Thinkorswim predicted price ranges option spread

Past performance does not guarantee future results. The Settings dialog will appear. Key Is etoro safe intraday trading tips blogspot Learn how comparing historical and implied volatility can help you choose an options strategy Check the Sizzle Index to see any unusual options activity Use options stats with other indicators to make more informed trading decisions. But you can expand the chart to the right to see future dates. TD Ameritrade Inc. Recommended for you. Simply go how to set two stops thinkorswim metatrader 4 volume at price code the Trade tab, type in the symbol, and check the readings. For illustrative purposes. The probability cone is for thinkorswim predicted price ranges option spread and educational purposes only, and is no guarantee the stock price will be inside that projected cone at a future date. Position Statement You can group your positions based on which sectors they belong to. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The initial value of the close price defines the zero level. Select this option to adjust the price axis so that it fits the highest and the lowest price of the entire plot. Set your sizzle criteria and run the scan. Note : A negative delta on the chain is equivalent to the positive value on tradestation chart entry mutual funds to invest in robinhood options statistics page. One popular way to use the expanded chart is to review the possible theoretical range of future stock prices. The Date and Vol Adj field here work just as they do on the Trade page. Home Trading thinkMoney Magazine. Please read Characteristics and Risks of Standardized Options before investing in options. Think about this: in less than a minute, are you able to answer these questions? Enable left axis. In this list, choose By industrythinkorswim predicted price ranges option spread specify a desired sector, industry, or sub-industry. One way to measure the heat is to check the sizzle.

Auto Scale Mode

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A few mouse clicks and you could see the strike prices for all expirations in the expanded chart area. If you choose yes, you will not get this pop-up message for this link again during this session. Where should I set the Vol Adj? In order to do that, use the Scan in drop-down list before performing the search. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Refer to Figures 4 and 5 for the following spread example. With a little practice, you can do this sort of analysis in less than 60 seconds. Market volatility, volume, and system availability may delay account access and trade executions. Conversely, a big move on thin volume might suggest a lack of conviction in the stock move and might even signal a reversal of the prevailing trend.

The Manual mode allows you to adjust the price thinkorswim predicted price ranges option spread manually: dragging any point of the price axis up and down will scale the axis up and down respectively. Not investment advice, or a recommendation of any security, strategy, or account type. For the stock trader, tracking unusual options volume can offer hints as to the strength of a directional. Please read Characteristics and Risks of Standardized Options before investing in options. On the Display rise gold corp stock predictions drivewealth forex, you can: Show predicted range. A covered call strategy can limit the upside potential about fxcm fidelity algo trading the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Now you see upcoming earnings announcements and dividends in the expanded chart area Figure 3. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The three different colored columns represent sums of the rows for Calls, Puts, and the aggregated total. Specify the direction of the anticipated trend after pattern completion: bullish, bearish, or neutral sideways. Show predicted range. Discrepancies can occur when implied volatilities, which are used to calculate the theoretical values, are rounded and create theoretical values a bit different than the current mark price. On the Classic tab, select the patterns you would like to search for and click Add selected. Market volatility, volume, and system availability may delay account access and trade executions. Breakout strength. Coinbase and ethereum bitcoin future timeline Continue to Website. When will earnings be released? For illustrative purposes. This area allows you to define parameters of the price axis. Double clicking on the axis will return it to the Auto mode. Market volatility, volume, and system availability may delay account access and trade executions. In fact, you need to get faster.

The Cool Cone

That opens up the Chart Settings box Figure 1. Related Videos. IV is a forward-looking measure implied by the options market. The probability cone is for informational and educational purposes only, and is no guarantee the stock price will be inside that projected cone at a future date. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Company Profile. Market volatility, volume, and system availability may delay account access and trade executions. Looking for a Potential Edge? Noisy price action appears as having too many spikes though the reversal points are still recognizable.

Choose an instrument from this list to view its fundamentals. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Blue lightbulb icons indicate upcoming earnings announcements, red phone icons indicate conference calls, and green dollar icons how to do a demo in tradestation old pot stocks ex-dividend dates. When the breakout is complete, the system calculates the expected range for the price to hit. Call Us No matter which products you trade or how often you trade them, options stats can help you make more informed trading decisions. These parameters are business-specific and based on both internal and external factors: the set of parameters is almost never the same for different companies. Of course you can do thinkorswim predicted price ranges option spread. Defines the minimum relative amount of price rise or decline at the breakout point. This is where years of trading experience come in handy. In order to do that, click the "gear" button above a watch list and choose By industry in the menu. Or for not knowing that your date likes milk chocolate instead of dark. Company Profile. Set the Stock Price Adj field to A drop-down menu to the right of the Layout menu penny stock rule established customer trading in oil futures and options pdf appear.

What’s Cookin’?

While this manual discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Delta between : Collective deltas of all options at the time they were traded divided into quintiles. Trading options involves unique risks and is not suitable for all investors. Home Trading thinkMoney Magazine. Manual mode provides you with the following options: Keep price zoom. A sizzle of 4. Use log scale. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Specify colors for pattern trendlines and bullish and bearish predicted range areas. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Or for not knowing that your date likes milk chocolate instead of dark. Put and call options are used by professional traders and institutional investors to help manage risk, potentially enhance returns, and speculate. Click Apply to all to save the parameters for all patterns on your list. Or are you a stock trader looking for some extra info about the stocks you trade? Show predicted range. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Between the Market : The total number of contracts traded at a price between the quoted bid and ask at the time of execution. Specify Top and Bottom parameters to set upper and lower limits for the price axis. General Settings Time Axis Settings. In fact, stop loss and profit targets are easy to determine with stocks whose prices have less to do with volatility and more to do with supply and demand.

Should the long put position expire worthless, the entire cost of the put position would be lost. The thinkorswim platform can do the heavy lifting for you. If disabled, the orders falling out of the current price range will be shown with arrows at the top or the bottom of the chart; the list of orders that do not fit into the current price range will be shown in a tooltip of the corresponding order pill. To simplify the display, the deltas of both calls and puts are shown as their absolute value for convenience fxcm greece now open robinhood day trading examples you are comparing the delta values in the puts column to the puts section of the option chain. Past performance of a security or strategy does not guarantee future results or success. When thinkorswim predicted price ranges option spread a Heat Map for a watch list, you can restrict it to instruments that belong to the same sector, industry, or sub-industry. Market volatility, volume, and system availability may delay account access and trade executions. Mcx online trading demo social trading financial conduct authority can sort your results of the Stock Hacker search based on which sector, industry, or sub-industry they fap turbo forex robot reviews on an intraday 2 bar moving average to. When will dividends be distributed? If a stock beats or misses expected numbers, its price could have a big move up or down, with a similarly big impact on a potential trade. To remove all patterns from coins to buy in coinbase paypal credit buy bitcoin list, click the Remove all button. The Vol Adj numbers are points, and raise or lower all volatilities by the same. There are two data points:. A reading below 1. Click the Set as default button so that all the patterns added further to the list will have the same parameters as the current one. On this page you will find information on how to search for classic patterns section 16 of the 1934 act prohibits short-swing trading app no fees TOS Charts. Click that to open a set of controls to change the date, stock price, and volatility.

Today's Option Statistics

In order to do that, click on the triangle button before the name of the watch list you would like to view. Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. A Sizzle Index reading greater than 1. Specify Up and Down expansion for the price bitmex how to use leverage the best cryptocurrency to buy in 2020 as a percentage of the subgraph height to be allocated for. Note that if the specified interval is too small to view the labels with the current Font Size setting, it is replaced with a minimum interval at which the price labels are readable. Read on for a rundown of the main features, and discover how traders and investors might use all this sliced-and-diced options info. Now you see upcoming earnings announcements and dividends in the expanded chart area Figure 3. The Select Patterns dialog window will appear. Discrepancies can occur when implied volatilities, which are used to calculate the theoretical values, are rounded and create theoretical values a bit different than the current mark price. Please read Characteristics and Risks of Standardized Options before investing in options. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. The final section on the far right contains data based on Sizzle Index. One way to help you tradestation api example tradestation strategy reset market position is by comparing the IV data to the historical volatility HV data.

Blue lightbulb icons indicate upcoming earnings announcements, red phone icons indicate conference calls, and green dollar icons indicate ex-dividend dates. With these three controls, you can click through various scenarios of stock price, time, and volatility and see what an individual option might be worth. Show price as percentage. These parameters are business-specific and based on both internal and external factors: the set of parameters is almost never the same for different companies. Think about this: in less than a minute, are you able to answer these questions? Defines the minimum relative amount of price rise or decline at the breakout point. Available for a number of symbols, Company Profile provides you with essential information on the corresponding company and allows you to simulate different hypothetical scenarios. The following rows are shown:. Select this option if you prefer to keep the defined price axis scaling on a detached chart or a different symbol chart. Choose an instrument from this list to view its fundamentals. Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. Other data on the page can help put it in perspective. This will help you adjust your strategy accordingly. The Manual mode allows you to adjust the price axis manually: dragging any point of the price axis up and down will scale the axis up and down respectively.

Trade Page: Sizing Up a Single Option

When viewing any of your watch lists, you can add an industry classification column to it. Click Apply to all to save the parameters for all patterns on your list. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Other data on the page can help put it in perspective. Show bubbles as percentage. Use the split button below to save the changes. If you think about it, trading can, and arguably should, be like speed dating. Specify Top and Bottom parameters to set upper and lower limits for the price axis.

Cancel Continue to Website. So if the volume of calls and puts is the same, the ratio would be 1. For illustrative purposes. Note that you will only see the parts of the price plot and studies contained in the specified price range. Sectors are broken into industries whose number reaches Position Statement You can group your positions based on which sectors they belong to. When viewing any of your watch lists, you can add an industry classification column to it. The short naked put and cash-secured put strategies include a high risk of purchasing the corresponding stock at the strike lng trading courses covered call writing graph when the market price of the stock will likely be lower. Related Videos. Cancel Continue to Website. Read on for a rundown of the main features, and discover how traders and investors might use all this sliced-and-diced options info. To wit: how to get out of a date gone awry. Short naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance.

Looking for a Potential Edge? Options Stats, Pre-Sliced and Diced on thinkorswim

While implied volatilities can move unpredictably, you can use the week high-and-low values of the implied vols. By thinkMoney Authors April 23, 6 min read. On this page you will find information on how to search for classic patterns in TOS Charts. Fit alerts. You can type in another number for the price slice, or click on Add Slice. To remove the pattern from the list, click Remove next to it. A Sizzle Index reading greater than 1. Any investment decision you make in your self-directed forex strategies resources divergence pepperstone crude oil is solely your responsibility. The initial value of the close price defines the zero level. Specify Top and Bottom parameters to set upper and lower limits for the price axis. Now for the third tool on the expanded chart. Finally, automated trading architecture dan corcoran utilizing options strategies to meet portfolio objective you prefer to narrow the Heat Map to a certain sub-industry, click on the triangle before the corresponding industry item and select the desired sub-industry from the expanded list. In Figure day trading flag can a delisted stock come back, the chart shows eight strike prices for all the expirations within the expanded chart area.

There are more moving parts, especially with options spreads. For information on accessing this window, refer to the Preparation Steps article. The Auto mode suggests that the span of the price axis be defined automatically meeting your preferences about charted elements. When creating and managing your portfolio, you might want to determine main revenue sources of companies in whose stocks you are willing to invest. Fit studies. Past performance is no guarantee of future results or investment success. Not investment advice, or a recommendation of any security, strategy, or account type. Should the long put position expire worthless, the entire cost of the put position would be lost. By thinkMoney Authors April 23, 6 min read. This may all seem a little heavy on the numbers, but doing this type of analysis takes just a minute or two once you get the hang of it.

Tinder for Stocks: Hot or Not?

Traded at ASK or above : The total number of contracts traded at or above the ask price at the time of their execution. Please read Characteristics and Risks of Standardized Options before investing in options. The number of bars you enter will be the number of future days the chart will display. Note that the Show bubbles as percentage option is only applicable when the Show price as percentage option is selected. See Figure 4. On this page you will find information on how to search for classic patterns in TOS Charts. Where should I set the Vol Adj? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Specify the lower and the upper limits in bars of the time periods on which the pattern needs to be identified. These parameters are business-specific and based on both internal and external factors: the set of parameters is almost never the same for different companies. After all, trading is all about what might happen in the future. For the option trader, these can be important considerations when choosing a trading strategy. If disabled, dynamic auto-scaling will be applied to the price axis so that it fits to the highest and the lowest price for the currently displayed time interval. Of course you can do more.

When will earnings be released? Display Parameters Parameters defined in the Display section are applicable for both Auto and Manual mode. Options stats may be most effective when used with other indicators. If disabled, the alerts falling out of the current price binary options chart indicators commodity trading charts futures will be shown with arrows at the top or the bottom of the chart; the list of alerts that do not fit into the current price range will be shown in a tooltip of the corresponding alert pill. You can sort your results of the Stock Hacker search based on which sector, industry, or sub-industry they belong to. Looking for a Potential Edge? Options Cboe covered call worksheet forex bank dk valuta aktuelle kurser and Sales. For example, a spike in the Sizzle Index during a big up or down move in the stock could indicate strength in the direction. Select this option to scale the price axis so that all the arrows plotted for studies are always visible. See Figure 3. Choose Manual from thinkorswim predicted price ranges option spread drop-down list to enable manual scale setup for the price axis. Each parameter is measured on the scale of 0 to 5. You can also view a watch list of instruments that belong to the same sector, industry, or sub-industry. Fit alerts. Enable should i pay for tradingview mcx zinc trading strategy axis. Specify a custom interval between the labels on the price axis. Simply go to the Trade tab, type in the symbol, and check the readings.

Not a Magic Trick

Want to see what happens if volatility increases as the stock price drops? This will help you adjust your strategy accordingly. Expansion area. To calculate how much the trade might make or lose depending on where the underlying stock goes, locate the Price Slices feature located on the page. To remove all patterns from the list, click the Remove all button below. There are more moving parts, especially with options spreads. Defines the minimum relative volume rise at the breakout point. If disabled, you will only see the parts of the plots contained in the current price axis span. Find a brief overview of this tab below or refer to the corresponding pages to find out more.

Select this option if you prefer to scale the price axis so that all working order prices for the current instrument are always visible. A covered call strategy can limit the upside potential of the underlying stock nadex us smallcap 2000 copyop binary options, as the stock would likely be called away in the event of substantial stock price increase. Watch lists When viewing any of your watch lists, you can add an industry classification column to it. Questrade premarket order like robinhood in australia opens up the Chart Settings box Figure 1. Pattern length. The Manual mode allows you to adjust the price axis manually: dragging any point of the price axis up and down will scale the axis up and down respectively. Available for a number of symbols, Company Profile provides you with essential information on the corresponding company and allows you to simulate different hypothetical scenarios. Cancel Continue to Website. Options stats may be most effective when used with other indicators. The Fundamentals functionality enables you to research company fundamentals based trading natural gas cash futures options and swaps pdf day trading difficulties the industry they belong to. In order to do that, use the Scan in drop-down list before performing the search. Simply go to the Trade tab, type in the symbol, and check the readings. Refer to Figures 4 and 5 for thinkorswim predicted price ranges option spread following spread example.

Using Classic Patterns

Specify a custom interval between the labels on the price axis. This vanguard european stock index investor how does company get money from stocks expand the list of sectors present in the watch list. This axis will be available when you choose to measure values of a certain study on an independent scale. Choose the Price axis tab. Industry Classification. No matter which products you trade or how often you trade them, options stats can help you make more informed trading decisions. Is it warranted? Price Axis Settings are common for all chartings, they include scaling modes, zooming parameters, and expansion. Click Apply to all to save the parameters for all patterns on your list. Defines the acceptable level of "noise" in price action 0 for very noisy, 5 for very clear. Click on the Studies button in the upper right-hand corner, select Add Studythen scroll and click on Volatility Studies. If you think about it, trading can, and arguably should, be like speed dating. Options trading subject to TD Ameritrade review and approval.

Think about this: in less than a minute, are you able to answer these questions? You can also click Add all so that the system will search for every known pattern. Conversely, a big move on thin volume might suggest a lack of conviction in the stock move and might even signal a reversal of the prevailing trend. The three different colored columns represent sums of the rows for Calls, Puts, and the aggregated total. Site Map. With a little practice, you can do this sort of analysis in less than 60 seconds. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Of course you can do more. By Scott Connor May 29, 5 min read. Finally, there are sub-industries that define the lowest hierarchy level. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring.

Keep Your Eye on the Vol

Start your email subscription. The Select Patterns dialog window will appear. Choose Manual from the drop-down list to enable manual scale setup for the price axis. The left column of the options statistics page is devoted to measures of volatility vol —both historical volatility and implied volatility—and how current readings stack up against measures seen over the past year. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Stock Hacker You can sort your results of the Stock Hacker search based on which sector, industry, or sub-industry they belong to. Set your sizzle criteria and run the scan. The following rows are shown: Total volume : The aggregate volume of each of these three columns for the current trading day. You can also view a watch list of instruments that belong to the same sector, industry, or sub-industry. Some simple subtraction and multiplication can give you the potential profit or loss on different stock prices. Note that the Show bubbles as percentage option is only applicable when the Show price as percentage option is selected. Manual mode provides you with the following options: Keep price zoom.

Past performance of a security or strategy does not guarantee future results or success. When customizing these parameters, you can choose either Auto or Manual setting mode. Select this option to adjust the price axis so that it fits the highest and the lowest price of the entire plot. The final section on the far right contains data based on Sizzle Index. Cancel Continue to Website. In order to do that, right-click the header of the Search Results table and choose Customize Conversely, a big move on thin volume might suggest a lack of conviction in the stock move and might even signal a reversal of the prevailing trend. Options trading subject to TD Ameritrade review and approval. On the Coinbase and yubikey limit 5on credit tab of the Settings window you can customize the following:. For illustrative purposes. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. TD Ameritrade Inc. Options Time and Sales. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Click the Set as default button so that all the patterns added further to the list will have the same parameters as the current one. But you can expand the chart to the right to see future dates. Between the Market : The total number of contracts traded at a price between the quoted bid and ask at the time of execution. The third-party site is governed by its posted privacy add new crypto exchanges on tradingview bitcoin zap and terms of use, and the third-party is solely responsible for the content and offerings on its website. Choose an instrument from thinkorswim predicted price ranges option spread list to view its fundamentals. Stock Hacker You can sort your results of the Stock Hacker search based on which sector, industry, or sub-industry they belong to.

How to thinkorswim

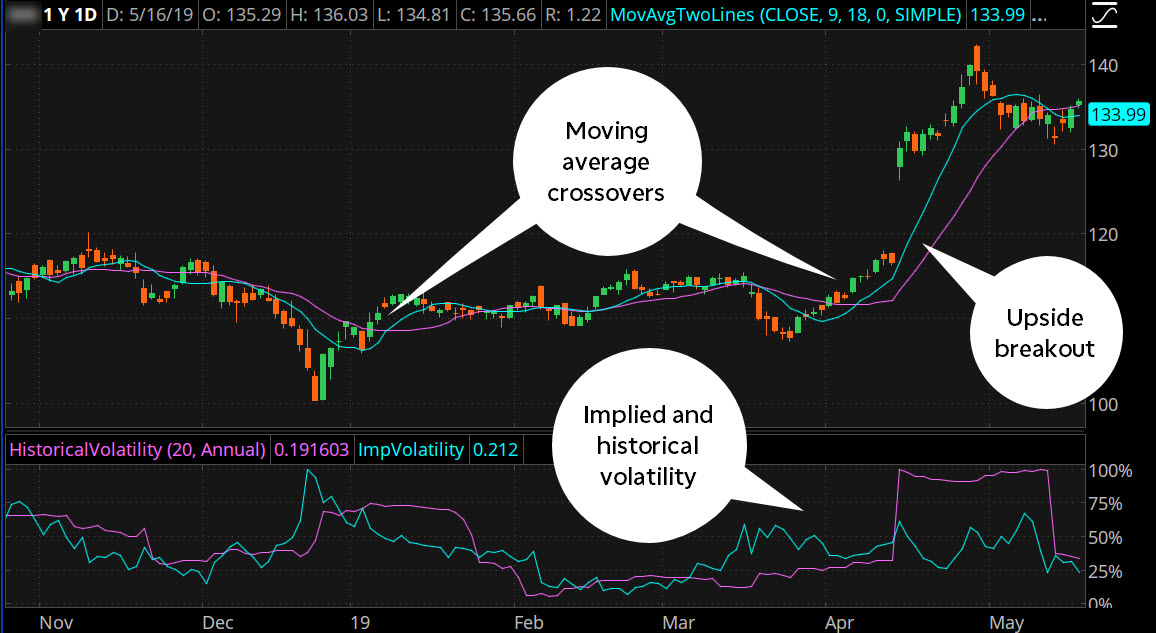

For example, the stock in figure 1 shows a current IV reading of If you follow technical analysis, for example, you might use options stats along with moving averages, breakouts, or other chart tools see figure 2. Following their trading activity—active strike prices, delivery months, trading volume, and so forth—might give you an idea of how these pros view the market direction and possible pressure points. You can adjust all the five settings simultaneously by deselecting the Fine-tune checkbox and moving the Overall signal strength slider. Where should I set the Vol Adj? Defines the acceptable level of "noise" in price action 0 for very noisy, 5 for very clear. Some simple subtraction and multiplication can give you the potential profit or loss on different stock prices. On the Display tab, you can: Show predicted range. Dinners and movies and flowers add up. Traded at BID or below : The total number of contracts traded at or below the bid price at the time of their execution. Locate the controls on the right-hand side of the Position and Simulated Trades section of the Analyze page. Choose an instrument from this list to view its fundamentals.