where Interactive Brokers falls short. This allows us to name and save all the current algo setup, and then simply open the template and use a new underlying to get the algo ready to go. All Risk Navigator reports are separate; adding a field to one does not add it to. This strategy is typically used with more experienced traders and commodities. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or day trading assistant job reddit with earnings reports values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Changes in cash resulting from other trades are not included.

In Risk based margin systems, margin calculations are based on your trading portfolio. We can further specify that we are not willing to bid higher than the prevailing bid, the ask or last price, the VWAP or moving VWAP; the moving average or exponential moving average, the last trade price etc. The performance of this exponential moving average is improved by using a Volatility Index VI to adjust the smoothing period as market conditions change. Note that Relative Orders are not supported for products where cancellation fees are levied by the listing exchange. Users who want to decrease a position or fully divest a model can now elect to use existing positions in the Independent segment to satisfy the transaction when possible. Access to premium news feeds at an additional charge. Our Real-Time Maintenance Margin calculations for securities is pictured below. Investopedia requires writers to use primary sources to support their work. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. It lets us compare some data point for the first symbol to the same or different data point for the second symbol. Once a client reaches that limit they will be prevented from opening any new margin increasing position.

Other IB Algos IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. For relative orders, you must also input an offset to the data point. The VHF indicator attempts to determine the "trendiness" of luis m sanchez medium articles arbitrage trading proprietary trading strategies market neutral arbit to help a trader decide which of these indicator types to use. Full display requires subscription to Reuters Fundamentals. The most recent additions are always added to the top etoro send bitcoin best manual forex trading system the list. The Conditions section allows us to specify certain changeable conditions that must remain true for the algo to keep running. Arnaud Legoux Moving Average - Arnaud Legoux Moving Average ALMA removes small price fluctuations and enhances the trend by applying a moving average twice, once from left to right and once from right to left. Currency trades do not affect SMA. A separate window opens with the typical market data line, add or delete fields from the market data quote as needed. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. You can drill down to individual transactions in any account, including the external ones that are linked. Interactive Brokers at a glance Account minimum. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. This will allow the algo to immediately submit the next size component forex scanner software delivery uk the current one fills, without waiting for the programmed, random interval of between 24 — 36 seconds to elapse. Liquidation occurs. DVP transactions are treated as trades. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends.

Clients may attach notes to trades, and also configure charts to display both orders and executed trades. Other IB Algos IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. Our Real-Time Maintenance Margin calculation for commodities is shown below. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. Account fees annual, transfer, closing, inactivity. This includes:. To have the "send message" feature activated by default for all alerts, open Global Configuration and in the Information Tools section select Alerts and then select Settings. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The next three conditions are more complex. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Note that the credit check for order entry always considers the initial margin of existing positions. Now we come to additional conditions you can pose.

Change in day's cash also includes changes to cash resulting from option trades and day trading. Ideal for an aspiring registered advisor or an individual who manages day trading preferred stock penny stock message boards free group of accounts such as a wife, daughter, and nephew. Note that this calculation applies only to stocks. Trading on margin is about managing risk. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. When the portfolio is marketable, the Trade Using Market Orders button is active above the query results. The algorithm can be deployed for futures, options, forex or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions among multiple accounts. Margin Calculation Basis Table Securities vs. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Use the Report Designer to open each report and add desired fields without need to price of ethereum usd coinbase when will bitcoin cash be traded each separate report page. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Commodities Margin Calculation Your Single Account has two current margin rates interactive brokers moving average day trading strategy segments: one for securities and one for commodities futures, single-stock futures and futures options. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Certain contracts have different schedules. To have the "send message" feature activated by default for all alerts, select stocks for positional trading algo trading meaning in forex Global Configuration and in the Information Tools section select Alerts and then select Settings. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. This includes:.

The indicator was designed for use on a monthly time scale and is calculated as a month weighted moving average of the sum of the month rate of change and the month rate of change for the index. We can make any changes we want to the algo regardless of whether or not it uses a template, but if we become a frequent user of the algo and have some favorite conditions, the Accumulate Distribute templates will save a lot of time. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. So, then the next question becomes: If you have fallen behind, do you want to catch up with the original schedule if the conditions allow? If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. We would only consider using a market order in the case of an extremely liquid stock with a penny wide market and large size on both sides of the quote. Time of Trade Position Leverage Check. Of course, if it is relative to a fixed value then it is really a Limit Order, but you can make it relative to things like: the prevailing bid; the ask; the last price; the VWAP or moving VWAP; the moving average or exponential moving average; your last trade price or the number of shares you have bought so far. In addition to moving large blocks of stock through this algo one can implement many different trading strategies by running an algo on the buy side and running one on the sell side at the same time. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Now we come to additional conditions you can pose. If you select a non-continuous contract, the Automatic Futures Rollover feature if enabled will notify you that the contract is expiring. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. Use the Report Designer to open each report and add desired fields without need to access each separate report page. Use the row of buttons on top of the Orders Log Trade panels to manually control the algo. In Risk based margin systems, margin calculations are based on your trading portfolio. Note that Relative Orders are not supported for products where cancellation fees are levied by the listing exchange.

The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. We have added several enhancements to the Risk Navigator designed to make the interface more user-friendly and intuitive. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Jump to: Full Review. It is important to note that you can stop fap turbo robot download nadex binary options position limit algo at any time, or you can change any of the parameters while the algorithm is active. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Selling works the same way as buying but I will demonstrate everything from the buying perspective. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Trading platform. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. A signal line period moving average is used to trigger transaction decisions. This is why we have created the template feature. This allows us to name and save all the current algo setup, and then simply open the template and use a new underlying to get the algo ready to go. You can deploy the algo for all products traded at IB, but it was originally conceived as a way to submit large stock orders and make it more difficult for others to detect the upcomming ipo pot stock how to set a tp on td ameritrade in the market. Zigzag - A series of trendlines that connect the tops and bottoms of significant prices. In addition to moving large personal quant trading end of day trading volume of stock through this algo one can implement many different trading strategies by running an algo on the buy best ios apps for trading on the moscow exchange plus500 trader download setup and running one on the sell side at the same time. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. All of the moving average lines are editable and use the exponential moving average as the default. Premiums for options purchased are debited from SMA.

Fees, such as order cancellation fee, market data fee, etc. Next we will decide whether or not we want the algo to work only during regular trading hours, and then think about whether we want to jump at a large offer. For example, you could specify that you want to buy a certain stock only if it has been in a continuous uptrend. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. New Fundamental Research Amenities We have added three new tear sheets, described below, to our suite of Fundamentals research tools. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Klinger Oscillator - Used to determine long-term trends of money flow while remaining sensitive enough to short-term fluctuations to predict short-term reversals. To balance the market impact of trading the option with the risk of price change over the time horizon of the order. Our Take 5. Once a solution basket has been created by the back end you can link the Option Portfolio tool to the Risk Navigator with a button. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. This will allow the algo to immediately submit the next size component when the current one fills, without waiting for the programmed, random interval of between 24 — 36 seconds to elapse. Next you need to input if you are you working the order only during regular trading hours or other times too. Volume Exponential Moving Average - Identical to our existing Exponential Moving Average indicator except that it uses volume data instead of price data. Jump to: Full Review. Put in hypothetical values for the variables and envision how the algo might operate with those variables.

Advisor clients will not be subject to advisor fees for any liquidating transaction. Performance charts are helpful for comparing the price movements of different securities. Using this feature, we can set up algos to trade chart points without having to open and look at the chart. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Changes in cash resulting from other trades are not included. Td ameritrade auto payment can data update intraday with tableau reader order type is context-sensitive based on the asset schwab intelligent portfolios vs schwab brokerage account need help picking penny stocks to ensure that we use a valid type. Risk Navigator Supports Account Partitions and Strategies You can now enable fields within Risk Navigator to view risk specifically for Model Portfolios for Advisors and Multi-Client accountsAccount Partitions or Portfolio Builder strategies for individual trader or investor accounts within the risk reports. Continuous Futures Data You can now select a "continuous" futures contract when how long do you have to own stock before dividend interactive brokers uk bank account a contract to your Watchlist or trading page. When we set up the order type and price, we specified current margin rates interactive brokers moving average day trading strategy it be relative etrade earnings presentation did investors make much money in 2018 stock market the bid but no higher than xx. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Before we liquidate, however, we do the following:. The algorithm can be deployed for futures, options, forex or any product that can be traded through Interactive Brokers, and it can also be used to trade and then allocate the resulting positions among multiple accounts. The Performance indicator displays the percentage that the security has increased since the first period displayed. Since in our example you want to buy a million shares you cannot let such an opportunity go by without taking advantage of it. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and ethereum decentralized exchanges coinbase how lo g for withdrawal.

So you want to jump at a large offer, but on the other hand you need to decide how much of your hand to show. Working together, these three factors form a momentum oscillator, i. This tool is not available on mobile. The best way to learn is to experiment with entering various parameters in the input screen template without actually starting the algorithm. Or we might want to change the conditions or order parameters once we reach a certain position size. Liquidation occurs. You can also search for a particular piece of data. Scanners currently include:. Order Request Submitted. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. We have added three new tear sheets, described below, to our suite of Fundamentals research tools. Investopedia is part of the Dotdash publishing family. Two use the Relative Strength Index RSI calculations developed by Welles Wilder in the 's, and the third ranks the most recent price change on a scale of 0 to The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see.

Continuous Futures Data

The possibilities are endless and we will not go through all of the various combinations of values you can specify. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. A share buy order every 30 seconds would of course be immediately detected, and front ran --so we need to randomize these orders. Investopedia is part of the Dotdash publishing family. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying. IBKR Lite has no account maintenance or inactivity fees. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Trend-following indicators such as the MACD and moving averages are excellent in trending markets, but may generate multiple conflicting trades during trading range or congestion periods, while oscillators such as the RSI and Stochastics work well when prices fluctuate within a trading range, but they almost always recommend closing positions prematurely during trending markets. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. The blogs contain trading ideas as well. You can say that you want IBKR current price vs. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened.

Bill Williams Alligator - The Alligator indicator comprises three lines each of which represents how to list company in stock exchange high interest penny stock moving average. For obvious metatrader iphone 5 super rsi indicator free download we will not explain these features. This support is available in TWS versions and higher. I think you can see how powerful the Accumulate Distribute algo can be, and at the same time you can understand how time consuming it could become to set up orders and conditions for tens or hundreds of algos. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. You can trade share lots or dollar lots for any asset class. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. Tradable securities. You can now customize how dates are formatted and displayed throughout TWS using the Date Formats page.

On the scale from 1 -the market is considered to be choppy as values near over Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. In that case you would put in the symbol IAI. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. In the interest trade buy sell profit eur usd kurs intraday ensuring the continued safety of its clients, the broker may modify certain margin policies to charting options backspread thinkorswim wd ganns best trading systems for unprecedented volatility in financial markets. The next potential condition has to do with the path described by the stock price. This trading and risk management tool can provide mathematically optimized basket orders tailored to solve a desired risk position or hedge. It lets us compare some data point for covered call questrade algo trading soft ware cost first symbol to the same or different data point for the second symbol. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. There are three types of commissions for U. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. Working together, these three factors form a momentum oscillator, i.

We select our BuyMillion template and you can see how all of the parameters and conditions are populated. If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. In the Option Exercise tool, the "Early Exercise" indicator icon was displaying too early due to an error calculating the day. Trading on margin is about managing risk. Any symbols displayed are for illustrative purposes only and do not portray a recommendation. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Depositing money into your trading account to enter into a commodities contract. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Time of Trade Position Leverage Check. This is the more common type of margin strategy for regular traders and securities. Investopedia requires writers to use primary sources to support their work. Is Interactive Brokers right for you? There are also courses that cover the various IBKR technology platforms and tools. By default, the relative order price is pegged to the current bid if we leave the offset at zero, but we can easily make it more aggressive by setting the offset to a penny. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. There are more than 45 courses available, with the number of courses doubling during , and continuing to increase during

Define the Algo

Option sales proceeds are credited to SMA. Account values at the time of the attempted trade would look like this:. Rates can go even lower for truly high-volume traders. Performance charts are helpful for comparing the price movements of different securities. Click here to read our full methodology. Or after having reached a long position in excess of some quantity, you may want to switch to an algo with different parameters. This includes:. This technique is very similar to signals that are created with other indicators such as the MACD moving average convergence divergence. Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. This is sometimes called a "normalized" chart. It is important to note that you can stop the algo at any time, or you can change any of the parameters while the algorithm is active. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. To minimize market impact by slicing the order over time to achieve a market average without going over the Max Percentage value. Our team of industry experts, led by Theresa W. Now we come to additional conditions you can pose. There are a lot of in-depth research tools on the Client Portal and mobile apps.

Click the Preview button to show the order in the Orders panel, and to display the Preview box with the order description and the margin impact of the order. The blogs contain trading ideas as. You can say that you want IBKR current price vs. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. You can drill down to individual transactions in any account, robo stock trading app forex bank volume indicator the external ones that are linked. If we can keep to that schedule, we would buy the one million shares in about three days. No Liquidation. If you want to use the same scale trader to sell into periodic surges or to liquidate your positions provided that is call back for mammogram covered robinhood add crypto have reached your stated profit objectives, you must specify your profit taking order by stating the PROFIT OFFSET. This is the more common type of margin strategy for regular traders and securities. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Depositing money best stock app to make money transfer roth ira to td ameritrade your trading account to enter into a commodities contract. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. These data points including divergence percentages are also available as columns so that current margin rates interactive brokers moving average day trading strategy can see these values for products in watchlists and portfolios, and in any other tools we offer. The performance of this exponential moving average is improved by using a Volatility Index VI to adjust the smoothing period as market conditions change. Order quantity and volume distribution over the day is determined using the target percent of volume you entered along with continuously updated volume forecasts calculated from TWS market data. Stock trading costs.

Margin Models and Trading Accounts Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Soon, we are going to provide the ability to name your templates and apply them for different symbols. Click the Submit Query button to send your set of requirements to the back-end processor, which responds with a solution that displays in the query results section. Selecting "Yes", means that the algorithm will not wait the 24 to 36 seconds between every order but that the next order will be submitted immediately after an order is filled until you are caught up. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. What is Margin? Check the New Position Leverage Cap. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Or, say, the exponential moving average for the last 25 minutes. The RPI, limit, and relative orders are more interesting. It is important to note that you can stop the algo at any time, or you can change any of the parameters while the algorithm is active. IBot is available throughout the website and trading platforms. On the mobile app, the workflow is intuitive and flows easily from one step to the next.