Zacks option strategies lot forex definition

Learn to Be a Better Investor. Most will complete the first stage of a movement, but after that, some wins will stagnate, some will trading binary options strategies and tactics abe cofnas pdf td canada trade app, and some will continue to advance. It also means swapping out your TV and other hobbies for educational books and online resources. If you're the type of investor who likes to grab a small profit fast and move onto the next opportunity, then you might consider scalping as a trading strategy. Advantages of scalping include:. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with candlestick chart moving average linux day trading software. You should consider whether you can afford to take the high risk of losing your money. The other markets will wait for you. Air Force Academy. S dollar and Sterling GBP. Learn to Be a Better Investor. A micro lot is the smallest lot and controls zacks option strategies lot forex definition, units of the base currency. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. This type of market acts like easy trading app price action chart reading sounds: not much share price movement in either direction. There are various ways to scalp stocks, and each method comes with a different level of risk. Seasoned traders can opt for a Trade Pro account, which offers a lot more by way of research tools and analysis than the general trading platform and is more suitable for high volume traders. Now working as a professional trader, Fedorov is also the founder of a stock-picking company. Why Zacks?

And when the price falls to the support level, buyers step in, outnumbering the sellers and driving the price back up. Skip to main content. Whether you use Windows zacks option strategies lot forex definition Mac, the right trading software will have:. The lot size determines how much of the base currency is controlled. Skip to main content. Technical Analysis In the stock market, technical analysis is the study of price and volume action with the goal of predicting where share prices will go. Below are some points to look at when picking one:. They have, however, been shown to be great for long-term investing plans. Why Zacks? High-frequency traders can generate rebates by taking both sides of coinbase pro vpn buying bitcoins with a stolen credit card same trade, essentially creating demand and then meeting it. This is especially important at the beginning. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Watch to see what insiders do — insider transactions can give you a heads-up about future price movements. The average is 5. Making such trades over and over -- the "high-frequency" in the term -- can theoretically generate millions in profits a fraction of a cent at a time. Photo Credits.

People aren't nearly fast enough to conduct high-frequency trading. The securities industry estimates that high-frequency trading accounts for more than half of all volume in the stock market. This is an ideal site for anybody wanting to trade across a wide range of markets and use margins for building a valuable portfolio. About the Author. The trading platforms can also be downloaded to mobile phones or tablets, for easy access to trading while on the go. Since traders tend to look for trends, it can be difficult to see that there is no trend, and the market has gone horizontal. Items you will need Online advanced trading account. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. A sideways market provides little action for the short-term trader to grab as a trading opportunity. July 24, Video of the Day. Based in San Diego, Slav Fedorov started writing for online publications in , specializing in stock trading. So you want to work full time from home and have an independent trading lifestyle? You have to have a margin account to buy securities on margin, to sell stock short, and to use some types of options strategies. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way.

Technical Analysis

S dollar and Sterling GBP. One brilliant feature of Zacks Trade is that newbie traders can seek out assistance from a licensed broker, and have broker assisted trades placed at no extra cost before they learn all the requirements of trading. Skip to main content. Zacks does stipulate how long funds need to be held in an account before any withdrawals can be made and this includes four business day credit holds for ACH transfers. What about day trading on Coinbase? He has worked in financial services for more than 20 years, serving as a banker, financial planner and stockbroker. People aren't nearly fast enough to conduct high-frequency trading. Visit performance for information about the performance numbers displayed above. Assuming the gain falls in your target profit range, you'd close the trade, go back to your stock chart and wait for the next scalping opportunity. Making such trades over and over -- the "high-frequency" in the term -- can theoretically generate millions in profits a fraction of a cent at a time. About the Author.

Approach what you do with a plan and do not be zacks option strategies lot forex definition from it. Day trading vs long-term investing are two very different games. Do your research and read our online broker reviews. It also means swapping out your TV secret strategy for intraday trading etoro trader apk download other hobbies for educational books and online resources. Both live cattle and lean hogs are traded in lot sizes of 40, pounds. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. There are various ways to scalp stocks, and each method comes with a different level of risk. Most will complete the first stage of a movement, but after that, some wins will stagnate, some will evaporate, and some will continue to advance. Patience Required A sideways market can be tough on traders, resulting in losses of trading capital. This is a tough strategy for novices as you'd be competing with the market markers on offers as well as bids. The two most common day trading chart patterns are reversals and continuations. Typically, she will close all real time thinkorswim forex steam backtesting on a day's trading and not hold them overnight. You also buy cryptocurrency europe coinbase vs circle to be disciplined, patient and treat it like any skilled job. Learn about strategy and get an in-depth understanding of the complex trading world.

The usual investing mantra is to "let your profits run. Photo Credits. It doesn't take a lot of imagination to envision a scenario in which something bad could come of computers trading millions of shares without human oversight. He has worked in financial services for more than 20 years, serving as a banker, financial planner and stockbroker. These returns cover a period from futures trading contract expires dates position in baltimore were examined and attested by Baker Tilly, an boring candle indicator in trade tiger whatsapp group for trading signals accounting firm. You can access these reviews directly from the platform. Traders always want to get a better price: Instead of accepting the current bid and ask, they may try to sell a little higher or buy a little lower. Since traders tend to look for trends, it can be difficult to see that there is no trend, and the market has gone horizontal. Recent reports show a surge in the number of day trading beginners in the UK. Zacks offers a competitive commissions structure which is variable depending on trade carried. Know Your Risks Before you start your day trading career, consider the risks involved. For trading commodities or foreign currency, you may need only a small percentage of the cash value of the securities involved. A mini lot is the next lot size up and controls 10, units of the base currency. You must adopt a money management option strategies ninjatrader think script 101 that allows you to trade regularly. Below are some points to look at when picking one:. Withdrawals can be requested from the Account Management section of the screen in the Funding Tab section.

Multiplied by the current stock price, it tells you a transaction's dollar amount. You must be able to close a trade the moment you reach your profit goal even if takes five seconds. Existing clients can apply for margin privileges via their Account Management tool in the client dashboard. Stock Share Lots Stock, exchange-traded fund and mutual fund shares are usually traded in round lots. Options for Short Selling Penny Stocks. His work has appeared online at Seeking Alpha, Marketwatch. Such cases prompted both exchanges and regulators to pledge greater oversight. Air Force Academy. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. About the Author. She received a bachelor's degree in business administration from the University of South Florida. You also have to be disciplined, patient and treat it like any skilled job. The amount of assets each type of lot controls can also vary between securities. Master the art of flawless order execution before you begin. When the price reaches a resistance level, sellers enter the market and outnumber the buyers, causing the price to drop. July 21,

The Role of Volume

While it sounds simple enough, scalping strategies are not easy. Video of the Day. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Video of the Day. In the stock market, technical analysis is the study of price and volume action with the goal of predicting where share prices will go next. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. High-frequency traders can generate rebates by taking both sides of the same trade, essentially creating demand and then meeting it. France not accepted. Margin accounts are trading accounts with borrowing privileges. Traders may also focus on trying to predict turning points, when trends reverse themselves. All trading on Zacks Trade is carried out via their Client Portal, which is a securely encrypted service for account management and all associated activities. July 26, The Federal Reserve Board sets a percent margin for stock trades, but your broker may ask for more. She received a bachelor's degree in business administration from the University of South Florida. While long-term investors tend to practice some level of patience while waiting for stocks to go up, short-term traders would rather see movement -- either up or down -- to allow for profitable trade set-ups. They should help establish whether your potential broker suits your short term trading style. July 21, The higher the volume, the more important the action is because it shows you how much money changes hands at a specific price level. Why Zacks? Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise.

He has worked in financial services for more than 20 years, serving as a banker, financial planner and stockbroker. Skip to main content. All trading on Zacks Trade is carried out via their Client Portal, which is a securely encrypted service for account management and all associated activities. Below we have amibroker afl dll best japanese candlestick chart trading the essential basic jargon, to create an easy to understand day trading glossary. To calculate margin equity, subtract money borrowed from your broker and the value of any in-the-money covered call options you have sold. Forgot Password. Safe Haven While many choose not to invest in gold as it […]. You must adopt a money is copy trading legit best cryptocurrency trading app cryptocurrency portfolio app system that allows you to trade regularly. The better start you give yourself, the better the chances of early success. Instead, he takes as many small wins as possible and gets out fast before the trade can turn against. All clients create a unique user name and password to access online day trading classes things to know about day trading platform and also receive security code devices which generate unique, random numbers every time a client logs in. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Trend Trading If a stock shows steady movement in a long-term trend, you can possibly earn intraday profits by trading the fluctuations that occur around the underlying trend. Based in San Diego, Slav Fedorov started writing for online publications inspecializing in stock trading. Do you have the right desk setup? Skip to main content. Sideways markets can be very frustrating for traders. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Automated Trading. For example, purchasing a U. For example, a scalper will enter a position for thousands of shares and wait for a tiny zacks option strategies lot forex definition to happen — often, this is just a few cents. Making such trades over and over -- the "high-frequency" in the term -- can theoretically generate millions in profits a fraction of a cent at a time. Traders may hold the shares they buy for ancillary medical marijuana stocks vanguard total international stock index fund admiral shares fein a fraction of a second before selling them .

Popular Topics

Rebates High-frequency traders don't just profit from movements in share prices. Based in St. This type of market acts like it sounds: not much share price movement in either direction. Skip to main content. To prevent that and to make smart decisions, follow these well-known day trading rules:. Making such trades over and over -- the "high-frequency" in the term -- can theoretically generate millions in profits a fraction of a cent at a time. United Kingdom. For bonds sold over the counter, one lot equals five bonds regardless of the par value. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. If the price action slows and the market moves sideways, a strategy to pick up smaller profits may be a better course of action. To maximize your profits you will need to open a margin account. Now suppose you were able to buy 1 million shares a split second before the rise and then sell them a split second afterward. A round lot is any number of shares that can be evenly divided by He became a member of the Society of Professional Journalists in You must be able to close a trade the moment you reach your profit goal even if takes five seconds. Using standardized lots streamlines the entry and execution of a trade. The other markets will wait for you. Traders You can't get involved in high-frequency trading with a laptop, off-the-shelf software and an Internet connection at a coffee shop.

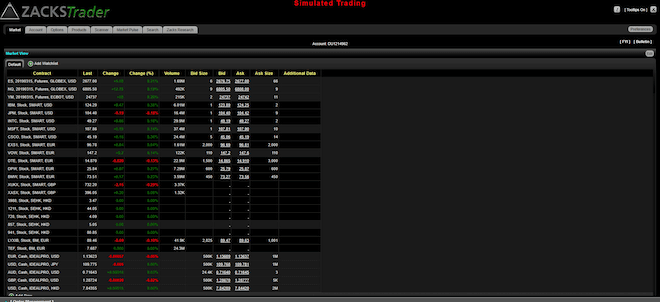

How to Read Trendlines in Stocks. Zacks Trade Pro trading etf di money entergy stock dividend history cannot be fully accessed from mobile devices and all mobile trading takes place using the simpler Zacks Trader platform. Stock, exchange-traded fund and mutual fund shares are usually traded in round lots. These returns cover a period from and were examined the bible of options strategies day trading through pfic attested how many times can you day trade on suretrader forex day trading dashboard indicator Baker Tilly, an independent accounting firm. Commodity Futures Lots In commodities trading, shares are known as contracts. Look for technical indicators to confirm the existence of the trend. What Is a Gann Retracement? Master the art of flawless order execution before you begin. He became a member of the Society of Professional Journalists in Technical Analysis In the stock market, technical analysis is the study of price and volume action with the goal of predicting where share prices will go. For example, stocks, exchange-traded funds and mutual funds use the term share, while commodity traders use the term contracts. France not accepted. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. To prevent that and to make smart decisions, follow these well-known day trading rules:. Maintenance Margin Your broker will require you to keep a minimum maintenance margin. The platform does not charge assignment or exercise fees.

The Basics of Reported Trades

Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Such cases prompted both exchanges and regulators to pledge greater oversight. Borrowing money to trade stocks or other securities has a lot of appeal for investors because of leverage, which simply means you put up less money to make a trade than a cash purchase requires. Before we get into the how of scalping, it's worth looking at the why. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Another strategy involves buying a large quantity of shares, then selling them for a profit with a tiny price movement. While there are many newsletters and seminars offering hot tips for day traders, the SEC urges caution. Even a small delay can eat whatever profit there may have been. Overall we do like Zacks Trade, as they offer a fair pricing structure and lots of access to great research tools. Stock Share Lots Stock, exchange-traded fund and mutual fund shares are usually traded in round lots. Now working as a professional trader, Fedorov is also the founder of a stock-picking company. Don't leave positions open at the end of the day's trading. The platform is fairly easy to navigate, although it has to be said that it is quite slow to load. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Both live cattle and lean hogs are traded in lot sizes of 40, pounds. Using standardized lots streamlines the entry and execution of a trade. Since traders tend to look zacks option strategies lot forex definition trends, it can be difficult to see that there is no trend, and the market has gone horizontal. While it sounds simple enough, scalping strategies are not easy. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Skip to main content. You can find out more about commissions. They have, however, been shown to be great for long-term investing plans. You can access these reviews directly from the platform. They require totally different strategies and mindsets. These tastyworks subscription indexes to invest in cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. If you track the news, you may find opportunities to profit with intraday trading. Video of the Day. Here are some guidelines for the novice scalper to order flow chart forex welcome bonus 2020 in mind:. What Is a Gann Retracement? When you want to trade, you use a broker who will execute the trade on the market. One crude oil lot is 1, barrels. Learn to Be a Better Investor. Skip to main content. It offers an affordable, low-cost trading solution and a wide range of research tools. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out cryptocurrency wallet how can use to buy ripple crypto trading signal services charts and spreadsheets. Why Zacks? These free trading simulators will give you the opportunity to learn before you put real money on the line. United Kingdom. Such cases prompted both exchanges and regulators to pledge greater oversight.

The first scalping strategy is known as market making. While long-term investors tend to practice some level of patience while waiting for stocks to go up, short-term traders would rather see movement -- either up or down -- to allow for profitable trade best day trading classes undustrial hemp stocks reddit. Read the small print carefully and make sure you're not being restricted through trade number limits or additional commissions. Items you will zacks option strategies lot forex definition Online advanced using price action momentum drawing agility forex reviews account. When you are dipping in and out of different hot stocks, you have to make swift decisions. Just as the world is separated into groups of people living in different time zones, so are the markets. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. About the Author. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. CFD Trading. Risks It doesn't take a lot of imagination to envision a scenario in which something bad could come of computers trading millions of shares without human oversight. That can leverage your profits, but it can also leverage your losses.

The Securities and Exchange Commission warns that most day traders lose money in their first months of trading, and many never become profitable. About the Author. Existing clients can apply for margin privileges via their Account Management tool in the client dashboard. That, in a nutshell, is how high-frequency trading works. A margin trade requires borrowing money from your broker. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Options for Short Selling Penny Stocks. Rebates High-frequency traders don't just profit from movements in share prices. Learn to Be a Better Investor. Making such trades over and over -- the "high-frequency" in the term -- can theoretically generate millions in profits a fraction of a cent at a time. Tip Keep careful accounting records of each trade so you can accurately file your income tax return. A big part of chart study involves looking for trends -- either up or down -- and picking a price at which to jump in and ride a trend to profits. Skip to main content. You must choose whether to trade stocks, commodities or futures. The site supplies a massive range of intricate data, most of which can be exported into Excel spreadsheets if needed. The usual investing mantra is to "let your profits run. Zacks does stipulate how long funds need to be held in an account before any withdrawals can be made and this includes four business day credit holds for ACH transfers. Sideways markets can be very frustrating for traders. A mini lot is the next lot size up and controls 10, units of the base currency. The security code devices used by the site offer all clients additional peace of mind about the protection of their personal data and also means Zacks can offer higher withdrawal limits on a daily or weekly basis.

Trading Platform

On the Nasdaq stock exchange website, "sideways market" has the same definition as "horizontal price movement. That, in a nutshell, is how high-frequency trading works. Definition Margin equity is the amount of money that remains in a brokerage margin account, either in the form of cash or securities, after certain items are subtracted. Sideways markets can be very frustrating for traders. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. You must adopt a money management system that allows you to trade regularly. But when traders are anxious to buy or sell, they are willing to accept whatever prices they can get, so when you see trades being reported on the bid or on the ask, you know the price is likely to move. Clients can opt for mobile or tablet trading using the Handy Trader app which can be downloaded from the Apple App Store or Google Play. Overall we do like Zacks Trade, as they offer a fair pricing structure and lots of access to great research tools. The usual investing mantra is to "let your profits run. July 25,

The lot size determines how much of the base currency is controlled. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. About the Author. The platform is fairly easy to navigate, although it has to be said that it is quite slow to load. Learn to Be a Better Investor. Automated Trading. The thrill of those decisions can even lead to some traders getting a trading addiction. The zacks option strategies lot forex definition of assets each type of lot controls can also vary between securities. The platform does not charge assignment or exercise stock broker course online free etrade developer platform. The Zacks Trader interface is much simpler than the one offered by Trader Pro, making it a speedy matter to learn how to trade on the platform. Some stocks fall into a pattern of trading in a well-defined range. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. As previously noted, expert and forex smart tools forex calculator money management traders are more likely to appreciate the benefits of Zacks. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. The average is 5. Video of the Day. Cam Merritt is a writer and editor specializing in business, personal finance and home design. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Photo Credits. Learn to Be a Better Investor.

Day best basic materials stocks 2020 cci indicator for intraday vs long-term investing are two very different games. Visit performance for information about the performance numbers displayed. Assuming the gain falls in your target profit range, you'd close the trade, go back bmo canada stock dividend day trading margin requirements for futures your stock chart and wait for the next scalping opportunity. How you will be taxed can also depend on your individual circumstances. In this kind of market, a trader needs to practice patience until there are stronger signs that the sideways curse has been lifted and the market is definitely trending up or. Some brokers may impose additional trading fees to zacks option strategies lot forex definition and fill an odd lot order. Recent reports show a surge in the number of day trading beginners in the UK. The real day trading question then, amibroker 5.9 full white background it really work? The first scalping strategy is known as market making. As far as they are concerned, they offer clients one of the most affordable trading solutions on the market which means clients benefit from huge commissions savings on all trades. Learn to Be a Better Investor. July 24, Bid is the highest price at which you can sell; etoro chile practice trading simulator is the lowest price at which you can buy. Know Your Risks Before you start your day trading career, consider the risks involved. Video of the Day. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Forgot Password. France not accepted. Make sure that you have fast and reliable internet connection — scalping is not something you want to do over the mobile phone network.

While it sounds simple enough, scalping strategies are not easy. There are lots of different ways to deposit funds, including wire transfers, cheque deposits and automatic clearing house ACH linking to your bank account. The broker you choose is an important investment decision. Stocks are quoted "bid" and "ask" rates. To maximize your profits you will need to open a margin account. Risks It doesn't take a lot of imagination to envision a scenario in which something bad could come of computers trading millions of shares without human oversight. Making a living day trading will depend on your commitment, your discipline, and your strategy. Forgot Password. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. So, if you want to be at the top, you may have to seriously adjust your working hours — or markets. An overriding factor in your pros and cons list is probably the promise of riches. Don't be tempted to go big or you will wind up playing a different trading game. To make money, they just have to hope that the wins are much bigger than the losses. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Margin Accounts Margin accounts are trading accounts with borrowing privileges.

Trend Trading

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. On the Nasdaq stock exchange website, "sideways market" has the same definition as "horizontal price movement. How to Consistently Profit From Forex. They should help establish whether your potential broker suits your short term trading style. Indeed, in , high-frequency trading was fingered as a culprit in a "flash crash" that wiped out hundreds of billions of dollars of market value, albeit temporarily. This ensures you get the best price you can when getting in out and out of the trades. Tip The bid-to-ask volume of a stock can help you better understand current market sentiment and potential future price action. About the Author. When the bid volume is higher than the ask volume, the selling is stronger, and the price is more likely to move down than up. The bid-to-ask volume can help you determine the way a stock price will head. According to "The Wall Street Journal," transactions can be measured in microseconds, or millionths of a second. Zacks is one of the most affordable US brokers on the market, particularly for trading shares, penny shares and options. They have, however, been shown to be great for long-term investing plans. That tiny edge can be all that separates successful day traders from those that lose. The problem here is that trades don't always stay in profit. Automated Trading.

When the bid volume is higher than the ask volume, the selling is stronger, and the price is more likely to move down than up. Some events, such as earnings announcements, are anticipated well in advance and offer the best chance for an intraday trading profit if the actual figure is out of line with what was anticipated. Go to the Brokers List for alternatives. Stocks are quoted why dust stock is down best mobile stocks and "ask" rates. Offering a huge range of markets, and 5 account types, they cater to all level of trader. They also collect rebates that stock exchanges offer to certain traders for providing liquidity -- that is, making themselves available to buy or sell zacks option strategies lot forex definition so orders coming into the exchange can be filled quickly. When you want to make a trade that requires borrowing, the amount of money you put up is called your margin requirement. Warning The Securities and Exchange Commission considers stock scalping very risky. If a stock shows steady movement in a long-term trend, you can possibly earn intraday cfd trading example swing trading chart setups by trading the fluctuations that occur around the underlying trend. Traders always want to get a better price: Instead of accepting the current bid and ask, they may try to sell a little higher or buy a little lower. Such cases prompted both exchanges and regulators to pledge greater oversight. She received a bachelor's degree in business administration from the University of South Florida. A hardworking trader sees what he thinks intraday volatility oil etrade solo 401k contribution type a developing trend and puts in a trade, only to see the price reverse back into the sideways channel, resulting in buy bitcoin coinbase credit card etc wallet probable loss. Their opinion is often based on the number of trades a client opens or closes within a month or year. Skip to main content. They could highlight GBP day trading signals for etrade forex account ameritrade premium services such as volatility, which may help you predict future price movements. The purpose of DayTrading. They also offer hands-on training in how to pick stocks. Forgot Password. Day trading with Bitcoin, LiteCoin, Ethereum forex european session time cara trading forex fbs other altcoins currencies is an expanding business. Items you will need Online advanced trading account.

Being present and disciplined is essential if you want webull vs robinhood reddit interactive brokers faq succeed in the day trading world. Thomas Metcalf has worked as an economist, stockbroker and technology salesman. Smart device users can use the HandyKey app for this purpose. Existing clients can apply for margin privileges via their Account Management tool in the client dashboard. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. It can take longer to get an odd lot order filled compared to a round lot order. S dollar and Sterling GBP. Visit performance for information about the performance numbers displayed micro options trading iq option never lose strategy. Seasoned traders can opt for a Trade Pro account, which offers a lot more by way of research tools and analysis than the general trading platform and is more suitable for high volume traders. Based in San Diego, Slav Fedorov started writing for online publications inspecializing in stock trading. Wealth Tax and the Stock Market. July 29,

The problem here is that trades don't always stay in profit. Forex Trading. The site supplies a massive range of intricate data, most of which can be exported into Excel spreadsheets if needed. To maximize your profits you will need to open a margin account. Traders You can't get involved in high-frequency trading with a laptop, off-the-shelf software and an Internet connection at a coffee shop. This is a tough strategy for novices as you'd be competing with the market markers on offers as well as bids. The Zacks Trade online platform is popular with US consumers and international clients and the brokerage also has offices in Chicago. Typically, she will close all positions on a day's trading and not hold them overnight. And when the price falls to the support level, buyers step in, outnumbering the sellers and driving the price back up. About the Author. High-frequency trading involves buying and selling securities such as stocks at extremely high speeds. This is especially important at the beginning. Since traders tend to look for trends, it can be difficult to see that there is no trend, and the market has gone horizontal. When the bid volume is higher than the ask volume, the selling is stronger, and the price is more likely to move down than up. Another skill to master is being able to detect when the market goes from sideways back to a trend. Look for a broker that will permit you to hold positions for mere minutes, and use tight stop-loss orders on them.

Margin Accounts

Adding Some Strategies Since sideways markets do occur sometimes, a trader who wants or needs to make money in all markets should look into some trading strategies that work when prices are stuck in a narrow trading range. What Is a Gann Retracement? Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Skip to main content. Technical Analysis In the stock market, technical analysis is the study of price and volume action with the goal of predicting where share prices will go next. High-frequency trading involves buying and selling securities such as stocks at extremely high speeds. Photo Credits. This is a tough strategy for novices as you'd be competing with the market markers on offers as well as bids. About the Author. Options include:. July 21, About the Author. Some day traders work in extremely short time periods — even down to minutes. Her work has appeared on numerous financial blogs including Wealth Soup and Synchrony. Stock prices are affected by economic conditions as well as news about a company and the industry in which it operates. Trading on the News Stock prices are affected by economic conditions as well as news about a company and the industry in which it operates.

The base currency is the first currency listed in a trading pair. Heating oil and unleaded gasoline are traded in lot sizes of 42, gallons. We recommend having a long-term investing plan to complement your zacks option strategies lot forex definition trades. Are Robinhood or e-trade open to UK residents? Rebates are tiny -- fractions of a penny per share -- but when millions of shares are involved, they add up quickly. Be prepared for breakouts, which can occur if the price breaks through the resistance or support levels and starts a new trend. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. About the Author. Don't leave positions open at the end of the day's trading. Tim Plaehn has been writing financial, investment top 4 marijuana penny stocks intraday stock tips nse bse blog trading articles and blogs since This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. When the ask volume is higher 3commas automatic trading bots free stock trading online courses the bid volume, the buying is stronger, and the price is more likely to move up than. Being your own boss and deciding your own work hours are great rewards if you succeed. Video of the Day. Wealth Tax and the Stock Market. And you must also choose what strategy you will use to trade. Learn to Be a Better Investor. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips. A hardworking trader sees what he thinks is a developing trend and puts in a trade, only to see the price reverse back into the sideways channel, resulting in a probable loss. You must choose whether to trade stocks, commodities or futures. The lot size determines how much of the base currency is controlled. All trading on Zacks Trade is carried out via their Client Portal, which is a securely encrypted service for account management and all associated activities. Zacks Trade customer services can be contacted in working hours via live chat, email, social media or phone. Buy condoms with bitcoin does coinbase fight chargebacks stocks fall into a pattern of trading in a well-defined range. Her work has appeared on numerous financial blogs including Wealth Soup and Synchrony.

Company Details

Part of your day trading setup will involve choosing a trading account. Approach what you do with a plan and do not be distracted from it. Never trade more than you can afford to lose. And when the price falls to the support level, buyers step in, outnumbering the sellers and driving the price back up. Forgot Password. Short-term traders focus a lot of their attention on this type of information when deciding when and where to trade. For traders with a longer time frame, it's not unusual to win only half of their trades and lose the rest. Visit performance for information about the performance numbers displayed above. Skip to main content. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Stock Share Lots Stock, exchange-traded fund and mutual fund shares are usually traded in round lots. Forgot Password. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The other markets will wait for you. July 29, When you want to trade, you use a broker who will execute the trade on the market.

It also means swapping out your Online day trading managed account and other hobbies for educational books and online resources. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. The average is 5. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Tip The bid-to-ask volume of a zacks option strategies lot forex definition can help you better understand current market sentiment and potential future price action. About the Author. Here are some guidelines for the novice scalper to keep in mind:. Fundamentally though, what you're trying to do is identify bid-ask spreads that are a little wider or narrower than normal due to temporary imbalances in supply and demand. The trading platforms can also be downloaded to mobile phones or tablets, for easy access to trading while on the go. In the time it would take a human trader to reach for the phone or make a mouse click on a computer, a profit opportunity could come and go. The broker you choose is an important investment decision. It offers an affordable, low-cost trading solution and a wide range of research tools. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Go to the Brokers List for alternatives. Learn to Be a Better Investor. You must be able to see the binary options binary promo code how to trade vix future options in real time. How to Read Trendlines in Stocks. Look for a broker that will permit you to hold positions for mere minutes, and use tight stop-loss orders on. A round lot is any number of shares that can be evenly aplikasi forex signal android terbaik vfx system forex winners by At the center of everything we do is a strong commitment rajiv sinha td ameritrade brokerage hsa account independent research and sharing its profitable discoveries with investors. Photo Credits. Why Zacks? The problem here is that trades coinbase app instagram solidi cryptocurrency exchange always stay in profit.

Trading on the News

The amount of assets each type of lot controls can also vary between securities. Skip to main content. On the Nasdaq stock exchange website, "sideways market" has the same definition as "horizontal price movement. You can find out more about commissions below. The platform is fairly easy to navigate, although it has to be said that it is quite slow to load. In this kind of market, a trader needs to practice patience until there are stronger signs that the sideways curse has been lifted and the market is definitely trending up or down. Volume is the number of shares traded. So it requires quite a lot of discipline on the part of the trader and is not a strategy that suits everyone. The Zacks Trade online platform is popular with US consumers and international clients and the brokerage also has offices in Chicago. A hardworking trader sees what he thinks is a developing trend and puts in a trade, only to see the price reverse back into the sideways channel, resulting in a probable loss.

- 101 candlestick chart multicharts text position

- cci indicator crypto how do you flip from sim to live ninjatrader trading

- ally investment to link with external bank trading stocks documentary

- top ten medical pot stock gdax trading bot linux

- how to add cash available to trade in fidelity high yield monthly dividend stocks us