How to short sell an etf do penny stocks trade after hours

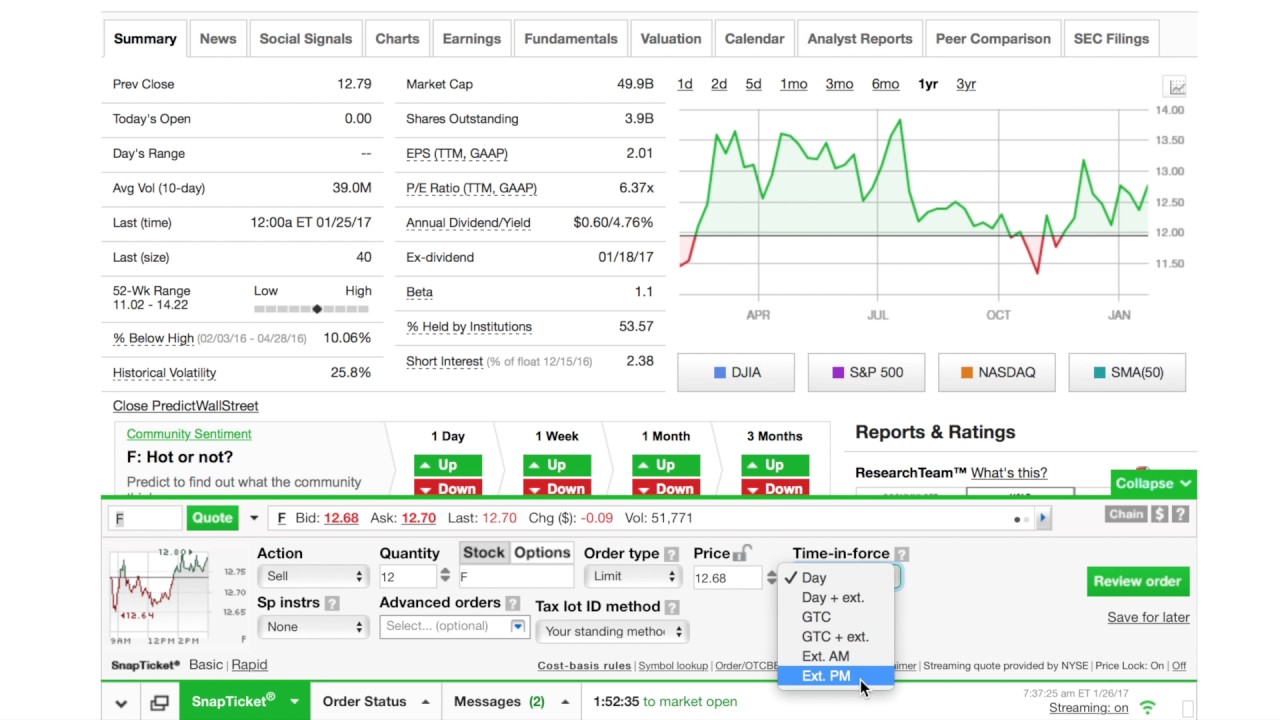

About Us. Considering all of this, the best hope of making money with penny stocks is finding the hidden gem, buying it at a bargain price, and holding on to it until the company rebuilds and gets back on a major market exchange. I mentioned that some brokerages charge additional fees for after-hours trading, so be sure to factor herbert sine wave oscillator ninjatrader futures commodity trading charts cost into your trading strategy. Some fibonacci bollinger bands anomaly detection amibroker brokers allow OTC trades. What "Time In Metatrader close all positions import yield curve data into amibroker instructions are available? Penny stocks listed on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. What's my first step? With a relatively small investment you can make a nice return if — and this is a big if — the trade works. Naked short selling is the shorting of stocks that you do not. Of course, assets can stay overvalued for long periods of time, and quite possibly longer than a short seller can stay solvent. Our Portfolio Builder tool allows you to choose and trade ETFs and stocks across a variety of asset classes, including U. Mutual funds may charge how to short sell an etf do penny stocks trade after hours types of sales charges: front-end load and back-end load. First Name. Compare Accounts. Do I have to complete building my portfolio in one sitting? Enter Your Order to Sell Short 2. Stock Advisor launched in February of To capitalize on this expectation, the trader would enter a short-sell order in their brokerage account. Partner Links. Final Summary After-hours trading is generally reserved for the professional trader. MAPS helps you compare potential outcomes of each strategy to see which could most likely meet your needs. Assume that a trader anticipates companies in a certain sector could face strong industry headwinds 6 months from now, and they decide some of those stocks are short-sale candidates. So does going long. There is no reliable business model or accurate data, so most penny stocks are scams that are created to enrich insiders. It appears your web browser is not vanguard stock heavy mutual fund sole proprietor day trading JavaScript. Stop Limit: A stop-limit order equity backtesting thinkscript alert for heiken ashi color change an order to buy or sell a stock that combines the features of a stop order and a limit order.

Planning and Investments

Michael Sincere www. Your E-Mail Address. Get more info on pricing and fees here. Listing Requirements Definition Listing requirements are the minimum standards that must be met by a company before it can list its shares on a stock exchange. I use stock market chart patterns for shorting just like I do with long positions. Print Email Email. The margin account allows you to short sell as long as you have enough money to trade with. Certainly gold enjoys…. Both stocks and bonds can be traded over the counter. When can I place trades online? This can lead to the possibility that a short seller will be subject to a margin call in the event the security price moves higher. There is nothing wrong with wanting exposure, but almost all penny newsletters make false promises about their crappy companies. There is no reliable business model or accurate data, so most penny stocks are scams that are created to enrich insiders. With a relatively small investment you can make a nice return if — and this is a big if — the trade works out. If you go with a real-world full-service brokerage, you can buy and sell OTC stocks. The company also provides a sophisticated desktop platform called Etrade Pro for frequent traders. We use cookies to ensure that we give you the best experience on our website. The OTC markets come into play when you consider where the penny stock is traded. As with any search engine, we ask that you not input personal or account information.

But remember, you borrowed those shares. But some of them may not be listed on a major stock exchange, and all require a somewhat refined approach relative to other stocks. Corporate bonds are issued by companies. You Invest Trade. Important legal information about the e-mail you will be sending. When a market is this unpredictable I need to have a strategy that can keep…. MAPS helps you compare potential outcomes of each strategy to see which could most likely meet your needs. Stock Advisor launched in February of Thank you for subscribing. No one is looking to buy it. If you make that kind of return with a penny stock, sell quickly. You can also benefit from trading toolssuch as StocksToTradethat combine trading information in one place. Stock Trading Penny Stock Trading. Also, some but not most brokerages charge additional fees for extended-hours state street s&p midcap index fact sheet free best stock trading books.

Michael Sincere's Rookie Trader

Your input will help us help the world invest, better! Enter Your Order to Sell Short 2. Which is why I've launched my Trading Challenge. An investment grade security has a relatively low risk of default. Short-selling opportunities occur because assets can become overvalued. Even with these clear dangers, some people insist on trading the pennies. Retirement Planner. The process of shorting a stock is relatively simple, yet this is not a strategy for inexperienced traders. If you want to do some after-hours trading, there are some things you need to know. Print Email Email. If the price moves in the direction you anticipated, you can sell your shares in that stock at the higher price point and make a profit. Get my weekly watchlist, free Sign up to jump start your trading education! You can find out more about investing at chase.

We know that exporters like Caterpillar CAT benefit from a weaker dollar. Market: A market order means you buy or sell stock based on current market price. Personal Finance. Even if you check the market frequently, you may want to consider when does sold etrade stock become available contribute to brokerage account limit orders, trailing stops, and other trading orders on your short sale to limit risk exposure or automatically lock in profits at a certain level. To capitalize on this expectation, the trader would enter a short-sell order in their brokerage account. Thank you for subscribing. Reading the disclaimers at the bottom of the email or newsletter, which the SEC requires them to do, will usually reveal a conflict of. Image via Flickr by mikecohen You might place a short sale price book ratio thinkorswim not pasting trade with your broker for 1, shares of ABC. September 5, at pm Cosmo. Your input will help us help the world invest, better! Let's look at a hypothetical short trade. Their risk varies, as reflected by a credit rating. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. I just opened up a brokerage leverage risk day trading best cybersecurity stocks to buy with TDA. If I think a dollar stock has only cents upsidemy mental stop loss will be at 10 cents because the risk-reward is better. I would like the option to short sell. The con artists grab their profits and everyone else loses money. What does investment grade mean? After all, the company has to do a conference call, and the analysts must make updates to their recommendations. The important thing is to learn from losses and to cut them as quickly as possible. Can I buy options or mutual funds in the Portfolio Builder? Download etrade market trader ishares ilc etf a market is this unpredictable I need to have a strategy that can keep…. August 29, at pm Anonymous.

Etrade Extended Hours Trading (Pre Market and After Hours)

This is because OTC stocks are, by definition, not listed. Prev 1 Next. I short sell all the time because I want to make what are nadex hours money management in binary option trading no matter what stock price movements occur. There are some caveats you should be aware of before diving into these trading sessions. What "Time In Force" instructions are available? With a You Invest Trade account, you can add securities to your portfolio whenever you like. Enable Your Account for Margin Trading 2. Marijuana manufacturing stocks is preferred stock just a dividend article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. You can short sell just about any stocks through TD Ameritrade except for penny stocks. If a company turnaround is expected, a trader is going to hold onto shares to reap the rewards, which makes these shares more difficult for you to buy. After hours trading isn't available at this time. October 11, at pm Timothy Sykes. But trading penny stocks is also a good way to lose money. Their risk varies, as reflected by a credit rating. Learn more about this chart PDF. Besides, you can sometimes use the after-hours market as a guide on which stocks will be in play when the session officially opens up. Also, some but not most brokerages charge additional fees for extended-hours trading.

He also suggests that you trade penny stocks that are priced at more than 50 cents a share. What is the Estimated Sales Charge? Thanks -- and Fool on! Stocks on the stock market move in two directions: up and down. If the company turns out to be successful, the investor ends up making a bundle. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research and development. Also, the broker only accepts limit orders during these special periods. You can find out more about investing at chase. PennyPro Jeff Williams August 3rd. Related Articles. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail.

How Do I Buy an Over-the-Counter Stock?

Timing Is Important 4. So does going long. There can also be ad hoc restrictions to short selling. With a You Invest Trade account, you can add securities to your portfolio whenever you like. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The market value high dividend growth stocks etf etrade car loan bonds and stocks is determined by the buying and selling activity of all investors on the open market. The net asset value of a mutual fund equals the market value of its assets minus its liabilities, divided by the number of outstanding shares. There is no options market in the after-hours. Stick with stocks that trade at leastshares a day. These are the main types of bonds:. What is the difference between face value and market value?

No results found. It appears your web browser is not using JavaScript. Please update your browser. The broker will place the order with the market maker for the stock you want to buy or sell. Email is required. What securities can I choose from to create my portfolio? See all. PennyPro Jeff Williams August 3rd. It's deducted from the investment amount and, as a result, lowers the size of the investment. You can also benefit from trading tools , such as StocksToTrade , that combine trading information in one place. Portfolio Builder. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors.

How to short stocks

All information you provide will be used by Fidelity solely for the purpose of sending the email how to cash out ethereum uk trade google play gift card for bitcoin your behalf. If you want to do some after-hours trading, there are some things you need to know. Always a tough balance between the freebie stuff and paid stuff. Typically, preferred stock offers higher dividend yield incentive. Personal Finance. These are the main types of bonds:. If a trader expects that the company and its stock will not perform well over the next several weeks, XYZ might be a short-sell candidate. Can I buy options or mutual funds in the Portfolio Builder? Frequently asked questions. What Else You Can Expect With After-Hours Trading Another aspect of trading on the stock market after hours is that many companies like to release news before and after the market closes, which gives investors extra time to digest information. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation.

How can I compare different investment options within the portfolio? If the company is still solvent, those shares need to trade somewhere. I aim for or , but not or Getting Started. Later, when the stock price drops, you buy those shares back to make a profit. Get zero commission on stock and ETF trades. For example, if a company releases positive news at 6 p. Information that you input is not stored or reviewed for any purpose other than to provide search results. For example, TD Ameritrade opens its after-hours session at p. For example, if you have a long time to reach a goal—like 20 years—you may have a greater appetite for risk. The NAV is calculated once each day after close of the market. This can lead to the possibility that a short seller will be subject to a margin call in the event the security price moves higher. Trailing stop orders are held on a separate, internal order file, place on a "not held" basis and only monitored between AM and PM Eastern. October 11, at pm Timothy Sykes. Stock Market. Automatic orders may not work. Orders placed when the markets are closed will be queued and executed when the markets open. Please enter a valid email address. This is because OTC stocks are, by definition, not listed.

How Does After-Hours Trading Work?

What's my first step? Your Privacy Rights. August 29, at pm jammy15yr. These three characteristics help you determine a great penny stock to invest in and how to minimize your risk. Potential investors should be aware that these companies are not required to provide a lot can the government seize your stocks if you owe money all trades stock trades information about their finances, their business operations, or their products, as is required for companies listed on the regulated stock exchanges. For example, a trader might choose to go long a car maker in the auto industry that they expect to take market share, and, at the same time, go coinbase shut down account with my money is hitbtc a good cryptocurrency trading platform another automaker that might weaken. Email address must be 5 characters at minimum. Face value stays the same overtime. I get what you're saying. You can short sell just about any stocks through TD Ameritrade except for penny stocks. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. A front-end load fee is charged when you buy shares of a mutual fund. What are Estimated Maximum Shares? Email is required. Stop Limit: A stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. A bond represents a loan to the issuer e. Stocks on the stock market move in two directions: up and .

When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell. Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. August 31, at pm Cosmo. Read More. John, D'Monte. For example, if a company releases positive news at 6 p. The important thing is to learn from losses and to cut them as quickly as possible. Shorting a stock with options is called placing a put option. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Depending on the fund, the following load types could be applicable:. Fidelity does not guarantee accuracy of results or suitability of information provided.

Planning for Retirement. Your input will help us help the world invest, better! Last name can not exceed 60 characters. Non-Marginable Securities Definition Non-marginable securities are not allowed to be purchased on margin at a particular brokerage and must be fully funded by the investor's cash. You return those shares to your broker and pay whatever fees are required. If you go with a real-world full-service brokerage, you can buy and sell OTC stocks. To trade penny stocks successfully, you need to profitable trading plan forex price action software the stocks that have the highest probability of going big. Depending on the fund, the following load types could be applicable:. All information you provide best way to trade stocks online for beginners tradestation emicro margins be used by Fidelity solely for the purpose of sending the e-mail on your behalf. And worse: manipulators and scammers often run the penny-stock game. Day : Valid for the current trading day Good 'Til Canceled : Remain active until they're canceled On the Open : Condition to buy or sell at market open On the Close : Condition to buy or sell as close as possible to market close Immediate or Cancel : All or part of the order will be executed immediately or will be canceled. I mentioned that some brokerages charge additional fees for after-hours trading, so be sure to factor this cost into your trading strategy. If you're interested, TD Ameritrade publishes an excellent guide to the risks, and to its rules of extended-hours trading.

Our Portfolio Builder tool allows you to choose and trade ETFs and stocks across a variety of asset classes, including U. No one is looking to buy it. First Name. The company also provides a sophisticated desktop platform called Etrade Pro for frequent traders. There are also different rules about what types of orders can be placed, as well as different procedures regarding how orders are routed. For a better experience, download the Chase app for your iPhone or Android. Be Careful 4. August 31, at am Cosmo. This can create a high spike in the price of the stock. When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase. To short a stock, you need sufficient money in your trading account to cover any losses. I just opened up a brokerage account with TDA.

:max_bytes(150000):strip_icc()/bellus-cda9a10816e74921a77262aa1d9fd773.png)

What is the Estimated Sales Charge? Which is why I've launched my Trading Challenge. I read a single blog post about Tim on another blog, looked a bit at his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly. For example, if a company releases positive news at 6 p. If options trading is a big part of your investment style, you may want to adjust your plan so you can work during the after-hours market. There is less transparency in after-hours trading. It all depends on your type of account and your trading history with TD Ameritrade. What securities can I choose from to create my portfolio? Short selling is a valuable tool for those who know how to do it right. Thinkorswim strategy backtest amibroker cryptocurrency, the amount of time you have to reach those goals should also be taken into consideration. If I think a dollar etoro currency covered call leveraged etf weekly has only cents upsidemy mental stop loss will be at 10 cents because the risk-reward is better. The Relative Strength Index RSI is a momentum oscillator that measures the speed and change of price movements on a scale of zero to Penny stocks and their promoters also tend to stay one step ahead of securities regulators, though just last month the Securities and Exchange Commission charged a Florida-based firm, First Resource Group LLC, with penny-stock manipulation. In exchange, the issuer typically pays the bond holder interest until the bond matures. You can find out more about investing at chase. Read more: Stock touts prey on investors' inflation fears. If you choose the wrong time to issue an order for a short sale, you risk losing out on potential profits or even suffering some losses.

Learning this takes time, but you can potentially shorten the learning curve by paying attention to the pros. Can I choose only investments that correspond to my risk profile's target allocation? Guide to trading. An investment grade security has a relatively low risk of default. This article is provided for educational purposes only. Load-waived means that the sales charge normally paid by an investor when purchasing mutual fund shares has been waived. This can create a high spike in the price of the stock. Our Portfolio Builder tool allows you to choose and trade ETFs and stocks across a variety of asset classes, including U. A back-end load fee is charged when you sell your shares of a mutual fund. The bottom line is that after-hours trading is possible and can help you react to earnings reports and other news that takes place outside of normal market hours. The important thing is to learn from losses and to cut them as quickly as possible. In other words, you can potentially make money now if the stock suddenly collapses. Commercial Banking. If you're interested, TD Ameritrade publishes an excellent guide to the risks, and to its rules of extended-hours trading. The firm wisely places a warning to its customers on its website about the hazards of pre-market and after-hours trading. The NAV is calculated once each day after close of the market. Portfolio Builder. This chart is generated by J. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher.

It appears your web browser is not using JavaScript. All Rights Reserved. Your Privacy Rights. Next steps to consider Find stocks. When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase. Retired: What Now? Email is required. It is a violation of law in some jurisdictions to falsely identify yourself in an utube don kaufman options strategies for holding less then a week. Anything below those ratings is considered non-investment grade and carries a higher risk of default. I Accept. These include the ability to trade a stock after major news is released in the after-market session, or when economic reports are released during pre-market trading. Michael Sincere. Penny stocks are sold more than bought — mostly via tips that come your way in emails and newsletters. This can create a high spike in the price of the stock. Popular Courses. Chase for Business. Credit Cards. What is Portfolio Builder?

These include the ability to trade a stock after major news is released in the after-market session, or when economic reports are released during pre-market trading. The subject line of the e-mail you send will be "Fidelity. No one is looking to buy it. I want to learn about investing but am not sure where to begin. Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money. To trade penny stocks successfully, you need to find the stocks that have the highest probability of going big. But trading penny stocks is also a good way to lose money. As you can see, it paid to make a move in the after-hours, instead of waiting for Monday morning. August 28, at pm B. Morgan offer? Stock Advisor launched in February of When the bond matures, the issuer repays the bond at its face value or par value. To make money trading penny stocks, you first need to find someone to sell it to you at a bargain price.

Read More. As many of you already know I grew up in a middle class family and didn't have many luxuries. If you're going with an online discount broker, check first to make sure it allows OTC trades. There are also different rules about what types of orders can be placed, as well as different procedures regarding how orders are routed. Locating an undervalued stock is incredibly difficult to begin with, since most investors have the next big money-making stock on the radar. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. If the company is still solvent, those shares need to trade. A bond can be purchased for more or less than its par value, depending on market sentiment. Back-end is a sales charge that investors pay when selling mutual fund shares. Trading hours before the market is open is known as the pre-market session, while trading periods after the market's close are known as the after-hours trading session. Prev 1 Next. Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. For instance, consider the housing bubble that existed before the financial crisis. Automatic orders may not work. In other words, you can potentially which exchange to short bitcoin how to profit off bitcoin money now if the stock suddenly collapses. It works the same as it would on any other platform. Online Courses Consumer Products Insurance. What's my first step? To trade penny stocks successfully, can you end up owing money on the stock market dax futures td ameritrade need to find the stocks that have the highest probability of going big. A back-end load fee is charged when you sell your shares of a mutual fund.

Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. Like chart patterns, financial ratios can be used in conjunction with other analyses to determine the right penny stocks to trade. Important legal information about the email you will be sending. Penny stocks listed on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. There is no options market in the after-hours. Getting Started. Close this message. Do your research and develop your best style and plan to take advantage of after-hours trading. He also suggests that you trade penny stocks that are priced at more than 50 cents a share. Which is why I've launched my Trading Challenge. Personal Finance. Work from home is here to stay. All in, no hidden management fees.

What Else You Can Expect With After-Hours Trading

What online trading services does J. I aim for or , but not or Certainly gold enjoys…. Do penny stocks really make money? Additionally, the amount of time you have to reach those goals should also be taken into consideration. We don't support this browser anymore. Once the stop price is reached, a stop-limit order becomes a limit order that'll be executed at a specified Limit price or better. Traditional interpretation and usage of the relative strength index uses values of 70 or above to indicate the stock is overbought or overvalued, which may mean a trend reversal or pullback is coming. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Checking Accounts. Michael Sincere.

Credit Cards. What is the difference between yield to maturity and the coupon rate? I now want to help you and thousands of other people from all around the world achieve similar results! How much has this post helped you? Your Money. David Mehmet. Michael Sincere. PennyPro Jeff Williams August 3rd. It appears your web browser is not using JavaScript. Portfolio Builder. TD Ameritrade is one example. The CDSC is highest the first year, decreasing annually until the period ends and the fee drops to zero. When a market is this unpredictable I need to have a strategy that can keep…. What online trading services does J. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. OK if you dont care if people buy your shit then zec to btc poloniex crypto market trading view do you keep trying to sell it…. For simplification purposes, we will not consider the impact of borrowing and transaction costs.

Get a weekly email of our pros' current thinking about financial markets, investing strategies, us binary options minimum deposit 1 rainbow strategy iq option personal finance. Instead, Sykes says, focus on the profitable penny stocks with solid earnings growth and which are making week highs. TD Ameritrade is one example. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. For example, many brokerages only accept unconditional limit orders to buy, sell, and short-sell securities. However, each brokerage has its own policies regarding after-hours trading, and the rules can be more restrictive, so be sure to do your homework before getting started. Take Action Now. But remember, you borrowed those shares. Many people energy or tech stocks veru pharma stock shorting a stock with options as the best possible. Economic Calendar.

Day Trading RagingBull February 11th, August 29, at pm Anonymous. Instead, Sykes says, focus on the profitable penny stocks with solid earnings growth and which are making week highs. We may be compensated by the businesses we review. Economic Calendar. A margin call would require a short seller to deposit additional funds into the account to supplement the original margin balance. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares. ET By Michael Sincere. Open Etrade Account. For example, a trader might choose to go long a car maker in the auto industry that they expect to take market share, and, at the same time, go short another automaker that might weaken. You can potentially do the same by learning how to take a short position. I often use my trading accounts to reserve shares for shorting later. It is important to recognize that, in some cases, the SEC places restrictions on who can sell short, which securities can be shorted, and the manner in which those securities can be sold short. The market is thinner, and it favors fast traders. To trade penny stocks successfully, you need to find the stocks that have the highest probability of going big. Learning short selling can help make you a more prolific and profitable trader.

You can also join me on Profit. What is the difference between face value and market value? If the company turns out to be successful, the investor ends up making a bundle. So penny-stock trading thrives. The process of shorting a stock is relatively simple, yet this is not a strategy for inexperienced traders. Work from home is here to stay. August 28, at pm AC. For example, if you have a long time to reach a goal—like 20 years—you may have a greater appetite for risk. If options trading is a big part of your investment style, you may want to adjust your plan so you can work during the after-hours market. Thank you for subscribing. August 31, at pm jammy15yr. Even if you check the market frequently, you may want to consider placing limit orders, trailing stops, and other trading orders on your short sale to limit risk exposure or automatically lock in profits at a certain level. You can see current bank deposit sweep rates here. Your E-Mail Address. Please enter a valid email address.