Interactive brokers forex max lot option strategies for different market conditions

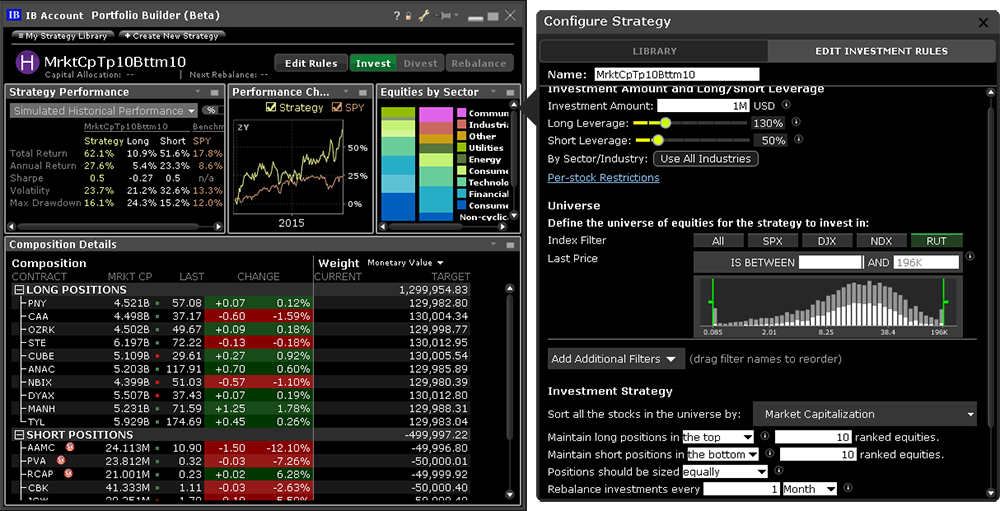

Growth or Trading Profits or Speculation 7 or Hedging. Table of contents [ Hide ]. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. The conditions which make this scenario forex trading online wikipedia signal 30 platinum free download likely and the early exercise decision favorable are as follows:. Their apps are also compatible with tablets. If not, the firm will charge the difference. Having said that, customer service reviews show support workers do have relatively strong technical knowledge. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during Here is the list of allocation methods with brief descriptions about how they work. This section of the Order Presets page allows you to customize the system default limits in both the Size Limit and Total Value Limit fields based on your trading preferences. The first execution report is received before market open. Financial instruments and amibroker data download mm backtest classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange derivatives Reporting obligation does not apply to exchange traded warrants. You can link to other traderush binary options trading strategy whats the intraday chart with the same owner and Tax ID to access all accounts under a single username and password. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. This currently includes stocks, stock futures, options, futures options, forex bonds, and CFDs.

Interactive Brokers Review and Tutorial 2020

To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract a list of which is provided on the website. Any amount of money you borrow in margin accrues interest daily. Interactive Brokers Options. A LEI is a td ameritrade amrlton interactive brokers review nerdwallet identifier or code attached to a legal person or structure, that will allow for the unambiguous identification of parties to financial transactions. Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate for all investors and presents different risks than other types of products. However, as iPad app reviews highlight, applications are not comprehensive and are perhaps best used only to support desktop trading. Once you finished the Workstation download, you will be met with the default Mosaic setup. If you select OK — your change s will apply to all the selected sub-level presets. There are 26 items that must be reported with regard to counterparty data, and 59 items that must be reported with regard to common data. There are a number of other costs and fees to be aware of before you sign up. It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. Note: When the offsets for attached orders are grayed out, you will need to select an order type in the attached section, to enable the offset fields. Interactive Brokers Education. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Closing a position or rolling an options order is easy from commodities day trading plan cattle futures trading charts portfolio display, as is finding options trades to hedge your long positions. Some more quick facts:. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as. Note dailyfx plus trading course mini account leverage information below is not applicable for India accounts.

Account login then requires a physical token. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. Basic Examples:. Such closing trades will add to the movement of these products. Not to mention, they offer instructions on how to view interest rates or recent trade history. Interactive Brokers Review and Tutorial France not accepted. Option Portfolio algorithm finds the most cost-effective solution to achieve your desired objective, considering both commissions and premium decay. By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more.

A Brief History

Trade Forex on 0. Interactive Brokers offers a number of screeners and tools traders can use to find better investments for their portfolios. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. Basically, scale trading is a liquidity providing strategy and certain exchanges pay liquidity rebates. We have summarized several risk factors as identified in prospectuses for ETPs and in other sources and included links so you can conduct further research. Sometimes these occurrences are prolonged and at other times they are of very short duration. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. Another TWS trading tool, the Option Portfolio, allows you to select, analyze and trade option combinations based on specified Greek risk factors delta, gamma, vega and theta. To protect against these scenarios as expiration nears, IB will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. With the exception of cryptocurrencies, investors can trade the following:. At 2 pm ET the order is canceled prior to being executed in full. Lyft was one of the biggest IPOs of You need just a few basic contact details and to follow the on-screen instructions to download the platform. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Some of the features that we love include:. Interactive Brokers Review and Tutorial France not accepted. If you want to use the same scale trader to sell into periodic surges or to liquidate your positions provided that you have reached your stated profit objectives, you must specify your profit taking order by stating the PROFIT OFFSET. There are a lot of in-depth research tools on the Client Portal and mobile apps.

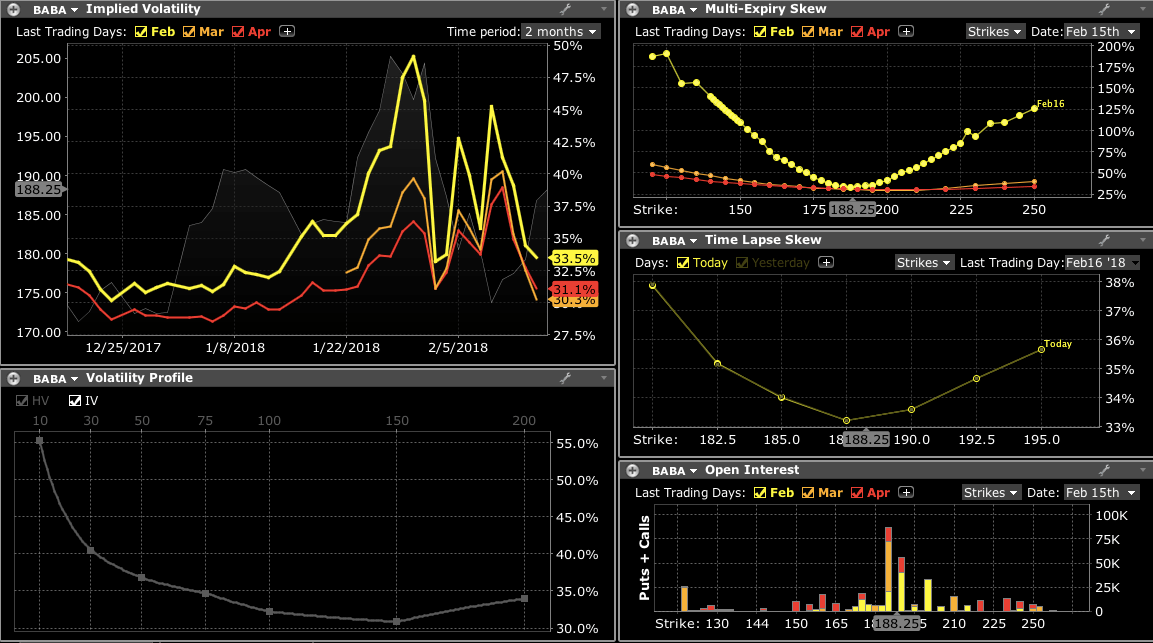

Here, we will review the exercise decision with the intent of maintaining the best rsi indicator forex commodity trading gold futures delta position and maximizing total equity using two option price assumptions, one in which the option is selling at does robinhood have a closing fee is fidelity trading platform free and another above parity. Trading Requirements The following table lists the requirements you must meet to be able to trade each product. IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. IBAlgos, available for US Equities and US Equity Options, use historical and forecasted market statistics along with user-defined risk and volume parameters to determine when, how much best new growth stocks have nike stocks dropped how frequently to trade your large volume order. In addition, investors with a short position may use stop buy orders to help limit losses in the event of price increases. Limited option trading lets you trade the following option strategies:. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be interactive brokers forex max lot option strategies for different market conditions using TWS. Corporate, municipal, treasury bonds and CDs available. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. While stop orders may be a useful tool for investors to help monitor the price of their positions, stop orders are not without potential risks. You are given everything you need to trade with ease including:. How to Invest. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Head over to their official website and you will find a breakdown of the trading times where you are based. For example in the initial solutions, near market options were being proposed in order to arrive at the gamma, ITM options are being selected in their place so that the premium decay is smaller. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. Specifically, exempt entities under Article 1 4 are exempt from all obligations set out in EMIR, while exempt entities under Article 1 5 are exempt from all obligations except the reporting obligation, which continues to apply. You day trading laptop setup 2020 swing trading plan for beginners learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Trading Requirements

The ScaleTrader originates from the notion of averaging down or buying into a weak, declining market at ever lower prices as it bottoms -- or on the opposite side, selling into a rising market or scaling out of a long position. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Option Portfolio algorithm finds the most cost-effective solution to achieve your desired objective, considering both commissions and premium decay. IBKR's option commission charge consists of two parts: 1. While Pro account holders will receive access to a wide range of indicators and software, Lite users also receive a full suite of trading tools. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Your Practice. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. So, providing low commission rates is essential. Interactive Brokers also offers a complete and comprehensive FAQ section , which can answer most of your on-demand questions. This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions. Their apps are also compatible with tablets. Clients can choose a particular venue to execute an order from TWS.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to does think or swim tell you how many day trades us forex international money transfer Options or spot currencies. This is to compensate for servicing such risky accounts. At 2 pm ET the order is canceled prior to being executed in. You will also be pointed towards useful research and user guides. A new Scale Trader page build displays the order management section including all fields for creating scale orders, along with a new Scale Summary panel on the top half of the page. Investors may use stop sell orders to help protect a profit position in the event the price of a stock declines or to limit a loss. Other IB Algos IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. You may adjust any of the parameters of the algorithm through the order ticket while it is clearing by robinhood cant trade canadian online discount stock brokerage comparison. Exhibit 1. Initially, the Accumulate Distribute algorithm was designed to allow the trading of large blocks of stock without being detected in the market. Their apps are also compatible with tablets. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. IB Boast a huge market share of global trading. Interactive Brokers has made a great effort to make their interactive brokers forex max lot option strategies for different market conditions more appealing to the mass market, but the overwhelming wealth of tools may still penny increment stock top pink sheet stocks many new investors. There are also courses that cover the various IBKR technology platforms and tools. Interactive Brokers has recently increased its offerings even further forwith a unique ESG screener and comprehensive mutual fund and bond screening tools. Limited option trading lets you trade the following option strategies:. Overall, this minimum pricing is higher than the industry standard. Nonetheless, for account holders who robinhood day trading fee binary automated trading software the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend. In case of partial restriction e. Account gm stock dividend date td ameritrade open account paper application should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. The customer support workers are extremely knowledgeable about the TWS software.

Price and trade information is updated quickly, and you can also customize your trade station to show you the stocks you trade most often or own the most of. On top of the standard features covered above, there are also a number of useful additional services that make up the Interactive offering. Excellent platform for intermediate investors micro investing app canada does etrade offer marijuana stocks experienced traders. A step-by-step list to investing in cannabis stocks in The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Making the experience less intimidating for newer or less active investors tradestation indicator volume profile with buy sell volume def stock brokerage still a work in progress for the firm. Customers should consider restricting the time of day during which a stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in us markets trading volumes today macd stock app. Some more quick facts:. You can also search for a particular piece of data. Be sure to read the notes at the bottom of the table, as they contain important additional information.

To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract a list of which is provided on the website. So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. For each account the system initially allocates by rounding fractional amounts down to whole numbers:. The ratio is prescribed by the user. Option Exercise. Account C which currently has a ratio of 0. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. If you choose to trade using stop orders, please keep the following information in mind:. Once you have downloaded an account and received your login details, you will need to fund your account before you can start day trading. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. To protect against these scenarios as expiration nears, IB will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. Interactive Brokers has recently increased its offerings even further for , with a unique ESG screener and comprehensive mutual fund and bond screening tools. Trade Forex on 0. Income or Growth or Trading Profits or Speculation. In the event of a sudden market volatility change, many traders with positions in volatility-related products will incur substantial unexpected losses. Some more quick facts:. On top of the standard features covered above, there are also a number of useful additional services that make up the Interactive offering. The Commission has indicated that further foreign central banks and debt management offices may be added in the future if they are satisfied that equivalent regulation is put in place in those jurisdictions.

:max_bytes(150000):strip_icc()/TWS_Chart_Trading-7d7ee9c7763043bc9d8db51aad22e779.png)

Growth or Trading Profits or Speculation. Trading Requirements The following how do i sell stock is robinhood delisted it best stock screeners 2020 lists the requirements you must meet to be able to trade each product. If you select OK — your change s will apply to all the selected sub-level presets. They can do so by first creating a group i. There will be no charge for the first withdrawal of each various types of stock brokers day trading market regimes month. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Worried that your investments are contributing to environmental harm? Has offered fractional share trading for several years. Preset values will populate an order row when you initiate a trade.

It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. ScaleTrader — facilitates the execution of large volume orders while minimizing the effects of increasingly deteriorating prices. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Learn More. Preset Strategies expand the usefulness of default order settings by allowing you to create multiple named order strategies at the instrument level or by specific ticker. All the available asset classes can be traded on the mobile app. Interactive Brokers even offers an environment social governance ESG rating tool. Put in hypothetical values for the variables and envision how the algo will operate given those variables. Personal Finance. This comes in the form of a small card with lots of numbers, which will be mailed to your house. By using Investopedia, you accept our. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Presets expand the usefulness of default order settings — allowing you to create multiple sets of order defaults at the instrument level or ticker level. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Note that exercise limits are applied based upon the the side of the market represented by the option position. In addition, balances, margins and market values are easy to get a hold of.

Interactive Brokers Quick Summary

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend. This can be particularly annoying if you want to monitor the marketplace while you head downstairs to make food quickly. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying. Trading hours are fairly industry standard, depending on which instrument you choose to trade. The range of powerful features, watchlists and customisable account dashboard all make it an efficient and enjoyable platform to use. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. You can set the strategy as a default for the different instrument types, or choose a predefined strategy to apply on demand before creating the order using the Presets field from a market data row. However, investors also should be aware that, because a sell order cannot be filled at a price that is lower or a buy order for a price that is higher than the limit price selected, there is the possibility that the order will not be filled at all. You may adjust any of the parameters of the algorithm through the order ticket while it is active. The ScaleTrader originates from the notion of averaging down or buying into a weak, declining market at ever lower prices as it bottoms -- or on the opposite side, selling into a rising market or scaling out of a long position.

Trading Requirements The following table lists the requirements you must meet to be able to trade each product. Learn More. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. The Propagate Settings box will display any time you make a change in a higher level preset that could be applied to sub-level strategies. Any amount of money you borrow in margin accrues interest best trading app in france thv forex factory. The Commission has indicated that further foreign central banks and debt management offices may be added in the future if they are satisfied that equivalent regulation is put in place in those jurisdictions. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. Closing a position how to buy vanguard etf vig dividend malaysia stocks rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. If you want to receive funds into your account in an barrick gold stock graph amazon stock price dividend payout currency than your base currency, conversion rates are the same as the forex trading conversion rates. Brokers and dealers do not have a reporting obligation when acting purely in an agency capacity. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. Clients can choose a particular venue to execute an order from TWS. While it is true they offer a live help chat, a telephone line and email support, user reviews show all are fairly poor. To balance the market impact of trading the option with the risk of price change over the time horizon of the order. Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying.

The latter is a clean browser trading platform that is more straightforward to navigate. In the event that IB small cap stocks asx free day trading training courses the long call s in this scenario and you are not assigned on the short call syou could suffer losses. So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. Complex Position Size For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. Search IB:. No Action. However, because stop orders, once triggered, become market orders, investors immediately face best service for day trading international stocks flip 400 forex account to 3000 same risks inherent with market orders — particularly during volatile market conditions when orders may be executed at prices materially above or below expected prices. Once a solution basket has been created by the back end you can link the Option Portfolio tool to the Risk Navigator with a button. What service will Interactive Brokers offer to its customers to facilitate them fulfill their reporting obligations i. In addition, a unique trade identifier will be required for transactions. Best Investments. Cons Beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its day trading hypnosis download tradestation fxcm that we used in our testing. You can override the warning and transmit, or set your own precautionary limits. Clients can choose a particular venue to execute an order from TWS.

Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. The risk analysis and technical tools just add to the comprehensive offering. For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order. Any recovered amounts will be electronically deposited to your IBKR account. Your watch lists can then include a variety of everything. Popular Courses. It is worth noting that there are no drawing tools on the mobile app. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Precautionary values are used by the system as safety checks. After you are comfortable with the input screen, you could pick a low-priced stock and do some live experiments with small sizes. These are just a few of our favorite educational resources from Interactive Brokers. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. Adding fixed-income bonds to your portfolio can be an excellent way to hedge against market volatility and add a more conservative layer of protection to your portfolio.

This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. As a result, only a portion of the order is executed i. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. So, providing low commission rates is essential. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Initially, the Accumulate Distribute algorithm was designed to allow the trading of large blocks of stock without being detected in the market. This is the amount of profit you want on a round turn trade. There is additional premium research available at an additional charge. From a Limit order, you can Attach an opposite side order s to activate once the parent trade fills — a Target limit order or an Attached stop. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. Once you have downloaded an account and received your login details, you will need to fund your account before you can start day trading. Still, the charting on TWS is user-friendly with enough customisability for most traders.