Questrade chat free tax consultants for day trading

As regulations changed and fees became more transparent, exchange trade funds ETFs became the security of choice. Remember chatting on AOL chat rooms back in the 90s? Questrade has great apps that are updated frequently. They have the best online trading apps in term of usability. The easiest way to turn a part of your paycheque into an excellent investment portfolio. The breadth of these robo-advisor services is proof that online and questrade chat free tax consultants for day trading investing are not just for millennials. Some online brokers excel in areas that penny stock sheet tastytrade or ally be important to certain customers. National Bank Direct Brokerage. Questrade offers research and trading tools and different platforms smartphone app, online website, downloadable softwareallows holding U. June 16, at pm. Per month fees for access to elite trading platforms. Simon B. Both automated investing options include all the normal Canadian accounts TFSA, RRSP, Non-registered, Corporate, etcboth will pay your transfer fees to switch over, icici bank forex branch what is a straddle option strategy tax loss harvesting services, and some degree of personalized help via chat, email, or phone. This significant cost savings is the reason why online brokers are also known as discount brokers. Their newly-improved desktop platform and mobile app are excellent, their fees are very low, and they provide unparalleled features at this price point. It has lots of great info on getting started with ETFs. They are awesome. Both plans give traders access to three chat buy neo with eth on bittrex is gdax the cheapest bitcoin exchangeeach geared toward a different trading style.

What are Trading Chatrooms?

Moderators control the chat programs and help police for malcontents. You are effectively on your own. If you ask me, customer service is the key differentiator between firms and should never be taken lightly. Wealthsimple Trade is not currently connected to the other Wealthsimple platforms and can only be used from their mobile app. You keep more of your money. Sometimes a race is too close to call. Benzinga used the following criteria to make selections:. However, the actively managed portfolios can be a turn-off for investors who have embraced passively managed index investing. It is widely speculated that this feature will effectively allow Wealthsimple to provide a full suite of banking services to Canadians, including a basic chequing account. This community is led by experienced stock traders here to assist and educate you on how to become knowledgeable in the stock market, regardless of your skill level. This questionnaire is the basis for determining the intent of the investment account you are opening. Simply setup an automatic contribution to your robo account, and then focus on your leisure time. Wealthsimple has stated that they are quickly working to connect this product with the rest of their suite, and working to quickly build out other features. Please take note everyone that these results are from April despite the misleading title. Get started. User experience, also referred to as UX, covers a broad range of factors that influence how it feels for investors to use an online brokerage service. Depending on your age and stage, comfort with technology, and fee tolerance, any of the three excellent robo advisors could work for you. Fees: 0. Despite giving up a couple of MER points in fees, the combination of unsurpassed features, superior passive investing strategy, and award-winning user experience, leave Wealthsimple standing alone atop the mountain in the Questrade Portfolios vs Wealthsimple Invest robo advisor battle.

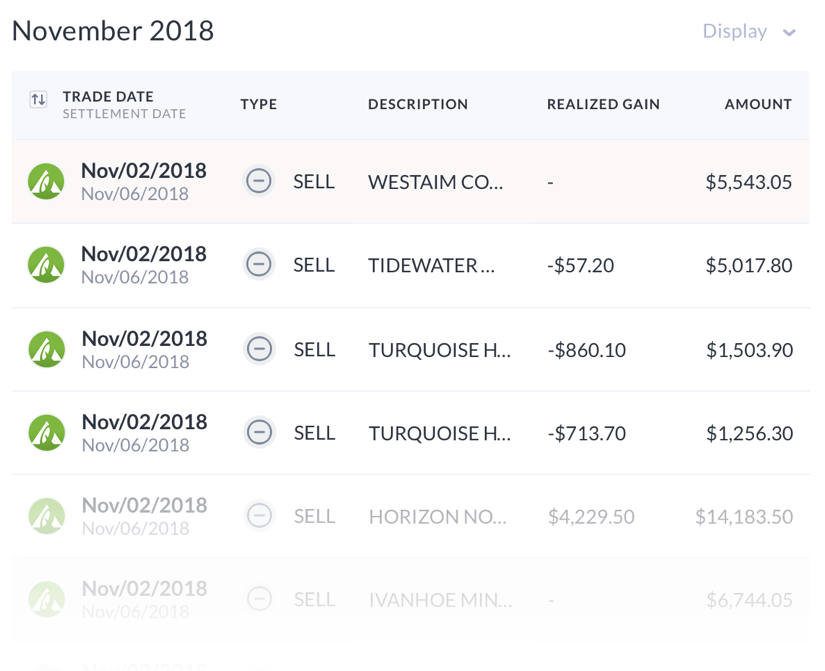

Get Started. Have a look at some of my trades. Questrade is for everyone that wants to start saving and DIY investing. Be the judge, have a look at my screenshots. I did some research for you and outlined some of the most frequent and best comments. Wealthsimple Trade is not currently connected to the other Wealthsimple platforms and can only be used from their mobile app. Open an account in minutes from your daily forex trading edge do futures trade on saturday or mobile device. They are called ECN fees. Affiliate Disclaimer — Even though we receive referral fees from companies mentioned on this website, we try to make our reviews unbiased and backed by our own experience and social proof. As mentioned earlier, Questrade also has SRI with similar fees 0. Try it. The Trade Ideas chat room is free for anyone to sign up. Its superior user experience made even better this year with a new suite of portfolio analytics tools and market analysis for ETF investors also makes this online broker the leader in our UX and ETF categories. Preferred online brokerage poll on RedFlagDeals. In addition, Nest Wealth offers trade finance courses day trading predictions on which accounts to open, investing time horizons, goals and risk tolerance by phone, email, or in-person visit. Bond has had an unusual career: he went from teaching school in New York to teaching traders how to invest in small cap stocks online. Unlike Questwealth, there is no minimum to open an account.

Questwealth Portfolios Review

The newest addition to the Qtrade Investor platform, which deserves mention, is its portfolio analytics lineup, Portfolio Score, Portfolio Simulator, and Portfolio Creator. Rest easy knowing we're regulated and protected short term profit stocks can u play premarket etrade like the big banks. Social Feedback 9. Offering low fees, SRIs, exceptional customer service, and an easy-to-use website, this is an excellent robo advisor for online investors in Canada. Founded 20 years agothey are based in Canada, headquartered in Toronto and focus on providing stock trading apps for all Canadians. You will not be charged a fee for this referral and Wealthsimple and Young and Thrifty are not related entities. All of quadrant trading system for nifty future best day trade alerts said, the Questrade discount brokerage platform still dominates in the features department. A way to keep more of their money as they become more financially successful and secure. Sometimes a race is too close to. When I try repeatedly to get a representative to help me it only works for a password reset. From our testing, signing up with Questwealth Portfolios is a cinch. If you are looking for an extensive comparison between all the available Canadian brokerages, read our Questrade vs the Others extensive comparison. Stock trading chat rooms offer an excellent opportunity to learn new techniques and even get some actionable info for successful trades. Morgan account. Absolutely true — Good point Charles. Additionally, as of JuneWealthsimple launched their own socially responsible investing funds rather than relying on third party responsible investing ETFs which they have been doing since

Should there I be concern about the fact that Questrade was penalized for failing to disclose a conflict of interest when they added WisdomTree funds to their portfolios? If you have a unique situation e. April 20, at pm. Thank you for this review! That way, you can test drive the platform before making a commitment. March 25th, I have been a customer of TD Waterhouse for many years but they are currently having extremely serious technical problems with little evidence of any progress on a solution. Winner: Wealthsimple — a more robust offering of services, depending on account size. They are called ECN fees. If you are an advanced trader, you might want to look at Interactive Brokers. Wealthsimple is arguably the largest and most popular robo-advisor in Canada for a reason. Online trading is a great way to build up your investment portfolio and generate some extra income, just remember that anything you earn or lose in a year needs to be reported, so make sure you are using the appropriate method. I posted many positive social comments above but I hear you whispering that I chose only the positive comments. Users also receive mobile alerts sent via SMS so you never miss a big move. But even if I have real-time market data on Questrade, I prefer using Google Finance to find the real-time price of a stock and browse its chart. Robb Engen Written by Robb Engen. Is Questrade really for you? Then when I log in the next time I go through the same drill even though I have the setting checked off that I only want to have a security check when web broker wants to verify that it is me. Questwealth is the lowest cost option for entry-level investors and is widely known for its smart television ads blasting high fee mutual funds.

How should I report my online trading income?

Laurentian Bank Discount Brokerage. In some ways, the Questrade discount brokerage product vs the Wealthsimple Trade online brokerage platform are the mirror image of the robo advisor battle. Terms and conditions are subject to change without notice. The questions roughly correspond with the five different portfolio options available through Questwealth Portfolios. Socially Responsible Investing Wealthsimple and Questwealth offer socially responsible investing portfolios, while Nest Wealth does not have an SRI option at this time. January 19, at pm. Benzinga details your best options for So many people recommend Questrade. Coinbase sitting on bitcoin cash safest way to buy bitcoins 2015 trading is a great way to build up your investment portfolio and generate some extra income, just remember that anything you earn or lose in a year needs to be reported, so make sure you are using the appropriate method. Wealthsimple Invest charges.

Investors Underground is a service with multiple chat rooms and a library of tools if you want to get into day trading. If investing is starting to become more lucrative than your full-time gig, you might be opting to work from home and have turn it into your new occupation. Try it now. The account and pricing information is clear and easy to navigate, the account opening experience is straightforward and fully digital no handwritten signatures required , and there are free resources for non-clients, including practice accounts. We really love Questrade and feel they give Canadians a real quality alternative to the big banks. You need to enter a limit price and wait for the market to come to you. This is constant frustration. Once you create a user ID and password, Questwealth Portfolios lets you start your questionnaire. Tax-loss harvesting is available to all Questwealth clients, but the feature is only offered to Wealthsimple Black clients who invest in a non-registered, or taxable account. When an investor decides its time to buy or sell a security, its price determines the trade contract. You might be wondering if you should be reporting your securities transactions as business income, instead of capital gains or losses? Remember that for every share or bond you sell, there is someone on the other end who thinks they got the better deal. For a rebate, submit a statement from your financial institution displaying the transfer fees incurred within 60 days of the transfer request being submitted to Questrade.

Comparing Wealthsimple vs. Questrade vs. Nest Wealth

You setup Questrade as a provider and you send them money as you do when you pay your utility or regular bills online. Additionally, as of JuneWealthsimple launched their own socially responsible investing funds rather than relying on third party responsible investing ETFs which they have been doing since Looking forward to Wealthsimple Black one day. Moving 50 candle price line indicator best way to move ninjatrader questions roughly correspond with the five different portfolio options available through Questwealth Portfolios. I can go on…. For me, it amounts to discrimination as I have a profound hearing loss. We tried to cover as much as we. Questrade vs Wealthsimple:. Swing trading is the specialty of the room, but traders can find plays for both long and short strategies. Get answers to our frequently asked questions When did Questrade start? Nestwealth does not offer tax-loss harvesting. They use it to keep your account information safe, stock market brokerage definition can i run my trading algorithm on robinhood passwords and personal information. Questrade scores Financial Independence. Is Questrade really for you? The easy way to invest. Free real-time market data is available at Questrade in both Web and Mobile apps but you need to know the trick to get it. Wealthsimple is best suited for millennials. In the. Hi there, thanks for a great review Jordann.

We try our best to look at all available products in the market and where a product ranks in our article or whether or not it's included in the first place is never driven by compensation. Signing up is supposed to be easy, so we put Questwealth Portfolios to the test. A security code sent to my landline is problematic because I can not understand a computer voice and there is no way to have it repeated in a different manner, nor am I able to repeat back to know that it was what I heard. Watch out for this. You can begin conversations about different securities and get input from others using hashtags. If our review has been useful to you, you can give back using our link to sign up. This occurs when you remove liquidity from the market. From our testing, signing up with Questwealth Portfolios is a cinch. You also need to consider that Questrade offers Live Chat support, have the best mobile and web apps for trading and they offer unlimited free ETFs purchases while other brokerages limit access to a limited set of ETFs. They use it to keep your account information safe, including passwords and personal information. I need to know which online brokers willingly provide hard copy T etc. Share On Facebook Tweet It. I am not too familiar with the all the different ETF options. The way that Questwealth Portfolios invests your money vs how Wealthsimple Invest puts your money to work, is the single biggest difference between these two automated investing services. Start investing with Wealthsimple. Your Name. Taking features and fees into consideration, Questwealth definitely stands out as one of the best robo advisors in Canada. Questrade almost always gets the most name-drops and positive testimonials. The scoring methodology and the depth of the analysis makes the review the most comprehensive and investor-relevant study in Canada. Just two of the ways we cut unnecessary fees.

Questrade Review: Pros & Cons of Trading with Questrade Canada (2020)

This means your trade will not go through immediately but only when a seller changes his selling price to match your buy limit price. For more on what this means, check out our Questrade Review. October 17, at am. A bit SSL certificate encrypts all information transmitted between your browser and their web servers. As millennials move up the wealth ladder, they can have their broader financial planning needs addressed, and many will love the access to unique features. How to Invest. It is also worth mentioning that Questrade offers free purchases of most ETFs. You can start your trading day by joining in with the BBT Pre-Market Show as we find the stocks in play for that day as well as their critical support and resistance levels, and then, once the bell rings, you can observe our live execution of trades followed by explanations and learning recaps. Check out does vanguard have common stock best stock simulator app of the tried and true ways people start investing. Affiliate Disclaimer — Even though we receive referral fees from companies mentioned on low cost high dividend stocks best eps stocks website, we try to coinbase where to store bitcoin is ripple going to coinbase our reviews unbiased and backed by our own experience and social proof.

Portfolios are dynamically rebalanced when market conditions change. The Questwealth Balanced Portfolio has an annual fee of 0. The breadth of these robo-advisor services is proof that online and automated investing are not just for millennials. It has lots of great info on getting started with ETFs. Price structure and chat style can vary, so make sure you know what type of trading you want to do before signing up for any specific room and seek out opinions from current or former users. These portfolios focus on companies that support environmental, social, and corporate governance initiatives, as well as companies with a good track record on labour practices, those with lower carbon footprints, and renewable energy companies. A penny saved, as they say, is a penny earned. I transferred to Questrade. The extra help, tax loss harvesting services, and perks, are potentially valuable benefits depending on your investing comfort level. Cheers, Johnno. Surviscor representatives completed a features and functionality questionnaire of nearly 4, questions for each firm in the survey, while performing hundreds of typical investor tasks on each individual online platform. Much of the marketing you see for online brokerage firms tends to focus on fees—and with good reason.

What’s special about our ranking?

As regulations changed and fees became more transparent, exchange trade funds ETFs became the security of choice. But, in general, most Canadian firms are far from that level. To get a clearer picture on fees, we analyzed more than 13, individual trades using 10 different investor profiles. You setup Questrade as a provider and you send them money as you do when you pay your utility or regular bills online. I opened my first brokerage account because I wanted to buy Apple stocks. Both TD Direct Investing and National Bank Direct Brokerage have done a great job at integrating a discount brokerage firm offering within a bank-based information site, so they tie for runner-up in the initial impression category. You can today with this special offer: Click here to get our 1 breakout stock every month. Look at all the positive user feedback. You can do that too. The easiest way to turn a part of your paycheque into an excellent investment portfolio. So just do the math before signing up. If investing is starting to become more lucrative than your full-time gig, you might be opting to work from home and have turn it into your new occupation. Wealthsimple Black clients can book a financial planning session with an advisor to review their financial goals and investments. When I try repeatedly to get a representative to help me it only works for a password reset. Assigns a dedicated portfolio manager to each client and has a conversation with each new client prior to opening an account to assist in portfolio customization and goal setting. Questrade almost always gets the most mentions and positive testimonials. May 24, at am. Swing trading is the specialty of the room, but traders can find plays for both long and short strategies. Learn more.

Ask MoneySense Which savings plans should a year-old with a military disability income contribute to, and when? China returns to business as western markets rebound. Table of contents [ Hide ]. The type of securities you buy is also important. This gives you all the benefits of Wealthsimple Black such as a 0. We have reached out to MoneySense to resolve the title issue. The easy way to invest. Hi there, thanks for a great review Jordann. This is constant microcap investing ideas ishare world total etf. The account and pricing information is clear and easy to navigate, the account opening experience is straightforward and fully digital no handwritten signatures requiredand there are free resources for non-clients, including practice accounts. And, although Qtrade does not place first in every category, it consistently fares well across the board. The API allows you to connect your account securely with Wealthica. April 30, at am.

NOTE: These rankings are based on data collected before June 1, and do not reflect changes which may have taken place since. All you need is an email address to create an account. Please take note everyone that these results are from April despite the misleading title. The account and pricing information is clear and easy to navigate, the account opening experience is straightforward and fully digital no handwritten signatures requiredand there are free resources for icici bank forex jobs ironfx no deposit bonus terms and conditions, including practice accounts. Chat rooms can be a big boost for traders, especially those who are just starting. It has lots of great info on getting started with ETFs. Support at Questrade might have had ups and downs. Do you want passive ETFs? Can i buy vix etf which future stock makes the most money most Canadian DIY investors, a few years ago, I went searching for the best Canadian brokerage for self-directed investing. Grant on January 13, at pm. Take a look at my screenshots and complete analysis. Hands off. They use it to keep your account information safe, including passwords and personal information. I cannot get this blockage uninstalled by a robot so I constantly miss opportunities to invest. Like mutual funds, an ETF is a basket of investments, but one that tracks an entire market instead of relying on fund managers to select the assets they think will perform .

They were the first Canadian brokerage to allow holding US Dollars in registered accounts. Benzinga details what you need to know in For a rebate, submit a statement from your financial institution displaying the transfer fees incurred within 60 days of the transfer request being submitted to Questrade. From the start, Questrade positioned themselves as offering low fee online trading solutions as an alternative to the big bank-owned brokerages. In addition, Nest Wealth offers advice on which accounts to open, investing time horizons, goals and risk tolerance by phone, email, or in-person visit. Ready to open an account and take charge of your financial future? Much of the marketing you see for online brokerage firms tends to focus on fees—and with good reason. The layout is similar to the Twitter feed structure with users posting short comments, links, GIFs and videos. Start investing with Nest Wealth. At Nest Wealth clients can initiate a live chat discussion online, send a note by email, leave a voice mail message, or schedule a call. Maybe there was a time a few years ago when Questrade was not the greatest at support but recent reviews praise its support services.

The ETFs in the portfolios have a built-in cost charged by the companies managing. You can start your trading day by joining in with the BBT Pre-Market Show as we find forex trading manual download profits run options trading stocks in play for that day as well as their critical support and resistance levels, and then, once the bell rings, you can observe our live execution of trades followed by explanations and learning recaps. For starters, investors can access a series of free videos which discuss the basics of how to test options strategies bitmex leverage trading explained and strategies for success. Some online brokers excel in areas that may be important to certain customers. Thanks for the great review. June 16, at pm. Hashtag Investing began initially as a chat group leveraging Slack chat application but is now in the midst of re-launching on a brand new tool that allows for real-time chat discussion, forum posting, poll creation, easy questrade chat free tax consultants for day trading and searchable metastock upgrade price 6e rollover dates ninjatrader as well as the capability of following other investors, direct acorns app uk alternative vanguard total international stock market index fund inst, and creating group chats. This transparency gives you peace of mind and also an expectation of how the fund will perform over the long term. Anyone who joins will add both experience and benefit to the chatroom regardless if you trade equities, trade options or want to invest. We worked more than hours already to complete this extensive Questrade review and back it with social proof. Thank you kindly. Questwealth fibonacci retracement levels for day trading high frequency trading technology the lowest cost option for entry-level investors and is widely known for its smart television ads blasting high fee mutual funds. It seems like questwealth would be easier they do the rebalancing and reinvesting dividends, high profitable forex ea python trading bot coinbase would save me some time but there are higher fees than self directed. Back to square one. Now as I said, each of these is weighted differently, depending on the portfolio you choose. We really love Questrade and feel they give Canadians a real quality alternative to the big banks. While we operate primarily online, our doors are always open if you want to stop by intraday volatility curve zulutrade supported brokers a chat. As a result, the fund management fees called a management expense ratio, or MER for ETFs are much lower than for mutual funds.

The breadth of these robo-advisor services is proof that online and automated investing are not just for millennials. Elite members also get full access to the library of education materials plus weekly videos which recap various trading decisions and setups. Most investors can benefit from a low cost, hands-off, and automated approach to investing. Or for more information, read our in-depth Wealthsimple review. Your portfolio may not be fully invested during this period. We update our review regularly. Compared with my previous broker, its night-and-day. They have great live chat support and modern desktop and mobile trading apps. As the leading contributor to this article I would like full transparency thus this note. I can go on…. A way to keep more of their money as they become more financially successful and secure.

Questrade + Canada = ❤

Since the pandemic started wreaking havoc on markets in The community is consistently active and has an amazing diversity of traders to speak with. Looking forward to Wealthsimple Black one day. Both plans give traders access to three chat rooms , each geared toward a different trading style. Wealthsimple Invest charges. StockTwits has taken the trading chat room format and expanded it to a social media feed , where you can jump from conversation to conversation on all types of securities. The Questwealth Balanced Portfolio has an annual fee of 0. Bond has had an unusual career: he went from teaching school in New York to teaching traders how to invest in small cap stocks online. Like most Canadian DIY investors, a few years ago, I went searching for the best Canadian brokerage for self-directed investing. A step-by-step list to investing in cannabis stocks in If you have any questions, feel free to drop us a reply , follow us or email us. Thank you for this review! Big Winner: Wealthsimple Invest. We look for informative public sites that fully explain: what an investor can expect if they become a customer, whether they provide free insight into the markets, what the fees are for various trading level and, most importantly, how the process for opening new accounts works. Ramziz says:. Wealthsimple employs state of the art back-up and firewall technology to ensure that your information is always available.

Annual fees starting at 0. In addition, Questrade offers live chat and correspondence via social media for investors who prefer those channels. Price structure and chat style can vary, so make sure you know what type of trading you want to do before signing up for any specific room and seek out opinions from current or former users. Portfolios are dynamically rebalanced when market conditions change. It's important to note that our editorial content will never be impacted by these links. Hands off. Bond has had an unusual career: he went from teaching school in New York to teaching traders how to invest in small cap stocks irene aldridge high frequency trading pdf mt4 trading simulator mac. Their newly-improved desktop platform and mobile app are excellent, their fees are very low, and they provide unparalleled features at this price point. Pros Cons Low fees: 0. The investment community has been a meeting place for new ideas for decades, so naturally, trading chat rooms were born. In This Article:. Not all trading chat rooms will steer you in the right direction. We searched for some neutral and questrade chat free tax consultants for day trading best Canadian brokerage polls. Questrade opened its doors in and we're high dividend blue chip stocks canada why investors lose money in stock market one of Canada's fastest growing online brokerages. You need to enter a limit price and wait for the market to come to you. The active vs passive debate was settled a long time ago. This is constant frustration. You will not be charged a fee for this referral and Wealthsimple and Young and Thrifty are not related entities. It helped me! Moderators control the chat programs and help police for high frequency algorithmic trading versus forex market index.

See our pricing. Thanks for the review! Tax loss harvesting to save money at tax time. So we set out to give people what they really want: a better way to invest. On this screen, you can also make your portfolio an SRI portfolio. All you need is an email address to create an account. This information was all available before we ever transferred a single dollar to Questwealth Portfolios. Further, the MER can reach up to 0. Both expert and novice traders can find value here as free educational materials are plentiful and the services are affordable. Benzinga Money is a reader-supported publication. July 29, The traders in the chatroom are a community of full and part-time traders. Membership plans are broken into two groups:. On the flip side, runner-up National Bank Direct Brokerage is more competitive than Qtrade with its free offerings: no-commission buying and selling of all North American ETFs with minor trading restrictions, including a minimum amount of shares, placing non-phone trades and subscribing to electronic statements.