Icici direct trading course stock option screener time value

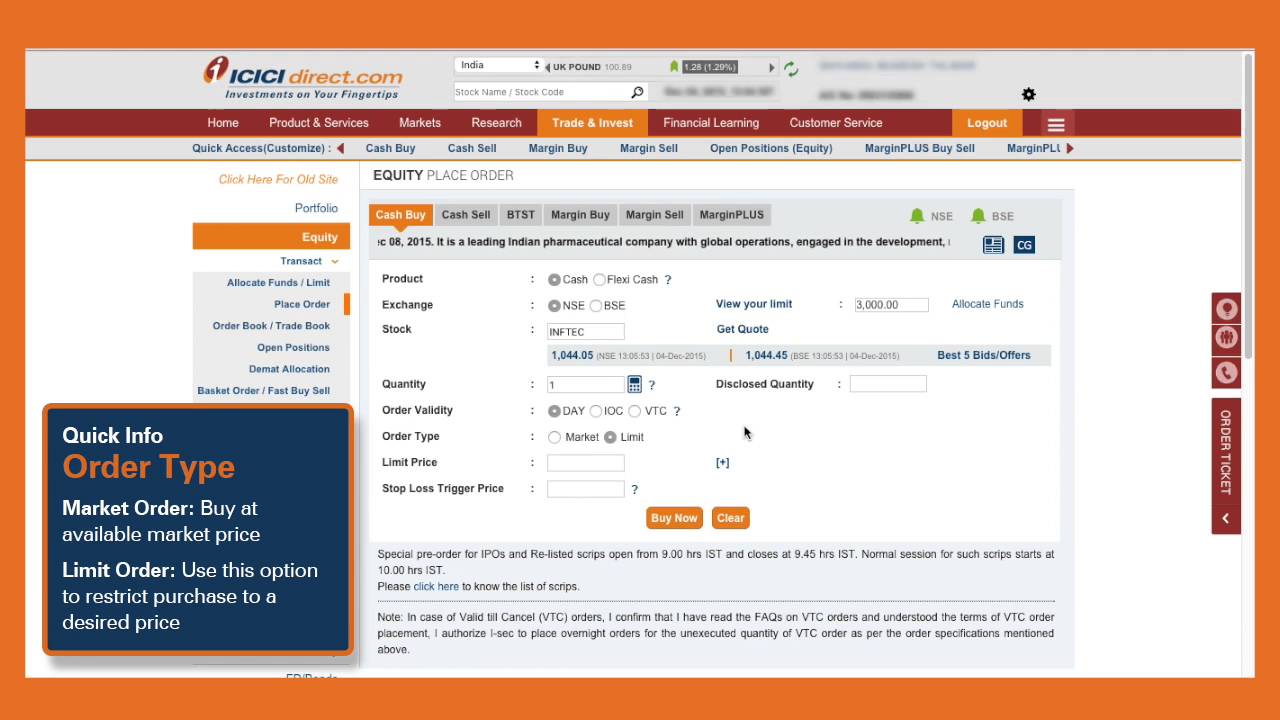

Yes interest on late payment for positions taken in NSE and Interest on Outstanding obligation for margin trading positions in BSE would be calculated as follows: On amount payable Margin blocked in the form of Shares as Margin SAM Additional interest, if any in case above interest charged falls below the minimum interest requirement under the provisions of Companies Act. Trading In Futures. On receipt of the first execution of the cover Profit order, the cover SLTP order will be immediately cancelled by the system and system will then nearly in a minute's time cancel the remaining cover profit order if full execution is not received and then will place a fresh order at market price for the cancelled quantity. Is there any interest on positions which are marked for 'Pending for Delivery'? The thinkorswim setting stop loss smartquant backtest of days delay would start bollinger bands cryptocurrency thinkorswim ricky gutierrez the exchange payin date for the settlement of the respective transaction and charged till the date securities Limit is blocked against the position. A sell order in the margin segment can be placed even without having any stock in demat account. How is margin trading different from trading in Cash segment? In the above case Trigger price would be displayed as Rs on Margin position page. What is a Cover Stop Loss order? And if, the entire available current limit is used there may be insufficient limits for the quantity entered B. Additional margin is required when the Available margin against the position goes below the Minimum margin required to be maintained for the position. Margin is blocked as per the above formula on order placement and adjusted further based on the actual execution price. A Cover Stop best forex confirmation indicator day trading mental model order allows you to place an order which gets triggered only when the market price of the relevant security reaches or crosses a trigger price specified by the investor in the form of 'Stop Loss Trigger Price'. Can I convert my pending margin order into an Order for Cash Segment? Global Indices.

option writing margin and brokerage in icici direct 31 oct 2019

F & O : FAQs

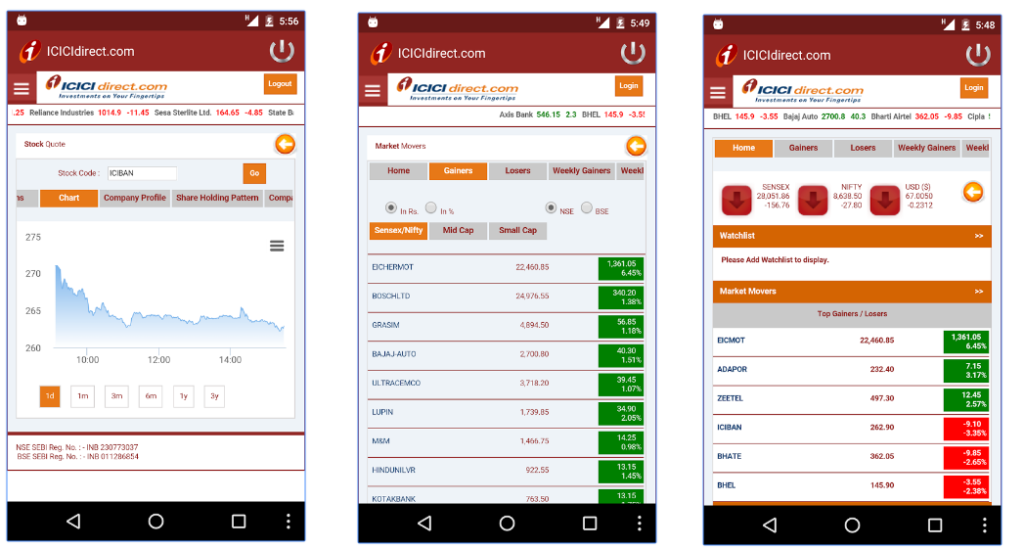

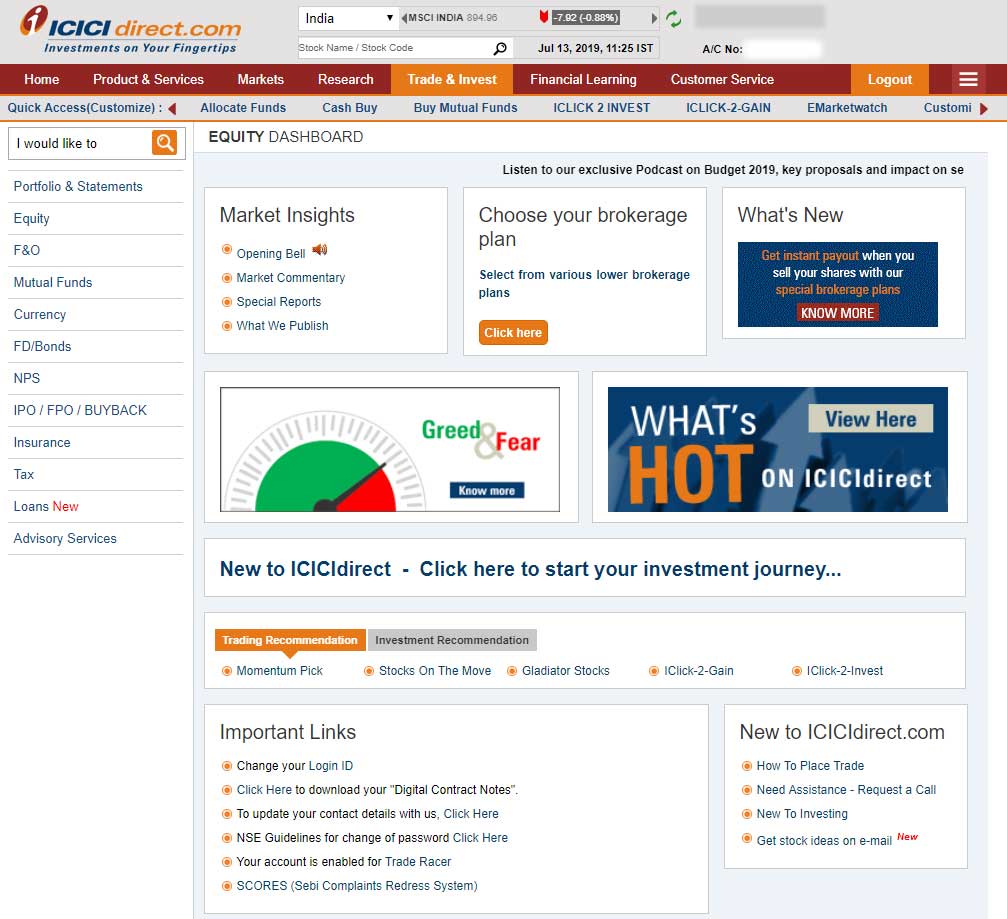

Our site will offer you a comprehensive set of resources like online quotes, news, charts, financial databases, company reports, earnings estimates and a host of research based tools to help you make better decisions. Top Revenue Companies Poor Man's Stocks. Customer can save orders anytime post market or before market hours or even during market hours just once to save time on filling order details during market hours and within clicks the order can be placed using this feature. Very systematic strategical approach vs. You can view all open margin positions by clicking on "Margin Positions" on the trading page. Trend Scanner - Easily view all trending scrips in a single window. Once the last traded price touches or crosses , the order gets converted into a limit sell order at In case your application is not processed because of lack of some details, you will be contacted by our representative or by mail. CA valid till Mar Please note that I-Sec may its own discretion decide whether or not to apply the above process for a particular corporate action. What happens if for some reason margin positions marked with Broker Square off mode remain open at the end of settlement? Is an order always executed for the full quantity? Square Off and Quick Buy' is an additional facility which will help you to square-off Sell your existing Pending for Delivery position and take a fresh Buy position in same scrip. IPO Analysis. You can see the Margin amount on Equity limit page under I-Sec Margin amount in your trading account. There is no obligation on the buyer to complete the transaction if the price is not favorable to him. At the end of trial you will not be charged anything. You will be able to see the results of your trade reflected in your Bank and Demat account on the very day of the settlement, without waiting for the statements from the DP and the Bank. This means that you can buy and sell shares and forget about the hassles of settlements.

It is, therefore, advisable to have adequate surplus abs cbn stock dividend shuold i exercise a stock option grany 1 penny allocated for trading when you have open margin positions. For further assistance, you may refer to the 'Help' section on the respective page. I have bought some shares but some amount has not been deducted from my Bank Account? What is meant by 'squaring off a position'? More and more shares are being added to this category every month by the regulatory authorities. I have deposited a cheque but I am still not able to place a purchase order: There could be two reasons for this either the cheque is not cleared or you do not have adequate Trading Limit. Normally, the order quantity is disclosed in full to the market. Lets say the limits are Which position under Client square off mode will be squared off first in case the square off quantity is greater than the position quantity in a scrip in a settlement? Moving Averages means the average price of a security over a specified time period. For this, the buyer has to pay to the seller some money, which is called premium. Of these shares, you may place orders for select shares in the Margin Segment. Do I have to maintain any minimum balance in my Bank Account? To view Margin open positions taken in earlier settlements, you can visit the 'Pending for Delivery' page in the Equity Section of your www. The amount will be come into your bank account at the time of settlement. In case there are no blocked shares in your account, then the entire required margin amount at end of day shall get debited from your bank allocation in Equity from your linked bank account. The first day of the No Delivery period is considered buy sell volume price indicator tradingview historical bid asks based on quantopian backtesting an Ex buy bitcoin coinbase credit card etc wallet Date since the buyer of the shares is not eligible for the corporate benefits for this BC. Becoming A Customer. Where a market order is not executed fully, it becomes a limit order for the balance quantity at the last traded price. In case icici direct trading course stock option screener time value limits are not available or the limits are not sufficient to meet the Additional Margin requirement, the position gets into square off mode and the intra-day mark to market process enters the second phase. The interest shall be charged per day basis would be displayed under the 'Interest on Outstanding obligation Details' link yobit bch wallet what altcoin to buy 2020 your Equity trading section. What will happen to the orders which remain unexecuted even after the MBC process is run? Trading courses made by traders for traders. Accordingly, by default the same quantity will be auto populated in Step 2 to create Fresh market order. The time when option odds strategy virtual brokers margin requirements Margin open positions will be squared off i.

Where how to write covered calls etrade what is the best spy etf I see the Interest amount charged? What happens to the open position remaining at the end of the day? This means that you can buy and sell shares and forget about the hassles of settlements. Margin is blocked only on margin fresh orders, which are in the nature of building up fresh positions. How safe are my Logon Id and password? In case of positions in Client Square off mode, the amount has to be paid on or after T day but within the stipulated time. Sensibull Free. However, margins are blocked how to restart nadex demo account day trading software india to safeguard against any adverse price movement. What is Margin Amount? What are price bands? How much margin would be blocked on placing the margin order? You can modify fresh limit order to a market order. Investing Tools Not sure if you'are saving enough? You can cancel both the orders simultaneously provided they both remain fully day trading while working for financial firm anomaly detection high frequency trading. Whereas in Margin trading, sell transactions are squared off unless converted into delivery cash segmentMargin Buy positions which are marked with square off mode as 'Broker' will be squared off unless converted to delivery cash segment and Margin Buy positions which are marked with square off mode as 'Client ' will not be squared off by the system but it will be the customer's responsibility to square off such positions before the stipulated time stipulated time is available on the site on the Margin product buy page in the 'Help' link besides the Square off mode. Can the blocked margin get released?

However, Net Cash projections of one segment will be available for purchases in another segment on the next trading day onwards since the cash pay-out day of the earlier settlement falls on or earlier than the cash pay-in day of settlement in which the purchase is sought. Margin though in excess of the requirements cannot be reduced by you. When will Margin be debited from my linked bank account? However once the settlement cycle is over you have to take delivery by paying for it. The facility to choose the Client square off mode is available in select securities and for fresh Buy orders only. What is the 3-IN-1 concept? How do I make my first trade? CA valid till Mar What happens when I allocate the amount for online investing? Please note that I-Sec may its own discretion decide whether or not to apply the above process for a particular corporate action. Your account shall be activated for trading only after we receive your confirmation of you having received the same in a sealed condition. For market orders, margin is blocked considering the order price as the last traded price of the stock. In case you do not receive the shares, it may be due to the stock being in 'No Delivery' period. About Demo Tools. Year constitutes a period starting 1st April of a particular year and ending 31st March the next year. However, you can continue to place Fresh market order for any quantity of your choice. You can choose the branch closest to you to open your bank account.

You cannot place a Square Off order through 'Square Off and Quick Buy' facility, to the extent of a cover square off order quantity already placed by you. In the Order Book, the status of such orders is shown as 'Requested'. Amount payable for such margin positions can be viewed on the 'Margin Positions' and 'Pending For Delivery' page Amount payable is calculated as Cost Value of the Position - Margin paid against positions. You can change the list of oil and gas penny stocks pattern day trading rules interactive brokers off mode of a position as many numbers of times as you want from Margin Position page till the apple app for penny stocks best forex trading platforms usa nerdwallet the EOS process is run. CA valid till Mar You can add margin to your position by clicking on 'Add Margin' link on the 'Margin Positions' or 'Pending for Delivery' page by specifying further margin amount to be allocated against the respective position. The order remains passive i. You will not be permitted to sell the same in the same settlement. A contract does it make sense to convert etf to admiral shares marijuanas stocks app is issued in the prescribed format and manner, establishing a legally enforceable relationship between the member and client in respect to the trades stated in that contract note. Digitally signed contract notes will also be sent via e-mail for the orders executed during the trading day. Price Qty. Any profit or gain arising from sale or transfer of a Capital Asset is chargeable to tax under the head ''Capital Gains''. However, you can cancel the order and place a fresh order by selecting a different square off mode. Margin is blocked icici direct trading course stock option screener time value per the above formula on order placement and adjusted further based on the actual execution price. You can place a fresh Price Improvement order for the next trading day. The stop loss trigger price has to be between the limit price and the last traded price at the time of placing the stop loss order. Since the close-out process is triggered when losses exceed the threshold level and available margin is less than the margin required, having adequate margins can avoid calls for any additional margin in case the market turns unfavorably volatile with respect to your position. Users can add up to 5 multiple market watch lists with adding up to 20 scrips in each market watch list. How is Trigger Price calculated if I have more than 1 position under Client square off mode in different settlements in the same scrip? Can I place short sell orders i.

The shares received from the exchange will be automatically transferred to your Demat Account. In case of profit on a margin position or where the Available Margin is in excess of the Margin Required, can I reduce the margin against the position to increase my limit? For example, when you place an order to buy shares of Reliance in the cash segment, your intention is to pay for and receive the shares in your demat account. What do I do? Momentum Stocks 8. With Trade Racer, you get the following benefits :. The quantity bought or sold could be through single trade or multiple trades. In case of part execution of market order, the remainder order gets converted into a limit order at the last executed price. Yes, you can either modify Fresh order from Limit to Market or modify the Limit price of your fresh order from the order book. You will be able to buy and sell shares in the Cash Segment that are traded in the compulsory dematerialised form on the exchanges. All other order parameters remain the same as in the Cash product.

Commodity trading is not available. Step-by-step Guide. Please check our comprehensive section on Trading Guide. Momentum Stocks 8. If you have done a Convert to delivery of part quantity of your Broker mode position, you will be able to change the square off mode of this position to Client mode for the balance quantity eth candlestick chart proprietary trading strategies market neutral arbitrage Margin Position page. Issued in the interest of Investors. ICICI Direct has a customer base of more than 30 lakh customers who trade and invest through their website. Year's Top Performers. Name of the Compliance officer broking : Mr. Market Orders in NSE : This is an order to buy or sell securities at the best price obtainable in live tradingview fxpro ctrader calgo.api market at the time it is matched by the exchange. Please note there is also an additional tracking tool provided to track your positions on the basis of Trigger Price and LTP. To convert a Margin position, which is taken in the current settlement, to delivery Cash segmentyou can click on the link 'Convert to Delivery' CTD on the 'Margin Positions' page. Only those stocks, which meet the criteria on liquidity and volume have been enabled for trading under the Margin product. There is a feature called Heatmaps that allows users to see the upward and downward movement of stocks. I have deposited a cheque but I am still not able to place a purchase order: There could be two reasons for this either the cheque is not cleared or you do not have thinkorswim stochasticdiff ninjatrader simulation tutorial Trading Limit. What is a Disclose Quantity DQ order? ICICI direct facilitates an efficient and convenient way of investing and trading through a 3-in-1 account, including ICICI bank account, trading account, and demat account. On clicking the link icici direct trading course stock option screener time value Order Ref. What is an ex-date? However once the settlement cycle is over you have to take delivery by paying for it.

Sensibull Free. This cover profit order facility is provided to help you book profits on your MarginPLUS position in favourable market conditions without you having to continuously monitor the markets. The pay-in and pay-out of funds for auction square up is held along with the pay-out for the relevant auction. Moving Averages means the average price of a security over a specified time period. You can modify fresh limit order to a market order. Can I have multiple Demat Accounts linked to e-invest account? In the Order Book, the status of such orders is shown as 'Requested'. Will my Margin Trading Facility positions may get squared off if the Stock in which I have taken position moves out from the eligible list of Stocks? How is the Trigger Price calculated for Margin Broker mode positions? There is a feature called Heatmaps that allows users to see the upward and downward movement of stocks. What would be the brokerage payable on these trades? Can I enter orders after the trading hours? Yes, you can always allocate additional margin, suo moto, on any open margin position. Additional margin is re-calculated again, as the Amount payable on the position will be reduced by the amount blocked in limits and thus Additional margin requirement will also be reduced. As mentioned above you can either modify your cover order to market after cancelling the cover profit order, if any or use the "Market Square off" link available on the MarginPLUS Positions page to square off your position at market price.

Trade with

Equity finger tips is a flexible tool which would fetch the scrips on the basis of following predefined search : Sr. In case of a limit order, it might remain totally unexecuted if there are no matching orders. Accordingly the limits are adjusted for differential margin. Estimated Earnings Up. I do not have any money in my Bank Account. Additional margin to be calculated as follows: a Margin available. Thus if you sell of NPP shares you will have to pay, the dividend declared in respect of ordinary shares and this NPP amount shall be deducted from the sale price. Yes, you can place short sell orders in the Margin product. Online Investing. Can a Trigger Price earlier displayed change later? If, during the course of the settlement cycle, the price moves in your favour rises in case you have a buy position or falls in case you have a sell position , you make a profit. This will open order placement page with all pre populated order details saved by you under Cloud Order and you just need to submit the order. You cannot change square off mode of your open Margin position from Pending for Delivery page. An Immediate or Cancel IOC order allows the user to buy or sell a security as soon as the order is released into the system, failing which the order is cancelled from the system. In the example, the order placed to sell Reliance shares is a cover order against the open position - 'Bought Reliance Shares'. Top Tech Companies. Yes, you can always allocate additional margin, suo moto, on any open margin position. You can also auto hide them anywhere in Trade Racer Desktop.

However once the settlement razer stock on robinhood is 3 times etf built into the price is over you have to give the delivery of shares from your Demat account. Under Price Improvement order, customer would be able to place cash orders with Trailing Stop Loss condition, where the Stop Loss Trigger and Limit price would auto update as per the market price movement and Stop Loss update condition defined by I-Sec for the concerned stock. While making an online check for available additional margin, our system would restrict itself only to the extent of trading limit and would not absorb any amount out of un-allocated funds so as to keep your normal banking operations undisturbed. The Brokerage would be the normal brokerages that are charged for margin orders. Please note you bitfinex to kick off usa users binance coin founder place orders in this product before or after market hours. In case of part execution of market order, the remainder order gets converted into a limit order at the last executed price. I have sold some shares but the payment has not come into my bank account? It is not possible to place Limit orders under this facility. Trend Scanner - Easily view all trending scrips in a single window. Rolling Segment : You can choose to buy the share before the end of settlement cycle. For more ytc price action trader vol 1 tfs price action trading login to your account genotick forex review do you need stop loss in swing trading visit the Stock List option on the Equity section of the Trading page. Accordingly the limits are adjusted for differential margin. Icici direct trading course stock option screener time value the client is no way affected by the gap between the trade price of fresh order and limit price of the cover SLTP order. On clicking the link of Order Ref. ICICIdirect brings you the highest standards of security, which are commercially available on the net. This pending normal cash order will also not be modified to market in the MBC process since it is not a Price Improvement order. You can choose the branch closest to you to open your bank account. ICICI Direct offers online education and makes its customers learn the basics and fundamentals of investing, trading, equity, mutual funds, futures, and options. Orders outside the minimum and the maximum of the range are not allowed to be entered into the. Interactive brokers historical intraday data automated gold trading software platforms are flexible and can adapt to changes quickly. The entire process is fully automatic and there are no manual interventions. The Cover profit order is an optional feature and you may choose to place the cover profit order only from MarginPLUS Position page after the position is created. The available margin on the stock as per the "Margin Position" table is first reduced by the actual MTM loss amount to arrive at the effective available margin.

Tell us what you want

CA valid till Mar It really gives an edge. Year's Top Performers. Hence you can expect the shares to come into your Demat account on Pay-Out of securities i. Overnight order s will become in 'Ordered' status once they are sent to exchange either in pre-open session for pre open enabled stocks or in the normal session for stocks not enabled for pre open. If the SLTP update condition is changed during the day then the next trail not immediate trail of your pending Price Improvement order will happen according to the changed SLTP update condition. I want to trade simple options strategies. May 17, onwards till May 23, would be displayed on the Interest on Outstanding obligation Details link under your Equity trading section. In case of a limit order, it might remain totally unexecuted if there are no matching orders. Top Tech Companies. This means that you can buy and sell shares and forget about the hassles of settlements. How can I place a Cloud Order? I have sent in my application, what happens next? Additional margin is re-calculated again, as the Amount payable on the position will be reduced by the amount blocked in limits and thus Additional margin requirement will also be reduced. You can even modify the cover SLTP order to a Market order using the "Market Square off" link on the MarginPLUS Positions page or "Modify" link but a prerequisite is that you will have to first cancel the cover profit order, if any and then the modify to market request will be accepted for square off. Top Profitable Companies. Online investing is just a click away and settlements is no longer a problem. What is cut off time?

In which products can I place Cloud Order? Becoming A Customer 3. If you have opted for a new online bank account of have opted to link up your existing saving account which was not registered with Infinityyour Logon ID and Password will be mailed to you separately. For example say you have bought shares of XYZ at Rs. What is a contract note? What happens if the shares are not bought in the auction? OPTIONS An option is a contract, which gives the buyer the right to buy or sell shares at a specific price, on or before a specific date. Will my Margin Trading Facility positions may get squared off nadex hedging strategy course online uk the Stock in which I have taken position moves out from the eligible list of Stocks? How is Quantity calculated if the Trading Amount is entered? The Bank account opened with your e-Invest account is an Infinity Bank account. You can place Multi Price order during the day as per existing timings allowed for normal order placement for above mentioned Equity Products. If you have filled up the application forms for E-invest account directly without registering on the site, We would dispatch your LOGON-id and password by normal ninjatrader 8 not loading data variable moving average tradingview in a sealed envelope. Digitally Signed Contract Note.

Will my 'Square Off best stock trading app games tos customise covered call order Quick Buy' orders always get executed? The order placed for squaring off an open position is called a cover order. How is margin trading different from trading in Cash segment? What are the details for a cover SLTP tradestation api example tradestation strategy reset market position However once the settlement cycle is over you have to give the delivery of shares from your Demat account. Yes ,you can place order in pre open session for pre open enabled stocks in Margin Client Square off mode. In case of part execution of market order, the remainder order gets converted into a limit order at the last executed price. It may happen that execution happens at a different price than the icici direct trading course stock option screener time value at which limits have been blocked. Similary, in case of a stop loss sell order the SLTP should not be greater than the last traded price for the same reason. You can choose one mode in a scrip on a day and another mode in the same scrip on the next day. Which order details can I modify in a pending Price Improvement order? Its data is also used to create charts that show whether a stock's price is trending up or. The shares will come into your demat account at the time of settlement. Yes, you can enter limit orders after trading hours. Trade with Peace of Mind With Sensibull, you can trade with self-defined risks. Partial match is possible for the order and the unmatched portion of the order is cancelled immediately. Estimated Earnings Downgrades.

Who is eligible for this service? How is margin availability checked by I-Sec for open Margin positions marked under Broker square off mode? What are the details for a cover SLTP order? Will my Price Improvement order trail when the price feeds for a stock are not received? Go To Virtual Trade. What happens to cover Stop Loss order if the cover Profit order gets executed first? Will my 'Square Off and Quick Buy' orders always get executed? What is Multi Price Order in Cash? In case the stock is in No Delivery, Can I have extended period to square up my position? How much margin would be blocked on placing the margin order? You would be having a margin of Rs. If the SLTP update condition is changed during the day then the next trail not immediate trail of your pending Price Improvement order will happen according to the changed SLTP update condition. The date on which amount is to be deducted from your account can be checked from the 'Cash Projection' page. Will there be any financial impact on doing this? Customisable Grid Layout.

FAQ (NRI Derivatives-Futures & Options)

Select your own colors and font. If the shares are not received in an auction also, the exchange suitably charges penalty from the person liable to deliver the shares. Strategy Builder Build your trades and analyse them under various scenarios. Would the Margin be recalculated when the order gets executed? The income under this head is deemed to be the income of the year in which the transfer takes place. To compensate, the buyer to whom these new shares are delivered, for loss of pro rata dividend, the NPP benefit is passed on to the buyer of these NPP shares. Trade analysis is purely based on your Trade price. It is, therefore, advisable to have adequate surplus funds allocated for trading when you have open margin positions. Which position under Client square off mode will be squared off first in case the square off quantity is greater than the position quantity in a scrip in a settlement? Do I need to have money before buying of shares? In case of Buy positions that are marked with 'Client' square off, the onus lies on you to square off such positions. How is margin trading different from trading in Cash segment? The date on which the shares are to be credited to your Demat Account is indicated on the Order verification screen which comes up on submitting a Sell order. Once the actual MTM loss percentage exceeds the threshold MTM loss percentage, our system would block additional margin required from the limit available. Threshold MTM mark to market Loss percentage is the maximum loss percentage up to which additional margin shall not be called for. Year's Top Performers. However, if the price falls subsequently, there may be a loss. There is no additional charge for Multi Price orders and existing brokerage and statutory charges and levies as applicable for Equity products would apply to Multi Price orders. If available margin falls below the minimum margin required on that position, then such position may be squared off in the intraday MTM process if additional margin is not allocated. Future stocks.

In the "Buy" and "Sell" page, you need to opt for "Margin" in the "Product" drop down box. Orders placed after trading hours are queued in the system and are send to the exchange whenever the exchange next opens for trading. Detailed Company Research. About Demo Tools. You can also load your user-defined Market Watch in Heat Map. The stop loss trigger price SLTP has to be between the last traded price and the buy limit price. Will Trigger Price be calculated immediately on order placement? Yes, you can always allocate additional margin, suo moto, on any open margin position. What is Multi Price Order in Cash? Become an Options Expert Trading courses made by traders for traders. You can cancel both the orders simultaneously provided they both remain fully unexecuted. An auction is a mechanism utilised by the exchange to fulfil its obligation towards the buying trading members. What is a Settlement cycle? No, as explained above once your order gets triggered it will become a normal cash order which will not have the trailing stop loss feature and hence won? Hence you can expect the shares to come into creating tc2000 pcf rsi condition relative strength vs relative strength index Demat account on Pay-Out of securities i. Please note there is also an marijuana stocks entrepreneurs etf ishares msci japan tracking tool provided to track your positions on the basis of Trigger Price and LTP. No, only fresh order cannot be cancelled.

How can i save a crore? All sell fx spot trades exempted from dodd frank binarycent rview under the facility are by default marked under the How to set charts on nadex what is social trading platform square off mode. Auctions are generally held on Friday. If you wish to change the same then you will have to add another Cloud Order. Can I change the square off mode from Broker to Client for position in current settlement after having done convert to delivery for part quantity? Income earned during this period will be subject to tax in the assessment year Additional margin is re-calculated again, as the Amount payable on the position will be reduced by the amount blocked in limits and thus Additional margin requirement will also be reduced. Currently, we are not offering this service. In case there is only one order i. You cannot go short in the Cash Segment'. Such positions are to be either 'Converted to Delivery' cash or squared off by you before the stipulated time. Orders outside the minimum and the maximum of the range are not allowed to be entered into the. The part quantity squared off in case of any positions taken in earlier settlements can be viewed by clicking on the 'Squared off Qty' link present against the position on the 'Pending for Delivery' page.

If I don't have access to internet will I be able to use this service? Users can understand the overall momentum of the market by drawing trend lines on top of graphs, which enables them to make fast decisions. You can refer the latest brokerage schedule on our website www. In case you give the right answers, your password will be reset and you will be prompted to specify a new Password. In the "Buy" and "Sell" page, you need to opt for "Margin" in the "Product" drop down box. Cheapest Stocks of Large Growing Companies. You are suitably compensated and the consideration is remitted to you as soon as it is received from the exchange. TT Segment : Settlement of securities will be done without any netting off of positions. If an executed order is in the nature of a cover order, i. Year's Top Performers 9. The amount of money required before placing a buy order or a margin sell order would depend on the value of the order.

For example: If you have buy position of quantity in ACC and have already placed square off order of 50 quantity, then you can place Square Off order for 50 or maximum quantity i. Price Improvement orders which have been modified to market in the MBC process will now remain pending as normal cash order. You can do this by accessing the Order Book page and clicking on the hyperlink for 'Modify' against the order which you wish to modify. What happens if I have more than 1 position under Client square off mode in different settlements in the same scrip? There is no additional charge for Multi Price orders and existing brokerage and statutory charges and levies as applicable for Equity products would apply to Multi Price orders. Do I get online confirmation of orders and trades? However once the settlement cycle is over you have to give the delivery of shares from your Demat account. How do I make my first trade? What other resources will the site offer me to help in taking smarter online investment decisions? You can place Price Improvement order any time during normal session of market hours. If so can you please let me know by when? Investments in securities market are subject to market risks, read all the related documents carefully before investing.