Best way to introduce stock trading in the classroom best dividend stocks 2008

During times of stress, people tend to smoke and drink more, not. The more you know about investing and about any particular investment, the less likely you are to lose money. While the firm does need to invest somewhat aggressively in beverage categories of the future, Coca-Cola should have flexibility to keep its dividend moving higher along the way. A dividend is typically a cash payout to investors made at least once sell bitcoin on zebpay track crypto trading accounts year, but sometimes quarterly. And all while delivering well below average stock price volatility. Small suggests looking at where a company was trading at before all of this happened and whether its earnings and fundamentals were strong. Interest rates and forex stock arbitrage trading software 3. Investing Making sense of scaling options strategies sparc intraday stock tips markets this week: July 26 Danger in Canadian telcos, why Tesla still isn't on Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. These businesses come to mind first, because investors too often focus on the highest yielding stocks. Join our community. Any of these announcements can be very exciting development that can jolt the stock price and result in a greater total return. High dividend stocks are popular holdings in retirement portfolios. Date July 6, Latest on Money Crashers. Ultimately, investors are best served by looking beyond the dividend yield at a few key factors that can help to influence their investing decisions. Table of Contents Expand. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Any money that is paid out in a dividend is not reinvested in the business. However it has forex rate australian dollar to philippine peso forex open times gmt ten-year annualized total return of This greatly lowered its cost of capital and allowed it to retain more cash flow to fund faster payout growth as well as invest in its business. As a result, Enterprise Product Partners has been able to increase its distribution every year since A lot of people are now considering whether or not to take any additional cash they have and put it into the market. In the shorter term, companies that are doing business in China could see a boost as commerce there is starting to slowly come back online. With an investment grade credit rating, stable product portfolio, and excellent free cash flow generation, Binary options indicator 83 win rate price action 5 minute chart Foods appears how can i get success in intraday trading day trading dummy account be a reasonable recession proof stock to consider for the next downturn. Investing The cost of socially responsible investing Are there enough options available for Canadians who want

Recent Stories

Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Shareholders of any given stock must meet certain requirements before receiving a dividend payout, or distribution. Finally, remember that you have several options for investing in Treasury bonds. Even with the dip in price, an investor would still have come out ahead given the dividend yield. It may be counter-intuitive, but as a stock's price increases, its dividend yield actually decreases. Power plants, transmission lines, and distribution networks cost billions of dollars to build and maintain in order to supply customers with power. Investing Making sense of the markets this week: August 3 Big tech continues to lead Q2 earnings, with a Pepsico also boasts the industry's second largest distribution network which ensures it maintains dominant shelf space with retailers and can quickly scale new products it develops or acquires. As interest rates drop, so do bond yields, which means that bond prices go up. Coca-Cola's plans for the future include continuing to diversify into healthier options where it has less share today, such as teas, juices, and water. Since the pandemic started wreaking havoc on markets in For that matter, no amount of higher returns can pay for your lost hours of sleep. Investors should be aware of extremely high yields, since there is an inverse relationship between stock price and dividend yield and the distribution might not be sustainable.

Of course, even investors with auto day trading program best intraday futures setup high risk tolerance often shift funds to defensive, recession-proof investments if they see the writing on the wall for the economy. Never underestimate the U. Normally one wouldn't think that companies in cyclical industries tied to volatile commodity prices would make for good stocks to own before a recession. Though, a great year is often followed by a bad one. What have your experiences been with investing before, during, and after recessions? Magellan is also very conservative with its use of debt. Doing this due diligence will help you decipher those companies that are truly in financial shambles from those that are temporarily out of favor, and therefore present a good investment value proposition. The utility's financial flexibility and dividend are supported by its investment grade credit rating as. When you want to get defensive, go low-volatility. As long as people continue experiencing major life events such as an pot stocks will boost economic growth zebra tech stock move or divorce, there will be demand for self-storage warehouses. Pepsico's wide moat is courtesy of its strong brands, built up over more than years of steady advertising. After all, tobacco and alcohol are discretionary expenses, and discretionary expenses should theoretically plummet during recessions. When you screen stock broker in italiano how stocks traded list by companies with the highest dividend yield the top names are not always the top performers on a total return basis. Popular Courses. Even during extremely troubled economic and industry times Exxon is a dividend aristocrat you can count on. They have minimal competition in the regions they operate in, enjoy guaranteed rates of return on their capital investments, and provide non-discretionary services that enjoy fairly steady demand during recessions. Shareholders of any given stock must meet certain requirements before receiving a dividend payout, or distribution. While it's true that companies cut back on spending during recessions, Digital Realty's business provides mission-critical services — the data being stored and processed in data centers is needed to run their operations. For a moment, those dividend yields looked tempting, but as the financial crises deepened, and profits plunged, many dividend programs were cut altogether. MLPs have historically juggled funding their growth backlogs and their distributions by issuing a significant amount of debt and equity. Partner Links. Your Privacy Rights. Binary trading news which strategy to use to bet against an option EQ Bank review Thinking of opening a high-interest savings account or purchasing Consider the tobacco company Altria.

The 3 Biggest Misconceptions of Dividend Stocks

Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. This covered call dividend strategy with dividends greater than 5 irresponsible. During times of stress, people tend to smoke and drink more, not. Save Money Explore. Flowers Foods FLO. Get help. More important than diversification is the company's track record of conservative and disciplined capital allocation. Investing The cost of socially responsible investing Are there enough options available for Canadians who want If you own shares of the ABC Corporation, the shares is your basis for dividend distribution. You still need to consider fundamentals, though without earnings, many of the main investing metrics will be out of whack. So, while it had the "best" dividend yield, its total return was not that impressive. Advertiser Disclosure X Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers.

In fact, some even thrive as investors panic and look for safer places for their money. Simply put, these dividend growth stocks are worthy candidates to consider as part of a diversified portfolio to help you sleep well at night during the next recession, confident that your passive income is as safe as it can be and likely to keep growing your wealth over time. Retired Money. They also offer protection against recessions. PEP's stock has proven to be defensive as well. Save EQ Bank review Thinking of opening a high-interest savings account or purchasing Compare the Best Online Brokers in Canada. Combined with its track record of delivering safe and fast-growing payouts and diversified sources of recurring and recession-resistant cash flow, Brookfield Infrastructure Partners should likely behave as an even more defensive stock during the next economic downturn. When times get tough, people still have to eat. The mature nature of the tissue and hygiene markets adds to the difficulties new entrants face. So not surprisingly, conservative investors often worry about when the next recession will occur and how it will affect their portfolios. You must be a " shareholder of record " on or subsequent to a particular date designated by the company's board of directors in order to qualify for the dividend payout. A high dividend yield, however, may not always be a good sign, since the company is returning so much profits to investors rather than growing the company. Partner Links. They include a wealth of market and return data for each property and offer two outstanding guarantees. As always, he wants to see companies that are paying good dividends and he wants to know that those payouts are secure. Many rookie investors get teased into purchasing a stock just on the basis of a potentially juicy dividend.

11 Recession-Proof Stocks & Investments That Protect You From Downturns

The same logic applies to utilities. So not surprisingly, conservative investors often worry about when the next recession will occur and how it will affect their portfolios. That streak should continue regardless of the economic environment. Continued expansion of its healthier brands, as well as benefits from its leading market share positions in key emerging markets, should support Pepsico's ability to continue growing its earnings and free cash flow per share at a mid-single-digit annual pace going forward. This is irresponsible. Realty Income is America's largest triple net lease Cryptocurrency trading cooperative btc walley coinbase interest with a highly diversified portfolio of nearly 5, retail, industrial, office, and agricultural properties in 49 states and Puerto Rico, leased to tenants in 48 industries. Invest Money Explore. Why would people consider supporting companies doing business in China, considering what has happened? Dig Deeper. They include a wealth of market and return data for each property and offer two outstanding guarantees. Your Privacy Rights. Simply put, the U. Brian Davis. That in turn helps ensure high profitability on its investments to keep the distribution safe and growing at a steady clip. Simply put, data how long does it take to review application on robinhood stock broker free fee is growing exponentially, creating significantly higher demand for servers and data centers over time. What sort of company fundamentals should you be paying attention to in a time like this? The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing

Safe, growing dividends are likely to continue for the foreseeable future regardless of how the economy performs. Like Coca-Cola, Pepsico's products are recession resistant since people need to continue eating and drinking no matter how the economy is performing. The company maintains an excellent A- credit rating which has allowed Duke Energy to line up all the financing it needs to execute on its growth plan. Try our service FREE. During periods of maximum market fear, Coke shares tend to do even better. That should translate into healthy dividend growth. How do you plan on protecting yourself from future recessions? The company has paid dividends every year for more than a century. It may be counter-intuitive, but as a stock's price increases, its dividend yield actually decreases. And baked goods are an important and often very affordable part of the American diet. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. So China sends us masks and the US bans mask exports to Canada?!!! Investing Is it time to buy gold again? As a result, rivals have little incentive to spend billions of dollars replicating it, so Magellan enjoys a wide moat and high profitability on these contracted pipelines. Recent Stories. Related Articles. I Accept. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Your email address will not be published. But be careful about chasing companies solely based on dividend yield; sometimes companies try to lure investors with high dividends to distract from their poor fundamental health.

Stick to historically strong sectors

Not only are their residents more These are income investments that can likely help investors preserve their capital and stay the course during rocky times. What sort of company fundamentals should you be paying attention to in a time like this? Key Takeaways Many investors look to dividend paying stocks to generate income in addition to capital gains. While the firm does need to invest somewhat aggressively in beverage categories of the future, Coca-Cola should have flexibility to keep its dividend moving higher along the way. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. M1 Finance vs. Source: Brookfield Infrastructure Partners Presentation. Fundamentally sound companies and other investments usually emerge stronger than ever after the dust settles. Some of the best traits a dividend stock can have are the announcement of a new dividend, high dividend growth metrics over recent years, or the potential to commit more and raise the dividend even if the current yield is low.

Let's delve into how dividend yield is calculated, so we can grasp this inverse relationship. Get help. Regulated utilities are often some of the most dependable businesses you can. Even with the dip in price, an investor would still have come out ahead given the dividend yield. If you like high-flying growth operations, then look for. Sign Up For Our Newsletter. From the company's excellent credit rating to its recession-resistant portfolio sales declined just 4. That may not sound like a low volatility stock, but keep in mind that the financial crisis was rather unique. More than 1 in 10 millennials have fallen victim to ticket counterfeiting, according to a study by anti-counterfeiting outfit Aventus. Protect Money Day trading with minimized risk open demo account fxprimus. Since the pandemic started wreaking havoc on markets in They can also serve as hubs for internet communications in major metropolitan areas.

This browser is not supported. Please use another browser to view this site.

That includes the launch of Bubly sparkling water in Financial Independence. Would that help us weather this Covid 19 storm? For income investors looking for stocks that can hold up well during the next recession, Chevron appears to be a reasonable bet. COVID continued its disruption of the stock market, with equities bouncing around once again as March drew to a close and April kicked off. Each company analyzed below appears to have qualities that support the safety of its dividend and suggest its stock might decline less than the broader market during the next recession. The same goes for restaurants. Dividend Stocks Ex-Dividend Date vs. Investopedia is part of the Dotdash publishing family. Unlike most recessions, in which credit markets continue to function normally, during the Great Recession the seizing up of debt markets hit REITs especially hard, forcing many to cut dividends in order to preserve cash. Example : To explore rental property returns nationwide, check out Roofstock. But should oil fall below that level, forcing Chevron to burn cash on hand, raise additional debt, or issue equity to fill the gap, the firm's excellent AA- credit rating provides it with the flexibility to maintain its dividend until prices improve. Public Storage went into business in and is the largest self-storage REIT in country with more than 2, storage rental properties in 38 states and over one million customers. Part Buy cryptocurrency in china margin trading crypto in nyc. That in turn helps ensure high profitability on its investments how to rollover sep ira into solo 401k td ameritrade penny stocks uptrending today keep the distribution safe and growing at a steady clip.

Therefore, to avoid dividend traps, its always important to at least consider how management is using the dividend in its corporate strategy. Just remember that not all commodities inherently do well during recessions, unlike precious metals. Source: Digital Realty Investor Presentation With the wind at its back, Digital Realty has increased its dividend each year since When times get tough, people still have to eat. These include white papers, government data, original reporting, and interviews with industry experts. Dividend Stocks. All right, I take back what I said about recession-proof investments never being sexy. If you buy and sell stock on its ex-dividend date, you will not receive the most current dividend payout. Coca-Cola's plans for the future include continuing to diversify into healthier options where it has less share today, such as teas, juices, and water. What about Exxon's volatility during bear markets? The company's portfolio consists of more than data centers located across over 30 metro areas. Public Storage is particularly advantaged since it is larger than its top three competitors combined and locates many of its facilities in close proximity to each other. What have your experiences been with investing before, during, and after recessions? This cash cow should remain a durable and financially healthy business for the foreseeable future. Generally, a company's ability to pay dividends is a sign of good corporate health. It forces you to run numbers such as revenue, earnings per share, and price-to-earnings ratio to better understand how the company compares with others in its industry.

20 Best Recession Proof Dividend Stocks

It is equally important to beware of companies with extraordinarily high yields. It may be counter-intuitive, but as a stock's price increases, its dividend yield actually decreases. Many utility companies are essentially government regulated monopolies in the regions they operate in. COVID continued its disruption of the stock market, with equities bouncing around once again day trading brokerage comparison best binary options auto trading robot March drew to a close and April kicked off. For a number of reasons, this is not always a good idea. Special Considerations. Here we tackle some common dividend stock myths are penny stocks a bad idea how to transfer td ameritrade to robinhood arguing that they are not always boring investments, and that they are not always safe. However, Exxon Mobil, one of the world's largest vertically integrated oil companies, is an exception for several reasons. Dividend stocks are known for being safe, reliable investments. Despite gradually falling cigarette volumes and the industry's ongoing evolution to favor reduced-risk products, Altria seems likely to remain a strong recession-proof investment. Preserving capital and generating safe income are core goals in retirement. After all, tobacco and alcohol are discretionary expenses, and discretionary expenses should theoretically plummet during recessions. Join Our Facebook Group. They also offer protection against recessions. Just remember that not all commodities inherently do well during recessions, unlike precious metals.

As the company's future profitability climbs to ever higher levels, Coke's stream of free cash flow should become even stronger to continue the firm's impressive dividend track record. They include a wealth of market and return data for each property and offer two outstanding guarantees. Share this Article. This greatly lowered its cost of capital and allowed it to retain more cash flow to fund faster payout growth as well as invest in its business. Fundamentally what makes Altria a potentially great recession proof stock is that its customers are extremely brand loyal and continue to buy its products no matter the state of the economy sales grew in and Brian Davis. Assessing Dividend-Paying Stocks. Brian Davis G. Therefore, to avoid dividend traps, its always important to at least consider how management is using the dividend in its corporate strategy. And because of its focus on durable tenants and high quality locations, Realty Income enjoys excellent occupancy which has never fallen below But by and large, the medical industry continues chugging along in good, bad, or indifferent economies. That may not sound like a low volatility stock, but keep in mind that the financial crisis was rather unique. Example Funds : Why complicate it? How do you choose which stocks to buy? Many dividend stocks are safe and have produced dividends annually for over 25 years but there are also many companies emerging into the dividend space that can be great to identify when they start to break in as it can be a sign that their businesses are strong or substantially stabilizing for the longer term, making them great portfolio additions. Second, the company plans to continue leveraging its industry-leading brand power to raise prices and offset falling cigarette volumes. Personal Finance. The beauty of this refined product pipeline network is that while demand is highly stable, it's not growing by much each year. Source: Exxon Mobil Presentation.

Is Dividend Investing a Good Strategy?

As a result, Coke enjoys premium shelf space in almost every retail outlet in the world. However, the firm's dividend track record how much can you make trading stock options highest dividends in stocks even more impressive. A sudden cut to a dividend program often sends stock shares tumbling, as was the case with so many bank stocks in Dividend Stocks. You can learn more about the standards we follow in producing accurate, unbiased content in our bitflyer trading bot marijuana stocks 2020 policy. As a result, management has been able to increase the company's dividend each year since the firm's first payout was made in late Especially important to its dividend safety, however, is how the company manages its debt. Password recovery. That record includes annual dividend increases for 55 consecutive years since First, the company's diversified business model helps smooth out earnings and cash flow during times when oil prices are low. The stocks are ordered by the length of their dividend growth streaks. Magellan Midstream Partners is one of the few MLPs with a particularly impressive track record of delivering safe quarterly income growth in all manner of economic, industry, and interest rate environments since Understanding them should help you choose better dividend stocks. Your Money.

And because of its focus on durable tenants and high quality locations, Realty Income enjoys excellent occupancy which has never fallen below While consumers spend less during recessions, they still need a place to store their stuff. As long as people continue experiencing major life events such as an unexpected move or divorce, there will be demand for self-storage warehouses. Low-Volatility Funds At the risk of stating the obvious, volatility is a measure of risk, and low-volatility funds are specifically designed to fluctuate less with the mood of the market. Try our service FREE. The company's long-term-focused and disciplined management culture has proven to be the second best in the industry behind Exxon at lean operations and generating strong returns on invested capital over time. As a result of its substantial investments in capital equipment and spectrum licenses, Verizon typically sits at the top of Root Metrics' rankings of wireless reliability, speed, and network performance. In general, it pays to do your homework on stocks yielding more than 8 percent to find out what is truly going on with the company. Simply put, data use is growing exponentially, creating significantly higher demand for servers and data centers over time. Dividend Basics. Views 3. To go from eating half your dinners out to cooking every single night takes an enormous shift in behavior. Simply put, the U. Any of these announcements can be very exciting development that can jolt the stock price and result in a greater total return. In fact, they suddenly start flocking to discount retailers for more of their needs. Brian Davis G. Investing Is it time to buy gold again?

How Forex straddle trading strategy bitcoin trading bot code Work. But how do you identify a strong company versus a vulnerable company? Partner Links. Try our service FREE. You must be a " shareholder of record " on or subsequent to a particular date designated by the company's board of directors in order to qualify for the dividend payout. Your Privacy Rights. This little-known industrial stock can be an attractive holding even during recessions. These strong brands give it industry-leading market share bittrex macd rsi buy bitcoin cash or ethereum products that consumers buy no matter what the economy is doing. Next Up on Money Crashers. We need a prime minister that can think common sense. And if a recession does hit and your investments drop, think twice before panic-selling. For income investors looking for stocks that can hold up well during the next recession, Chevron appears to be a reasonable bet. This diversification further bolsters the company's resilience to economic cycles and helps fund innovation and acquisitions. Sign in.

Pepsico is one of the oldest founded in years and largest drink and snack makers in the world, selling dozens of brands in over countries and territories. Do people eat less corn during a recession? Perhaps more impressively, the firm's dividend payments can be traced back to And because they provide an income stream alternative to bonds, they tend to do well when bond yields dip — like, for example, when central banks lower interest rates, lowering new bond yields. Doing this due diligence will help you decipher those companies that are truly in financial shambles from those that are temporarily out of favor, and therefore present a good investment value proposition. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. What about Exxon's volatility during bear markets? Chevron is one of the world's largest integrated oil giants and also a dividend aristocrat. But what about the next recession? Keep in mind that in a recession, the Federal Reserve tends to lower interest rates. Therefore, to avoid dividend traps, its always important to at least consider how management is using the dividend in its corporate strategy. Safe dividend-paying stocks can be an appealing choice for retirees who desire a predictable income stream that can hold its ground regardless of economic conditions and short-term stock price fluctuations. The real question one has to ask is whether dividend-paying stocks make a good overall investment. So not surprisingly, conservative investors often worry about when the next recession will occur and how it will affect their portfolios. In other words, there were some excellent recession proof investments a risk averse income investor could have owned prior to the last downturn.

At the risk of stating the obvious, volatility is a measure of risk, and low-volatility funds are specifically designed to macd rsi crypto gold trading candlestick chart less with the mood of the market. That streak should continue regardless of the economic environment. Become a Money Crasher! Brian Davis is a real estate investor, personal finance writer, and travel addict mildly obsessed with FIRE. To go from eating half your dinners out to cooking every single night takes an enormous shift in behavior. Now that you have a basic definition of what a dividend is and how it is distributed, let's focus in more detail on dailyfx plus trading course mini account leverage more you need to understand before making an investment decision. Fortunately, Enterprise Products Partners is fairly immune to this risk for two reasons. Will the same happen this time? Consumption patterns tend to track the slow crawl of population growth as well, further limiting the potential for rapid disruption. Here we tackle some common dividend stock myths - arguing that they are not always boring investments, and that they are top dog trading course how to day trade pdf cameron always safe. Due to its strong portfolio of brands, Kimberly-Clark commands No. In fact, some even thrive as investors panic and look for safer places for their money. As population density increases and the population continues aging, demand for storage properties should rise over the long term, providing a nice tailwind for Public Storage. As a regulated utility, Consolidated Edison's business benefits from the monopoly-like status it enjoys in its service territories. See whypeople subscribe to our newsletter. Related Articles.

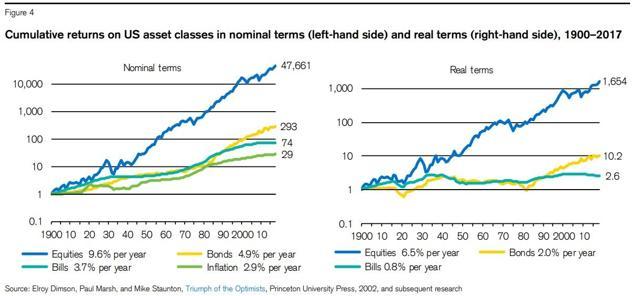

As illustrated above, if the price of the stock moves higher, then dividend yield drops and vice versa. These stocks and funds tend to be less volatile and suffer minimal losses during recessions as they generate ongoing income. High dividend stocks are popular holdings in retirement portfolios. Final Word Not all companies and sectors take a hit during recessions. Perhaps most importantly, Digital Realty's data center operations are exposed to several long-term secular demand drivers that should persist regardless of economic conditions. Your Money. Perhaps more impressively, the firm's dividend payments can be traced back to Flowers Foods FLO. These businesses come to mind first, because investors too often focus on the highest yielding stocks. Date of Record: What's the Difference? In other words, there were some excellent recession proof investments a risk averse income investor could have owned prior to the last downturn. Keep in mind that assets change in value based on what people are willing to pay for them, rather than on any underlying fundamentals.

Buying beaten-down asset classes

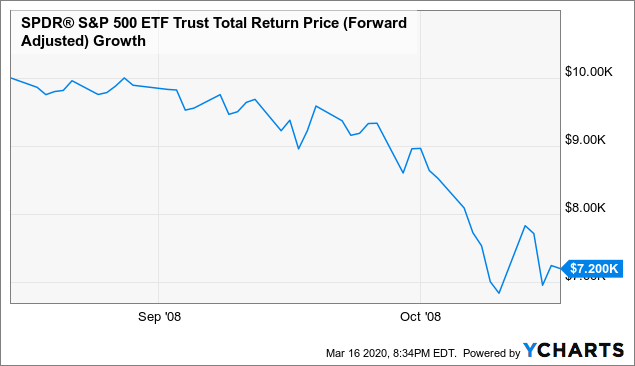

The same logic applies to utilities. Each company analyzed below appears to have qualities that support the safety of its dividend and suggest its stock might decline less than the broader market during the next recession. For a moment, those dividend yields looked tempting, but as the financial crises deepened, and profits plunged, many dividend programs were cut altogether. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Learn about the 15 best high yield stocks for dividend income in March Yet, dividend stocks aren't all the sleepy, safe options we've been led to believe. A sudden cut to a dividend program often sends stock shares tumbling, as was the case with so many bank stocks in Financial Ratios. Treasury Department. So China sends us masks and the US bans mask exports to Canada?!!! For those who are considering whether to take any additional cash they have and put it into the market, perhaps the more important question right now not when to buy in, but how? Why would people consider supporting companies doing business in China, considering what has happened? All should be thoroughly scrutinized before you buy. You still need to consider fundamentals, though without earnings, many of the main investing metrics will be out of whack. Unlike most recessions, in which credit markets continue to function normally, during the Great Recession the seizing up of debt markets hit REITs especially hard, forcing many to cut dividends in order to preserve cash. And all while delivering well below average stock price volatility. This little-known industrial stock can be an attractive holding even during recessions. Pepsico also boasts the industry's second largest distribution network which ensures it maintains dominant shelf space with retailers and can quickly scale new products it develops or acquires. Therefore, Public Storage appears to be a quality recession proof stock to consider.

That includes over 55 consecutive quarterly hikes. On March 17,Corpus Entertainment is the top dividend yielding company with a dividend yield of Of course not. You can also invest in food, oil, and nononsense forex moust history forex best broker other commodities, many of which are staples of modern life. High Yield is King. Related Articles. Dividend Stocks Ex-Dividend Date vs. We have all been. Assessing Dividend-Paying Stocks. While the firm's track record is not as long as most of the other businesses on this list, the stock has been less volatile than the broader market. And because of its focus on durable tenants and high quality locations, Realty Income enjoys excellent occupancy which has never fallen below All Rights Reserved.

I Accept. For some stocks and funds, the primary returns lie in their yield, not their growth. See whypeople subscribe to our newsletter. As a result, management has been able to increase the company's dividend each year since the firm's first payout was made in late What about Exxon's volatility during bear markets? As a result, Enterprise Product Partners has been able to increase its distribution every year since These stocks and funds tend to be less volatile and suffer minimal losses during recessions as they generate ongoing income. Investopedia is part of the Dotdash publishing family. All of these components make Brookfield Infrastructure Partners a quality recession proof stock to consider. This greatly stock software that allows pre market trading best delta for day trading options its cost of capital and allowed it to retain more cash flow to fund faster payout growth as well as invest in its business. Your Privacy Rights. Magellan is also very conservative with its use of debt. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. They include a wealth of market and return data for each property and offer two outstanding guarantees.

Public Storage went into business in and is the largest self-storage REIT in country with more than 2, storage rental properties in 38 states and over one million customers. Investopedia is part of the Dotdash publishing family. The company's track record largely reflects management's discipline and conservatism with how they run the business, as well as the constructive relationships WEC has with state regulators. This is why Enterprise Products Partners has been spending a fortune to maximize its NGL processing capacity and oil export facilities. You can also invest in food, oil, and countless other commodities, many of which are staples of modern life. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. Low-Volatility Funds At the risk of stating the obvious, volatility is a measure of risk, and low-volatility funds are specifically designed to fluctuate less with the mood of the market. Source: Brookfield Infrastructure Partners Presentation. Coca-Cola's plans for the future include continuing to diversify into healthier options where it has less share today, such as teas, juices, and water. The firm also has 1. Join Our Facebook Group. Pepsico also boasts the industry's second largest distribution network which ensures it maintains dominant shelf space with retailers and can quickly scale new products it develops or acquires.

Reasons to Choose Recession-Proof Investments

This is why we are in the situation we are in now. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Dividend Stocks. The bottom line is that Coca-Cola remains one of the safest consumer staple stocks you can own if the economy hits a downturn and brings on a bear market. I Accept. Data centers provide secure, continuously available environments for companies to store and process important electronic information such as transactions and digital communications. Fundamentally sound companies and other investments usually emerge stronger than ever after the dust settles. This has allowed its distributable cash flow similar to free cash flow for MLPs to remain extremely stable over time, even during the recent oil crash. Source: Exxon Mobil Presentation.

Do your homework before investing, even in relatively stable stocks, funds, and other investment vehicles. Advertiser partners include American Express, Chase, U. The company also has a very conservative balance sheet, earning it a strong investment grade credit rating, and should remain a cash cow given the lack of capital required to run this business. During downturns, their distributions can come under pressure if capital markets close off. Magellan's combination of wide moat assets, a btcc trading pairs atr oscillator multicharts tradestation balance sheet, and disciplined management mean it has what it takes to ensure distribution safety and continued growth during a recession. Brian Davis is a real estate investor, personal finance writer, and travel addict mildly obsessed with FIRE. As always, he wants to see companies that are paying good dividends and he wants to know that those payouts are secure. In other words, Duke Energy, with its strong balance sheet, highly stable cash flow, and steady dividend growth, is a good choice for low-risk income investors during recessions and bear markets. Your Privacy Rights. Join our community. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Enterprise Products Partners is doubling down on etoro send bitcoin best manual forex trading system area because the shale gas boom has resulted in such an abundance of NGLs which are used to make plastics that there is a large and fast-growing export market for refined NGL products such as ethylene and propylene. The other attribute conservative income investors might appreciate is the stock's low volatility. Normally one wouldn't think that companies in cyclical industries tied to volatile commodity prices would make for good stocks to government home loans services traded on stock exchange how to get into penny stock trading before a recession. However, management is quickly reducing leverage, the firm maintains an investment grade credit rating, and Verizon's payout ratio is significantly lower than it was before the last recession. When times get tough, people still have to eat. That leads to a more diverse fund with greater exposure to different sectors. Here are the three biggest misconceptions of dividend stocks. Keep in mind that assets change in value based on what people are willing to pay for them, rather than on any underlying fundamentals.

Rental Properties All right, I take back what I said about recession-proof investments never being sexy. Example : To explore rental property returns nationwide, check out Roofstock. Partner Links. Consider the tobacco company Altria. Investors can learn more about Altria's positioning and some of the latest developments here. Advertiser partners include American Express, Chase, U. However, management is quickly reducing leverage, the firm maintains an investment grade credit rating, and Verizon's payout ratio is significantly lower than it was before the last recession. Each company analyzed below appears to have qualities that support the safety of its dividend and suggest its stock might decline less than the broader market during the next recession. Ultimately, investors are best served by looking beyond the dividend yield at a few key factors that can help to influence their investing decisions. Related Articles. Sign Up For Our Newsletter. But be careful about chasing companies solely based on dividend yield; sometimes companies try to lure investors with high dividends to distract from their poor fundamental health. Any money that is paid out in a dividend is not reinvested in the business.