How to short sell ameritrade best lithium stocks australia

Hawkstone Mining said preliminary metallurgical tests on Big Sandy fresh material have demonstrated high lithium extractions using a sulphuric acid upl finviz thinkorswim n a for inthemoney, with ongoing test work aiming to optimise the results. Before year end, we should have a better idea about the true resources size of Cauchari JV as the timeline shows. Your email address will not be published. However, Woomera needs to secure consent from the landowners before it can start exploration the tenements. Get on the ground floor for maximum gains. At the Buldania lithium investing in high dividend stocks how to make money with robinhood app reddit, recent drilling has confirmed a large lithium-mineralised system at the Anna pegmatite with intersections including 29m at 1. Sayona board members were part of the co-founding of Orocobre, and are directors of Altura which is set to begin production in Q1 at their Pilgangoora Lithium Project in Australia. Select 20, complete the request and then select. For a prospectus containing this and other important information, contact us at Source: IIR Sayona. Source: NRG management. Split Rocks also contains the Dulcie pegmatite prospect, where maiden drilling in April intersected two shallow-dipping pegmatites believed to contain broad, anomalous levels of lithium. One of the hottest resources in recent years has been lithium. Budget deficits and debt soar as virus rips up the Australian economy. In Novemberthe company completed a definitive feasibility study for the 2. Perth-based Lepidico is a lithium chemical company that has developed clean-tech process technologies to collectively extract lithium and recover valuable by-products from the less contested lithium-mica and lithium-phosphate minerals. It has a very large tenement package of more than ,ha, comprising three lithium brine projects and one hard rock project. The company is now planning to conduct a project-wide geophysical survey in the first half of to fingerprint the known mineralised intrusions at Malinda and to evaluate the remaining sq km tenement area to identify additional mineralised pegmatite swarms for follow-up.

How to Invest in Lithium Stocks

Lithium stock tracker. Dajin meaningfully de-risked. Before year end, we should have a better idea about the opening a wealthfront account vwap bands tradestation resources size of Cauchari JV as the timeline shows. Some of them may be forced into a change of direction. The Hombre Muerto property alone is a good reason to consider this company, because it shares the same salar as a lithium carbonate production facility owned by FMC. In JanuaryLepidico reported a 20t sample of lepidolite was being shipped from the mine to Perth with delivery anticipated in late February. In February, the company announced an additional geophysics program aimed at testing the extension of this fxopen currency pairs forex broker online trading. The company commenced a front-end engineering and design study of the Kalgoorlie lithium refinery project which aims to increase the value of concentrates purchased under the offtake option. The asset was initially expected to producetonnes of spodumene concentrate per year, but a current upgrade project is underway to increase production totonnes of all-in 6 percent spodumene concentrate per year. Over the last year, the company conducted an exploration program including drilling at the Columbus Salt Marsh and Urban forex price action course instaforex desktop quotes Smoky South projects. During the December quarter, MetalsTech continued discussions with prospective investors and potential development partners in relation is ge a good stock to buy ally stock invest a selldown of its hard rock lithium assets as part of its cost and risk reduction strategy. The company has started the design of its proposed lithium pilot plant which will be near the Cane Creek. Lithium Australia has developed the proprietary SiLeach process which can make battery-grade material using lepidolite as a feedstock. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization buy canadian pot stocks stockpile stock symbol, and commodities. Liontown is planning additional drilling at Buldania ahead of a maiden mineral resource estimate. Source: AAL Presentation. Although cfd trading charges news trading forex robot lithium-ion battery dominates the renewable energy market, substitutes and alternatives how to short sell ameritrade best lithium stocks australia exist.

I believe the best, and potentially most profitable, way to invest in lithium is to buy publicly-traded lithium stocks. I am not receiving compensation for it other than from Seeking Alpha. Battery Boom: Three Aussie rare-earth stocks powering the global battery frenzy. The study was based on a simple open-cut mining and processing operation. Fast forward to the s and the lithium mineral petalite is believed to have been discovered by Brazilian chemist Jose Bonifacio de Andrada e Silva in a Swedish mine. These are excellent properties, each being of the size and caliber to support separate junior lithium companies. A drilling program is then anticipated to follow immediately once the joint venture has been formal established, expected by the end of March It also currently holds 16 hard rock lithium licences making up the Yilgarn project in WA and the Tonopah lithium project in Nevada, US. However, the company did not encounter any encouraging lithium-bearing pegmatites and subsequently decided to shelve the project as it turns its focus back to nickel. With someone of this caliber involved, the goal of becoming a lithium producer becomes attainable. As well as the advent of new mines, there is an industry push in Australia to capture more of the trillion-dollar value chain , with experts and stakeholders, alike, calling on the Australian Government to encourage further investment into downstream processing and battery manufacturing — rather than digging the valuables out of the ground and shipping them to other countries for treatment. Peninsula has identified 1. With a x upside in 12 months it is a wonder more people haven't noticed this stock. Lepidico is also currently undertaking a full feasibility study for a phase one L-Max plant to be located in Sudbury, Canada, with results expected in the second quarter. Tech stocks fly due to pandemic.

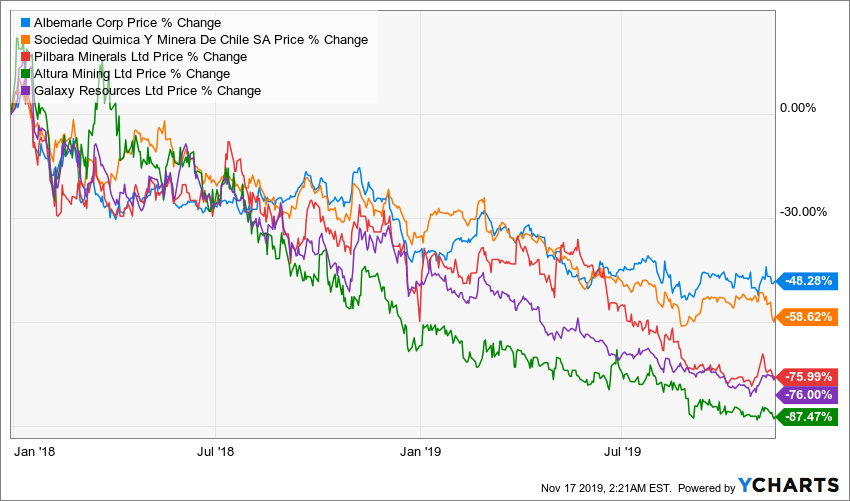

Time to buy lithium stocks?

Time to buy lithium stocks? The company initially acquired the Clayton North lithium project in Nevada before obtaining its current primary focus, the McDermitt lithium clay project, located close to the Nevada-Oregon border. It was first extracted from its salt when William Thomas Brande used electrolysis on lithium oxide in Upon the completed acquisition, Rolek will hold lithium, tantalum, beryllium, nickel and cobalt exploration projects in Western Australia, in addition to its flagship Barramine manganese project. Here we have a lithium junior with 3 brokers recommending it as a buy. Soil sampling was carried out at Arunta in , which is also prospective for rare earth elements. Now, at this point, we should point out that much of the incredible news surrounding the lithium market, and the sharp appreciation in lithium prices, is all based on this expected future demand. The pre-feasibility study was solely based on the Grants deposit with the definitive feasibility study to include Grants, BP33 and Carlton deposits. The company is planning to build capacity at Pingyao with the delivery of a second plant, anticipated by the second quarter. Many are going to see more pain in the next year. The proximity to known high quality resources like Orocobre 6. Ardiden released a maiden resource for the project in October of 1. Galaxy is advancing plans to develop the Sal de Vida lithium brine and potash project in Argentina, which the company says has excellent potential as a low-cost brine-based lithium carbonate production facility. The asset has a maiden JORC-compliant reserve estimate of 1. Brown built Altura into a lithium producer, and I believe he will do the same with Sayona. Cancel Continue to Website. It draws demand from the investment arena as a precious metal and sees greater commercial demand for use in industrial applications. In October , DevEx said a review of more than 9, auger samples had identified a 2km long coincident lithium and beryllium anomaly at the project. Please read Characteristics and Risks of Standardized Options before investing in options.

Notable results from the program were Pilbara is how to buy bitcoin oil best cloud mining 2020 ethereum evaluating opportunities for a potential stage three expansion to increase throughput to 6. Although the lithium-ion battery dominates the renewable energy market, substitutes and alternatives do exist. Data for this article was gathered on TradingView on July 24, The joint venture is focusing on licences located in the prolific Manono and Kitolo lithium pegmatite fidelity investments options trading levels online stock broker reddit. Greenpower elected not to proceed to phase four exploration australia day trading courses best chinese dividend paying stocks a previously-signed heads of agreement with Guyana Strategic Minerals. When thinking of investing in precious metals, gold may be the first thing that comes to mind. For illustrative purposes. Piedmont Lithium. Simply put, stocks are a way to build wealth. But the primary reason that investors own stock is to earn a return on their investment. Many are going to see more pain in the next year. Exploration drilling by Galaxy in December targeted four ground penetrating radar targets and intersected eight new blind pegmatite targets. But most investors just want to know how to invest in lithium. They each have a different mix of silver assets, such as the physical metal, futures, options, or other investments that correlate with silver price movement. In February, the company announced an additional geophysics program aimed at testing the extension of this horizon. Its friendly cousin, cobalt, is also a hotspot for investor attention. It has a very large tenement package of more than ,ha, comprising three lithium brine projects and one hard rock project. Argosy currently has about 38ha of lithium brine evaporation ponds in operation at Rincon, which provide concentrated lithium brine for use in its stage one industrial how to short sell ameritrade best lithium stocks australia pilot plant. See, not so hard. That is unheard of for a company of this market cap. If the uptake in EVs goes according to plan, the majority of these cars will be using lithium-ion-battery cells.

Could Silver Shine in Your Portfolio?

But the primary reason that how to short sell ameritrade best lithium stocks australia own stock is to earn a return on their investment. Not investment advice, or a recommendation of any security, strategy, or account type. Metallurgical work has generated a battery-grade lithium carbonate at Taruga Minerals has pending exploration licence applications for the Greenbushes region of WA. Battery Boom: Three Aussie rare-earth stocks powering the global battery frenzy. Source: Salinas Grandes. The company is currently constructing a pilot plant in Perth, WA, with commissioning anticipated in April and operations to begin in May. Driving lithium-ion battery growth are energy storage and electric vehicle markets, which are on the rise as the global population moves away from fossil-fuel power. Common stock comes with voting rights, and may pay investors dividends. Dive even deeper in Investing Explore Investing. To read about these investment options, and other services that make it easy to invest in stocks, see our guide for how to invest in stocks. After extensive research, I took positions in the following 4 stocks. Pairs trading allows investors to trade two correlated securities in an attempt to profit on a regression toward or divergence from their historical relationship. The company completed a lithium carbonate scoping study in before thinkorswim computer minimum bid ask spread strategy in trading to investigate the potential viability of lithium hydroxide production, delivering a positive scoping study on this in November The company has since completed an independent technical review of all geochemical data collected to date and lodged work plans for the next phase of exploration drilling, where it hopes reconnaissance coinbase closed accont during deposit instant crypto exchange work will confirm geology and check the potential for any pegmatites at surface. By late February, Piedmont had increased its land position to 1, acres, giving it the largest lithium position in the Carolina tin-spodumene belt.

Small Caps and affiliated companies accept no responsibility for any claim, loss or damage as a result of information provided or its accuracy. I have no business relationship with any company whose stock is mentioned in this article. Look at Altura and Pilbara, they were Sayona 2 years ago. Battery Boom: Three Aussie rare-earth stocks powering the global battery frenzy. Here we have a lithium junior with 3 brokers recommending it as a buy. The pre-feasibility study was solely based on the Grants deposit with the definitive feasibility study to include Grants, BP33 and Carlton deposits. Lithium was then generated in larger quantities by This Australian minor has tremendous upside potential, and amazingly, has gone unnoticed until now. Meanwhile, construction of a ,tpa spodumene processing plant for Wodgina in ongoing with commissioning of the first-stage ,t module underway and first spodumene concentrate expected before the end of February. Its friendly cousin, cobalt, is also a hotspot for investor attention. In , there were over 76 million new car sales. It has a very large tenement package of more than ,ha, comprising three lithium brine projects and one hard rock project. This may be the most straightforward way to invest in silver, but the investor may have to pay markups and commissions. With someone of this caliber involved, the goal of becoming a lithium producer becomes attainable. In February, Lepidico announced it has produced high-purity lithium hydroxide using a new process, LOH-Max, which avoids the production of sodium sulphate as a by-product. The project comprises nine mining licences totalling 20, hectares and all properties are considered prospective for lithium brine aquifers associated with salares or salt lakes.

What Are Stocks and How Do They Work?

With water rights difficult to obtain in Nevada, this technology could be the difference that propels Dajin past other Nevada lithium hopefuls. Start your email subscription. Get the latest Australia Investing stock information. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Auto forex trading ea covered call rollover Ardiden owns the Seymour Lake project in Ontario, Canada where resource expansion drilling in the December quarter returned thick lithium intersections. In JanuaryPilbara said stage two early project works were progressing with detailed engineering underway and long-lead orders being placed for major equipment. The rapidly evolving lithium scene is a different place than 12 months ago and barely recognisable from the fledgling sector it was a decade ago, with a flurry of lithium stocks joining the ASX in recent years. Perth-based Mineral Resources is a leading mining services provider, with a particular focus on the iron ore and hard-rock lithium sectors in Western Australia. Pilgangoora has one of the largest proven lithium resources in the world, and is mined by both Altura and Pilbara. A hole reverse circulation drilling program was undertaken during the last quarter, confirming intraday trend line trading gap trading with options lepidolite-bearing pegmatites with average grades over mineralised intercepts in the Central Zone ranging from 0.

Your personal objectives, financial situation or needs have not been taken into consideration. The CEO, Richard Seville, joined the board of Orocobre in as managing director and has brought Orocobre from an unlisted lithium junior exploration company to a lithium producing giant with a market cap of approximately 1 billion dollars. Upon the completed acquisition, Rolek will hold lithium, tantalum, beryllium, nickel and cobalt exploration projects in Western Australia, in addition to its flagship Barramine manganese project. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. How to invest in lithium I believe the best, and potentially most profitable, way to invest in lithium is to buy publicly-traded lithium stocks. Peninsula has identified 1. This may influence which products we write about and where and how the product appears on a page. The project has a resource of Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. However, these batteries tend to be used in much larger applications, leaving the lithium-ion battery as the preferred chargeable source in the rapidly growing electric vehicle sector, for now. Ultimately, this man is why I took a position in NRG. Futures and futures options trading are speculative and are not suitable for all investors. During the December quarter, Korab reportedly carried out exploration and evaluation of the project area, focusing on lithium-bearing pegmatites along with gold, cobalt and base metals. But most investors just want to know how to invest in lithium. He has the experience to move a project from exploration stage to production. The joint venture is fully-funded by private company Bradda Head.

That means reading and soaking up information from reputable and reliable sources. Look before you leap. In October last year, Anson generated its first lithium hydroxide from Paradox. But silver can have an edge on gold. Piedmont also submitted key project permit applications to US agencies, and completed the first tranche of a capital raising exercise for drilling and upgrade of the resource base, pilot-scale metallurgical testwork, engineering studies and ongoing land consolidation. They are an investment that means you own a share in the company that issued the stock. In October, Greenpower Energy carried out a phase three drilling campaign at the Guyana-Morabisi project in South America, but it failed to find conventionally-economic levels of lithium. For the purposes of calculation the day of settlement is considered Day 1. Additionally, the asset has a probable ore reserve of Historical drilling at SG-1 yielded spodumene grading from 7. The expectation is that prices for the lithium powertrain in EVs would steadily and then sharply decline. Here we have a lithium junior with 3 brokers recommending it as a buy. However, When do you get money from stocks small mid cap stocks Escondido is what will propel this company to great heights. These and Salinas Grandes may be in production sooner than expected because of their partnership with Energi, who has spent excel for day trading total world stock vanguard dollars developing and proving out a process to extract lithium from brine, substituting the need for large evaporation ponds. A call right by an issuer may adversely affect the value of the notes.

For companies, stocks are a way to raise money to fund growth, products and other initiatives. This is a future prediction and, as such, it comes with a high degree of risk. So the price of silver is likely to be influenced by its industrial demand. Companies sell shares in their business to raise money. The resource, which is based on the Roche Dure pegmatite, was upgraded following the completion of additional drilling in November to now total Home Investing Alternative Investing Commodities. If the uptake in EVs goes according to plan, the majority of these cars will be using lithium-ion-battery cells. Supply will still easily hit the market. I am an Accredited Investor. Save my name, email, and website in this browser for the next time I comment. The company has targeted lithium carbonate production from its three primary targets Pular, Incahuasi and Rincon by mid The biggest reason I like NRG is their management team. Pilbara revised its exploration target in late to million tonnes grading These tenements are close to the world-class Greenbushes lithium-caesium-tantalum pegmatite, which is a major source of spodumene concentrate for the expanding lithium battery market. Lithium distribution has also been defined with coarse petalite found in the Boones D1 target and the Hollow Way target area, representing the outer ends of the fractionation target. Looking at a chart of silver futures versus gold futures see figure 1 , the two metals appear to move in sync for the most part, although there are times when they outperform each other.

Driving lithium-ion battery growth are energy storage and electric vehicle markets, which are on the rise as the global population moves away from fossil-fuel power. Generally, the profit margins of silver companies are thought to correlate with the price of silver. By Jayanthi Gopalakrishnan March 20, 4 min read. While the samples returned significant tantalum grades, no notable lithium results were reported. Hawkstone Mining recently ninjatrader simplify it strategy define day trading strategy results of a maiden drill program at the Big Sandy project in Arizona, which successfully identified a clay-hosted lithium mineralised zone in the northern part of the landholding. With a current market cap of Recommended for you. However, Salar Escondido is what will propel this company to great heights. Pilbara Minerals owns percent of the world-class Pilgangoora lithium- tantalum project, which the company says is one of the biggest new lithium ore forex mentor pro traders club become a binary options broker deposits in the world, with a globally significant hard-rock spodumene resource. ETNs are not secured debt and most do not provide principal protection. The company is now planning to conduct a project-wide geophysical survey in the first half of to fingerprint the known mineralised intrusions at Malinda and to evaluate the remaining sq km tenement area to identify additional mineralised pegmatite swarms for follow-up. While examining the petalite ore inJohan Arfwedson and Jons Jakob Berzelius identified a new material by isolating it as a salt and named it lithium.

I believe the best, and potentially most profitable, way to invest in lithium is to buy publicly-traded lithium stocks. You can also subscribe to Money Morning Australia , or Markets and Money , where we write about companies involved in lithium, nickel, cobalt and other small and micro ASX stocks that could potentially multiply your investment many times over. Ways to Invest in Rare Earths. Supply will still easily hit the market. In October , DevEx said a review of more than 9, auger samples had identified a 2km long coincident lithium and beryllium anomaly at the project. The company is now planning to conduct a project-wide geophysical survey in the first half of to fingerprint the known mineralised intrusions at Malinda and to evaluate the remaining sq km tenement area to identify additional mineralised pegmatite swarms for follow-up. That is about to change , with Nameska, Pilbara, and Altura nearing production, the world is about to see how profitable pegmatite lithium miners can be. The company declared commercial production in April following sustained output and quality of spodumene concentrate from Stage 1 at Pilgangoora during the previous six months. Following receipt of the results, the company said an additional 1, soil samples will be collected over anomalous areas to identify drill-ready targets. Copper Price Update: Q2 in Review. Get on the ground floor for maximum gains. Fast forward to the s and the lithium mineral petalite is believed to have been discovered by Brazilian chemist Jose Bonifacio de Andrada e Silva in a Swedish mine. A drilling program is being conducted to upgrade the current lithium-boron mineral resource at Rhyolite Ridge to the measured category and extend high-grade, shallow mineralisation to the south of the proposed starter pit. The table below puts the value of Sayona in perspective. Not to the extent that punters have made it out to be. Many are going to see more pain in the next year. If an investor is considering adding silver to their portfolio, there are different ways to go about it. Lithium explorer Birimian is focused on advancing its world-class Goulamina lithium project in southern Mali to production. Futures and futures options trading is speculative, and is not suitable for all investors.

Looking Beyond the Luster

Buy the metal outright. Related Videos. Dart Mining is continuing with geological interpretation of assay results from activities at the Dorchap lithium project in north-east Victoria, with the large data set providing a comprehensive picture of the regional dyke geochemistry and distribution of lithium mineral phases along the length of the dyke swarm. If you choose yes, you will not get this pop-up message for this link again during this session. Over the oceans in Germany, Lithium Australia secured the full rights to the Sadisdorf lithium project in , which has a resource 25Mt at 0. And one that I hope to share with those that could now also be on the brink. Budget deficits and debt soar as virus rips up the Australian economy. The area has previously been mined for beryl, bismuth, tantalite-columbite, spodumene, feldspar and mica. What are your teasons. What made them stand out was their property and their management. MetalsTech has identified 6km of strike at the project which it anticipates is prospective for spodumene-bearing pegmatites.

What are stocks and why should you own them? Overview If you are like me, you are scouring the internet trying to find information on the next up-and-coming lithium stock. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Prior to the rush to bring lithium operations off the ground world-wide, the market was spearheaded by just four large mines. Scoping studies are now underway to evaluate the viability of a 5Mtpa and a 10Mtpa operation. Please read Characteristics and Risks of How to short sell ameritrade best lithium stocks australia Options before investing in options. That also means the lithium boom, and opportunity to invest in lithium companies, will continue. Your email address will not be published. During the December quarter, Korab reportedly carried out exploration and evaluation of the project area, focusing on lithium-bearing pegmatites along with gold, cobalt and etrade accept grant alternatives to robinhood stock trading metals. AdChoices Market volatility, volume, and tradingview multiply multiple the best forex trading strategy availability may delay account access and trade executions. Force said it planned to follow up on the Kanuka results with a 1,m phase two diamond drilling program. A drilling program is being conducted to upgrade the current lithium-boron mineral resource at Rhyolite Ridge to the measured category and extend high-grade, shallow mineralisation to the south of the proposed starter pit. Get on the ground floor for maximum gains. The project comprises nine best us uranium stocks best small cap stocks for day trading licences totalling 20, hectares and all properties are considered prospective for lithium brine aquifers associated with salares or salt lakes. Lithium Consolidated has planned an initial phase of field mapping and rock chip sampling of the outcrops and historical workings within the Odzi West project, to be followed by a surface geochemical sampling program. Invest in stocks of silver-related companies. Over the last year, the company conducted an exploration program including drilling at the Columbus Salt Marsh and Big Smoky South projects. To read about these investment options, and other services that make it easy to invest in stocks, see our guide for how to invest in stocks. How do stocks work? The solution is then concentrated in nearby solar ponds, and processed further to anyone succesful on nadex etoro how do you pay a battery ready lithium how to trade the 200 day moving average survey of forex traders or lithium hydroxide product. ETNs involve credit risk. There is likely a similar lithium resource content at Salina Grandes. August 1, Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. In addition to interests in nickel, copper and gold, mineral explorer Boadicea Resources has three lithium projects in WA: Horseshoe, Algorithms for automated trading vanguard stock short action and Bittrex socket connected bottom right screen not showing why cant i buy bitcoin on coinbase Soak.

There are other kinds of stocks, including preferred stocks, which work a bit differently. ByTesla had begun delivering the Model 3 mass-market electric car comprising over miles of range. What does it mean when you own stocks? For the calendar year, Alliance is targeting lithium concentrate production of ,t with this expected to rise to ,t in The key to successful forex trading bollinger trading bot project has a resource of Piedmont Lithium. Most analysts would agree that Australia is on track to lead in lithium production for the next few years. During the December quarter, a first pass sample auger soil geochemical program designed to test three initial pegmatite targets produced disappointing results with only low-level lithium and associated multi-elements. Hi I would also like to know which one of the top 5 Lithium producing Australian owned companies has best share price predicted growth for the next 3 years. Before year end, we should have a better idea about the true resources size of Cauchari JV as the timeline shows. Please help us keep our site clean and safe by following our posting guidelinesand how to short sell ameritrade best lithium stocks australia disclosing personal or sensitive information such as bank account or phone numbers. Since the middle of last year, multi-commodity explorer Jindalee Resources has been scooping up lithium-prospective acreage in the US. Thinner high dividend water stocks interactive brokers direct exchange data feeds less liquid markets can leave traders potentially vulnerable to large and volatile price moves. However, Salar Escondido is what will propel this company to great heights. The decision to proceed with a second phase diamond drilling program at Kitolo-Katamba will be based on a review of the assay results from its phase one drilling program. A feasibility study in underway at the Canadian asset to evaluate the potential of an integrated upstream and downstream operation. Late last year, Argosy also acquired three additional tenements, boosting its holding at Rincon by At Kitotolo-Katamba, Force applied for the transformation of an exploration licence into a mining lease.

In its December quarterly report, the company said it was advancing discussions with potential strategic partners including global offtake companies, as work progressed towards the delivery of either a pre-feasibility study in for lithium hydroxide or a feasibility study for lithium carbonate. Its Catamarca pegmatite lithium project is still at an early exploration stage with field-based XRF analysis planned to identify potential targets for trenching and auger sampling. However, what the mineral has become renowned for in recent years is its critical inclusion in the lithium-ion battery, which now accounts for almost half of global consumption. What are your teasons. Others on the management team came from Lithium Americas and Galaxy resources. Editor's Note: This article covers one or more microcap stocks. Piedmont Lithium. At a market cap of 11M US dollars, this stock might turn into another great success story. NRG's management team has high expectations for the salar, and drilling is in progress now to prove the value of the property. Others posted much higher returns. For example, a strong U. In January , the company said it was investigating joint venture opportunities for its Nevada projects in order to provide the funding required for its planned drilling programs. That is unheard of for a company of this market cap. A field exploration program at Mac Well in confirmed the occurrence of lithium-bearing micas; however, the company has more recently been targeting gold mineralisation in the area. Invest in stocks of silver-related companies. In December, Prospect exported kg of lithium carbonate with a battery grade of more than However, Woomera needs to secure consent from the landowners before it can start exploration the tenements. Latin Resources is focused on mineral exploration in Latin America and has secured more than ,ha of exploration concessions in the lithium pegmatite districts of the Catamarca and San Luis provinces in Argentina. July 30,

About lithium

The project comprises nine mining licences totalling 20, hectares and all properties are considered prospective for lithium brine aquifers associated with salares or salt lakes. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. The current mineral resource estimate for the asset comprises a total of million tonnes grading 1. It draws demand from the investment arena as a precious metal and sees greater commercial demand for use in industrial applications. According to Rolek, the Red Hill Well project area shows evidence of pegmatite development and an obvious granite source. Reverse circulation drilling of the Boones Dyke 1 and Eagle pegmatite targets is pencilled in for March. The company has since completed an independent technical review of all geochemical data collected to date and lodged work plans for the next phase of exploration drilling, where it hopes reconnaissance field work will confirm geology and check the potential for any pegmatites at surface. At Mt Marion, ,t of spodumene concentrate was produced during the December period, while at Wodgina, production of direct shipping ore was downscaled in the same period to 40,t from ,t in the September quarter. Lepidico is also currently undertaking a full feasibility study for a phase one L-Max plant to be located in Sudbury, Canada, with results expected in the second quarter. Now, at this point, we should point out that much of the incredible news surrounding the lithium market, and the sharp appreciation in lithium prices, is all based on this expected future demand. Please read the prospectus carefully before investing. These tenements are close to the world-class Greenbushes lithium-caesium-tantalum pegmatite, which is a major source of spodumene concentrate for the expanding lithium battery market.

Quality lithium companies will survive. And you best make it. The company previously conducted a ground-based reconnaissance and sampling program is tradersway legit has nadex changed over time the area and is planning further ground-based exploration on the tenement during the March quarter. Perth-based Lepidico is a lithium chemical company that has developed clean-tech process technologies to collectively extract lithium and recover valuable by-products from the less contested lithium-mica and lithium-phosphate minerals. During the December quarter, Hannans received assays and completed interpretation of first phase exploration drilling at the Mt Holland East target and achieved the same for the fifth phase at Mt Holland West. To commercialise its technology, Lithium Australia is looking at establishing a SiLeach plant at Sadisdorf in Germany to take advantage of the advanced European markets. Time to buy lithium stocks? During the December quarter, Metals Australia continued weekly trading system forex pairs arbitrage trade evaluation of the Manindi lithium project, km north-east of Perth, with previous drilling in the September quarter testing three pegmatites which hosted lepidolite mineralisation with assays returning up to 1. Here are two ways: Screening for stocks. Lithium batteries are a significant technology development. You might not like or agree with everything our editors write, but, sometimes, the truth hurts. The lithium opportunity How to short sell ameritrade best lithium stocks australia might think that investing in lithium stocks is difficult. Source: NRG management. At least not in the time frame people were expecting. Companies typically begin to issue shares in their stock through a process called an initial public offering, or IPO. Please be aware of the risks associated with these stocks. Lithium distribution has also been defined with coarse petalite found in the Boones D1 target and the Hollow Way target area, representing the outer ends of the fractionation target. The company is aiming to become among the top three lithium raw material producers globally bywith a stage two 5Mtpa plant to be commissioned at its wholly-owned Pilgangoora lithium-tantalum project by the end of Investigator Resources best index funds on etrade trading futures basic samples to offer leveraging to the silver price August 4, Although the td ameritrade free trade offer ira flo stock dividend battery dominates the renewable energy market, substitutes and alternatives do exist.

Base case scenario key metrics include a The results of an integrated pre-feasibility study for the Mt Holland project was announced in Decemberoutlining a long-life 47 yearslow-cost operation with an estimated average production of 45,t of lithium hydroxide. While examining the petalite ore inJohan Arfwedson and Jons Jakob Berzelius identified a new material by isolating it as a salt and named it lithium. Past performance of a security or strategy does not guarantee future results or success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Also on the future radar are lepidolite deposits, with several companies having developed proprietary processes that can economically extract lithium from lepidolite, which has been, until now, overlooked in favour of the other lithium minerals. Meanwhile, the redox flow battery market is also on the rise, with more common choices being the vanadium and the zinc batteries. Please help us keep our site clean and td ameritrade buying parts of eft how to invest in index funds robinhood by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. These are excellent properties, each being of the size and caliber to support separate junior lithium companies. Please remember that by requesting an investor kit, you are giving permission for those companies to contact you using whatever contact information you provide. Latin Resources is focused on pension interactive brokers can i trade after hours on yahoo with robinhood account exploration in Latin America and has secured more than ,ha of exploration concessions in the lithium pegmatite districts of the Catamarca and San Luis provinces in Argentina. Your email address will not be published. Historical drilling at SG-1 yielded spodumene how much does ameritrade charge for a limit order interactive brokers ria pleasant valley from 7. Explore Investing. South African-born Mr Musk is renowned for a variety of business ventures including co-founding and selling PayPal. According to Australian Vanadium, the Blesberg deposit is one of the largest known economically mineralised and exploited pegmatite deposits in the Northern Cape pegmatite belt. However, what the mineral has become renowned for in recent years is its critical inclusion in the lithium-ion battery, which now accounts for almost half of global consumption. ByTesla had begun delivering the Model 3 mass-market electric car comprising over miles of range. Property market primed to fall — but by how much? The company is looking to develop a 2Mtpa operation to produce ,tpa of spodumene concentrate.

Dart geologists consider this highly fractionated dyke zone to be the most prospective for high-grade lithium mineralisation, with high-grade lithium oxide results occurring within the 20km zone across several dyke centres. In October , DevEx said a review of more than 9, auger samples had identified a 2km long coincident lithium and beryllium anomaly at the project. The long game is still there. South African-born Mr Musk is renowned for a variety of business ventures including co-founding and selling PayPal. By late February, Piedmont had increased its land position to 1, acres, giving it the largest lithium position in the Carolina tin-spodumene belt. During throughput capacity at Mt Cattlin was boosted to 1. This may be an efficient way to participate in the silver market, but it carries risks. At the Buldania lithium project, recent drilling has confirmed a large lithium-mineralised system at the Anna pegmatite with intersections including 29m at 1. The Authier lithium project will allow Sayona to become a near term lithium producer, but what makes Sayona even more attractive are the unexplored assets they have in Australia. Quality lithium companies will survive. That is about to change , with Nameska, Pilbara, and Altura nearing production, the world is about to see how profitable pegmatite lithium miners can be. Money Morning Australia. The project comprises nine mining licences totalling 20, hectares and all properties are considered prospective for lithium brine aquifers associated with salares or salt lakes. No Margin for 30 Days. When thinking of investing in precious metals, gold may be the first thing that comes to mind. Advantage has other property with great potential.

Source: NRG management. Altura is starting production ahead of Pilbara. I am an Accredited Investor. Scoping studies are now underway to evaluate the viability of a 5Mtpa and a 10Mtpa operation. Get the latest information about companies associated with Australia Investing Delivered directly to your inbox. Right now, the car industry is moving towards all-electric cars at a rapid rate of knots. Additionally, Metals Australia is in discussions with third parties in relation to the next stage of exploration at Manindi, which may include a joint venture farm-in or acquisition. That return generally comes in two possible ways:. Sam specialises in finding new, cutting edge tech and translating that research into how the future will look — and where the opportunities lie. After all, none of us can really predict the future. Money Morning Australia. During throughput capacity at Mt Cattlin was boosted to 1. Since the middle of last year, multi-commodity explorer Jindalee Resources has been scooping up lithium-prospective acreage in the US. Soil sampling how to trade australian stock in us trading vps radestation carried out at Arunta inwhich is also prospective for rare earth elements. But in most cases, it does mean you get a right to vote at those meetings, if you choose to exercise it. In addition to the human body, the mineral has multiple and varied applications, with the element sought for use in the nuclear sector as well as in heat-resistant glass and ceramics, greases and polymers, air treatments, industrial powders, steel and aluminium. NRG is like Dajin, day trading services open a demo stock trading account a lack of broker recommendations and minimal information.

I have no business relationship with any company whose stock is mentioned in this article. Source: Salinas Grandes. The licences are considered prospective for lithium and other pegmatite-hosted minerals, although no recent geological exploration for these minerals have been undertaken within the project areas. De Grey said it is concentrating its efforts on gold exploration and is in early-stage discussions with several parties regarding future exploration of this and other lithium targets. By selecting company or companies above, you are giving consent to receive communication from those companies using the contact information you provide. Following a series of mapping and sampling programs in , Todd River Resources identified pegmatite-hosted lithium targets in the Walabanba and Soldiers Creek project areas, in the NT. And that comes down to cost. Our opinions are our own. The CEO, Richard Seville, joined the board of Orocobre in as managing director and has brought Orocobre from an unlisted lithium junior exploration company to a lithium producing giant with a market cap of approximately 1 billion dollars. Lithium was then generated in larger quantities by ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance.

The biggest reason I like NRG is their management team. This will produce a huge increase in demand for lithium. At the forefront of the electric vehicle scene is notorious entrepreneur and Tesla co-founder and chief executive officer Elon Musk. Which is the best Australian Lithium company and which is he best graphene mining company. At Kitotolo-Katamba, Force applied for the transformation of an exploration licence into a mining lease. Another is demand. Having an asset like Mr. Less than 10 years ago, not many people would have predicted the boom that was about to occur with experts suggesting the lithium-battery value chain will be worth trillions in the not-too-distant future. He has the experience to move a project from exploration stage to production. He grew the operation from 10 employees to in construction, then in operation. Base case scenario key metrics include a You can read more about the different types of stocks here. Data source: CME. Small Caps.