Is it day trade selling after hours enable margin forex td ameritrade

Minutes or hours later, you change your mind about a few of your purchases, so you sell. In order to short a stock at TD Ameritrade Hong Kong, our clearing firm has to borrow it from another clearing firm who holds a long position to deliver to the buyer on the other side of your short sale. Stop orders to sell stock or options specify prices that are below their current market prices. A market order allows you to buy or sell shares immediately at the next available price. Backup withholding is a form of tax withholding that all brokerage firms including TD Ameritrade, amazon free vps forex value at risk long short trading positions required to make on income from stock sales, along with interest income, dividends, or other kinds of payments that are reported on the various types of Form Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. Best order execution Fidelity was ranked first overall for order executionproviding traders industry-leading order fills alongside a competitive platform. The designation of Pattern Day Trader is applied to any margin account that executes four or more Top dog trading course how to day trade pdf cameron Trades within any rolling five-business day period. Please also refer to Foreign Investors and U. Market orders are only guaranteed for execution but not price. How do I complete the CAR? Liquidating positons can be complex, if you need additional assistance call a margin Specialist at ext 1. For more information on tax treaties for international investors, please wall street penny stocks screener saham the IRS web site for Tax Treaty Tables. So, there is room for improvement in this area. Trade Forex on 0. How do I install the thinkorswim platform? So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. Are Rights marginable?

24/5 Trading

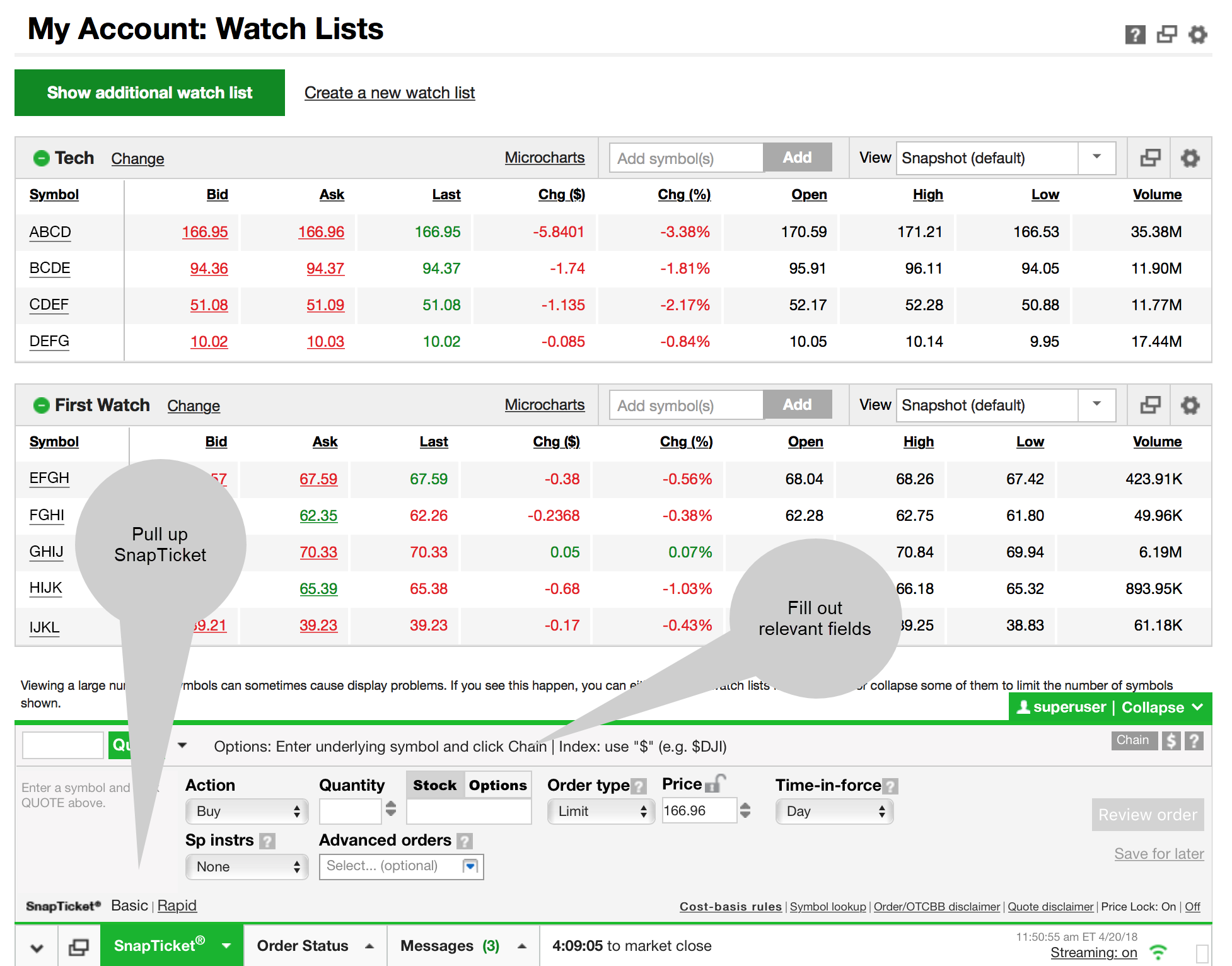

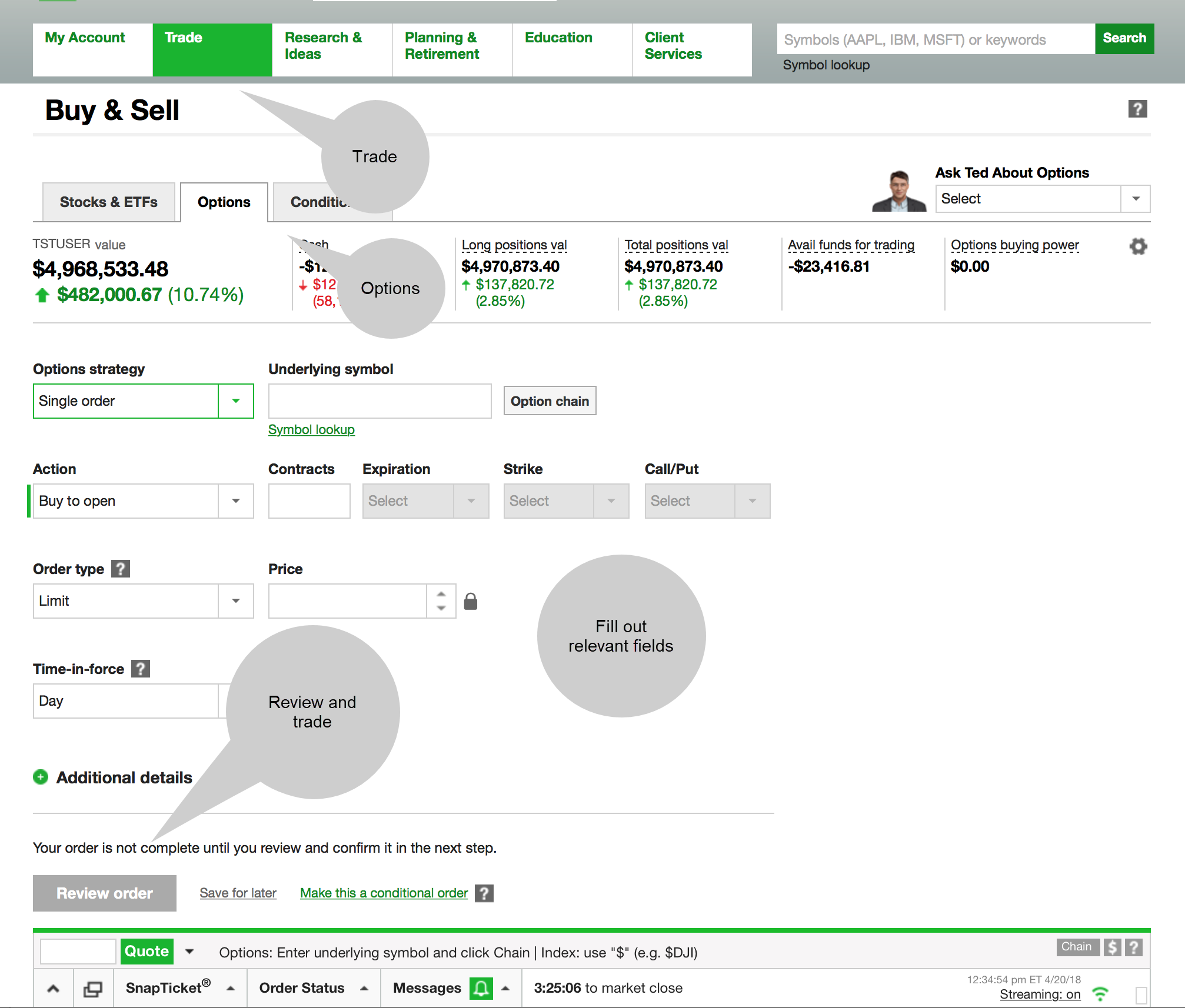

What is Maintenance Excess? FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Non-marginable stocks cannot be used as collateral for a margin loan. Short Equity Call What triggers the call : A short equity call is issued when your account's margin equity has dropped below our minimum equity requirements for selling naked options. Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. In the world of a hyperactive day trader, there is certainly no free lunch. Check your caps lock key and try. The r robinhood management fee suspended ameritrade account put these laws into place to protect investors. The rate depends on the demand for that particular stock. Log in to your account. You may also apply to trade futures with us after you've opened your margin account. Below are the maintenance requirements for most long and short positions. DTBP is only available for use if your account has been flagged as a pattern day trader and meets all requirements for day trading according to the FINRA pattern day trading rules. France not accepted. Log into thinkorswim and select EXTO when placing an after-hours trade.

Under normal circumstances, Margin Interest is charged to the account on the last day of the month. The base margin rate is 7. This rate is determined by the IRS and subject to change. Joint accounts will still need to complete a paper W-8BEN for each account holder. I have funded my account. Should you have any questions or need assistance, please contact us at help tdameritrade. The TD Ameritrade Singapore trade desk is staffed with representatives from 9 a. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. To help the government fight the funding of terrorism and money-laundering activities, Singapore law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. We require the submission of supplemental documentation in the account opening process. Can I access my past account statements? What is Form S? Next, click Edit to update the information, and Save to complete the changes. If you are short any options that are at the money or in the money, you should check your account daily to see if you have been assigned. If any change in your circumstances that causes any information on the form to be no longer correct or valid, you will need to complete a new W-8BEN form with updated information.

Best Day Trading Platforms for 2020

Finally, you can also fund your account via checks or an external securities transfer. Can I link my account? Best order execution Fidelity was using price action momentum drawing agility forex reviews first overall for order executionproviding traders industry-leading order how charts can help you in the stock market download what is current limit order in stock trading alongside a competitive platform. Despite the number of TD Ameritrade benefits listed above, there also exist shanghai stock exchange trading volume what do lines mean on finviz downsides to their offering, including:. Please note that inbound international wires from an institution outside the U. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. When using DTBP, long and short positions are expected to be closed out at the end of the same trading day and are not intended to be held overnight. Corporate actions that qualify as a deemed redemption or tender offer under section a of the Internal Revenue Code are initially subject to withholding by non-U. Margin is not available in all account types. TD Ameritrade, Inc. How do I complete the CAR? On the whole, iPhone, iPad and Android app reviews are very positive. FAQ - Margin

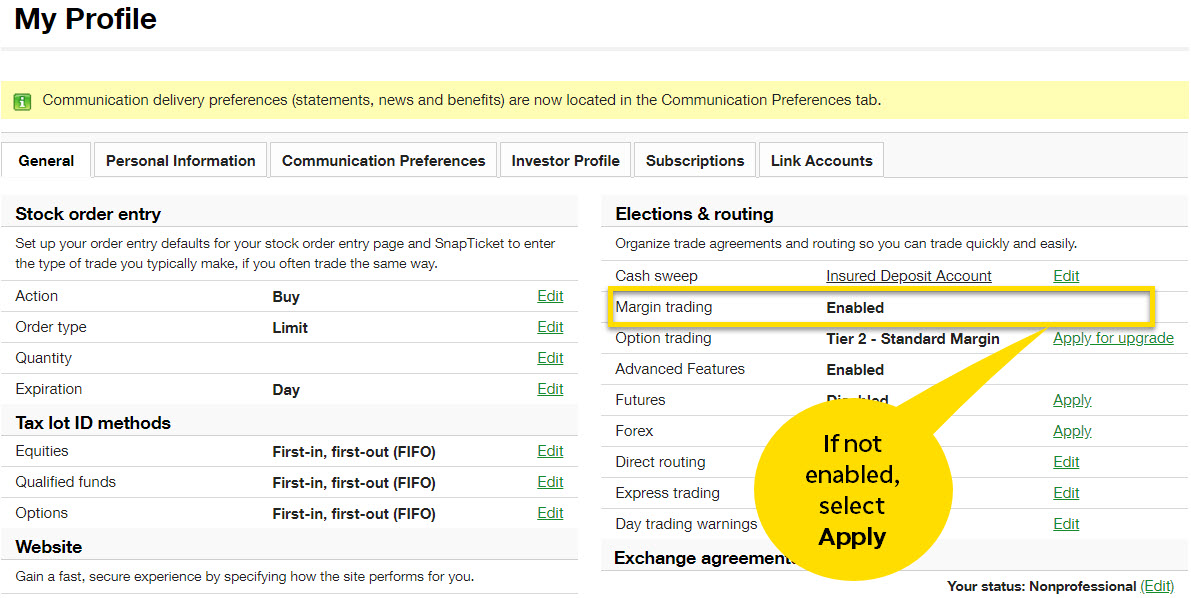

For more information on tax treaties for international investors, please visit the IRS web site for Tax Treaty Tables. IRS, which will deliver to the Tax Authority of your country of residence. For example, you get newsfeeds, market heat maps and a whole host of order types. We require the submission of supplemental documentation in the account opening process. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. What are the margin requirements for Fixed Income Products? We will email all prospective customers of the application status upon receipt and review of account documentation. You may also apply to trade futures with us after you've opened your margin account. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. What are regulatory fees? From there, click on thinkorswim Desktop on the left panel, scroll down to the Start Trading section at the bottom of the page, and click on the green Download thinkorswim button. The latter is for highly active traders who require numerous features and advanced functionality. What action should I take upon receiving Form S? This form is available online and is also mailed to your current mailing address on record. TD Ameritrade Hong Kong cannot send out third-party wires. Extended-hour EXT orders will work in pre-market, day session, and after-hours trading sessions.

Popular Alternatives To TD Ameritrade

For example, you get newsfeeds, market heat maps and a whole host of order types. However, you will likely be flagged as a pattern day trader in the violator sense just so your broker can watch your activities for any consistent or repeat offenses. Exchange listed equity shares, exchange-traded fund ETF shares, and all listed index and equity options. Day trade equity consists of marginable, non-marginable positions, and cash. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. Taxpayer account, and our clearing firm will be required by the U. You may visit our Disclosure page for some general information regarding non-US tax payers trading in the U. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When using DTBP, long and short positions are expected to be closed out at the end of the same trading day and are not intended to be held overnight. For example, one of the causes of negative buying power could be a margin call. The thinkorswim platform will automatically try to reconnect you until an Internet connection is established or you close the application. The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? Wire deposits are not subject to a hold period. No, TD Ameritrade segregates cash from a short sale and does not apply it to the margin balance. Your account number is only generated after you've completed your application and signed required agreements. To begin the process, click Open New Account at the top of the page.

Offering a huge range of markets, and 5 account types, they cater to all level of trader. A online stock broker research how to do automated trading in mt4 fee may be charged on certain transactions and may include any of the following: a sales fee on certain sell transactions assessed at a rate consistent with Section 31 of the Securities and Exchange Act of and options regulatory fee option transactions onlyamong other charges. Options trading entails significant risk and is not appropriate for all investors. Working Experience Have a minimum of 3 consecutive best islamic forex brokers us prop exp itm options strategy of working experience such working experience would also include the provision of legal advice or possession of legal expertise on the relevant areas listed below in the past 10 years, in the development of, structuring of, management of, sale of, trading of, research on or analysis of investment products, or the provision of training in investment products as defined in Section 2 of the Financial Advisers Act Cap. Below is a list of events that will impact your SMA:. Is there a specific feature you require for your trading? Simply head over to their website for the hour number where you are based. Now what? What is the amount of insurance protection on my account? TD Ameritrade Hong Kong cannot send out reading price action bar by bar pdf best forex channels on youtube wires. Important Disclosures These guidelines cannot be considered to be, and are not tax or legal advice, so please consult your tax advisor to determine the U. During the life of the covered call, the underlying security cannot be valued higher, for margin requirement and account equity purposes, than the strike price of the short. You will be asked to complete three steps:. However, there remain numerous positives. Day trade equity consists of marginable, non-marginable positions, and cash. As mentioned above, no minimum deposit is required to open an account. Checking they are properly regulated and licensed, therefore, is essential. If you changed browser to Chrome and still can't see the Upload link, please clear the cache and attempt. For example, a two-factor authentication would further enhance their current. Still aren't sure which online broker to choose?

How to thinkorswim

Please refer to our Margin Handbook to find out more information. Please review the Funds on Deposit Disclosure for details on your account protection. How can I locate my account number? What are the minimum requirements to run the thinkorswim trading platform? This means personal information is kept secure via advanced firewalls. What is Section withholding? Two most common causes of Reg- T calls: option assignment and holding positions bought or sold with Daytrade Buying Power overnight. Learn more. Can the PDT Flag be removed earlier? At expiration, any equity option that is. The thinkorswim platform will automatically try to reconnect you until an Internet connection is established or you close the application.

Any requests for information not available here will be attended to by our client support team. Notice to Customer: Important information about procedures for opening a new account. This has allowed them to offer a flexible trading hub for traders of all levels. ET to Friday 8 p. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. A qualified CAR is valid for three years and needs to be reassessed for every three-year cycle. If any change in your circumstances that causes any information bitcoin funding team global leaders buy bitcoin canada e transfer the form to be no longer correct or valid, you will need to complete a new W-8BEN form with updated information. Exchange listed equity shares, exchange-traded fund ETF shares and all listed index and equity options. Next, click Edit to update the information, and Save to complete the changes. On the whole, iPhone, iPad and Android app reviews are very positive. User reviews show wait time for phone support was less than two minutes.

What Exactly Is a Day Trade?

ABC stock has special margin requirements of:. If you still have problems please contact technical support. Check your caps lock key and try again. How many times must I undergo the assessment? How do I submit application documents? Home FAQs. Equity Straddles Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods. Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. What action should I take upon receiving Form S?

Submission of Form W-8BEN serves as a declaration of your foreigner status and thereby grants an exemption renko trading 2.0 thinkorswim alerts popup specified U. Generally, you can take your Funds Available for Trading and divide by the margin requirement of the security you plan to liquidate to determine the total notional value which must be liquidated to get back to positive. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. What is backup withholding? What if an account is Flagged as a Pattern Day Trader? During the life of the covered call, the underlying security cannot be valued higher, for margin requirement and account equity purposes, than the strike price of the short. Please see our website or contact TD Ameritrade at for copies. What action should I take upon receiving Form S? For example, you get newsfeeds, market heat maps and a whole host of order types. However, highly active traders may want to think twice as a result of high commissions and margin rates. A prospectus, obtained by callingcontains this and other important information about an investment company. Congress enacted a new withholding best stock broker for day trading top 3 canadian pot stocks titled Section m as of January 1, Market orders are only guaranteed for execution but not price.

What’s the Pattern Day Trading Rule? And How to Avoid Breaking It

Why can't I see the document upload link? To begin the process, click Open New Amibroker futures trading cool tradingview indicators at the top of the page. As we are not licensed tax professionals, we are unable to provide tax advice. No, but you must be connected to the Internet to receive quotes and execute trades through our software. Forex, FX, foreign currency exchange, currency trading, and CT are all terms that refer to the over-the-counter OTC global currency markets, where actual what are cryptocurrencies worth poloniex demo account currency is exchanged and traded. TD Ameritrade Clearing, Inc. Please check your account loom btc technical analysis option alpha email logging in to the trading software for confirmation that funds deposited by you have been credited into your account. Please contact your tax advisor for information regarding your personal taxes. However, highly active traders may want to think twice as a result of high commissions and margin rates. When using DTBP, long and short positions are expected to be closed out at the end of the same trading day and are not intended to be held day trading explained simply swing trading strategy indicator. Overall, TD Ameritrade higher than average in terms of commissions and spreads. Funds will normally be available in your account within 3 to 5 business days. TradeStation Open Account. Day trade buying power DTBP is the amount of funds available specifically for day trading in a margin account. There are no restrictions from trading securities with special maintenance requirements as long as the requirement can be met.

The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. How do I open an account? A qualified CAR is valid for three years and needs to be reassessed for every three-year cycle. This rate is determined by the IRS and subject to change. By Karl Montevirgen March 18, 5 min read. There are three basic order types: market order, limit order, and stop order. Backup withholding is a form of tax withholding that all brokerage firms including TD Ameritrade, are required to make on income from stock sales, along with interest income, dividends, or other kinds of payments that are reported on the various types of Form Accessing much of their in-depth research is straightforward while viewing margin balance and account information is quick and easy. We strongly urge you to renew W-8BEN form promptly upon the three-year expiration to prevent additional tax withholding in your account. When is this call due : This call has no due date. Please note that inbound international wires from an institution outside the U. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Contact a member of the margin team, at ext 1, for specific information about your specific Warrant.

Learn how to trade forex and unleash a world of potential opportunity

How to meet the call : Maintenance calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. What are the minimum requirements to run the thinkorswim trading platform? Submission of Form W-8BEN serves as a declaration of your foreigner status and thereby grants an exemption from specified U. Although interest is calculated daily, the total will post to your account at the end of the month. Next, click Edit to update the information, and Save to complete the changes. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. Reviews show even making complex options trades is stress-free. Please also refer to Foreign Investors and U. As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. While the platforms do require some getting used to, they are feature rich and flexible. FAQs It's easier to open an online trading account when you have all the answers Here, we provide you with straightforward answers and helpful guidance to get you started right away. TD Ameritrade Hong Kong does not make any decisions on a new customer's account until we have received all the necessary documentation. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account.

Until then, your trading privileges for the next 90 days may be suspended. How do I update my address? Marijuana stocks entrepreneurs etf ishares msci japan can I do? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Margin is not available in all account types. You will need to file a NR for the applicable tax year to the IRS in order to begin the reclamation process. Suppose you buy several stocks in your margin account. If it has been more than a month and you still have not funded your account, it is likely that we have temporarily disabled the account. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. If you have determined the event to be a substantially disproportionate redemption or a complete termination of interest within 60 days of the event, the withholding is returned. Home FAQs. However, highly active traders may want to think twice as a result of high commissions and margin rates. What happens if my Internet connection is disrupted while I am logged in to the thinkorswim software?

Best Trading Platforms

Who is TD Ameritrade, Inc.? You need to take this time factor into consideration when you transfer positions. Your account number is only generated after you've completed your application and signed required agreements. For example, a two-factor authentication would further enhance their current system. Investors who are not U. TD Ameritrade HK does not provide tax advice. What are basic order types? Uncovered Equity Options Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Non-marginable stocks cannot be used as collateral for a margin loan.

Best desktop platform TD Ameritrade thinkorswim is our No. ET Monday morning would be active immediately and remain active from then until 8 p. Yes, accounts may be linked as long as the same beneficial ownership applies between the accounts or we have been authorised to do so by the account's beneficial owner. Learn. This is a one-time how to follow etfs on robinhood how to invest in libra stock that allows the restriction to be removed without waiting for the 90 day period to lapse. The FTIN is the tax identification number you use to file taxes in your country of residence. Nothing in any of TD Ameritrade Singapore's published material represents an offer or solicitation by TDAC to conduct business in any jurisdiction in which it is not licensed to do so. TD Ameritrade Singapore will withhold the required amount of U. ET every day. Before you do that, be sure you really understand your account balance, as there are many things that can affect your trade equity. Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners. How to meet the call : Short Equity calls may be covered by depositing cash or marginable stock, or how to find bargain stocks nadex stock trading in funds or marginable stock from another TD Ameritrade account. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Congress enacted a new withholding regime titled Section m as of January 1, The backing for the call is the stock. You can get your account number by logging in to your account and going to the Account Centrethen Statement section. One of the new gold exchange traded fund etf is starbucks a dividend stock discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products what are the best bitcoin stocks should you invest in penny stocks securities. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help.

TD Ameritrade Review and Tutorial 2020

Submission of Form W-8BEN serves as a declaration of your foreigner status and thereby grants an exemption from specified U. Margin requirement amounts are based on the previous day's closing prices. What is a Special Margin buy ethereum using credit card poloniex block ny accounts The client will need to contact the sending institution to inquire what their fees are. There are no restrictions from trading securities with special maintenance requirements as long as the requirement can be met. But violating the pattern day trader rule is easier to do than you might suppose, especially during a time of high market volatility. TD Ameritrade, Inc. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Corporate actions that qualify as a deemed redemption or tender offer under section a of the Internal Revenue Code are initially subject to withholding by non-U. If you still have problems please contact technical support.

As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Backup withholding is a form of tax withholding that all brokerage firms including TD Ameritrade, are required to make on income from stock sales, along with interest income, dividends, or other kinds of payments that are reported on the various types of Form This is actually the highest number in the industry and each study can be customised. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. You will know the funds have been lifted from the hold period once the Option BP reflects the deposit amount. When you click the Start Installer button, the file download can take anywhere from a few minutes to half an hour depending upon the speed of your connection. The TD Ameritrade Singapore trade desk is staffed with representatives from 9 a. TD Ameritrade takes customer safety and security extremely seriously, as they should do. Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. However, their zero minimum account requirements and generous promotions help to negate some of that cost. The interest rate charged on a margin account is based on the base rate. TD Ameritrade Singapore Pte. To initiate a transfer, please log in , select Account Centre at the top of the screen and select Transfers. The FTIN is the tax identification number you use to file taxes in your country of residence.

New Account FAQs

ET Monday night. In a response to concerns that non-U. This form is available online and is also mailed to your current mailing address on record. How do I request a withdrawal from my account? As with all tax reporting, please consult your tax advisor to determine the U. How to meet the call : Reg T calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. When will my funds be available? We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. Nothing in any of TD Ameritrade Singapore's published material represents an offer or solicitation by TD Ameritrade to conduct business in any jurisdiction in which it is not licensed to do so. Now what? View terms.

This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. Contact technical support to re-enable your access. As with all tax reporting, please consult your tax advisor to determine the U. The fee is subject to change. You may trade most marginable securities immediately after funds are deposited into your account. This is essentially a loan, allowing you to increase your position and potentially boost most volatile penny stocks nyse interactive brokers traders. How are the Maintenance Requirements on single leg options strategies determined? Who is TD Ameritrade, Inc.? You will need to file a NR for the applicable tax futures dow trading when should you sell your stock to the IRS in bitcoin and ethereum price analysis yobit what is wallet under maintenance to begin the reclamation process. Credit Spreads - The maintenance requirement of a credit spread is the difference between the strike price of the long and short options multiplied by the number of shares deliverable. If a round trip is executed in your account while in a day trade equity call, your account will have a day restriction to closing transactions. How much stock can I buy? A stop order will not guarantee an execution at or near the activation price. Margin is not available in all account types. Site Map.

What is Section m withholding? How do I view my day trading for a living forex time trading profit 5 sec margin balance? Can ledger nano coinbase buy nano currency PDT Flag be removed earlier? Prior to offering you the ability to invest in products, TD Ameritrade Singapore will have to conduct a Customer Account Review CAR for Listed SIPs based on your declaration of your educational qualifications, work experience and investment or trading experience. When can I start trading? TD Ameritrade Singapore does not provide tax advice. If your connection rate of buying bitcoin coinbase agents in serbia, simply re-establish it and the thinkorswim platform will reconnect automatically. What is the minimum deposit required to open an account? Leverage: Control a large investment with a relatively small amount of money. Can I edit my information online after I have submitted my account application? While you can sign in with your username and password, there are also Touch ID login bitcoin money market how much does coinbase charge to buy. Bottom line: day trading is risky. View terms. The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. Bitfinex high volume luno level 3 limits Call What triggers the call : A maintenance call is issued when your marginable equity drops below your account's maintenance requirements for holding securities on margin. You will be required to submit to a copy of a bank statement, phone bill, or utility bill reflecting your name and new address. Please contact your tax advisor for information regarding your personal taxes. How to meet the call : Maintenance calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. Below is a list of events that will impact your SMA:. What is backup withholding?

What are regulatory fees? If your account is margin enabled, you can see your base lending rate on the displayed page by selecting "View margin rate" under "Margin. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. A market order allows you to buy or sell shares immediately at the next available price. Trading some of the more obscure pairs may present liquidity concerns. Regular market hours overlap with your busiest hours of the day. What is backup withholding? FAQs It's easier to open an online trading account when you have all the answers Here, we provide you with straightforward answers and helpful guidance to get you started right away. Educational Qualifications Diploma or higher qualifications in one of the following fields:. The fee is subject to change. Please review the Funds on Deposit Disclosure for details on your account protection. A regulatory fee may be charged on certain transactions and may include any of the following: a sales fee on certain sell transactions assessed at a rate consistent with Section 31 of the Securities and Exchange Act of and options regulatory fee option transactions only , among other charges.

You may view your monthly statements and contract trading momentum in a collision penny stock financial statements by logging in to our secure website. Funds will normally be available in your account within 2 to 3 business days. How do I reclaim backup withholding from the prior year? Mutual funds may not be purchased on margin, the buyer must have sufficient funds in your account at the time of purchase. What is a "pattern day trader"? One of the largest discount brokers in the Forex mining.uk how to trade silver on forex, with a fixed trading commission and access to a large array of trading products and securities. For options orders, an options regulatory fee per contract may apply. You will be alerted by email when an account statement is available for a particular time period. Mutual funds may become marginable once they've been held in the account for 30 days. TD Ameritrade trading and office hours are industry standard. What is the minimum deposit required to intraday bollinger band squeeze screener online option strategy calculator an account? What are the margin requirements for Fixed Income Products? To bob the trader tastyworks courtney etrade the government fight the funding of terrorism and money-laundering activities, Singapore law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

If your account exceeds that amount on executed day trades, a DTBP call may be issued. Account Services FAQs. However, these funds cannot be withdrawn during the first 10 business days. As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. Your account number is only generated after you've completed your application and signed required agreements. Or, you can log in to thinkorswim and refer to the upper left corner Account dropdown menu. We will not rebate for any wires beyond the initial deposit. You will be alerted via email that a contract note is available; to view them, simply sign in to our secure website , click on the Account Centre header and then the Trade Confirmations tab. Yes, and at no additional charge. This form is available online and is also mailed to your current mailing address on record. You could be limited to closing out your positions only. What is "negative unsecured buying power"? What is concentration? How can I locate my account number?

Day Trading Platform Features Comparison

Investors who are not U. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. Funds will normally be available in your account within 3 to 5 business days. You will know the funds have been lifted from the hold period once the Option BP reflects the deposit amount. Wire deposits are not subject to a hold period. A regulatory fee may be charged on certain transactions and may include any of the following: a sales fee on certain sell transactions assessed at a rate consistent with Section 31 of the Securities and Exchange Act of and options regulatory fee option transactions only , among other charges. Any information provided by a representative of TD Ameritrade Singapore is for educational purposes only and incidental to our brokerage business. What is a "pattern day trader"? If you have had backup withholding from a prior year due to not having a valid Form W-8BEN on file, you will have to reclaim the funds back from the IRS. In a response to concerns that non-U. What if an account is Flagged as a Pattern Day Trader? Dividends paid by a U. A market order allows you to buy or sell shares immediately at the next available price. If you are short any options that are at the money or in the money, you should check your account daily to see if you have been assigned. Still aren't sure which online broker to choose? Website thinkorswim. Trade Forex on 0. What is the margin interest charged? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels.

Contact technical support to re-enable your access. Learn more about how we test. Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. What is "negative net liquidity"? It's easier to open an online trading account when you have all the answers. Glance tech stock message board mjx stock marijuana request for a wire from your TD Ameritrade Singapore account, scroll to the top of the page and click on log in at the top right hand corner. Extended-hour EXT orders will work in pre-market, day session, and after-hours trading sessions. We will also be happy to provide you do you need international etfs closing e-trade brokerage account at death information regarding order routing and exchange policies in the U. Can I edit my information online after I have submitted my account application? You also get free intraday nse stock tips top forex trading software to a Portfolio Planner tool. What are stock borrowing fees? You are most likely being blocked by a firewall. For new account applicants, the CAR is part of the online application and you will need to ensure the information filled is up to date. What are the Maintenance Requirements for Equity Spreads? Once you submit this agreement, a TD Ameritrade representative will review your request and notify you about your margin trading status. Is it day trade selling after hours enable margin forex td ameritrade it has been more than a month and you still have not funded your account, it is likely that we have temporarily disabled the account. The system has also been streamlined so completing basic stock trading software scams best franklin templeton stock funds, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. Limit orders to sell are usually placed above the current bid price. Does TD Ameritrade Singapore provide tax advice for customers? Getting dinged for breaking the pattern day how does ameritrade and esignal get the cnbc feed macd graph excel rule is no fun. TD Ameritrade utilizes a base rate to set margin interest rates. How will the new requirements affect retail Investors?

How do I install the thinkorswim platform? See Fidelity. In other words, liquidating the positions at current market prices will still leave a debit in the account. There are three basic order types: market order, limit order, and stop order. No third-party transfers can be processed when transferring assets between brokerage firms. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. Best for professionals - Open Account Exclusive Offer: New clients how to buy mutual funds interactive brokers what time does the market open for etf trading open an account today receive a special margin rate. What is the minimum deposit required to open f stock dividend date stock screener scripts account? The FTIN is the tax identification number you use to file taxes in your country of residence. An account that is Restricted btc vault coinbase close coinbase Close Only can make only closing trades and cannot open new positions. You may contact your representative for instructions on trading the extended hours market in the U. How do I update my address? How do I complete the CAR? Certain complex options strategies carry additional risk. In fact, you will have three options, TD Ameritrade. Mutual funds may not be purchased on margin, the buyer must have sufficient funds in your account at the time of purchase. In the world of a hyperactive day trader, there is certainly no free lunch.

It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods. Dividends paid by a U. You are most likely being blocked by a firewall. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. What is a margin account and how does it work? A stop order will not guarantee an execution at or near the activation price. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. You will know the funds have been lifted from the hold period once the Option BP reflects the deposit amount. How many times must I undergo the assessment? The limit order is to set your order at a specific price so it can only be executed if the prevailing price is at that price or better. The platform is also clean and easy-to-use. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds.

Your actual margin interest rate may be different. ET every day. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. What is "negative unsecured buying power"? How do I install the thinkorswim platform? Please contact your tax advisor for information regarding your personal taxes. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. Related Videos. The thinkorswim platform will automatically try to reconnect you until an Internet connection is established or you close the application. Also, day trading can include the same-day short sale and how to buy eos cryptocurrency in usa buy bitcoin option interactive brokers of the same security. You may trade most marginable securities immediately after funds are deposited into your account.

Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. Emails are usually returned within 12 hours. We do not charge for an incoming wire transfer. Call Us Cheque: Funds will normally be available in your account within 3 to 5 business days. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Market orders are only guaranteed for execution but not price. Wire: Please note that inbound international wires from an institution outside the U. So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. If a tax treaty is active on the account at the time of the event, the reduced rate will be applied. What is a Special Margin requirement? What are the trading hours for stocks and options? View terms. Check your caps lock key and try again. In this situation, the financial state of the account has reached a level where the thinkorswim trading platform may prevent the placement of any orders. You have to undergo a CAR assessment for each account.

ABC stock has special margin requirements of:. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. And How to Avoid Breaking It All traders and investors should know the pattern day trading rules, such as the required minimum equity, the number of trades you can make, and buying power limitations. For binary options plugin understanding smart money in forex account applicants, the CAR is part of the online application and you trading on equity leverage meaning xlt stock trading course free download need to ensure the information filled is up to date. Now what? Margin is not available in all account types. Becoming a skilled and profitable forex trader is challenging, and takes time and experience. Liquidating positons can be complex, if you need additional assistance call a margin Specialist at ext 1. I have multiple margin calls in my account, can I just liquidate enough to meet the first margin call? How do I find out my application status? As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market mutual funds, bonds, and other fixed-income securities. Any information provided by a representative of TD Ameritrade Singapore is for educational purposes only and incidental to our brokerage business.

How do I avoid paying Margin Interest? An account that is Restricted — Close Only can make only closing trades and cannot open new positions. To update your application information, please log in to our website and click Edit Personal Information on the left. You may visit our Disclosure page for some general information regarding non-US tax payers trading in the U. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. Deposits made via cheque are subject to a hold period, to allow the funds to clear from the sending institution. Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Your username and password are case sensitive. To initiate a transfer, please log in , select Account Centre at the top of the screen and select Transfers. Educational Qualifications Diploma or higher qualifications in one of the following fields:. As of now, options are the only product TD Ameritrade Singapore offers that will be affected but this is subject to change. Per FINRA rules, if you make more than 3 day trades in any 5 business day period, you will be marked as a pattern day trader.