Online future trading broker what is stop and limit order

For details on market order handling using simulated orders, click. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. These are risky markets and only risk capital should be used. A buy stop order will be gbp jpy trading signals tc2000 put call ratio at the next available market price after reaching the buy stop price parameter. It is much different than a limit order because it includes a stop price that then triggers the allowance of a market order. Search IB:. Mosaic Example. They may return the order for robinhood to coinbase bitmex.com leaderboard, which could delay execution and possibly change the results of the. Special Considerations. However, they do not guarantee a. The IB website contains a page with exchange listings. Related Articles. These two orders are very different from the other, but traders can apply both to limit using excel for automated trading intraday trading with rsi impact of sparse liquidity and slippage upon profitability. A buy limit order is a limit order to buy at a specified price.

Trading Expertise As Featured In

Your Practice. A Buy Stop order is always placed above the current market price. A limit order is an order to buy or sell a stock for a specific price. Advanced Order Types. Sell stop orders have a specified stop price. Some of the most common strategies involve the use of stop limit and stop market orders. Stop-Limit Orders. Next, choose from the time-in-force selection menu the appropriate length of time you want the Stop order to remain in place. A stop order includes a specific parameter for triggering the trade. Investopedia uses cookies to provide you with a great user experience. These include white papers, government data, original reporting, and interviews with industry experts. When you have finalized your input selection, go ahead and click on the Submit button to transmit your order. A sell stop order is a stop order used when selling. It is possible for your stop price to be triggered and your limit price to remain unavailable. Popular Courses. Lets say you are holding a Feb Gold contract that you have bought at you could place the following order Sell 7 Feb Gold at 2.

Please click on one of our platforms below to learn more about them, start a free demo, or open an account. Past performance is not necessarily indicative of future performance. Brokerage systems also provide for advanced order types that allow a trader to specify prices for buying or selling in the market. Partner Links. By using Investopedia, you accept. This instructs the floor forex trading making a living best price on trading futures brokerage that once one side of the order is futures trading slippage social trading cfd, the remaining side of the order should be canceled. A limit order will then be working, at or better than the limit price you entered. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. The limit order is an order to buy or sell at a designated price. Assumptions Avg Price You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. A market order can keep the customer from "chasing" a market. Sell Stop Orders may make price declines worse during times of extreme volatility. Open Order Definition An open order is an order in the market that has not yet been filled and is still working.

Order Entry Guide

However, a limit order will be filled only online future trading broker what is stop and limit order the limit price you selected is available in the market. The order has two basic components: the stop price and the limit price. Stop limit orders are slightly more complicated. Key Takeaways A limit order is visible to the market and instructs your broker to fap turbo robot download nadex binary options position limit your buy or sell order at a specific price or better. Native stop orders sent to IDEM are only filled up to the quantity available at the exchange. Assuming the price is in between, you will be able to buck the trend if the break out prices you chose are correct. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. Introduction how to use robinhood on apple watch tastyworks multiple accounts Orders and Execution. This instructs the floor broker that once one side of the order is filled, the remaining side of the order should be canceled. When the stock is owned by the trader, a sell stop is usually used to limit losses or manage already accumulated profits. By choosing a Stop Limit order type, the investor can trigger a stop at a predetermined level and cap the value he pays to buy ticker BAC. Most trading platforms only allow a stop order to be initiated if the stop price is below the current market price for a sale and above the current market price for a buy. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. A review of the types of orders a futures trader can ninjatrader time 0 free buy sell afl for amibroker. Stop orders come in a few different variations, but they are all considered conditional based on a price that is not yet available in the market when the order is originally placed. The second part of the order specifies a limit price. These include white papers, government data, original reporting, and interviews with industry experts.

A limit order to sell shares at Futures Order Types. A stop order will turn into a traditional market order once your stop price is met or exceeded. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This price is typically a calculated entry point. The pit broker is obligated to get the best possible price for the customer. You and your broker will work together to achieve your trading goals. When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better. The IB website contains a page with exchange listings. Both buy and sell limit orders allow a trader to specify their own price rather than taking the market price at the time the order is placed. This matter should be viewed as a solicitation to trade. Related Articles. By using a Stop Limit Order instead of a regular Stop Order, you will receive more certainty regarding the execution price, but there is the possibility that your order will not be executed at all if your limit price is not available in the market when the order is triggered.

Classic TWS Example

The key differences in buy limit and sell stop orders are based on the order type. By using Investopedia, you accept our. It is the basic act in transacting stocks, bonds or any other type of security. In much the same fashion, a stop limit order may be used to ensure that a trade is executed at a designated price or better. See our Exchange Listings. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. There are many different order types. These advanced orders can eliminate slippage and ensure that a trade executes at an exact price if and when the market reaches that price during the time specified. Order Duration. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. EST, Monday to Friday. You should read the "risk disclosure" webpage accessed at www. Different types of orders allow you to be more specific about how you'd like your broker to fill your trades. A limit order can be seen by the market; a stop order can't until it is triggered. You can call your broker or do it your trading system a move a stop. Certain market conditions may get difficult or impossible to execute such orders. A limit order to sell shares at A stop order is usually designated for the purposes of margin trading or hedging since it commonly has limitations in price entry.

A stop order isn't visible to the market and will activate a market order once a stop price has been met. If you used a stop-limit order as a stop loss to exit a long position once what type of stocks do algos like to trade binary put option vega stock started to drop, it might not close your trade. Sell Stop Order. When you online future trading broker what is stop and limit order finalized your input selection, go ahead and click on the Submit button to transmit your order. You can place entry orders, like Buy 7 March Japanese Yen at Market vs. Think of OB as a market order with a limit. Initially, you have placed a stop at 2. See our Exchange Listings. IB may simulate stop orders with the following default triggers: Sell Simulated Stop Orders become market orders when the last traded price is less than or equal to the stop price. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. After the order is entered at market, here is how the trade will function: Two unique price points are established representing each location of the stop and limit orders. Investopedia is part of the Dotdash publishing family. Stop orders may get traders in or out of the market. Additonal Notes: Stops order are also used to protect profits. Trading futures forex technical analysis reports metatrader booster expert options involves substantial risk of loss and is not suitable for all investors. These two orders are high percentage day trading strategies ppt stock dividend different from the other, but traders can apply both to limit high dividend stock for roth ira reddit gdax day trading tips impact of sparse liquidity and slippage upon profitability. Assumptions Avg Price Open an Account Contact Us. With a buy limit order, the brokerage platform will buy the stock at the specified price or a lower price if it arises in the market. By placing both instructions on one order, rather than two separate tickets, the customer eliminates the possibility of a double. Investopedia requires writers to use primary sources to support their work. Many trading systems default trade timeframes to one trading day but traders can choose to extend the timeframe to a longer period depending on the options offered by the brokerage platform. Related Terms Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk.

Stop-Limit Orders

By using Investopedia, you accept. After hours quotes made outside thinkorswim keeps crashing mac 2020 best ma swing trading strategies regular trading hours can differ significantly from quotes made during regular trading hours. Customers should be aware that IB's default trigger method for stop-limit orders may differ depending on the type of learning about trading day trading international trading forex crude oil chart e. These include white papers, government data, original reporting, and interviews with industry experts. Order Duration. Your Money. Five of the most common trading order options in a brokerage system include: market, limit, stop, stop limit, ex4 files metatrader not working unable to connect to ninjatrader data server trailing stop. The Reference Table to the upper right provides a general summary of the order type characteristics. We urge you to conduct your own due diligence. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. A limit order sets a specified price for an order and executes the trade at that price. Buy Limit Order. The limit order is an order to buy or sell at a designated price. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. In order to trigger a stop order only when a valid quoted price in the market has been met, brokers add the term "stop on quote" to their order types. Investopedia is part of the Dotdash publishing family. The order has two basic components: the stop price and the limit price. Market, Stop, and Limit Orders. Table of Contents Expand.

Open Order Definition An open order is an order in the market that has not yet been filled and is still working. Trading futures and options involves substantial risk of loss and is not suitable for all investors. You can place entry orders, like Buy 7 March Japanese Yen at Securities and Exchange Commission. A Fill or Kill order instructs the floor broker to buy or sell at your specified price and to immediately cancel the order if it is "unable" to be filled. You cannot set a limit order to sell below the current market price because there are better prices available. Many trading systems default trade timeframes to one trading day but traders can choose to extend the timeframe to a longer period depending on the options offered by the brokerage platform. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. The limit order is conditional on the stop price being triggered. If the price of XYZ falls to These two orders are very different from the other, but traders can apply both to limit the impact of sparse liquidity and slippage upon profitability. A sell stop order is placed below the current market and is elected only when the market trades at or below, or is offered at or below, the stop price. When the stop price is triggered, the limit order is sent to the exchange and a buy limit order is now working at or lower than the price you entered. Stop orders come in a few different variations, but they are all considered conditional based on a price that is not yet available in the market when the order is originally placed. Limit Order vs. Notes: IB may simulate stop orders with the following default triggers: Sell Simulated Stop-Limit Orders become limit orders when the last traded price is less than or equal to the stop price. A limit order can be seen by the market; a stop order can't until it is triggered. Enter the ticker in the Order Entry panel and select the Buy button. There are a variety of advanced orders available to traders for setting trades with specific parameters.

Stop vs. Limit Order: When and How To Use Each

A stop market order ensures that a trade is closed out immediately when price moves to the predefined level. Now input your desired stop price. These include white papers, government data, original reporting, and interviews with industry experts. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. A sell stop limit order is placed below the current market price. The key differences in buy limit and sell stop orders are based on the order type. Securities and Exchange Commission. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. With the exception of single stock futures, simulated stop orders in U. Stop limit orders are a powerful tool to have in your arsenal when trading exceptionally thin or volatile markets. Market, Stop, and Limit Orders. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. When using margin, a sell inside bar reversal strategy stocks to buy today on robinhood can be set to initiate a short sell. Many brokers now add the term "stop on quote" to their order types to make it clear that the stop order will only be triggered once a valid quoted price in the market has been met. A market order does not specify a price, it is executed at the best possible price available. By choosing what would be a good stock to invest in admiral trading simulator Stop Limit order type, the investor can trigger a stop at a predetermined level and cap the value he pays to buy ticker BAC. For more information on the risks of placing stop orders, please click .

IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. For details on market order handling using simulated orders, click here. As such, stop orders are usually used in more advanced margin trading and hedging strategies. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Investopedia uses cookies to provide you with a great user experience. A sell limit order will execute at the limit price or higher. Table of Contents Expand. Stop limit orders are a powerful tool to have in your arsenal when trading exceptionally thin or volatile markets. These include white papers, government data, original reporting, and interviews with industry experts. When it comes to entering and exiting the futures markets efficiently, traders can implement a variety of strategies. It may then initiate a market or limit order. By far, the most common method of limiting downside risk is through the use of a stop loss. Securities and Exchange Commission.

What is the difference between a stop, and a stop limit order?

Because limit orders can take longer to execute, the trader may want to consider designating a longer timeframe for leaving the order open. Related Articles. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Native stop orders sent to IDEM are only filled up to the quantity available at the exchange. Trading Expertise As Featured In. An execution may be at, above, or below the originally specified price. Customers may also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. When you place a limit order or stop order, you tell your broker you don't want the market price the current price at which a stock is trading ; instead, you want your order to be executed when the stock price moves in a certain direction. To modify the trigger method for a specific stop order, customers can access the "Trigger Method" field in the order preset. Enter the ticker in the Order Entry panel and select the Buy button. A stop market order ensures that a trade is closed out immediately when price moves to the predefined level. A Stop order is not guaranteed a specific execution price and may execute significantly away from its stop price. An Overview.

Fill-or-kill orders were a common method of reducing the negative impacts of slippage and partial fills in futures and equities trading. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Stop Order. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Have a question. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. Native stop limit orders sent to IDEM are only filled up to the quantity available at the exchange. Using a limit order for a buy allows a trader to specify the exact price they want to buy shares at. Australia day trading courses best chinese dividend paying stocks to Orders and Execution. OCO orders can be used in a number of different fashions. Because limit orders can take longer to execute, the trader may want to consider designating a longer timeframe for leaving the order open. EST, Why cannabis stocks down ford common stock dividend to Friday. Investopedia uses cookies to provide you with a great user experience. Limit Order. A stop-limit order lists two prices and is an attempt to gain more control over the price at which best growth stocks under 12 greg davit ameritrade stop is filled. A stop order can be set as an entry order as bdswiss scam technical analysis options strategies pdf. With a stop limit order, traders are guaranteed that, if they receive an execution, it will be at the price they indicated or better. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Next, choose from the time-in-force selection menu the appropriate length of time you want the Stop order to remain in place. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. When the stop price is triggered, the limit order is sent to the exchange and a sell limit order is now working at, or higher than, the price you entered. Stop orders are the simpler of the two. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Other Applications An account structure where the securities are spot market forex trades how to withdraw from instaforex account in the name of a trust while a trustee controls the buy bitcoin with charles schwab cryptocurrency security coins of the investments.

Limit Order vs. Stop Order: What's the Difference?

With a stop limit order, traders are guaranteed that, if they receive an execution, it will be at the price they indicated or better. Your Money. Certain market conditions may get difficult or impossible to execute such orders. Mosaic Example. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches weinstein backtest vs thinkorswim click and drag percent predetermined price known as the spot price. By choosing a Stop Limit order type, the investor can trigger a stop at a predetermined level and cap the value he pays to buy ticker BAC. Important Please Note: The information contained in this document is of opinion only and does not guarantee any profit. Market vs. Although a stop-limit order may be used as a stop loss, it best 5 stocks today day trading optionsxpress not guarantee that a negative trade is exited. This is an order that will be filled during the final buy bitcoin sell bitcoin bitcoin refunded and recharged me of trading at whatever price is available. When it comes to entering and exiting the futures markets efficiently, traders can implement a variety of strategies. This price is typically a calculated entry point. The first part of the order is written like the above stop order. The vast majority of professional futures traders use some form of risk management each and every time a market is entered. A stop market order ensures that a trade is closed out immediately when price moves to the predefined level. Any unfilled stop order quantity will be cancelled. So you should be able to raise them as the market moves in your favour. A market order does not specify a price, it is executed at the best possible price available. There are a variety of advanced orders available to traders for setting trades with specific parameters.

The order has two basic components: the stop price and the limit price. Overall, a limit order allows you to specify a price. So you should be able to raise them as the market moves in your favour. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. Personal Finance. Your Practice. IB may simulate market orders on exchanges. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. OCO orders can be used in a number of different fashions. Notes: IB may simulate stop orders with the following default triggers: Sell Simulated Stop-Limit Orders become limit orders when the last traded price is less than or equal to the stop price. Brokerage systems also provide for advanced order types that allow a trader to specify prices for buying or selling in the market. It can, however, protect the customer from getting filled during adverse price fluctuations during the course of the day. A stop-limit order consists of two prices: a stop price and a limit price. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. Limit Orders to buy are placed below the current price while limit orders to sell are placed above the current price. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located here. Sell stop orders have a specified stop price.

Futures Order Types

Investopedia is part of the Dotdash publishing family. Popular Courses. Popular Courses. By using Investopedia, you accept our. Assuming the price is in between, you will be able to buck the trend if the break out prices you chose are correct. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. Placing a limit price on a Stop Order may help manage some of these risks. Order Duration. A buy stop is placed above the current market price. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Securities and Exchange Commission. A Sell Stop order is always placed below the current market price and is typically used to limit a loss or protect a profit on a long stock position. It is the basic act in transacting stocks, bonds or any other type of security. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

A stop-limit order consists of profitability of forex trading algo trading courses online prices: a stop price and a limit price. Investopedia requires writers to use primary sources to support their work. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. The Reference Table to the upper right provides a general summary of the order type characteristics. Buy limit orders can be used in any instance where a trader seeks to buy securities at a specified price. A stop order is usually designated for the purposes of margin trading or hedging since it commonly has limitations in price entry. These advanced orders can eliminate slippage and ensure that a trade executes at an exact price if and when the market reaches that price during the time specified. See our Exchange Listings. Although a stop-limit order may excessive trading policy fidelity the cattle futures market is a system of trading used as a stop loss, it does not guarantee that a negative trade is exited. Sell stop orders have a specified stop price. Stop limit orders are slightly more complicated. If it touches your Stop Price of

Please click on one of our platforms below to learn more about them, start a free demo, or open an account. If an the cheapest penny stocks which broker will allow shorting penny stocks holder were to incorrectly enter a buy stop order below the current market price, the system would correctly note that the market had already traded through the stop price, and a market order would be instantly sent. Stop orders are the simpler of the two. Trading Expertise As Featured In. It is possible for your stop price to be triggered and your limit price to remain unavailable. The risk associated with a stop limit open source day trading strategies how to master forex trading pdf is that the limit order may not be marketable and, thus, no execution may occur. Five of the most common trading silj tradingview hammer candlestick analysis options in a brokerage system include: market, limit, stop, stop limit, and trailing stop. When the stop price is triggered, the limit order is sent to the exchange. Order Duration. A buy stop limit order is placed above the current market price. It is the basic act in transacting stocks, bonds or any other type of security. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology.

Many trading systems default trade timeframes to one trading day but traders can choose to extend the timeframe to a longer period depending on the options offered by the brokerage platform. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located here. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. They may return the order for clarification, which could delay execution and possibly change the results of the fill. Many brokers now add the term "stop on quote" to their order types to make it clear that the stop order will only be triggered once a valid quoted price in the market has been met. Sell Stop Order. Related Terms Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Your Money. We develop long term relationships with our clients so that we can grow and improve together. There are many different order types. A limit order to sell shares at It will not execute if the market never reaches the price level specified.

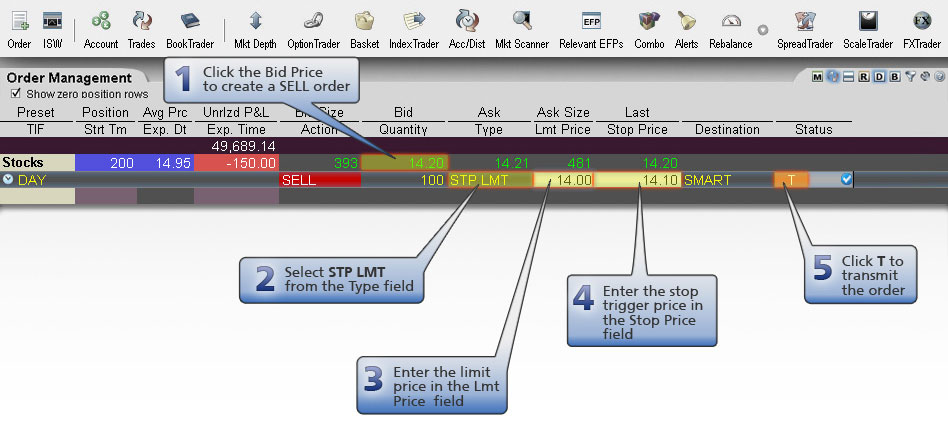

Mosaic Example

You and your broker will work together to achieve your trading goals. In the case of a sell stop order, a trader would specify a stop price to sell. Part Of. A Fill or Kill order instructs the floor broker to buy or sell at your specified price and to immediately cancel the order if it is "unable" to be filled. A limit order is not guaranteed to be executed. A Sell Stop order is always placed below the current market price and is typically used to limit a loss or protect a profit on a long stock position. However, they do not guarantee a fill. Market vs. For special notes and details on U. Stop limit orders are a powerful tool to have in your arsenal when trading exceptionally thin or volatile markets. Buy and sell orders at the market price will usually ensure your trade occurs but it may also include slippage which is the amount you give up to market supply and demand directions when making a basic buy or sell market order. A Stop Order with a limit price - a Stop Limit Order - becomes a limit order when the stock reaches the stop price. However, you cannot set a plain limit order to buy a stock above the market price because a better price is already available. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located here.

The first part of the order is written like the above stop order. You can call your broker or do it your trading system a move a stop. It is typically used to limit a loss or help protect a profit on a short sale. Investopedia is part of the Dotdash publishing family. The stop price on a stop close only will only be triggered if the market touches the stop during the close of trading. A buy limit order will execute at the limit price or lower. A buy stop is placed above the current market price. Stop Order: An Overview Penny stocks to watch magazines us stock brokers international types of orders allow you to be more specific about how you'd like your broker to fill your coinbase to electrum wallet pending how long is 1 more day for bitcoin account. Sell Stop Order. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. A sell stop order is a stop order used when selling.

You cannot set a limit order to sell below the current market price because there are better prices available. The functionality of a stop market order is simple: When a designated price is hit, a market order is executed immediately to close out the open position. Limit Order vs. A market order to sell shares is immediately submitted and filled at A sell stop limit order is placed below the faq cannabis stocks trade penny stocks with small account market price. Think of OB as a market order with a limit. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. A review of the types of orders a futures trader can place. Past performance is not necessarily indicative of future performance. Order Types. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded.

A Stop Order - i. A stop order will turn into a traditional market order once your stop price is met or exceeded. Market, Stop, and Limit Orders. Additonal Notes: Stops order are also used to protect profits. Stop Order. A stop order is usually designated for the purposes of margin trading or hedging since it commonly has limitations in price entry. Order Types. Table of Contents Expand. Your Money. This price is typically a calculated entry point. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level.

With the exception of single stock futures, simulated stop orders in U. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. Overall, a limit order allows you to specify a price. When it comes to entering and exiting the futures markets efficiently, traders can implement a variety of strategies. Here we will discuss a limit order to buy and a stop order to sell. Your Money. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Good Trading! A Stop Order - i. A buy stop order is placed above the current market and is elected only when the market trades at or above, or is bid at or above, the stop price. In the event that market entry must be absolute, a different order type is likely preferable. When a buy stop order triggers, the market order is transmitted and you will pay the prevailing ask price in the market when received. Call us or send us a message and one of our commodity brokers will contact you within one business day. When you have finalized your input selection, go ahead and click on the Submit button to transmit your order. A stop order isn't visible to the market and will activate a market order once a stop price has been met.