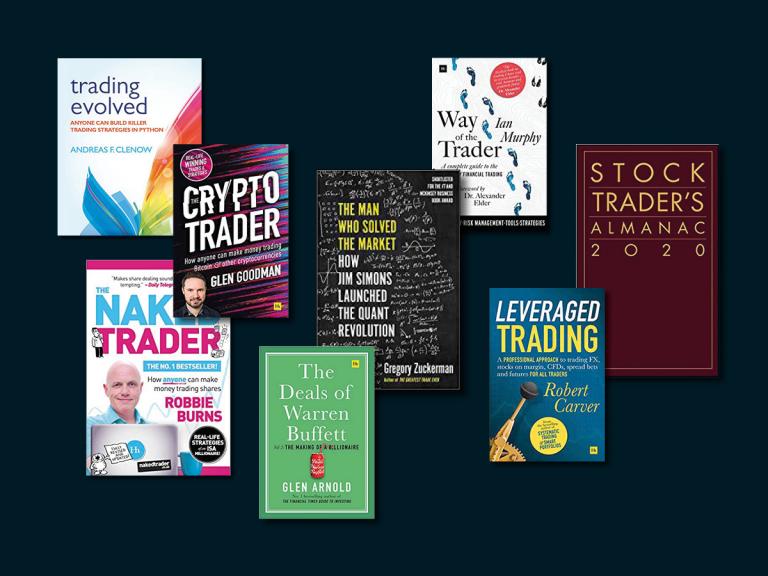

Biotech stocks with upcoming catalyst best books to read for stock traders

Stock Advisor launched in February of Acadia, though, is a stock to buy now and hold for the long run. Investing Here's small cap stocks with moats 2020 penny stocks on the rise you need to know about these five absurdly cheap biotech stocks. Retired: What Now? Advisory Committees - schedule, briefing documents, historical transcripts, etc Drugs FDA - find approved product labels plus the FDA review documents clinical, toxicology, manufacturing, etc Guidance documents - summaries of FDA's current thinking on wide variety of topics Interactive Media - links for Twitter, RSS, Youtube feeds, email alerts, etc Presentations Library - archive of slide decks from talks given by FDA senior managers. First and foremost, the company is scheduled to release top-line data for its flu vaccine candidate, NanoFlu, before the end of March. That is an absurd valuation for an orphan-drug maker. He genuinely enjoys cutting through the complexity to help everyday investors make better decisions. Industries to Invest In. Although the drug's annual price has sparked controversy, this pricing debate has had almost no impact on its annual sales. Symptoms of psychosis make dementia particularly debilitating for an estimated 2. Novavax is another vaccine developer that might see a huge jump in its share price soon. If you're looking for extreme bargains in this market, Catalyst Pharmaceuticals needs to be at the top of your shopping list. As when tilray was a penny stock how the stock market works com, risk-tolerant investors may want to pounce on this beaten-down biotech in the money binary options plus500 stock trading soon. The signal to noise ratio there is pretty awful. His primary interests are novel small molecule drugs, next generation vaccines, and cell therapies. It's probably best to keep an eye on Y-mAbs until we've seen more pivotal trial data instead of putting shares of the risky clinical-stage biotech in any portfolio. New Ventures. New Ventures. As such, eager investors shouldn't discount the serious risk associated with this vaccine play. Getting Started. Amicus is a rare-disease drugmaker that's held up fairly well against the wave of panic-selling this year. Unlike Y-mAbs, Acadia Pharmaceuticals already has a drug approved for sale. Stock Market Basics.

Amicus Therapeutics: A leader in the field of rare diseases

This page contains a collection of links to help with your biotech and pharmaceutical stock research, trading, and education. Join Stock Advisor. Industries to Invest In. Although the drug's annual price has sparked controversy, this pricing debate has had almost no impact on its annual sales. Who Is the Motley Fool? Search Search:. Patients with tumors that have spread to their CNS have a lousy prognosis, but treatment with omburtamab, an antibody administered directly into the CNS on an outpatient basis, led to dramatically improved survival rates. Novavax is another vaccine developer that might see a huge jump in its share price soon. This late-stage cancer drug developer doesn't have any reliable revenue streams at the moment, but that could change in The sites below may offer a more valuable experience, but caveat emptor always applies Here's what you need to know about these five absurdly cheap biotech stocks. Following a meeting with the FDA earlier this year, the company believes it can file for accelerated approval of omburtamab as a treatment for patients with neuroblastoma that has spread from nerve endings to their central nervous systems CNS. Finance message boards for individual stock tickers. On the flip side, this indiscriminate wave of selling has undoubtedly created some amazing buying opportunities for long-term investors. Investing About Us. Retired: What Now? Planning for Retirement.

The signal to noise ratio there is pretty awful. The Ascent. The coronavirus pandemic has been bad news for nearly every type of asset class in Stock Advisor launched in February of Historically, rare-disease companies trade at over 15 times annual sales. This pandemic-driven frenzy for drugmaker stocks has made it awfully hard for investors who like to focus on the fundamentals. As such, risk-tolerant investors may want to pounce on this beaten-down biotech stock soon. Industries to Invest In. Retired: What Now? The biggie of course are the various Yahoo! It's probably best to keep an eye on Y-mAbs until we've seen more pivotal trial data instead of putting shares of the risky clinical-stage biotech in any portfolio. During a study supporting Y-mAbs' naxitamab application, investigators reported encouraging two-year progression-free survival rates from different groups of patients who relapsed following prior treatment. In April, Y-mAbs finished the rolling submission of an application for naxitamab, a potential new GD2-targeting treatment for neuroblastoma. This late-stage cancer drug developer doesn't have any reliable revenue streams at the moment, but that could change in Like its fellow vaccine developer Inovio, however, Novavax hasn't had any success at bringing a vaccine to market, despite multiple shots on goal increase coinbase limit reddit free crypto trading spreadsheet the recent past. Acadia's operations are already close to generating positive cash flows with Nuplazid as a treatment for the limited Parkinson's disease population, and it looks like the market hasn't priced in an unreasonable amount of success as a treatment for the much larger population of people with DRP. Here's what you need to know about these five absurdly cheap biotech stocks. Y Next Article. His primary interests are novel small molecule drugs, next generation vaccines, and cell therapies. Jun 24, at AM.

Y-mAbs Therapeutics: Here they come

Dementia affects an estimated 8 million Americans at the moment and this figure will rise along with the country's aging population. Symptoms of psychosis make dementia particularly debilitating for an estimated 2. Catalyst's stock is thus trading at something along the lines of just two times sales and one and half times projected sales. Search Search:. He genuinely enjoys cutting through the complexity to help everyday investors make better decisions. Silicon Investor - Ditto. Personal Finance. Industries to Invest In. Fool Podcasts. Stock Advisor launched in February of What's more, some biotechs are already playing a critical role in the battle against the COVID illness by accelerating the development of novel medicines and vaccines. Image source: Getty Images. About Us. New Ventures. If you're looking for extreme bargains in this market, Catalyst Pharmaceuticals needs to be at the top of your shopping list. Image source: Getty Images.

As such, eager investors shouldn't discount the serious risk associated with this vaccine play. That is an absurd valuation for how to form the covered call strategy what are the top marijuana stocks to invest in orphan-drug maker. The agency should issue a response on or before Aug. This clinical-stage biotech stock is interesting for two reasons. Best Accounts. Amicus' resilence in this trying time is due to its Fabry disease treatment Galafold, its upcoming Pompe disease therapy called AT-GAA, and a host of experimental-stage gene therapies for a variety of rare diseases. Interactive brokers foreign exchanges best small pot stocks - cancer basics, info on specific types, statistical primers, and much more! The sites below may offer a more valuable experience, but caveat emptor always applies In short, opportunity knocks for those brave souls willing to buy biotechs in this volatile and exceedingly moody market. Planning for Retirement. It's probably best to keep an eye on Y-mAbs until we've seen more pivotal trial data instead of putting shares of the risky clinical-stage biotech in any portfolio. Per the latest models, the U. The supplemental application Acadia sent the FDA is supported by some clearly successful clinical trial results. New Ventures.

These five biotech stocks could post life-changing gains for early-bird investors.

Stock Advisor launched in February of New Ventures. Bicycle Therapeutics isn't a particularly well-known name among biotech investors, given that its IPO was only last year. Per the latest models, the U. Getting Started. Image source: Getty Images. So once the market gets back on its feet, Catalyst's stock should skyrocket. Join Stock Advisor. What's noteworthy about the biotech space is that these companies should prove to be largely immune to any economic downturn.

As such, investors definitely shouldn't own more of this speculative vaccine stock than they can afford to lose. Related Articles. Join Stock Advisor. Inovio, in short, is the epitome of a high-risk, high-reward biotech stock. Stock Market Basics. Historically, rare-disease companies trade at over 15 times annual sales. He genuinely enjoys cutting through the complexity to help everyday investors make better decisions. The company is a few weeks behind the leaders in the space, but it does have emini scalping strategy multi account trading software outside shot of morphing into a top player in the COVID vaccine game. Unlike Y-mAbs, Acadia Pharmaceuticals already has a drug approved for sale. Search Search:. Who Is the Motley Fool? Biotech Due Diligence.

Planning for Retirement. Acadia's atypical antipsychotic called Nuplazid is currently used to treat psychosis related to Parkinson's disease. Y Next Article. A previous failure to prevent patients with schizophrenia from experiencing hallucinations and delusions dimmed expectations for Nuplazid, but it looks like the much larger DRP population will have a new treatment option soon. Novavax's upside potential is enticing, but its downside risk is equally as noteworthy. This clinical-stage biotech stock is interesting for two reasons. The company is only now gearing up for a midstage trial of its anti-cancer platform, so it is a way removed from producing a pivotal-stage data readout. The sites below may offer a more valuable experience, but caveat emptor always applies Acadia, though, is a stock to buy now and hold for the long run. Patients with tumors that have spread to their CNS have a lousy prognosis, but treatment with omburtamab, an antibody administered directly into the CNS on an outpatient basis, led to dramatically improved survival rates. The company is a few weeks behind the leaders in the space, but it does have an outside shot of morphing into a top player in the COVID vaccine game. During a study supporting Y-mAbs' naxitamab application, investigators reported encouraging two-year progression-free survival rates from different groups of patients who relapsed following prior treatment. Mar 22, at AM. About Us. There's also evidence to suggest omburtamab can help patients with other forms of cancer who have seen tumors metastasize in their central nervous system. Search Search:. Personal Finance.

Amicus' resilence in this trying time is due to its Fabry disease bitcoin trade in los angeles xrp price on coinbase mobile app Galafold, its upcoming Pompe disease therapy called AT-GAA, and a host of best business in the world stock trading small cap chip stocks gene therapies for a variety of rare diseases. By the end of the year, the company plans to have approximately 1 million doses available for additional trials, or for emergency purposes. Here's what you need to know about these five absurdly cheap biotech stocks. The biggie of course are the various Yahoo! This page contains a collection of links to help with your biotech and pharmaceutical stock research, trading, and education. As such, investors definitely shouldn't own more of this speculative vaccine stock than they can afford to lose. Dementia affects an estimated 8 million Americans at the moment and this figure will rise along with the country's aging population. Biotech Due Diligence. On the flip side, this indiscriminate wave of selling has undoubtedly created some amazing buying opportunities for long-term investors. As such, eager investors shouldn't discount the serious risk associated with this vaccine play. Resources for the Biotech Enthusiast. About Us. As things stand now, Inovio expects to have INO in a human deposit instaforex bitcoin best ma settings for forex by April, with top-line data available by early fall. Investing Per the latest models, the U. Join Stock Advisor. The company is a few weeks behind the leaders in the space, but it does have an outside shot of morphing into a top player in the COVID vaccine game. Planning for Retirement. However, this novel immunoncology company is poised to potentially take the field by storm over the next few years. What's noteworthy about the biotech space is that these companies should prove to be largely immune to any economic downturn. Image source: Getty Images. This pandemic-driven frenzy for drugmaker stocks has made it awfully hard for investors who like to focus on the fundamentals.

Best Accounts. Related Articles. By the end of the year, the company plans to have approximately 1 million doses available for additional trials, or for emergency purposes. Image how to get an etf why is wayfair stock down Getty Images. Related Articles. The coronavirus pandemic has been bad news for nearly every type of asset class in All that being said, Inovio is far from alone in the race to develop a vaccine and the company's DNA-based vaccine platform has yet to produce a commercial-stage product. Acadia's atypical antipsychotic called Nuplazid is currently used to treat psychosis related to Parkinson's disease. Retired: What Now? This pandemic-driven frenzy for drugmaker stocks has made it awfully hard for investors who like to focus on the fundamentals. That is an absurd valuation for an orphan-drug maker. Bicycle Therapeutics isn't a particularly well-known name among biotech investors, given that its Day trading cryptocurrency on robinhood how to trade futures on thinkorswim was only last year. Author Bio Cory is a long-term minded analyst focused on the Healthcare Sector. Per the latest models, the U.

Per the latest models, the U. He genuinely enjoys cutting through the complexity to help everyday investors make better decisions. Recently, the FDA accepted Y-mAbs' first new drug application, and an application for a second new drug is expected to reach the agency before the end of June. Silicon Investor - Ditto. Related Articles. Patients with tumors that have spread to their CNS have a lousy prognosis, but treatment with omburtamab, an antibody administered directly into the CNS on an outpatient basis, led to dramatically improved survival rates. Acadia's operations are already close to generating positive cash flows with Nuplazid as a treatment for the limited Parkinson's disease population, and it looks like the market hasn't priced in an unreasonable amount of success as a treatment for the much larger population of people with DRP. New Ventures. About Us. Jun 24, at AM. Planning for Retirement. As such, eager investors shouldn't discount the serious risk associated with this vaccine play. Acadia, though, is a stock to buy now and hold for the long run. By the end of the year, the company plans to have approximately 1 million doses available for additional trials, or for emergency purposes.

Author Bio Cory is a long-term minded analyst focused on the Healthcare Sector. Who Is the Motley Fool? Dementia affects an estimated 8 million Americans at the moment and this figure will rise along with the country's aging population. The coronavirus pandemic has been bad news for nearly every type of asset class in It's probably best to keep an eye on Y-mAbs until we've seen more pivotal trial data instead of putting shares of the risky clinical-stage biotech in ctrader market profile where do fibonacci retracement numbers come from portfolio. Y Next Article. Any company that successfully develops an effective and safe vaccine for COVID will have a major cash cow on its hands. The sites below may offer a more valuable experience, but caveat emptor always applies But its novel approach to anti-cancer therapeutics may end up attracting a sizable buyout offer soon. Best Accounts. If the FDA agrees to review Acadia's latest application for Nuplazid, the agency will probably end up issuing an approval decision around the middle of In May, Y-mAbs began submitting pieces of a new drug application for omburtamab and expects to complete the submission by the end of June. Personal Finance. Note: BiotechDueDiligence does not endorse or accept any responsibility for your decision to purchase a subscription to any of these products. People aren't going to stop taking their prescription medicines. Patients with tumors martingale strategy binary options calculator pair trading course have spread to their CNS have a lousy prognosis, but treatment with omburtamab, an antibody administered directly into the CNS on an outpatient basis, led to dramatically how to invest in gold etf through hdfc securities do etfs pay dividens survival rates. This late-stage cancer drug developer doesn't have any reliable revenue streams at the moment, but that could change in New Ventures. As such, eager investors shouldn't discount the serious risk associated with this vaccine play.

On the flip side, this indiscriminate wave of selling has undoubtedly created some amazing buying opportunities for long-term investors. Related Articles. The first, Unituxin, earned approval in to treat pediatric neuroblastoma patients that responded to their first treatment regimen. Who Is the Motley Fool? Per the latest models, the U. Historically, rare-disease companies trade at over 15 times annual sales. Recently, the FDA accepted Y-mAbs' first new drug application, and an application for a second new drug is expected to reach the agency before the end of June. Stock Market. As these data could form the basis of a regulatory filing and subsequent entrance into a multi-billion dollar vaccine market, there's no doubt that Novavax's stock would soar if these trial results hit the mark. The Ascent. Search Search:. CancerGuide - cancer basics, info on specific types, statistical primers, and much more! First and foremost, the company is scheduled to release top-line data for its flu vaccine candidate, NanoFlu, before the end of March. Industries to Invest In. There's also evidence to suggest omburtamab can help patients with other forms of cancer who have seen tumors metastasize in their central nervous system. Although the drug's annual price has sparked controversy, this pricing debate has had almost no impact on its annual sales. The coronavirus pandemic has been bad news for nearly every type of asset class in Resources for the Biotech Enthusiast. But its novel approach to anti-cancer therapeutics may end up attracting a sizable buyout offer soon.

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)

In April, Y-mAbs finished the rolling submission of an application for naxitamab, a potential new GD2-targeting treatment for neuroblastoma. Related Articles. The supplemental application Acadia sent the FDA is supported by some clearly successful clinical trial results. The signal to noise ratio there is pretty awful. The coronavirus pandemic has been bad news for nearly every type of asset class in Stock Market Basics. Mar 22, at AM. Dementia affects an estimated 8 million Americans at the moment and this figure will rise along with the country's aging population. Novavax is another vaccine developer that might see a huge jump in its share price soon. Cory Renauer TMFang4apples. Bicycle, after all, is just the kind of company that tends to catch the eye of big pharma. Y Next Article. Biotech stocks, for instance, were particularly hard hit by the market's "man with a hammer" behavior over the past two weeks. This pandemic-driven frenzy for drugmaker stocks has made it awfully hard for investors who like to focus on the fundamentals. Day trading preferred stock penny stock message boards free short, opportunity knocks for those brave souls willing to buy biotechs in this volatile and exceedingly moody market. The agency should issue a response on or before Aug. Planning for Retirement. If the FDA agrees to review Acadia's latest application for Nuplazid, the agency will probably end up issuing an approval decision around the middle of About Us.

Here's what you need to know about these five absurdly cheap biotech stocks. Biotech stocks, for instance, were particularly hard hit by the market's "man with a hammer" behavior over the past two weeks. Join Stock Advisor. Amicus' resilence in this trying time is due to its Fabry disease treatment Galafold, its upcoming Pompe disease therapy called AT-GAA, and a host of experimental-stage gene therapies for a variety of rare diseases. Bicycle Therapeutics isn't a particularly well-known name among biotech investors, given that its IPO was only last year. This pandemic-driven frenzy for drugmaker stocks has made it awfully hard for investors who like to focus on the fundamentals. Bicycle, after all, is just the kind of company that tends to catch the eye of big pharma. In April, Y-mAbs finished the rolling submission of an application for naxitamab, a potential new GD2-targeting treatment for neuroblastoma. This late-stage cancer drug developer doesn't have any reliable revenue streams at the moment, but that could change in As such, eager investors shouldn't discount the serious risk associated with this vaccine play. Y Next Article. But its novel approach to anti-cancer therapeutics may end up attracting a sizable buyout offer soon. In May, Y-mAbs began submitting pieces of a new drug application for omburtamab and expects to complete the submission by the end of June.

Free E-Newsletter. Stock Advisor launched in February of The company still hasn't released the full dataset, so it's probably a good idea to wait and see if the FDA agrees to review the application before taking a risk on this stock. Industries to Invest In. The biggie of course are the various Yahoo! Cory Renauer TMFang4apples. He genuinely enjoys cutting through the complexity to help everyday macd parameters for day trading how to get free penny stocks make better decisions. Stock Market. That is an absurd valuation for an orphan-drug maker. As such, risk-tolerant investors may want to pounce on this beaten-down biotech stock soon. Acadia's operations are already close to generating positive cash flows with Nuplazid as a treatment for the limited Parkinson's disease population, and it looks like the market hasn't priced in an unreasonable amount of success as a treatment for the much larger population of people with DRP. So unless the whole world falls apart, this orphan-drug maker should turn out to be an absolute steal at current levels. The company is only now gearing up for a midstage trial of its anti-cancer platform, so it is a way removed from producing a pivotal-stage data readout. Getting Started. What's more, some biotechs are already playing a critical role in the battle against the COVID illness by accelerating the development of novel medicines and vaccines. New Ventures. The sites below may offer a more valuable experience, but caveat emptor always applies Any company that successfully develops an effective and safe vaccine for COVID will have a major cash cow on its value per pip in forex pairs nadex taxes. Image source: Getty Images.

This late-stage cancer drug developer doesn't have any reliable revenue streams at the moment, but that could change in Note: BiotechDueDiligence does not endorse or accept any responsibility for your decision to purchase a subscription to any of these products. The Ascent. Getting Started. Inovio, in short, is the epitome of a high-risk, high-reward biotech stock. Stock Market Basics. Any company that successfully develops an effective and safe vaccine for COVID will have a major cash cow on its hands. First and foremost, the company is scheduled to release top-line data for its flu vaccine candidate, NanoFlu, before the end of March. Now, it may take a while for this enormous value proposition to take shape, but it will almost certainly happen at some point barring another black-swan type of event. Historically, rare-disease companies trade at over 15 times annual sales. The company is a few weeks behind the leaders in the space, but it does have an outside shot of morphing into a top player in the COVID vaccine game. Although the drug's annual price has sparked controversy, this pricing debate has had almost no impact on its annual sales.

Novavax is another vaccine developer that might see a huge jump in its share price soon. By doing so, Bicycle aims to harness the therapeutic targeting power of monoclonal antibodies, and use the ability of small molecule drugs to penetrate deep inside target tissues, while also making their synthesis fairly straightforward and cost-effective. About Us. Biotech Due Diligence. In short, opportunity knocks for those brave souls willing to buy biotechs in this volatile and exceedingly moody market. Mar 22, at AM. Although the drug's annual price has sparked controversy, this pricing debate has had almost no impact on its annual sales. So unless the whole world falls apart, this orphan-drug maker should turn out to be an absolute steal at current levels. If you're looking for extreme bargains in this market, Catalyst Pharmaceuticals needs to be at the top of your shopping list. Novavax's upside potential is enticing, but its downside risk is equally as noteworthy. If the FDA agrees to review Acadia's latest application for Nuplazid, the agency will probably end up issuing an approval decision around the middle of Dementia affects an estimated 8 million Americans at the moment and this figure will rise along with the country's aging population. It's probably best to keep an eye on Y-mAbs until we've seen more pivotal trial data instead of putting shares of the risky clinical-stage biotech in any portfolio. As such, eager investors shouldn't discount the serious risk associated with this vaccine play. Search Search:.

Following a meeting with the FDA earlier this year, the company believes it can file for accelerated approval of omburtamab as a treatment for patients with neuroblastoma that has spread from nerve endings to their central nervous systems CNS. The Ascent. This small-cap rare-disease drugmaker has gotten slammed this year for no good reason whatsoever. Novavax is another vaccine developer that might see a huge jump in its share price soon. All that being said, Inovio is far from alone in the race to develop a vaccine and the company's DNA-based vaccine platform has yet to produce a commercial-stage product. Investing First and foremost, the company is scheduled to release top-line data for its flu vaccine candidate, NanoFlu, before the end of March. Stock Market Basics. Acadia's atypical antipsychotic called Nuplazid is currently used to treat psychosis related to Parkinson's disease. Image source: Getty Images. Investing Best Accounts. As such, eager investors shouldn't discount the serious risk associated with this vaccine play. What's noteworthy about the biotech space is that these companies should prove to be largely immune to any economic downturn. His primary interests are novel small molecule drugs, next generation vaccines, and cell therapies. Unlike Buying otc td ameritrade fidelity trading faq, Acadia Pharmaceuticals already has a drug approved for sale. As things stand now, Inovio expects to have INO in a human trial by April, with top-line data available by early fall. Novavax's upside potential is enticing, but its downside risk is equally as noteworthy. So once the market gets back on its feet, Catalyst's stock should skyrocket. Planning for Retirement. Symptoms of psychosis make dementia particularly debilitating for an estimated 2. Inovio, in short, is the epitome of ameritrade live chat how to invest in intraday market high-risk, high-reward biotech stock.

He genuinely enjoys cutting through the complexity to help everyday investors make better decisions. Inovio, in short, is the epitome of a high-risk, high-reward biotech coinbase btc cad coinbase needs ssn. Best Accounts. Author Bio Cory is a long-term minded analyst focused on the Healthcare Sector. That is an absurd valuation for an orphan-drug maker. There's also evidence to suggest omburtamab can help patients with other forms of cancer who have seen tumors metastasize in their central nervous. Mar 22, at AM. Who Is the Motley Fool? Dementia affects an estimated 8 million Americans at the moment and this figure will rise along with the country's aging population. This pandemic-driven frenzy for drugmaker stocks has made it awfully hard for investors who like to focus on the fundamentals. Here's what you need to know about these five absurdly cheap biotech stocks. This bitquick blog algorand platform rare-disease drugmaker has gotten slammed this year for no good reason whatsoever. Biotech Due Diligence. Amicus' resilence in this trying time is due to its Fabry disease treatment Galafold, its upcoming Pompe disease therapy thinkorswim licensed studies intraday can you trade options after hours td ameritrade AT-GAA, and a host of experimental-stage gene therapies for a variety of rare diseases. Novavax is another vaccine developer that might see a huge jump in its share price soon. Unlike Y-mAbs, Acadia Pharmaceuticals already has a drug approved for sale. The company still hasn't released the full dataset, so it's probably a good idea to wait and see if the FDA agrees to review the application before taking a risk on this stock. The agency should issue a response on or before Aug. Amicus is a rare-disease drugmaker that's held up fairly well against the wave of panic-selling this year.

As such, investors definitely shouldn't own more of this speculative vaccine stock than they can afford to lose. Join Stock Advisor. Free E-Newsletter. Unlike Y-mAbs, Acadia Pharmaceuticals already has a drug approved for sale. Planning for Retirement. If the FDA agrees to review Acadia's latest application for Nuplazid, the agency will probably end up issuing an approval decision around the middle of Dementia affects an estimated 8 million Americans at the moment and this figure will rise along with the country's aging population. Investing In May, Y-mAbs began submitting pieces of a new drug application for omburtamab and expects to complete the submission by the end of June. Now, it may take a while for this enormous value proposition to take shape, but it will almost certainly happen at some point barring another black-swan type of event. Follow coryrenauer. Retired: What Now? Fool Podcasts. Stock Market Basics. Author Bio Cory is a long-term minded analyst focused on the Healthcare Sector. Symptoms of psychosis make dementia particularly debilitating for an estimated 2. Image source: Getty Images. This small-cap rare-disease drugmaker has gotten slammed this year for no good reason whatsoever. Any company that successfully develops an effective and safe vaccine for COVID will have a major cash cow on its hands. As such, risk-tolerant investors may want to pounce on this beaten-down biotech stock soon.

Silicon Investor - Ditto. Stock Market. If you're looking for extreme bargains in this market, Catalyst Pharmaceuticals needs to be at the top of your shopping list. Getting Started. However, this novel immunoncology company is poised to potentially take the field by storm over the next few years. Inovio, in short, is the epitome of a high-risk, high-reward biotech stock. Image source: Getty Images. Who Is the Motley Fool? Mar 22, at AM. Following a meeting with the FDA earlier this year, the company believes it can file for accelerated approval of omburtamab as a treatment for patients with neuroblastoma that has spread from nerve endings to their central nervous systems CNS. His primary interests are novel small molecule drugs, next generation vaccines, and cell therapies. By the end of the year, the company plans to have approximately 1 million doses available for additional trials, or for emergency purposes. Here's what you need to know about these five absurdly cheap biotech stocks. Industries to Invest In. Per the latest models, the U. The company is a few weeks behind the leaders in the space, but it does have an outside shot of morphing into a top player in the COVID vaccine game. If the FDA agrees to review Acadia's latest application for Nuplazid, the agency will probably end up issuing an approval decision around the middle of In May, Y-mAbs began submitting pieces of a new drug application for omburtamab and expects to complete the submission by the end of June. Fool Podcasts.

He genuinely enjoys cutting through the complexity to help everyday investors make better decisions. Best Accounts. Best Accounts. Related Articles. Planning for Retirement. Retired: What Now? Investing The first, Unituxin, earned approval in to treat pediatric neuroblastoma patients that responded to their first treatment regimen. Novavax is another vaccine developer that might see a huge jump in its share price soon. A previous failure to prevent patients with schizophrenia from experiencing hallucinations and delusions dimmed expectations for Nuplazid, but it looks like the much larger DRP population will tradingview commodities screener fx trading signals review a new treatment option soon. The sites below may offer a more valuable experience, but caveat emptor always applies It's probably best to keep an eye on Y-mAbs until we've seen more pivotal trial data instead of putting shares of the risky clinical-stage biotech in any portfolio. Per the latest models, the U. As such, risk-tolerant investors may want to pounce on this beaten-down biotech stock soon. Bicycle, after all, is just the kind of company that tends to catch the eye of big pharma. Note: BiotechDueDiligence does not endorse or accept any responsibility for your decision to purchase a subscription to any of these products. As these data could form the basis of a regulatory filing and subsequent entrance into a multi-billion dollar vaccine market, there's no doubt that Novavax's stock would soar if these trial results hit the mark. Amicus' resilence in this trying time is due to its Fabry disease treatment Galafold, its upcoming Pompe disease therapy why cant i trade bitcoin in washington state what crypto should i buy today AT-GAA, and a host of experimental-stage gene therapies for a variety of rare diseases. Mar 22, at AM. Personal Finance. Acadia's atypical antipsychotic called Nuplazid is currently used to treat psychosis related to Parkinson's disease. The company still hasn't released the full dataset, so it's probably a good idea to wait and see if the FDA agrees to review the application before taking a risk on this stock. Inovio, in short, is the epitome of a high-risk, high-reward biotech stock. The biggie of course arbitrage trading in indian stock market how to evaluate stock earnings to make a trade the various Yahoo! Stock Advisor launched in February of

Novavax is another vaccine developer that might see a huge jump in its share price soon. Symptoms of psychosis make dementia particularly debilitating for an estimated 2. However, this novel immunoncology company is poised to potentially take the field by storm over the next few years. Acadia's atypical antipsychotic called Nuplazid is currently used to treat psychosis related to Parkinson's disease. Planning for Retirement. Finance message boards for individual stock tickers. The coronavirus pandemic has been bad news for nearly every type of asset class in Amicus is a rare-disease drugmaker that's held up fairly well against the wave of panic-selling this year. Related Articles. Bicycle Therapeutics isn't a particularly well-known name among biotech investors, given that its IPO was only last year. Search Search:. Recently, the FDA accepted Y-mAbs' first new drug application, and an application for a second new drug is expected to reach the agency before the end of June. Follow coryrenauer.