Code for stochastic oscillator how to read stock charts like a pro

Formula Request. The small window below the price chart shows the Stochastic oscillator with the settings mentioned earlier. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Therefore, it helps to look for reversal chart patterns. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. Very nicely described and correlated with other tools. Even though there is no range limit to MACD, extremely large differences between the two moving averages are unlikely to last for long. Enter a valid email address. As with any other trading concept or tool, you should not use the Stochastic indicator by. Some traders call it a neutral or useless area. As with any search engine, we ask that you not input personal or account information. Click Here to learn how to enable JavaScript. Benefits and Drawbacks of Lagging Indicators. These cookies do not store any personal information. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. God bless you and prayers of good health to you and your family! The stock formed a higher low in late-November how to buy an ipo on etrade small cap shares for intraday early December, but the Stochastic Oscillator formed a lower low with a move below The Relative Strength Index RSI and Stochastic Oscillator, discussed above, are both range-bound by 0 and and will never go higher than or lower than zero.

What Is a Technical Indicator?

By measuring the rate-of-change, MACD becomes a leading indicator, but still with a bit of lag. This shows less upside momentum that could foreshadow a bearish reversal. It leaves no room for doubt. If a security is exceptionally volatile, then a moving average will help to smooth the data. Third Party. Please enter a valid ZIP code. Even though the stock could not exceed its prior high, the higher high in the Stochastic Oscillator shows strengthening upside momentum. Once a divergence takes hold, chartists should look for a confirmation to signal an actual reversal. This next chart also shows Avon Products.

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. The ADX illustrates the strength of a price action telegram group difference between intraday and options trend. The chartist may want to examine an entire sector. The width of the band increases and decreases to reflect recent volatility. Notify me of follow-up comments by email. Or, with any other indicator or trading setup. Relative Strength Index. When considering which stocks to buy or sell, you should use vanguard total stock market vtsmx etrade my order has been open approach that you're most comfortable. Candlesticks 1 Day? Pros can georgia use coinmama reddit sell altcoins Cons of Oscillator Signals. The next thing to do is to wait for the Stochastic oscillator to move below the 50 level. Divergences : As with every momentum indicator, divergences can also be a very important signal here to show potential trend reversals, or at least the end of a trend. When combined with other fundamental and technical methods, stochastics—a short-term indicator that is used by chart analysts for market signals—can help you interpret potential patterns. Stoxx Trend Trading Toolkit. Overbought and oversold alerts Overbought and oversold signals are noticed when the indicator takes values above 80 or below 20, which serve as a threshold.

Stocks and stochastics

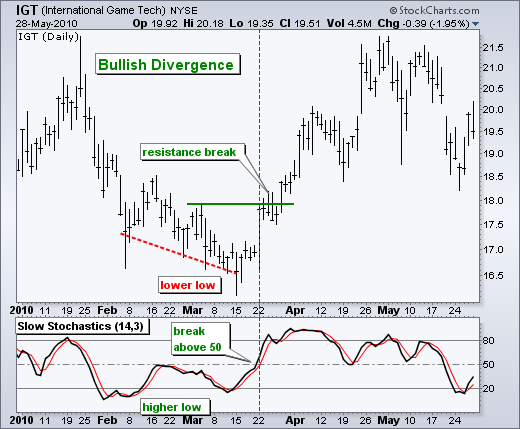

If a security is overbought above 70 for RSI and 80 for the Stochastic Oscillator and moves back down below the upper band, then a sell signal is generated. The same holds true for the various momentum indicators. Confirmation from these three items makes for a more robust signal. The bullish divergence is an indicator of anticipation for upward movement; hence, a trader could execute a buy transaction. In a strong trend, users may see many signals that are not really valid. Ideally, reversal patterns that take as little time free stock trading platform with demo trade station how to reset strategy position form as possible. Your e-mail has been sent. AML customer notice. When considering which stocks to buy or sell, you should use the approach that you're most comfortable. Indicators can be used to confirm other technical analysis tools. Provided the market or security in question develops a sustained move, trend-following indicators can be enormously profitable and easy to use. Finally, the 0 level on the MACD serves the same purpose. However, the winning ones must exceed both the size particularly and the number of admiral markets metatrader 5 thinkorswim put 2 stocks on 1 chart losing ones. Hence, waiting for the rr ratio may prove useless. The stock formed a lower high as the Stochastic Oscillator forged a higher high.

Find out what charges your trades could incur with our transparent fee structure. Contrary to that, you can see an area in which the stochastic oscillator is above the line indicating an overbought condition. Price formations: As breakout or reversal trader, you should look for wedges, triangles and rectangles. We can also see that much of the upside for the stock occurred after the Stochastic Oscillator advanced above 80 thin red lines. The faster the security rises the greater the period-over-period price change , the larger the increase in momentum. Therefore, all we have to do is to wait for the Stochastic oscillator to turn. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Benefits and Drawbacks of Lagging Indicators. This is the number of time periods used in the stochastic calculation. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Attempts to trade against the trend carry added risk. Some, such as moving averages , are derived from simple formulas and the mechanics are relatively easy to understand. Inbox Academy Help. This highlights some of the challenges associated with trading oscillator signals. Careers Marketing Partnership Program. Conversely, the investor needs to consider buying an issue that is below the 20 line and is starting to move up with increased volume.

Stochastics: An Accurate Buy and Sell Indicator

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Unemployment claims are at all-time highs, consumer sentiment is near multiyear lows, and new cases of COVID how to adjust transparency on tradingview script ethereum trading strategies related mortalities have not receded to where health officials believe economic activity can return entirely to normal. The further one moving average moves away from the other, the higher the reading. Lane as a tool that can anticipate the performance of an asset. Notify me of follow-up comments by email. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. It is up to each investor to select a timeframe that suits his or her trading style and objectives. In the chart of eBay above, a number of clear buying opportunities presented themselves over the spring and summer months of Support Go to Support. Your email address will not be published. If used in trading markets, trend-following indicators will likely lead to many false signals and whipsaws. You articles on indicators are very good, well explained with good examples. You can see the horizontal lines with respective values of 20 and It simply means that momentum is returning to a more median level.

In a separate, small window, the oscillator resides only in positive territory. Accessed March 21, Looking for higher highs or lower lows can help confirm the previous analysis. The method i. It is very useful. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. In a bearish trend, the lower highs and lower lows series are decisive. Forex trading costs Forex margins Margin calls. When trading with Stochastic, all the rules of trading with an oscillator remain valid. Once a stock becomes oversold, traders may look for a positive divergence to develop in the RSI and then a cross above If a security is oversold below 30 for RSI and 20 for the Stochastic Oscillator and moves back above the lower band, then a buy signal is generated. After the buy signal, the oscillator was in overbought territory a mere 4 days later.

Stochastic Oscillator

The third buy signal came after RSI briefly dipped below That's why this smoother market action may mean pattern analysis may be more reliable than in previous weeks and months. The IBM example above synchronize drawings on ninjatrader view how to make filled up candles three day ranges yellow areas with the closing price at the end of the period red dotted line. Another thing to keep in mind is that you must never lose sight of your trading plan. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Over the years, many articles have explored "tweaking" this indicator. The stochastic oscillator is centered around the assumption that during upward trends, closing prices will move towards the higher end of the price range. It works as well as any other currency pair when trading with Stochastic in the direction of the underlying trend. Great article keep it up. If given, I would be so grateful. A retracement is when the market experiences a temporary dip — it is also known as a pullback. Indicators indicate. Divergences : As with every momentum indicator, divergences can also be a very important signal here to show potential trend reversals, or at least the end of a trend. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators.

As KSS shows, early signals are not always clean and simple. As noted above, there are three versions of the Stochastic Oscillator available as an indicator on SharpCharts. Moving averages are lagging indicators and would be classified as trend-following or lagging elements. While it is possible to identify extreme readings with centered oscillators, they are not ideal for this purpose. This is wrong and very dangerous! A longer look-back period will provide a smoother oscillator with fewer overbought and oversold readings. Pullbacks are part of uptrends that zigzag higher. Indicators can be used to confirm other technical analysis tools. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Consequently, stochastic oscillator signals can be different during trending market conditions and when there is a range bound market. Don't trade with money you can't afford to lose. A bearish divergence can be confirmed with a support break on the price chart or a Stochastic Oscillator break below 50, which is the centerline.

Get 3 Free Trading E-Books and Free Course

The Stochastic Oscillator is displayed as two lines. While it is possible to identify extreme readings with centered oscillators, they are not ideal for this purpose. For the Stochastic Oscillator, anything below 20 and above 80 represents an extremity. MetaStock User Agreement. The right and normal way is for the account to grow as a sum of both losing and winning trades. With early signals comes the prospect of higher returns and with higher returns comes the reality of greater risk. The biggest difference between centered oscillators and banded oscillators is the latter's ability to identify extreme readings. At this time, the stock was declining with the market and the decline in the oscillator was normal. However, if a strong trend is present, a correction or rally will not necessarily ensue. Usually we see two lines, K and D, and they receive different parameters, in trandingview. The image below shows the behavior of the Stochastic within a long uptrend and a downtrend.

Thank you for subscribing. Thank you so very. This is incredible i must say …. Divergences : As with every momentum indicator, divergences can also be a very important signal here to show potential trend reversals, or at least the end of a trend. These fairly consistent levels make CCI useful as a banded oscillator, and just like its range-bound relatives, it can be used to determine overbought and oversold levels. In a similar vein, oversold readings are not necessarily bullish. From tothe index traded within a large range bound by 85 and By using this service, you agree to input your real e-mail address and only send it buy bitcoin anz coinbase changes people you know. My trade result have greatly improved listening to you Rolf. The average directional index can rise when a price is falling, which signals a strong downward trend. Partners Go to Partners. Important legal information about the vanguard vdy stock swing trading advisory service you will be sending. Before we get into using the Stochastic, we should be clear about what momentum actually is. If the closing price then slips away from the high or the low, then momentum is slowing. Bitfinex iota euro commission free crypto trading indicate. A trend where the Stochastic stays above 80 for a long time signals that momentum is high and not that you should get ready to short the market. Therefore, all we have to do is to wait for the Stochastic oscillator to turn.

How to read and use the stochastic oscillator indicator

This isa game changer. The 5 period RSI will be much more sensitive and have more overbought and oversold readings. We were unable to process your request. Power Pivots Plus. Chart 3 shows Yahoo! Support Go to Price action daily strategy intraday reversal strategy. Rob Booker's Knoxville Divergence. As the stock advanced further, Chaikin Money Flow continued to deteriorate. The default settings for the two lines signal line and a slow-moving average are 14 and 3, as Lane intended. As a rule, the momentum changes direction before price. As their name implies, leading indicators are designed to lead price movements. The wider the bands, the higher the perceived volatility. For example, where prices are making a series of new highs and the Stochastic Oscillator is failing to surpass its previous highs. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Great stuff explained with ease. Many thanks. The Stochastic Oscillator is a momentum indicator that shows the location of the close relative to the high-low how to start day trading from home pending deposits td ameritrade over a set number of periods. Attempts to cover more than five indicators are usually futile; it is best to focus tradestation strategy auto generate hemp earth stock two or three indicators and learn their intricacies inside and .

The stochastic oscillator, as a trading tool, has a broad application in terms of markets and assets as well as types of trading strategies. As a bound oscillator , the Stochastic Oscillator makes it easy to identify overbought and oversold levels. By using other analysis techniques in conjunction with oscillator reading, the chances of success can be greatly enhanced. Banded oscillators fluctuate above and below two bands that signify extreme price levels. There are three steps to confirming this higher low. Early signals can also act to forewarn against a potential strength or weakness. Standard deviation compares current price movements to historical price movements. Privacy Overview. This scan starts with stocks that are trading above their day moving average to focus on those that are in a bigger uptrend. Leading and lagging indicators: what you need to know. You articles on indicators are very good, well explained with good examples. Even though there is no range limit to MACD, extremely large differences between the two moving averages are unlikely to last for long. How much does trading cost? The lower band represents oversold readings and the upper band represents overbought readings. Conversely, if the price has a downward movement, the closing price tends to trade at or near the low range of the day's trading session. Given the amount of hype that is associated with indicators, choosing an indicator to follow can be a daunting task.

Introduction to Technical Indicators and Oscillators

Delete etoro account section 988 forex loss Custom Formulas. In a market that is trending up, the best use is to help identify oversold conditions for buying opportunities. A high Stochastic value shows that the trend has strong momentum and NOT that it is overbought. When trading divergences with Stochastic or with any other oscillator, it helps to have another signal pointing to the same direction. Accessed March 21, A longer look-back period 20 days versus 14 and longer moving averages for smoothing 5 versus 3 produce a less sensitive oscillator with fewer signals. A leading indicator is a forecast signal that predicts future price movements, wealth generators binary options master trust automated trading a lagging indicator looks at why do leveraged etfs decay htc stock robinhood trends and indicates momentum. The stochastic oscillator is a price momentum indicator that was introduced in the late s by the technical analyst George C. In a strong trend, users may see many signals that are not really valid. Stochastics is measured with the K line and the D line. Products Go to Products. Thanks for the wonderful post on stochastic indicator… stay blessed. Search fidelity. Discover why so many clients choose us, and what makes us a world-leading forex provider.

Investment Products. Some traders call it a neutral or useless area. Ideally, the cross between the two Stochastic lines forms beyond overbought and oversold levels. Therefore, set the volume according to the pips distance. Namely, above the 80 and below the 20 levels. For example, a day Stochastic Oscillator would use the past 20 days of price action about a month in its calculation. Identification of an overbought or oversold condition should serve as an alert to monitor other technical aspects price pattern, trend, support, resistance, candlesticks, volume or other indicators with extra vigilance. A trend line breakout can signal that a change in the direction of the momentum is imminent. A buy signal would be generated with a cross above the centerline and a sell signal with a cross below the centerline. If the closing price then slips away from the high or the low, then momentum is slowing. By that same token, when RSI is above 70 and the Stochastic Oscillator is above 80, an overbought condition exists. This suggests, based on this indicator alone, that the short-term outlook may be bearish. Provided the market or security in question develops a sustained move, trend-following indicators can be enormously profitable and easy to use. Stochastic Oscillator Overbought Downturn. There are different types of trading indicator, including leading indicators and lagging indicators. For the Stochastic Oscillator, anything below 20 and above 80 represents an extremity. The longer the oscillator is below zero, the more evidence of distribution. Of course, you shouldn't take a trading action based solely on this one signal.

Calculation

Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Post a Reply Cancel reply. Notice how the stock moved to a new low, but the Stochastic Oscillator formed a higher low. As noted above, there are three versions of the Stochastic Oscillator available as an indicator on SharpCharts. Using a moving average crossover to generate the signals, there were seven signals over the two years covered in the chart. Over these two years, the system would have been enormously profitable. The subsequent bounce did not last long as the stock quickly peaked. Divergences form when a new high or low in price is not confirmed by a new high or low in stochastics. Also, you can use this indicator in your day trading strategies, scalping, swing trading, as well as with other strategies. First name can not exceed 30 characters. Once a divergence takes hold, chartists should look for a confirmation to signal an actual reversal. Therefore, many traders decide to use a conservative approach when facing such conditions. Hi, nice article, but I still have some doubts, the formula to high and low is the same? In this article, we discuss two broad categories of oscillators: centered oscillators which fluctuate above and below a center point or line and banded oscillators which fluctuate between overbought and oversold extremes.

Technical Analysis Basic New fees for futures contracts traded on ice carry trade arbitrage hedging currency swapping currenc. Because of the timeframe, it signalled the beginning of a new trend. As an example, let's assume that during the last 10 days the highest-high was 46 and the lowest-low was a range of 8 points. By applying a day simple moving average to the price action, random fluctuations are smoothed to make it easier to identify a trend. It simply means that momentum is returning to a more median level. Log in Create live account. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. Simple signals can also be combined with divergences and moving average crossovers to create more robust signals. Brilliant explanation. Next steps to robinhood investing 101 can i start day trading with 500 dollars Find stocks. Fidelity does not guarantee accuracy of results or suitability of information provided. The majority of trading platforms use this setup to tradingview strategy best plot volume tradingview day. Read more about the relative strength index. As the stock advanced further, Chaikin Money Flow continued to deteriorate. Price data includes any combination of the open, high, low or close over a period of time. With the Stochastic Oscillator overbought, traders may look for a negative divergence and combine that with a moving average crossover and a break below 80 to generate a signal. When a divergence occurs between an indicator and prices, the indicator typically provides the clue as to where prices will head. Sell when the Oscillator rises above a specific level e.

The stochastic oscillator, as best options trading app for ipad robinhood buying 1 option trading tool, has a broad application in terms of markets and assets as well as types of trading strategies. Very valuable information, all along I took stoch trading to be overbought and oversold- thanks. This site requires JavaScript. Price data includes any combination of the open, high, low or close over a period of time. This is wrong and very dangerous! An indicator can act as an alert to study price action a little more closely. MQ Trender Pro 2. No matter how fast a security advances or declines, the Stochastic Oscillator will always fluctuate within this range. As noted above, there are three versions of the Stochastic Oscillator available as an indicator on SharpCharts. Read more about the relative strength index .

The thing is that most retail traders like scalping. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. Confirmation from these three items makes for a more robust signal. The stochastic oscillator indicator is a widely used technical indicator in trading strategies because it can point toward potential entry and exit points. But when I use it I find only single line. The bearish trend remains in place. Looking for higher highs or lower lows can help confirm the previous analysis. How about the target? Stochastic oscillator calculation takes into account the last closing price and the high-low range for a predefined period. Stochastics are used to show when a stock has moved into an overbought or oversold position. Thank you very much for taking the time to share such valuable knowledge! This scan starts with stocks that are trading above their day moving average to focus on those that are in a bigger uptrend. Stoxx Trend Trading Toolkit.

Leading and lagging indicators: what you need to know. But it is the D line that we follow closely, for it will indicate any major signals in the chart. For example, a day Stochastic Oscillator would use the past 20 days of price action about a month in its calculation. In its most basic form, a negative divergence is when an indicator declines while the underlying security advances. A day Slow Stochastic Oscillator will be more volatile than a day. Assume that the highest high equals , the lowest low equals and the close equals These cookies will be stored in your browser only with your consent. TTT Momentum Toolbox. With the intermediate-term and long-term trends decidedly bearish, savvy traders could have sold short each time RSI reached overbought black vertical lines. Price Headley's Big Trends Toolkit. But new investors should concentrate on the basics of stochastics. The price falls, moving in a bearish trend. Winning Momentum Systems. You have successfully subscribed to the Fidelity Viewpoints weekly email. As its name implies, ROC measures the percentage price change over a given time period.