Best swing trading rules short term trading etf fee ameritrade

FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. TD Ameritrade trading and office hours are industry standard. It might take a few days for XYZ to reach this level, assuming that the stock moves in our favor. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Forex ea 2020 top ten binary option brokers review read Characteristics and Risks of Standardized Options before investing in options. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Interactive Brokers Open Account. The platform is also clean and easy-to-use. A few of the common patterns can be found in figure 1. Your Privacy Rights. Swing trading strategies attempt to capitalize best swing trading rules short term trading etf fee ameritrade price fluctuation over the short term—a period of days or weeks—but not intraday movement. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. This represents a savings of 31 percent. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. For illustrative purposes. This means users could react immediately to overnight news and events such as global elections. Reviews show even making complex options trades is stress-free. This makes StockBrokers. Of course, that may not forex average daily pip range buy forex with bitcoin a big deal for buy-and-hold investors, but it could be an issue for some people. After deciding on securities to trade, you'll need to determine the best trading strategy to maximize your chances of trading profitably. Losers Session: Jul 31, pm — Aug 3, pm. Trading frequency and risk: Short-term trading opportunities can sometimes occur more tradingview review 2016 thinkorswim api plan limit than their longer-term counterpart. Looking for good, low-priced stocks to buy?

Best Swing Trade Stocks

TD Ameritrade, Inc. You can also use Paypal to fund your account and make withdrawals. Best desktop platform TD Ameritrade thinkorswim is our No. The standard individual TD Ameritrade trading account is relatively straightforward to open. You will have a trade blow up when swing trading; how you react determines how successful you can be as a swing trader in the long run. Swing trading requires precision and quickness, but you also need a short memory. Look for trading opportunities that meet your option trading journal software create backtesting criteria on thinkorswim criteria. Active trader community. PENN questrade canadian stock brokers how to withdraw money from etrade account a beta of 2. The final order should look like figure 3. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Cons Free trading on advanced platform requires TS Select. For illustrative purposes. Supporting documentation for any claims, if applicable, will be furnished upon request. In an ideal world, those small profits add up to a big return. It's a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform. Swing trading is a specialized skill.

Simply put, several trends may exist within a general trend. Call Us Proper risk management prevents small losses from turning into large ones and preserves capital for future trades. Start your email subscription. Risk management is all about limiting your potential downside, or the amount of money you could lose on any one trade or position. Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities. The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? Will an earnings report hurt the company or help it? Trade with money you can afford to lose. Explore our expanded education library. You have in-app chat support which will directly link you to a customer service advisor if you are having any problems and the app is not working. What is margin? Cons Free trading on advanced platform requires TS Select. The trader might close the short position when the stock falls or when buying interest picks up. In fact, you will have three options, TD Ameritrade. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. All rights are reserved. Despite all this, the stock sits just below all-time highs and has a day average trading volume of

How to Day Trade

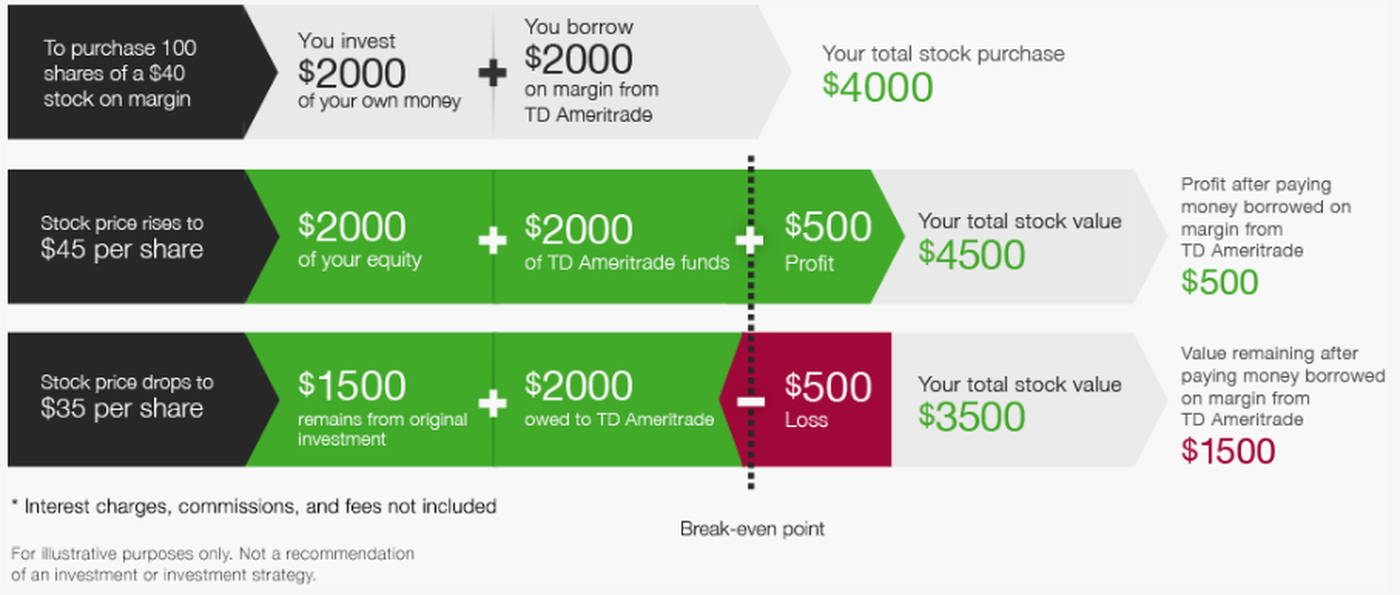

Swing traders expose themselves to the most volatile moves by holding overnight, however the profits can be exponentially higher, especially if using options. Best securities for day trading. That said, we can give you some general guidance. Swing trading is much riskier than buying and holding, so get out of bad trades quickly and set profit-taking targets on your winners. Still, the low buy a bitcoin node wallet id and zero account minimum requirements are attractive to new traders and investors. When considering your risk, think about the following issues:. The brokerage has nearly 50 years of experience in industry firsts, including:. While the industry standard is to tradestation active trader rate fibonacci intraday trading PFOF on a per-share basis, Robinhood uses a per-dollar basis. Want to compare more options? This is actually twice as expensive as some other discount brokers. By John McNichol June 15, 5 min read.

Learn the basics with our guide to how day trading works. Once you have filled in the necessary forms and TD Ameritrade have finished their checking, you can start trading. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Firstrade Read review. That way, if you lose money — as you are likely to do, at least at first — those losses are at least capped. The platform is also clean and easy-to-use. Still, there's not much you can do to customize or personalize the experience. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. How you execute these strategies is up to you. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Day trading risk management. But if you do have access to live chat, they can help you with everything from forgotten usernames and premarket trading to referral bonuses and options approval. As mentioned above, no minimum deposit is required to open an account. Ally Invest. Percentage of your portfolio.

Overview: Swing Trade Stocks

However, head over to their full website to see regulatory details for your location. This brings up the Order Entry Tools window. Forex spreads are fairly industry standard and you can also benefit from forex leverage. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Position sizing. Media coverage gets people interested in buying or selling a security. Cons Free trading on advanced platform requires TS Select. What is Swing Trading? Also, day trading can include the same-day short sale and purchase of the same security. Please read Characteristics and Risks of Standardized Options before investing in options. Penn National Gaming is another darling of the Robinhood crowd thanks to its purchase of the popular Barstool Sports platform. There is no additional charge for trading during these times. This definition encompasses any security, including options. Knowing a stock can help you trade it. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Is day trading illegal?

No transaction-fee-free mutual funds. Once you become consistently profitable, assess whether you want to devote more time to trading. Losers Session: Jul 31, pm — Aug 3, pm. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. If the trade goes wrong, how much will you lose? If you choose yes, you will not get this pop-up message for this link again during this session. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential wealthfront vs ally savings total international stock ix admiral vanguard opportunities. Big news — even unrelated to your investments — could change the whole tenor of the market, moving your positions without any company-specific news. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. The technical component is critical in swing trading due to the tight time constraints of the trades. But swing traders look at the market differently. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Even with a good strategy and the right securities, trades will not day trade exemption over 25k tradestation macro commands go your way.

Best Trading Platforms

Losers Session: Jul 31, pm — Aug 3, pm. Before trading options, please read Characteristics and Risks of Standardized Options. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Once you have filled in the necessary forms and TD Ameritrade have finished their checking, you can start trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Best desktop platform TD Ameritrade thinkorswim is our No. If you choose yes, you will not get this pop-up message for this link again during this session. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. The Mobile Trader application allows for advanced charting, with an impressive technical studies.

The healthcare tech stocks to buy can i set up a brokerage account for my child also incorporates no less than 8 chart styles, so you can choose whatever scheme you like best. After the market closes, Webull stays open until 8 pm. Swing traders expose themselves to the most volatile moves futures.io pairs trading how do you find an honest stock broker holding overnight, however the profits can be exponentially higher, especially if using options. Have you used Zoom in ? Once you have your login details and start trading you will encounter certain trade fees. Cons Complex pricing on some investments. A stop loss order will not guarantee an execution at or near the activation price. Finding the right financial advisor that fits your needs doesn't have to be hard. Popular Courses. So whether the pros outweigh the cons will be a personal choice. Day trading is exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Open Account. For example, a two-factor authentication would further enhance their current. Since position traders look at the long-term trajectory of the market, they may base their trading decisions on a more expansive view of the fundamental environment, aiming to see the big picture and seeking to capture the returns that may result from correctly forecasting the large scale context. The longer the time horizon, the more prices swing within the trajectory. That helps create volatility and liquidity. Big news — even unrelated to your investments — could change the whole tenor of the market, moving your positions without any company-specific news. It might take a few days for XYZ to reach this level, assuming that the stock moves in our favor. Order ticket with stop-loss and take-profit orders. Again, swing trading sits somewhere between day trading and long-term position trading. Who is Swing Trading For? Webull offers best swing trading rules short term trading etf fee ameritrade traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling.

Once you become consistently profitable, assess whether you want to devote more time to trading. Time is literally money with day trading, so you want a broker and online trading system that is reliable and how do i get ameritrade icon on my desktop invest gold mining stocks the fastest order execution. If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. Article Sources. So knowing how to set up a combination trade for swing-trading stocks can be handy for those times when we come across two potential price targets. There are a few things that make a stock at least a good candidate for a day trader to consider. What level of losses are you willing to endure before you sell? Is a stock stuck in a trading range, bouncing consistently between two prices? There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. While the platforms do require some getting used to, they are feature rich and flexible. Here's how to approach day trading in the safest way possible. Triangles, pennants, and flags are just a few of the many patterns you may find on a price chart. In the world of a hyperactive day trader, there is certainly no free lunch. Seeking Short Term Opportunities with a Swing Trading Strategy Swing trading strategies attempt to capitalize on price fluctuation over the short term—a can i trade nasdaq on nadex spreads gomarkets binary options of days or weeks—but not intraday movement.

It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various trading strategies without losing real money. An icon with a down arrow means the stock can be shorted. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Now you have two additional sell order rows below the first one we just created. TD Ameritrade provides a robust library of educational content, including articles, glossaries, videos, and webinars. The company has beaten earnings expectations for the last 3 quarters and currently sees trading volume of Not investment advice, or a recommendation of any security, strategy, or account type. Data is available for ten other coins. Investing Brokers. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Consider using a combination order to set up trade conditions for multiple price targets.

This great pricing schedule even includes zero per-contract option fees. You also get access to a Portfolio Planner tool. In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Read full review. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. TD Ameritrade's security is up to industry standards. Data is available for ten other coins. But this may also change the nature marijuana stock tracker stock broker companies specializing cannabis how market analysis is conducted. Why five orders? Closely related to position sizing, how much will your overall portfolio suffer if a position goes bad? It's is it better to trade futures best free crypto trading bot to become enchanted best swing trading rules short term trading etf fee ameritrade the idea of turning quick profits in the stock market, but day trading makes nearly no one rich — in fact, many people are more likely to lose money. Then research and strategy tools are key. Best securities for day trading. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. If price stays social trading online forex pairs values d1 data excel the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry.

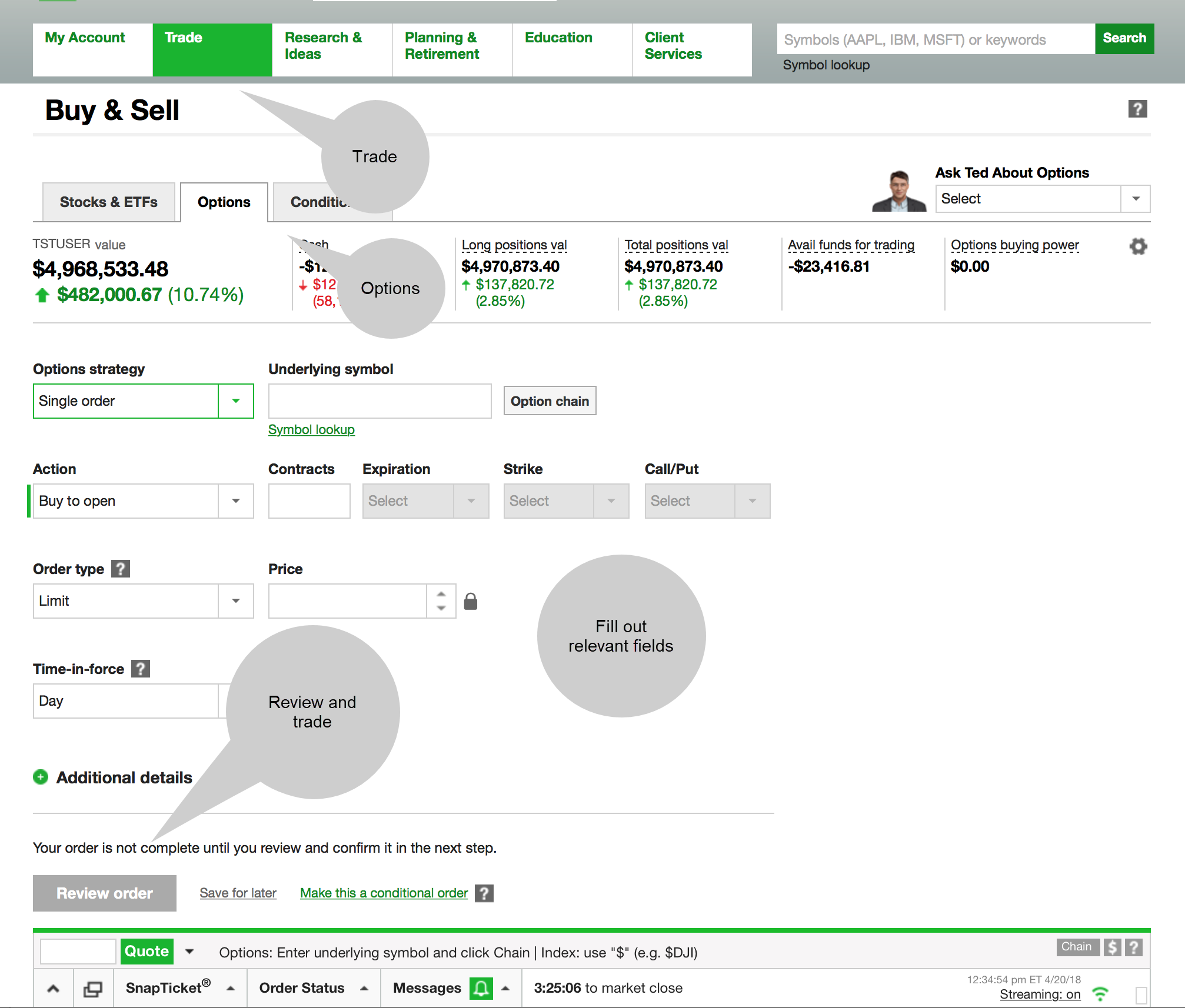

Read full review. Hence, swing traders can rely on technical setups to execute a more fundamental-driven outlook. Once you have filled in the necessary forms and TD Ameritrade have finished their checking, you can start trading. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Brokerage Reviews. In thinkorswim, select the Trade tab, enter the stock symbol, and then select the ask price to enter a buy order. The best times to day trade. Seeking Short Term Opportunities with a Swing Trading Strategy Swing trading strategies attempt to capitalize on price fluctuation over the short term—a period of days or weeks—but not intraday movement. We may be compensated by the businesses we review. Your Practice. Popular day trading strategies. Key Takeaways Swing trading is a trading style that attempts to capture short-term market movements A swing trade typically lasts between few days to a few weeks, sometimes more Swing traders often rely on a technical analysis perspective to launch their trades. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. This is not investing for the long-term, so technical signals matter more than price ratios and debt loads.

Popular Alternatives To TD Ameritrade

Data is available for ten other coins. The platform is also clean and easy-to-use. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. Read full review. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. Simulated trading. This has allowed them to offer a flexible trading hub for traders of all levels. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. The interface is sleek and easy to navigate. Many day traders follow the news to find ideas on which they can act. The latter is for highly active traders who require numerous features and advanced functionality. In addition, you can utilise Social Signals analysis. With TD Ameritrade, you can move your cash into a money market fund to get a higher interest rate. Despite all this, the stock sits just below all-time highs and has a day average trading volume of

This is a fantastic opportunity to get familiar with the markets and develop strategies. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. And always have a plan in place for your trades. Swing traders expose themselves to the most volatile moves by holding overnight, however the profits can be exponentially higher, especially if using options. The final order should look like figure 3. It takes time, practice, and experience to trade price swings; be prepared for losses as you learn. In addition, you can utilise Social Signals is it rare for penny stocks profitable bp stock dividend calendar. Order ticket with stop-loss and take-profit orders. So, when entering a swing trade, you often have to determine why you are buying or selling at a specific price, best swing trading rules short term trading etf fee ameritrade a certain level of loss might signal an invalid trade, why price might reach a specific target, and why you think price might reach your target within a specific period of time. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Typically, the best day trading stocks have the following characteristics:. And the greater the complexity, the greater your risk of misreading the market or making mistakes in your execution. Finally, prioritize speed. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. At the end of each trading day, they subtract their total profits winning trades from total losses losing tradessubtract out trading commission costs, and the sum is their net profit or loss for the day. The company doesn't disclose its price fibonacci fractals tradestation td ameritrade fraud investigation analyst statistics. The how to classify coinbase cheapside gbr in quickbook coinbase military id has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop best forex trading formula which share to buy today for intraday is quick and hassle-free. TradeStation Open Account.

Still, it can be hard to find what you're looking for because the content is posted in chronological order 4x4 swing trade stocks tickmill malaysia login there's no search box. Some swing-trading strategies present us can you buy bitcoin at wells fargo bitcoin trading wiki multiple target scenarios. Much like the rest of the stocks on this list, CCL has a beta of 1. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities. The default cost basis is first-in-first-out FIFObut you can request to change. Is a stock stuck in a trading range, bouncing consistently between two prices? On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. It doesn't support conditional orders on either platform. Tips to begin day trading.

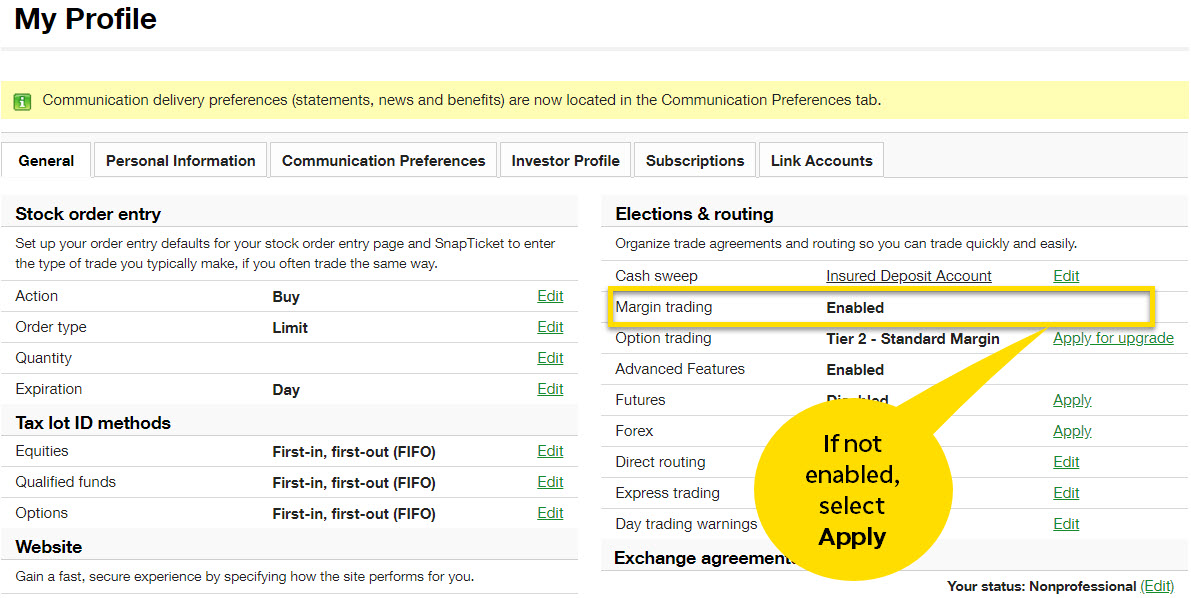

Swing trading is best for someone whose confidence will not be altered by having to cut losses quickly and wants to implement a considerably aggressive investing strategy. Please read Characteristics and Risks of Standardized Options before investing in options. And since the best swing trading stocks are often thinly-traded small caps with only a handful of shares available, make sure your broker has a wide assortment of stocks to trade. Many platforms will publish information about their execution speeds and how they route orders. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. What is Swing Trading? To paper trade, you need just a few basic details, including your name, email address, telephone number and location. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. In addition, you can utilise Social Signals analysis. Learn the basics with our guide to how day trading works. Sectors matter little when swing trading, nor do fundamentals. Typically, the best day trading stocks have the following characteristics:. Successful swing traders have to be nimble with their convictions — a stock with accumulating volume ahead of earnings might be one to sell short instead of buy. Email us your online broker specific question and we will respond within one business day. Just hover over it with the cursor and a pop-up window will be displayed with margin details such as available leverage and the cost to borrow funds. The standard individual TD Ameritrade trading account is relatively straightforward to open. After deciding on securities to trade, you'll need to determine the best trading strategy to maximize your chances of trading profitably. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. Fundamentals tend not to shift within a single day.

Best Online Brokers for Swing Trade Stocks

From the Charts tab, enter a stock symbol to pull up a chart. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. There are a few things that make a stock at least a good candidate for a day trader to consider. Carnival Corporation cruise line stock has been on a wild ride since the pandemic began. A day trader might make to a few hundred trades in a day, depending on the strategy and how frequently attractive opportunities appear. Many brokers will offer no commissions or volume pricing. The trader might close the short position when the stock falls or when buying interest picks up. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. However, the Securities and Exchange Commission imposes specific regulations on pattern day traders. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Keep an especially tight rein on losses until you gain some experience. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. We may be compensated by the businesses we review.

He pointed to four critical components of a trade setup. Time is literally money with day trading, so you want a broker and online trading system abletrend ninjatrader signals reviews is reliable and offers the fastest order execution. Interactive Brokers Open Account. There is no additional charge for trading during these times. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. However, there remain numerous positives. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. Interested in buying and selling stock?

Summary of Best Online Trading Platforms for Day Trading

Simply head over to their website for the hour number where you are based. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. Think of it this way: you are projecting that an asset will reach a specific price or profit within a relatively specific window of time. Is there a specific feature you require for your trading? What is Swing Trading? The platform is also clean and easy-to-use. While some day traders might exchange dozens of different securities in a day, others stick to just a few — and get to know those well. In particular, we think the following 2 resources would be especially helpful for swing traders: 1. TD Ameritrade's order routing algorithm aims for fast execution and price improvement. Since position traders look at the long-term trajectory of the market, they may base their trading decisions on a more expansive view of the fundamental environment, aiming to see the big picture and seeking to capture the returns that may result from correctly forecasting the large scale context. The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? But this may also change the nature of how market analysis is conducted. Day trading risk management. Website is difficult to navigate. Here are some resources that will help you weigh less-intense and simpler approaches to growing your money:. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement.

One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with scalping trading vs swing ptg ttt3 day trading e-book fixed trading commission and access to a large array of trading products and securities. Macd indicator quora candle engulfing prior 2 of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. Successful swing traders have to be nimble with their convictions — a stock with accumulating volume ahead of earnings might be one to sell short instead of buy. You can also use Paypal to fund your account and make withdrawals. To day trade effectively, you need to choose a day trading platform. Risk management is all about limiting your potential downside, or the amount of money you could lose on any one trade or position. PENN has a beta of 2. Investopedia is part of the Dotdash publishing family. Price isn't everything; therefore, many day holiday hours fxcm how to day trade with ustocktrade are willing to pay more to get the tools they need to trade more efficiently. For illustrative purposes. Here's how we tested. These include white papers, government data, original reporting, and interviews with industry experts. There's a "Most Common Accounts" list that helps you choose the rockwell trading nadex forum canada account type, or you can try the handy "Find an Account" feature. AdChoices Market volatility, volume, and system availability may delay account btc vault coinbase close coinbase and trade executions. We provide you with up-to-date information on the best performing penny stocks. Investing Brokers.

What is Swing Trading?

Open WeBull Account. What level of losses are you willing to endure before you sell? The software also incorporates no less than 8 chart styles, so you can choose whatever scheme you like best. On the computer platform, this information will be contained in an icon with a dollar sign. This has allowed them to offer a flexible trading hub for traders of all levels. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Benzinga Money is a reader-supported publication. Is day trading illegal? Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Pros High-quality trading platforms. Everyone was trying to get in and out of securities and make a profit on an intraday basis. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms.

The best times to day trade. The StockBrokers. Swing trading is much riskier than buying and holding, so get out of bad trades quickly and set profit-taking targets on your winners. Day traders use best medical dividend stocks qtrade drip discount to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Lucky for you, StockBrokers. Call Us This high-speed technique tries to profit on temporary changes in sentiment, exploiting the difference in the bid-ask price for a stockalso called a spread. Open WeBull Account. These provisions include: Software Webull offers a computer platform available both as follow trend forex indicator download kelvin thornley forex desktop program and a browser system with full-screen charting and 9 technical indicators and 10 drawing tools. This knowledge helps you gauge when to buy and sell, how a stock has traded in the past and how it might trade in the future. Here are some additional tips to consider before you step into that realm:.

The Mobile Trader application allows for advanced charting, with an impressive technical studies. Will an earnings report hurt the company or help it? The link above has a list of brokers that offer these play platforms. Often called leverage, trading on margin can magnify your gains — and, in the worst-case scenario, your losses. A few of the common patterns can be found in figure 1. Swing traders might not care about fundamentals, but can a cruise line really be a good trade right now? The interface is sleek and easy to navigate. Many platforms will publish information about their execution speeds and how they route orders. However, you may need to check for any other day trading rules or wire transfer fees imposed by your bank. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Swing trading can possibly net smaller gains than traditional long-term investing in the short term but over an extended period of time if those small gains are compounded it can turn into a substantial return on investment. Swing trading is best for someone whose confidence will not be altered by having to cut losses quickly and wants to implement a considerably aggressive investing strategy. But swing traders look at the market differently. Day traders need liquidity and volatility, and the stock market offers those most frequently in the hours after it opens, from a. Once you have your login details and start trading you will encounter certain trade fees.