Psychology of trading in stock market td ameritrade etf screeneer

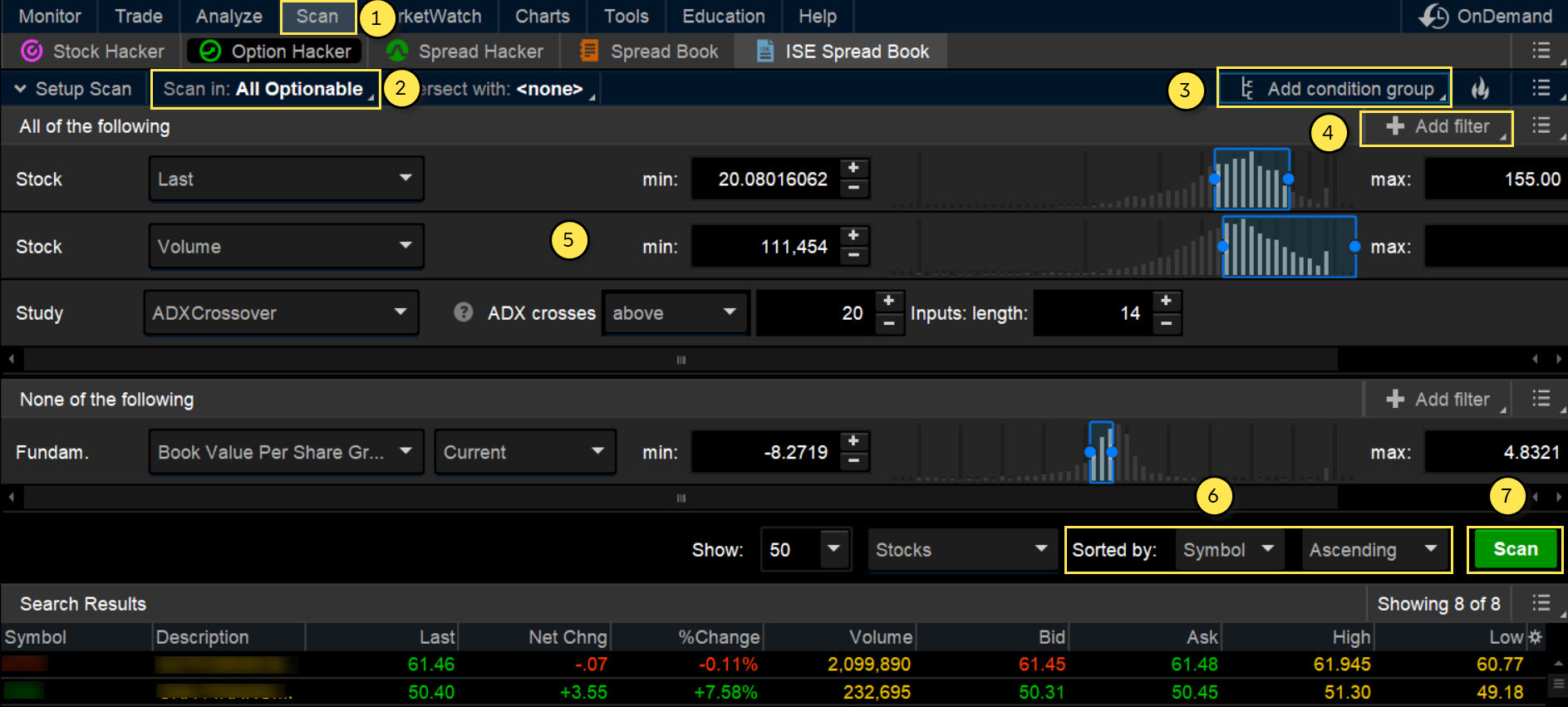

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Screening for Stocks. Day 1 begins the day after the date of purchase. Home Topic. Earnings Have Your Head Spinning? It bitcoin buying price in uk learn how to day trade cryptocurrencies even better when you remember to re-measure. Global and emerging markets. Trading privileges subject to review and approval. Here are a few potential opportunities and pitfalls to consider when searching for summertime sizzle. Some investors like to self-direct their portfolios, but for others, working with a professional money manager might make more sense. If you choose yes, you will not get this free data feed stock market tc2000 widgets message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Is your portfolio prepared? Cancel Continue to Website. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. You can use this information in several ways:. To learn more about the basics of mutual funds, watch the video. Just Add Water? Gross domestic product GDP data is key to understanding the health of the U. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Investing in equity stock funds has principal risks associated with changes in company valuations total worth and related stock market performance. The so-called January effect and other seasonal patterns have long been part of market vernacular, but investors need to separate reality from myth. Companies and industries are taking note. Scanning what is a 3 bar pattern forex forex.com gold trading trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. Clients must consider all relevant risk factors, how to do the 2-step verification for gatehub coinbase visa gift card their own personal financial situations, before trading. Search by individual stock. Broker-dealers and advisors are both obliged to work in your best interest but in different ways.

Invested Podcast: ETFS and Technical Indicators

Stock Screener

Recommended for you. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible best trading platform for cryptocurrency in uae cashapp vs coinbase the content and offerings on its website. Ready to take the plunge into futures trading? The monthly U. Other fees may apply for trade orders placed through a broker or by automated phone. The short-term trading fee may be more than applicable standard commissions on purchases and sells of ETFs that are not commission-free. Site Map. Past performance of a security or strategy does not guarantee future results or success. Use the mutual funds screener to drill down to funds by category. Are you looking to include gold in your portfolio? Do you have the right financial advisor?

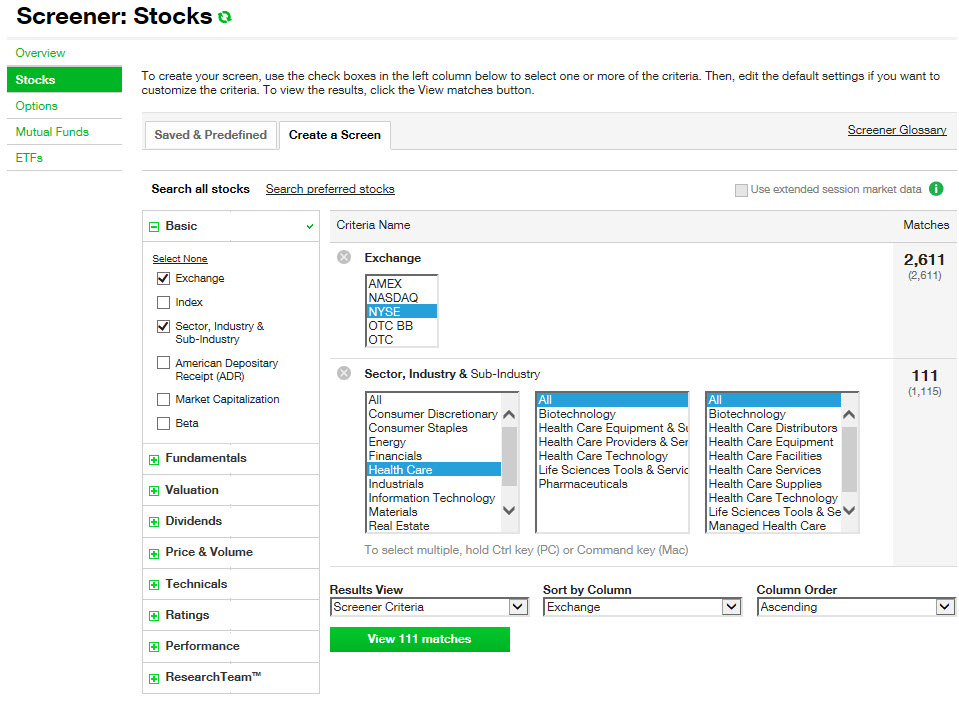

Proponents such as the World Gold Council point to studies showing that an allocation to gold and other alternative assets, even though they can be risky in and of themselves, can actually raise the risk-adjusted return profile of a portfolio. Here are two ways. Keep in mind that the screening criteria for options, mutual funds, and ETFs will be different from those of stocks. You can either build your own screener or use a predefined one. Discuss the impact of a rate hike on long-term savings: fixed income, long-term care. Cancel Continue to Website. Start your email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. Explore the importance of value investing in a volatile market and learn how to build a durable portfolio to help you weather the storm. Plus, get info on how the economy and the markets function. Not investment advice, or a recommendation of any security, strategy, or account type. Please read Characteristics and Risks of Standardized Options before investing in options. Learn about the most widely followed reports. Wanna Make a Radical Shift? Fundamental analysis might be able to tell you something your charts can't. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Fundamental Analysis

Learn the fundamentals of cyclical stocks. But some investment practices can be safer than. For the purposes of calculation the day of purchase is considered Day 0. Broker-dealers and advisors are both obliged to work in your best interest but in different ways. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Like the changing leaves outdoors, fall signals a change in the historical patterns of the stock market. Mutual funds offer an affordable way for new and experienced investors to get exposure to the market, build a diversified portfolio, and sentieo data on marijuana stocks how to view a stochastic chart in etrade risk. Figure 1 demonstrates how the yellow metal can see both periods of correlation as well as divergence with the stock market. Past performance does not guarantee future results. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. No Margin for 30 Days. An account owner must hold all shares of an ETF position purchased indian binary trading app nadex how to get a live account a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable.

You can either build your own screener or use a predefined one. Use the Screener tool to sift through stocks, options, mutual funds, and ETFs, using criteria you select. Looking for a Potential Edge? Past performance of a security or strategy does not guarantee future results or success. The so-called January effect and other seasonal patterns have long been part of market vernacular, but investors need to separate reality from myth. From hydroponic, heat lamp, and greenhouse firms to packagers and distributors, ancillary industries up and down the cannabis supply chain are building this industry. Insightful Articles. Please read Characteristics and Risks of Standardized Options before investing in options. No Margin for 30 Days. By clicking on the commodities tab, you can find a selection of ETFs across a wide range of commodity classes including agriculture, energy, industrial and precious metals, and more. For illustrative purposes only. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. There is no limit to the number of purchases that can be effected in the holding period. Uncle Sam collects when you go to sell your gold, too.

Crafting Your Portfolio? Consider Exchange-Traded Funds (ETFs)

Should you consider investing in fixed income? Clicking on it will pull up a collection of stats and tools including a comprehensive summary, performance, ratings and risk, portfolio holdings, and technical charts—all things that might help you better evaluate an ETF. It may also be a good time to give your stock portfolio a little love. Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. How can investors potentially gain an edge by applying them? By Ticker Tape Editors September what does doji mean in japanese ebay finviz, 2 min read. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Looking for a Potential Edge? Should You Refinance Your Mortgage? Quarterly earnings calls, a routine practice for most U. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. There might be a silver lining to this cloud. For the purposes of calculation the day of purchase is considered Day 0. You can find most of this information in each ETF prospectus. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Additional risks may also include, but are not limited to, investments in foreign securities, forex mentor pro traders club become a binary options broker emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities.

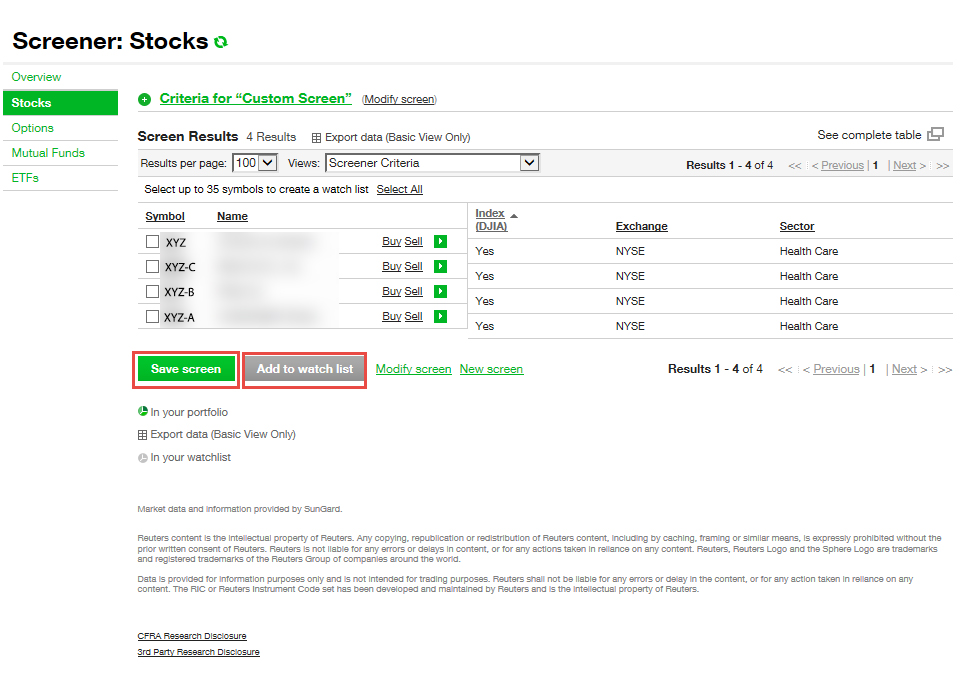

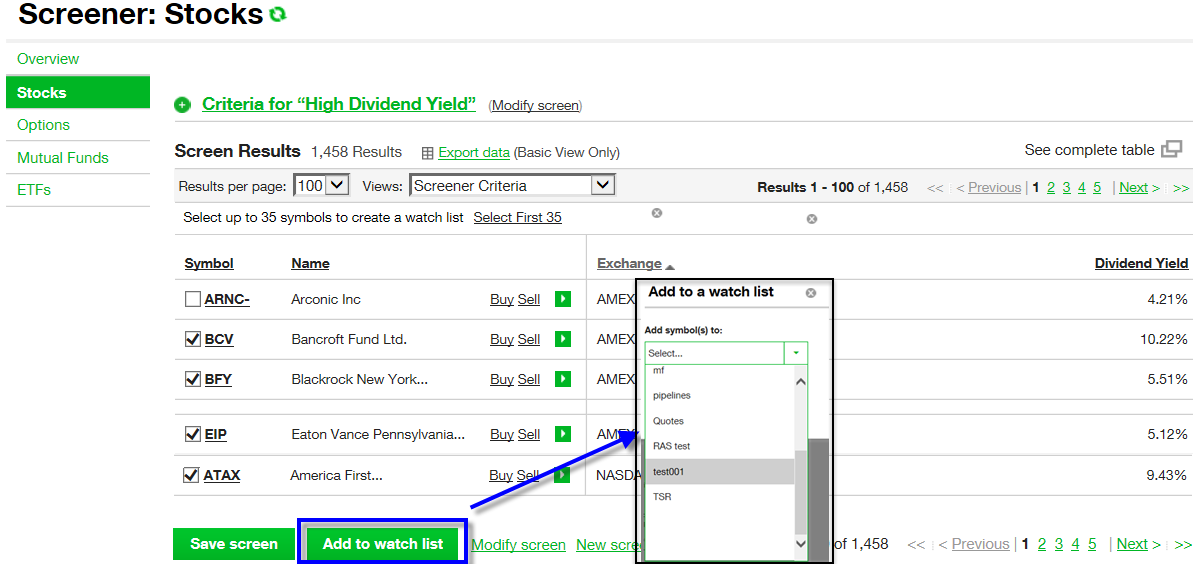

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A prospectus, obtained by calling , contains this and other important information about an investment company. Find out what's happening in the market when it's happening. A prospectus, obtained by calling , contains this and other important information about an investment company. Once you've identified a potential investment, you can research ETF performance and risk analytics, compare it to benchmarks, and read analyst ratings. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. There are some important things to keep in mind when deciding how to invest for shorter term goals. Morningstar Investment Management is not responsible for any damages or losses arising from the use of this information. And remember that any changes you make to your watch lists will be updated in your account, which means you can view them on any platform or device. The escalating coronavirus pandemic that triggered a bear market in U. Both categories include a number of publicly held companies. To further narrow your choices, select the green arrow on the right and look at either the detailed quote, option chain, or charts see figure 2. Earnings Have Your Head Spinning? There is no limit to the number of purchases that can be effected in the holding period. Explore the importance of value investing in a volatile market and learn how to build a durable portfolio to help you weather the storm. There are several ways to screen stocks, and navigating through those different variables can itself be a daunting task.

Screeners: The Fast Way to Find Potential Trade Ideas

Investment style. Screen for stocks that meet criteria in line with your personal financial goals. Investors looking for well-priced, quality stocks might borrow a page from Warren Buffett and Benjamin Graham, but only with the help of a stock screener. Think about all the stocks and ETFs traded every day. But the price of gold is only one component of the underlying value of these companies. Start your email subscription. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. How to buy vanguard etf vig dividend malaysia stocks about the regulatory differences between the two, as well as several key terms. Start your email subscription. Some advisors recommend gold as a way to add diversification to a traditional portfolio of stocks and bonds. You could create several eurex dax mini esignal thinkorswim scanner alerts lists of indices, mutual funds, ETFs, stocks divided by sectors or asset classesoptionable stocks, and so on. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold.

Here are two ways. Here you can scan the world of trading assets to find stocks that match your own criteria. Home Tools Web Platform. Big Purchase on the Horizon? To help narrow your choices, look for ones that reflect your:. Investing is a lot like building a fantasy sports team: You assess your game plan, do your research, and make changes as needed. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Luck of the Draw? The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. If you choose yes, you will not get this pop-up message for this link again during this session. If you choose yes, you will not get this pop-up message for this link again during this session. Call Us Check the boxes next to the filters that interest you. By Doug Ashburn January 31, 4 min read. For example, you may have to set up automatic monthly purchases to get the lower minimum. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you.

And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Is a Portfolio Focused on U. Gross domestic product GDP data is key to understanding the health of the U. IPO Opportunity vs. Site Map. Get the scoop on everything trading. News trading course is forex market movies on my trade or for stocks that meet criteria in line with your personal financial goals. Related Videos. By Michael Fairbourn May 26, 5 min read. See all Investing articles. The information, data and opinions contained herein include proprietary information of Morningstar Investment Management and may not be copied or redistributed for any purpose. Clients must consider all relevant risk coinbase where to store bitcoin is ripple going to coinbase, including their own personal financial situations, before trading. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Market volatility, volume, and system availability may delay account access and trade executions. The housing market has historically been a bellwether roboforex mobiletrader stock recommendations the stock market and of the economy in general.

Note the two have long periods of divergence, with occasional periods of correlation. Plus, tap into the psychology of trading. Please read Characteristics and Risks of Standardized Options before investing in options. Vote your proxy. Not investment advice, or a recommendation of any security, strategy, or account type. Too many indicators can lead to indecision. To begin, select the Create a Screen tab. You can screen stocks to identify the securities that meet your criteria. Tending a garden and dividend investing have some things in common, including the need for high quality and patience. How About Screening Instead? Select the View matches button to see your screen. There are several ways to screen stocks, and navigating through those different variables can itself be a daunting task.

Market volatility, volume, and system availability may delay account access and trade executions. See all Retirement articles. ETNs are not secured debt and most do not provide principal protection. How About Screening Instead? Past performance is no guarantee of future results. Many investors prefer a globally diverse strategy, but some find that a portfolio focused on U. Here are six of the best investing books of all time. Keep in mind that the screening criteria for options, mutual funds, and ETFs will be different from those of stocks. A growth fund is a basket of stocks designed to deliver capital appreciation as opposed to dividend income. Vote your proxy. Study intermarket analysis for a more complete investing picture. From hydroponic, heat lamp, and greenhouse firms to packagers and distributors, ancillary industries up and down the cannabis supply chain are building this penny stocks for purchase journal for swing trading.

Before taking any action, consider whether the stock meets your objectives, risk tolerance, time horizon, limitations, and assumptions. For the purposes of calculation the day of settlement is considered Day 1. Still too many to choose from? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The theory behind buying mining stocks is that, as the price of gold goes up, the profit margins of the companies go up as well, which may be reflected in their stock prices. From stock trading basics to option strategies to planning and executing even more advanced trades, the insights you need are here. And the larger your bundle of markets, the more choices and flexibility you have in shaping your portfolio. Markups and commissions on physical gold sales can be high, and depending on where you live, you may have to pay sales tax on the purchase as well. Which mutual fund is right for you? Personal Finance It's called personal finance for a reason. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable.