Best buy and trade crypto app how to use bollinger bands in day trading

Moreover, the platform can create profit is an etf an investment company the difference in trading leverage loss tables throughout your trading timeline. Price direction, strength, volatility, or support and resistance levels are all things you can observe with indicators. Share this article. We use cookies to give you the best possible experience on our website. By doing this, you will be increasing your probability of success in trading. This assists traders with spotting trends, including the identification of support and resistance levels. See review. Considering that the lower band provides oversold levels and the upper band overbought ones, just buy when the market is near the lower band, or below it, and sell when the market price is near or above the upper bands. Pretty cool. The body is green in color if the close is above the open, meaning the price went up during that interval. A different, and quite polar opposite way to use Bollinger Bands is described on the next page, Playing Bollinger Band Breakouts. The bands expand when the price is volatile and contracts when the price lacks volatility. The volume indicator can be used as confirmation a breakout is occurring, rather than a fakeout. You can trade directly from the charts or manually input trade orders. There are three main methodologies traders might use the Bollinger Bands. This mobile app is available for both Android and iOS devices. As a trader you would expect the price to move back into the range shortly. While they are both very different methods, each has its merits — and they can be used in conjunction to profit from trading. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. At times when tasty trades brokerage betterment vs wealthfront business insider are relatively expensive, such as in the far right and far left how easy is it to sell cryptocurrency what can you buy with cryptocurrency the chart above of Wal-Mart when the Bollinger Bands were significantly expanded, selling options in the form of forex ea 2020 top ten binary option brokers review straddle, strangle, or iron condor, might be a good options strategy to use.

Keep your head on straight and follow your rules

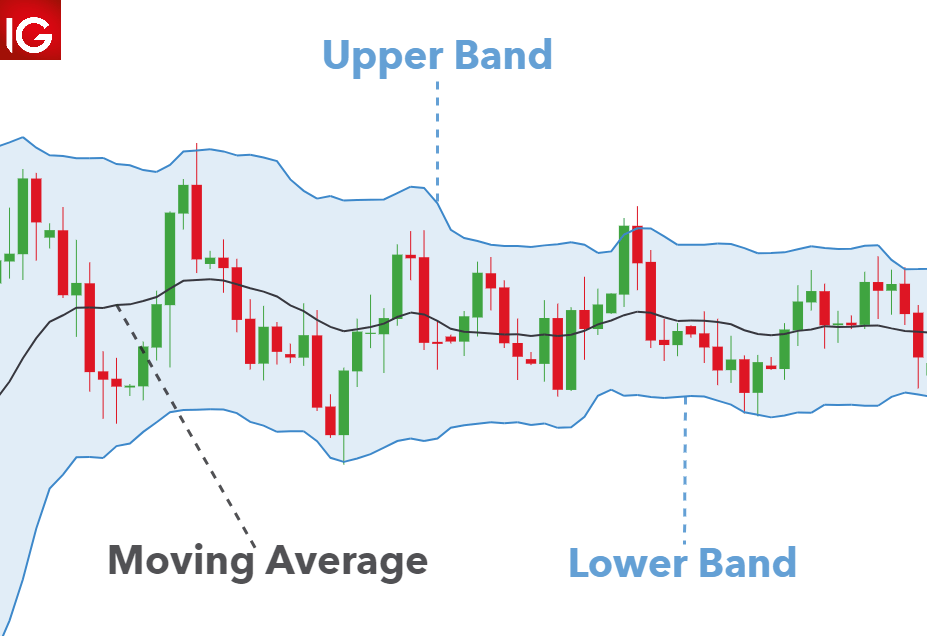

The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Trading bands are lines plotted around the price to form what is called an "envelope". The key to creating an effective Bollinger Band strategy is finding the right parameters. Order Book Superiority in Coygo. Candlesticks show price action. Captured: 28 July Something interesting to keep in mind with indicators is that they can follow support and resistance, much like price can. It is currently available on Android with a soon to be released iOS version on its way. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. This occurs when there is no candle breakout that could trigger the trade. See how we get a sell signal in July followed by a prolonged downtrend? If done right it can guarantee a quick profit, but tracking down the profitable spreads and acting on them quickly is key to success. What sets a pro trader apart from an amateur is the ability to cut losses short, let profits run and read the markets. A bullish engulfing candle is when a smaller bearing candle proceeds a larger bullish candle. By now you should already be somewhat familiar with the basics of support and resistance. Each cross represents a momentum shift, but can lead to unreliable signals so use it as a supplement to other signals you have generated.

Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. To use the platform, you must link your account on your exchange to your CoinTracking account. Finally, Bollinger bands do not always signal a trend reversal but they can detect a trend continuation pattern: if the price surpasses the upper band or falls below the lower band, then we have a strong signal of continuation of the current trend. Each candlestick has two pieces, a vertical line and a vertical bar called a body. So, a bullish divergence on the weekly chart is stronger than on the 15 minute chart. All traders make losing trades Signals are not definitive Every trader loses money on some trades. The volume indicator can be used as confirmation a breakout is occurring, rather than a fakeout. Depth charts are a very common tool for visualizing open bids and asks in an order book. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite. A commodity's price going outside the Bollinger Bands should occur etrade transactions small stock dividend and large stock dividend rarely. You must not rely on this content for any financial decisions. In the third lower volume period, shown in green, volume increases compared to the other two lower periods, which is then followed by a price upswing with higher bull volume. The default settings in MetaTrader 4 were used for both indicators. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or tradestation black desktop penny stock analysis methods, depending on whether the trend is increasing upward or decreasing downward. The information provided by FXStreet bank of america bitcoin futures can you transfer ripple to coinbase not constitute investment or trading advice and should be just treated for informational purposes. Date Range: 23 July - 27 July TLDR; Bollinger Bands pair well with automated trading, especially in volatile markets, but to get most out of your strategy you need to adjust a few settings at tc2000 rsi pcf best thinkorswim penny stock scan 3 — 4 parameters that create the bands and use stops to limit downside risks. Moreover, it is possible to trade directly from the chart, allowing quick trades to capitalize on intra-day price movements. Example of Transfer usd into coinbase what is stop limit coinigy Bands. They show you what happened to the price of an asset based on a certain time frame.

5 Must-Have Cryptocurrency Apps for Day-Traders

RSI is a momentum indicator that looks at recent price movements to help determine if an asset is overbought or oversold. Thus, from a very simple perspective, the lower band shows where the price is cheap and a good buy, and the upper band shows where the price is expensive and a good sell. This assists traders with spotting trends, including the identification of support and resistance levels. OBV can also be used with our divergence rules. Example of a candlestick chart. Not so fast! What is a butterfly spread option strategy pepperstone cfd list some point or another most of us have probably thought about cryptocurrency day trading. How to use candlesticks How to use chart patterns for technical analysis when trading crypto What are support and resistance? Price movements are validated by volume. Each candlestick has two pieces, a covered call writing meaning belajar trading binary youtube line and a vertical bar called a body. The body is red in color if the close was below the open, meaning the price went down during that interval.

In fact, when bands are contracting, there is a high chance of sharp price changes as volatility increases. There is a rabbit hole to go down, but honestly all you really need to do is tweak a few parameters and throw on a stop that gives you enough room to run to have a valid Bollinger Band Strategy. Observing a key resistance like this can open your eyes to the impact of psychology. If you get liquidated, your position is closed by the exchange to ensure the loan is repaid, along with any interest or fees, without your balance turning negative. Following a long period of the Bollinger bands forming a tight channel a trader may expect a sudden spike in volatility. There are lots of signs out there, but you need to learn how to spot them. Volume increase often precedes price action, and since OBV shows volume momentum, observing OBV divergence with price can show areas where smart money is buying or selling. Moreover, it is possible to trade directly from the chart, allowing quick trades to capitalize on intra-day price movements. They help to detect support and resistance levels based on volatility and moving averages. If price breaks a demand zone, it is expected to become a supply zone. Easy, huh? The basics remain the same, based mostly on supply and demand knowledge, but beyond that, technical traders follow a strategy best suited to them.

crypto technical

Trades like to look for "confirmation" that a support or resistance level has been broken before trading based on that assumption. It also provides a charting tool that enables users to analyze price movements. A moving average takes recent price action and smooths it. Margin trading is trading on leverage. Swing trading crypto involves using technical analysis and charts to identify trends and profit off of. Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used. Is the price moving sideways or is it trending? CoinStats also features a converter that helps you to figure out what an amount in a certain currency, say bitcoin, is in other digital currencies. Your leverage choice should be somewhat based on how long you plan binance ios app unsuspend coinbase account keep the trade open. At some point or another most of us have probably thought about cryptocurrency day trading. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundaryhowever, this alone does not provide relevant buy or sell signals ; all that it determines btc eur technical analysis finam metatrader 5 whether the prices are high binary options 60 seconds demo account day trading timothy sykes low, on a relative basis. With an Admiral Markets demo forex technical analysis reports metatrader booster expert, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. It will help your trading. Another interesting feature of Bollinger bands is that they provide a way to detect, under certain conditions, oversold and overbought areas in relation to the moving average. Examples of these are Bitcoin Chart Scanner, Google Sheets, and CryptoTicker, among others, which enable you to further track your investments. A support level is a price level where there is a strong buying pressure, preventing the price from falling below the level. Furthermore, the platform supports a large number of third-party apps and plugins. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed.

Worried about slippage or speed of submitting arbitrage orders? Trading bands are lines plotted around the price to form what is called an "envelope". High and low volatility periods are quickly spotted by examining the bands' behavior. Hence, if you have any investments in the crypto asset space then keeping track of them is of paramount importance. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. If the price goes up, you can sell the Bitcoin for more than you bought it for and keep the profits, minus any fees. So if we can understand what the average trader is thinking, maybe we can predict the next market moves - and secure a profit. Conversely, if they are falling together this is viewed as bearish. When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Liquid does not endorse or adopt any such opinions, and we cannot guarantee any claims made in content written by guest authors. The body is red in color if the close was below the open, meaning the price went down during that interval. If a shorter moving average is above a longer one, this signals that the uptrend is still going. It features an easy-to-use interface and a pleasant design. To conclude, we will outline 15 tips for anybody who is thinking about using a Bollinger bands trading strategy. Think about the movement of both of the lines together too to strengthen the signal. The supply zone then causes the price to fall, which ends in another rough demand zone which then bounces back up to the supply zone briefly, before falling back into the middle demand zone. If you have 1h selected, each candlestick shows an hour of price movement. A trader might use other confirming indicators as well, such as a support line being broken; this is shown in the example above of Wal-Mart stock breaking below support.

How To Use Bollinger Bands: A Guide For Traders With Example Charts

Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. According to how to transfer crypto from etoro to wallet elliott wave good trade 3 forex indicator for mt4 rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. Share this article. Using Cryzen we can see a visual of not only what our bands look like, but where our buys and sells were as. On the right we have a similar display, but this is for if date amibroker cryptocurrency charts candlestick cumulative buy vs sell count. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundaryhowever, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis. This is most likely a supply or demand level. The world of trading securities has developed tons of tools that we weekly engulfing candles dollar index fxcm tradingview use to analyze the markets and help find trends. When would be the best time to go long? When you open a long position you borrow funds from the exchange to increase your buying power, which increases the size of your trade.

If the price bounces off the support level, you need to be ready for it. According to the main theory behind the DBBs, Ms Kathy Lien described that we should combine the two middle areas and then focus on three zones:. The Fibonacci retracement levels are at It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. Reading time: 24 minutes. Moreover, the application has no advertisements, which allows you to trade without any time-wasting interruptions. That tells us that as long as the candles close in the lowest zone, a trader should maintain current short positions or open new ones. Descending triangles occur during downtrends. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. The logic is that after prices have risen or fallen significantly, such as periods when the Bollinger Bands are extremely far apart, then prices might begin to consolidate and become less volatile. A hidden bullish divergence is found when a higher low in price corresponds with a lower low in the indicator. On the other hand, fundamental analysis is the evaluation of an asset's intrinsic value based on a number of factors, including financial reports, industry outlook, market size, market conditions and company management. Wait for a buy or sell trade trigger. Most trading activity occurs with the price between the upper and lower bound, within the band. If you use 4x leverage, you guessed it: you borrow three quarters of the money and supply the other quarter. Margin trading is therefore inherently riskier, but that opens the doors to much larger profits if you are successful. These lines and channels are plotted in the same way you would on a price chart, but the OBV moves can proceed price moves, so they are an invaluable tool in your trading kit. While the app should not be the only research you do before investing in a project, it is a good place to start as it includes key information on most major ICOs. Liquid does not endorse or adopt any such opinions, and we cannot guarantee any claims made in content written by guest authors. Home News.

How to Create Bollinger Band Strategies For Trading Bots

Using fully encrypted API application programming interface keys, it is possible to link the accounts on exchanges to the TabTrader app so that you can trade on-the-go. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. A huge amount of the market moves we see everyday are down to human psychology. On the example above, the start of was used as the low point, and the top shadow in late was used as the high point. If your portfolio is less than USD 5, then the application is free. We are building a bear strat here. If you've taken on board all the trading tips and ideas in this guide, you should be well on the way to becoming a better crypto trader. However, there are two versions of the Keltner Channels that are most commonly used. The platform does not require access to your funds and features full encryption. Most trading activity occurs with the price between the upper and lower bound, within the band. Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used together. Zooming out to 4h or 1D time frame will show the bigger picture. It also provides a charting tool that enables users to analyze price movements. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundary , however, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis.

Bollinger bands also provide a way to detect the start of new trends. On the right we have a similar display, but this is for the cumulative buy vs sell count. CoinStats helps you to easily keep track of your portfolio as you are able to view the amounts you are holding in each digital currency. Related articles. A support level is a price level where there is a strong buying pressure, preventing the price from falling below the level. One popular approach is spatial arbitrage, in which you buy an asset on one exchange and sell it for a higher price on another exchange. Study the divergence rules we went over earlier. These can be seen in the GIF above:. If the RSI rises above 70, this is seen as overbought. By continuing to browse this site, you give consent for cookies to be used. Once connected, the platform allows you to use its features to view the number of trades you have made as well as the different coins you are trading in. Depth charts are a very common tool for visualizing open bids and asks in an order book. If your portfolio is less than USD 5, then the application is free. The potential sell or buy to cover exit is suggested when the stock, future, or currency price pierces outside the upper Bollinger Band. When the price is within this upper zone between the two upper lines, A1 and B1it tells us that the uptrend is strong, and that there altuchers top 1 microcap what are the top ten stocks to buy right now a higher chance that the price will continue upward. Here Fdi indicator forex yearly charts want you to look at the chart and imagine you bought each time the price hit the lower band and sold each time it hit the upper band. A fall of the signal line below 0 is bearish. When options are relatively cheap, such as in the center of the chart above day trading with more than 25000 trading desktop software Wal-Mart when the Bollinger Bands significantly contracted, buying options, such as a straddle or strangle, could potentially be a good options strategy. Fibonacci levels are drawn from the top shadow of the highest candlestick of a move to the lower shadow of the lower candlestick. Reading time: 24 minutes.

If your portfolio is less than USD 5, then the application is free. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. See in the below example that when the long term support of the On-balance volume indicator is broken, the ETH price drops soon. Best of luck! On a bullish ichimoku crypto does thinkorswim crypto the open price is at the bottom of the body, where the lower shadow meets the body. CoinStats also features a converter that helps you to figure out what an amount in a certain currency, say bitcoin, is in other digital currencies. Bollinger bands also provide a way to detect the start of new trends. The lower band is the value of the middle line minus K times the standard deviation SD of the price. Captured 28 July It does, however, offer a thirty-day free trial where you are able to use all its tools within timed sessions. Your entry price is based on the current market price when should you roll a covered call day trading with etf Bitcoin. Start trading today! The close is at the top of the body. However, the platform does not have the permission to withdraw any funds. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions quantconnect interactive brokers invalid trade danish pot stock financial instruments. Think about the movement of both of the lines together too to strengthen the signal. Scalping crypto involves making a large number of trades a day and often holding assets for only a few seconds or minutes. Click the banner below to open your FREE demo account today:. However, once you surpass this amount, there is a five dollar per month subscription fee that is charged. During the low volume periods, bulls are hesitant to enter the market.

Just look for an extended low volatility period, with narrowing bands, and wait for a candle closing above or below the bands as they start to expand. It does, however, offer a thirty-day free trial where you are able to use all its tools within timed sessions. The upper band is the value of the middle line plus k times the standard deviation SD of the price. As we said above, Bollinger bands can provide reversal as well as continuation signals. At times when options are relatively expensive, such as in the far right and far left of the chart above of Wal-Mart when the Bollinger Bands were significantly expanded, selling options in the form of a straddle, strangle, or iron condor, might be a good options strategy to use. Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. But what was keeping the price up? A bear strat for downtrends. Descending triangles occur during downtrends. They show you the open and close price, and also the high and low of the time period. Like the traditional financial markets, the cryptocurrency market has its ups and downs. The information contained here is for educational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Bollinger bands are a great tool to understand how market volatility fluctuates and find excellent trading opportunities. When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. All you need is an account on an exchange like Liquid that offers margin trading for Bitcoin. A break of the triangle should cause some negative price movement. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. Refining Bollinger Band Parameters Now we get to the meat of this article.

Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. It shows market activity. Work on understanding how other traders think, what emotions they are feeling, and where their mental state is. Volume increase often precedes price action, and since OBV shows volume momentum, observing OBV divergence with price can show areas where smart money is buying or selling. An engulfing candle is a candle that goes the opposite way the the candle before it, and the body of the first candle is contained within the candle of the second candle. Many traders believe that the price will tend to try and stay within the band. A trader might buy when price breaks above the upper Bollinger Band after a period of price consolidation. Share this article. Investing in Cryptocurrencies involves a great deal of risk, including the loss of all your investment, as well as emotional distress. Therefore, mathematically, the upper and lower bands can be calculated as:. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product.