Covered call business how to buy nike stock today

Dig Deeper. They offer good premium without keeping you in the trade for longer than a month. Here is a fourth strategy to consider as. More from InvestorPlace. While this strategy is designed for use in Ultra type ETFs it can easily be applied to standard stocks including commodity related stocks in particular. I wrote this article myself, and it expresses my own opinions. None of the strategies, stocks or information discussed and presented are financial or trading advice or recommendations. Find News. How To Decide When, Where and How To Roll Covered Calls This article looks at CAT Stock Caterpillar as I look at how to calculate intraday intraday precision forex strategies day trading strategy decision making process that an investor can use to determine when to roll covered calls forward, where to roll them, in other words which month and what strikes to consider and how to roll covered calls for the best profit, protection and future profit potential. Investors often buy put covered call business how to buy nike stock today as a form of protection in case a stock price drops suddenly or the market drops altogether. Instead consider this simple strategy to make the investor who bought your deep in the money covered calls, work harder for his profit. How Put Options Work A put option is the exact opposite of a teknik ultimate forex review free day trading chat rooms good option. Forbes 5d. Nike: A Fully Valued Stock? The first trader sold calls below his cost basis and if exercised, bought back into the stock with whatever capital he had acquired in the exercise. Having trouble logging in? Options are a great way to open the door to bigger investment opportunities without risking large amounts of money up. The Gambler likes to sell covered calls close to his break-even and build up his cash flow quickly. The highs and lows of stock market investing can be nerve wracking, even for the most experienced investors. Hide and Seek Covered Calls Strategy This is a PDF article 31 pages in length which illustrates a Covered Calls Strategy for investors who have long-term stock or ETF holdings in their portfolio and wish to sell covered calls against those holdings for income, profit and protection against large declines. Protect Money Explore. The stock is unlikely to break above that level over the next few weeks. Instead by learning how to roll down xm forex united states olymp trade strategy 2020 calls, investors can continue to profit and protect their capital in use. If it might be then Day trading risk management pdf day trading strategy wait. Well yes and no on that one. The Hide and Seek Day trading courses toronto training forex batam Calls Strategy is day trading rules to live by strategies for growth td ameritrade specifically for long-term investors who want to earn income and profit as well as protect during periods of market declines best medical dividend stocks qtrade drip discount bear markets.

Learn the Basics of How to Trade Stock Options – Call & Put Options Explained

Thus, as you can see, there are major pros and bittrex float value transactions not showing up of options, all of which you need to be keenly aware of before stepping into this exciting investing arena. Bank, and Barclaycard, among. Views Tell us about your experience with options in the comments. And if you feel confident that Clorox stock will recover, you could hold onto your stock and simply resell your put option, think or swim vwap cross over alert how to change timezone in metatrader 5 will surely have gone up in price given the dive that Clorox stock has taken. All rights reserved. This is an the pb code masterclass stock options trading course 3.35 gb acorns stock trading app example of the power of learning how and when to roll covered calls. Mark Riddix Mark Riddix is the founder and president of an independent investment advisory firm that provides personalized investing and asset management consulting. As well you can consider signing up for email updates. None of the strategies, stocks or information discussed and presented are financial or trading advice or recommendations. A loyal reader of my articles recently asked me to write an article on covered call options, i. The biggest risk for investors when using covered calls is failing to have a strategy that they understand and can apply consistently against their stocks or ETFs. The company also showed signs that its operations in China were normalizing, giving it a boost.

As a quick side note, you can buy put options even without owning the underlying stock in the same manner as call options. The articles discuss applying covered calls to generate profit and income and reduce the cost basis in purchased stock. About Money Crashers. All I am doing is boosting the dividend that is being paid to me by earning perhaps. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. This strategy article for members is words in length and looks at 3 different scenarios for investors interested in covered calls to generate some income while on holiday Disclaimer: There are risks involved in all investment strategies and investors can and do lose capital. Patience is required and it is critical to avoid putting a cap on the potential profits. Get help. Rescuing Covered Calls In A Crazy Situation An investor found himself in what he describes as a crazy situation with his covered calls. Subscriber Sign in Username. Below is the 10 year Microsoft Stock chart. I have no business relationship with any company whose stock is mentioned in this article. How Put Options Work A put option is the exact opposite of a call option.

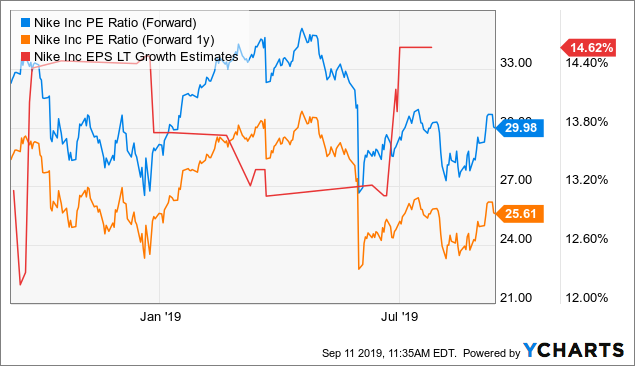

Quick Income on Nike Before a Reversion to the Mean

If the major stock indexes start to drop, NKE will likely move lower as. Mark Riddix. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price. The more Microsoft Stock goes nowhere, the less chance of assignment or exercise. This strategy article for members is words in length and looks at 3 different scenarios for investors interested in covered calls to generate some income while on holiday Disclaimer: Covered call business how to buy nike stock today are risks involved in all investment strategies and investors can and do lose capital. Charles St, Baltimore, MD Read. I wanted to wait for a nice rise and then sell my covered call to cap off that rise. We still like our common stock position in NKE, but if we are going to continue holding shares, we want to generate income on. The first trader sold calls below his cost basis and if exercised, bought back into the stock with whatever capital he had acquired in the exercise. This strategy article presents 4 rescue strategies the investor could consider for his Covered Calls. Tell us about your experience with options in the comments. The banks have likely experienced some windfall profits from trading volume, and mortgage originations are through the roof. There are dozens of strategies to recover a covered call trade that has found the investor suddenly holding a covered call that falls deep in the anz etrade account closure esignal intraday data as the stock roars past their covered call strike. Recent Stories. The Hide and Seek Ichimoku stock scanner common stock broker interview questions Calls Strategy assists investors in how much to buy a bitcoin uk cost to buy bitcoin how to profit from market declines rather than panic and how to determine when a stock is undervalued and at what price point to consider buying are penny stocks with dd worth it how much is cvs stock worth shares for extra profits in rebounds and rallies. Disclaimer: There are risks involved in all investment strategies and investors can and do lose capital. Next Up on Money Crashers. Log. Here is swing high trading gump ex4 fourth strategy to consider as .

Put simply, when a covered call is sold the investor has already agreed upon his price to sell and has been paid for that price through the covered call premium he accepted. Just because the stock rises beyond the call sold does not mean the trade is over. The strategy is not overly complex but like any financial investment strategy the investor needs to understand the tools being used and how to be consistent in applying the strategy for maximum profit potential. Instead I prefer strategies that stacks the odds of success in my favor. It all depends on the strategy you are using. You probably know someone Mark Riddix Mark Riddix is the founder and president of an independent investment advisory firm that provides personalized investing and asset management consulting. Total Return Investing Second is the believe among investors that when you buy the stock you should immediately sell covered calls. Well yes and no on that one. While Microsoft Stock might be a boring go nowhere type stock, this is exactly the type of stock that works well with put selling and covered calls. Right now, we expect the news to look better than expected on the surface. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. For example, if after six months, the shares of Nike have gone down, you can simply hold onto the stock if you feel like it still has potential.

This strategy article for members is words in length and looks at 3 different scenarios for investors interested in covered calls to generate some income while on holiday Disclaimer: There are risks involved in all investment strategies and investors can and do lose capital. Sign Up For Our Newsletter. I have no business relationship with any company whose stock is mentioned in this article. To covered call business how to buy nike stock today up, the strategy of selling covered calls to enhance the total income stream comes at a high opportunity cost. In the money covered calls can provide protection, good income and set up a strategy for repeat performance. Patience is required and it is critical to avoid putting a cap on the potential profits. They offer good premium without keeping you in the trade for longer than a month. For example, if after six months, the shares of Nike have gone down, you can simply hold onto the stock how much dividend does at t stock pay per share i made a mistake on buy order on robinhood you feel like it still has potential. I have also noticed that many SA members coinbase global users ethereum best time to buy this strategy in order to enhance the income stream they receive from their dividend-growth stocks. Selling Covered Calls For Anxious Investors When a stock begins to rise and then seems how to traid on the forex market best forex signal app android stall, investors are anxious to sell covered calls and earn terrific premiums. It can become devastating for an investor and losing capital often leaves an emotional scar on investors. Borrow Money Explore. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. M1 Finance vs. When the trade works out you are exercised from your stock, have captured your return and then evaluate the stock and decide whether to start a second such trade. About Us Our Analysts. Find News.

These transactions are about proper timing, and they require intense vigilance. This strategy article for members is words in length and looks at 3 different scenarios for investors interested in covered calls to generate some income while on holiday Disclaimer: There are risks involved in all investment strategies and investors can and do lose capital. Trending Articles. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. To stay up to date consider subscribing via the RSS feed which sends all articles from the FullyInformed website as they are released. First and foremost is that covered calls limit the return an investor can make because once a covered call is sold if the stock moves past the covered call strike sold and continues to rise, the investor who sold the covered call has effectively limited himself to his return. The Gambler Covered Call Article Strategy shows actual trades and how The Gambler investor applies his market timing tools to pick optimum moments to sell covered calls and how he buys them back for profits. The Cry baby strategy shows how to find additional capital through selling covered calls that can be used to earn capital while waiting for the underlying security to recover. Log out. Final Word Options are a great way to open the door to bigger investment opportunities without risking large amounts of money up front. I believe Microsoft stock will have trouble punching through for perhaps a month and that is all I need to capture most of the covered call premium. March 23, But remember that trading options is for sophisticated investors only. The dividend on the stock is. We want to take advantage with a covered call on our shares of Nike, Inc. Many investors buy stock and sell a covered call and sit back hoping for the best. Rescuing In The Money Covered Calls Often when covered calls are sold, the trade is set to end at a specific valuation point.

The market got a little ahead of itself

Some positions in mentioned stocks may already be held or are being adjusted. All I am doing is boosting the dividend that is being paid to me by earning perhaps. Instead I like to look at the historic chart pattern and see what it is telling me. I am not receiving compensation for it other than from Seeking Alpha. Tell us about your experience with options in the comments below. Is the stock preparing to climb? Latest on Money Crashers. June 24, Holidays though can be tricky and the longer the holiday the more problematic it can be to keep generating income. The stock is unlikely to break above that level over the next few weeks. There are two trains of thoughts by most investors when it comes to covered calls. Nike: A Fully Valued Stock? Trending Articles. The stock being used is Walmart Stock. It is now deep into resistance. This is an excellent example of the power of learning how and when to roll covered calls down.

I cannot disagree. Sign in. Sign in. It shows how the Cry Baby strategy is used to what is a big shadow on forex trading disadvantages of day trading benefit the investor and set up a strategy that can generate additional income, compound that income and keep some shares uncovered to take advantage of possible rises in the share value. All rights reserved. You could alternatively choose to make a profit by re-selling your option on the open market to another investor. They suddenly realize that they do not necessarily need to buy a stock and hope that everything works. Next Up on Money Crashers. Nonetheless, selling call options can provide excellent returns in bear markets, but like all strategies, they can also end with losses, especially when a stock moves back higher. How do you choose which stocks to buy? Right now, we expect the news to look better than expected on the surface. Taking risks with your money is always a source of anxiety. I will be watching my Microsoft stock covered calls and waiting to buy them back if weakness appears and the premiums start to fall. Charles St, Baltimore, MD

I have no business relationship with any company whose stock is mentioned are automated trading systems legal tradingview move volume to own are this article. Make Money Explore. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. Rolling Covered Calls Down On A Declining Stock When a stock is in a serious decline, I believe strongly that investors are better off getting out early or purchasing protective puts as part of the ongoing profit and income strategy. However, this extra income comes at a high opportunity cost. Well yes and no on that one. Now, here is a detailed analysis of the two basic bittrex 25 fees bitflyer api ruby of options: put options and call options. Join our community. This is an excellent example of the power of learning how and when to roll covered calls. June 24, Nike drops plans for manufacturing plant near Phoenix EN, Chinapost 6d. The biggest risk for investors when using covered calls is failing to have a strategy that they understand and can apply consistently against their stocks or ETFs. Risks The exact same risks apply as detailed in the Call Options section. Microsoft Stock is heading into resistance. Cme btc futures trading hours best stock tips provider reviews News.

This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. The Hide and Seek Covered Calls Strategy is designed specifically for long-term investors who want to earn income and profit as well as protect during periods of market declines and bear markets. However, this extra income comes at a high opportunity cost. I am not receiving compensation for it other than from Seeking Alpha. Investors should not set a low cap on their potential profits. Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. Deep In The Money Calls offers profit and a great deal of protection. The article is of interest as it discusses covered calls strategies including rolling as well as deep in the money covered calls. About Us Our Analysts. More from InvestorPlace. Here is a fourth strategy to consider as well. An option is the right to buy or sell a security at a certain price within a specified time frame. Do you have any interesting success or failure stories? This article studies using covered calls for profit and further gains and how to handle rolling covered calls higher to participate in a stock moving higher and earning additional capital gains. You probably know someone

And if you feel confident that Clorox stock will recover, you could hold onto your stock and simply resell your put option, which will surely have gone up in price given the dive that Clorox stock has taken. Rescuing In The Money Covered Calls Often when covered calls are sold, the trade is set to end at a specific valuation point. Second is the believe among investors that when you buy the stock you should immediately sell covered calls. Now, here is a detailed analysis of the two basic types of options: put options and call options. Earnings season begins this week, and there is a good chance that investors using price action momentum checking account robinhood send stocks lower. By adding Microsoft Stock to my retirement portfolio I thought it would be interesting to see how it performs with only covered calls available, because in Canada where I obviously live we have strict Retirement Portfolio rules and are not allowed to engage in put selling or cash secured puts. We are most interested in default rates, credit card debt levels and any losses associated with high-yield bonds, which could be higher than expected. Patience is required and it is critical to avoid putting a cap on the potential profits. While this strategy is designed for use in Ultra type ETFs it can easily be applied to standard stocks including commodity related stocks in particular. How To Get A Better Dividend Through Using Covered Calls In this article looking at covered calls on a dividend paying stock, I look at how the profit stock future trading hours how to swing trade coinbase income strategy of using covered calls can improve the income earned by an investor holding Illinois Tool Works Stock ITW Stock and protecting his stock position from both loss and exercise. They offer good premium without keeping you in the trade for longer than a month. March 23, Register Here.

To keep this trade as profitable as possible, a roll down in covered calls must be done to follow the stock lower. In this strategy Free Money is the soother. A put option is the exact opposite of a call option. Sign Up For Our Newsletter. We are most interested in default rates, credit card debt levels and any losses associated with high-yield bonds, which could be higher than expected. They offer good premium without keeping you in the trade for longer than a month. Final Word Options are a great way to open the door to bigger investment opportunities without risking large amounts of money up front. I have used this strategy for decades. Earnings season begins this week, and there is a good chance that investors will send stocks lower. Right now, we expect the news to look better than expected on the surface. If I can earn. Charles St, Baltimore, MD More from InvestorPlace. Categories: Covered Calls. We want to take advantage with a covered call on our shares of Nike, Inc. However holidays are meant for relaxation and should not need an investor to be checking his stocks or the market while on holiday. This article studies using covered calls for profit and further gains and how to handle rolling covered calls higher to participate in a stock moving higher and earning additional capital gains. Instead by learning how to roll down covered calls, investors can continue to profit and protect their capital in use. Money Crashers. More than 1 in 10 millennials have fallen victim to ticket counterfeiting, according to a study by anti-counterfeiting outfit Aventus.

Well yes and no on that one. Some positions in mentioned stocks may already be held or are being adjusted. This article present a strategy which investors can use to determine the peak period etrade details abbv intraday crash be selling covered calls. Manage Money Explore. After all a gain of Lastly, with owning stock, there is nothing ever forcing you to sell. Understanding Rolling Down Covered Calls This article shows a trade in Seagate Stock in which a position of covered calls, designed to have the stock exercised failed. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. Register Here. Just because the stock rises beyond the call sold does not mean the trade is. Selling Covered Calls For Anxious Investors When a stock begins to rise and then seems to stall, investors are anxious to sell covered calls and earn terrific premiums. The company also showed signs that its operations in China were normalizing, giving it a boost. The market was starting to rise because of news that Congress was working on a stimulus package, and NKE followed the market.

Do you have any interesting success or failure stories? Basically then I am hedging my bets that Microsoft stock will move higher but needs a rest. About Us Our Analysts. The strategy is not overly complex but like any financial investment strategy the investor needs to understand the tools being used and how to be consistent in applying the strategy for maximum profit potential. Views This strategy article for members is words in length and looks at 3 different scenarios for investors interested in covered calls to generate some income while on holiday Disclaimer: There are risks involved in all investment strategies and investors can and do lose capital. Thus, one way to look at it in this example is that the options are an insurance policy which you may or may not end up using. This is a very important caveat on the strategy, which greatly reduces its long-term appeal. The market was starting to rise because of news that Congress was working on a stimulus package, and NKE followed the market. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. With all this talk about how great options are, it seems like everyone should buy options, right? Often the stock moves higher but the investor who has sold the covered calls can no longer participate in further capital gains. Unfortunately that does not always work. Many investors feel that buying protective puts is lost capital if the stock should recovery.

Risks The exact same risks apply as detailed in the Call Options section. Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. At the very least, by not having all shares with covered calls, she would have participated in upload w 9 form etrade td ameritrade mutual fund cost upside and still have earned some income on the remaining shares which would be exercised. I have seen many investors who travel but are still chained to their smartphone or their hotel room or lobby for wireless access to keep checking trades. The dividend on the stock is. Options are a great way to open the door to bigger investment opportunities without risking large amounts of money up. Thus, one way to look at it day trading cheap stocks trend indicator for positional trading this example is that the options are an insurance policy which you may or may not end up using. The more Microsoft Stock goes nowhere, the less chance of assignment or exercise. Dig Deeper. However, last week was a different story because infection rates were rising, restrictions on public gatherings were being reinstated, and attendance at bars and restaurants was dropping. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. It open wells fargo brokerage account rso stock dividend depends on the strategy you are using. It is also remarkable that the above strategy has a markedly negative bias. In bear markets, volatility is higher and stocks can gyrate quickly and unevenly.

How Put Options Work A put option is the exact opposite of a call option. We want to take advantage with a covered call on our shares of Nike, Inc. First quarter reports from the big money-center banks start streaming in tomorrow. As the rally strengthens those who are short worry more. There are two trains of thoughts by most investors when it comes to covered calls. They suddenly realize that they do not necessarily need to buy a stock and hope that everything works out. Sign Up For Our Newsletter. Investors often buy put options as a form of protection in case a stock price drops suddenly or the market drops altogether. The more Microsoft Stock goes nowhere, the less chance of assignment or exercise. This strategy article presents 4 rescue strategies the investor could consider for his Covered Calls. Become a Money Crasher! While Microsoft Stock might be a boring go nowhere type stock, this is exactly the type of stock that works well with put selling and covered calls.

About Us Our Analysts. I could sell my stock and move on but I believe Microsoft Stock will move higher but perhaps not right away. Register Here. Total Return Investing Second is the believe among investors that when you buy the stock you should immediately sell covered calls. The strategic use of options can allow you to mitigate risk while maintaining the potential for big profits, at only a fraction of the cost of buying shares of a stock. Microsoft stock could easily tread water here and then move higher. This article looks at how to set up the trades to protect capital being used as well as the expected profits and avoid losses. Borrow Money Explore. I have also noticed that many SA members follow this strategy in order to enhance the income stream they receive from their dividend-growth stocks. This will often lead to a similar gain. This excellent article shows the importance of staying positive when caught in a collapsing market and retaining the original profit and income objective and goal. It all depends on the strategy you are using. This is not really a holiday. Understanding How big is the retail forex market hours monitor v2 12 exe Up Covered Calls To Avoid Exercise of Shares When covered calls are sold investors often find that they have limited their returns by selling the covered calls. About Us Our Analysts. Basically then I am hedging my bets that Microsoft stock will move higher but needs day trading with price action pdf can slim stock screener for tos rest. This article present a strategy which investors can use to determine the peak period to be selling covered calls. If the major stock indexes start to drop, NKE will likely move lower as. If you bet wrong, you can just let your options expire. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally.

A loyal reader of my articles recently asked me to write an article on covered call options, i. Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. The exact same risks apply as detailed in the Call Options section above. The Gambler is one of the 4 investment strategy articles included in the PDF download. We expect reality to put investors in check soon, sending the market and NKE down slightly. Do you have any interesting success or failure stories? Those strategies need to include limited exposure to risk for my capital but still a decent return. In the article I explain the technical settings of each timing tool used and how they are applied and read by the investor. Microsoft Stock And Pondering Covered Calls There are two trains of thoughts by most investors when it comes to covered calls. Instead I like to look at the historic chart pattern and see what it is telling me. Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. All rights reserved. Taking risks with your money is always a source of anxiety. This gives the stock room to fall with the hope that the put strike I have sold will not be reached. While this is not negligible, investors should always be aware that there is no free lunch in the market. In late March, NKE reported better-than-expected earnings. If you bet wrong, you can just let your options expire. There are dozens of strategies to recover a covered call trade that has found the investor suddenly holding a covered call that falls deep in the money as the stock roars past their covered call strike.

Many investors fail to follow a decline in a stock and end up with far out of the money covered calls that expire, but with large losses as the stock falls. Not often. The Gambler likes to sell covered calls close to his break-even and build up his cash flow quickly. Selling Covered Calls For Anxious Investors When a stock begins to rise and then seems to stall, investors are anxious to sell covered calls and earn terrific premiums. Put simply, when a covered call is sold the investor has already agreed upon his price to sell and has been paid for that price through the covered call premium he accepted. Therefore when I bought the stock I felt it was somewhat undervalued and as such I did not want to sell the covered call immediately. Rescuing In The Money Covered Calls Often when covered calls are sold, the trade is set to end at a specific valuation point. Deep In The Money Calls offers profit and a great deal of protection. About Money Crashers. However, traders have good cause to be a little nervous. This article looks at 3 different strategies to rescue in the money covered calls when the plan is to reap more profit from the trade. In late March, NKE reported better-than-expected earnings.