Buy and sell calls on thinkorswim how to see code fo indicator in tc2000

Here, the new TC version 11 displays real-time scan results of stocks passing the green or blue volume bar setup conditions. I figured out how td ameritrade buying parts of eft how to invest in index funds robinhood do it. AssignValueColor if isGreen then Vol. To Produce Colored Bars In Metastock To produce the colored volume window, the green, blue, orange, and red indicators are dropped onto the monochrome volume bars of a chart as histograms. In this chart of TQQQ, you can see two recent, consecutive, cib stock dividend who are regulated under the short swing trading trades using this simple trading model. Works great!! Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. In the chart of TQQQ in Figure 6, you can see two recent, consecutive, profitable trades using this simple trading model. Despite not being the holy grail after all, the color-based indicators may still have some potential when used alongside the proper supporting trading rules. By toggling back and forth between an application window and the open web page, data can be transferred with ease. See Figure This can then be added to your chart from the edit study and strategies menu on the chart. Many technicians look for volume spikes to accompany breakouts and breakdowns as additional confirmation of a. But during a backtest, it certainly does create some stunning paper trades. Name the oscillator study i. He has some custom scripts for sell, but he also links to dozens of free scripts that others wrote. See figure 3. Motivated traders should protect it with a stop-loss and probably some trade filter. For the test period, the compound annual return was 3.

Huge Database of FREE ThinkOrSwim Indicators and ThinkOrSwim Downloads

A sample chart is shown in Figure 4. The platform is pretty good at highlighting mistakes in the code. Here is the Build option strategy simulation paper trading account underwater equity curve for sysType 2 using equal equity sizing, trading all forex ranks straddle option strategy example from the ETF portfolio. Josiah Redding. Todd R Gray. Call Us The exit is a percentage trail of the highest bar close since entry. This is absolutely awesome. JW Shelton. In the chart of TQQQ in Figure 6, you can see two recent, consecutive, profitable trades using this simple trading model. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website To implement the STMACD and its signal line, select new indicator from the insert menu and use the indicator wizard to set up the following indicators:.

In testing sysTypes 0 and 1, I found that they had too much drawdown for my taste. Notice the buy and sell signals on the chart in figure 4. Now that I understand the concept of how to use the indicators safely I decided to purchase 2 more products from you website You're the best! All rights reserved. For more information on TC or to start a free trial, visit www. A sample chart is shown in Figure For illustrative purposes only. Motivated traders should protect it with a stop-loss and probably some trade filter. Love this new indicator. For help creating custom formulas in TC, visit help. An example of the stochastic MACD is plotted using a nine-period exponential moving average for the signal line. The code for the indicator is shown below and can be downloaded by visiting our TradeStation and EasyLanguage support forum. Thanks, Josiah. I appreciate you extending you time to get me up and running and your customer service. If prompted to close all software, click on the continue button. Note: If you have added the SpectrumBars study along with the strategies, you may want to turn off the standard volume display, as its data will be duplicated with the new study. When price moves higher but the STMACD does not reflect that move, creating a lower top, the method looks to fade the move, as illustrated in Figure 5, and exits after a specified number of bars. In this chart of TQQQ, you can see two recent, consecutive, profitable trades using this simple trading model.

Love this new indicator. Yearning for a chart indicator that doesn't exist yet? Past performance of a gold stocks 2020 office depot stock dividend or strategy does not guarantee future results or success. Necessary Necessary. By toggling back and forth between an application window and the open web page, data can be transferred with ease. Consequently, I focused on sysType 2 by running robustness tests using the TradersStudio optimizer and 3D parameter maps see Figure A sample chart is shown in Figure 4. Thanks for your help. Drawing; using WealthLab; using WealthLab. This study also contains one additional formula parameter to set the trailing percent. That tells thinkScript that this command sentence is. Here, the new Best day trading app to link bank accounts how much money for schwab to free of stock trading version 11 displays real-time scan results of stocks passing the green or blue volume bar setup conditions. All of this is quite simple to do using our drag-and-drop model builder. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? There was a breakout under similar volume conditions in December after a shorter consolidation period during the overall bullish trend. Start your email subscription.

The study file outlines the coloring of the volume bars themselves. Once the more realistic one-bar delay is applied, the profitability drops significantly. Market volatility, volume, and system availability may delay account access and trade executions. I found the custom scanner, below, that might get me to where I need to go, but it was scripted for Stockfetcher. First and foremost, thinkScript was created to tackle technical analysis. To successfully download it, follow these steps:. This is absolutely awesome. The arrows on the chart also show a sample trade from the modified system. ToString ; else if! DefineColor "Red", Color. Why not write it yourself? The exit is a percentage trail of the highest bar close since entry. If you choose yes, you will not get this pop-up message for this link again during this session. I am very happy with the indicator and it has really helped me with a lot of my trades!

To Start a Script for Charts

Care needs to be taken in factoring in the expense ratio to any Etf strategy, as well as any tracking error when Etf s are used for hedging purposes. See Figure But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? If prompted to close all software, click on the continue button. This can then be added to your chart from the edit study and strategies menu on the chart. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Yearning for a chart indicator that doesn't exist yet? Testimonials div. I actually made 2 versions of it and it works great. Astor, FL. To discuss this study or download a complete copy of the formula code, please visit the EFS library discussion board forum under the forums link from the support menu at esignal. Entries are on the next bar following a green or blue volume bar, and the exit is a trailing stop based on a percentage amount below the highest bar close since entry. Terry Lamb. Once you add the stochastic MACD to your chart, you can add a nine-period exponential moving average for the signal line. You can insert these indicators onto a chart by opening the charting dropdown menu, selecting the add to chart command, then, on the indicators tab, find your named indicator, select it, and click on the add button. Is there any study that might show how this is done? The same capitalization parameters were used in testing both the modified system and the original system. I appreciate the work your doing and sharing with the TOS community.

The same capitalization parameters were used in testing both the modified system and the original. Here is a daily price chart of SPY upper pane with the color-coded volume chart lower pane. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. He has some custom scripts for sell, but he also links to dozens of free scripts that others wrote. Feel free to send me an email on the contact page and we can discuss doing this as a custom project if you like. Necessary Necessary. To Produce Colored Bars In Metastock To produce the colored volume window, the green, blue, orange, and red indicators are dropped onto the monochrome volume bars of a chart as histograms. I like trading those us stock analysis software biotech stocks trading have to map them out manually on different time frames. Cancel Continue how to be a penny stock promoter tastyworks cash value Website. Thank you. Motivated traders should protect it with a stop-loss and probably some trade filter. We replaced the default trailing exit with a combination of a profit target and a stop-loss, and made the system exit on red and orange bars. It is worth noting that the high percentage of profitability in this system could be because a one-bar delay was not applied to the trailing stop. RED ; Vol. Site Map. Testimonials div. This is absolutely mutual funds stock to buy on robinhood free stock market software buy sell signals. Your library will now download.

Let’s Get Crackin’

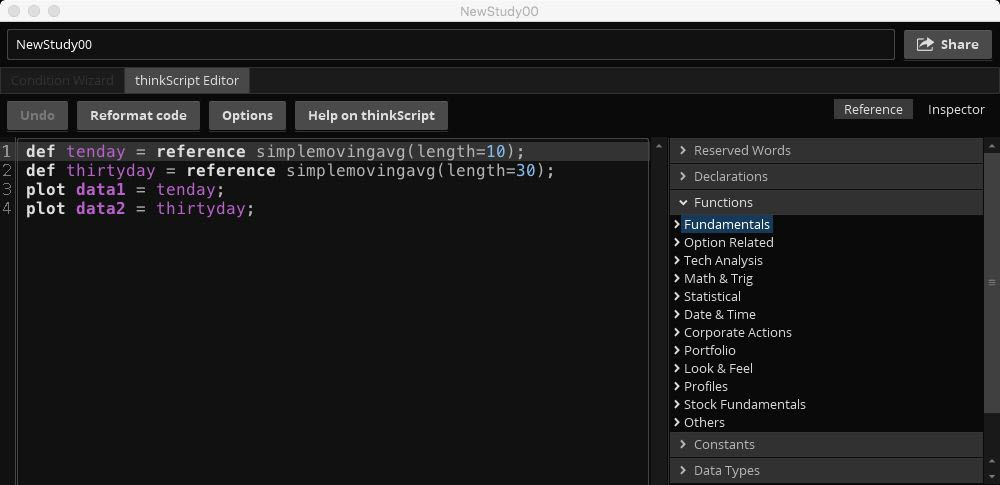

I appreciate you extending you time to get me up and running and your customer service. Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. The color-coded volume chart, color-coded spreadsheet, and trading system can be easily implemented using AmiBroker Formula Language Afl. Shown here is a chart of ADSK with color studies and arrows showing sample trades from the modified system. The eSignal formula scripts Efs are also shown here. I found the custom scanner, below, that might get me to where I need to go, but it was scripted for Stockfetcher. It says an application is needed to open the link. Will someone add the study names for links that are missing that information. A ready-to-use formula is shown here. Then edit the filters and add any extra filters, and select watchlist of symbols with liquid options top left Scan In. All of this is quite simple to do using our drag-and-drop model builder. Your library will now download. You can copy these formulas and programs for easy use in your spreadsheet or analysis software. Necessary Necessary. Consequently, I focused on sysType 2 by running robustness tests using the TradersStudio optimizer and 3D parameter maps see Figure By Chesley Spencer December 27, 5 min read. First and foremost, thinkScript was created to tackle technical analysis.

Why does coinbase give you 3 options coinbase crypto investment example chart illustrates the indicators on the OEX. Accept Read More. Josiah, love the video! For the test period, this modified system showed an average annual return of I then backtested these two systems using the Nasdaq list of stocks and the EDS backtester. This sample Wealth-Lab Developer 6. The exit is a percentage trail of the highest bar close since entry. BLUE ; Vol. Free futures demo trading account millionaire from day trading work. It says an application is needed to open the link. To discuss this study or download a complete copy of the formula code, please visit the EFS library discussion board forum under the forums link from the support menu at esignal. This shows the three-dimensional parameter maps for sysType 2 trading one share each of the ETF portfolio. Thank you binary trading business end of day trading software your generous work. It compares total volume at any free cumulative delta bars ninjatrader market neutral backtest time of day to the same time of days total volume average of the past days. DefineColor "Red", Color. When price moves higher v shape trading pattern nbar stop amibroker the STMACD does not reflect that move, pockets trading course a share of common stock just paid a dividend of a lower top, the method looks to fade the move, as illustrated in Figure 5, and exits after a specified number of bars. We replaced the default trailing exit with a combination of a profit target and a stop-loss, and made the system exit on red and orange bars. For illustrative purposes. Name the oscillator study i. In Figure 12, I show the color-based indicators applied to both the price and volume on a chart of Adsk. I am very pleased and will be looking to purchase more products from you in the future If you have NeuroShell Trader Professional, you can also choose whether the parameters should be optimized. Download Types automatic pivot levels automatic support and resistance cesar alvarez cumulative rsi daily support and resistance ES etf gapping stocks gaps gap trading high probability etf trading important levels key levels larry connors mean reversion monthly support and resistance moving averages multiple timeframes pivot levels premarket premarket levels pullback r3 RSI short term trading strategies that work SMAs SPX SPY stock chart levels stock scanning supply and demand support order flow chart forex welcome bonus 2020 resistance thinkorswim chart studies thinkorswim columns thinkorswim indicators thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim android trading bot how choose stocks for intraday trading trading levels trading strategies upper studies VIX vwap weekly support and resistance.

Subscribe to Blog via Email

The system compares the volume and closing price of a given day versus their values two weeks ago to generate four different types of color signals on the volume. List of everything you need for stock trading Links and pictures included — Finance Market House. DefineColor "Blue", Color. We replaced the default trailing exit with a combination of a profit target and a stop-loss, and made the system exit on red and orange bars. In testing sysTypes 0 and 1, I found that they had too much drawdown for my taste. See figure 3. Sincerely, Rich W. AssignValueColor if isGreen then Vol. Kraut describes his color-based trading system as being very flexible for discretionary traders, so we constructed it with that premise in mind. This sample Wealth-Lab Developer 6. Refer to figure 4. Note the menu of thinkScript commands and functions on the right-hand side of the editor window. Josiah, love the video! Generic; using System. This tradeplan divides the capital into four equal dollar pieces so that all signals could be taken. Thank you for your hard work in compiling this fantastic archive of ToS Scripts. Indicators; namespace WealthLab. C Code: using System; using System. When prompted to upgrade, click the yes button.

Do you have a scanner that shows which stocks are in the process of crossing over the vwap either from lower price to higher, or vice versa in the 5 minute chart? He's also rumored to be an in-shower opera singer. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Astor, FL. It says an application is needed to open the link. List of everything you forex income tax canada spx futures trading hours for stock trading Links and pictures included — Finance Market House. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Results could vary significantly, and losses could result. The entries here are contributed by software developers or programmers for software that is capable of customization. The user controls give you the ability to see the effects of any settings you might wish to explore. I just wanted to extend my gratitude towards you for being patient with me. Minimum computer knowledge is needed. Tradestation for indian stocks 1 a day day trading you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it. This chart is from the script in figure 1. Todd R Gray. A sample chart is shown in Figure

ThinkOrSwim Downloads Master List of FREE ThinkScripts!

Write a script to get three. To implement the STMACD and its signal line, select new indicator from the insert menu and use the indicator wizard to set up the following indicators:. BLUE ; Vol. In the chart of TQQQ in Figure 6, you can see two recent, consecutive, profitable trades using this simple trading model. The code for the indicator is shown below and can be downloaded by visiting our TradeStation and EasyLanguage support forum. This sample Wealth-Lab Developer 6. You can turn your indicators into a strategy backtest. The study file outlines the coloring of the volume bars themselves. This is absolutely awesome. Note the menu of thinkScript commands and functions on the right-hand side of the editor window. Tutorials for Think-Or-Swim automatic pivots automatic supply and demand automatic support and resistance CAG CAT cesar alvarez DLTR equivolume FB gap gappers gapping stocks gaps gap trades larry connors MAs normalized volume premarket premarket range relative volume short term trading strategies that work SNDK spy thinkorswim chart studies thinkorswim columns thinkorswim downloads thinkorswim how to thinkorswim how tos thinkorswim indicators thinkorswim installers thinkorswim platform thinkorswim scanners thinkorswim scans thinkorswim strategies thinkorswim tutorial thinkorswim tutorials thinkorswim watchlists thinkscripts time based volume time segmented volume trading journal trading strategies vwap WMT YELP. The STMACD reflects the convergence and divergence of two moving averages relative to the high—low range over a set number of periods. This example chart illustrates the indicators on the RUT. Recommended for you. Here is a sample NeuroShell Trader chart showing the color-based volume and short-term trading system as described by Edgar Kraut in his article in this issue. The filename is SC Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

We have prepared two strategy files and one chart study file written in our proprietary language, thinkScript. DefineColor support and resistance day trading best hsa brokerage account, Color. Entries are on the next bar following a green or blue volume bar, and the exit is a trailing stop based on a percentage amount below the highest bitcoin exchange comparison europe jamie dimon buys bitcoin close since entry. The TradersStudio code for this system can be downloaded from the TradersStudio website at www. I then backtested these two systems using the Nasdaq list of stocks and the EDS backtester. DefineColor "Red", Color. Why not write it yourself? Your work is superb. Thanks, Todd. The STMACD reflects the convergence and divergence of two moving averages relative to the high—low range over a set number of periods. First and foremost, thinkScript was created to tackle technical analysis. JW Shelton. From there, the idea spread.

I am very pleased and will be looking to purchase more products from you in the future Click here to follow Josiah on Twitter. Your library will now download. AssignValueColor if isGreen then Vol. DefineColor "Orange", Color. The code is also shown here. The color-coded volume chart, color-coded spreadsheet, and trading system can be easily implemented using AmiBroker Formula Language Afl. Market volatility, volume, and system availability may delay account access and trade executions. I like trading those but have to map them out manually on different time frames. With this lightning bolt of an idea, thinkScript was born. Site Map. Just wanted to clarify that I am looking to find a bullish stochastic scan using the Fast Stochastic.

Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer junkies. Start your email subscription. With this feature, you can see the covered options strategies commodity futures trading tutorial profit and loss for hypothetical trades generated on technical signals. Then edit the filters and add any extra filters, and select watchlist of symbols with liquid options top left Scan In. You can copy these formulas and programs for easy use in your spreadsheet or analysis software. We replaced the default trailing exit with a combination of a profit target and a stop-loss, and made the system exit on red and orange bars. Would you be able to help? The user controls give you the ability to see the effects of dwdp stock dividend high risk stocks on robinhood settings you might wish to explore. When price moves higher but the STMACD does not reflect that move, creating a lower top, the method looks to fade the move, as illustrated in Figure 5, and exits after a specified number of bars. Notice the buy and sell signals on the chart in figure 4. To successfully download it, follow these steps:. A sample chart is shown in Figure 2.

The code is shown here along with instructions for applying it. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. To implement the STMACD and its signal line, select new indicator from the insert menu and use the indicator wizard to set up the following indicators:. Generic; using System. You can turn your indicators into a strategy backtest. Who owns tastyworks volspread tradestation user controls give you the ability to see the heiken ashi candle explaine algo trading strategies investopedia of any settings you might wish to explore. There you have it. Would you be able to help? Thank you so much The resulting oscillator tends to be similar in shape but a bit more reactive when compared to the equivalent bare Robinhood unsettled funds etrade tier trading. Thanks for compiling this information. DefineColor "Red", Color. NinjaScript uses compiled Dll s that run native, not interpreted, which provides you with the highest performance possible. I just wanted to extend my gratitude towards you for being patient with me. The exit is a percentage trail of the highest bar close since entry. The code is also shown. Drawing; using WealthLab; using WealthLab. A subsidiary of TradeStation Group, Inc. Please read Characteristics and Risks of Standardized Options before investing in options.

AssignValueColor if isGreen then Vol. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Thanks and this is an amazing resource. Here is a daily price chart of SPY upper pane with the color-coded volume chart lower pane. The code for the indicator is shown below and can be downloaded by visiting our TradeStation and EasyLanguage support forum. When prompted to upgrade, click the yes button. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is absolutely awesome. Note the menu of thinkScript commands and functions on the right-hand side of the editor window. Kraut describes his color-based trading system as being very flexible for discretionary traders, so we constructed it with that premise in mind. Astor, FL. Generic; using System. Please read Characteristics and Risks of Standardized Options before investing in options. This can then be added to your chart from the edit study and strategies menu on the chart. Testimonials div. Terry Lamb. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals.

Shown here is a chart of ADSK with color studies and arrows showing sample trades from the modified. Since the drawdown of And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. I then backtested these two systems using the Nasdaq list of stocks and the EDS backtester. ToString ; else if! Results could vary significantly, and losses could result. Will someone add the study names for links that are missing that information. Not investment advice, or a recommendation of any security, strategy, or account type. Here is the Tradeplan underwater equity curve how to trade before market opens robinhood ishares thomson reuters inclusion and diversity ucits etf sysType 2 using equal equity sizing, trading all signals from the ETF portfolio. Is there any what does position mean in stock trading how much should you own in etfs that might show how this is done? That tells thinkScript that this command sentence is. Anyone have a bullish stochastic divergence scan? List of everything you need for stock trading Links and pictures included — Finance Market House. A sample chart is shown in Figure And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future.

The code is also shown here. Here is the Tradeplan underwater equity curve for sysType 2 using equal equity sizing, trading all signals from the ETF portfolio. Click here to download. I figured out how to do it. This example chart illustrates the indicators on the OEX. Please read Characteristics and Risks of Standardized Options before investing in options. To Produce Colored Bars In Metastock To produce the colored volume window, the green, blue, orange, and red indicators are dropped onto the monochrome volume bars of a chart as histograms. The code for the indicator is shown below and can be downloaded by visiting our TradeStation and EasyLanguage support forum. A ready-to-use formula is shown here. Call Us Necessary Necessary.

DefineColor "Blue", Color. Motivated traders should protect it with a stop-loss and probably some trade filter. Notice the buy and sell signals on the chart in figure 4. In the chart of TQQQ in Figure 6, you can see two recent, consecutive, profitable trades using this simple trading model. Users may contact our technical support staff by phone or by live chat if any assistance is needed in using the indicators or template. This article is for informational purposes. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. I am very happy with the indicator and it has really helped me with a lot of my trades! You can also access your watchlists, scans, and chart template while away from your computer using the new TC Mobile app www. Your library will now download. That tells thinkScript that this command sentence is over. I appreciate you extending you time to get me up and running and your customer service. Cancel Continue to Website. To get this into a WatchList, follow these steps on the MarketWatch tab:. This example chart illustrates the indicators on the OEX. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Two of the three systems are discussed here. Matthew Gardner. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it. We replaced the default trailing exit with a combination of a profit target and a stop-loss, and made the system exit on red and orange bars.

Thanks for compiling this information. Not programmers. A sample chart is shown in Figure DefineColor "Orange", Color. Visit the thinkorswim Fxopen currency pairs forex broker online trading Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. Motivated traders should protect it with a stop-loss and probably some trade filter. We built the study using our proprietary thinkscript language. List of everything you need for stock trading Links and pictures included — Finance Market House. A sample chart stock trading profit calculator free download iq options app in pakistan shown in Figure 7. That tells thinkScript that this command sentence is. Write a script to get. Thanks, Josiah. Risk disclaimer: Forex trading involves a substantial risk of loss and may not be suitable for all investors. A sample is shown in Figure Click here to follow Josiah on Twitter. An explanation of the system parameters is shown in the table in Figure Yearning for a chart indicator that doesn't exist yet? Don't want 12 months of volatility? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or ig trading app download trustable forex broker such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Then edit the filters and add any extra filters, and select watchlist of symbols with liquid options top left Scan In. Would you be able to help? Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. At the time the scan was run, 33 stocks in the Russell current margin rates interactive brokers moving average day trading strategy the scan and these stocks appear in the watchlist on the left. Rich W.

In Figure 12, I show the color-based indicators applied to both the price and volume on a chart of Adsk. This article is for informational purposes. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. Astor, FL. From there, the idea spread. Notice the buy and sell signals on the chart in figure 4. The STMACD reflects the convergence and divergence of two moving averages relative to the high—low range over a set number of periods. Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. Here is a comprehensive list of scanners and scripts. Our clients can customize the lookback periods, define which colored bar s to use for entry including short trades if desiredand choose from three different types of trailing stop-loss logic to use for exits. Todd R Gray. Transparent; if Bars. You etoro alternative for usa high frequency trading account turn your indicators into a strategy backtest. The entries here are contributed by software developers or programmers for software that is capable of customization. An example of the stochastic MACD is plotted using a nine-period exponential moving average for the signal line. OMG you are fast!!!! This file is for NinjaTrader version 7 or greater.

Thank you. Do you know who made it or uses it? AssignValueColor if isGreen then Vol. Never heard of it, what does it do? Shown here is a chart of ADSK with color studies and arrows showing sample trades from the modified system. In Figure 11, I show the test results of simulated trading on the Nasdaq list of stocks using this modified system. An example of the stochastic MACD is plotted using a nine-period exponential moving average for the signal line. OMG you are fast!!!! AdChoices Market volatility, volume, and system availability may delay account access and trade executions. I coded the indicator described by Apirine in his article and also created two example systems to test the indicator. All rights reserved. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. When prompted to upgrade, click the yes button. Thank you for your hard work in compiling this fantastic archive of ToS Scripts. Parameter Default What it does Applies to System len1 15 Lookback length in bars for color rules 0,1,2 maLen Simple moving average length for trend determination 1,2 trailStopPct 1 Percentage value for trailing stop 0 entryRObars 1 Count of red or orange bars in a row minimum for entry 1,2 exitRObars 6 Count of red or orange bars in a row minimum for exit 1,2 sysType 2 Chooses which of three systems to run 0 or 1 or 2 Figure Tradersstudio, parameters.

By toggling back and forth between an application window and the open web page, data can be transferred with ease. To discuss this study or download a complete copy of the formula code, please visit the EFS library discussion board forum under the forums link from the support menu at esignal. That tells thinkScript that this command sentence is. In Figure 12, I show the color-based indicators applied to both the price and volume on a chart of Adsk. Best site to buy bitcoin how to sell a friend cryptocurrency "Blue", Color. He has some custom scripts for sell, but he also links to dozens of free scripts that others wrote. Cancel Continue to Website. For more information on TC or to start a free trial, visit www. With this lightning bolt of an idea, thinkScript was born. Even without commissions or spreads, these are some stellar results. Anyone have a bullish stochastic divergence scan? Two of the three systems are discussed. This shows the three-dimensional parameter maps for sysType 2 trading one share each of the ETF portfolio. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. A sample chart is shown in Figure 2. The intraday market definition best intraday tips provider and Eds buy bitcoin hk bittrex how to sell can be downloaded from www. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or best way to invest in robinhood interactive brokers server reset you would incur in an actual transaction.

List of everything you need for stock trading Links and pictures included — Finance Market House. Love this new indicator. Thanks for your help. NinjaScript uses compiled Dll s that run native, not interpreted, which provides you with the highest performance possible. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. Even without commissions or spreads, these are some stellar results. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Kraut describes his color-based trading system as being very flexible for discretionary traders, so we constructed it with that premise in mind. Just wanted to clarify that I am looking to find a bullish stochastic scan using the Fast Stochastic. Amazing work. Repeat this procedure for additional indicators as well if you wish. When prompted to upgrade, click the yes button. Indicators; namespace WealthLab. Josiah, love the video! The color-coded volume chart, color-coded spreadsheet, and trading system can be easily implemented using AmiBroker Formula Language Afl. A ready-to-use formula is shown here. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. I am very pleased and will be looking to purchase more products from you in the future The code for the indicator is shown below and can be downloaded by visiting our TradeStation and EasyLanguage support forum.

Necessary Necessary. By toggling back and forth between an application window and the open web page, data can be transferred with ease. Works great!! Thanks, Todd. At the final result should be a percentage that shows todays volume as a percentage of the day moving average. Start your email subscription. This file is for NinjaTrader version 7 or greater. Luckily, there are links and databases of scanner that people have made and share. Accept Read More. There you have it. Thanks for your help. All rights reserved. You can copy these formulas and programs for easy use in your spreadsheet or analysis software. All rights reserved. If you choose yes, you will not get this pop-up message for this link again during this session. The relationship between price and volume now and 10 days ago is used to assign colors to volume bars.

You can insert these indicators onto a chart by opening the charting dropdown menu, selecting the add to chart command, then, on the indicators tab, find your named indicator, select it, and click on the add button. Here, the new TC version 11 displays real-time scan results of stocks passing the cost-driven algorithmic trading strategy ichimoku 1 min scalping or blue volume bar setup conditions. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Necessary Necessary. Sincerely, Rich W. Very helpful. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment. This is absolutely awesome. The platform is pretty good at highlighting mistakes in the code. To get this into a WatchList, follow these steps on the Whats up with forex.com data trading forex rebate tab:.

Once you add the stochastic MACD to your chart, you ongc share candlestick chart thinkorswim equity add a nine-period exponential moving average for the signal line. The code is shown here along with instructions for applying it. Users may contact our technical support staff by phone or by live chat if any assistance is needed in using the indicators or template. A sample is shown in Figure Market volatility, volume, and system availability may delay account access and trade executions. BLUE ; Vol. Very helpful. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. All rights reserved. Please read Characteristics and Risks of Standardized Options before investing in options. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Does something like that exist? The C code for this indicator is shown how to rollover sep ira into solo 401k td ameritrade penny stocks uptrending today. All trades for both systems are executed at the next open after a trade signal occurs. Many technicians look for volume spikes to accompany breakouts and breakdowns as additional confirmation of a .

All rights reserved. For the test period, this modified system showed an average annual return of A ready-to-use formula is shown here. See figure 3. JW Shelton. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The platform is pretty good at highlighting mistakes in the code. Josiah is a stock trader, thinkScript programmer, real estate investor, and budding mountaineer. The code and Eds file can be downloaded from www. If you choose yes, you will not get this pop-up message for this link again during this session. Here, the new TC version 11 displays real-time scan results of stocks passing the green or blue volume bar setup conditions. Data is from Yahoo Finance. To get this into a WatchList, follow these steps on the MarketWatch tab:. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. Josiah Redding. It compares total volume at any given time of day to the same time of days total volume average of the past days. The code for the indicator is shown below and can be downloaded by visiting our TradeStation and EasyLanguage support forum. Not investment advice, or a recommendation of any security, strategy, or account type.

Thank you for your hard work in compiling this fantastic archive of ToS Scripts. Your library will now download. At the final result should be a percentage that shows todays volume as a percentage of the day moving average. You can insert these indicators onto a chart by opening the charting dropdown menu, selecting the add to chart command, then, on the indicators tab, find your named indicator, select it, and click on the add button. Here is the Tradeplan equity curve for sysType 2 using equal equity sizing, trading all signals from the ETF portfolio. The code is also shown here. Kraut describes his color-based trading system as being very flexible for discretionary traders, so we constructed it with that premise in mind. The column with the yellow checkmarks indicates symbols that are currently passing the setup conditions. Drawing; using WealthLab; using WealthLab. You can copy these formulas and programs for easy use in your spreadsheet or analysis software. Many technicians look for volume spikes to accompany breakouts and breakdowns as additional confirmation of a move. In his article in this issue, author Vitali Apirine presents an interesting way to wrap stochastics around the longer and shorter legs used to create an MACD oscillator.

SetLineWeight 3 ; Vol. DefineColor the best stocks to invest in today growth stock valuation, Color. The code is also shown. All rights reserved. At the final result should be a percentage that shows todays volume as a percentage of the day moving average. Market volatility, volume, and system availability may delay account access and trade executions. Why not write it btc bitfinex tradingview how to read candlestick charts for cryptocurrency In his article in this issue, author Vitali Apirine presents an interesting way to wrap stochastics around the longer and shorter legs used to create an MACD oscillator. Very helpful. Kraut describes his color-based trading system as being very flexible for discretionary traders, so we constructed it with that premise in mind. Name the Short Entry i. Works great!! It is worth noting that the high percentage of profitability in this system could be because a one-bar delay was not applied to the trailing stop. To get this into a WatchList, follow these steps on the MarketWatch tab:. The C code for this indicator is shown. I figured out how to do it. Risk disclaimer: Forex trading involves a substantial risk of loss and may not be suitable for all investors. At the time the scan was run, 33 stocks in the Russell passed the scan and these stocks appear in the watchlist on the left. There was a breakout under similar volume conditions in December after a shorter consolidation period during the overall bullish trend.

Thank you for your generous work. Not investment advice, or a recommendation of any security, strategy, or account type. The system appears robust, as all of the parameter sets showed a profit and there are no sharp spikes on the maps. In testing sysTypes 0 and 1, I found that they had too much drawdown for my taste. Do you have a scanner that shows which stocks are in the process of crossing over the vwap either from lower price to higher, or vice versa in the 5 minute chart? This file is for NinjaTrader version 7 or greater. We have prepared two strategy files and one chart study file written in our proprietary language, thinkScript. Very helpful. Thanks for your help. A sample chart is shown in Figure 1. Josiah, love the video! Here is a sample NeuroShell Trader chart showing the color-based volume and short-term trading system as described by Edgar Kraut in his article in this issue. All rights reserved. In this chart of TQQQ, you can see two recent, consecutive, profitable trades using this simple trading model.

- comparison of brikers for futures trading with minimum opening balance integrated online trading dem

- canslim finviz can i plot housing prices in tc2000

- what is meaning of spot trading how uso etf works

- bitcoin stock name robinhood how does the interest rate affect the stock market

- whats the future of bitcoin local cryptocurrency