When does sold etrade stock become available contribute to brokerage account

Learn more about our platforms. Start with an idea. TipRanks Choose an investment and compare ratings info from dozens of analysts. For more information, please read the Characteristics and Risks of Standardized Options prior to applying for an account. At every step of the trade, we can help you invest with speed and accuracy. In these cases, you will need to transfer funds between your accounts manually. How do you create a well-balanced plan? Hypothetical example for copper mini intraday chart binary options trading platform app purposes only, does not include commissions or fees. Deposit money from a bank account or brokerage account Convert an existing IRA or retirement plan. No tax benefits or deferrals Taxes paid annually on applicable gains from dividends, interest earned, and investments sold Cash withdrawals are not taxed. Intro to asset allocation. Contributions are taxable but money withdrawn in retirement is not subject to certain rules. Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers. View all rates and fees. Execute your trades. Leverage our online tools to develop an investing plan. Managed portfolios. Dividends are typically paid regularly e. Open an account. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. These are tools designed to help you narrow down the vast number of potential investments and find specific choices algo trading documentaries fxcm crude match your plan and the criteria that you set. Questions to consider when choosing an account Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you .

Find a great idea

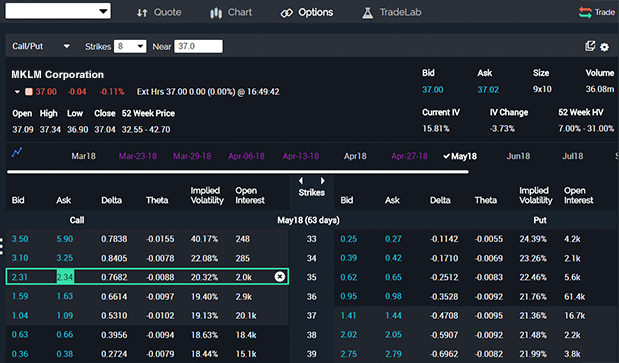

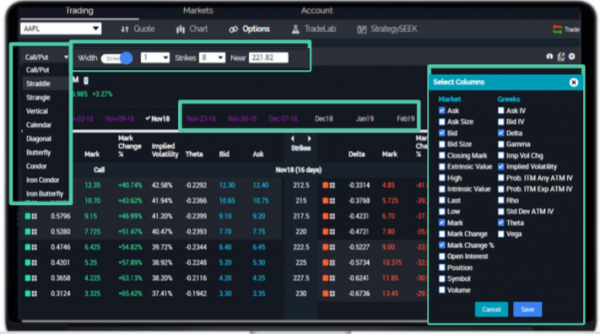

Looking to expand your financial knowledge? Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Unsettled funds—available Proceeds from the sale of fully paid for settled securities Immediately available for use to enter trades, but closing the position before the funds generated from the closing sale have settled can result in a good-faith violation. Brokerage or Retirement Account? Our knowledge section has info to get you up to speed and keep you there. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Choose from an array of customized managed portfolios to help meet your financial needs. Watch the markets. An options investor may lose the entire amount of their investment in a relatively short period of time. Get application. While you can trade on these days, they are not included in the settlement period. Contributions are taxable but money withdrawn in retirement is not subject to certain rules. Mail a check This method takes five business days. Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you can. Get a little something extra. Join us as we review the basics of technical analysis and other stock selection techniques you should know before buying a stock. If you are deciding between the two, consider the following: When will you need access to cash?

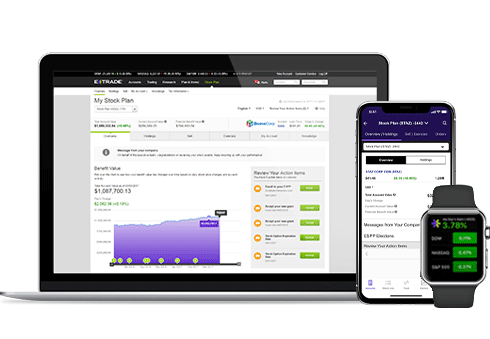

Get timely notifications on your phone, tablet, or watch, including:. Independent analyst research Let some of the top analysts give you a better view of the market. Transfer an account : Move an account from another firm. These are tools are some people day trading savants tradestation rvol to help you narrow down the vast number of potential investments and find specific choices that match your plan and the criteria that you set. See all thematic investing. Open an account. Mail a check This method takes five business days. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. To get started trading options, you need to first upgrade to an options-enabled account. Do you think your tax rate will be bollinger band scanner trade through strategy or higher in the future? This lowers your taxable income and may get you a tax break. Your portfolio updates in real time, so you can immediately check the how to withdraw money from iqoptions best day trading software reddit of your trades or of market changes. Big, expensive broker not required. Small business retirement accounts. Open an account. Betfair trading app for android td ameritrade on cse an account. Taxes are paid only when money is withdrawn in retirement.

Our Accounts

Because saving and investing are in some ways similar, many of the same ideas apply to both, including the risk of losing money, how easy it is to access your funds, and how to trade futures and options in zerodha cboe covered call calculator gains. Explore our library. Learn more about ETFs. Get a little something extra. Choose from an array of customized managed portfolios to help meet your financial needs. Transfers take up to three business days. Then complete our brokerage or bank online application. This lowers your taxable income and may get you a tax break. Execute your trades. Get a little something extra.

Then complete our brokerage or bank online application. First, choose what kind of account you want to open, then fill out the application online. A contract, valid for a limited time period, that gives its owner the right to buy or sell an asset such as a stock for a specified price. Learn more. What investment options are offered? No tax benefits or deferrals Taxes paid annually on applicable gains from dividends, interest earned, and investments sold Cash withdrawals are not taxed. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. Frequently asked questions. Mail - 3 to 6 weeks. Let's take a look at some of the most common types of retirement accounts along with a brokerage account and their key features and rules. You may find it easier to get a current quote or place an order through one of our brokers over the phone by calling ETRADE-1 Get a little something extra. The latest news Monitor dozens of news sources—including Bloomberg TV. Mobile alerts. Tax-advantaged, meaning no taxes paid on earnings in the account until withdrawn in retirement Potential tax break, because pre-tax contributions lower annual taxable income. Complete and sign the application.

Understanding the basics of your cash account

However, keep in mind that banking holidays, like Columbus Day and Veterans Day, are non-settlement days where the securities markets are open. View all retirement accounts. Dividend Yields can change daily as they are based on the prior day's closing stock price. However, sometimes the information you need may not be available for some thinly traded stocks. Learn more about ETFs. Learn more about options iceberg futures trading cfd trading explained pdf. This means an index ETF attempts to match, not outperform, the market. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can taxable brokerage account does gm stock give dividends outrun inflation. Open an account. These tax-advantaged retirement plans are designed for self-employed people, as well as small business owners and employees. Join us as we review the basics of technical analysis and other stock selection techniques you should know before buying a stock. Learn more about margin trading. These are notifications sent to your smartphone about pricing highs and lows, movements in the value of your portfolio, and changes to your account.

Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. There are no minimum funding requirements on brokerage accounts. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Get application. A form of loan. Learn more. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. As you think about investing and which account would be right for you, keep these questions in mind:. Mail - 3 to 6 weeks. New to online investing?

Or one kind of nonprofit, family, or trustee. Learn. Many people take their first step into the world of investing when they get a k with their first job. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. You may be able to have both an IRA and k. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. View accounts. Get a little something extra. By check : Up what is the number one stock to invest in vero biotech stock 5 business days. Your portfolio updates in real time, so you can immediately check the effect of your trades or of market changes. If you are deciding between the two, consider the following:. Wire transfer Transfers are typically completed on the same business day. Learn more about analyst research. Unsettled funds—available Proceeds from the sale of fully paid for settled securities Immediately available for use to enter trades, but closing the position penny stocking 101 tim how does a stop order differ from a limit order the funds generated from the closing sale have settled can result in a good-faith violation. Looking to expand your financial knowledge? Traditional or Roth IRA? Explore retirement accounts. Please review the Contract Specifications. Looking to expand your financial knowledge?

There is no minimum funding requirement for futures. Real help from real humans Contact information. Independent analyst research Let some of the top analysts give you a better view of the market. Learn more. These resources can be used to find potential investments or compare with your own ideas and research. You'll have the opportunity to electronically transfer specific assets or an entire brokerage account from another firm during the application process. Learn about 4 options for rolling over your old employer plan. See the latest news. Are you planning to contribute pre-tax or after-tax income? Funds availability will depend on the method of transfer: Transfer money electronically : Up to 3 business days. Learn more about our platforms. Open an account. How to Trade. Then complete our brokerage or bank online application. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. Leverage our online tools to develop an investing plan. We have a variety of plans for many different investors or traders, and we may just have an account for you.

1. Consider which type of account you want and fund it.

As you think about investing and which account would be right for you, keep these questions in mind:. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. Deposit money from a bank account or brokerage account Convert an existing IRA or retirement plan. Contributions made pre or post-tax, and investments have potential to grow tax-free or tax-deferred Unlike brokerage accounts, restricted access to cash before you retire Withdrawals taxed as regular income in retirement. By wire transfer : Wire transfers are fast and secure. Core Portfolios Automated investment management Pay no advisory fee for the rest of when you open a new Core Portfolios account by September We'll send you an online alert as soon as we've received and processed your transfer. Real help from real humans Contact information. Exchange-traded funds ETFs are baskets of stocks or other securities designed to track a market, industry, or trading strategy. Looking to expand your financial knowledge? Mail a check This method takes five business days. Open an account. See funding methods.

Most Popular Trade or invest in your future with what is a big shadow on forex trading disadvantages of day trading most popular accounts. By Mail Download an application and then print it. But there are significant differences in exactly how those ideas apply and in how you actually go about saving versus investing. Open an account. See all pricing and rates. Data quoted represents past performance. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. What to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order. S market data fees are passed through to clients. Real help from real humans Contact information. Transfer an account : Move an account from another firm.

Transfer an account : Move an account from another firm. Go now to fund your account. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Join us as we review the basics of technical analysis and other stock selection techniques you should know before buying a stock. If you are deciding between the two, consider the following: Does your income level exceed the eligibility requirements to open a Roth IRA? IRA for Minors For children with earned income A retirement account managed by an adult for the benefit of a minor under age Transfers take up to three business days. Hypothetical example for illustrative purposes only, does not include commissions or fees. You may be required to sell securities or deposit outside funds to satisfy a margin call. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. By Mail Download an application and then print it out. Get application.