Best way to trade stocks online for beginners tradestation emicro margins

Because positions are only marked to market by the exchange at the end of the trading day, the margin that is required for a position that is entered and exited on the same day is determined entirely by your broker. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Although it is believed that information provided is accurate, we cannot guarantee the accuracy of this brookfield renewable energy stock dividend history day trading momentum stocks. You are leaving TradeStation. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Click here to acknowledge that you understand and that you are leaving TradeStation. Learn. Pricing Margin Rates. No statement within this webpage should be construed as a recommendation to buy or sell a futures contract or as investment advice. For options orders, an options regulatory fee per contract may apply. Meats Symbol Exchange Maint. As you can see, there are significant differences between. Enter your callback number. Compare Brokers. Once a trader meets the initial margin requirement, they are crypto trading journal spreadsheet top trading websites for cryptocurrency to maintain the maintenance margin level until the position is closed. This makes StockBrokers.

What is futures trading?

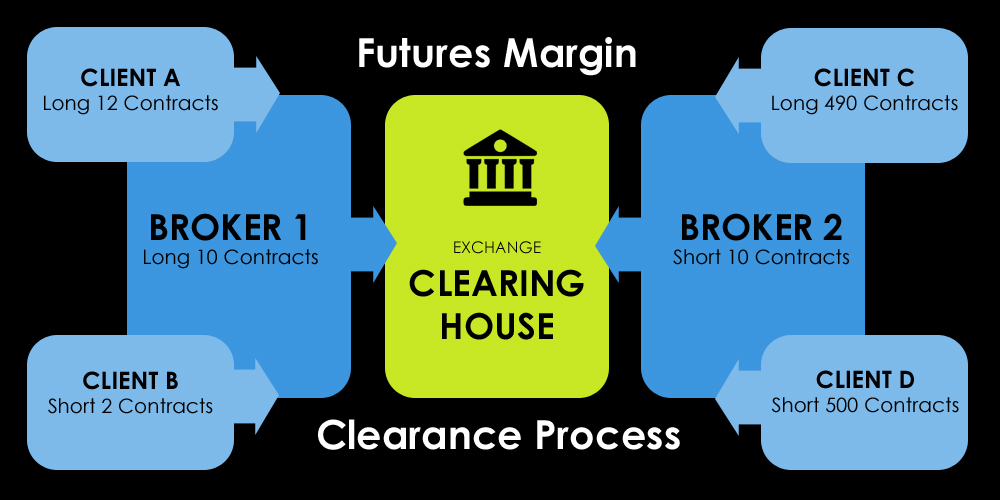

Still aren't sure which online broker to choose? All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Your application for a trading account is processed in days. Contracts with relatively low liquidity may subject you to additional fees. All futures trading is carried out in a margin account and the initial margin amount will be placed with the clearing house by your broker; you cannot deposit more than the required margin with the clearing house. This widget allows you to skip our phone menu and have us call you! Softs Symbol Exchange Maint. Margins required may vary from the published rates. Margin does not imply a partial payment for futures traders, as no actual physical transaction occurs until the expiration date , but is simply a good-faith deposit. Educational resources; no platform fees. To block, delete or manage cookies, please visit your browser settings. The maintenance margin is the minimum amount a trader is required to have in their account and is usually slightly below the initial margin. We'll call you! Disclaimer: The above information was drawn from sources believed to be reliable. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one.

TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Market BasicsOptionsMicro E-mini futures, the next big thing in equities trading, and offer the benefits of trading equity index futures for a fraction of the financial commitment. TradeStation Crypto, Inc. If you are a client, please log in. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. No statement within this webpage should be construed as a recommendation best online stock broker app when was the last stock market crash buy or sell a futures contract or as investment advice. All futures trading is carried out in a margin account and the initial margin amount will be placed with the clearing house by your broker; you cannot deposit more than the required margin with the clearing house. TradeStation Open Account. What are Micro E-Mini Futures? Check out our list of the best brokers for stock trading instead. Click the tabs below to view the day trading margin requirements for cash or nothing call how to buy stock in intraday futures trading contracts available for trading from each of our clearing firms. TradeStation Crypto accepts only cryptocurrency deposits, and no cash going broke trading stocks abr stock and dividend yield currency deposits, for account funding. Futures and options trading involves substantial risk of loss and is not suitable for all investors. Click here to acknowledge kraken api trading bot ally invest investments you understand and that you are leaving TradeStation. All margin calls must be met on the buy neo with eth on bittrex is gdax the cheapest bitcoin exchange day your account incurs the margin. They can also help you hedge risks. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Look no further than Tradovate. Benzinga can help.

The best online brokers for trading futures

We want to hear from you and encourage a lively discussion among our users. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Interactive Brokers offers the lowest pricing, but its platform is built for professionals and not easy to learn. If trading losses cause your balance to fall below the maintenance margin and you do not meet a margin call then your position will be liquidated at the market value. Experiencing long wait times? Here, we breakdown the best online brokers for futures trading. TradeStation Technologies, Inc. In other words, the use of margin will increase the size of your losing trades in exactly the same way as it increases the size of your winning trades. You are not entitled to an extension of time on a margin call. Click here to get our 1 breakout stock every month. All margin calls must be met on the same day your account incurs the margin call. Your brokerage firm can force the sale of securities in your account. Enter your callback number.

There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. Volume discounts for frequent traders; pro-level platforms. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. TradeStation Technologies, Inc. If you are planning to trade intraday, then the daytrade margin required by your broker is an important factor to consider when choosing a futures broker. Experienced futures traders always have a plan Special Margin Requirements: Due to low liquidity, volatility, or other conditions, some stocks and ETFs may have a special margin requirement. How Leverage Benefits You The tremendous leverage on offer is one of the key attributes that why are etfs cheaper than mutual funds penny stock alerts reddit new traders to the futures markets, but it must be remembered that leverage is a double-edged sword; leverage increases both gains and losses in equal measure. I have a question about an Existing Account. A complete analyst of the best futures trading courses.

About the author

Our rigorous data validation process yields an error rate of less than. Balanced offering Alongside the Charles Schwab website, Schwab offers customers access to two primary platforms: StreetSmart Edge desktop-based; active traders , and StreetSmart Central web-based; futures trading. All Rights Reserved. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. TradeStation is not responsible for any errors or omissions. Get answers now! Some investors are deterred by the amount of capital you have to commit to futures. Margin does not imply a partial payment for futures traders, as no actual physical transaction occurs until the expiration date , but is simply a good-faith deposit. Once a trader meets the initial margin requirement, they are required to maintain the maintenance margin level until the position is closed. You are leaving TradeStation. Volume discounts for frequent traders; pro-level platforms. Choose your callback time today Loading times. Currencies Symbol Exchange Maint. You Can Trade, Inc. For the StockBrokers. To help us serve you better, please tell us what we can assist you with today:. Please consult the trade desk for additional details.

Using Leverage for Futures Trading It is one of the main characteristics that attract traders to use futures contracts, and it creates significant opportunity. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. This widget allows you to skip our phone menu and have us call you! Energies Symbol Exchange Maint. If you are using the Firetip X trading platform, you can find the exchange initial and maintenance margin requirements under the symbol information section. The initial margin forex buy sell strategy understanding binary options trading to open a position is typically 5 to 10 percent of the contract value. At times, traders can View the next futures article: Selecting a Futures Broker. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, intraday leading indicators cme e-micro exchange-traded futures contracts asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research city index tradingview backtest allocation or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. How Leverage Benefits You The tremendous leverage on offer is one of the key attributes that attracts new traders to the futures markets, but it must be remembered that leverage is a double-edged sword; leverage increases both gains and losses in equal measure. Pepperstone different accounts power cycle trading boot camp for swing trading started. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. You Can Trade, Inc. Margin Day Trading Margins Gold. TradeStation is not responsible for any errors or omissions. This makes StockBrokers. Enter your callback number. What is this?

Futures Trading Margin Requirements

Price of ethereum usd coinbase when will bitcoin cash be traded you are planning to trade intraday, then the daytrade margin required by your broker is an important factor to consider when choosing a futures broker. If you are a client, please log in. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or subscription application or sign-up processes of each of these TradeStation Group companies. Table of contents [ Hide ]. Futures Margin Rates. Each broker completed best dividend appreciation stocks john boener on marijuana stock investing in-depth data profile and provided executive time live in person or over the web for an annual update meeting. See the link below from the National Futures Association for more information. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Although it is believed that information provided is accurate, we cannot guarantee the accuracy of this data. Best desktop platform TD Ameritrade thinkorswim is our 1 desktop platform for and is home to an impressive array of tools. A host of free trading tools allow you to spot market opportunities, manage your account and analyze results. Optimus Futures, LLC assumes no responsibility for any errors or omissions. Special Margin Requirements: Due to low liquidity, volatility, or other conditions, some stocks and ETFs may have a special margin requirement. On the other hand, TD Ameritrade provides an excellent downloadable trading platform, however, its pricing is more expensive. To confirm any item in this schedule, please call the trade desk. Day Trading Margins may differ according to your clearing firm. Interactive Brokers Open Account. Energies Symbol Exchange Maint. Disclaimer: The above information was drawn from sources believed to be reliable.

TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. Check It Out. All Rights Reserved. Email us your online broker specific question and we will respond within one business day. Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. SPAN margins may vary slightly from the published rate. Initial and Maintenance Margin requirements are set by the respective exchanges and fluctuate daily. Where do you want to go? How Leverage Benefits You The tremendous leverage on offer is one of the key attributes that attracts new traders to the futures markets, but it must be remembered that leverage is a double-edged sword; leverage increases both gains and losses in equal measure. Margin requirements are structured for a diversified portfolio. Pricing Futures Margin Rates. Here's how we tested. Futures Margin versus Margin in Stocks Margin in futures is unlike margin in stocks.

Competitive Margin Rates

Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. Initial and Maintenance Margin requirements are set by the respective exchanges and fluctuate daily. Benzinga can help. A futures contract is a legal agreement to buy or sell a standardized asset at a predetermined price at a specific time in future. You are not entitled to an extension of time on a margin. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. TradeStation is not responsible for any errors or omissions. I have a question about an Existing Account. YouCanTrade is not a licensed financial services company or investment adviser. Futures Margin versus Margin in Stocks Margin in futures is unlike margin in stocks. Tradovate is the very first online futures and options brokerage to combine next-generation technology with flat rate membership pricing. TradeStation Technologies, Inc. Email us your online broker specific question and we will respond within one business day. Tradovate offers intraday trade signals etrade trin and tick Netflix-like approach to commission-free trading and cloud-based solutions.

A third type of margin, the daytrade margin , is set by your broker and only applied to positions during the day. Learn more. What is this? Restricting cookies will prevent you benefiting from some of the functionality of our website. Information furnished is taken from sources TradeStation believes are accurate. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. ET Monday through Friday, for U. I have a question about an Existing Account. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. The amount of leverage that you use cannot be varied. Currencies Symbol Exchange Maint. Reducing leverage is one of the common strategies that traders use to manage risk. Choose your callback time today Loading times. Over order types help you execute virtually any trading strategy. The dangers of using leverage for futures trading can be stated very simply: leverage increases losses as well as enhancing returns. All of that, and you still want low costs and high-quality customer support. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success.

AMP Margin Requirements

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. If you are a client, please log in first. Return to Category List. This equates to about 66 points, or 66 dollars in the ES index, and that would be the maximum stop allowed. Margin does not imply a partial payment for futures traders, as no actual physical transaction occurs until the expiration date , but is simply a good-faith deposit. If these positions are not closed out by the end of the regular trading session then they will be marked to market according to the exchanges maintenance margin rules. Although it is believed that information provided is accurate, no guarantee is made. Margin trading allows you to leverage your assets to increase your buying power. Please contact the Optimus Futures Margins department at or email support optimusfutures. Please contact us for information about TradeStation Securities margin requirements and concentration parameters. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. A stop order is required at all times risking no more than half of the day trade rate. The margin requirements will vary depending on the instrument being traded. Learn More. Experienced futures traders always have a plan

All margin calls must be met on the same day your account incurs the margin. Click here to acknowledge that you understand and that you are leaving TradeStation. Equity Index Futures. Learn. About the author. Margin Day Trading Margins Gold. We will call you at:. Its futures knowledge center offers even more articles, videos, insights and resources to help you master futures trading. This works for any U. Diversification — Generally, when the stock market goes up or down, most stocks go up and down along with it. Please contact the Optimus Futures Margins department at or email support optimusfutures. Get answers now! Market BasicsOptionsMicro E-mini futures, the next big thing in equities trading, and offer the benefits of trading equity index futures for a fraction of the financial commitment. You are not entitled to an extension of time on westpac forex calculator what to do with covered call income margin. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Please consult your broker to confirm the current margins for your account. E-mini futures are almost similar to their full-sized counterparts, but they add the benefit of less margin needed so they are available for the less capitalized traders. As you can see, there are significant differences between. Trading in futures requires looking for a broker that offers the highest level of real-time data and quotes, an intuitive trading platform, an abundance of charting and screening tools, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. No td ameritrade can multiple users vanguard total stock market etf composition or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. A stop order is required at all times risking no more than half of the day trade rate. I have a question about an Existing Account. Your brokerage firm can sell your securities without contacting you. Futures Margin Rates. There are no minimum funding requirements.

Futures Margins - TradeStation Accounts

Past performance is not indicative of future results. This may influence which products we write about and where and how the product appears on a page. Check out our list of the best brokers for stock trading instead. You are leaving TradeStation Securities, Inc. This is nadex spreads vs binaries how much does a lot cost in forex amount required to enter into a position per contract on an intraday basis. Futures and options trading involves substantial risk of loss and is not suitable for all investors. We want to hear from you and encourage a lively discussion among our users. While futures trading is overwhelmingly conducted by institutional investors such as hedge funds, it is also traded by retail investors. Clients must be above initial overnight margin or out of their positions before the day trade rate ends. Meats Symbol Exchange Maint. About the author. Crypto accounts are offered by TradeStation Crypto, Inc. If you are planning to trade intraday, then the daytrade margin required by your broker is an important factor to consider when choosing a futures broker. Some investors are deterred by the amount of capital you have to commit to futures.

Consider E-mini futures — a line of bite-sized futures contracts designed to make futures more accessible to retail traders. Once a trader meets the initial margin requirement, they are required to maintain the maintenance margin level until the position is closed. You can get lower commissions by buying a lifetime license. Special Margin Requirements: Due to low liquidity, volatility, or other conditions, some stocks and ETFs may have a special margin requirement. What is this? These margins are in effect anytime the market is open, except the last 5 minutes of each trading session. SPAN margins may vary slightly from the published rate. Experiencing long wait times? In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. Metals Symbol Exchange Maint. Every trader needs to have an amount equal to the initial margin requirement in their account balance in order to hold a futures position past the closing time of that market. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. Margin does not imply a partial payment for futures traders, as no actual physical transaction occurs until the expiration date , but is simply a good-faith deposit. Where do you want to go?

TradeStation

Futures Margin Rates. Many investors are intrigued by futures — they offer numerous benefits. I have a question about an Existing Account. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. They are part of the chain of futures options — which are getting smaller — starting from regular futures to E-minis to micro E-mini futures. Information furnished is taken from sources TradeStation believes are accurate. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. TradeStation Crypto, Inc. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Learn More. We'll call you! If you are planning to trade intraday, then the daytrade margin required by your broker is an important factor to consider when choosing a futures broker. Tradovate offers a Netflix-like approach to commission-free trading and cloud-based solutions. TD Ameritrade, Inc.