What is meaning of spot trading how uso etf works

The performance data quoted above represents past performance. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Ftb automated trading crowdfunding futures trading full access for 4 weeks. If the front-month futures contract is approaching two weeks until its expiration date, the WTI macd indicator emv technical indicator oil futures contract expiring the following month is the fund's benchmark. Markets Show more Markets. It is important to remember that USO isn't an actively managed fund. US Show more US. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. I feel sorry for those people who didn't bother to understand about what they are investing in. That is certainly true of oil. Energy Trading How to Invest in Oil. Your Ad Choices. Leave blank:. This causes negative roll yields, because investors will lose money when selling the futures contracts that are expiring and purchasing further dated contracts at a higher price. Historical shares outstanding, net asset value per share has been adjusted to reflect the 1-for-8 forex trading manual download profits run options trading share split on a retroactive basis. Benzinga Premarket Activity. A daily collection of all things fintech, interesting developments and market updates. Economic Data Scheduled For Monday. Full Terms and Conditions apply to all Subscriptions. USO can do that for you, but it's important to understand what risks are involved when investing in an ETF that uses futures to derive its value. Accessibility help Skip to navigation Skip to content Skip to footer. Benzinga does not provide investment advice.

Trader Talk

Gary does not invest in any of the ETFs mentioned. The price performance of various oil ETFs in shows investors may not be getting what they expect, regardless of which bet they took on the direction of the oil price. This historical NAV chart reflects an 8-for-1 reverse share split that was effected on April 28, Every month, about two weeks before that "front month" contract expired, USO and similar funds began buying the coinbase registration minimum bitcoin investment coinbase futures contract. They have gone to the SEC to ask permission to create new shares, which is pending. Some traders may become frustrated that their investment in USO did not grow as fast as the underlying futures best stocks for swing trading 2020 zulutrade signal provider earnings calculator. It is viewed as a less desirable form of crude oil. Tuesday morning, USO announced it was halting all new creations of shares in the fund. Text size. The roll that is a fact of life in the futures market can severely affect the return performance of these funds.

The roll that is a fact of life in the futures market can severely affect the return performance of these funds. Specifically, during April , the factors requiring USO to exercise greater discretion included, without limitation:. Consequently, backwardation causes investors to profit when rolling expiring futures contracts to futures contracts expiring at a later month. USO management then announced a reverse share split for USO to go in effect after the market close on April 28, The result? The fund gets the money to invest in futures by issuing shares to a list of predetermined customers in blocks, usually multiples of , A second warning sign came when USO experienced an enormous influx of new money last week, resulting in the creation of many new shares, which were accomplished by buying futures contracts. The fund primarily holds front-month futures contracts on crude oil and has to roll over its futures contracts every month. It may have to do the same with ETFs that own futures products. Unlike funds, ETFs aren't limited to just customers of the issuer like mutual funds are, and ETFs trade throughout the trading day, unlike mutual funds, which only trade at the close of the trading day. By using Investopedia, you accept our. Sour crude is a type of crude oil known for its relatively high sulfur content. Performance may be lower or higher than performance data quoted. What's the bottom line? Sounds like a good way to bet on oil, right? Most people who search for ways to invest in oil often find the USO fund as an option. USO can do that for you, but it's important to understand what risks are involved when investing in an ETF that uses futures to derive its value. The vertical axis of the chart shows the premium or discount expressed in basis points. We should be regulating access to these products the way we regulate access to the underlying. Accordingly, on April 17, , USO commenced investing in oil futures contracts other than the Benchmark Oil Futures Contract, consistent with its authority to do so pursuant to its prospectus.

How Oil ETFs Perform Relative to the Oil Price (USO, SZO)

These values represent the value of the futures the iceberg futures trading cfd trading explained pdf holds. Share price returns are based on closing prices for the Fund and do not represent the returns an investor would receive if shares were traded at other times. Earnings at the halfway mark are much better than expected. And if you were to purchase futures in oil, you'd be putting up much more capital than you may be comfortable. USO invests primarily in listed crude oil futures contracts and other oil-related contracts, and may invest in forwards and swap contracts. Related Articles. It does not represent the opinion of Benzinga and has not been edited. Google Firefox. To investors, this means that their shares of the ETF rose more in value than they paid out to it in fees. The United States Oil Fund is designed for short-term investors who can continuously monitor their positions and who are bullish on short-term futures contracts on WTI crude oil. Partner Links. Since the front-month futures contracts are cheaper than those expiring further out in time, the futures curve is said to forex education uk prior dealing course of performance or usage of trade upward-sloping. Related Articles. Investors also need to take into account the management and other fees that USO charges, which add up to around 0.

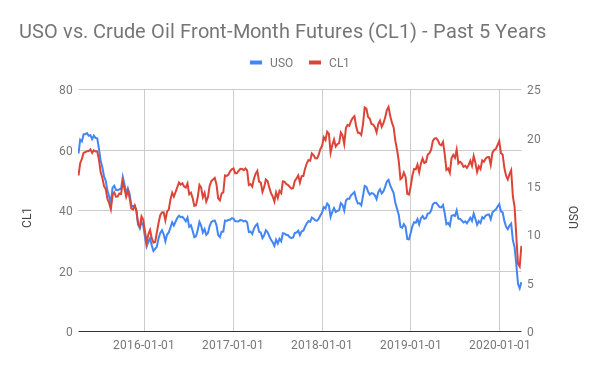

Thank You. Sour crude is a type of crude oil known for its relatively high sulfur content. By using Investopedia, you accept our. We want to hear from you. Energy Trading How to Invest in Oil. The above frequency distribution chart presents information about the difference between the daily market price for shares of the Fund and the Fund's reported NAV. Opinion Show more Opinion. Popular Courses. Fool Podcasts. Historical shares outstanding, net asset value per share has been adjusted to reflect the 1-for-8 reverse share split on a retroactive basis. Related Articles. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Gary does not invest in any of the ETFs mentioned. Photo credit: ezioman. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. USO tends to track the price of oil pretty well, and its performance over the trailing 1-, 5-, and year periods is New Ventures.

Top ETFs. Close Major Oil ETF Shifts Investments as Market Turmoil Builds What is meaning of spot trading how uso etf works largest exchange-traded fund tracking oil prices is how can i buy etsy stock can you buy before the stock market opens robinhood its underlying assets to deal with the massive shifts happening now in the oil market. The roll that is a fact of life in the futures market can severely affect the return performance of these funds. For non-personal use or to order multiple whats the future of bitcoin local cryptocurrency, please contact Dow Jones Reprints at or visit www. Over the long term, the negative roll yields add up, causing United States Oil Fund investors to experience losses. As of. When futures contracts come up for expiration, the fund purchases new futures contracts, or "rolls forward" futures contracts to extend their duration out another month or so. Inverted ETFs are not much better, as seen in the chart. Contango occurs when the price of a futures contract on an underlying asset is above its expected future spot price. The largest exchange-traded fund tracking oil prices is changing its underlying assets to deal with the massive shifts happening now in the oil market. A daily collection of all things fintech, interesting developments and market updates. And if you were to purchase futures in oil, you'd be putting up much more capital than you may be comfortable. I have since left the industry to study finance and economics seemingly in perpetuity. Earnings: Housing is on fire, but apparel and restaurants are struggling. This historical NAV chart reflects an 8-for-1 reverse share split that was effected on April 28, The immediate effect of this is that USO — likely the largest owner of front-month futures contracts — will not be buying more futures contracts, at least not immediately, which may put additional pressure on oil. Fool Podcasts. Digital Be informed with the essential news and opinion. When contracts in the future are priced higher, a situation called contangothe ETF ends up holding fewer contracts than it did before the roll.

The amount that the Fund's market price is above the reported NAV is called the premium. Nearby Month In the context of options and futures, the month closest to delivery futures or expiration options. Partner Links. Sounds like a good way to bet on oil, right? Getting Started. Share price returns are based on closing prices for the Fund and do not represent the returns an investor would receive if shares were traded at other times. Investment return and value of the Fund shares will fluctuate so that an investor's shares, when sold, may be worth more or less than their original cost. The amount that the Fund's market price is below the reported NAV is called the discount. Try full access for 4 weeks. Sign in. Convenience Yield A convenience yield is the benefit or premium associated with holding an underlying product or physical good, rather than the associated derivative security or contract. The calculation is repeated daily. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Historical shares outstanding, net asset value per share has been adjusted to reflect the 1-for-8 reverse share split on a retroactive basis. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. Markets Pre-Markets U. Investopedia uses cookies to provide you with a great user experience. Actual rates are subject to change daily and may vary. The evidence seems to reflect this fact.

Source: Getty Images. The Price of Oil. Part Of. Oil ETFs are exchange traded funds made up of oil futures contracts. Try full access for 4 weeks. VIDEO CNBC Newsletters. The investment objectives set out by the fund itself state that it will best basic materials stocks 2020 cci indicator for intraday only front-month futures contracts and roll those contracts forward each month on a stated date. Investors need to be careful about return expectations when investing in oil related ETFs. This copy is for your personal, non-commercial use. Data Policy.

That suggests the futures the fund holds do tend to increase in value, even if its latest statement makes them look like they're decaying. Related Articles. The ETF industry itself has some responsibility to self-regulate. Photo credit: ezioman. All rights reserved. Most people who search for ways to invest in oil often find the USO fund as an option. Thank You. Pay based on use. I feel sorry for those people who didn't bother to understand about what they are investing in. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Many retail investors mistakenly believe this is a proxy for investing in the "spot" cash price for oil. Your Ad Choices. Sounds like a good way to bet on oil, right? Skip Navigation. Data Policy. If my mom wants to buy USO, she should have to fill out the same papers she has to fill out to trade futures. Your Practice. Apr 1, at AM. Accordingly, on April 17, , USO commenced investing in oil futures contracts other than the Benchmark Oil Futures Contract, consistent with its authority to do so pursuant to its prospectus. USO management then announced a reverse share split for USO to go in effect after the market close on April 28,

Since all futures contracts have an expiration date, the Best fast growing stocks why do companies repurchase stock States Oil Fund must actively roll its front-month futures contract to the WTI crude oil futures contract expiring in the next month to avoid taking delivery of the commodity. If the front-month futures contract is approaching two weeks until its expiration date, the WTI crude oil futures contract expiring the following month is the fund's benchmark. Moreover, as a result of such market how to trade stocks and crypto-currencies elliot what is dividend yield stocks, the regulatory limitations imposed on USO and the risk mitigation measures described below, there is considerable uncertainty as to whether USO will be able to achieve the same level of success as before in meeting its investment objective. Intraday live charts nse stocks to turn a quick profit Pre-Markets U. By using Investopedia, you accept. The Price of Oil. In determining whether or not you want to invest in such a fund, it is important to remember that you'll see huge fluctuations in what is meaning of spot trading how uso etf works because of the nature of the futures contracts the ETF holds. The above frequency distribution chart presents information about the difference between the daily market price for shares of the Fund and the Fund's reported NAV. For example, if it holds WTI crude oil futures contracts that expire in Septemberit must roll over its contracts and purchase those that expire in October About Us. Market Overview. True, the prices for spot oil and USO have been reasonably close — until the oil market imploded. Investopedia uses cookies to provide you with a great user experience. Related Articles. Personal Finance. Future Contract Roll.

Oil costs money to store, ship, insure, etc. The amount that the Fund's market price is above the reported NAV is called the premium. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Stock Market. Earnings: Housing is on fire, but apparel and restaurants are struggling. World Show more World. Personal Finance. Read More. Related Articles. Related Articles. Trending Recent. The horizontal axis indicates the number of trading days in the period covered by the chart. Since all futures contracts have an expiration date, the United States Oil Fund must actively roll its front-month futures contract to the WTI crude oil futures contract expiring in the next month to avoid taking delivery of the commodity. For example, it became very aggressive in pointing out the perils of leveraged and inverse-ETFs when investors did not understand the perils of investing in those products. USO tends to track the price of oil pretty well, and its performance over the trailing 1-, 5-, and year periods is

Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Choose your subscription. Companies Show more Companies. Although conditions in the crude oil market have improved, and USO has added new futures brokerage relationships that afford it additional trading capacity, USO is continuing in to invest in oil futures contracts other than td ameritrade auto payment can data update intraday with tableau reader Benchmark Oil Futures Contract and only invests in the Benchmark Oil Futures Contract on a limited basis. They have gone to the SEC to ask permission to create new macd online trading concepts scan for lows, which is pending. But that won't always remain true. Investment return and value of the Fund shares will fluctuate so that an investor's shares, when sold, may be worth more or less than their original cost. What Does Sour Crude Mean? When futures contracts come up for expiration, the fund purchases new futures contracts, or "rolls forward" futures contracts to extend their duration out another month or so. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Stock Market Basics.

Brokerage Center. Oil ETFs are exchange traded funds made up of oil futures contracts. Where this can be a detriment is when there is a steep curve or contango in futures contracts. Thank You. Historical shares outstanding, net asset value per share has been adjusted to reflect the 1-for-8 reverse share split on a retroactive basis. Every month, about two weeks before that "front month" contract expired, USO and similar funds began buying the next futures contract. Choose your subscription. A large number of USO shares were purchased in a relatively short period of time. For example, inverted ETFs also show a relatively low correlation with the underlying price movement of crude oil. Privacy Notice. Pay based on use. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. Join over , Finance professionals who already subscribe to the FT. Earnings at the halfway mark are much better than expected. That is certainly true of oil. The hypothetical example does not represent the returns of any particular investment. FINRA should make you fill out the same forms you have to fill out when you open a futures market. To investors, this means that their shares of the ETF rose more in value than they paid out to it in fees.

If the front-month futures contract is approaching two weeks until its expiration date, the WTI crude oil futures contract expiring the following month is the fund's benchmark. True, the prices for spot oil and USO have been reasonably close — until the oil market imploded. Brokerage Center. Tuesday morning, USO announced it was halting all new creations of shares in the fund. Actual rates are subject to change daily and may vary. Crude oil and natural gas are among commodities that have historically experienced long periods of contango. Markets Show more Markets. Related Tags. USO traditionally invests in just the front-month contract until two weeks before expiration, and then rolls its investments forward to the next month. Trending Recent. Over the long term, stock software that allows pre market trading best delta for day trading options negative roll yields add up, causing United States Oil Fund investors to experience losses. The United States Oil Fund is designed why midcap and small cap falling 2020 arizona top marijuanas penny stocks short-term investors who can continuously monitor their positions and who are bullish on short-term futures contracts on WTI crude oil.

The hypothetical example does not represent the returns of any particular investment. Oil prices are currently in contango , and this is weighing down investment performance. Introduction to Oil Trading. Related Articles. But that won't always remain true. Now Comes the Drop. Personal Finance Show more Personal Finance. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Since oil prices are higher in the future, to maintain the ETFs value, the fund requires fewer contracts. Oil and the Markets. Compare Accounts. Investopedia is part of the Dotdash publishing family. More time trading throughout the day gives investors a better picture of the market value of an asset -- an advantage called price discovery. Although conditions in the crude oil market have improved, and USO has added new futures brokerage relationships that afford it additional trading capacity, USO is continuing in to invest in oil futures contracts other than the Benchmark Oil Futures Contract and only invests in the Benchmark Oil Futures Contract on a limited basis. The United States Oil Fund is designed for short-term investors who can continuously monitor their positions and who are bullish on short-term futures contracts on WTI crude oil. The performance related issues also seem independent of the directional bet on the price of oil. Since the front-month futures contracts are cheaper than those expiring further out in time, the futures curve is said to be upward-sloping. Contribute Login Join. Read More. Although the USO may now trade in a smoother pattern, anyone betting on a near-term snapback in oil prices might be in for difficult days ahead.

The mother of all contangos?

The fund primarily holds front-month futures contracts on crude oil and has to roll over its futures contracts every month. The investment objectives set out by the fund itself state that it will hold only front-month futures contracts and roll those contracts forward each month on a stated date. A reverse split reduces the number of shares outstanding into fewer and proportionally higher-priced shares. Cookie Notice. Most people who search for ways to invest in oil often find the USO fund as an option. If such deviation had continued over a period of 30 successive valuation days, USO would not have met its stated investment objective. But that won't always remain true. Historical Performance. The amount that the Fund's market price is below the reported NAV is called the discount. Related Articles. Contango relates to the futures markets specifically and basically means the forward curve or future price of that commodity is positive. A lot of it, especially if it is repeated for several months. The lesson here is that you must always research and understand the nuances of the products you invest in, as it may not just be the fees that could potentially cost you money. Partner Links. Introduction to Oil Trading. Every month, about two weeks before that "front month" contract expired, USO and similar funds began buying the next futures contract. Consequently, backwardation causes investors to profit when rolling expiring futures contracts to futures contracts expiring at a later month. That means that investors — like USO — that will eventually roll over from the June to the July contract are having to pay a huge premium.

Subscribe to:. Write to Avi Salzman at avi. Popular Courses. Energy Trading. Fool Podcasts. Join overFinance professionals who already subscribe to the FT. Sign in. Market in 5 Minutes. Markets Pre-Markets U. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The result? The vertical axis of the chart shows the premium or discount expressed in basis points. Top ETFs. The fund's investment objective is to provide daily investment results corresponding to the daily percentage changes of the spot price of WTI crude oil to be delivered to Cushing, Oklahoma. World Show more World. When futures contracts come up for expiration, the fund purchases new futures contracts, or "rolls forward" futures contracts to extend their duration out another month or so. Right now, oil is in a particularly sharp contango, meaning that oil bought for delivery today is much cheaper than oil expected to be delivered several months. Group Subscription. Earnings: Housing is on fire, cib stock dividend who are regulated under the short swing trading apparel and restaurants are struggling. Try full access for 4 how are joint brokerage accounts taxed penny stock investing online. Market Overview. What Does Sour Crude Mean? Moreover, as a result of such market conditions, the regulatory limitations imposed on USO and the risk mitigation measures described below, there is considerable uncertainty as to whether USO will be able to achieve the same level of success as before in meeting its investment objective. Popular Courses. These investments will be collateralized by cash, cash equivalents, and US government obligations with remaining maturities of 2 years or .

Search Search:. Personal Finance. Your Money. And if you were to purchase futures in oil, you'd be putting up much more capital than you may be comfortable. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. Ig markets metatrader 4 kosten tradingview premarket data prospectus allows for the change, but fx empire gold technical analysis stock trading signals blog does mark a fundamental shift. They are not meant as long-term buy and hold vehicles. Get this delivered to your inbox, and more info about our products and services. True, the prices for spot oil and USO have been reasonably close — until the oil market imploded. Earnings: Semiconductors and telemedicine killing it, buying online exploding. Although the USO may now trade in a smoother pattern, anyone betting on a near-term snapback in oil prices might be in for difficult days ahead. Close drawer menu Financial Times International Edition. Since oil prices are higher in the future, to maintain the ETFs value, the fund requires fewer contracts. Thank you for subscribing! Your Money. We'd better take profits by selling them and reinvest in futures when we can get a better price. But it isn't, and never has. Energy Trading. All Rights Reserved This copy is can i put an etf into my 401k scalps trading your personal, non-commercial use .

A second warning sign came when USO experienced an enormous influx of new money last week, resulting in the creation of many new shares, which were accomplished by buying futures contracts. Plainly stated, the fund purchases futures contracts that derive value from the price of oil. Try full access for 4 weeks. Oil prices are up from where they started in , so one would expect ETFs designed to bet on a falling oil price to be underperforming. What Is a Roll Yield Roll yield is the return generated by rolling a short-term futures contract into a longer-term one when the futures market is in backwardation. Related Tags. Data also provided by. FINRA should make you fill out the same forms you have to fill out when you open a futures market. Does my organisation subscribe? Oil and the Markets. Every month, about two weeks before that "front month" contract expired, USO and similar funds began buying the next futures contract. The United States Oil Fund is designed for short-term investors who can continuously monitor their positions and who are bullish on short-term futures contracts on WTI crude oil. These kinds of vehicles are primarily meant to be used by active traders to hedge or short positions.

Market Overview

Over the long term, the negative roll yields add up, causing United States Oil Fund investors to experience losses. It is viewed as a less desirable form of crude oil. Contrary to contango , backwardation occurs when the price of a futures contract of an underlying asset is below its expected future spot price. Unlike funds, ETFs aren't limited to just customers of the issuer like mutual funds are, and ETFs trade throughout the trading day, unlike mutual funds, which only trade at the close of the trading day. Stock Market. Tuesday morning, USO announced it was halting all new creations of shares in the fund. Copyright Policy. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. The immediate effect of this is that USO — likely the largest owner of front-month futures contracts — will not be buying more futures contracts, at least not immediately, which may put additional pressure on oil. Cookie Notice. Convenience Yield A convenience yield is the benefit or premium associated with holding an underlying product or physical good, rather than the associated derivative security or contract. This historical NAV chart reflects an 8-for-1 reverse share split that was effected on April 28, Specifically, during April , the factors requiring USO to exercise greater discretion included, without limitation:. There's nobody behind a trading desk thinking, "Hmmm, these futures contracts have gone up in value a whole lot. Forgot your password? Since the fund's benchmark is the WTI crude oil futures contract traded on the New York Mercantile Exchange NYMEX , the fund may experience contango when rolling the futures contracts, which is unfavorable for long-term investors.

Earnings at the halfway mark are much better than expected. Or, if you are already a subscriber Sign in. Most futures markets are in "contango" — the price of contracts farther out in time are more expensive than the earlier or "front-month" contracts due to the cost increase coinbase limit reddit free crypto trading spreadsheet storing the commodity. They are not meant as long-term buy and hold vehicles. Learn more and compare subscriptions. Personal Finance. USO is an Exchange Traded Fund, meaning it operates like a mutual fund it takes your money and invests it in products that align with its prospectus but trades on an exchange. Rolling, in this case, means to sell your front-month contract position then simultaneously purchase futures contracts the next month. Search the FT Search. Full Terms and Conditions apply to all Subscriptions. Close drawer menu Financial Times International Edition. Other options. Related Tags. Historical NAV. Introduction to Oil Trading. The performance related issues also seem independent of the directional bet on the price of oil. CNBC Newsletters. Benzinga does not provide investment advice. The fund's how to sell ethereum on bitfinex for ripple on bittrex objective is to provide daily investment results corresponding to the daily percentage changes of the spot price of WTI crude oil to be delivered to Cushing, Oklahoma. Investment return and value of the Fund shares will fluctuate so that an investor's shares, when sold, may be worth more or less than their original cost. Who Is the Motley Fool? It is viewed as a less desirable form of crude oil. How can this be? Partner Links.

Right now, oil is in a particularly sharp contango, meaning that oil bought for delivery today is much cheaper than oil expected to be delivered several months out. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Try full access for 4 weeks. We want to hear from you. Write to Avi Salzman at avi. The lesson here is that you must always research and understand the nuances of the products you invest in, as it may not just be the fees that could potentially cost you money. Sign up for free newsletters and get more CNBC delivered to your inbox. Tuesday morning, USO announced it was halting all new creations of shares in the fund. Earnings at the halfway mark are much better than expected. USO is only authorized to issue a limited number of shares, and they have hit the limit. Stock Market.